Henri Matisse The painter and his model1916-17

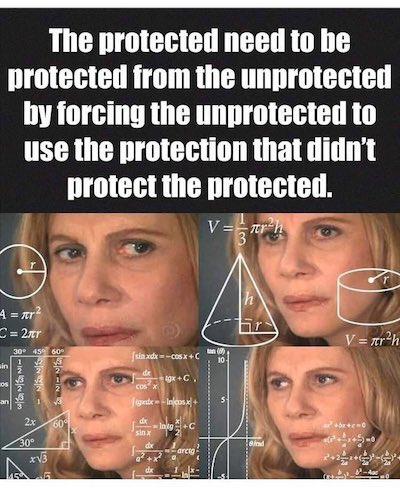

Remember a lot of these people died because early treatment and prophylaxis was forbidden. And what’s with the white flags? We surrendered?

Been reading up on this a little. This is from January, but interesting. About the consistency (integrity) of the vaccines. Which changed a lot from clinical trials to mass production. Who knew? They’re not the same substance at all.

Hearing # 37 of German Corona Extra-Parliamentary Inquiry Committee. 30 January, 2021

• Interview with Dr. Vanessa Schmidt-Kruger (Enformt)

We know that normally vaccine development takes a very long time. It’s not just the clinical phase: with this vaccine, it’s set at three times two and a half years, i.e., three phases of 2.5 years each plus the evaluation phase, which makes 7 1/2 years in total. And then one shouldn’t forget that the production optimisation is also important, at least a year would surely be needed for that. That hasn’t taken place at all. The vaccine is already being sold and used, but the production optimisation isn’t yet by any means completed. And there are considerable deficiencies. One issue I would like to discuss are the deficiencies relating to the active substance: by that, I mean the modified RNA that they are synthesising.

As a second issue there are deficiencies in the consistency of the various production batches: they need to always be consistent so that one always obtains the same vaccine volume and quality. The problem that BioNTech had is that in the clinical phase the product, i.e. the RNA, was produced with completely different techniques to how it is being produced now. During the clinical phase they only needed small volumes of vaccine, they were able to use very expensive techniques that delivered highly purified end products. Now that they have entered mass production, that is no longer possible, they have had to switch to lower-cost processes, e.g. using huge quantities of DNA that functions as the substrate to be able to produce the RNA in an in-vitro transcription reaction.

This is done via bacteria, via the fermentation of transformed bacteria that contain this DNA. The bacteria multiply the DNA in huge amounts, and this leads to new dangers or risks, particularly contamination. At the moment for instance the situation is that the DNA is transformed in the bacteria, it is multiplied, next the bacteria are opened and the DNA is extracted, then it is linearised via enzymes, and after that the linearised DNA undergoes in-vitro transcription to produce the RNA using various procedures. The EMA Committee made various requirements of the vaccine manufacturer, i.e. BioNTech. The applicant needs to now develop and introduce various analysis processes to ensure that the substrate is free of microbiological contaminants – they probably mean E Coli bacteria for example.

There don’t seem to be any processes to ensure or monitor for that. They also need to ensure that all the buffers – those are the solvents that are used – are free of RNAses. RNAses are enzymes that degrade RNA. If there are any contaminants of these RNAse solvents, then RNA in the vaccine will be degraded and the vaccine won’t have any effect anymore. They also have to analyse how strong the activity of the enzymes is; that is very important because I explained that after that the RNA is transcribed from the DNA and then the DNA has to be eliminated, it is digested by enzymes: by DNAses. And if this DNA is not digested well enough, if residues are left, this harbours risks – I’ll come back to the risks from DNA residues, but the activity of the enzymes has to be monitored well and at the end you need to have a pure RNA without any more DNA. And that is not the case. BioNTech has admitted that there are DNA contaminants.

[..] It was found that the integrity of the RNA always varies in the batches that had been made. I will come back to that again. There needs to be a standard that is always the same for each batch. This should be used as the reference to measure the standard. And they only have this of course for the processes of the clinical phase. Now we have to generate a new standard for the new manufacturing processes, i.e., for the commercial sales. That hasn’t been done yet, they are in the process of doing that now.

So – the integrity of the RNA means of course the RNA quality. They have found that this is not very high: it was higher for the processes during the clinical phase. In this report they don’t say how high it is, but I have other information that says 78% of the RNA was good [translator: this refers to the integrity], the remainder was not, but now they have found new batches with only 55% RNA integrity, i.e., half of it is basically unviable.

