Edgar Degas At the Milliner’s 1905-10

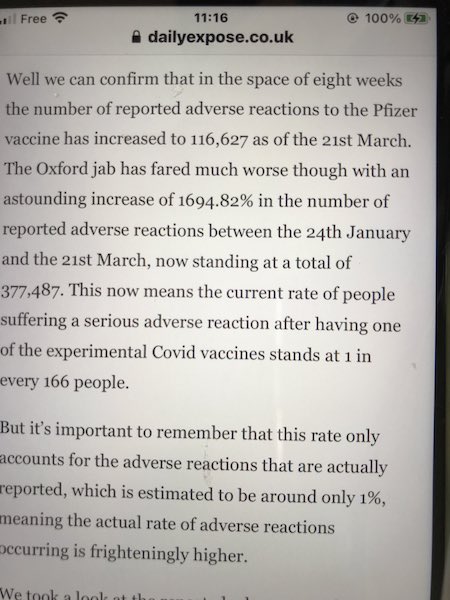

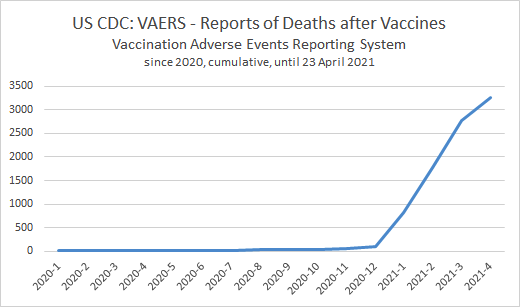

Tucker VAERS

No wonder Hancock doesn’t want to answer the question for the UK. Exactly how many people are dying from the vaccine? pic.twitter.com/fTWyXJLufY

— Lee (@VictoryDay_Hope) May 6, 2021

This will be claimed as a vaccine victory, though it was predicted long before. Seasonal.

• CDC Predicts Sharp Decline In Covid-19 Activity By July (Cidrap)

New modeling from the Centers for Disease Control and Prevention (CDC) predicts the United States will see a sharp drop off of COVID-19 infections and deaths by July, if high vaccination coverage is achieved and most of the country maintains a moderate adherence to non-pharmaceutical interventions (NPIs), including physical distancing. The data from six models were published yesterday in Morbidity and Mortality Weekly Report. Researchers predicted different outcomes based on four scenarios with different vaccination coverage rates and effectiveness estimates and strength and implementation of NPIs for a 6-month period (April–September 2021) using data available through Mar 27, 2021, the authors said.

The four scenarios included: high vaccination with moderate NPI use, high vaccination with low NPI use, low vaccination with moderate NPI use, and low vaccination with low NPI use. “All scenarios included the spread of the B.1.1.7 variant, with the assumption that it was 50% more transmissible than were previously circulating SARS-CoV-2 variants,” the authors said. “In all four scenarios, COVID-19 cases were projected to increase through May 2021 at the national level because of increased prevalence of the B.1.1.7 variant and decreased NPI mandates and compliance,” the authors found. “A sharp decline in cases was projected by July 2021, with a faster decline in the high-vaccination scenarios.”

The United States reported 44,51[0] new COVID-19 cases yesterday, and 776 deaths, according to the Johns Hopkins COVID-19 tracker. In total, 32,580,188 COVID-19 cases have been confirmed in the United States, including 579,653 deaths. The country is currently averaging 46,656 new COVID-19 cases and 686 deaths per day, according to a CNN analysis of Johns Hopkins data. The United States has not seen the 7-day average of deaths this low since July. The CDC COVID Data Tracker shows 321,549,335 COVID-19 vaccine doses have been delivered in the United States, and 249,556,820 have been administered, with 107,346,533 Americans fully vaccinated.

[..] As early as next week, the Food and Drug Administration (FDA) is poised to issue an emergency use authorization for Pfizer’s COVID-19 vaccine for children ages 12 to 15. But according to the Kaiser Family Foundation, only 3 in 10 parents polled of children in that age group said they would get their child vaccinated as soon they are able. One quarter say they will wait and see how the vaccine is working, 18% say they will wait to see if school requires it, and one quarter say they will not get their child vaccinated.

“People would actually begin to associate non-masking people with safety, while mask-wearing people would signal danger.”

