Pablo Picasso The three dancers 1925

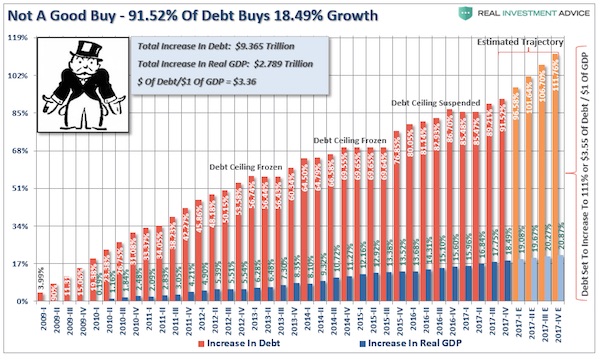

Another great piece by Lance Roberts. Here’s the part on debt. It now takes $3.71 of debt to create $1 of economic growth. That won’t last.

• The Mirage That Will Be Q2-GDP (Roberts)

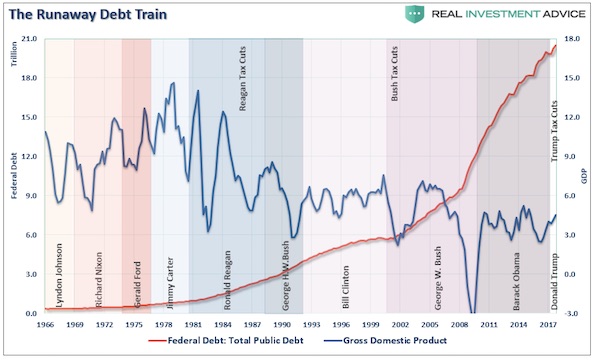

With wage growth stagnant, corporations struggling to pass through rising commodity and tariff related costs and debt service requirements on the rise as the Fed continues to hike rates, the drag from the consumption side of the economic equation will likely dwarf the current boosts in the next two quarters. Furthermore, as I noted previously, tax cuts and reform, tariffs and other fiscal remedies promoted by the current administration fail to address the main drag to economic growth over time. The debt. “It now requires $3.71 of debt to create $1 of economic growth which will only worsen as the debt continues to expand at the expense of stronger rates of growth.”

In fact, as recently noted by our friends at the Committee for a Responsible Federal Budget, the U.S. deficit is set to surge. To wit: “The White House Office of Management and Budget recently released its annual mid-session review which updated deficit projections in its fiscal year 2019 budget request. The report projected deficits will reach $1.085 trillion in FY 2019 under their budget, which is double the $526 billion called for in the FY 2018 budget.” The report specifically addresses the biggest point of concern:

“The last time the nation experienced trillion-dollar deficits was during a serious economic downturn, no less – lawmakers took the issue seriouly. PAYGO laws were established, a fiscal commission was formed, new discretionary spending caps were implemented and policymakers entered a multi-year debate on how best to bring down long-term debt levels. This time around, with the emergence of trillion-dollar deficits during a period of economic strength – when we should be saving for future downturns – few seem to even take notice. On our current course, debt will overtake the size of the entire economy in about a decade, and interest will be the largest government program in three decades or less. This will weaken both our economy and our role in the world.”

And more debt. And then some more.

• Household Debt In UK ‘Worse Than At Any Time On Record’ (G.)

British households spent around £900 more on average than they received in income during 2017, pushing their finances into deficit for the first time since the credit boom of the 1980s. The Office for National Statistics said the shortfall amounted to nearly £25bn – equal to almost a quarter of the NHS budget – and the overspend was mostly paid for with borrowed money, though households also ran down savings. The figures pose a challenge to the government, which was warned last year that Britain’s consumer credit bubble of more than £200 billion was unsustainable. A dramatic rise in debt-fuelled spending since 2016 has also taken place against the backdrop of the Brexit vote, which triggered a rise in inflation at a time of weak wage growth. .

Analysts warned that a squeeze on household incomes from benefit cuts, lacklustre wages and high inflation would continue to force poorer households to borrow more to pay basic bills. Tom Selby, a research analyst at financial adviser AJ Bell, said the figures presented ministers with a significant challenge as they sought “to build financial resilience in the UK”. Researchers at the ONS said the situation was worse than at any time on record after the £25bn deficit last year surpassed the £300m deficit recorded in 1988. British household finances also slumped from being among the most solvent in the 1990s to being among the most indebted compared with households in other major western countries.

42% of global GDP.

• BRICS Nations Pledge Unity As Trade War Threatens (AFP)

Five of the biggest emerging economies on Thursday stood by the multilateral system and vowed to strengthen economic cooperation in the face of US tariff threats and unilateralism. The heads of the BRICS group – Brazil, Russia, India, China and South Africa – met in Johannesburg for an annual summit dominated by the risk of a US-led trade war, although leaders did not publicly mention President Donald Trump by name. “We express concern at the spill-over effects of macro-economic policy measures in some major advanced economies,” they said in joint statement. “We recognise that the multilateral trading system is facing unprecedented challenges. We underscore the importance of an open world economy.”

