Vincent van Gogh Peach trees in blossom 1888

This stuff must stop, but it won’t. These idiots are endangering the entire world. And that wanking rodent Schiff pops up again too.

• Russia Stoked Ukraine Allegations To Undermine Biden – US Intel (Pol.)

Russia tried again last year to help then-President Donald Trump win the White House, the U.S. intelligence community said Tuesday in a long-awaited postmortem — adding that a “primary” tactic in that effort was the spreading of corruption allegations involving Democratic challenge Joe Biden and Ukraine. But the effort fell short of the Kremlin-backed efforts to assist Trump in his 2016 contest against Hillary Clinton, the spy community wrote in its unclassified assessment of foreign threats to the 2020 U.S. federal elections. And the agencies found no attempts by foreign countries to change vote tallies or final results.

“We assess that Russian President [Vladimir] Putin authorized, and a range of Russian government organizations conducted, influence operations aimed at denigrating President Biden’s candidacy and the Democratic Party, supporting former President Trump, undermining public confidence in the electoral process, and exacerbating sociopolitical divisions in the U.S.,” the assessment said. “The primary effort,” the document added, “revolved around a narrative-that Russian actors began spreading as early as 2014-alleging corrupt ties between President Biden, his family, and other US officials and Ukraine.” It said Russia’s intelligence services “relied on Ukraine-linked proxies and these proxies’ networks-including their US contacts-to spread this narrative.”

Unlike in 2016, however, “we did not see persistent Russian cyber efforts to gain access to election infrastructure,” added the document, issued by the Office of the Director of National Intelligence. Iran, meanwhile, waged a “covert influence campaign intended to undercut” Trump’s reelection bid without directly promoting his rivals in order to “undermine public confidence in the election process” and “sow division and exacerbate societal tensions” in the country. “We assess that Supreme Leader Khamenei authorized the campaign and Iran’s military and intelligence services implemented it using overt and covert messaging and cyber operations,” the examination states. The agencies found no efforts by China to interfere in the election, although one intelligence official maintained in a minority opinion that Beijing “took at least some steps to undermine” Trump’s chances, “primarily through social media and official public statements and media.”

Schiff

Democratic Rep. Adam Schiff discusses the US Intel report which says Russia interfered in the 2020 election with the hope of “denigrating” Biden and helping Trump. “The Russians amplified that message that Americans can’t trust their own electoral system.” pic.twitter.com/Es8MG7DPRp

— The Situation Room (@CNNSitRoom) March 16, 2021

Russia Russia Russia Russia Russia

• Big Media Outlets “Independently Confirm” Each Other’s Falsehoods (Greenwald)

For a few weeks following the issuance of the Mueller report, Democrats and media figures gamely attempted to deny that it obliterated the conspiracy theories to which they had relentlessly subjected the country for the prior four years. How could they do otherwise? They staked their entire reputations and the trust of their audience on having this be true. To avoid their day of reckoning, they would hype ancillary events such as Paul Manafort’s conviction on unrelated financial crimes or Michael Flynn’s guilty plea for a minor and dubious charge (for which even Mueller recommended no prison time) or Roger Stone’s various process charges to insist that there was still a grain of truth to their multifaceted geopolitical fairy tale seemingly lifted straight from a Tom Clancy Cold War thriller about the world’s two largest nuclear powers.

But even they knew this was just a temporary survival strategy and that it was unsustainable for the long term. That the crux of the scandal all along was that key Trump allies if not the President himself would be indicted and imprisoned for having conspired with the Russians was too glaring to make people forget about it. That was why former CIA Director John Brennan assured the MSNBC audience in March — just weeks before Mueller closed his investigation with no conspiracy crimes alleged — that it was impossible that the investigation could close without first indicting Trump’s children and other key White House aides on what Brennan correctly said was the whole point of the scandal from the start: “criminal conspiracy involving the Russians . . . . whether or not U.S. persons were actively collaborating, colluding, cooperating, involved in a conspiracy with them or not.”

Brennan strongly insinuated that among those likely to be indicted for criminally conspiring with the Russians were those “from the Trump family.” As we all know, literally none of that happened. Not only were Trump family members not indicted by Mueller on charges of “criminal conspiracy involving the Russians,” no Americans were. Brennan believed there was no way that the Mueller investigation could end without that happening because that was the whole point of the scandal from the start. To explain why it had not happened up to that point after eighteen months of investigation by Mueller’s subpoena-armed and very zealous team of prosecutors, Brennan invented a theory that they were waiting to do that as the final act because they knew they would be fired by Trump once it happened. But it never happened because Mueller found no evidence to prove that it did.

