Jerry Bywaters Oil Field Girls 1940

Right. Questions: How much of the $32 trillion was made doing things that increased emissions? How much of it is presently invested in polluting companies? And how much are the investors prepared to lose in order to comply with whatever it takes to lower emissions?

To put it simply: these people are talking their books. They got rich by polluting. They intend to get even richer by going green.

If you’re serious about the topic, don’t join them.

• Investors Managing $32 Trillion In Assets Call For Climate Change Action (R.)

Global investors managing $32 trillion in assets have called on governments to accelerate steps to combat climate change, as policymakers meet for talks at a United Nations conference in Poland. A total of 415 investors from across the world including UBS Asset Management and Aberdeen Standard Investments signed the 2018 Global Investor Statement to Governments on Climate Change demanding urgent action. “The global shift to clean energy is underway, but much more needs to be done by governments to accelerate the low carbon transition and to improve the resilience of our economy, society and the financial system to climate risks,” the statement said.

The intervention is the single largest on the topic to date, the Institutional Investors Group on Climate Change said, as talks continue in the Polish city of Katowice to agree how to slow global warming to below 2ºC. That goal was agreed at a 2015 meeting in Paris, but investors said national governments were being too slow in enacting the policies needed to help the world transition to a low-carbon economy. Failure to act could lead to permanent economic damage three or four times the scale of the impact of the financial crisis, British asset manager Schroders said.

As well as ramping up the involvement of the private sector, governments needed to commit to improving climate-related financial reporting, a move that would help investors better assess the risk and allocate capital to the right companies. “The reality is that the long-term nature of the challenge has, in our view, met a zombie-like response by many,” said Chris Newton, Executive Director Responsible Investment, IFM Investors. “This is a recipe for disaster as the impacts of climate change can be sudden, severe and catastrophic.”

If these activist shareholders succeed, the value of their shares will plunge. That’s why in an earlier vote at Shell, 94% of shareholders votied against and 5% abstained. That reduces this to window dressing.

• BP, Chevron, ExxonMobil Face Shareholder Challenge Over Carbon Targets (G.)

BP, Chevron and ExxonMobil face a shareholder challenge to set carbon targets in line with the Paris climate agreement, as a green group seeks to repeat its success in pressuring Shell to set environmental benchmarks. When Shell’s chief executive, Ben van Beurden, laid out an ambitious long-term carbon target last year, he acknowledged the role played by a resolution on carbon targets submitted by Dutch activist shareholders Follow This. Follow This is hoping to use investor power to push other major oil and gas firms into setting similar goals. The organisation has bought shares in several major fossil fuel groups and has submitted two resolutions to the European firms BP and Shell. It will file identical resolutions with the US companies Chevron and ExxonMobil later this week if other parties do not submit a similar demand.

Investors at the firms’ annual general meetings next year will be asked to vote in favour of them publishing climate change targets in alignment with the international goal of keeping the rise in global temperatures well below 2C. Mark van Baal, the founder of Follow This, said: “Targets should be on the agenda of every oil company, given that the oil industry can make or break the Paris climate agreement.” The group has little chance of winning by persuading a majority of the four companies’ shareholders to back the resolution but it believes the tactic can put public and investor pressure on firms. Although backed by the Church of England and major pension funds, the resolution filed for Shell’s AGM on carbon targets failed in 2017, with 94% of shareholders voting against and 5% abstaining.

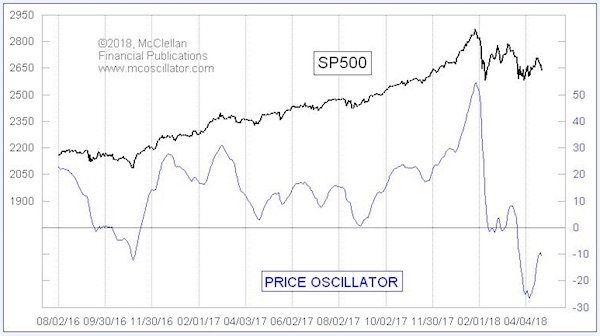

New Davis have no idea how big the fall will be, no more than you or I. And besides, they think that by spring, “the pain will be largely behind the Street”.

