Rembrandt van Rijn The Angel Appearing to the Shepherds 1634

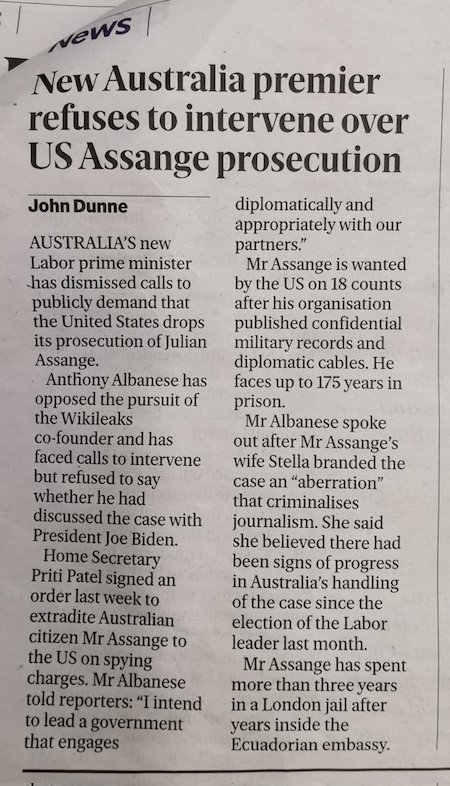

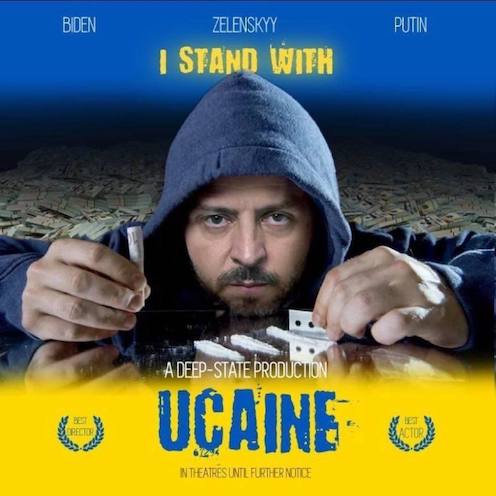

Stone Flynn Zel

“#Ukraine is at the very top – human trafficking, money laundering, drug trafficking and weapons trafficking – globally. This is what Ukraine does, and has done for many many years.”

– General Michael Flynn pic.twitter.com/HUD2gRDGNa— Brandon Taylor Moore (@LetsGoBrando45) December 24, 2022

“..a world that has allowed the life, teachings and crucifixion of Jesus to be drowned out by partisan politics, secularism, materialism and war..”

• Jesus Would Be Branded A “Domestic Terrorist” Today (Whitehead)

