Jackson Pollock Greyed Rainbow 1953

The best way to stop Covid-19 is to reset the global financial system. Once most small businesses are bankrupted and the majority of our freedoms have been stripped away virus will disappear.

— Karmic Reset (@daretocontraire) November 29, 2020

• Nearly One-Third Of NY, NJ Small Businesses Reportedly Closed In 2020 (NYP)

It has been a bad year for ma and pa. Nearly one-third of small businesses in New York and New Jersey remain closed since January amid the coronavirus pandemic, according to a watchdog. In the Empire State, 27.8 percent of small businesses have not reopened their doors, while Jersey has lost 31.2 percent as of Nov. 16, according to TrackTheRecovery.org, a Harvard-run database that keeps tabs on the economic impact of the virus. The figures are in line with estimates from the New Jersey Business & Industry Association, which says 28 percent of the Garden State’s small businesses had shut up shop by the end of October, according to the Star Ledger newspaper. And with the region now seeing a resurgence of the virus, business leaders are worried the number could go even higher.

“It’s really bad,” Eileen Kean, New Jersey state director of the National Federation of Independent Businesses told the Star-Ledger. “And without federal dollars coming into New Jersey, the Main Street stores and other establishments are not gonna make it through the winter.” More than half of small businesses in both states were forced to shut their doors in the spring at the height of the pandemic, with both hitting highs in mid-April — 52.5 percent of New York businesses and 53.9 percent in the Garden States, the stats show. “It’s devastating how many restaurants have shuttered and jobs have been lost,” said Andrew Rigie, executive director of NYC Hospitality Alliances, which represents bars, restaurants, and clubs in the Big Apple.

And it happens everywhere. So much of this will never come back. Are we prepared for that?

• Almost 700,000 Driven Into Poverty By COVID Crisis In UK (G.)

Almost 700,000 people in the UK, including 120,000 children, have been plunged into poverty as a result of the Covid economic crisis, according to a thinktank analysis. The Legatum Institute also said an additional 700,000 people had been prevented from falling below the breadline by the chancellor’s temporary £20-a-week boost to universal credit, introduced in April to help claimants cope with the extra costs of the pandemic. Overall, the pandemic has pushed the total number of people in the UK living in poverty to more than 15 million – 23% of the population – according to the institute, which uses poverty measures developed by the independent Social Metrics Commission. The Conservative peer Philippa Stroud, the institute’s chief executive, said the findings showed a “clear need for a comprehensive anti-poverty strategy to be placed at the heart of the UK’s Covid recovery response”.

Lady Stroud, in common with many other anti-poverty campaigners, has called for the government to retain the 12-month uplift to universal credit after it is due to end in April 2021. Ministers last week said they would decide in January. The new analysis relies on “nowcasting” techniques using employment, earnings data and the impact of government policy to enable up-to-date and robust poverty estimates, because official figures for the first year of Covid are not due until 2022. Those hardest hit by the economic crisis were young workers, those in relatively low-paying employment and those working in sectors such as hospitality and retail. Elderly people were financially least badly hit, the analysis found. Of the 700,000 people newly in poverty, just over half had incomes up to 25% below the poverty line, 160,000 were between 35% and 50% below, and 270,000 had slipped more than 50% below, known as “deep poverty”.

Oh wait, there’s our comeback. Shop till you drop at 4 am.

• UK Shops To Be Allowed To Open 24 Hours A Day In December And January (G.)

Shops will be given permission to trade around the clock as the high street tries to recoup some of the losses it has suffered during the pandemic, a cabinet minister has said. Retailers normally have to go through a lengthy process to apply to local authorities under the Town and Country Planning Act if they wish to extend hours outside the window of 9am to 7pm. But the communities secretary, Robert Jenrick, said he wanted to remove the bureaucracy to encourage greater trade – allowing shops to open for up to 24 hours a day in December and January. Writing in the Daily Telegraph, he said: “With these changes local shops can open longer, ensuring more pleasant and safer shopping with less pressure on public transport.

How long will be a matter of choice for the shopkeepers and at the discretion of the council, but I suggest we offer these hard-pressed entrepreneurs and businesses the greatest possible flexibility this festive season. “As local government secretary I am relaxing planning restrictions and issuing an unambiguous request to councils to allow businesses to welcome us into their glowing stores late into the evening and beyond.” It comes after Jenrick suggested some areas could be moved into a lower tier when the first 14-day review of the latest system of tiered local controls takes place in mid-December. A record number of shops closed during the first half of 2020 due to the coronavirus lockdown, according to research from the Local Data Company and PwC.