• Bear Market Is Here, Stocks To Plunge At Least 20% – Ned Davis Research (CNBC)

The wild trading that’s gripped Wall Street may be no ordinary correction. According to Ned Davis Research’s Ed Clissold, a bear market is officially here. “If you take this as a typical bear market, not associated with a recession, it’s going to take you down around 20% — maybe a little bit more,” the firm’s chief U.S. market strategist told CNBC’s “Futures Now” last week. “That’s what we need to be thinking about over the next several months.” A bear market is defined as an environment when overwhelming pessimism sparks a 20% drop or more from recent highs. In this case, it would wipe out 588 points from the S&P 500’s all-time high of 2940.91 hit on Sept. 21. The index closed Friday in correction territory at 2,633.08. That’s down 10% from the high and 4.6% for the week.

Originally, Clissold called for a bear market to hit Wall Street in 2019, due to jitters over interest rate hike risks, U.S.-China trade tensions and slowing growth in earnings and the economy. However, he decided to move up his forecast due to “severe” technical damage from the October correction. Now, it appears the market may soon get hit with another batch of discouraging news. “Earnings growth is becoming a front-burner issue. Everybody expected it to slow down next year because we don’t have the benefit of tax cuts. But the slowdown is probably going to be more than expected,” said Clissold. [..] He may be predicting a deep pullback, but he does not see any signs of a recession. By spring, Clissold said, the pain will be largely behind the Street.

Everyone still relies on central banks.

• Everyone Is Bearish But No-One Is Short (ZH)

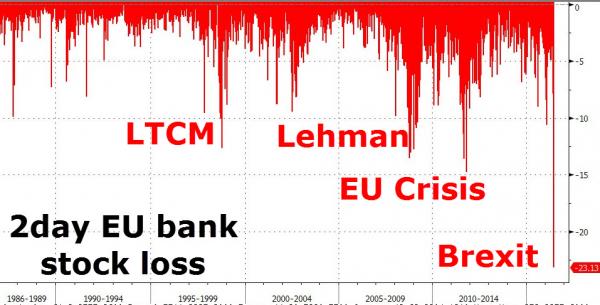

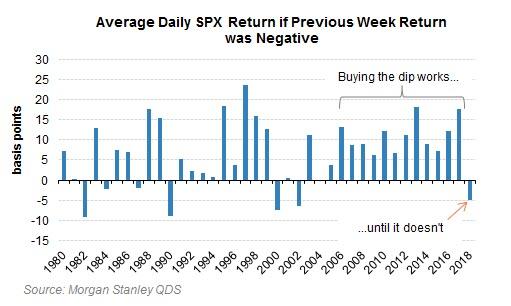

In the past two months we have written extensively on how most market participants got caught offside by the dramatic reversion in risk assets, and which after several attempts at bottom-fishing – attempts which have failed because as Morgan Stanley first noted two months ago the Buy The Dip trade no longer works…

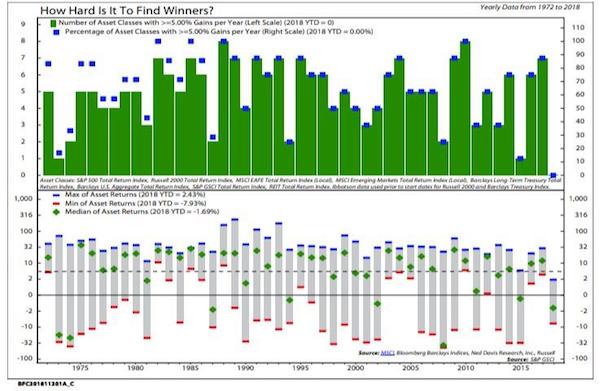

… increasingly more traders have thrown in the towel, resulting in YTD returns which are truly “historic” with not one single asset generating positive returns for the first time since the Nixon presidency.

