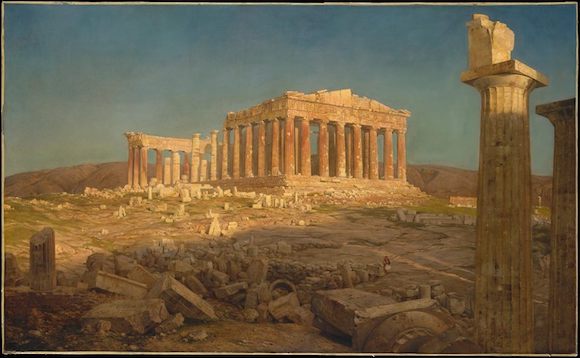

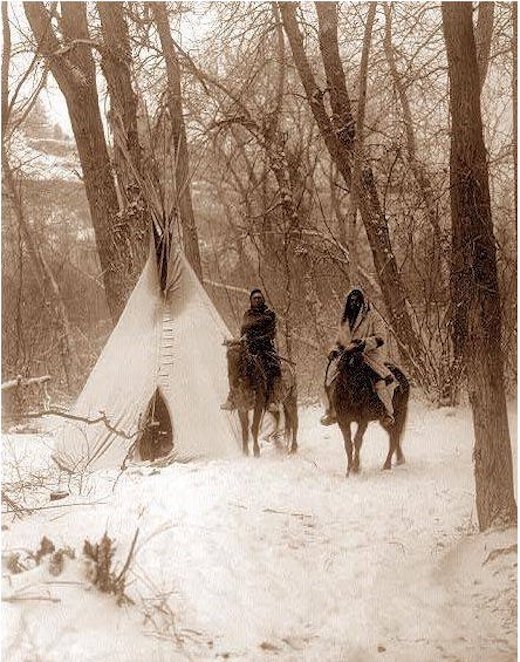

Edward S. Curtis Tipi in the snow 1908

“The United States can pay any debt it has because it can always print money to do that, so there is zero probability of default.”

• Social Security Can Never Run Out Of Money – Just Ask Alan Greenspan (BI)

I asked Kelton why, given her counterintuitive argument that deficits don’t really matter, Americans should take her word for it. Her reply: Don’t. Instead, listen to what Alan Greenspan, the prominent Republican former Federal Reserve chairman who is a purported deficit hawk, had to say on the matter. In March 2005, he was pressed by a young congressman named Paul Ryan about the need for privatizing Social Security because of the prospect of a looming “entitlements crisis.” Greenspan replied rather bitingly that there was no such thing or even a remote possibility. “I wouldn’t say that the pay-as-you-go benefits are insecure in the sense that there’s nothing to prevent the federal government to create as much money as it wants and pays it to somebody,” Greenspan told an incredulous Ryan. “The question is how do you set up a system that assures that the real assets are created which those benefits are employed to purchase.

So it’s not a question of security — it’s a question of the structure of the financial system.” That’s what Democrats should be saying, rather than regurgitating the old Republican rouse — which even the GOP is willing to abandon when it’s convenient — about a looming government debt crisis that never comes. “Instead of repeating talking points that reinforce the idea that Social Security is somehow financially unsustainable, Democrats should play Greenspan’s remarks on a loop. They should call attention to what Greenspan said — under oath — about the program’s long-term sustainability,” Kelton said. “Instead of accepting the premise that Social Security is in trouble, Democrats should accept Greenspan’s challenge — put forward an agenda that will do more to promote future growth than anything the Republicans are offering.”

The financial crisis was instructive on this count. Many critics of both the federal government’s fiscal stimulus and the Federal Reserve’s bond purchases worried that the country was getting so deep into debt that one of two things was bound to happen: a crisis in the Treasury market or a bout of runaway inflation. Nine years into the recovery, Treasury yields remain near historic lows and inflation is not only contained but remains worryingly low. That last point is key: It’s not that folks like Kelton and Baker believe there is no risk to government spending. They simply argue that the only risks are the misallocation of resources and inflation — not some amorphous “debt crisis” or default of the sort some politicians and market analysts have shouted about.

Unlike Greece, which actually did default on its debt because of a lack of control over its own currency, the US could default only by choice. Trump flirted with that choice once as a candidate — but quickly backed away from the threat after he realized the catastrophic market and economic consequences such a debacle would have. In August 2011, after the US’s credit rating was downgraded for the fist time following a prolonged impasse over the US debt ceiling, Greenspan was asked during a “Meet the Press” interview about the issue of “unfunded liabilities” and “entitlements.” His response again spoke volumes: “The United States can pay any debt it has because it can always print money to do that, so there is zero probability of default.”

Read more …

Quite a reversal. Brazile was fired from CNN a year ago when it was discovered she fed the Clinton campaign debate questions. Still, what a mess. Will they clean it up or try to ignore?

• Inside Hillary Clinton’s Secret Takeover of the DNC (Donna Brazile)

When I got back from a vacation in Martha’s Vineyard I at last found the document that described it all: the Joint Fund-Raising Agreement between the DNC, the Hillary Victory Fund, and Hillary for America. The agreement—signed by Amy Dacey, the former CEO of the DNC, and Robby Mook with a copy to Marc Elias—specified that in exchange for raising money and investing in the DNC, Hillary would control the party’s finances, strategy, and all the money raised. Her campaign had the right of refusal of who would be the party communications director, and it would make final decisions on all the other staff. The DNC also was required to consult with the campaign about all other staffing, budgeting, data, analytics, and mailings. I had been wondering why it was that I couldn’t write a press release without passing it by Brooklyn. Well, here was the answer.

