Banksy Girl With a Pierced Eardrum (and face mask) 2020

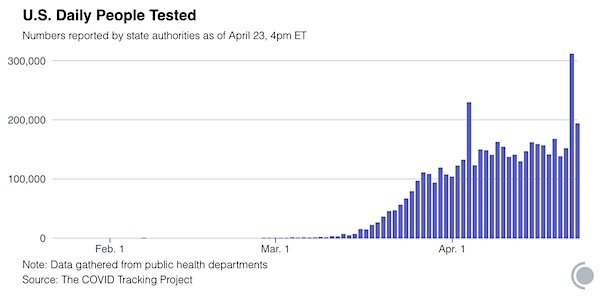

• US records 3,176 #coronavirus deaths in 24 hours – total fatalities near 50,000: Johns Hopkins tally

• The US has 866,646 confirmed cases, up 26,971 from the previous day

Yaneer Bar-Yam

@yaneerbaryam

• Our Getting to Zero list:

Yesterday new cases:

South Korea +11

Greece +7

Iceland +7

Estonia +7

Australia +4

Hong Kong +4

New Zealand +3

Jordan +2

Taiwan +1

Vietnam 0

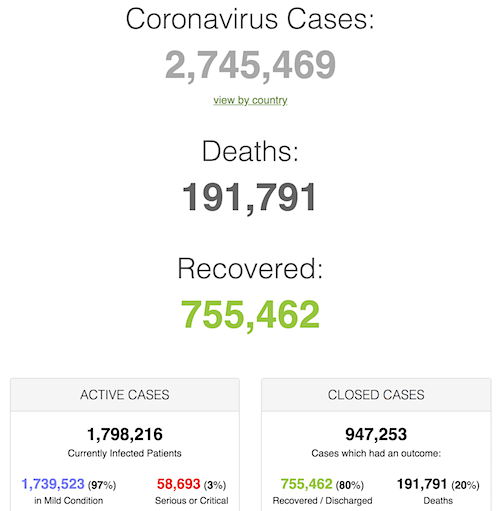

• Cases 2,745,469 (+ 89,078 from yesterday’s 2,656,391)

• Deaths 191,791 (+ 6,635 from yesterday’s 185,156 )

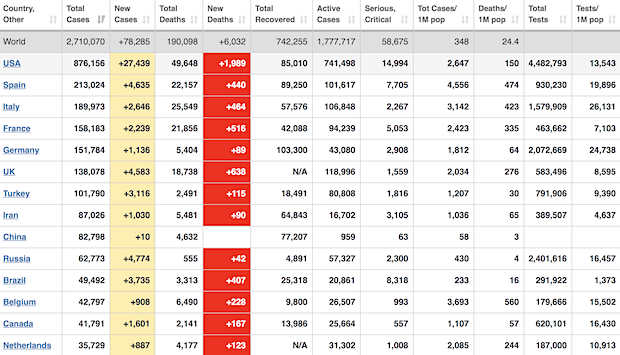

From Worldometer yesterday evening -before their day’s close-

From Worldometer – NOTE: among Active Cases, Serious or Critical fell to 3%. Among Closed Cases, Deaths have fallen to 20%

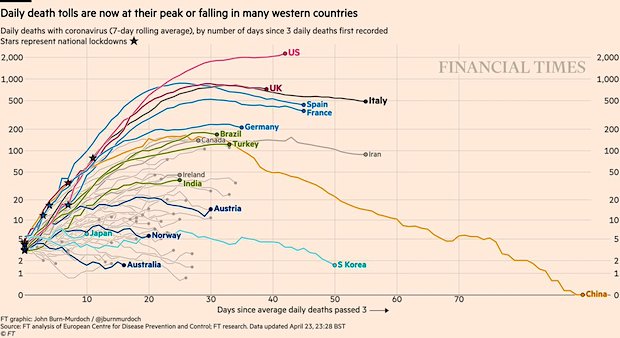

From SCMP:

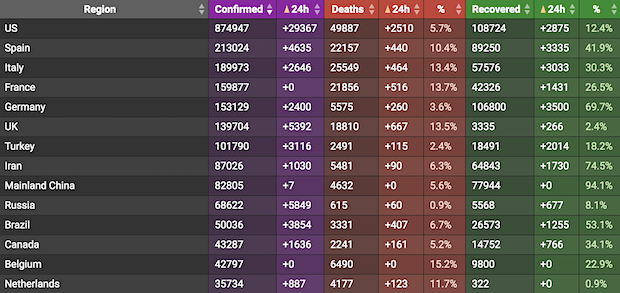

From COVID19Info.live: Note: Turkey, Russia, UK are the biggest risers

Or maybe it’s simply too soon?

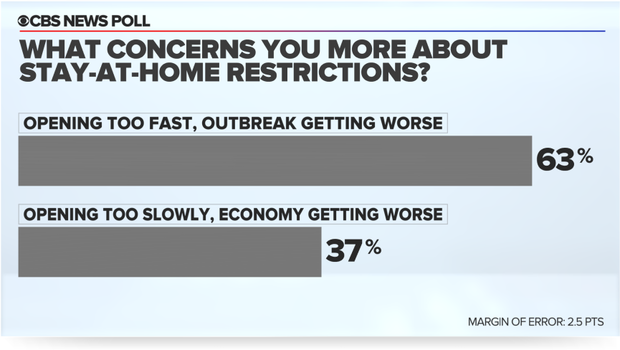

• Americans Prioritize Staying Home, Worry Restrictions Will Lift Too Fast (CBS)

Health concerns still take precedence over economic concerns by a wide margin for Americans in their views on when to reopen the economy — both in what they want for the nation, and in what they’d do themselves. Many say they need to be confident the coronavirus outbreak is over before returning to public places, and big majorities of all partisans agree the stay-at-home orders are effective. The health concerns may be so salient that even for those whose finances have been impacted and even for those concerned about job loss, most of them still worry the country will open up too fast. 63% of Americans are more worried about restrictions lifting too fast and worsening the outbreak — than worry about lifting restrictions too slowly and worsening the economy.

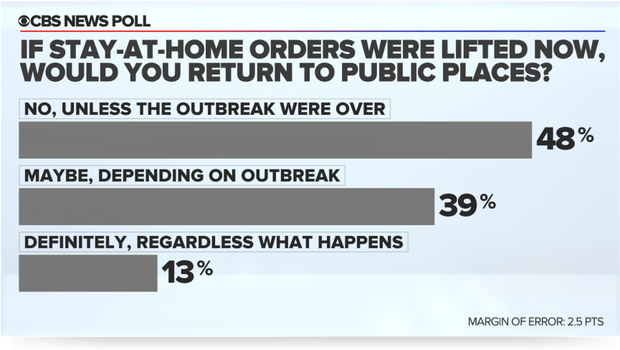

And what would Americans actually do if restrictions were lifted right now? Would anyone show up to public places or would they be too worried about health risks? That could be the most important factor in the economy. Only 13% say they would definitely return to public places over the next few weeks if restrictions were lifted right now, regardless of what else happened with the outbreak. Almost half — 48% — say they would not return to public places until they were confident the outbreak was over. Another 39% are “maybes”: they’d return depending on whether they saw the outbreak getting better. These views are not decidedly partisan: most Republicans are “maybes” at best, as are most Democrats and independents.

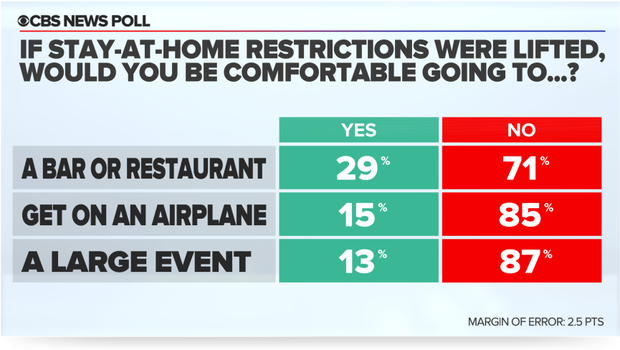

Small numbers for specific things:

• Only 13% would be comfortable going to a large sports or entertainment event.