Well, that’s not exactly right: one asset is outperforming – the one which usually does best just as the economy slides into a recession or worse: cash. As Bank of America notes, the YTD score for the top global assets is the following: • equities -4.2%, • bonds -2.3%, • commodities -6.2%, • cash 1.7%, • US$ 4.9%.

Drilling down reveals an even uglier picture: the 2018 bear market has spared nobody with US Treasuries down -4.9%, the 5th largest loss since 1970, US IG bonds -3.3%, their 4th largest loss since 1970, meanwhile 1881 of 2767 global stocks are in a bear market, down more than 20%, 86 of 94 equity indices underwater, and the cherry on top – the FAANG bull market “leader” is down -26% from highs, which according to BofA’s Michael Hartnett is “a big nasty bear market.” The result, per Bank of America, is that “capitulation to lower credit & equity allocations begins but from high allocations to risk assets.” That’s the good news: the bad news is that even as investors are bailing out of risk assets, they are also dumping safe havens like treasuries, and in the last week we saw broad based risk-off flows, including $5.2BN outflow from equities, and $8.1BN outflow from bonds this week

By the day, it becomes more like one of those Shakespeare plays with gossiping and backstabbing and all that. Love it.

• Senior Tory Vultures Circle With May On Brink (Ind.)

Theresa May is set for the bleakest week of her time in power after leadership rivals publicly positioned themselves to grab the Tory crown if her Brexit plans collapse. Ex-cabinet ministers Boris Johnson, Dominic Raab and Esther McVey all signalled a willingness to bid for the leadership amid speculation that Ms May faces a heavy defeat in the crunch Commons vote on her proposed Brexit deal. More resignations were expected from the front bench in the run-up to the vote, with government insiders indicating it could still be delayed. If she survives the first half of the week, Ms May is expected to head to Brussels where she will implore the EU to offer a concession on the hated “Irish backstop” so that she can try to sell the deal to Tory rebels one last time.

The prime minister spoke to president of the European Council Donald Tusk on Sunday, who said afterwards that it would be “an important week for the fate of Brexit”. In London thousands of protestors waving union jacks joined a “Brexit betrayal” march sponsored by Ukip and addressed by far-right activist Tommy Robinson, while even more were said to have turned up to an anti-fascist counter-march. The febrile atmosphere as the week starts is only set to intensify as MPs return to Westminster on Monday, with talk of Conservative plots and leadership challenges filling the air. One Tory backbencher told The Independent: “No one knows if the prime minister is still going to be in Downing Street at the end of the week.

Ha ha! Don’t forget to say thank you to the EU for your freedoms, Brits! Rumor has it May’s Plan B will include a second vote that does not have a Remain option.

• EU’s Top Court Says UK Can Unilaterally Stop Brexit (R.)

The European Union’s top court ruled on Monday that the United Kingdom can unilaterally revoke its divorce notice, raising the hopes of pro-Europeans ahead of a crucial vote in the British parliament on Prime Minister Theresa May’s divorce deal. Just 36 hours before British lawmakers vote on May’s deal, the Court of Justice said in an emergency judgement that London could revoke its Article 50 formal divorce notice with no penalty. May’s government says the ruling means nothing because it has no intention of reversing its decision to leave the EU on March 29. But critics of her deal say it provides options — either to delay Brexit and renegotiate terms of withdrawal, or cancel it altogether if British voters change their minds. “The United Kingdom is free to revoke unilaterally the notification of its intention to withdraw from the EU,” the court said.

Surprised? Don’t be.

• UK Government Funds Secret Anti-Corbyn, Labour Unit (DR)

A secret UK Government-funded infowars unit based in Scotland sent out social media posts attacking Jeremy Corbyn and the Labour Party. On the surface, the cryptically named Institute for Statecraft is a small charity operating from an old Victorian mill in Fife. But explosive leaked documents passed to the Sunday Mail reveal the organisation’s Integrity Initiative is funded with £2million of Foreign Office cash and run by military intelligence specialists. The “think tank” is supposed to counter Russian online propaganda by forming “clusters” of friendly journalists and “key influencers” throughout Europe who use social media to hit back against disinformation.