When the party chooses the nominee, the custom is that the candidate’s team starts to exercise more control over the party. If the party has an incumbent candidate, as was the case with Clinton in 1996 or Obama in 2012, this kind of arrangement is seamless because the party already is under the control of the president. When you have an open contest without an incumbent and competitive primaries, the party comes under the candidate’s control only after the nominee is certain. When I was manager of Gore’s campaign in 2000, we started inserting our people into the DNC in June. This victory fund agreement, however, had been signed in August 2015, just four months after Hillary announced her candidacy and nearly a year before she officially had the nomination.

I had tried to search out any other evidence of internal corruption that would show that the DNC was rigging the system to throw the primary to Hillary, but I could not find any in party affairs or among the staff. I had gone department by department, investigating individual conduct for evidence of skewed decisions, and I was happy to see that I had found none. Then I found this agreement. The funding arrangement with HFA and the victory fund agreement was not illegal, but it sure looked unethical. If the fight had been fair, one campaign would not have control of the party before the voters had decided which one they wanted to lead. This was not a criminal act, but as I saw it, it compromised the party’s integrity.

Read more …

We’ll go with Danielle DiMartino Booth for now. Powell’s no PhD, and not a Yellen clone. But he’s been at the Fed for 5 years already, which doesn’t make him an obvious agent for change.

• Jay Powell – A Quiet Leader (DDMB)

The sheer breadth of Powell’s experience is refreshing compared to what we’ve had for the past 30 years. Powell has a deep understanding of the law and politics. He worked in the Treasury Department under Nicholas Brady and was confirmed as Undersecretary of the Treasury under George H.W. Bush. His background in politics and the experience he has had at the Fed thus far have prepared him well for his role as liaison to Congress and the White House. Powell’s experience as an investment banker was critical in his carrying out the investigation and sanctioning of Salomon Brothers. Understanding the entirely different type of politics that exists in big banks will bode well for his capacity to regulate the banks. This attribute especially will dilute the power traditionally exerted by the NY Fed in recent years, a District that has a long history of conflicts of interest vis-à-vis the banks it regulates.

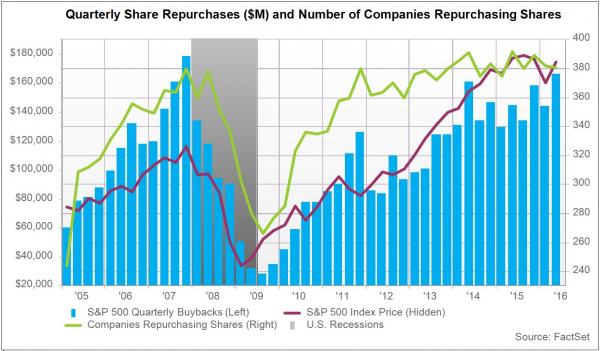

A stronger regulator as Fed chair in the years leading up to the financial crisis. At the Carlyle Group, Powell founded and ran the Industrial Group within the Buyout Fund. A separate missing characteristic among Fed leaders for the past 30 years has been a woeful lack of understanding as to how Fed policy effects corporations and the decisions CEOs and CFOs make driven by Fed policy, the most obvious of which has been debt-financed share buybacks at the expense of capital expenditures. Some in the media have questioned Powell’s being the wealthiest individual at the Fed. That is an extremely strong attribute. In his work between 2010 and 2012 at a bipartisan think tank, Powell worked for a salary of $1 per year to carry out his mission to raise the debt ceiling. His wealth affords him the luxury of having no preset agenda. His history of working for his country to its best end exemplifies that he is at the Fed because he truly believes he is doing a greater good in servicing his country.

Powell’s work on Too Big to Fail banks also speaks to his ability to be independent and objective in his approach to regulating big banks with deep-pocketed lobbyists who hold huge sway over politicians. If he is willing to go up against the biggest banks, he will hopefully prove to be a leader cast in the mold of William McChesney Martin, the longest serving Fed Chairman famous for testifying to Congress that it was the Fed’s job to take away the punch bowl just as the party gets going. [..] His experience in the financial markets suggests he will be less apt to keep rates too low for too long as has been the case with his three predecessors. Powell was not in favor of the third round of QE, but voted for its nevertheless. This is his biggest black eye and why market participants perceive him to be as dovish as they do.

Read more …

Savings and pensions need higher rates, fast. But…

• Why Would Anyone Want The Fed Job? (Crudele)

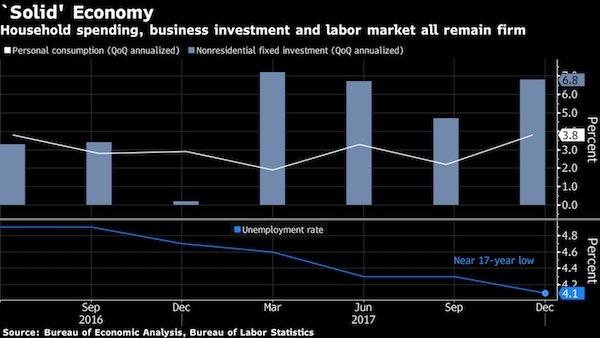

No matter who is appointed, the next Fed chairman has a problem. Right now, the economy is looking healthy. The stock market is booming. Consumer confidence is high. Home prices are soaring. And some economic indicators seem to say, “Happy days are here again.” Just Wednesday, for instance, the Atlanta Federal Reserve raised its forecast for economic growth in the fourth quarter to a booming 4.5% annual rate. The nation’s gross domestic product, the standard for measuring economic growth, rose at a healthy 3% annual rate in the third quarter. That 3% figure was puzzling because hurricanes should have stunted growth, which means that number might be revised downward once better-quality statistics come in.