Sounds nice, but if the virus is endemic, and it sure looks that way, what will happen when those stores open 24/7?

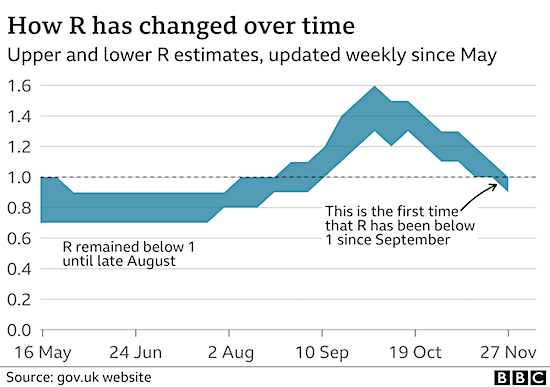

• Covid Infections In England Fall By 30% Over Lockdown (BBC)

Coronavirus infections in England have fallen by about a third over lockdown, according to a major study. Some of the worst-hit areas saw the biggest improvements – but, despite this progress, cases remained high across England. Health Secretary Matt Hancock said the data showed the country could not “take our foot off the pedal just yet”. The findings by Imperial College London were based on swabbing more than 100,000 people between 13-24 November. The React-1 study is highly respected and gives us the most up-to-date picture of Covid-19 in the country. Its researchers estimated the virus’s reproduction (R) rate had fallen to 0.88. That means on average every infection translated to less than one other new infection, so the epidemic is shrinking.

Run alongside pollster Ipsos MORI, the Imperial study involved testing a random sample of people for coronavirus, whether or not they had symptoms. The results of these tests suggested a 30% fall in infections between the last study and the period of 13-24 November. Before that, cases were accelerating – doubling every nine days when the study last reported at the end of October. Now cases are coming down, but more slowly than they shot up – halving roughly every 37 days. In the North West and North East, though – regions with some of the highest numbers of cases – infections fell by more than half. The findings suggest cases are now highest in the East Midlands and West Midlands.

11 months into the mess, “Testing is a struggle, PPE and staff are daily challenges.” Sweet lord.

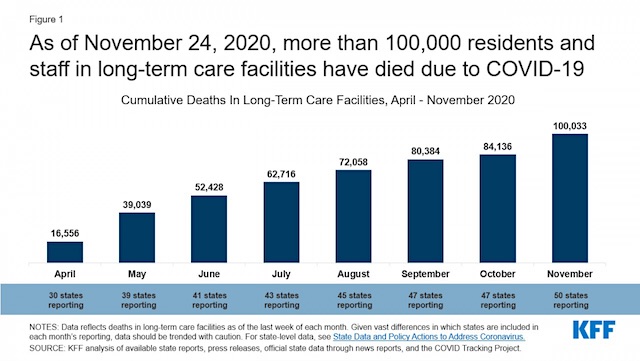

Kaiser says 40% of US COVID deaths are in long term care homes. I was corrected recently about a Canada graph I posted which said it 98% in Ontario, but even then it was two-thirds of all deaths there.

With such concentrations, anything you can do to decrease the numbers in these homes can change the entire picture of the disease countrywide. Why is that not happening?

NOTE: the graph may be a little misleading; not oly do the numbers of deaths rise, the numbers of states reporting also do.

• Over 100,000 US Nursing Home Residents, Staff Killed by Pandemic (CD)

As of the last week of November, Covid-19 has claimed the lives of more than 100,000 people who live and work in long-term care facilities in the United States, according to the Kaiser Family Foundation’s latest analysis of state-reported data. The following chart depicts the growth in Covid-19 deaths among nursing home residents and staff in the U.S. since April. According to the Kaiser Family Foundation (KFF), 40% of the nation’s Covid-19 deaths have occurred in long-term care facilities. “While early action to prevent the spread of coronavirus in long-term care facilities led to strict protocols related to testing, personal protective equipment, and visitor restrictions,” KFF pointed out that “several of these measures have been reversed in recent months, and some long-term care facilities continue to report shortages of PPE and staff.”