But our investigation has found worrying evidence the shadowy programme’s official Twitter account has been used to attack Corbyn, the Labour Party and their officials. [..] David Miller, a professor of political sociology in the School for Policy Studies at the University of Bristol, added: “It’s extraordinary that the Foreign Office would be funding a Scottish charity to counter Russian propaganda which ends up attacking Her Majesty’s opposition and soft-pedalling far-right politicians in the Ukraine. “People have a right to know how the Government are spending their money, and the views being promoted in their name.”

That’s not legal, is it?

• Comey: FBI Never Verified Steele Dossier Used To Justify Special Counsel (ZH)

Former FBI Director James Comey didn’t know a lot during Friday’s congressional testimony – claiming hundreds of times (245 according to Trump) that he simply couldn’t remember various things. What Comey did remember, however, confirms that the FBI could not verify the dossier submitted by former UK spy Christopher Steele – which the agency used as the foundation of a spy warrant application to surveil the Trump campaign. While Comey said the dossier came from “a reliable source with a track record, and it’s an important thing when you’re seeking a PC warrant,” he also admitted that the FBI was unable to corroborate the document’s claims.

“But what I understand by verified is we then try to replicate the source information so that it becomes FBI investigation and our conclusions rather than a reliable source’s,” Comey said, adding “That’s what I understand it, the difference to be. And that work wasn’t completed by the time I left in May of 2017, to my knowledge.” The FBI is required to fully vet information they submit to FISA courts, which they of course did not do in their haste to deploy a counterintelligence dragnet on the Trump campaign during the final months of the 2016 US election. Steele, meanwhile, was fired by the FBI for leaking information to the press while the agency was using him as a source. To get around this, the FBI went through former #4 DOJ official Bruce Ohr – who was demoted twice for lying about his contacts with Steele.

Ohr’s wife, Nellie Ohr, worked for the embattled research firm Fusion GPS on the Trump dossier. Fusion GPS hired Steele as part of their ongoing effort to investigate the Trump campaign and any ties with Russia. It was discovered in 2017 that Fusion GPS was being paid by the Hillary Clinton campaign and the Democratic National Committee through the campaign’s law firm Perkins Coie to investigate any alleged ties between Trump and Russia. More importantly, the FBI used information from Steele, a foreign source who was openly antagonistic about Trump. In fact, Ohr told FBI officials that he “was desperate that Donald Trump not get elected and was passionate about him not being president,” as stated in the House Intelligence Committee investigation memo. -Sara Carter

Comey’s confirmation echoes comments made in a string of emails quietly requested by House Republicans for declassification – as reported last week by The Hill’s John Solomon. The emails – kept from Congressional investigators for over two years, “included then-FBI Director James Comey, key FBI investigators in the Russia probe and lawyers in the DOJ’s national security division,” according to the report – and took place in early to mid-October of 2016, prior to the FBI successfully securing a FISA warrant to spy on Trump campaign adviser Carter Page.

In a worst case scenario, the US will use this as a reason to attack now, before Americans figure out they can’t win.

• Russian Stealth Jets To Be Armed With New Hypersonic Missiles (ZH)

The advanced Sukhoi Su-57 multipurpose jet, Russia’s first domestically produced fifth-generation stealth fighter, will be armed with new hypersonic missiles, according to a Russian military source. “In accordance with Russia’s State Armament Program for 2018-2027, Su-57 jet fighters will be equipped with hypersonic missiles,” a Russian defense industry source toldTASS news agency on December 06. “The jet fighters will receive missiles with characteristics similar to that of the Kinzhal missiles, but with inter-body placement and smaller size,” the source added. Moscow said the new Kinzhal (“Dagger”), a nuclear-capable air-launched ballistic missile, can hit speeds of up to Mach 10 and can perform evasive maneuvers that can render NATO’s US-led missile defense system completely “useless.”