Or it could mean that growth is darn good, despite the weather. Nevertheless, the 4.5% estimate for the fourth quarter — on top of the 3% growth in the July to September quarter — is going to force whoever ends up running the Fed to seriously consider raising interest rates faster than usual. But that’s where it gets tricky. Once rates increase, the economy could slow because borrowing costs will rise for both consumers and companies. When the cost of borrowing money increases, people and companies tend to cut back on spending. But there’s another possible twist that could complicate the job of the next Fed boss even more. The relatively impressive growth in the third-quarter GDP and the even better performance in the fourth quarter could turn out to be another fake-out.

The GDP, for instance, rose by a 4.6% annual rate in the second quarter of 2014 and by a 5.2% rate in the third quarter of that year, only to collapse back to subpar growth in the next eight quarters. Also, the New York Fed, which is more influential, doesn’t agree with the Atlanta Fed. It had current GDP at closer to 3%. With all that’s going on, why would anyone want the Fed job?

Read more …

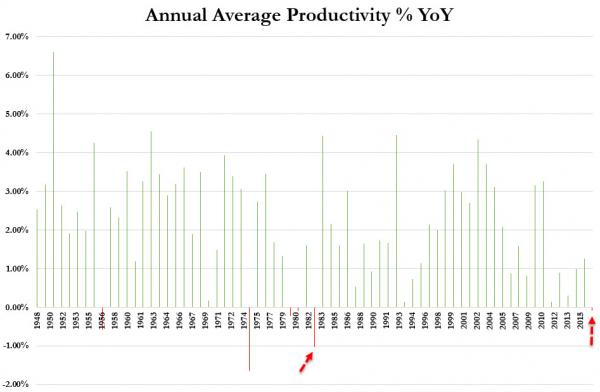

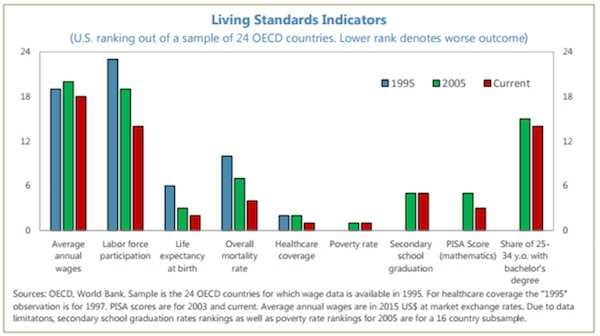

When anyone tells you the economy has recovered, show them any of these graphs.

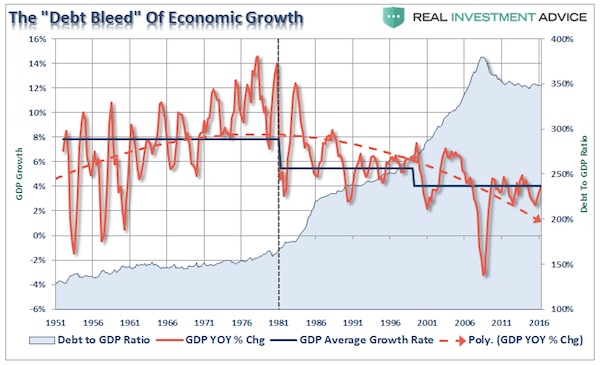

• The Borrower Is The Slave To The Lender (Lance Roberts)

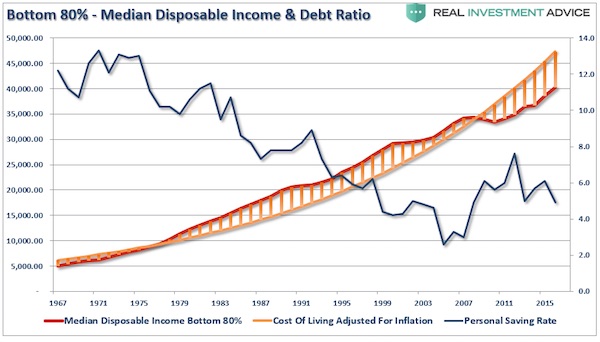

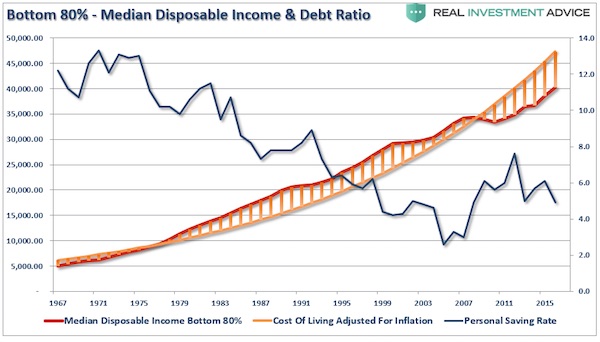

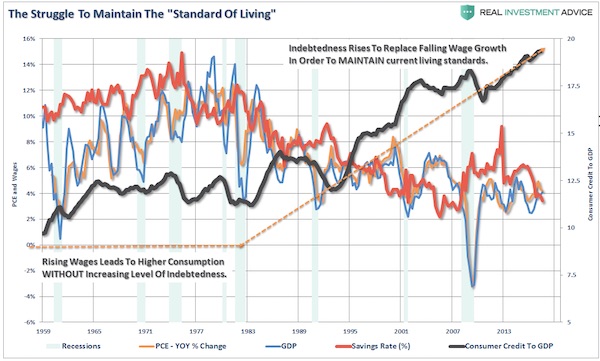

Despite the bullish economic optics, the reality for the majority of Americans is they simply have not yet recovered from the financial crisis. As the chart below shows, while savings spiked during the financial crisis, the rising cost of living for the bottom 80% has outpaced the median level of “disposable income” for that same group. As a consequence, the inability to “save” has continued.