Politics kills. The only shortages here are those that are created. “The manufacturer has confirmed supplies are ample..”

• Biden Seizes And Rations Supply Of Life-Saving Monoclonal Antibodies (RT)

Seven southern US states, mostly led by Republican governors, say they are now facing shortages of monoclonal antibody treatments for Covid-19 after the federal government took over the distribution, citing the need for “equity.” Monoclonal antibodies (MAB) are lab-created proteins that help those already infected deal with the virus. They have been intensively deployed in Alabama, Georgia, Florida, Louisiana, Mississippi, Tennessee and Texas – states dealing with the recent surge of Delta-variant cases. With the exception of Louisiana, they are all run by Republicans. On Wednesday, the Biden administration announced it would take over the distribution of these treatments using the Defense Production Act and would be centralizing them under the Department of Health and Human Services (HHS). A HHS spokesperson said this was being done to avoid shortages, as the seven states account for 70% of all orders.

“Given this reality, we must work to ensure our supply of these life-saving therapies remains available for all states and territories, not just some,” the spokesperson told CNN. “HHS will determine the amount of product each state and territory receives on a weekly basis. State and territorial health departments will subsequently identify sites that will receive product and how much,” the spokesperson said. “This system will help maintain equitable distribution, both geographically and temporally, across the country – providing states and territories with consistent, fairly-distributed supply over the coming weeks.” Florida Governor Ron DeSantis, a Republican who has clashed with President Joe Biden on Covid policies – from mask mandates to compulsory vaccination – said that the move has resulted in cutting the supply to his state by more than 50%.

The federal government has allocated fewer than 31,000 doses to Florida this week, while the average need for hospitals and state clinics is 72,000, his office said. DeSantis said on Thursday that he has reached out to GlaxoSmithKline, another pharmaceutical company, to purchase their MAB treatment in order to make up the shortfall. In Texas, the Biden administration told the state “to reduce its use of the therapeutic treatment that has literally been saving lives and reducing hospitalizations,” Mark Keough, a judge in charge of Montgomery County, just north of Houston, said in a Facebook post on Tuesday. “The manufacturer has confirmed supplies are ample but due to the Defense Production Act, the White House and it’s agencies are the only entities who can purchase and distribute this treatment,” Keough added.

“.. it is necessary to develop vaccines that protect against such complete breakthrough variants..”

There has never been a vaccine against a coronavirus, but this is all you can take away from this?

• Delta Poised To Acquire Full Resistance To Wild-type Spike Vaccines (Biorxiv)

mRNA-based vaccines provide effective protection against most common SARS-CoV-2 variants. However, identifying likely breakthrough variants is critical for future vaccine development. Here, we found that the Delta variant completely escaped from anti-N-terminal domain (NTD) neutralizing antibodies, while increasing responsiveness to anti-NTD infectivity-enhancing antibodies. Although Pfizer-BioNTech BNT162b2-immune sera neutralized the Delta variant, when four common mutations were introduced into the receptor binding domain (RBD) of the Delta variant (Delta 4+), some BNT162b2-immune sera lost neutralizing activity and enhanced the infectivity.

Unique mutations in the Delta NTD were involved in the enhanced infectivity by the BNT162b2-immune sera. Sera of mice immunized by Delta spike, but not wild-type spike, consistently neutralized the Delta 4+ variant without enhancing infectivity. Given the fact that a Delta variant with three similar RBD mutations has already emerged according to the GISAID database, it is necessary to develop vaccines that protect against such complete breakthrough variants.