According to physician and public health expert Michael Barnett, 7.7% of the nation’s nursing home residents, or one in 13, have now died as a result of Covid-19. “Things have never really gotten better,” he tweeted. “Testing is a struggle, PPE and staff are daily challenges.” Soon after reaching the “bleak milestone” of 100,000 pandemic deaths in long-term care facilities, which happened on Tuesday, the U.S. on Thursday experienced a new record-high number of coronavirus-related hospitalizations, as Common Dreams reported earlier Friday.

Millions of Americans have passed through airports in the past week, despite the Centers for Disease Control and Prevention’s recommendation against traveling for Thanksgiving. Dr. Anthony Fauci, the nation’s top infectious disease expert, does not expect conditions to improve by Christmas and the New Year. As KFF explained, the predicted “surge in cases after holiday gatherings and increased time indoors due to winter weather… will have ripple effects on hospitals and nursing homes, given the close relationship between community spread and cases in congregate care settings.”

It’s still not done yet.

• The ‘Smartest Man In The Room’ Has Joined Sidney Powell’s Team (AT)

In her Georgia complaint, Sidney Powell included the declaration of Navid Keshavarz-Nia, an expert witness who stated under oath that there was massive computer fraud in the 2020 election, all of it intended to secure a victory for Joe Biden. Dr. Kershavarz-Nia’s name may not mean a lot to you, but it’s one of the weightiest names in the world when it comes to sniffing out cyber-security problems. We know how important Dr. Kershavarz-Nia is because, just two and a half months ago, the New York Times ran one of its Sunday long-form articles about a massive, multi-million-dollar fraud that a talented grifter ran against the American intelligence and military communities. Dr. Kershavarz-Nia is one of the few people who comes off looking good:

“Navid Keshavarz-Nia, those who worked with him said, “was always the smartest person in the room.” In doing cybersecurity and technical counterintelligence work for the C.I.A., N.S.A. and F.B.I., he had spent decades connecting top-secret dots. After several months of working with Mr. Courtney, he began connecting those dots too. He did not like where they led.” Not only does Dr. Kershavarz-Nia have an innate intelligence, but he’s also got extraordinary academic and practical skills in cyber-fraud detection and analysis. The reason we know about his qualifications is that it takes seven paragraphs for him to list them in the declaration he signed to support the Georgia complaint.

His qualifications include a B.A., M.A., and Ph.D. in various areas of electrical and computer engineering. In addition, “I have advanced trained from the Defense Intelligence Agency (DIA), Central Intelligence Agency (CIA), National Security Agency (NSA), DHS office of Intelligence & Analysis (I&A) and Massachusetts Institution of Technology (MIT).” Professionally, Dr. Kershavarz-Nia has spent his career as a cyber-security engineer. “My experience,” he attests,” spans 35 years performing technical assessment, mathematical modeling, cyber-attack pattern analysis, and security intelligence[.]” I will not belabor the point. Take it as given that Dr. Kershavarz-Nia may know more about cyber-security than anyone else in America.

So what does the brilliant Dr. Kershavarz-Nia have to say? This: 1. Hammer and Scorecard is real, not a hoax (as Democrats allege), and both are used to manipulate election outcomes. 2. Dominion, ES&S, Scytl, and Smartmatic are all vulnerable to fraud and vote manipulation — and the mainstream media reported on these vulnerabilities in the past. 3. Dominion has been used in other countries to “forge election results.” 4. Dominion’s corporate structure is deliberately confusing to hide relationships with Venezuela, China, and Cuba. 5. Dominion machines are easily hackable. 6. Dominion memory cards with cryptographic key access to the systems were stolen in 2019.

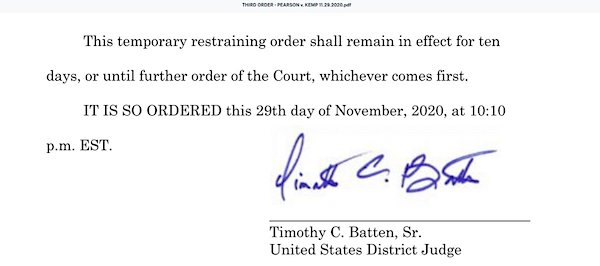

The strangest case of all so far?! People protest in court against Dominion machines being wiped clean on order of Sec of State, judge orders wiping stopped (it was already in progress), then reverses order because plaintiffs don’t have the machines, then reverses that order again. Buy why would you wipe election machines to begin with, especially before the election has been decided?