The Advocate, Mar. 10, 2017

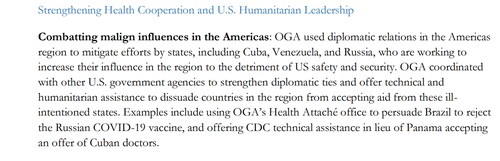

“Combatting malignant influence in the Americas…”

Who’s the actual malignant influence?

• US Admits Waging InfoWar Against Russia’s Sputnik Vaccine (ZH)

The Kremlin on Tuesday called out what’s it’s dubbed the “unprecedented” propaganda war against Russia’s Sputnik V vaccine. The words were issued by spokesman Dmitry Peskov in response to widespread allegations that the Untied States is actively trying to dissuade its allies from purchasing the Russian-produced vaccine. This despite the emerging scientific consensus that’s found it to be at least 91% effective while further preventing inoculated persons from becoming severely ill. The Kremlin is responding to newly emerged proof that the US intervened with the largest country in South America, Brazil.

The Washington Post details that “Buried deep in the dry, 72-page annual report of the U.S. Department of Health and Human Services lay a startling admission: U.S. health officials under President Donald Trump worked to convince Brazil to reject Russia’s Sputnik V coronavirus vaccine.” Brazil has long stood as the second highest COVID-19 infected country in the world behind the US, with over 11.5 confirmed infections so far (with the US now approaching the 30 million mark). Here’s the key controversial section from the 71-page document. The section is entitled “Combatting malignant influence in the Americas”…

“Examples include using OGA’s Health Attache office to persuade Brazil to reject the Russian COVID-19 vaccine,” the government report spelled out explicitly. Brazil’s Ministry of Foreign Affairs has since claimed it never received directives or “consultations” such as are described in the report from the US, with a statement saying, “the Embassy of Brazil in Washington has not received consultations or actions from United States authorities or companies regarding the possible purchase, by Brazil, of the Russian vaccine against Covid-19.” Kremlin spokesman Peskov in his comments didn’t name the allegations specifically but only denounced generally that “In many countries the scale of pressure is quite unprecedented… such selfish attempts to force countries to abandon any vaccines have no prospects.

“Cuomo is not liked and, now, not useful. If Biden becomes similarly expendable in the future, he may finally face the same kind of treatment.”

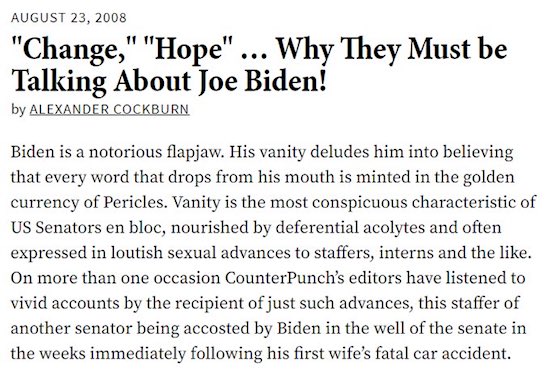

• Biden Gets Away With Exactly What Cuomo Is Accused Of (Emmons)

Gov. Andrew Cuomo has been accused of unwanted touching and sexual harassment. President Joe Biden has been accused of everything from creepily sniffing women’s hair to sexual assault. Yet Biden is the one who gets the folksy treatment, perceived as merely touchy-feely, while Cuomo, despite his status as prince of the pandemic press conference, could be facing the end of his career. Prominent Democrats have called for the governor’s resignation over the scandal. Seven women now say they experienced unwanted touching at the governor’s hands. Cuomo claims he never did it, and apologized for making anyone feel bad. By his own admission, Cuomo may be a little handsy. He’s said that “You can go find hundreds of pictures of me kissing people . . . it is my usual and customary way of greeting.”

The public is meant to believe that it’s simply part of his charm. Contrast this to Biden in 2019, who said “I’m not sorry for any of my intentions, I’m not sorry for anything that I have ever done. I have never been disrespectful intentionally or a man or a woman. So that’s not the reputation I’ve had since I was in high school for God’s sake.” Cuomo apologized and he’s going down. Biden refused to apologize, and he’s practically sanctified. “Social norms are changing. I understand that,” Biden said, “and I’ve heard what these women are saying. Politics to me has always been about making connections, but I will be more mindful about respecting personal space in the future. That’s my responsibility and I will meet it.”