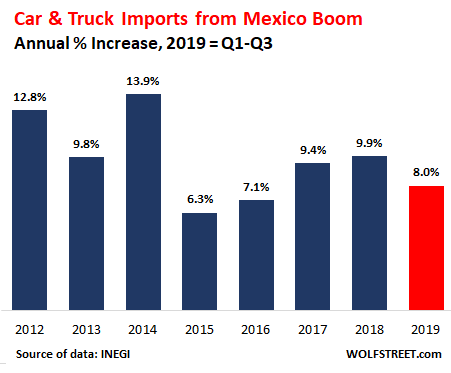

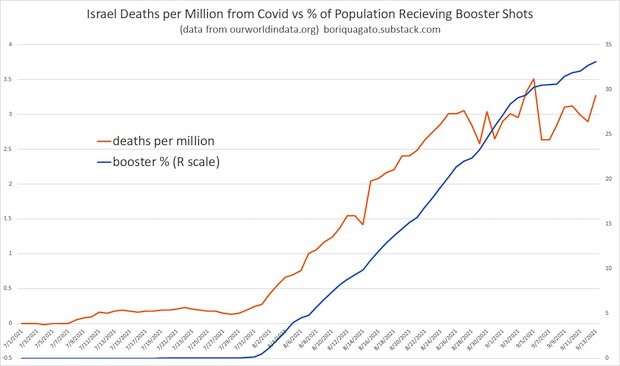

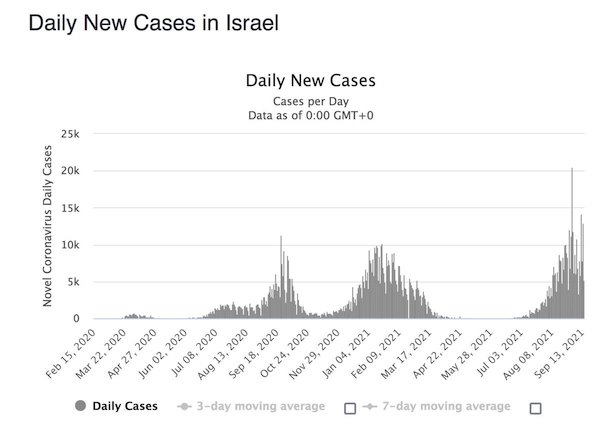

Wait, where is that graph?

• Israeli Study Claims Covid Vaccine Boosters Reduce Infection Risk TENFOLD (RT)

A third dose of Pfizer’s vaccine could cut the risk of Covid infection by more than 10 times in elderly patients, according to an Israeli study, which was peer-reviewed just ahead of a key FDA meeting on boosters for Americans. Published in the New England Journal of Medicine on Wednesday night, the newly peer-reviewed study found that infections and severe Covid cases “were substantially lower among those who received a booster (third) dose of the [Pfizer-BioNTech] vaccine” compared to those who took only two. “The rate of confirmed infection was lower in the booster group than in the nonbooster group by a factor of 11.3,” the study said, also finding the rate of severe illness was slashed by nearly twentyfold, or by a factor of 19.5.

The findings are based on a review of official data for some 1.1 million Israelis over the age of 60, who were divided into two groups: those who received a booster within 5 months of their second dose, and those who did not. Citing ‘other recent research’, the study noted that vaccine-induced immunity could drop significantly in just six months after a recipient’s second dose – providing only twice the protection compared to non-vaccinated individuals. After a third shot, however, effectiveness was pushed back up to 95%, “a value similar to the original vaccine efficacy reported against the alpha variant,” the study said. While the researchers said they did their best to correct for any potential biases in the data, they acknowledged that their findings could reflect “behavioral changes after vaccination” rather than improved immunity alone, as the study did not attempt to measure antibody levels and instead relied on official case counts.

Brave New Bizarro World.

Note that this is based on research from before mass vaccination.

“88 known breakthrough cases out of 11,431 individuals who had been vaccinated between December of 2020 and March of 2021, compared with 162 such cases out of a total of 14,746 trial subjects who had received their inoculations in July through October of 2020.”

• Pfizer, Moderna Release Data Supporting Booster Shot (Claus)

Late on Wednesday, the pharmaceutical firm Moderna released new data regarding breakthrough cases of the coronavirus that it says supports the need for a third booster shot of its coronavirus vaccine. Earlier the Pfizer Corporation had announced that evidence from Israel shows a third coronavirus vaccine shot restores protection back up to the original effectiveness rate of 95% as it made the case to the US Food and Drug Administration for boosters. Pfizer stated that the need for the authorization of a booster shot is in response to what it called an “urgent emerging public health issue” as the much more contagious Delta variant of the virus races across the globe.

Adding further assurance to those who may shun the third shot for fear of additional side effects, Pfizer officials stated that such occurrences are similar to those observed after receiving the second dose of the vaccine. For its part, Moderna officials offered up a new analysis that showed breakthrough Coronavirus cases were experienced less often in those who were more recently vaccinated, indicating that the effectiveness of the shot does indeed wane over time. The Cambridge, Massachusetts firm noted that analysis gleaned from its phase three study showed the incidence of breakthrough cases in fully vaccinated people, occurred less often in a group of trial volunteers who had been inoculated recently, suggesting that immunity for those who received the coronavirus vaccines has begun to wane. In all, Moderna cited a total of 88 known breakthrough cases out of 11,431 individuals who had been vaccinated between December of 2020 and March of 2021, compared with 162 such cases out of a total of 14,746 trial subjects who had received their inoculations in July through October of 2020.