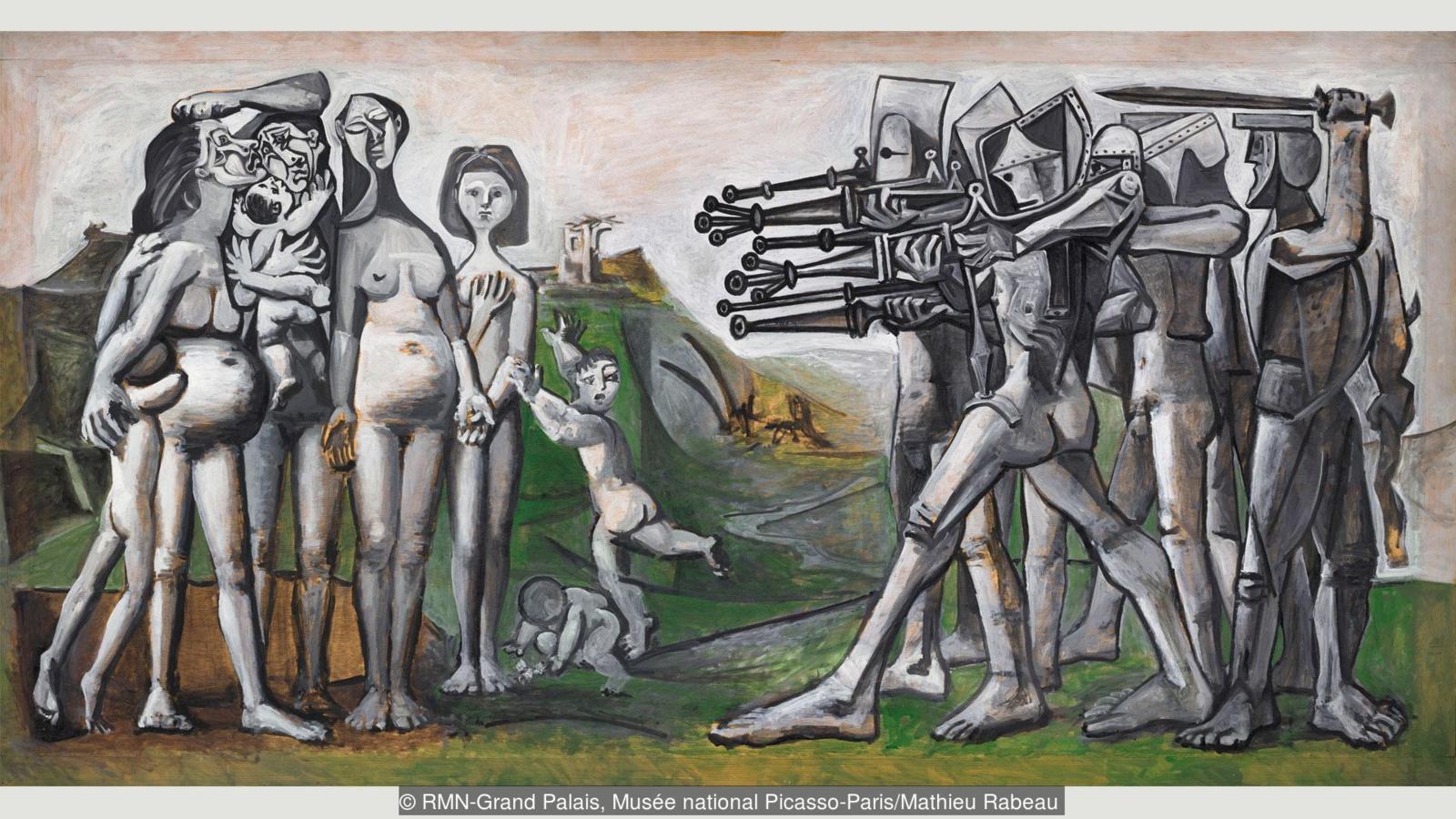

The Christmas story of a baby born in a manger is a familiar one. The Roman Empire, a police state in its own right, had ordered that a census be conducted. Joseph and his pregnant wife Mary traveled to the little town of Bethlehem so that they could be counted. There being no room for the couple at any of the inns, they stayed in a stable (a barn), where Mary gave birth to a baby boy, Jesus. Warned that the government planned to kill the baby, Jesus’ family fled with him to Egypt until it was safe to return to their native land. Yet what if Jesus had been born 2,000 years later. What if, instead of being born into the Roman police state, Jesus had been born at this moment in time? What kind of reception would Jesus and his family be given? Would we recognize the Christ child’s humanity, let alone his divinity?

Would we treat him any differently than he was treated by the Roman Empire? If his family were forced to flee violence in their native country and sought refuge and asylum within our borders, what sanctuary would we offer them?A singular number of churches across the country have asked those very questions in recent years, and their conclusions were depicted with unnerving accuracy by nativity scenes in which Jesus and his family are separated, segregated and caged in individual chain-link pens, topped by barbed wire fencing. Those nativity scenes were a pointed attempt to remind the modern world that the narrative about the birth of Jesus is one that speaks on multiple fronts to a world that has allowed the life, teachings and crucifixion of Jesus to be drowned out by partisan politics, secularism, materialism and war, all driven by a manipulative shadow government called the Deep State.

The modern-day church has largely shied away from applying Jesus’ teachings to modern problems such as war, poverty, immigration, etc., but thankfully there have been individuals throughout history who ask themselves and the world: what would Jesus do. What would Jesus—the baby born in Bethlehem who grew into an itinerant preacher and revolutionary activist, who not only died challenging the police state of his day (namely, the Roman Empire) but spent his adult life speaking truth to power, challenging the status quo of his day, and pushing back against the abuses of the Roman Empire—do about the injustices of our modern age.

“..the olden days, when service providers were generally focused on improving the quality of life of their customers..”

• Christmas Eve Cold Weather Brings Rolling Blackouts Along East Coast (CTH)

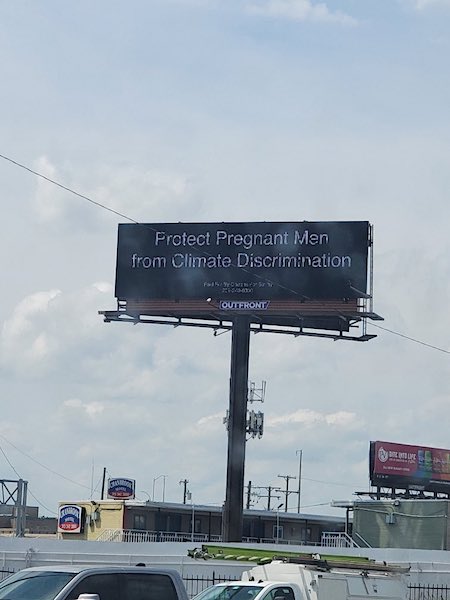

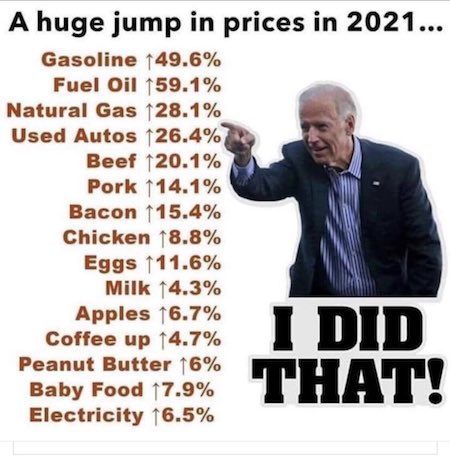

If you visit a local library, you may discover there was a time when the focus of electricity companies was to generate and provide the most dependable, efficient, lowest cost and critical power to customers who need electricity to live. Alas, those were in the olden days, when service providers were generally focused on improving the quality of life of their customers. In the modern era, the horrible carbon emitters, aka customers, have become the parasite to manage. People are now a problematic encumbrance blocking the high-minded climate and financial aspirations of the energy corporations. Heating, cooling and comfort? Get a grip Boomers and GenXer’s, those insufferably selfish indulgences were the priorities of yesteryear.