Trump has said he is ready to impose tariffs on all $500 billion of Chinese imports, complaining that China’s trade surplus with the US is due to unfair currency manipulation. Trump has already slapped levies on goods from China worth tens of billions of dollars, as well as tariffs on steel and aluminium from the EU, Canada and Mexico. “We should stay committed to multilateralism,” Chinese President Xi Jinping said on the second day of the talks. “Closer economic cooperation for shared prosperity is the original purpose and priority of BRICS.” Russian President Vladimir Putin, who held a controversial meeting with Trump last week, echoed the calls for closer ties among BRICS members and for stronger trade within group. “BRICS has a unique place in the global economy — this is the largest market in the world, the joint GDP is 42% of the global GDP and it keeps growing,” Putin said.

For what it’s worth.

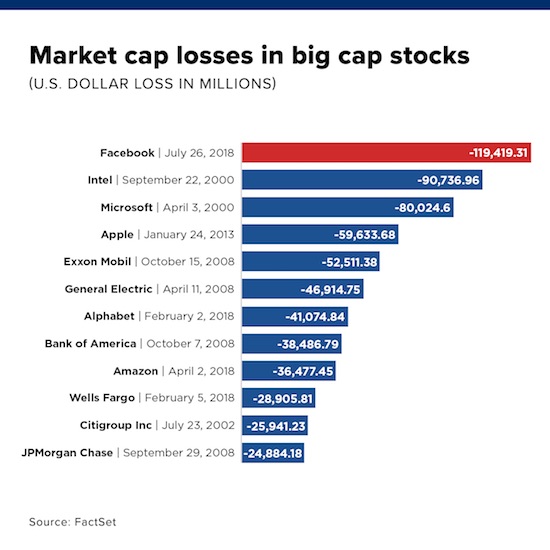

• Facebook’s $120 Billion Rout Biggest Loss In Stock Market History (CNBC)

Facebook on Thursday posted the largest one-day loss in market value by any company in U.S. stock market history after releasing a disastrous quarterly report. The social media giant’s market capitalization plummeted by $119 billion to $510 billion as its stock price plummeted by 19 percent. At Wednesday’s close, Facebook’s market cap had totaled nearly $630 billion, according to FactSet. No company in the history of the U.S. stock market has ever lost $100 billion in market value in just one day, but two came close. On Sept. 22, 2000, Intel shed $90.74 billion in market value as the dot-com bubble burst. Earlier that year, Microsoft lost $80 billion from its market cap in one day.

Other companies that have experienced similar one-day losses in dollar amount include Apple in 2013, when it lost $59.6 billion, and Exxon Mobil in 2008, when it lost $52.5 billion. Facebook’s enormous loss in value came a day after the company reported weaker-than-expected revenue for the second quarter as well as disappointing global daily active users, a key metric for Facebook. The company also said it expects its revenue growth rate to slow in the second half of this year. Several analysts downgraded Facebook’s stock, including Nomura Instinet’s Mark Kelley. “With stagnating core user growth, we think there is too much near- to mid-term uncertainty to recommend shares at this point,” Kelley, who downgraded the stock to neutral from buy, said in a note.

But who’s winning?

• Trade Deal With EU Greater In Scope Than Expected – US Official (R.)

The U.S. administration got more out of a trade deal with the European Union than it had expected and the two will work together to deal with China’s market abuses, a top White House official told Reuters on Thursday. President Donald Trump and Jean-Claude Juncker, president of the European Commission, the EU’s executive body, struck a surprise deal on Wednesday that ended the risk of an immediate trade war between the two powers. “The EU came into the conversation and they were open to the proposals we had made about getting rid of tariffs, non-tariff barriers and subsidies,” said the official, who spoke on condition of anonymity.

Trump agreed on Wednesday to refrain from imposing car tariffs while the two sides launch negotiations to cut other trade barriers. Europe agreed to increase purchases of U.S. liquefied natural gas and lower trade barriers to American soybeans. The official stressed on Thursday that Trump retained the power to implement tariffs on cars if needed and said there was no deadline for the completion of talks. He said Trump was committed to getting zero tariffs from the European Union.= As part of the deal, the United States and Europe will work together on China. The two powers in the past have cooperated on measures to deal with theft of company secrets by Chinese entities.

France doesn’t want to include agriculture. It gets 100s of billions in subsidies. So Macron talks about steel instead.