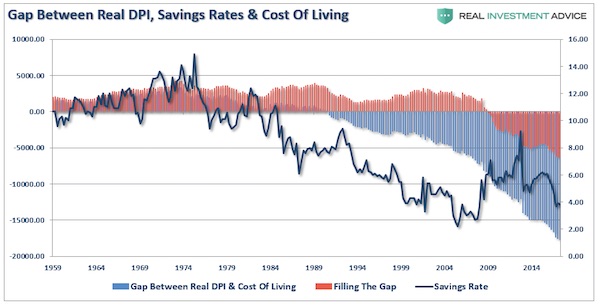

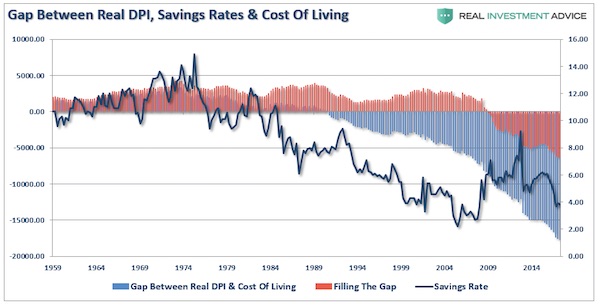

I discussed previously the problem of rising debt. Beginning in 1990, the gap between the “standard of living” and real disposable incomes went negative with the resultant “gap” filled through the use of debt. However, since the financial crisis, this has no longer been the case. I modified the previous chart with the savings rate which tells the same story, as the cost of living began outpacing incomes the difference came from savings, and a continuous increase in debt. Again, despite the temporary uptick in the savings rate following the financial crisis, the real cost of living continues to erode the middle class.

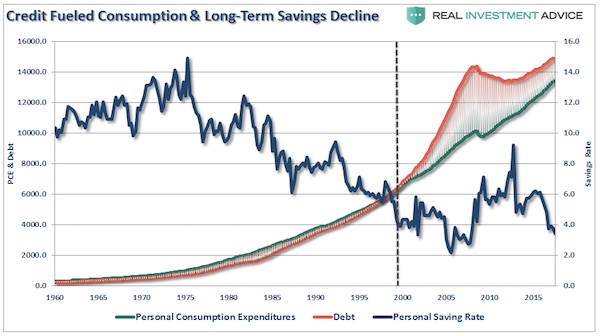

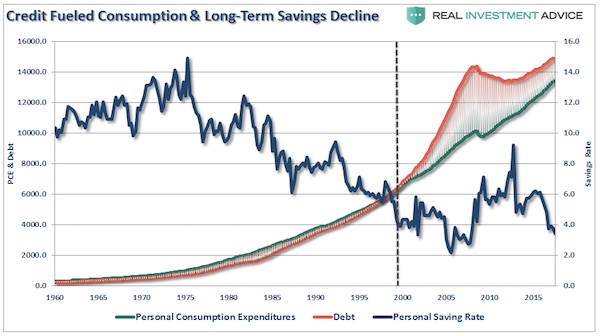

You can see the erosion of the savings rate more clearly when you look at the rate of Personal Consumption Expenditure (PCE) growth as compared to debt growth. As spending and debt accelerated, the savings rate declined. More importantly, in 2000 the growth rate of debt sharply accelerated above PCE growth. This debt-fueled consumption, however, has not led to stronger rates of economic growth.

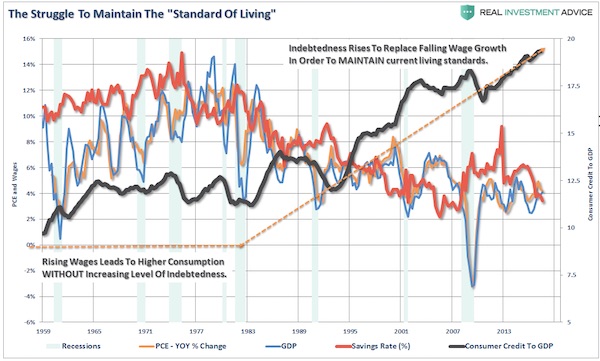

Debt is a negative thing for the borrower. It has been known to be such a thing even in biblical times as quoted in Proverbs 22:7: “The borrower is the slave to the lender.” Debt acts as a “cancer” on an individual’s wealth as it siphons potential savings from income as those funds are diverted to debt service. Rising levels of debt means rising levels of debt service which reduces actual disposable personal incomes that could be saved or reinvested back into the economy. The mirage of consumer wealth has been a function of surging debt levels. “Wealth” is not borrowed but “saved” and as shown in the chart below, this is a lesson that too few individuals have learned. The reality is that since “savings” are the cornerstone of economic growth longer-term, as savings provide for productive investment and lending, it should be of NO surprise that, as shown in the next chart, there is a very high correlation between the savings rate, GDP, and PCE.