Yes Alice, as we try to peer through the looking glass, we discover it’s a mirror now. The reflection is the opposite of normal, the reflection is the world of pretending. Say hello to the modern Christmastime when you pray for coal in your stocking. From Pennsylvania and New Jersey, westward to Illinois and Ohio and all the way south into South Carolina, Tennessee, Georgia and beyond, power companies are turning off the electricity to preserve and equally distribute the minimal amount of energy they are able to generate. This my friends, is the “equitable distribution of misery.” How weird does it feel to see that generational prediction turning into reality?

TENNESSEE – […] The TVA began instructing local power companies to reduce power usage on Friday night, and some have instituted rolling blackouts in some cities such as Nashville, Tennessee. Some local power companies have also started using rolling blackouts after the TVA asked them to reduce power usage. PJM Interconnection, based in Pennsylvania, also asked companies within its system to conserve energy. The company asked residents to turn off non-essential lights, set their thermostats lower than usual, and not use major appliances like dishwashers and laundry machines, the AP reported. PJM covers areas in Delaware, Illinois, Indiana, Kentucky, Maryland, Michigan, New Jersey, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia and Washington, D.C, according to the AP.

“We are pro-Hungarian. We are on the side of the Hungarians in the Russian-Ukrainian war..”

• Peace In Ukraine Depends On Washington – Orban (RT)

The prospects of ending the Ukraine-Russia conflict are in the hands of the US, in its role as Kiev’s main backer, Hungarian Prime Minister Viktor Orban has said. “Ukraine can only fight as long as the US supports it with money and weapons,” Orban insisted in an interview with the Magyar Nemzet newspaper on Saturday. “If Americans want peace, there will be peace,” he stressed. Since the conflict in Ukraine broke out in late February, Washington has provided Kiev with billions of dollars in military and financial assistance, as well as with military intelligence. Deliveries of lethal aid have included sophisticated hardware such as HIMARS multiple rocket launchers, M777 howitzers, and combat drones. It was recently announced that the Ukrainian military will also receive Patriot air-defense systems.

Earlier this week, US President Joe Biden welcomed his Ukrainian counterpart Vladimir Zelensky to the White House, and pledged: “we will stay with you for as long as it takes.” Russia has long insisted that a “proxy war” is actually being waged against it in Ukraine by the US and NATO. Orban was also asked how he felt about Hungary being branded “pro-Russian” in the EU over its continued economic cooperation with Russia, criticism of the bloc’s anti-Moscow sanctions, and reluctance to send arms to Kiev. “We are pro-Hungarian. We are on the side of the Hungarians in the Russian-Ukrainian war,” the PM responded. Budapest wants Ukraine to stay sovereign and Russia not to pose a threat to Europe, but believes that severing all economic ties with Moscow goes against the country’s interests, he explained.

“The backing of Kiev has ultimately become one of the main reasons behind Draghi’s downfall..”

• Only Putin Can End Ukrainian Conflict – Draghi (RT)

Only Russian President Vladimir Putin is able to end the ongoing conflict between Moscow and Kiev, Italy’s former prime minister Mario Draghi believes. Russia, for its part, has repeatedly said it is open to talks, since negotiations with Kiev in Istanbul fell through in March. “The prospects for peace are difficult even if a lot has changed in the last period: the channels of communication are much more open and China seems to be more active in staging negotiations,” Draghi stated, in an exclusive interview with daily Corriere della Sera published Saturday. He added that it was still only up to the Russian leadership to end its offensive against Ukraine.

During his time in office, Draghi became one of the most vocal proponents of Ukraine in the West, sending in weaponry as well as rallying international support for the country. The backing of Kiev has ultimately become one of the main reasons behind Draghi’s downfall, as a disagreement over arms shipments caused a split in the Five Star Movement party, toppling his coalition government. Still, the former PM stood by his policies, claiming that his strong support of Ukraine has thwarted Russia’s plans, as Moscow has allegedly hoped for “ambiguity” in Rome. “I was aware of the strong past ties between Italy and Moscow, but we could not remain passive in the face of unmotivated aggression and systematic violations of international law and human rights,” Draghi stated.

“However, the Kremlin has so far shown that it does not want peace,” he went on. But it is only President Putin who can put an end to this bloodshed. Amid the ongoing conflict, he said, Moscow has repeatedly signaled readiness to negotiate with Ukraine but any talks must take Russia’s interests into account. Russia has also blamed the lack of any diplomatic effort to end the conflict on Kiev and on its willingness to continue the hostilities.

Moreover, top Ukrainian officials have repeatedly pledged to reconquer the formerly-Ukrainian regions of Donetsk, Lugansk, Kherson, and Zaporozhye – which formally joined Russia in early October – as well as Crimea, which has been part of Russia since a 2014 referendum. And Ukrainian president Vladimir Zelensky has formally ‘banned’ himself from negotiating with the Russian president altogether. The countries were on the verge of striking a peace deal after talks in Istanbul in late March. At that time they inked a proposed agreement, which would have given Ukraine international security guarantees in exchange for neutral status. Kiev pulled out of the talks soon afterwards, with Zelensky claiming that fresh evidence of war crimes allegedly committed by Russian troops had left him no other option. Moscow rejected the accusations, calling the evidence falsified.

I think he always has recognized reality.