• Why Masks Are Still Mandatory (AT)

Joe Biden is in a pickle. He wants to continue to convince Americans they should get the experimental biological agent (AKA “the vaccine”), but, as Tucker Carlson pointed out last week, the administration and the CDC have offered no explanation as to why you need to continue to wear a mask after you have taken “the vaccine.” Why would they want us to doubt the efficacy of the vaccine? Why would any sane person who is not in a high-risk group contemplate becoming a lab experiment subject if you are not allowed (yes, our rights are now derived from government and will be doled out based on compliance) to burn your mask and return to a pre-pandemic way of life?

That’s just bad salesmanship…until you think about the alternative. Think about what would happen if they allowed (there’s that word again) people not to wear masks after being vaccinated. Here’s a typical scenario. The vaccinated test subject enters the supermarket. The vigilante mob of leftists can’t wait to accost and demand compliance to their edict, using physical violence if necessary. The test subject then proclaims that he has put his mask in his pocket. A short time later, the test subject hears the man claim the same immunity.

In this fictional example, you can begin to see what the ramifications of this policy would be. Within weeks, the majority of Americans would stop wearing masks. (Along with social distancing, and lockdowns, and getting the vaccine). People would actually begin to associate non-masking people with safety, while mask-wearing people would signal danger. The danger of the unvaccinated. The government has just lost all control. Do you really think these people will give up their newfound power so easily? I’m afraid not. I imagine that their Big Tech partners are working furiously building a mandatory vaccine passport system as you read this. Until that is up and running, you can expect the regime to continue requiring all people to wear masks, especially those who have been “vaccinated.”

Google translated from a Belgian doctors’ site. Odd.

• CDC Uses Different PCR Test Rules For Vaccinated, Non-Vaccinated (AVV)

The Centers for Disease Control and Prevention has changed the rules for the PCR test so that vaccinees are less likely to be tested as infected than those who are not vaccinated. They have lowered the CT value from 40 to 28. The PCR test, on which the entire corona policy was based, is extremely unreliable and yields up to 90% false positives. So say Nature, WHO, The Lancet and many others. Without all those false positives, we wouldn’t have had this whole “crisis”. The current PCR test analyzes genetic material from the virus using 37 or 40 cycles, but health experts say that is too high because it detects even small amounts of the virus that do not pose a risk of contamination.

“Tests with such high thresholds can detect not only live virus, but also genetic fragments, remnants of infections that pose no particular risk – similar to finding hair in a room long after a person has left,” said Dr. Michael Mina, an epidemiologist at Harvard T.H. Chan School of Public Health, New York Times. “If you adjust that down to a more reasonable CT threshold of 30, anywhere from 40% -90% of lab results * are no longer positive. * The rest is well beyond the point of infectivity,” Mandavilli wrote on Twitter. The problem is that high CT threshold.

PCR tests are a very smart method to specifically amplify the smallest DNA fragments so often that they can be easily detected, TKP reports. As each cycle is doubled, very high gain percentages are achieved. How high this percentage must be in order to be able to detect an infection as such with any probability has been the subject of discussion for some time. The US agency CDC is now lowering the cycle threshold for detecting infections after vaccination from 37 to 40 to 28. A number of studies have shown that more than 24 to 27 cycles can certainly no longer detect infectious viruses. If you need more than 28 cycles, you have proof that there is no longer a reproducible virus.

But it goes beyond that, because in fact PCR cannot basically detect whether or not there is reproducible virus in the smear, because it only first converts small particles of it into DNA and then amplifies them. This is how the Swedish health authority Folkhälsomyndigheten describes it: “The PCR technology used in tests to detect viruses cannot differentiate between viruses capable of infecting cells and viruses that have been rendered harmless by the immune system, and therefore these tests cannot be used to detect viruses. whether or not someone is contagious.

Vaccine porn.

• Experts Say It’s Vital That Parents Get Their Kids Vaccinated For Covid (F.)

Children and teenagers might soon be the next focus of the U.S. Covid-19 pandemic. By the last week of April, cases among children and teens accounted for more than 22% of new cases in the U.S, and there was a 4% increase in the total number of cases in kids. Almost 4 million kids have been diagnosed with Covid-19 since the beginning of the pandemic. Luckily, vaccines for kids are arriving soon. On May 4th, Pfizer said the vaccine it co-developed with BioNTech will likely get an FDA authorization for use in kids aged 12-15. The companies hope to get the vaccines authorized for kids aged 2-11 by September. Moderna is just behind, having started its phase 2 / 3 clinical trial in children less than 12 years old in March.