• Macron ‘Not In Favour’ Of Vast New US-EU Trade Deal (AFP)

French President Emmanuel Macron said Thursday he viewed talks between US President Donald Trump and EU Commission chief Jean-Claude Juncker as “useful”, but he was “not in favour” of a “vast new trade deal” between the European Union and the United States. “European and France never wanted a trade war and the talks yesterday were therefore useful in as far as they helped scale back any unnecessary tension, and working to bring about an appeasement is useful,” the French leader said after a meeting with Spanish Prime Minister Pedro Sanchez in Madrid. “But a good trade discussion… can only be done on a balanced, reciprocal basis, and in no case under any sort of threat,” Macron said. “In this regard, we have a number of questions and concerns that we will clarify”.

Macron said he was “not in favour of us launching a vast trade agreement, along the lines of the TTIP, because the current context does now allow for that,” referring to a transatlantic free-trade deal which stalled two years ago. And he reaffirmed his opposition to including agriculture in any such deal. “I believe that no European standard should be suppressed or lowered in the areas of the environment, health or food, for example.” Macron went on to insist that “clear gestures are needed from the US, signs of de-escalation on steel and aluminium, on which the United States have imposed illegal taxes. That, for me, would constitute a prelude to making further concrete headway” on trade.

Rinse and repeat.

• EU’s Barnier Kills Off Theresa May’s Brexit Customs Proposals (G.)

Michel Barnier has warned that attempts to appeal to EU leaders over his head were a waste of time as he rejected Theresa May’s proposals on customs after Brexit, in effect killing off the Chequers plan. On Friday Theresa May travels to Austria to meet Chancellor Sebastian Kurz and the Czech prime minister Andrej Babis, before heading off on her summer holiday. May’s trip follows the EU chief Brexit negotiator insisting there was no difference of opinion in European capitals to exploit. “Anyone who wants to find a sliver of difference between my mandate and what the heads of government say they want are wasting their time, quite frankly,” he told reporters at a joint press conference with the new Brexit secretary, Dominic Raab, in Brussels.

The British negotiators have become increasingly frustrated with the EU’s attitude to the white paper thrashed out at the prime minister’s country retreat. They feel that it will take an intervention by leaders, most likely at a summit in Salzburg in September, to move the dial in favour of a deal. A number of cabinet ministers have been despatched around EU capitals to make their case for greater flexibility. The impasse in the negotiations was laid bare in the press conference in the European commission’s Berlaymont headquarters as a thunderstorm broke outside. While Raab insisted that with “political will” a deal on trade and on avoiding a border on the island of Ireland was achievable by a crunch summit in October, Barnier offered a damning verdict on a major element of the UK’s vision of the future.

And the lira plunges some more…

• Trump Threatens Turkey Sanctions Over Detained Pastor (AP)

President Donald Trump says the U.S. will hit Turkey with “large sanctions” over a American pastor detained on terror and espionage charges, and he called for the pastor’s immediate release. Tweeting from aboard Air Force One, Trump said: “The United States will impose large sanctions on Turkey for their long time detainment of Pastor Andrew Brunson, a great Christian, family man and wonderful human being.” Trump said Brunson “is suffering greatly. This innocent man of faith should be released immediately!”

Just hours earlier, Vice President Mike Pence said that if Turkey does not take immediate action to free Brunson, “the United States of America will impose significant sanctions on Turkey.” Pence spoke at the close of a three-day conference in Washington on religious freedom. Brunson, 50, an evangelical Christian pastor originally from North Carolina, was let out of jail Wednesday, after 1 1/2 years, to serve house arrest because of “health problems,” according to Turkey’s official Anadolu news agency.�

Hope Judge Sabraw comes down hard on them. When he set the deadlines a month ago, he said: “These are firm deadlines; they’re not aspirational goals.”

• US Government Misses Judge’s Midnight Deadline For Reunifying Families (Ind.)

US lawyers and activists have described “chaos and confusion” at immigrant detention facilities as the Trump administration scrambles to reunify the more than 2,500 migrant children it separated from their parents at the border in recent months. The government is rushing to meet a Thursday night deadline set by US District Court Judge Dana Sabraw, who ordered all of the families reunified as part of a lawsuit brought by the American Civil Liberties Union last month. As of Tuesday, officials said they had identified 1,634 parents possibly eligible for reunification with their children, and successfully reunified some 1,012 of them. The government was scheduled to provide an updated count to Judge Sabraw on Friday morning.

But the government also said more than 900 parents may not be eligible for reunification because they had waived their right to reunification, had criminal backgrounds, or were otherwise deemed unfit. Some 462 of those parents had already left the country, the administration said, though it was unclear whether they had volunteered to leave or had been deported against their will. Lee Gelernt, the lead attorney on the case, took issue with this number, saying the Trump administration was “unilaterally picking and choosing who is eligible for reunification”. “We will continue to hold the government accountable and get these families back together,” he said in a statement.