• US Says Putin Finally “Acknowledging Reality” After 300 Days Of War (ZH)

The Biden administration has responded to a Thursday speech by Vladimir Putin wherein the Russian leader used the word “war” for the first time to refer to what for ten months he previously only called a “special military operation”. The State Department on Friday called on Putin to keep “acknowledging reality” and to pull his troops from Ukraine. “Since Feb. 24, the United States and rest of the world knew that Putin’s ‘special military operation’ was an unprovoked and unjustified war against Ukraine. Finally, after 300 days, Putin called the war what it is,” a State Department spokesperson said. “As a next step in acknowledging reality, we urge him to end this war by withdrawing his forces from Ukraine,” the US official added. The statement explained that regardless of Putin’s now apparent shift in terminology, it remains that “Russia’s aggression against its sovereign neighbor has resulted in death, destruction and displacement.”

“The people of Ukraine no doubt find little consolation in Putin stating the obvious, nor do the tens of thousands of Russian families whose relatives have been killed fighting Putin’s war,” the spokesperson said. Putin had said at a Thursday televised news conference: “Our goal is not to spin this flywheel of a military conflict, but, on the contrary, to end this war,” adding that “This is what we are striving for.” Putin’s unprecedented word choice of “war” came the day after Ukrainian President Zelensky visited Washington and met with President Biden, and gave an address before Congress, wherein he pledged “absolute victory”. Kremlin officials have throughout the invasion carefully avoided using the term “war” in describing the Ukraine invasion. US policymakers and defense officials have been forecasting a “very extended conflict” which could last “years” – and at the same time there seems little appetite for any level of dialogue or peace talks on either side.

“either waged wars against other countries or created conflicts, causing massive casualties and displacement of innocent civilians.”

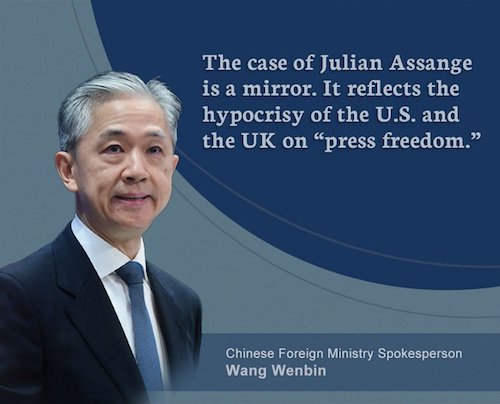

• China Calls US A ‘Direct Threat’ To The World (RT)

Washington intentionally hypes up the “China threat” as an exuse to boost its military spending in an effort to maintain its global dominance, the Chinese Defense Ministry said in a statement on Saturday, after President Joe Biden signed the 2023 US National Defense Authorization Act into law. “Facts have proved more than once that the US is the direct threat to the international order and the culprit of the regional turbulence,” said the ministry’s spokesman, Colonel Tan Kefei. The statement went on to claim that in pursuit of its selfish interests, the US on multiple occasions “either waged wars against other countries or created conflicts, causing massive casualties and displacement of innocent civilians.”

The $858-billion US military spending program for fiscal year 2023, which authorized $10 billion in security assistance and fast-tracked weapons procurement for Taiwan, is yet another in a series of provocative moves that “seriously jeopardize the peace and stability in Taiwan Straits and increase the risk of China-US military confrontation.” The Chinese People’s Liberation Army further vowed to “resolutely safeguard national reunification and territorial integrity of the country,” warning that Washington has no other choice but to “respect China’s core interests and major concerns.” The island of Taiwan has been self-governed since 1949, but never officially declared independence from Beijing, with China viewing it as part of its territory. Tensions between Beijing and Taipei have been high since the visit of US House speaker Nancy Pelosi to Taiwan in August. Washington must drop its “old trick of unilateral bullying” that it hands out to Beijing, Chinese Foreign Minister Wang Yi told US Secretary of State Antony Blinken in a phone call earlier this week. “It has not worked with China in the past, nor will it work in the future.”

“..it would be beneficial for both sides if the US gives up on its “Cold-War and zero-sum mentality”

• US Defense Act Is A ‘Political Provocation’ – China (RT)

The US National Defense Authorization Act hypes up the “China threat,” interferes in the country’s internal affairs and attacks the Chinese Communist Party, Beijing said on Saturday. The $858-billion military spending program for fiscal year 2023, signed into law by US President Biden on Friday, is “a serious political provocation against China,” that country’s foreign ministry pointed out in a statement. Beijing “deplores and firmly opposes” the new legislation, it added. The US defense act, which authorized $10 billion in security assistance and fast-tracked weapons procurement for Taiwan, is sending “a gravely wrong signal to ‘Taiwan independence’ separatist forces and severely affects peace and stability across the Taiwan Strait,” it said. The island of Taiwan has been self-governed since 1949, but never officially declared independence from Beijing, with China viewing it as part of its territory.

Tensions between Beijing and Taipei have been high since the visit of US House speaker Nancy Pelosi to Taiwan in August. “The US needs to stop seeking to use Taiwan to contain China, stop fudging, distorting and hollowing out the One-China principle, and stop moving even further down the wrong and dangerous path,” the ministry warned. Among other things, the bill also contained an amendment that restricted US government agencies from buying products that contain computer chips made by a specific group of Chinese companies. Beijing has urged Washington to refrain from implementing the “negative China-related sections” in the act or face “strong and resolute” counter-measures. According to the foreign ministry, it would be beneficial for both sides if the US gives up on its “Cold-War and zero-sum mentality” and develops a rational view on relations with China.