Read more …

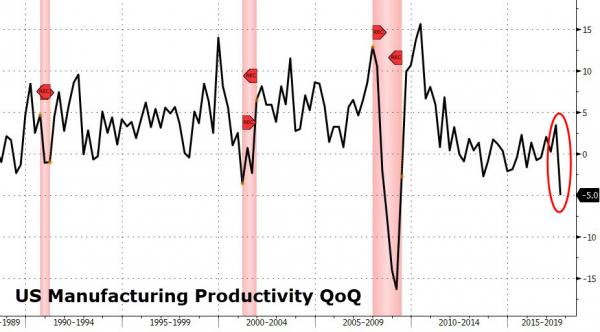

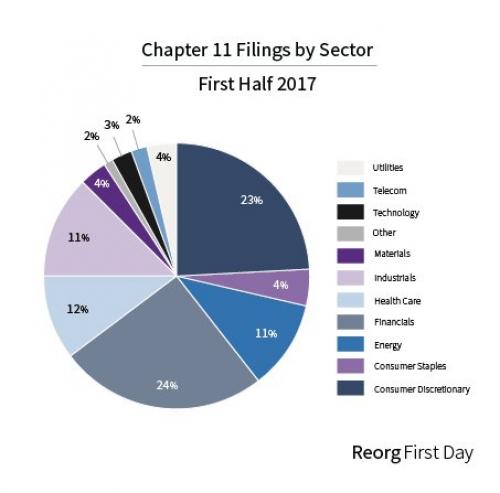

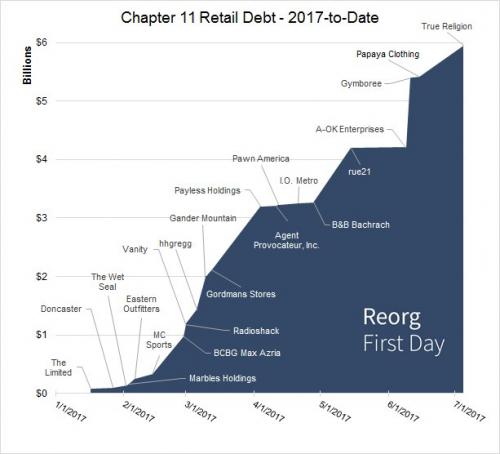

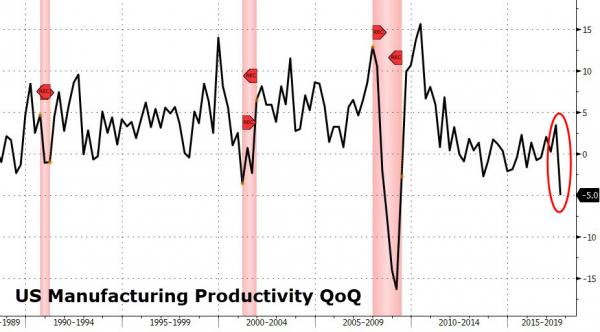

What happens when you don’t make stuff anymore.

• US Manufacturing Worker Productivity Crashes Most In 8 Years (ZH)

US worker productivity rose at 3.0% QoQ in Q3 – the best since 2014.

Unit labor costs rose at 0.5% annualized rate in Q3 (est. 0.4%) following 0.3% pace in Q2. Output rose at a 3.8% rate following 3.9%. Hours worked rose at a 0.8% pace after 2.4%. The latest figure compares with a 1.2% average over the period spanning 2007 to 2016. Weak productivity helps explain why companies are reluctant to raise workers’ wages, even as profit margins have improved. However, among manufacturers, productivity crashed 5% QoQ – the biggest drop since Q1 2009, when the economy was in recession – after rising 3.4% in Q2. Let’s hope that is storm-related.

Read more …

Insert your opinion here: “From what we can identify, the only reason today to buy or sell bitcoin is to make money, which is the very definition of speculation and the very definition of a bubble,..”

• Bitcoin Is the ‘Very Definition’ of a Bubble – Credit Suisse CEO (BBG)

The speculation around bitcoin is the “very definition of a bubble,” Credit Suisse CEO Tidjane Thiam said as the currency exceeded $7,000 for the first time. “From what we can identify, the only reason today to buy or sell bitcoin is to make money, which is the very definition of speculation and the very definition of a bubble,” he said at a news conference in Zurich Thursday. He added that in the history of finance, such speculation has “rarely led to a happy end.” The digital currency got new impetus this week after CME, the world’s largest exchange owner, said it plans to introduce bitcoin futures by the end of the year, citing pent-up demand from clients. That pushes bitcoin closer to the mainstream by making it easier to trade without the hassles of owning bitcoin directly. Other bankers are also sounding warnings about the currency.

JPMorgan Chase CEO Jamie Dimon has called bitcoin “a fraud” that will eventually blow up. UBS Chairman Axel Weber said last month that bitcoin has no “intrinsic value” because it’s not secured by underlying assets. Bankers also are steering clear of bitcoin for fear that criminals could use its anonymity to hide their activities, Thiam said. “Most banks in the current state of regulation have little or no appetite to get involved in a currency which has such anti-money laundering challenges,” he said. While bitcoin remains a no-go with the industry, banks are racing to develop blockchain, the technology underpinning the currency. Thiam said blockchain may have many applications in banking. Credit Suisse is among more than 100 banks are working within the R3, a consortium created to find ways to use blockchain as to track money transfers and other transactions.

Read more …

It’s by design, and that remains worrisome.

• One Bitcoin Transaction Now Uses as Much Energy as Your House in a Week (MBV)

Bitcoin’s incredible price run to break over $6,000 this year has sent its overall electricity consumption soaring, as people worldwide bring more energy-hungry computers online to mine the digital currency. An index from cryptocurrency analyst Alex de Vries, aka Digiconomist, estimates that with prices the way they are now, it would be profitable for Bitcoin miners to burn through over 24 terawatt-hours of electricity annually as they compete to solve increasingly difficult cryptographic puzzles to “mine” more Bitcoins. That’s about as much as Nigeria, a country of 186 million people, uses in a year. This averages out to a shocking 215 kilowatt-hours (KWh) of juice used by miners for each Bitcoin transaction (there are currently about 300,000 transactions per day).

Since the average American household consumes 901 KWh per month, each Bitcoin transfer represents enough energy to run a comfortable house, and everything in it, for nearly a week. On a larger scale, De Vries’ index shows that bitcoin miners worldwide could be using enough electricity to at any given time to power about 2.26 million American homes. Expressing Bitcoin’s energy use on a per-transaction basis is a useful abstraction. Bitcoin uses x energy in total, and this energy verifies/secures roughly 300k transactions per day. So this measure shows the value we get for all that electricity, since the verified transaction (and our confidence in it) is ultimately the end product. Since 2015, Bitcoin’s electricity consumption has been very high compared to conventional digital payment methods. This is because the dollar price of Bitcoin is directly proportional to the amount of electricity that can profitably be used to mine it.