While polls show that adults are increasingly willing to get vaccinated, if they haven’t already, some parents have expressed doubts about vaccinating their kids. These concerns range from a lack of data to the quick pace of production. That said, a recent poll showed that 30% of parents are enthusiastic about vaccinations. As vaccines become available for those under 18, pediatricians and researchers argue that it is essential to immunize kids against Covid-19, both for their own protection as well as the protection of everyone else. Usually, Covid-19 symptoms aren’t as severe for kids when compared to adults, but that doesn’t mean that kids feel no effect from the virus. The American Academy of Pediatrics reports that between 0.1% and 2% of Covid-19 cases affecting those under age 18 require hospitalization..

Additionally, more than 250 children in the U.S. have died from the disease in the past year. Children who have been infected with Covid-19 can see other complications. A multisystem inflammatory syndrome, called MIS-C, can cause fever, rash, and damage to the heart and other organs in children who had even asymptomatic cases of Covid-19. And just like adults, children can also get symptoms of “long-haul” Covid-19, which can include severe fatigue, headaches, and abdominal pain. Paul Offit, a pediatrician at the Children’s Hospital of Philadelphia, says that he’s seen a number of cases of both severe Covid-19 and MIS-C in children. “I’m sure all of those parents would have preferred the vaccine to the disease,” he says.

[..] “Reaching a level of immunity in the community is even more important as these more transmissible variants are circulating,” says Ted Chaconas, the chief medical officer of UCSF Benioff Children’s Hospital. And vaccinating kids won’t just help prevent them from getting the disease; it will also make the whole community safer. The more opportunity that the Covid-19 virus has to replicate in human bodies, the higher the likelihood that new mutations will emerge. Children make up almost 25% of the U.S. population, a huge group “that possibly has no preexisting immunity to this virus, that could become infected and produce new variants,” says Jennifer Nayak, a pediatric infectious disease doctor at the University of Rochester Medical Center.

Covid porn.

• Gates-Backed Institute Claims Covid Deaths Over Double Official Number (RT)

An outfit whose statistical models were used to justify early Covid-19 lockdowns is now arguing that the true death toll of the pandemic is far higher than the official numbers – and closer to their own apocalyptic predictions.

Covid-19 has killed more than 900,000 Americans and over 6.9 million people worldwide, the University of Washington’s Institute for Health Metrics and Evaluation (IHME) claimed on Thursday, citing their own statistical models based on excess mortality. By contrast, official figures compiled by Johns Hopkins University list 3.24 million deaths globally, of which 580,000 are in the US, as of May 6. IHME chief Dr. Christopher Murray explained in a series of videos that they used a “variety of statistical methods” to determine excess mortality, which was then weighed against six other factors to calculate whether it would have been due to the coronavirus or other causes.They compared “anticipated deaths from all causes based on pre-pandemic trends with the actual number of all-cause deaths during the pandemic,” then removed the deaths both “indirectly attributable” to the pandemic and “averted” by the lockdowns. “When you put all that together, we conclude that the best way, the closest estimate, for the true Covid death is still excess mortality, because some of those things are on the positive side, other factors are on the negative side,” Murray said. The institute apparently suggests that official Covid data is not to be trusted – and their extrapolated “statistics” imply that some nations are even more untrustworthy than the others. For instance, they claim that Russia had almost six times more coronavirus deaths than its official numbers – almost as many as Brazil, whose official numbers are supposedly off by a third, again by IHME metrics.

By contrast, the UK “undercounted” its deaths by only 60,000 or so. The bombshell claim, while promptly parroted by major media outlets, was met with some skepticism by other scientists. William Hanage of Harvard University told NPR in an email that IHME’s claim that Covid-19 deaths have been “substantially undercounted” in some places more than others “is likely sound, but the absolute numbers are less so for a lot of reasons.” “Their estimate of excess deaths is enormous and inconsistent with our research and others,” said Dr. Steven Woolf of Virginia Commonwealth University. “There are a lot of assumptions and educated guesses built into their model.”