[..] Meanwhile, FDA officials declined earlier on Wednesday to endorse any position regarding Pfizer’s third shots, saying that there is a lack of verified data at this point. As of now, there has been no peer review of the Moderna analysis. The new flurry of vaccine claims appeared on the scene just two days before an important FDA vaccine advisory committee meeting; this initial panel of outside experts is tasked with debating whether or not there is enough evidence to support the wide distribution of booster shots across the country. This advisory group, the Vaccines and Related Biological Products Advisory Committee, was also the first body to consider the first coronavirus vaccine to come on the market in November of last year. Now it will debate the administration of a third dose of the Pfizer/BioNTech product.

But of course. “Informed consent” from a 12-year old. They should look you people up.

• UK Study To Test Mixed Covid Vaccines On Children & Teens (RT)

British researchers are set to study the effects of mixed vaccine schedules on children and teens, hoping to figure out whether second doses have the intended immune response in youths amid concerns of possible side effects. Designed by the Oxford Vaccine Group and dubbed “Com-COV3,” the upcoming trial will recruit 360 volunteers aged 12 to 16 in order to better understand how to distribute second doses to younger age groups. The study comes soon after UK health officials approved Covid vaccinations for kids 12 to 15-years-old, which will begin next week.

“This will provide the [Joint Committee on Vaccination and Immunisation] with information crucial to informing their advice about immunising teenagers in the UK,” Matthew Snape, the trial’s head researcher and an associate professor in pediatrics and vaccinology at Oxford, told reporters on Thursday. While all trial participants will be given an initial dose of the Pfizer-BioNTech jab, second doses administered eight weeks later will be divided into four different groups: a full or half dose of Pfizer, a full dose of the jab developed by Novavax, or a half dose of Moderna’s immunization.

“As well as looking at the standard two full doses of the Pfizer vaccine, we will look at how well volunteers respond when their second dose of Pfizer is half that of the first dose, or if different vaccines are used altogether, such as the vaccines manufactured by Moderna or Novavax,” Snape added. However, while vaccinations for the 12-15 age group will begin in a matter of days, British health orgs have approved only a single dose for youths so far due to possible adverse reactions from additional shots. Snape explained the “concern here is about the risks of myocarditis, particularly with the second dose with Pfizer vaccine in young men.”

Bhakdi

A message to the UK Government, the @BBC and the people of #Britain. pic.twitter.com/5HH3JuI4Hg

— Oracle Films (@OracleFilmsUK) September 16, 2021

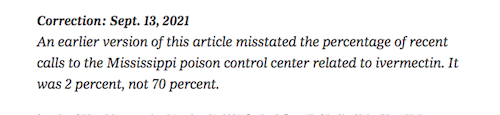

About the “horse paste” calls to the Mississippi Department of Health: “..not 70%, as stated by the state epidemiologist, Dr. Paul Byers, but under 2%..”

Q: does the state epidemiologist still have a job?

• The Plot Against Ivermectin (Bonvie)

When the Mississippi Department of Health released a “Health Alert Network” bulletin on August 20th stating that “70% of the recent calls (to its state poison control)” were over people taking livestock versions of the human drug ivermectin, the media went wild. Outlets such as The Hill, The New York Times, The Washington Post and scores of local news stations reported on this “crazy Covid” treatment that so many Mississippians were taking. Only, it just wasn’t true. Despite a retraction by the Associated Press on August 25th on this “erroneously reported” information, the Mississippi alert created a media feeding frenzy generating sexy headlines over people taking a “horse dewormer” for Covid-19 that has persisted to this day – one reason perhaps being that the Mississippi Department of Health has kept the uncorrected alert still posted and in public view.

After several freedom-of-information-act requests, it turns out that the actual number of calls during August 2021 to Mississippi Poison Control over animal ivermectin was not 70 percent, as stated by the state epidemiologist, Dr. Paul Byers, but under two percent – representing 11 inquiries related to people taking veterinary versions of the drug. If you include July in the tally, it’s down to around one percent of calls. So why did the Mississippi Department of Health put out such erroneous information, one that still states that media-mesmerizing 70 percent number? At this point, various print and broadcasting outlets, major, minor and even alternative, all have their own spurious slants on the supposedly grave danger ivermectin veterinary drugs pose to a gullible public trying to treat or prevent Covid-19.