As the price rises, miners add more computing power to chase new Bitcoins and transaction fees. It’s impossible to know exactly how much electricity the Bitcoin network uses. But we can run a quick calculation of the minimum energy Bitcoin could be using, assuming that all miners are running the most efficient hardware with no efficiency losses due to waste heat. To do this, we’ll use a simple methodology laid out in previous coverage on Motherboard. This would give us a constant total mining draw of just over one gigawatt. That means that, at a minimum, worldwide Bitcoin mining could power the daily needs of 821,940 average American homes. Put another way, global Bitcoin mining represents a minimum of 77KWh of energy consumed per Bitcoin transaction.

Even as an unrealistic lower boundary, this figure is high: As senior economist Teunis Brosens from Dutch bank ING wrote, it’s enough to power his own home in the Netherlands for nearly two weeks. As goes the Bitcoin price, so goes its electricity consumption, and therefore its overall carbon emissions. I asked de Vries whether it was possible for Bitcoin to scale its way out of this problem. “Blockchain is inefficient tech by design, as we create trust by building a system based on distrust. If you only trust yourself and a set of rules (the software), then you have to validate everything that happens against these rules yourself. That is the life of a blockchain node,” he said via direct message.

Read more …

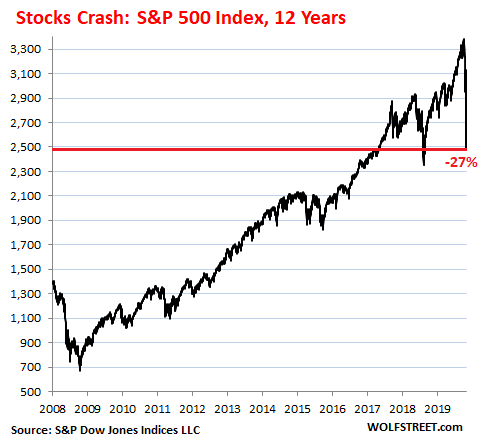

“Earnings are likely to fall short of expectations, which can lead to a correction. Once that happens, multiples can shrink as well. Soon you’re in a full-scale bear market with stock prices down 20% or more.”

• The Hidden Danger Bulls Are Missing (Rickards)

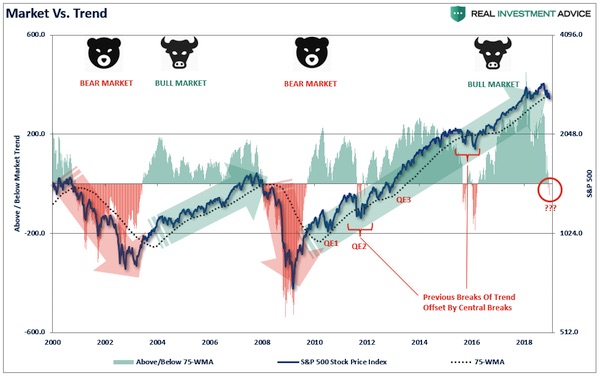

Bull markets in stocks seem unstoppable right up until the moment they stop. Then comes a rapid crash-and-burn phase. Is there ever any warning that a collapse is about to happen? Of course there is. Analysts warn about it all the time and provide mountains of data and historical evidence to back up their analysis. The problem is that everyone ignores them! You can talk about the dangers represented by CAPE ratios, margin levels, computerized trading, persistent low volatility and complacency all you want, but nothing seems to slow down this bull market. Yet there is one thing that can stop a bull market in its tracks, and that’s corporate earnings. The simplest form of stock market valuation is to project earnings, apply a multiple and, voilà, you have a valuation. Multiples are already near record highs, so there’s not much room for expansion there.

The only variable left is projected earnings and that’s where Wall Street analysts are having a field day ramping up stock prices. Earnings did grow significantly in 2017 on a year-over-year basis, but that’s mainly because earnings were weak in 2016, so the year-over-year growth was relatively easy. Now comes the hard part. How do you expand earnings again in 2018 when 2017 was such a strong year? Wall Street just uses a simple extrapolation and says next year will be like this year, only better! But there is every reason to doubt that extrapolation. This is from a recent Bloomberg article:

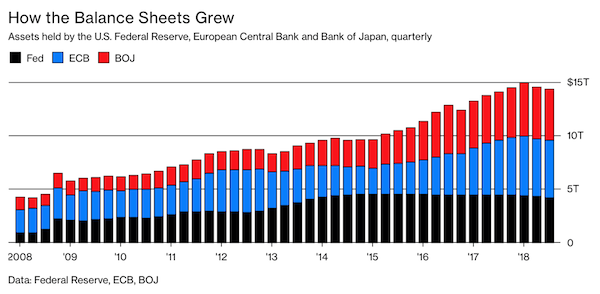

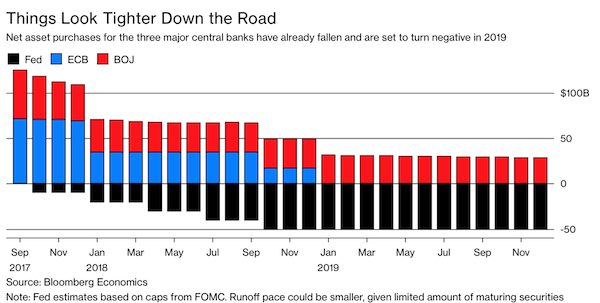

“Ominously, Weekly Leading Index growth turned down early this year and is now at a 79-week low. Such cyclical downturns have historically telegraphed [growth-rate cycle] GRC downturns. That shows very clearly that economic growth is about as good as it gets and that a fresh growth slowdown may be on the way… ” “Over time, we find that stock price corrections — big and small — have historically clustered around GRC downturns. In other words, the risk of corrections rises around economic slowdowns… Today, there are rising rates, with quantitative tightening about to begin. This will take place during an economic slowdown, implying a likely downswing in corporate profit growth, delivering a proverbial one-two punch.”