“Twitter had so much contact with so many agencies that executives lost track..”

• Twitter Files Thread: The Spies Who Loved Twitter (Taibbi)

After writing quite the pre-Christmas reflection Friday, night, Journalist Matt Taibbi has decided to grace us with a Christmas Eve edition of THE TWITTER FILES – which he says details “Twitter’s relationship to other government agencies – including some that don’t like to see their name in print much.”

2. It didn’t refute allegations. Instead, it decried “conspiracy theorists” publishing “misinformation,” whose “sole aim” is to “discredit the agency.”

3.They must think us unambitious, if our “sole aim” is to discredit the FBI. After all, a whole range of government agencies discredit themselves in the #TwitterFiles. Why stop with one?

4.The files show the FBI acting as doorman to a vast program of social media surveillance and censorship, encompassing agencies across the federal government – from the State Department to the Pentagon to the CIA.

5.The operation is far bigger than the reported 80 members of the Foreign Influence Task Force (FITF), which also facilitates requests from a wide array of smaller actors – from local cops to media to state governments.

6.Twitter had so much contact with so many agencies that executives lost track. Is today the DOD, and tomorrow the FBI? Is it the weekly call, or the monthly meeting? It was dizzying.

7.A chief end result was that thousands of official “reports” flowed to Twitter from all over, through the FITF and the FBI’s San Francisco field office.

8.On June 29th, 2020, San Francisco FBI agent Elvis Chan wrote to pair of Twitter execs asking if he could invite an “OGA” to an upcoming conference:

9.OGA, or “Other Government Organization,” can be a euphemism for CIA, according to multiple former intelligence officials and contractors. Chuckles one: “They think it’s mysterious, but it’s just conspicuous.”

10.“Other Government Agency (the place where I worked for 27 years),” says retired CIA officer Ray McGovern.

11. It was an open secret at Twitter that one of its executives was ex-CIA, which is why Chan referred to that executive’s “former employer.”

12.The first Twitter executive abandoned any pretense to stealth and emailed that the employee “used to work for the CIA, so that is Elvis’s question.”

“..the “government partners” were getting increasingly “aggressive” with their takedown requests..”

• CIA Pushed Twitter To Censor ‘Anti-Ukraine Narratives’ (RT)

The CIA, Pentagon and other US intelligence and law enforcement agencies, referred internally as OGA, were getting increasingly “more aggressive” with their takedown requests, effectively pushing the platform to engage in censorship of foreign policy stories that ran against the Washington-approved narrative, the latest trove of Twitter documents reveals.“The files show the FBI acting as doorman to a vast program of social media surveillance and censorship, encompassing agencies across the federal government – from the State Department to the Pentagon to the CIA,” journalist Matt Taibbi wrote in the Christmas Eve edition of the Twitter Files, released with a blessing from the company’s owner Elon Musk.

Among thousands of censorship requests flowing to Twitter from “Other Government Organizations” through the FBI’s Foreign Influence Task Force, many had nothing to do with purported “foreign meddling” and were linked to purely domestic issues. But when they had, Twitter executives often struggled to validate government claims, and were under constant pressure – but unable to find evidence to blame a foreign actor, Russia in particular. “Found no links to Russia,” an unnamed analyst said in one of the emails, further suggesting he could “brainstorm” to “find a stronger connection.” Former Trust and Safety chief Yoel Roth admitted he found “no real matches using the info” in another case. Internal communications show that Twitter had been getting so many requests that its executives lost track and had to improvise a system for prioritizing them.

The execs acknowledged it was “odd” how the feds apparently had dedicated personnel tasked with tailoring their takedown requests to Twitter’s policies for faster processing, but even then the company often struggled to find justification for censorship.“Many people wonder if Internet platforms receive direction from intelligence agencies about moderation of foreign policy news stories. It appears Twitter did, in some cases by way of the FITF/FBI,” Taibi wrote. At least some of these originated at the CIA, according to former agent and whistleblower, John Kiriakou, who said he “recognized the formatting.” The feds sometimes sent massive batches of over 1,000 accounts lined up for “digital execution,” with only a brief explanation of their alleged crimes. On multiple occasions they accused “Russian agents” of directing accounts that highlighted “predominantly anti-Ukraine narratives” or documented “purported rights abuses committed by Ukrainians.”

Another intelligence assessment sent to Twitter claimed that accounts spreading information about “neo-Nazis” in Ukraine were part of a Kremlin-controntrolled propaganda campaign and must be banned. In what Taibbi called a “damning admission,” an unnamed former CIA-turned-Twitter executive once noted that the “government partners” were getting increasingly “aggressive” with their takedown requests. “Due to a lack of technical evidence on our end, I’ve generally left it be, waiting for more evidence,” he said about one account. He further argued that since “BRICS is an inherently Russia-dominated economic organization” it was “always likely” that InfoBRICS was “directed by the Kremlin.” “Our window on that is closing, given that government partners are becoming more aggressive on attribution and reporting on it… I’m going to go ahead with suspension and marking the domain UNSAFE.”

“made many member-states reflect on the risks posed by cooperation with Washington in the military-biological area..”