• Only 15% would be comfortable getting on an airplane.

• 29% would be comfortable going to restaurants or bars.

Just a few lines from a long Reuters piece, which leaves you realizing there are as many doctors and studies as there are opinions. And when you read that in some cases 90% of people put on ventilators die, it’s obvious some people got some things pretty wrong.

• Doctors Rethink Rush To Ventilate (R.)

Luciano Gattinoni, a guest professor at the Department of Anaesthesiology, Emergency and Intensive Care Medicine, University of Göttingen in Germany, and a renowned expert in ventilators, was one of the first to raise questions about how they should be used to treat COVID-19. “I realised as soon as I saw the first CT scan … that this had nothing to do with what we had seen and done for the past 40 years,” he told Reuters. In a paper published by the American Thoracic Society on March 30, Gattinoni and other Italian doctors wrote that COVID-19 does not lead to “typical” respiratory problems. Patients’ lungs were working better than they would expect for ARDS, they wrote – they were more elastic. So, he said, mechanical ventilation should be given “with a lower pressure than the one we are used to.”

Ventilating some COVID-19 sufferers as if they were standard patients with ARDS is not appropriate, he told Reuters. “It’s like using a Ferrari to go to the shop next door, you press on the accelerator and you smash the window.” The Italians were swiftly followed by Cameron Kyle-Sidell, a New York physician who put out a talk on YouTube saying that by preparing to put patients on ventilators, hospitals in America were treating “the wrong disease.” Ventilation, he feared, would lead to “a tremendous amount of harm to a great number of people in a very short time.” This remains his view, he told Reuters this week. When Spain’s outbreak erupted in mid-March, many patients went straight onto ventilators because lung X-rays and other test results “scared us,” said Delia Torres, a physician at the Hospital General Universitario de Alicante.

They now focus more on breathing and a patient’s overall condition than just X-rays and tests. And they intubate less. “If the patient can get better without it, then there’s no need,” she said. In Germany, lung specialist Voshaar was also concerned. A mechanical ventilator itself can damage the lungs, he says. This means patients stay in intensive care longer, blocking specialist beds and creating a vicious circle in which ever more ventilators are needed. Of the 36 acute COVID-19 patients on his ward in mid-April, Voshaar said, one had been intubated – a man with a serious neuro-muscular disorder – and he was the only patient to die. Another 31 had recovered.

The virus was in the US in January.

• First Known US COVID19 Death Occurred On Feb. 6 In Santa Clara County (SFC)

A person who died at home in Santa Clara County on Feb. 6 was infected with the coronavirus at the time of death, a stunning discovery that makes that individual the first recorded COVID-19 fatality in the United States, according to autopsy results released by public health officials late Tuesday. That death — three weeks before the first fatality was reported in the U.S., in Washington state on Feb. 28 — adds to increasing evidence that the virus was in the country far earlier than once thought. Santa Clara County on Tuesday announced three previously unidentified deaths from the coronavirus: the Feb. 6 case; one on Feb. 17, which also predates the death that was earlier believed to be the first; and one on March 6. Initially, the first death in the county had been reported March 9.

“What it means is we had coronavirus circulating in the community much earlier than we had documented and much earlier than we had thought,” said Dr. Sara Cody, Santa Clara County’s public health officer. “Those deaths probably represent many, many more infections. And so there had to be chains of transmission that go back much earlier.” Cody did not provide details about the people who died in February but said the deaths “tell us we had community transmission – probably significant community transmission – far before we realized it and documented it.” “From what we understand, neither of the cases had a history of travel,” Cody said. “So we assume that they were acquired locally.”

People typically die of COVID-19 about a month after they are infected with the coronavirus, suggesting that the person who died Feb. 6 likely was infected in early January. At that time, the virus had been reported only in China — the U.S. Centers for Disease Control and Prevention had not yet issued any advisories to Americans about the potential threat.

Predictably, Chinese state media strike back. What caught my eye is:

“..infected more than 2.6 million Americans with nearly 20,000 deaths as of 4:30 pm Thursday.”