But has he? He barely gave a glance at Tara Reade’s accusations, never mind the myriad other women who stepped forward to say that Biden made them uneasy either with touching or his penchant for sniffing. The charges against Biden are well-documented, but it’s Cuomo that’s in the hot seat, and Biden chilling in the Oval. A take down of Biden over sexual harassment charges is simply not politically expedient. But for Democrats, Cuomo has got to go. While they are loath to admit it, the outcry over the sexual harassment scandal is likely about something else. Cuomo is embarrassing for Democrats who praised him during the COVID-19 outbreak. An investigation by the attorney general’s office found that not only did the Cuomo administration undercount nursing home deaths by up to 50 percent, they did so on purpose in order to avoid political fallout.

The Democrats who are intent on hounding Cuomo out of office do not want the political fallout of the nursing home deaths. It’s easier to hold Cuomo’s hands to the fire over these allegations of unwanted touching than it is to deal with the intentional cover-up of elder deaths, in which they may find themselves to have been complicit. In short, Cuomo is not liked and, now, not useful. If Biden becomes similarly expendable in the future, he may finally face the same kind of treatment.

https://twitter.com/i/status/1371660114629849094

Hirschhorn reached out to me after I published VandenBossche’s piece. I haven’t read his book -yet-. The video seems interesting.

• Pandemic Blunder (Hirschhorn)

A huge amount of data and information not covered by mainstream media are in Pandemic Blunder that tells the story of how over 300,000 Americans have died from COVID-19 unnecessarily because the government has blocked early home treatment and prevention. With 500,000 COVID deaths, learning about safe and effective early home treatment/prevention more important than ever. About the Book: Pandemic Blunder contains considerable medical information and data to support a number of proven safe, cheap generic medicines and protocols that knock out the coronavirus when given early. Read about the pioneering, courageous doctors who have been using innovative approaches to prevent their COVID patients from needing hospital care and facing death.

The book includes many expert opinions from doctors who support the view that 70 to 80 percent of COVID deaths could have been prevented—and still can be. Don’t be victimized by disinformation and propaganda from leftist media. Learn how corrupt forces are aiming to make billions of dollars from expensive medicines and vaccines, and how hundreds of thousands of deaths could have—and should have—been prevented! Pandemic blunder is defined as the failure of the United States public health system and federal agencies to support and promote early home/outpatient treatment for the COVID-19 pandemic disease.

Considerable medical information and data convincingly show that when given early a number of proven safe, cheap generic medicines and protocols knock out the coronavirus. Early means within the first few days of getting symptoms or a positive test. Some pioneering and courageous doctors have been using innovative approaches to prevent their covid patients from needing hospital care and facing death. Many expert views of doctors support the view that 70 percent to 80 percent of covid deaths could have been prevented – and still can for future victims of the disease. Learn how hundreds of thousands of deaths could have and should have been prevented.

This book does more than describe the pandemic blunder, particularly in terms of the influence of Dr. Anthony Fauci. It can help Americans protect their lives by not being victimized by disinformation and propaganda from leftist media. Pandemic management has failed because of corrupt forces aiming to make billions of dollars from expensive medicines and vaccines. There has been a widespread dereliction of duty on the part of many local, state, and federal government officials.

The virus is endemic. New variants will keep emerging.

• New Covid-19 Variant Found In Brittany May Not Show Up In Regular Tests (RT)

France’s health ministry has warned that a new variant of Covid-19 found in the country’s north may evade conventional PCR testing, but initial analysis suggests it is not more contagious or deadly. On Monday, the Directorate General of Health (DGS) said in a press release that a new Covid-19 variant was being investigated after genomic sequencing confirmed the existence of 8 cases at a single hospital, where the new strain had been identified but had initially not shown up after PCR tests. The DGS said the new variant does not appear to be more contagious or deadly, although this is a very early assessment.

The statement adds that the virus appears to have evaded RT-PCR (reverse transcription-polymerase chain reaction) test results on nasopharyngeal samples. Instead, the diagnosis had to be made “by serology or by performing RT-PCR on deep respiratory samples.” The statement concludes by noting that the local authorities and prefectures are stepping up measures to curb the transmission of the virus, “as a precaution.” Measures include “speeding up vaccination, reminding people of the importance of social distancing and limiting gatherings.” In a message to healthcare professionals, the DGS said analysis carried out by the Pasteur Institute had revealed the new variant was “carrying nine mutations in the region encoding the S protein but also in other viral regions.”

Freedom.

• Why We All MUST Reject Vaccine Passports (Krainer)

The enemy is fear. We think it is hate; but it is really fear.