• US Moving Bioweapons Research Out Of Ukraine – Moscow (RT)

After the operations of US-backed labs were uncovered in Ukraine, the Pentagon has been busy moving its bioweapons research to other countries, the head of Russia’s Nuclear Biological and Chemical Defense Troops has said. “The Pentagon is actively working to transfer its unfinished research projects to the countries in Central Asia and Eastern Europe,” Igor Kirillov insisted during a briefing on Saturday. The Americans have also been boosting cooperation with Cambodia, Singapore, Thailand, Kenya and some other nations in the Indo-Pacific and Africa, with “the US Department of Defense being most interested in countries that already possess laboratories with a high level of biocontainment”, he added.

According to the commander, data on illegal operations of US-backed laboratories in Ukraine was presented at the Organization for the Prohibition of Chemical Weapons conference, which took place in Geneva between November 28 and December 16. It included “documentary evidence that work with components of biological weapons and studies of pathogens of especially dangerous and economically significant infections had been carried out on the territory of Ukraine with financial, scientific, technical and personnel support of the US,” he noted. Papers obtained by Russia during its military operation in Ukraine reveal that “military-biological programs” have been performed by such organizations as Mechnikov Anti-Plague Research Institute in Kiev, Institute of Veterinary Medicine in Kharkov and Lviv-based Research Institute of Epidemiology and Hygiene, Kirillov said.

Those files also mentioned three Pentagon contractors and seven high-ranking officials of the US Department of Defense, he added. The full text of a report by the US Defense Threat Reduction Agency (DTRA) on its work in Ukraine, seen by the Russian military, contained data, “confirming the conduct of exercises and training activities with pathogens of especially dangerous infections” in Ukraine, Kirillov said. When the Pentagon released this report to the public, 80% of its content had been redacted, he pointed out. According to the Russian commander, the head of the American delegation at the conference declined to respond to Russia’s accusations of violations of the Chemical Weapons Convention (CWC) by his country.

“Such a stance by the US and its blocking of any initiatives to resume work on the verification mechanism of the CWC once again confirms that Washington has something to hide, and that ensuring transparency in terms of compliance with the convention doesn’t play into the hands of the Americans,” he said. However, the report by Russia didn’t go unnoticed by other countries and “made many member-states reflect on the risks posed by cooperation with Washington in the military-biological area,” Kirillov stressed. The Russian military has been gradually releasing materials on the work of the US-backed biolabs in Ukraine since March. Washington has denied Mocsow’s bioweapons claims, calling them disinformation and a conspiracy theory used by Russia to justify its military operation.

“..our gas is in demand, it is cheap, we have large reserves, and we will develop these areas..”

• Russia To Divert Gas Away From West – Official (RT)

Russian gas is still in high demand in the EU despite the bloc’s latest sanctions on the country’s energy exports, but Moscow intends to divert trade flows elsewhere, Deputy Prime Minister Aleksandr Novak said on Friday. In an interview with the Russia24 channel, he noted that European “colleagues are constantly asking us to increase supplies” via existing infrastructure such as the TurkStream or Blue Stream pipelines and the Ukrainian gas transportation system, adding that the European market remains relevant for Russia. But, given the current “political mood” in the EU to curb its dependence on Russian gas, Moscow is looking at other markets to redirect supplies, the official noted. “Because our gas is in demand, it is cheap, we have large reserves, and we will develop these areas,” he added.

Russia will diversify trade flows by boosting liquefied natural gas (LNG) supplies and pipeline gas deliveries to China, making Asia one of its key directions, Novak said, adding that the country has beefed up LNG production more than threefold. “If earlier only 11 million tons [of LNG] were produced in Russia, today there are already four plants operating, with a total capacity of 36 million tons,” the minister stressed. In the next three or four years Russia is set to boost LNG production to 60 million tons and then bring the figure up to 100 million tons annually, Novak projected. He also reminded his interviewer that along with growing supplies via the Power of Siberia pipeline, Russia and China have an agreement to build gas infrastructure with a capacity to deliver an additional ten billion cubic meters annually.

No gas? No problem!

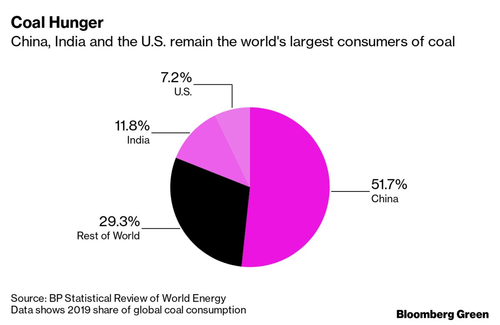

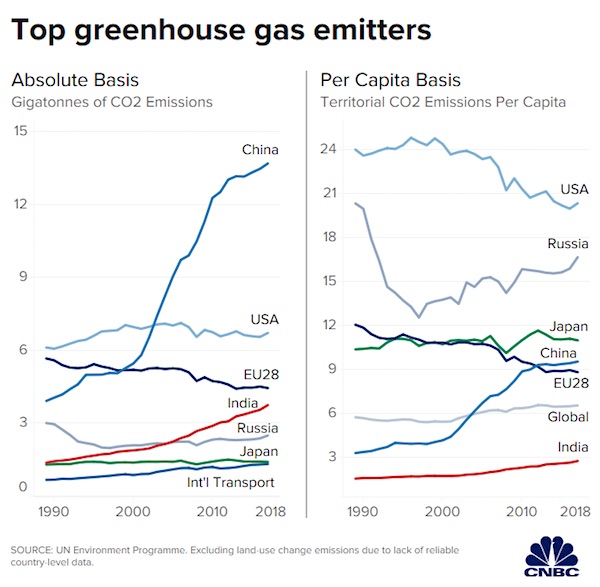

• German Coal Consumption Soars – Bloomberg (RT)