Worldometer, as I write this, says 886,000 infections and 50,000 deaths.

• Chinese Scientists ‘Unable To Judge’ If US Lab Is Virus Source (Global Times)

Responding to viral reports alleging that the novel coronavirus was leaked from a US military biochemical laboratory, Chinese scientists said that they could not make a judgment on the allegation, as the US had not given any public response on the issue. Shi Yi, a research fellow from the Institute of Microbiology, Chinese Academy of Sciences, made the remarks at a press conference Thursday, noting that the origin of the virus is a scientific issue requiring a long period of research and involves a great deal of uncertainty. The remarks came amid circulating reports alleging that the Fort Detrick laboratory, which handles high-level disease-causing materials such as Ebola, in Fredrick, Maryland, may be the origin of the deadly novel coronavirus, which has infected more than 2.6 million Americans with nearly 20,000 deaths as of 4:30 pm Thursday.

The lab was ordered to shut down in July 2019, reportedly for multiple causes, including failure to follow local procedures and a lack of periodic recertification training for workers in the biocontainment laboratories. Some other posts on social media platforms also alleged that a US armed diplomatic driver and cyclist who was in Wuhan in October 2019 for the cycling competition in the Military World Games, could be patient zero for COVID-19 in Wuhan. Netizens from both China and the US have called on the US government to respond to public concerns over the above mentioned issues. Some have even launched a petition on the White House website, but the US government has not made any comment so far.

The US political system is inherently incapable of getting this right. Not going to happen.

• House Passes $484 Billion Coronavirus Relief Package (Hill)

The House on Thursday voted overwhelmingly to pass legislation providing roughly $484 billion in coronavirus relief for small businesses, hospitals and expanded medical testing, capping weeks of contentious negotiations that had stalled Washington’s latest round of emergency aid. The vote was 388-5-1, with four conservative Republicans breaking with GOP leaders to oppose the measure, citing its effect on federal deficit. Rep. Alexandria Ocasio-Cortez (D-N.Y.) also voted against the measure, while Rep. Justin Amash (I-Mich.) voted present. The four Republicans who voted “no” were House Freedom Caucus Chairman Andy Biggs (Ariz.) and Reps. Ken Buck (Colo.), Jody Hice (Ga.) and Thomas Massie (Ky.).

The legislation, which the Senate passed unanimously on Tuesday, now goes to the desk of President Trump, who has promised to sign it quickly into law. The massive package is the fourth coronavirus bill to move through Congress over the last seven weeks, and brings the federal response to the global pandemic up to a whopping $2.8 trillion — by far the largest emergency relief effort in modern U.S. history. It came after two weeks of tense talks between the White House, led by Treasury Secretary Steven Mnuchin and the top Democrats in both chambers, Speaker Nancy Pelosi (D-Calif.) and Senate Minority Leader Charles Schumer (D-N.Y.), over the scope and direction of the latest infusion of emergency funds.

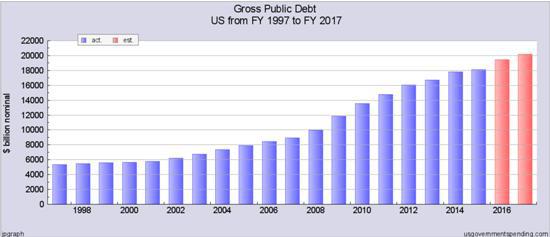

By now fully meaningless numbers for 99% of the population.

• Fed Balance Sheet Increases To Record $6.62 Trillion (R.)

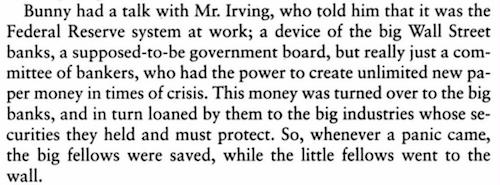

The Federal Reserve’s balance sheet increased to a record $6.62 trillion this week as the central bank used its nearly unlimited buying power to soak up assets to keep markets functioning amid an abrupt economic free fall due to the coronavirus pandemic. Since early March, the Fed has slashed interest rates to zero, restarted bond purchases and rolled out an unprecedented range of programs to keep credit flowing and shore up business and household confidence. The central bank’s balance sheet as of Wednesday rose about $200 billion from $6.42 trillion a week earlier. That is up from just $4.29 trillion in the first week of March. It is now the equivalent of roughly 30% of the size of the U.S. economy before the crisis struck, and will certainly grow larger in the weeks ahead as the Fed keeps piling on assets and the economy shrinks.