Intellectual property covers a lot of things, not just vaccines.

• Merkel Opposes Biden’s Call To Waive Covid-19 Vaccine Patent Protections (RT)

The Biden administration’s endorsement of a proposal to waive intellectual property rights on Covid-19 vaccines is facing new opposition from German Chancellor Angela Merkel. “The limiting factor for the production of vaccines are manufacturing capacities and high quality standards, not the patents,” a spokesperson for Merkel said Thursday, according to Bloomberg. “The protection of intellectual property is a source of innovation and this has to remain so in the future.” US Trade Representative Katherine Tai announced this week that the Biden administration was supporting a proposal in the World Trade Organization to open up patents on Covid-19 vaccines.

Tai said the “extraordinary circumstances of the COVID-19 pandemic call for extraordinary measures.” WHO chief Tedros Adhanom Ghebreyesus called the announcement a “monumental moment in the fight against Covid-19. Supporters of the measure have said removing intellectual property protections will help low-income countries produce and distribute vaccines faster. Critics, however, like vaccine advocate Bill Gates, have argued that such a move presents difficulties and could hinder the safety of future vaccines. After Biden’s endorsement of the proposal, stock for companies like Pfizer and Moderna fell. Pfizer CEO Albert Bourla said on Thursday he is “not at all” in favor of the US’ stance.

“The problem is that there are no facilities in the world outside the ones that we can build ourselves,” he told AFP. European Commission President Ursula von der Leyen said earlier on Thursday that the EU is ready to have discussions on the proposal to remove patent protections from vaccines. Russian President Vladimir Putin has also expressed its support for waiving patents.

Russia’s doing better but not great.

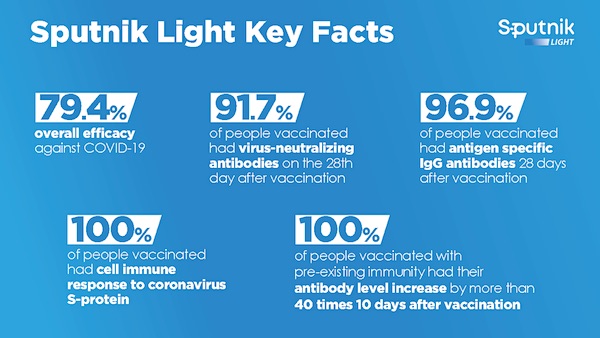

• Russia Authorizes Single-dose ‘Sputnik Light’ (RT)

The Russian Health Ministry has authorized the use of Sputnik Light, a one-shot coronavirus vaccine said to be even more efficient than some two-dose jabs currently on the market. Sputnik Light is the first component of the widely used Sputnik V coronavirus vaccine, its researchers explained. However, the single dose has shown 79.4% efficacy, which “is higher than that of many two-dose vaccines,” the developers said in a statement. Researchers have analyzed the efficacy rate based on data received from Russia’s mass vaccination program between December 2020 and April 2021. Having studied data taken 28 days after a single injection was administered, they said the infection rate among one-time vaccinated people was just 0.277%. The unvaccinated adult population showed 1.349% infection rate over the same period.

The scientists behind the vaccine say it’s effective against new Covid-19 strains. Antibodies neutralizing the deadly virus were activated in over 91% of recipients on the 28th day post shot. It is also said to provide absolute protection against severe cases of the disease. Following the trials, no serious side effects have been registered, Sputnik Light researchers report. Developers hope the single dose will help provide faster immunization among larger numbers of people. “The single-dose regimen solves the challenge of immunizing large groups in a shorter time, which is especially important during the acute phase of the spread of coronavirus, achieving herd immunity faster,” said Kirill Dmitriev, CEO of the Russian Direct Investment Fund (RDIF), which funds the vaccine. He also pointed out that Sputnik Light “has an affordable price of less than $10,” and can be easily transported and stored.

How is that not a prison?

• Australia Borders Could Be Shut Until Late 2022 (Y!)