Earnings are likely to fall short of expectations, which can lead to a correction. Once that happens, multiples can shrink as well. Soon you’re in a full-scale bear market with stock prices down 20% or more. That’s without even considering a war with North Korea and all of the dangers others have already mentioned. This may be your last clear chance to lighten up on listed equity exposure before the bubble bursts.

Read more …

Complex derivatives. What do they make you remember?

• As Credit Booms, Citi Says Synthetic CDOs May Reach $100 Billion (BBG)

The comeback in complex credit derivatives blamed for exacerbating the global financial crisis is picking up pace. That’s according to new research this week from Citigroup, one of the biggest arrangers of so-called synthetic collateralized debt obligations. Sales of the products may jump to as much as $100 billion this year from about $20 billion in 2015, Citigroup analysts wrote in an Oct. 31 report. While investors suffered billions of dollars in losses on similar bets a decade ago, the leverage offered by synthetic CDOs is luring back buyers in an era of low yields and dwindling volatility. “It would seem as if the low spread-low vol environment, similar to back in 2006-2007 (when investors couldn’t get enough of levered synthetic tranches) has revived some interest in portfolio credit risk,” Citigroup analysts led by Aritra Banerjee wrote.

“Investors may not have necessarily wanted to add leverage, but, simply put, they have had to, given the lack of alternatives.” While post-crisis deals are typically tied to corporate credit as opposed to the mortgage debt that helped spur the credit crunch, the return of synthetic CDOs is likely to generate unease among investors who worry that markets are too frothy. The controversial product’s resurgence coincides with a boom in other types of credit wagers, including options on credit derivative indexes and exchange-traded funds that provide quick and easy access to a broad swath of credit. There are some key differences in today’s synthetic CDOs versus the pre-crisis vintage. Citigroup said it has created over 50 “full capital structure” deals in recent years, which vary from the single-tranche bespoke deals that dominated before and just after the crunch.

Read more …

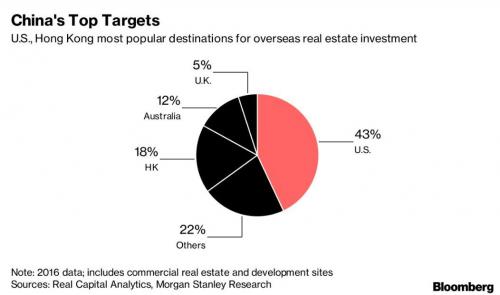

“China’s non-financial outbound direct investment (ODI) fell 41.9% in January-September from a year earlier to $78.03 billion. For September alone, it plummeted 42.5% on-year to $9.31 billion..”

• China Issues Guidelines On Overseas Investment Amid Crackdown On Deals (R.)

After years of rapid growth, China’s outbound investment has slumped so far in 2017 as authorities crack down on “irrational” overseas deals which are suspected of being used to bypass capital controls and move money offshore, pressuring the yuan currency. The draft regulations, released to the public to solicit feedback until Dec. 3, aim to improve oversight, safeguard national security and increase support, according to a post on the website of the National Development and Reform Commission (NDRC). Some administrative hurdles, such as a rule requiring that Chinese companies investing over $300 million overseas seek approval from the state planner, would be reduced or removed under the new rules, the post said.

At the same time, the new rules would also increase oversight on investments by overseas subsidiaries of Chinese companies, as well as for investments in sensitive sectors and countries, it said. Sensitive projects listed in the rules include those in countries that are at war, that do not have diplomatic ties with China or where investment is restricted by China’s commitments to international treaties, resolutions or requirements. Media organizations, weapons manufacturing, companies involved in multi-national water resources exploitation or those that China’s national macro policies restrict investment in were listed as sensitive sectors. A full list of sensitive areas would be released by the state planner in future, it said.

Punishments for companies that use dishonest measures to invest overseas, engage in unfair competition or damage national security will be increased, the rules said. The statement said that the new draft builds on previous regulations released in 2014. China’s non-financial outbound direct investment (ODI) fell 41.9% in January-September from a year earlier to $78.03 billion. For September alone, it plummeted 42.5% on-year to $9.31 billion, according to Reuters calculations.

Read more …

As Americans live paycheck to paycheck. Problem is, both parties support this lunacy.

• US Spends $250 Million Per Day For The War On Terror (TeleS)

The Department of Defense’s “cost of war” report suggests that the U.S. has spent $250 million per day for the past 16 years on ‘defense.’ According to a newly published United States Department of Defense (DoD) “cost of war” report, U.S. taxpayers have shelled out $1.46 trillion for war since September 11, 2001, when the War on Terror began. This amounts to around $250 million per day. The report was published by the Federation of American Scientists Secrecy News blog and covers the period of September 11, 2001 to mid-2017. As the report notes, nearly $1.3 trillion of the total cost spent on the Iraq and Afghanistan wars alone. On top of this, continuing operations in Afghanistan and the U.S.-led air campaign in Iraq and Syria has totalled $120 billion.

U.S. President Donald Trump promised to rebuild America’s military which he sees as less extravagant than it ever has been. “Our active-duty armed forces have shrunk from 2 million in 1991 to about 1.3 million today,” he said in a speech. “The Navy has shrunk from over 500 ships to 272 ships during this same period of time. The Air Force is about one-third smaller than 1991. Pilots flying B-52s in combat missions today. These planes are older than virtually everybody in this room.” Part of Trump’s plan to ‘rebuild’ the U.S.’ military is to make sure that the military is “funded beautifully.” The Trump administration has proposed a $603 billion defense budget, which well exceeds the cap of $549 billion, and would require the U.S. Congress to make spending cuts in other areas.