The central bank continued to snap up Treasury securities, mortgage bonds and other assets, according to data released on Thursday. The Fed’s holdings of mortgage-backed securities rose to $1.62 trillion from $1.57 trillion. Treasury holdings rose to $3.91 trillion from $3.79 trillion. Use of the Fed’s central bank liquidity swap lines, which allow foreign central banks to exchange their local currencies for dollars, rose to $409.7 billion on Wednesday from $378.3 billion the previous week. Loan balances for the Fed’s discount window, its last-resort lending program for banks, fell to $33.7 billion from $36.3 billion a week ago.

Worked for CNN though. They need new stories every day, or people will switch off.

• No, Trump Did Not Put A Labradoodle Breeder In Charge Of Covid19 Response (DN)

No, the Trump administration did not put a professional dog breeder from Dallas in charge of COVID-19 response. Yes, the chief of staff at the Department of Health and Human Services briefly owned a family business raising Labradoodles. But he’s also served three administrations in high level posts at HHS, the White House and the Pentagon. Colleagues who hired Harrison and served with him in government were appalled to see him disparaged Thursday as a mere “dog breeder,” as if Joe Exotic had catapulted from tiger king to head of the Centers for Disease Control and Prevention.

“This is so silly. He went home and worked in a family business,” said Jack Kalavritinos, who served with Harrison at HHS during the administrations of both George W. Bush and President Donald Trump, most recently as director for intergovernmental and external affairs, working on the opioid crisis and drug prices. “Brian was a no-brainer pick,” said another colleague, Michael Reilly, who hired Harrison for his first job at HHS under Bush. “His private sector experience is irrelevant.…He was a complete known commodity who had extensive experience.” Trump’s irritation with Harrison’s current boss, Secretary Alex Azar, has been apparent for months and some confidants suspect that he’s has gotten caught in the crossfire of a classic Washington ritual: finger pointing.

“At the end of the day, we have political systems,” Jonathan Kinloch, district chair of Michigan 13th Congressional District Democratic Party said according to The Detroit News. “We have political parties, and political parties exist for a reason.”

• Lawmaker Who Thanked Trump To Face Censure Vote From Michigan Democrats (JTN)

Michigan Democratic state Rep. Karen Whitsett, publicly expressed her gratitude toward President Trump for her coronavirus recovery, and now she is facing possible censure from her fellow Democrats. Whitsett has indicated that the president may have helped save her life by publicly discussing the drug hydroxychloroquine, which she says helped her to recover. The Detroit Free Press reported that when questioned about “whether she thinks Trump may have saved her life, Whitsett said: ‘Yes, I do,’ and ‘I do thank him for that.'” Whitsett earlier this month met with the president at a meeting of coronavirus survivors and expressed her gratitude. “At the end of the day, we have political systems,” Jonathan Kinloch, district chair of Michigan 13th Congressional District Democratic Party said according to The Detroit News.

“We have political parties, and political parties exist for a reason.” “I’m a Democrat, and I plan on continuing to be a Democrat, but they will change their ways,” Whitsett said according to the outlet. “I have my First Amendment right, and no one will take that away from me.” The Detroit News reports that one of the items mentioned in the resolution to censure Whitsett says she “‘has repeatedly and publicly praised the president’s delayed and misguided COVID-19 response efforts in contradiction with the scientifically based and action-oriented response’ from Michigan’s Democratic leadership, ‘endangering the health, safety and welfare of her constituents, the city of Detroit and the state of Michigan.'”

Shouldn’t they be able to sell more papers? If not now, when?