The missile can carry both conventional and nuclear warheads with a range of about 1,200 miles. The new hypersonic missile will be much smaller than the current Kinzhal; this is due to size constraints of fitting the weapon inside the stealth aircraft’s weapons bay. The alternative would be mounting the missile on the outside of the plane, but that would increase the jet’s radar signature. No details within the report explain about a timetable for the development or the planned specifications for the new missiles. The Defense Ministry would neither confirm nor deny the information. The Kinzhal missile is currently being tested in field training exercises.

The US needs to clean up its pharma, along with the entire healthcare system.

• Medical Researchers Still Routinely Hiding Funding From Big Pharma (RT)

A huge proportion of scientists and doctors publishing in major medical magazines continue to conceal ties to corporations relevant to their research, while punishment for not declaring interests remains weak, says a new report. “The system is broken,” Mehraneh Dorna Jafari, assistant professor of surgery at the University of California, Irvine, told the New York Times and ProPublica, an investigative journalism non-profit. Jafari was one of the authors of a landmark study published back in August that took the names of the 100 doctors receiving the most funding from medical equipment and drug manufacturers, and then studied whether they declared a potential conflict of interest in their published research. Only 37 did.

For example, Dr. Howard A. Burris III, has been elected as the president of the American Society of Clinical Oncology (ASCO) that includes 40,000 members, and can make influential recommendations on cancer drugs worth tens of billions of dollars. Companies where Burris is an employee have been paid $114,000 in speaking fees, and $8 million in research funding by private corporations. Yet in none of his last 50 articles did the man, whose bio boasts that he “was selected by his peers as a ‘Giant of Cancer Care’ for his achievements in drug development,” think it was necessary to declare any potential biases resulting from corporate involvement.

In the latest investigation, the Times and ProPublica revealed that Dr. Robert J. Alpern, the dean of the Yale School of Medicine, writing about an experimental kidney disease drug failed to state that he was on the board of the company producing it. When journalists approached the publisher of the article, the Clinical Journal of the American Society of Nephrology, its editor discovered that all 12 authors of the article in question had interests they failed to declare.

Really? Salvini is about to take on the Pope?

• Italian Priests Vow To Open Church Doors To Evicted Immigrants (G.)

Italian priests have declared their willingness to “open the church doors of every single parish” to people expelled from reception centres as an anti-immigration law from Italy’s rightwing government threatens to make thousands homeless. The so-called “Salvini decree” – named after Matteo Salvini, the interior minister and leader of the far-right League – left hundreds in legal limbo when its removal of humanitarian protection for those not eligible for refugee status but otherwise unable to return home was applied by several Italian cities soon after its approval by parliament earlier this month. The Catholic church expressed its profound disapproval immediately after the vote.

The Vatican’s position is “very clear”, its secretary of state, Cardinal Pietro Parolin, said last week. “You don’t leave migrants in the street … A profound sense of solidarity must prevail. You cannot put people in this position. You must always focus on people and their rights.” According to Italy’s ministry of the interior, between 2016 and 2017 Italy provided humanitarian protection to 39,145 asylum seekers, who under the Salvini decree risk being made homeless within weeks. In early December, a letter announcing the expulsion of 50 people was sent to the reception centre in Mineo, Sicily: the largest in Europe after the Moria camp in Greece.

The bishop of Caltagirone, Monsignor Calogero Peri, said he was prepared to provide 40 beds in nearby facilities owned by the church to welcome people who risk expulsion. “And if there are not enough beds? I have already spoken with other bishops: we will open the church doors of every single parish under our control,” he said. “It’s not a question of politics. It’s a matter of protecting individuals. Imagine this: in Italy now it is a crime to abandon dogs, but it is not a crime to abandon people. Even worse, abandoning men, women and children is now the law.”

A little nothing news. But cute.