Australia is likely to remain shut to visitors until late 2022, the country’s trade and tourism minister said Friday, as another global coronavirus surge smashed hopes of a quick reopening. Minister Dan Tehan said a wave of cases on the Indian sub-continent showed Australia’s near blanket ban on arrivals was still essential to keep the country Covid-free. Since March 20, 2020, Australians have been barred from travelling overseas and a hard-to-get individual exemption is needed for foreign visitors to enter the country. It is “very hard to determine” when borders could reopen, Tehan told Sky News, “the best guess would be in the middle to the second half of next year”.

Before the pandemic, around one million short-term visitors entered the country each month. That figure is now around 7,000. Anyone who does enter must undergo 14 days strict hotel quarantine. A recently established travel bubble with New Zealand has had mixed success, being paused for cities where the virus jumped from quarantine facilities before being contained. Australia has recorded 29,886 cases since the pandemic began. A large proportion were detected in hotel quarantine. Vaccination rollout has been slow, with just 2.5 million vaccines administered in a country of 25 million people, each needing two doses.

“..amount of unfunded liabilities is 775% of our current total economic output..”

• Gundlach Warns America’s “Unfunded Liabilities” Are $163 Trillion (ZH)

DoubleLine’s Jeffrey Gundlach called the Fed’s bluff late last month, telling investors during an interview that he suspected the central bank was merely “guessing” about the impact of inflation being “transitory”. Since then, we have only received more signs that inflationary pressures are growing in the US economy, while a growing number of investors have been persuaded to agree with Gundlach. The other day, DoubleLine released a recording of another talk given by Gundlach where he elaborated on the inflation theme, while also discussing other issues like the outlook for the US dollar in the face of President Biden’s tax-and-spend agenda.

During the course of an hour-plus conversation, much of it accompanied by a slide deck with some of Gundlach’s favorite charts, Gundlach tackled a few key topics that he feels could threaten the Fed’s ability to backstop financial markets. He started by slamming Biden’s plan to hike capital gains taxes on taxpayers with more than $1 million in earnings, arguing that fears of higher capital gains taxes is already weighing in the market. Gundlach argued that high-beta stocks and other speculative investments like bitcoin have the most to lose due to a hike in capital gains. After all, who is going to want to take a risk on a long shot if they need to give half of their winnings to the government?

“Today is an important day because the president has made good if you want to call it that on his promise to begin raising taxes and the capital gains tax if you make more than a million dollars a year in California the capital gains tax if the proposal goes through that was launched today will be 57 capital gains tax that’s the federal tax plus the California tax so it’s getting pretty ugly and i think it’s going to have some very significant effects which we started to see the minute that this tax proposal was was launched today we’ve seen bitcoin a very speculative darling investment these days go down about 20 from its high in the last couple of weeks and obviously a lot of people would think twice about speculating on something like bitcoin if they felt that if they won meaning the price went up from their cost that 57 percent of a highly speculative gamble if it hits if it hits would go to the federal government but the stock market also fell pretty sharply upon that no wonder it’s surprising that people haven’t been contemplating this already.”

[..] Gundlach also pointed out that the surge in the debt doesn’t fully capture how much money the federal government owes. There are also unfunded liabilities which, when combined with all local, state and federal debt, leave US citizens on the hook for $163 trillion. That’s more than 5x the $28 trillion national debt. “The government giveaway programs and the programs that we put in place to battle the economic impact especially to people who were suddenly unemployed and there were about 20 20 uh 20 million people that were suddenly unemployed those stimulus packages were originally thought to be temporary but now they’ve become a fixture and we can see that the blue line in recent months has needed uh as has grown again as a requirement in funding these non-stop stimulus programs so the US government is now has over 28 trillion dollars in debt and the US government has $163 trillion in unfunded liabilities when you roll it all together federal state and local level that amount of unfunded liabilities is 775% of our current total economic output,” Gundlach said.

No kidding.

• Big Tech Has Turned The Internet Into A Prison (Malic)

I once thought the internet would have the same effect on corporate media gatekeepers as the AK-47 had on colonial empires in Africa. That was before Big Tech turned that promise of freedom into the second coming of feudalism. Wednesday’s decision by Facebook’s “oversight board” – a transparent attempt to outsource responsibility for censorship to an international committee – to extend the ban on 45th US President Donald Trump is just the latest example, but by no means the most egregious. Earlier this week, the banhammer descended on RT’s digital project Redfish over posts criticizing… Italian fascist leader Benito Mussolini and the Holocaust, of all things.