• News Outlets Have Received Millions In Forgivable Stimulus Loans (JTN)

News outlets are receiving tens-of-millions in federal stimulus money as part of the $2.2 trillion coronavirus stimulus package that President Trump signed into law, among them such venerable newspapers as The Seattle Times and Tampa Bay Times. The money is coming through forgivable Paycheck Protection Program loans under the CARES Act that Congress passed last month. According to the Small Business Administration, businesses with under 500 employees can apply for PPP loans, which are forgivable if they are used for qualifying expenses such as payroll costs and rent. However, it’s unclear whether any of the news outlets intend to repay the money, or how much they’ll repay.

The Tampa Bay newspaper, which received an $8.5 million loan, told Just the News on Thursday that its chairman and CEO, Paul Tash, says the federal government will “likely forgive much of the loan” and that the “remaining balance” will carry an interest rate of 1 percent. The Seattle Times received a $9.9 million PPP forgivable loan from the federal government. In its voluntary announcement of the loan, the Seattle Times stated that the loan is forgivable but didn’t specify whether the company plans to repay any of the money. The paper did not respond to a request for comment before publication. The media outlet Axios, based in Arlington, Va., disclosed that it had received a forgivable PPP loan of roughly $5 million. Axios did not respond when asked if it plans to repay the loan.

Why has the word whistleblower been injected here? Wrongful dismissal doesn’t sound catchy enough?

• Ousted US Health Official To File Whistleblower Complaint (R.)

Lawyers for the ousted director of a U.S. agency responsible for the development of drugs to fight the COVID-19 pandemic said on Thursday he will file a whistleblower’s complaint with two government offices over his reassignment. Rick Bright said on Wednesday he was replaced as director of the Biomedical Advanced Research and Development Authority, or BARDA, because he resisted the Trump administration’s efforts to push hydroxychloroquine and the related chloroquine as cures for COVID-19, the respiratory illness caused by the coronavirus. U.S. President Donald Trump has repeatedly touted the malaria drugs as a treatment for coronavirus though few studies suggest a possible benefit.

“In our filing we will make clear that Dr. Bright was sidelined for one reason only — because he resisted efforts to provide unfettered access to potentially dangerous drugs, including chloroquine, a drug promoted by the administration as a panacea, but which is untested and possibly deadly when used improperly,” his lawyers said in a statement. His lawyers said they will file the complaint with the Office of Special Counsel and the Department of Health and Human Services’ Inspector General. Bright hopes he will be reinstated in his post at BARDA once the facts of the case become known, his lawyers said. The Office of Special Counsel, an independent U.S. government agency, investigates and can prosecute abuses against federal employees.

Wonder how this will evolve when food gets scarce.

• WTO Report Says 80 Countries Limiting Exports Of Face Masks, Other Gear (R.)

Eighty countries and customs territories have banned or limited the export of face masks, protective gear, gloves and other goods to mitigate shortages since the coronavirus outbreak began, the World Trade Organization reported on Thursday. It said the bans were imposed by 72 WTO members and eight non-WTO member countries, but only 13 WTO members had notified the global trade body as required by its regulations. Lack of transparency about restrictions and failure to cooperate internationally could undermine efforts to slow the spread of the COVID-19 disease, which has infected 2.64 million people around the world and killed 184,910, the WTO said.

“While the introduction of export-restrictive measures is understandable, the lack of international cooperation in these areas risks cutting off import-reliant countries from desperately needed medical products and triggering a supply shock,” the WTO report said. “And by interfering with established medical supply chains, such measures also risk hampering the urgently required supply response.” Export bans and restrictions are generally prohibited in the WTO, although there are exceptions which allow temporary measures to “prevent or relieve critical shortages of foodstuffs or other products essential to the exporting contracting party.” Travel restrictions had already slowed the flow of goods needed to fight the pandemic, but export restrictions made it difficult for governments and businesses to adjust purchasing decisions and find new suppliers, the report said.

As someone remarked: Jeffrey Epstein wasn’t available.

• Biden Campaign’s Outside Economic Advisers Include Larry Summers (R.)