Energy shortages and surging power prices have pushed Germany to boost coal use despite the country’s commitment to fighting climate change, Bloomberg reported on Thursday. To keep the lights on, Europe’s largest economy is now burning coal at the fastest pace in at least six years, despite the government’s ambitions to phase out the fossil fuel. According to Bloomberg, Germany will be one of the few countries to increase coal imports next year. Facing the dilemma of whether to cut carbon emissions or guarantee energy security in the country, Germany opted for the latter and reopened a number of coal plants. The International Energy Agency said in a recent report that most countries are using “a limited amount of coal power capacity” and “only in Germany, with 10 gigawatts, is the reversal at a significant scale.”

Coal consumption in the country has surged at times this month, bringing it to pollution levels comparable to those in South Africa and India, Bloomberg said, citing Electricity Maps data. According to the Federal Statistical Office (Destatis), the country now produces more than one third of its electricity from coal-fired plants. Power generation using coal was up 13.3% in the third quarter compared to the previous year, data shows. “Coal is coming back as a baseload generator,” founder and director of Perret Associates energy consultancy Guillaume Perret said, adding that the commodity will be less seasonal than it has been “with more coal-burning in summer, spring and autumn, as long as coal remains so much in the money versus gas and there remains a gas shortage.”

While the deficit of natural gas in Germany is one reason for reviving coal, another is the growing demand in France, where power generation was disrupted by nuclear reactor outages. This year, Germany may become a net exporter of electricity to France for the first time since at least 1990, according to Destatis. It is likely that Germany will have to suspend the government’s planned closure of the most polluting power plants by at least nine months and keep them operational until the end of 2024, Perret said.

Thought police.

• Without a Hope or a Prayer (Turley)

This week, the arrest of British Catholic woman for ‘praying’ outside an abortion clinic has attracted international attention. However, the jailing of Isabel Vaughan-Spruce, director of anti-abortion group March for Life UK, is neither surprising nor particularly rare as a denial of free speech in Great Britain. While this form of “protest” is uncommon as the basis for an arrest, free speech has been in a free fall in the UK for years. It is also a cautionary tale for those in the United States, which is facing arguably the largest anti-free speech movement in its history.Pictures from Birmingham show Vaughan-Spruce, 45, simply standing near the abortion clinic silently praying when an officer confronts her. She was not blocking access or displaying any protest signs or material.

Nevertheless, she was arrested, jailed, interrogated, and ultimately charged with four counts of violating the abortion clinic “buffer zone.” According to reports, the West Midlands Police officer asked her “are you praying?” She responded “I might be praying in my head, but not out loud.” That was it. She was arrested for praying “in her head” near an abortion clinic.A recent order from September 7 made clear that praying near an abortion clinic is now a criminal act in the country. The Birmingham City Council order says that prohibited acts includes “but is not limited to graphic, verbal or written means, prayer or counselling.”Various individuals heralded the arrest. Dr. John Michael Leslie went on Twitter to declare “No, you’re in violation of it you repeatedly harass women going to a Family Planning Clinic who might be asking for Abortion Advice.

“Praying in her head” is the spin from her supporters.”However, legally, that is itself a dangerous pin. She was not arrested for past conduct but her current conduct, which was praying in her head.Another poster objected that “It’s so obvious she’s martyring herself in the glare of the public as a way of publicising her beliefs, she knowingly went into that area to get arrested. You must think we’re all crackers.” Indeed, though “crackers” does not quite capture the free speech crisis in the UK. This is not the first thought crime prosecuted in the country.

Last year, Nicholas Brock, 52, was convicted of a thought crime in Maindhead, Berkshire. The neo-Nazi was given a four-year sentence for what the court called his “toxic ideology” based on the contents of the home he shared with his mother in Maidenhead, Berkshire. While most of us find Brock’s views repellent and hateful, they were confined to his head and his room. Yet, Judge Peter Lodder QC dismissed free speech or free thought concerns with a truly Orwellian statement: “I do not sentence you for your political views, but the extremity of those views informs the assessment of dangerousness.”

“..hire almost 100 temporary government lawyers to help prosecute January 6 protesters, a caseload now nearing 1,000 Americans with promises to add another 1,000 more..”

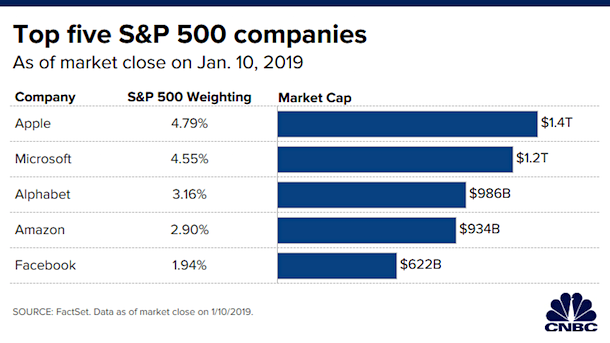

Zelenskyy, always in character, couldn’t even manage to wear a proper suit. His attire, of course, didn’t matter as long as his costume had lots of pockets. Zelenskyy is set to receive $47 billion more in U.S. tax dollars when those same slobbering lawmakers pass a $1.7 trillion government spending bill this month—bringing Zelenskyy’s total grab to $100 billion and counting. The omnibus package itself is one insult after another to the American people. As Rep. Dan Bishop (R-N.C.) detailed in a December 20 tweet thread, generous funding to secure the borders of other countries is included in the bill with little more than crumbs to protect our southern border, now dangerously wide open to human smugglers and drug runners. Billions more will be spent to promote gender equity, fight “structural racism,” expand access to abortion, and construct buildings and parks named after House Speaker Nancy Pelosi, retiring Senator Richard Shelby (R-Ark.) and former First Lady Michelle Obama among others.