– Mohandas Gandhi

To ‘normalize’ vaccine passports, the idea is increasingly being discussed in the media as we trudge on through the umpteenth version of lockdowns. On Saturday (13 March 2021) I got accosted by the police in Cap d’Ail (south of France) for the offense of taking my kids out in the sun without having a justificatif. I have long lost track of the ever changing rules and shifting logic, but I didn’t feel like arguing. The police were just doing their jobs, enforcing shitty rules that harass and antagonize people. For example, I would have been allowed to be where I was if it were a working day, but since it was Saturday, it was verboten. The objective of such rules is nothing to do with public health; they are intended to exasperate us all to the point where we yield to the indignity of vaccine passports when they are rolled out, just so we can live our lives and be left in peace.

Alexis de Tocqueville understood the nature of this dumb, slow march of bankers’ tyranny. In “Democracy in America” (1835) he predicted that the society would fall into a new kind of servitude which, “covers the surface of society with a network of small complicated rules,” which “does not tyrannise but it compresses, enervates, extinguishes and stupefies people, till each nation is reduced to be nothing better than a flock of timid and industrious animals of which the government is the sheppard.” De Tocqeville’s book was published mere two years after President Andrew Jackson ended the Second Bank of the United States, and the struggles between the bankers and the society was very pertinent to his observations.

The small complicated rules are a sinister trap and it is imperative that we not fall into it. Even if we are ready to yield on vaccines and vaccine passports to end our present predicament, our children and grandchildren will have to live with the consequences of our compromises. We therefore have no right to decline this struggle.

Former chief investment officer of Sustainable Investing at BlackRock

• Wall Street Is Greenwashing The Financial World (Fancy)

The financial services industry is duping the American public with its pro-environment, sustainable investing practices. This multitrillion dollar arena of socially conscious investing is being presented as something it’s not. In essence, Wall Street is greenwashing the economic system and, in the process, creating a deadly distraction. I should know; I was at the heart of it. As the former chief investment officer of Sustainable Investing at BlackRock, the largest asset manager in the world with $8.7 trillion in assets, I led the charge to incorporate environmental, social and governance (ESG) into our global investments. In fact, our messaging helped mainstream the concept that pursuing social good was also good for the bottom line. Sadly, that’s all it is, a hopeful idea. In truth, sustainable investing boils down to little more than marketing hype, PR spin and disingenuous promises from the investment community.

In many instances across the industry, existing mutual funds are cynically rebranded as “green” — with no discernible change to the fund itself or its underlying strategies — simply for the sake of appearances and marketing purposes. In other cases, ESG products contain irresponsible companies such as petroleum majors and other large polluters like “fast fashion” manufacturing to boost the fund’s performance. There are even portfolio managers who actively mine ESG data to bet against environmentally responsible companies in the name of profit, a short-selling strategy. Risk managers are focused on protecting their investment portfolios from potential damages done by a worsening climate rather than helping prevent that damage from occurring in the first place.

As disheartening as this reality is, claiming to be environmentally responsible is profitable. Last year alone, ESG mutual funds and exchange-traded funds nearly doubled. The investment community understandably reacted to this with cheers. But those cheers were only for fund managers and their bottom lines. No matter what they tout as green investing, portfolio managers are legally bound (as well as financially incentivized) to do nothing that compromises profits. To advance real change in the environment simply doesn’t yield the same return.

Green New Deal.

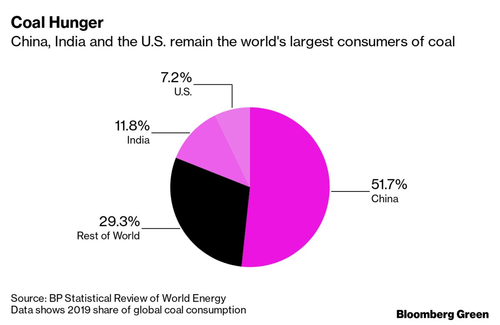

• US Joins India And China In Ramping Up Coal Usage (ZH)

Major users of coal across the world are set to ramp up their usage of the fossil fuel in coming months. Power plants in the U.S. are expected to consume 16% more coal this year than in 2020 and another 3% on top of that in 2022. China and India also have “no plans to cut back” their use of burning the fossil fueld. In fact, “it’ll almost be as if the pandemic-induced drop in emissions never happened,” Bloomberg reports. Inevitably, this will result in higher emissions, which stands at stark odds with the climate initiatives that President Joe Biden ran on. Amanda Levin, policy analyst at the New York-based National Resources Defense Council said: “We’re going to see a really marked increase in emissions with coal consumption at U.S. power plants returning almost to 2019 levels.”