How did it come to this? Years ago, in an argument over media censorship, I had brought up the internet as the modern version of the AK-47. While the European colonial armies were able to conquer Africa in the 19th century, using machine guns and repeating rifles, they became unable to hold it once the Kalashnikov automatic rifle put the peasants in places like Congo, Angola and Vietnam on equal footing with Western armies seeking to keep them down. Or, if you want a more peaceful metaphor, it was the promise of open pasture extended to people who had previously been treated like cattle, penned up in factory barns and fed slop from a trough.

That was in March 2011. Facebook, YouTube and Twitter were already around, but they were challenging the gatekeepers and offering their platforms to the common people like myself. In 2016, everything changed. That was the year Trump was able to bypass the corporate gatekeepers, using those platforms to speak to the American people directly. Having consolidated the internet between them, and under pressure from politicians they already supported, the corporations running these platforms began censoring content and users – first gradually, then suddenly. The pretext for this was “Russiagate,” the conspiracy theory pushed by Democrats and their corporate media allies to explain Hillary Clinton’s 2016 fiasco, delegitimize Trump’s presidency, and – as it turns out – justify censorship.

As demonstrated by the recent example of Twitter’s clash with Russia over illegal content, or Facebook’s standoff with Australia over paying for news, these mega-corporations aren’t opposed to censorship or committed to property on principle. Rather, their only “principle” is the Who-Whom reductionism, a world in which they and those they agree with can do no wrong, while anyone else can do no right. The long march from banning Alex Jones in 2018 to banning the sitting president of the United States in 2021 was completed with surprising alacrity. The collusion within Silicon Valley to ban Trump on the blatantly false pretext of “inciting insurrection” on January 6 may have been the political Rubicon, but Big Tech had begun putting their finger, fist and even elbow on the political scales long before.

Let them try.

• White House Says “We Support” Ukraine’s Ambitions To Join NATO (ZH)

While traveling aboard Air Force One for President Joe Biden’s visit to Louisiana on Thursday, White House deputy press secretary Karine Jean-Pierre bluntly stated that “we support” Ukraine’s ambition to join NATO. When she was asked by a press pool reporter if the White House “supports Ukraine joining NATO” – the deputy press secretary responded with “We supported it… yeah” – but then quickly sought to clarify that certain “commitments” have to be met. She explained, “The Biden administration remains committed to ensuring that NATO’s door remains open to aspirants when they are ready and able to meet the commitments.” “Secretary [of State Antony] Blinken is in Kiev right now to affirm our support for Ukraine’s sovereignty, territorial integrity, and independence. His trip also emphasizes the importance of Ukraine passing key legislation to advance rule of law, anticorruption and economic reforms that will strengthen Ukraine’s democracy and economy, and further Euro-Atlantic integration,” Jean-Pierre said.

“The Biden administration is committed to ensuring that NATO’s door remains open to aspirants when they are ready and able to meet the commitments and obligations of membership and contribute to security in the Euro-Atlantic area,” she later clarified. Rarely has the White House answered the controversial question so directly, especially given NATO’s clear requirements for entry stipulating that a country engaged in territorial disputes with neighbors, including internal civil conflict, is not eligible for membership. This is because of the obvious reality that the inevitable quick invocation of NATO’s Article 5 would immediately result in war. Last month’s renewed crisis and Russian troop build-up which thrust the Russia-Ukraine-Crimea dispute back in international headlines saw Kiev officials renew their vocal push for entry into NATO. Kiev had after the Maidan coup in 2014 cooled its NATO pursuit rhetoric given the obvious hurdles for entry and the conflict with Russian-backed separatists in the country’s east.

Crucially in the Thursday comments, which are sure to raise the alarm in Moscow, the White House spokeswoman additionally emphasized that the US “supports” Ukraine’s reforms (the very reforms which are meant to secure its future NATO membership) as well as “its border fight against Russia aggression.” The NATO question will likely be raised by Vladimir Putin assuming the much anticipated Biden-Putin summit actually materializes in June. Russia has long considered Ukraine and Georgia’s NATO pursuits to be a “red line” which the Kremlin says would make war all but certain.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

Support the Automatic Earth in virustime. Click at the top of the sidebars to donate with Paypal and Patreon.