Immigrants’ rights groups warned that many of the parents who had left the country already may have done so under duress or coercion, or armed with bad information. Advocates described parents being pressured by Immigration and Customs Enforcement (ICE) to sign paperwork they didn’t understand, or being told that they would not be reunified with their children unless they agreed to be deported.

The Wall Street Journal forgets to mention that consumers have nothing left to spend. Growth prospects?

• Taxation Strangles Greece’s Growth Prospects (WSJ)

Greece is scheduled to exit its marathon bailout this summer after hitting the tough fiscal targets set by its creditors. But the country has done so by raising taxes so high that they are strangling the small businesses that form the backbone of its economy. At the Dandy restaurant in downtown Athens, owner Charalampos Bonatsos said rising taxes have forced him to lay off half his staff and cut his remaining workers’ wages. He said he still struggles to cope with the last three years’ increases in corporate income tax, property tax and sales tax. “All that matters is reaching the bailout goals. No one cares whether doing business is possible with this policy,” Mr. Bonatsos said.

The tax increases have left Greece with some of Europe’s highest tax rates across several categories, including 29% on corporate income, 15% on dividends, and 24% on value-added tax (a rough equivalent of U.S. sales tax). Individuals pay as much as 45% income tax, plus an extra “solidarity levy” of up to 10%. Furthermore, workers and employers pay social-security levies of up to 27% of their salaries. The elevated taxes under Greece’s bailout program have fallen most heavily on small and midsize businesses and self-employed people. Lawyers and engineers, most of whom are self-employed, are fighting the government in court over having to pay what they say is up to 80% of their average monthly takings in taxes and levies.

Some also have to pay retroactive social-security contributions, to the point where professional associations say some of their members are having to pay more to the state than they make. The painfully high taxes reflect the tough demands of Greece’s main creditors: other eurozone countries led by Germany, and the IMF. Since Greece’s finances spun out of control, its bailout lenders have forced the country to cut its budget deficit from over 15% of GDP in 2009 to a surplus of around 1% in 2017. [..] The tax burden creates a serious disincentive for economic activity. It mainly hits the most productive part of the Greek society,” said George Pagoulatos, professor of economics at the Athens University of Economics and Business. “Greece resembles Scandinavian-style taxation, but its welfare state has nothing to compare to theirs: You don’t get anything in return.”

Words fail. Yesterday, heavy rains flooded areas 25km from Mati.

• Death Toll From Greek Wildfires Rises To 85, Scores Stll Missing (K.)

The death toll from the deadly blaze that ravaged the coastal town of Mati in east Attica on Monday rose to 85 on Thursday, after a 73-year-old man who was in intensive care in Athens’ Evangelismos hospital died and two more bodies were discovered by rescue crews. Earlier in the day, a fire service spokesperson told journalists the number had risen to 82. Stavroula Malliri said rescuers are looking for missing people but have not yet entered closed houses in affected areas. About 300 firemen and volunteers combed through the area looking for dozens reported missing, among them two 9-year old sisters.

“Understanding the agony of the relatives of those missing, we inform you that the search to find them will not stop until all buildings and areas affected by the blaze have been checked,” she told journalists. Malliri called on the relatives of those missing to visit the forensics department of the University of Athens in Goudi until Friday (8 a.m. to 8 p.m.) where they will be briefed about the procedure followed to identify the victims. The Infrastructure Ministry announced earlier on Thursday that 1,218 buildings (48.93 pct) out of the 2,489 assessed by its engineers since Tuesday were deemed uninhabitable.

Don’t worry, we’ll get to that yet.

• Only 13% Of World’s Oceans Are Still Untouched Wilderness (Ind.)

The area of the ocean that remains undamaged by humans is tiny, according to the first ever comprehensive analysis of “marine wilderness”. Global shipping, fishing operations and pollution running into the sea from land have all taken their toll on the world’s seas, including some of the most remote areas. Areas of true wilderness are vital as they are some of the most diverse parts of the ocean and the last places on Earth still inhabited by sizeable numbers of large predators like sharks. Even the few fragments that remain are threatened as advanced fishing technologies and melting sea ice expose them to human activity. Most of the remaining wilderness, which covers no more than 13% of the world’s oceans, can be found in the polar regions and around remote Pacific Island nations.

The scientists behind the study have called for international agreements to recognise the unique value of these zones. Kendall Jones of the University of Queensland, who led the research, said they were “astonished by just how little marine wilderness remains”. “The ocean is immense, covering over 70% of our planet, but we’ve managed to significantly impact almost all of this vast ecosystem,” he said. Crucially, less than 5% of the remaining wilderness is officially protected. “This means the vast majority of marine wilderness could be lost at any time, as improvements in technology allow us to fish deeper and ship farther than ever before,” explained Mr Jones. “Thanks to a warming climate, even some places that were once safe due to year-round ice cover can now be fished.”