Perhaps the most outrageous provision in the bill is a hefty budget hike for the Department of Justice. Attorney General Merrick Garland, who spends the majority of his time and resources targeting Donald Trump, his associates, and his supporters, will receive a nearly 10 percent raise next year, bringing the Justice Department’s annual budget to $38.7 billion. More than $212 million is earmarked to hire almost 100 temporary government lawyers to help prosecute January 6 protesters, a caseload now nearing 1,000 Americans with promises to add another 1,000 more. The Federal Bureau of Investigations will get $569 million more next year as that agency’s budget exceeds $11 billion for the first time. Garland and FBI Director Christopher Wray have made it clear by word and deed that the imaginary threat of “domestic violent extremists,” i.e., those who dare to criticize the regime will remain their top priority.

This means more predawn FBI raids of Capitol “trespassers,” more indefinite incarceration for those awaiting trial, more prison sentences for nonviolent offenses, more misery, and more destruction of Constitutional rights. And that’s just fine with the overwhelming majority of Republicans in Washington who’ve been silent in the face of this unprecedented form of government retaliation against Trump supporters. In fact, outgoing Senator Roy Blunt (R-Miss.) explained that the Justice Department really needed the big funding boost. “I’ve always been for prosecuting anybody who violated the law on January the 6th,” Blunt told NBC News this week. “And there are, like, 800 cases already. So I can’t imagine that they don’t need some extra money.”

The FBI, particularly in light of recent revelations of the bureau’s collusion with Big Tech to suppress coverage of Hunter Biden’s laptop and criticism of mail-in voting, should be dismantled and defunded, not rewarded for its interference in two presidential elections among other malfeasance. Nor should the agency receive $375 million in capital funding to build a shiny new headquarters in either Virginia or Maryland as the bill also provides.But that didn’t stop 18 Republican senators, including McConnell and two-time presidential loser Mitt Romney, from voting to pass the omnibus bill on Thursday. Another “yes” vote was from Senator Lindsey Graham (R-S.C.), the former chair of the Senate Judiciary who promised for years to “get to the bottom” of numerous Justice Department scandals.

“The reason there wasn’t a proper security presence on that day goes right to the speaker’s staff and the speaker’s office..”

• GOP Wants Pelosi to Testify Before Jan. 6 Committee (CB)

House Speaker Nancy Pelosi (D-Calif.) will be forced to relinquish her gavel to Republicans early next month after the GOP won a majority in the chamber during the midterm elections last month. But a pair of GOP lawmakers want her to answer some questions — presumably under oath — before a committee she created ostensibly to investigate the Jan. 6, 2021, riot at the U.S. Capitol Building. “The reason there wasn’t a proper security presence on that day goes right to the speaker’s staff and the speaker’s office,” Rep. Jim Jordan (R-Ohio) told Just the News Wednesday after the release of the House Republicans’ report detailing the security failures that led to the breach of the Capitol. “As you go back and look at the communications, there’s this pattern that develops where the Sergeant of Arms is meeting with Pelosi’s staff,” Jordan, the incoming House Judiciary Committee chairman, noted further.

“Many of those meetings, Republican staff wasn’t allowed to be there, but they had this pattern where everything had to run through her office, her staff, before the Sergeant of Arms could make a decision.” In a separate interview with the outlet, Rep. Troy Nehls (R-Texas) said that the National Guard was delayed in arriving at the Capitol on Jan. 6 because then-Sergeant at Arms Paul Irving was waiting to hear from Pelosi on the matter. “It’s almost like there were individuals within the current administration that wanted this to happen,” Nehls said. “All the intelligence was there, and what did they have? What did they have? They had bicycle racks. … A bicycle rack couldn’t keep your cat in your yard.” The two lawmakers are among five House Republicans who released the GOP report, which offered substantially more detail about events that day and leading up to it than have been noted or released by Pelosi’s Democrat-run committee.

Nehls made reference to some texts from Irving corroborating accounts that some U.S. Capitol Police officers ushered protesters into the Capitol Building, noting: “The American people aren’t hearing any of this from the sham [Jan. 6] committee.” The Texas lawmaker also said that a former D.C. National Guard commander told him that had Guard troops been deployed when police asked for assistance on Jan. 4, the riot would have “never, ever happened.” “And Nancy Pelosi. You do have questions you need to answer … Nancy, we’ll get you, and we’ll fly you back from Italy once you’re the ambassador,” Nehls said, making reference to earlier reports that President Biden will offer the U.S. Ambassador to Italy post to Pelosi, who is 82. The GOP report, in addition to Pelosi and her staff, also cited the USCP Intelligence and Interagency Coordination Division for ignoring or refusing to act on intelligence indicating there was a need for greater security due to politics, bureaucracy, and the “misplaced priorities of their leadership.”

Box jellyfish

https://twitter.com/i/status/1606472250206699521

Swim tigers

https://twitter.com/i/status/1606696483470086146

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.