• Why Greeks Traditionally Decorate a Boat Instead of a Christmas Tree (GR)

The most traditional symbol you will find in Greece during the holidays is a small boat decorated with lights, usually placed in the main square of a town and close to the more international Christmas tree. To karavaki, or small boat is rooted in the traditions of a country with a symbiotic relationship with the sea. In fact on the many Greek islands the Christmas boats remain the most popular ornament of the holiday season. Different legends explain the tradition of the Christmas Greek boat. One of them is related to Saint Nicholas (Agios Nikolaos), the Patron Saint of Sailors. This saint is celebrated on December 6, the day when many households start decorating their houses for Christmas. Some agree that this is why boats are decorated, in order to honor the saint.

It’s also true that Greece is proud of the large amount of sailors, fishermen and intrepid captains the country has, which makes them as a symbol of local identity. Men would often be away for months at a time, and those back home would be anxiously waiting for their return. On the islands, the wives, mothers, and daughters of seaman used to spend the cold and dark winter months with their heart and mind at sea. There, their men were battling the stormy seas during the holiday season. These were months of expectation, hope, and prayer for their safe return. The joy of seeing the boats coming back, approaching the shores, made the women celebrate in relief. The boat is a symbol to honor those brave men coming back home.

The tradition wanted the small wooden boats placed inside close to the fireplace and pointing towards the center of the house, never towards the door. They were also lovingly decorated to give a warm welcome to the men of the household. Even kids prepared their own boats with paper and chips of wood, and on Christmas Eve, they used these little boats to collect the treats they had received when singing the carols (kalanda) from house to house.

Don’t miss the fantastic Adam Curtis. He knows more about what makes our world go round than just about anyone. Watch his docs, all of them.

• The Antidote To Civilisational Collapse (Adam Curtis)

Adam Curtis: “HyperNormalisation” is a word that was coined by a brilliant Russian historian who was writing about what it was like to live in the last years of the Soviet Union. What he said, which I thought was absolutely fascinating, was that in the 80s everyone from the top to the bottom of Soviet society knew that it wasn’t working, knew that it was corrupt, knew that the bosses were looting the system, knew that the politicians had no alternative vision. And they knew that the bosses knew they knew that. Everyone knew it was fake, but because no one had any alternative vision for a different kind of society, they just accepted this sense of total fakeness as normal. And this historian, Alexei Yurchak, coined the phrase “HyperNormalisation” to describe that feeling.

I thought “that’s a brilliant title” because, although we are not in any way really like the Soviet Union, there is a similar feeling in our present day. Everyone in my country and in America and throughout Europe knows that the system that they are living under isn’t working as it is supposed to; that there is a lot of corruption at the top. But whenever the journalists point it out, everyone goes “Wow that’s terrible!” and then nothing happens and the system remains the same. There is a sense of everything being slightly unreal; that you fight a war that seems to cost you nothing and it has no consequences at home; that money seems to grow on trees; that goods come from China and don’t seem to cost you anything; that phones make you feel liberated but that maybe they’re manipulating you but you’re not quite sure. It’s all slightly odd and slightly corrupt.

[..] No one is really sure what Trump represents. My working theory is that he’s part of the pantomime-isation of politics. Every morning Donald Trump wakes up in the White House, he tweets something absolutely outrageous which he knows the liberals will get upset by, the liberals read his tweets and go “This is terrible, this is outrageous,” and then tell each other via social media how terrible it all is. It becomes a feedback loop in which they are locked together. In my mind, it’s like they’re together in a theatre watching a pantomime villain. The pantomime villain comes forward into the light, looks at them and says something terrible, and they go “Boo!!”. Meanwhile, outside the theatre, real power is carrying on but no one is really analysing it.

This is the problem with a lot of journalism, especially liberal journalism at the moment. It’s locked together with those people in the theatre. If you look at the New York Times, for example, it’s continually about that feedback loop between what Trump has said and the reaction of liberal elements in the society. It’s led to a great narrowing of journalism. So in a way, he is part of the hypernormal situation because it’s a politics of pantomime locked together with its critics. [..] ..It’s not a conspiracy. It’s a distraction from what’s really happening in the world. I would argue that there is a sense—in a lot of liberal journalism—of unreality. They’re locked into describing the pantomime politics and they’re not looking to what Mr Michael Pence is really up to, and what’s really happening outside the theatre.