She says that changes to mitigate usage could happen quickly if Biden implements his planned green-energy policies. In the U.S., the ramp comes as a result of both costlier natural gas, and a broad re-opening from the pandemic. For India and China, the steady use is indicative of growing demand, despite the fact that both countries are trying to use wind and solar, as well. China’s power consumption, for example, has grown, despite the country reducing coal’s share in the nation’s energy makeup. President Biden’s upcoming infrastructure bill is expected to include plans to “fulfill his campaign pledges on climate change, making the U.S. best poised to salvage progress in reducing global emissions,” Bloomberg reports. In China, President Xi Jinping has committed to net-zero emissions by 2060.

It will be a long fight.

• Courts Close In On Gig Economy Firms Globally (G.)

Gig economy companies, including Uber and Deliveroo, have faced at least 40 major legal challenges around the world as delivery drivers and riders try to improve their rights. The analysis of 39 employment cases, and seven linked cases on matters such as competition law, covers legal action in 20 countries including Australia, Chile, Brazil, South Korea, Canada and across Europe. The cases have been brought by gig economy workers seeking access to basic rights, such as minimum wages and sick pay. Put together by the International Lawyers Assisting Workers Network of more than 600 lawyers from at least 70 countries, the report highlights a string of court rulings in favour of drivers including in Italy, where authorities have fined Uber Eats, Glovo, Just Eat, and Deliveroo €733m (£628m) for misclassifying 60,000 couriers. That case is being appealed against.

A court in Spain ruled last year that drivers for food delivery firm Glovo were employees and the government in Madrid has since announced legislation confirming delivery riders’ status as salaried staff. In South Korea, a driver working via the Tada van hailing app was also ruled to be an employee. Last month, the UK supreme court dismissed Uber’s appeal against a landmark employment tribunal ruling that its drivers should be classed as workers with access to the minimum wage and paid holidays. On Tuesday night, Uber announced it will guarantee its 70,000 UK drivers a minimum hourly wage, holiday pay and pensions, in a dramatic u-turn which could put pressure on other gig economy firms to change tack.

Jeff Vogt, at the Washington DC based Solidarity Center workers rights group, said there was a clear trend towards recognising improved rights and employment status for those working for gig economy companies dealing with food delivery and taxi hire. “The courts are closing in on them,” he said. However, the report also warns that not all claims are successful and states must act to enforce the regulations as gig economy firms use their considerable resources to defend their practices. Tactics include contracts with mandatory arbitration clauses, which fend off legal action by forcing those with a grievance to pay costly administration and filing fees in the preliminary stages. This has proved a particular problem in the US.

”..we have the technology to make hyperinflation safe, comfortable, convenient and fun for the whole family!”

• Getting Hyperinflation Right (Dmitry Orlov)

The sheer mechanics of hyperinflation—of printing and issuing ever more notes, repeatedly exchanging older, increasingly worthless notes for newer ones, making payments using cartloads and wagonloads of cash—become increasingly burdensome. When it takes an entire suitcase of cash to pay for a pack of cigarettes or a bar of soap, soap and cigarettes themselves become a makeshift form of currency. Hyperinflation is most unpopular with people who insist on storing their savings in the form of cash. In response, they turn to buying up and hoarding other things, causing shortages and further driving up prices. But all of these problems can now be solved because we have the technology to make hyperinflation safe, comfortable, convenient and fun for the whole family!

However, this requires a change in mindset and a different approach to money. To start with, we need to recognize that money is not a physical quantity. It is dimensionless because it can only be measured relative to other currencies. Unlike any physical quantity, it is measured with infinite precision; any physical measurement, be it in kilograms, cubic meters or kilowatt-hours, has to have error bars on it to be meaningful, while monetary quantities, no matter how large, are precise down to the last penny. It is circularly defined: money derives its value from things that can be purchased with it, and these things in turn derive their price from the value of money.

Although money can be given a physical representation in the form of coins or paper currency, its essential nature is ephemeral, nonphysical and intangible. In essence, money only exists as pure thought in the minds of people who are involved in its exchange. Its physical embodiments are just theatrical props. Its reality is conceptual, similar to that of the irrational number π, which can also be given a physical representation—as, say, a one-meter-diameter circle carved in stone that has a circumference of π meters—but that would be pointless. Just as π is ubiquitous in mathematics, money is ubiquitous in economics.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

If you cannot explain something in simple terms, you don’t understand it.

– Richard Feynman

Support the Automatic Earth in virustime. Click at the top of the sidebars to donate with Paypal and Patreon.