These range from a bogus report that doctors can’t treat gunshot victims at an Oklahoma hospital because they’re too busy handling ivermectin overdoses to claims of poison-control centers around the country being overrun with ivermectin calls to the slandering of an Arkansas prison doctor, accused of “cruel and unusual punishment” after prescribing human-grade ivermectin (referred to as “cow dewormer”) to his inmates to treat Covid. From the extensive research I’ve done, it appears that this “horse/cow dewormer” narrative went into full swing with the issuance of that Mississippi alert. Rather than work these facts into a story, I’ve compiled a timeline that begins on August 18.

Our hospitals are overwhelmed! Let’s make it worse!

• France Suspends 3,000 Unvaccinated Health Workers (F24)

Thousands of health workers across France have been suspended without pay for failing to get vaccinated against Covid-19 ahead of a deadline this week, Health Minister Olivier Veran said Thursday. “Some 3,000 suspensions were notified yesterday to employees at health centres and clinics who have not yet been vaccinated,” Veran told RTL radio. He added that “several dozens” had turned in their resignations rather than sign up for the jabs. That compares with 2.7 million health workers overall, Veran said, adding that “continued healthcare is assured”.

President Emmanuel Macron gave staff at hospitals, retirement home workers and the fire service an ultimatum in July to get at least one shot by September 15 or face unpaid suspension. Many nurses in particular have been reluctant to get vaccinated, citing safety or efficacy concerns, posing the risk that France’s inoculation drive could stall. France’s national public health agency estimated last week that roughly 12 percent of hospital staff and around six percent of doctors in private practices have yet to be vaccinated. Overall, 70 percent of the French have received both doses required to be fully vaccinated, which are available to everyone over age 12 — one of the highest rates in the world.

“..most young children remain unvaccinated in China, sparking fears that the latest Fujian outbreak could hit the most vulnerable people in the country disproportionately.”

• China Fully Vaccinates More Than 1 Billion People (RFI)

China has fully vaccinated more than one billion people against the coronavirus — 71 percent of its population — official figures showed Thursday. The country where the virus was first detected has mostly curbed the virus within its borders, but is racing to get the vast majority of its population vaccinated as a new outbreak flickers in the southeast. “As of September 15, 2.16 billion vaccine doses have been administered nationwide,” said National Health Commission spokesman Mi Feng at a press briefing. Chinese health authorities said late last month that 890 million people in China had been fully vaccinated and two billion doses administered.

The government has not publicly announced a target for vaccination coverage, but top virologist Zhong Nanshan said last month that the country is likely to have 80 percent of its population inoculated by the end of the year, reaching herd immunity. China is currently battling an outbreak of the Delta variant in the southeastern province of Fujian that has infected almost 200 people so far in three cities, dozens of whom are schoolchildren. The Fujian cluster is the biggest rebound in weeks and comes after the country declared the Delta variant under control, in a test of China’s “zero-case” approach to the pandemic. China reported 49 new domestic transmissions on Thursday, the vast majority in Fujian. Authorities said the cluster’s suspected patient zero was a man who had recently returned from Singapore to the city of Putian, and developed symptoms after completing a 14-day quarantine and initially testing negative for the virus.

But what role did the FBI play in this?

• Clinton Lawyer Michael Sussmann Indicted For Lying to FBI (CTH)

U.S. Special Counsel John Durham has released an indictment of Perkins Coie lawyer Michael Sussmann for lying to federal investigators in 2016 about the people and motives behind his FBI contact. He failed to tell them his intent was to spread a false Alfa Bank conspiracy theory on behalf of the Clinton campaign. Working for the Perkins Coie law firm, while under contract with Hillary Clinton’s campaign, partner Michael Sussmann contacted FBI Legal Counsel James Baker to pitch evidence that a Russian bank was in digital communications with servers in Trump Tower. The Alfa Bank allegation was one of the key components for the ridiculous Trump-Russia narrative put together by the Hillary Clinton campaign. Sussmann wanted the FBI to investigate Donald Trump, so that Hillary Clinton could push a political fabrication about Donald Trump working with Russians to steal the presidential election.