In July, the House of Representatives approved $696.5 billion in defense spending, which includes a base budget of $621.5 billion and $75 billion in ‘Overseas Contingency Operations dollars’, commonly referred to as ‘war money’. Conversely, the Senate passed a $640 billion base defense budget with a $60 billion allocation for war money. Both versions of the budget well exceed the Trump administration’s proposal, making this defense budget, by far, the largest defense budget in U.S. history. While the U.S.’ current and proposed military spending is massive, the DoD’s “cost of war” report did not take into account other collateral costs of war, including veteran’s benefits and other related costs.

Read more …

Will Belgium extradite Puidgemont? 8 of his ministers are already in jail.

• Barcelona Council Says Catalan Government Legitimate, Independence Is Not (CN)

Barcelona City Council has declared that the government dismissed by Spain after the application of Article 155 is “legitimate,” although it does not recognize Catalonia as an official republic. After meeting on Thursday, the council approved the proposal put forth by pro-independence party Esquerra Republicana (ERC) to “recognize the government that emerged from the polls on September 27 as the legitimate government of Catalonia,” with votes in favour from Barcelona en Comú (BeC), ERC, PDeCAt, and the anti-capitalist party CUP. Votes against came from the Socialists (PSC), the Catalan People’s Party (PP), and Ciutadans (Cs).

CUP also proposed a motion to “recognize the proclamation of the Catalan Republic approved by the Parliament of Catalonia on October 27.” Although this motion received support from ERC, PDeCAT, and the CUP, it received more votes against from BeC, Cs, PSC, and PP. Alfred Bosch, president of ERC warned that “the fact that the Catalan government has been dismissed, and its powers passed on to the Spanish government, will have an effect on Barcelona.” Barcelona’s mayor, Ada Colau, received criticism from CUP representative María José Lecha, who said the mayor cannot be “neutral or equidistant” in the face of the judicial persecution of the October 1 referendum, and that she must side either with “the oppressor or the oppressed.”

Read more …

What a story this still is.

• Kim Dotcom Wins Settlement From New Zeland Police Over 2012 Dawn Raid (NZH)

Kim Dotcom and his former wife Mona have accepted a confidential settlement from the police over the raid which saw him arrested, saying he did so to protect their children and because the Government “recently changed for the better”. He said that their previous desire to see accountability had been trumped by wanting to “do what was best for our children” by bringing an end to the court case. The settlement came after a damages claim was filed with the High Court over what was considered an “unreasonable” use of force when the anti-terrorism Special Tactics Group raided his $30 million mansion in January 2012. The raid was part of a worldwide FBI operation to take down Dotcom’s Megaupload file-sharing website which was claimed to be at the centre of a massive criminal copyright operation.

Dotcom and three others were arrested and await extradition to the United States on charges which could land them in prison for decades. The NZ Herald has learned earlier settlements were reached between police and others arrested, including Bram van der Kolk and Mathias Ortmann. It was believed their settlements were six-figure sums and it is likely Dotcom would seek more as the main target in the raid. He was also the focus of risk assessments used to justify the use of the anti-terrorism squad which carried out a helicopter assault at dawn. Those assessments included photographs of Dotcom carrying shotguns – pictures taken while clay pigeon shooting – and descriptions of him as violent despite a lack of evidence to support the claim.

The court challenge also questioned “visual surveillance” which had not been authorised by the court. Evidence has emerged in court hearings of police watching the Dotcom Mansion from neighbouring properties, and scouting the mansion interior with a hidden camera carried on to the property by a local police officer on a goodwill meeting the day before the raid.

Read more …

Ban it. Ban the whole industry. We cannot afford this to continue. Let’s feed ourselves without poisoning ourselves in the process.

• Monsanto Halts Launch Of Chemical After Farmers Complain Of Rashes (R.)

Monsanto put on hold the launch of a chemical designed to be applied to crop seeds on Wednesday following reports it causes rashes on people, in the latest instance of complaints about a company product that was approved by U.S. environmental regulators. Monsanto froze plans for commercial sales of the product called NemaStrike, which can protect corn, soybeans and cotton from worms that reduce yields. The company said it conducted three years of field tests across the United States in preparation for a full launch and that more than 400 people used it this year as part of a trial. The delayed launch of what Monsanto calls a blockbuster product is another setback for the company, which is already battling to keep a new version of a herbicide on the market in the face of complaints that it damaged millions of acres of crops this summer.

“There have been limited cases of skin irritation, including rashes, that appear to be associated with the handling and application of this seed treatment product,” Brian Naber, U.S. commercial operations lead for Monsanto, said in a letter to customers about NemaStrike. Some users who suffered problems may not have followed instructions to wear protective equipment, such as gloves, company spokeswoman Christi Dixon said. The company expected NemaStrike to launch across up to 8 million U.S. crop acres in fiscal year 2018, Chief Executive Hugh Grant said on a conference call last month. The product was “priced at a premium that reflects its consistent yield protection” against worms known as nematodes, he said.

The U.S. Environmental Protection Agency (EPA) did extensive evaluations of the product before approving it for use, according to Monsanto, which has described NemaStrike as “blockbuster technology.” [..] “The technology is effective and can be used safely when following label instructions,” Monsanto said. The EPA last year approved use of Monsanto’s new version of a weed killer using a chemical known as dicamba on crops during the summer growing season.Problems have also emerged with the herbicide since the agency’s approval. Farmers have complained it evaporates and drifts from where it is applied, causing damage to crops that cannot resist it.

Read more …