Former U.S. Treasury Secretary Larry Summers, an academic and longtime economic aide to Democratic presidents, is among the people now advising Joe Biden’s presidential campaign, according to two people familiar with the matter. Summers is a renowned economist with long ties to presidential administrations, including Barack Obama’s. Biden, the presumptive Democratic nominee, served as Obama’s vice president. Summers is viewed critically by some liberals, who view his policy prescriptions as too centrist. Dozens of economic and public health policy officials are briefing Biden ahead of the Nov. 3 election, when Republican President Donald Trump hopes to win a second term.

If he is elected, Biden would be faced with a U.S. economy scarred by a pandemic that has brought large segments to a standstill, forced more than 26 million people to seek unemployment benefits since March 21, and raised the prospect of job losses not seen since the Great Depression of the 1930s. Before then, Biden has to bring together his own party behind his candidacy, including liberals who once backed Senators Bernie Sanders and Elizabeth Warren. The two senators have both endorsed Biden, but it is not clear how many of their supporters will turn out to vote for Biden. [..] “Joe Biden’s will be the most progressive agenda of any president in generations, and he looks forward to his continuing engagement with progressive leaders to build on his existing policies and further the bold goals driving his campaign,” [an] adviser said.

Simple question: who did the wiping and deleting?

• Steele Testified Emails Were Wiped, No Docs Related To Primary Source (DC)

The former MI6 officer made the disclosures during a March 17-18 deposition in a defamation case related to the dossier. The DCNF obtained a transcript of the deposition. Steele suggested in a Dec. 10 statement that he had evidence that would shed light on what his main dossier source told him back in 2016, when Steele was working for the firm Fusion GPS to investigate the Trump campaign. Steele’s statement was a response to an IG report released the day before that said that Steele’s source — dubbed the “Primary Sub-Source” — told the FBI in January 2017 that Steele misrepresented or embellished information in the dossier. That bombshell severely undermined Steele’s report, which the FBI used as part of its investigation into the Trump campaign.

In a rebuttal to the IG, Steele’s lawyers disputed what the dossier source purportedly told the FBI, and said that the source’s debriefings to Steele “were meticulously documented and recorded.” They also asserted that if Steele had been given a chance to respond to the IG report, “the statements by the ‘Primary Sub-Source’ would be put in a different light.” It is unclear if Steele made audio or video recordings of the debriefings with the source, or if the retired spy was referring to written or electronic documents. It is also unclear whether Steele got rid of the information himself, or if it was lost through other means. Steele’s lawyer did not respond to a request for comment.

The status of the information was revealed during an exchange Steele had on March 18 with Hugh Tomlinson, a lawyer for Petr Aven, German Khan, and Mikhail Fridman, the owners of Alfa Bank. The three Russian bankers are suing Steele for defamation over a memo in the dossier that accused them of making illicit payments to Vladimir Putin. Tomlinson pressed Steele over the accuracy of his memo, as well as his relationship with “Primary Sub-Source,” the transcript shows. The lawyer asked Steele about the existence of the documents and recordings that his attorneys mentioned in their rebuttal to the IG report. “But none of these documents exist, so they have all been destroyed?” a lawyer asked Steele. “They no longer exist,” Steele said.

Steele indicated that many other records related to the dossier were deleted, including from a personal email account he used for the Fusion GPS project. “As I understand your position, you have no contemporaneous notes or emails, save for your notes of interactions with the FBI; is that right?” Tomlinson asked. “I believe that is true, yes,” Steele replied. Steele said he had no records related to the creation of his dossier memos, including “Report 112” from the dossier, which dealt with the Alfa Bank owners. “You have no record of anything, have you?” Tomlinson asked. “I haven’t got any records relating to the creation of 112,” said Steele.

So 75% in Germany, France, but only a third of that overall? Anything to do with population density?

• Insect Numbers Down 25% Since 1990 (G.)