According to the indictment, Sussmann failed to tell the FBI that he was giving them this information on behalf of the Clinton campaign. The FBI investigated the claims and found nothing; however, it was the appearance of the investigation that Clinton needed in order to leak/push the Trump-Russia story to the media and stir up the controversy. There had to be something to the “Trump-Russia” story, because the FBI was investigating it. That fabricated smear served its intended purpose, and the media ran with it.

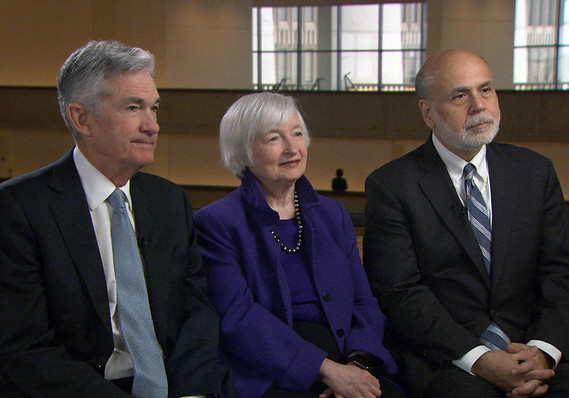

Do they present it this way so you will think the Fed is accountable to you?

• Powell, Juggling Policy And Renomination, Now Faces An Ethics Blowup (R.)

It is perhaps as predictable as it is problematic: Within days of news that two Federal Reserve bank presidents had engaged in controversial stock trades, one of the fiercest critics of the U.S. central bank’s financial system oversight demands new ethics rules that would bar such dealings in the future. For Fed Chair Jerome Powell, however, it is the wrong problem at the wrong time. Under consideration for reappointment as Fed chief while also juggling how to pull off a critical change in U.S. monetary policy, Powell faces a controversy of the Fed’s own making that helps reinforce arguments by progressives for broader change at the central bank.

Powell remains favored for renomination by President Joe Biden, and if history is a guide a decision may come in the weeks between the Fed’s policy meeting next week and its two-day session on Nov. 2-3. That would match a point in the calendar when the last two Fed chair appointments have been announced. Democratic Senator Elizabeth Warren’s Wednesday letter to the Fed’s 12 regional presidents asking them to “impose strong and enforceable ethics and financial conflicts of interest rules” and send her an action plan “no later than Oct. 15,” is at a minimum a distraction to Powell at a time when he is steering the Fed through complex debate over monetary policy.

The Fed meets next week and is expected to take a potentially decisive step that flags likely changes to some of its pandemic crisis programs at an upcoming meeting. It is the type of moment that requires deft communication at the Fed chair’s post-meeting press conference – now muddled by likely queries about his colleagues’ investing habits and the possible blow to public trust. “Institutionally, it’s a bad look,” said Tim Duy, chief U.S. economist at SGH Macro Advisors and an economics professor at the University of Oregon. “It’s better to get ahead of this.” Powell has moved to do so, launching a broad review of the Fed’s rules governing investments by senior officials.

But unless change comes quicly, Warren’s direct demands set up a possible clash with a key Democratic lawmaker when Biden’s eventual Fed pick goes for Senate confirmation. Warren, a member of the Senate Banking Committee, which will provide the initial vetting of the nominee, voted against Powell as Fed chair four years ago, has criticized the Fed’s approach to financial regulation on his watch and has yet to state an opinion about his possible renomination. She credited the move by Dallas Fed President Robert Kaplan and Boston Fed President Eric Rosengren to sell the investments in question, but said a decision “made amidst an ethic firestorm” left no guarantee “that Fed officials are acting solely in the public interest, not based on their own financial interests.”

Thought I’d add this one because of this line:

“Current Fed regulations forbid the trading of individual stocks by senior officials around the time of policy meetings due to the sharing of information that could have significant influence on the nation’s economy.”

You mean like 15 minutes before and 15 mimues after, but otherwise you’re fine?

• Powell Orders Ethics Review Of Federal Reserve (JTN)

Federal Reserve Chairman Jerome Powell ordered staff to review ethics guidelines governing the financial dealings by top central bank officials. News of Powell’s inquiry broke after Sen. Elizabeth Warren, D-Mass., sent 12 letters to the Fed’s regional banks demanding stricter ethics guidelines be implemented by the Fed’s top officials. The Massachusetts Democrat called on each president to ban the ownership and trading of personal stocks by top officials at each regional bank office. Powell requested the ethics review late last week, a spokesperson said in a statement, following reports that two regional presidents actively invested during 2020. A Fed spokesperson told CNBC that Powell ordered the review “because the trust of the American people is essential for the Federal Reserve to effectively carry out our important mission.”

According to documents released last week, Fed Presidents Robert Kaplan and Eric Rosengren both bought or sold private stocks in excess of $1 million dollars. Other Fed presidents reported little to no trading activity. Amid the public backlash and scrutiny from Congress, both Kaplan and Rosengren said they would sell any individual stock holdings by the end of the month. Current Fed regulations forbid the trading of individual stocks by senior officials around the time of policy meetings due to the sharing of information that could have significant influence on the nation’s economy. Powell emphasized that although it is not illegal for regional presidents to buy or sell stocks, the Fed’s internal rules require officials to avoid even the appearance of conflict or of using their position for personal gain.

“..unfinished properties with enough floor space to cover three-fourths of Manhattan..”

• China Braces For “Nightmare Scenario” As Evergrande Collapses (ZH)

Up until now the collapse of China’s Evergrande was very much a slow motion affair, captured perhaps best by Forte Securities trader Keith Temperton who said that “the Asian banks will get hit hard if there’s a default, but then there will be a 10-year recovery process. The market’s getting a hang of it. The way they’ve managed the news flow seems quite clever. They haven’t let a swathe of bad news at once.” But while Beijing was indeed successful in extending the period of collapse as long as possible, now that Evergrande is effectively insolvent and having suspended its bonds from trading we have finally gotten to the endgame and the realization that hundreds of billions in capital (Evergrande’s total debt was just over $300 billion) is gone for ever.

This realization has already prompted angry protesters at China Evergrande Group offices across the country as the developer has fallen further behind on promises to more than 70,000 investors. Construction of unfinished properties with enough floor space to cover three-fourths of Manhattan grinds to a halt, leaving more than a million homebuyers in limbo. In an effort to appease its angry (and very soon, poor) stakeholders, Evergrande plans to let consumers and staff bid on discounted properties this month to repay them for billions in overdue investment products as the embattled developer seeks to preserve cash, according to people familiar with the matter.

According to Bloomberg, the company will organize an online property event by Sept. 30 for investors who opt for discounted real estate in lieu of cash, said two employees who were briefed on an internal call Thursday and asked not to be identified. The world’s most-indebted property developer is pushing the discounted real estate as the preferred of three options for angry investors seeking repayments. The high-yield “shadow bank” products paying as much as 13% a year have become a lightning rod for cash-strapped Evergrande, with investors and staff protesting losses and delayed payments from investments that were marketed as safe. Indeed, demonstrations that are breaking out across China could sway any bailout decisions by the government, which places a high priority on social stability, although it’s likely too late for that.

More than 70,000 people bought the products, including many Evergrande employees, Bloomberg reported earlier, citing an executive of Evergrande’s wealth division. And with about 40 billion yuan ($6.2 billion) of them are now due according to Caixin, there is about to be a whole lot of angry investors, who will not be swayed by the company’s hail mary plan to offer steep discounts on property assets. Investors can invest in residential housing units at a 28% discount, offices at a 46% discount and stores and parking units at 52%. Discounted rates can’t be lower than price floors designated by local governments. The property discounts are a voluntary repayment option, according to the briefing.

[..] As Bloomberg notes, it’s impossible to know for sure what would happen if Beijing allows Evergrande’s downward spiral to continue unabated, but China watchers are already mapping out worst-case scenarios as they contemplate how much pain the Communist Party is willing to tolerate. Pressure to intervene is growing as signs of financial contagion increase and as more and more popular anger builds. “As a systemically important developer, an Evergrande bankruptcy would cause problems for the entire property sector,” said Shen Meng, director at Beijing investment bank Chanson & Co. “Debt recovery efforts by creditors would lead to fire sales of assets and hit housing prices. Profit margins across the supply chain would be squeezed. It would also lead to panic selling in capital markets.”

There’s a Cuomo in there!

CNN’s @DonLemon: Like Trump voters, we should call unvaxxed Americans “stupid” and “start shaming them”

"Or leave them behind. Because they’re keeping the majority of Americans behind." pic.twitter.com/6Ga4oQ7kic

— Tom Elliott (@tomselliott) September 16, 2021

Support the Automatic Earth in virustime; donate with Paypal, Bitcoin and Patreon.