The biggest assessment of global insect abundances to date shows a worrying drop of almost 25% in the last 30 years, with accelerating declines in Europe that shocked scientists. The analysis combined 166 long-term surveys from almost 1,700 sites and found that some species were bucking the overall downward trend. In particular, freshwater insects have been increasing by 11% each decade following action to clean up polluted rivers and lakes. However, this group represent only about 10% of insect species and do not pollinate crops. Researchers said insects remained critically understudied in many regions, with little or no data from South America, south Asia and Africa.

Rapid destruction of wild habitats in these places for farming and urbanisation is likely to be significantly reducing insect populations, they said. Insects are by far the most varied and abundant animals, outweighing humanity by 17 times, and are essential to the ecosystems humanity depends upon. They pollinate plants, are food for other creatures and recycle nature’s waste. The previous largest assessment, based on 73 studies, led scientists to warn of “catastrophic consequences for the survival of mankind” if insect losses were not halted. Its estimated rate of decline was more than double that in the new study. Other experts estimate 50% of insects have been lost in the last 50 years. Recent analyses from some locations have found collapses in insect abundance, such as 75% in Germany and 98% in Puerto Rico.

The new, much broader study found a lower rate of losses. However, Roel van Klink, of the German Centre for Integrative Biodiversity Research in Leipzig, who led the research, said: “This 24% is definitely something to be concerned about. It’s a quarter less than when I was a kid. One thing people should always remember is that we really depend on insects for our food.” The research, published in the journal Science, also examined how the rate of loss was changing over time. “Europe seems to be getting worse now – that is striking and shocking. But why that is, we don’t know,” said van Klink. In North America, the declines are flattening off, but at a low level.

Ever seen him do anything wrong?

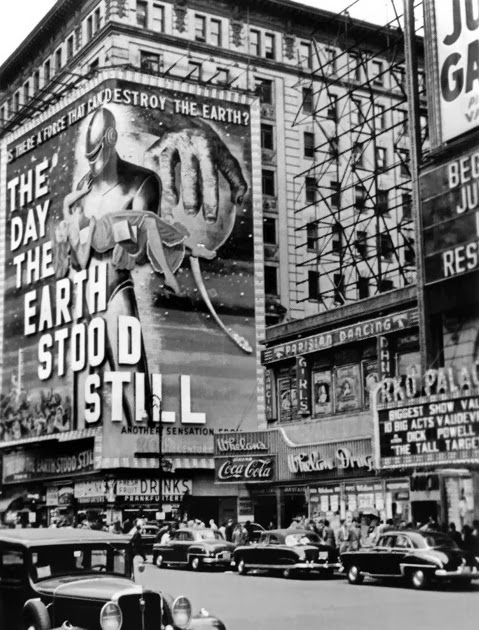

• Banksy’s ‘Girl with a Pierced Eardrum’ Gains A Coronavirus Face Mask (R.)

Banksy’s “Girl with a Pierced Eardrum” has been updated for the coronavirus era with the addition of a blue surgical face mask. The mural, a take on Dutch artist Johannes Vermeer’s “Girl with a Pearl Earring” but with a security alarm replacing the pearl, was painted on a harbourside building in the street artist’s home city of Bristol in west England in 2014. It is not known whether Banksy, whose identity is a closely guarded secret, or somebody else attached the fabric face mask to the painted girl.

The newly adorned mural did not appear on Banksy’s Instagram page where he usually posts images of his work. The COVID-19 pandemic has already inspired the artist. He unveiled a scene of his trademark stencilled rats running amok in a bathroom rather than on the streets last week, reflecting official advice form the British government to stay at home. “My wife hates it when I work from home,” he commented alongside the photos.

We would like to run the Automatic Earth on people’s kind donations. Since their revenue has collapsed, ads no longer pay for all you read, and your support is now an integral part of the process.

Thanks for your generosity.

From Upton Sinclair’s 1927 book “Oil!”, which inspired the movie There Will Be Blood

How to medical pic.twitter.com/0EDqJcy38p

— Sarah Cooper (@sarahcpr) April 24, 2020

Thanks celebrities, for everything you do for us.#giveusyourmoney pic.twitter.com/URCaZQmGiE

— Greta Lee Jackson (@gretaleejackson) April 24, 2020

Support the Automatic Earth for your own good.