• Republicans Plan to Occupy Georgia State House (GP)

A coalition of Republican groups are calling for an occupation of the Georgia State House in response to Secretary of State Brad Raffensperger ordering the Dominion voting machines in the state to be wiped. The groups are also calling for a protest at Raffensperger’s home on Monday evening. Raffensperger claims that he was ordering them to be reset ahead of the senate runoff election, but a reset would wipe all votes from the general election — the results of which are still being hotly contested by the Trump campaign. The deletion had been temporarily stopped on Sunday, when Judge Timothy C. Batten, Sr. issued an order to freeze ALL Dominion voting machines in the state of Georgia, but he reversed course within hours.

Currently, there is a major fight going on and it appears that a short time later, a federal judge ordered officials not to reset the machines. The volatile and unknown situation has lead to Republican activists and organizers to call for a full on occupation of the Georgia State House on Monday — as well as protest at the Secretary of State’s house. “After the Secretary of State ordered the voting machines to be wiped in a blatant destruction of evidence, coalition groups plan to OCCUPY THE STATE CAPITOL in Georgia on Monday November 30 at 12pm. They also plan to protest outside the Sec. of States house at 6pm,” Republican activist, influencer, and entrepreneur Mike Coudrey tweeted.

“Defendants are hereby ENJOINED & RESTRAINED from altering, destroying, or erasing, or allowing the alteration, destruction, or erasure of, any software or data on any DOMINION VOTING MACHINE…”

When you look at these numbers, yes, it’s strange.

• The 2020 Presidential Election Is Deeply Puzzling (Basham)

I am a pollster and I find this election to be deeply puzzling. I also think that the Trump campaign is still well within its rights to contest the tabulations. Something very strange happened in America’s democracy in the early hours of Wednesday November 4 and the days that followed. It’s reasonable for a lot of Americans to want to find out exactly what. First, consider some facts. President Trump received more votes than any previous incumbent seeking reelection. He got 11 million more votes than in 2016, the third largest rise in support ever for an incumbent. By way of comparison, President Obama was comfortably reelected in 2012 with 3.5 million fewer votes than he received in 2008. Trump’s vote increased so much because, according to exit polls, he performed far better with many key demographic groups.

Ninety-five percent of Republicans voted for him. He did extraordinarily well with rural male working-class whites. He earned the highest share of all minority votes for a Republican since 1960. Trump grew his support among black voters by 50 percent over 2016. Nationally, Joe Biden’s black support fell well below 90 percent, the level below which Democratic presidential candidates usually lose. Trump increased his share of the national Hispanic vote to 35 percent. With 60 percent or less of the national Hispanic vote, it is arithmetically impossible for a Democratic presidential candidate to win Florida, Arizona, Nevada, and New Mexico. Bellwether states swung further in Trump’s direction than in 2016. Florida, Ohio and Iowa each defied America’s media polls with huge wins for Trump.

Since 1852, only Richard Nixon has lost the electoral college after winning this trio, and that 1960 defeat to John F. Kennedy is still the subject of great suspicion. Midwestern states Michigan, Pennsylvania, and Wisconsin always swing in the same direction as Ohio and Iowa, their regional peers. Ohio likewise swings with Florida. Current tallies show that, outside of a few cities, the Rust Belt swung in Trump’s direction. Yet, Biden leads in Michigan, Pennsylvania, and Wisconsin because of an apparent avalanche of black votes in Detroit, Philadelphia, and Milwaukee. Biden’s ‘winning’ margin was derived almost entirely from such voters in these cities, as coincidentally his black vote spiked only in exactly the locations necessary to secure victory. He did not receive comparable levels of support among comparable demographic groups in comparable states, which is highly unusual for the presidential victor.

We are told that Biden won more votes nationally than any presidential candidate in history. But he won a record low of 17 percent of counties; he only won 524 counties, as opposed to the 873 counties Obama won in 2008. Yet, Biden somehow outdid Obama in total votes. Victorious presidential candidates, especially challengers, usually have down-ballot coattails; Biden did not. The Republicans held the Senate and enjoyed a ‘red wave’ in the House, where they gained a large number of seats while winning all 27 toss-up contests. Trump’s party did not lose a single state legislature and actually made gains at the state level. Another anomaly is found in the comparison between the polls and non-polling metrics.

The latter include: party registrations trends; the candidates’ respective primary votes; candidate enthusiasm; social media followings; broadcast and digital media ratings; online searches; the number of (especially small) donors; and the number of individuals betting on each candidate. Despite poor recent performances, media and academic polls have an impressive 80 percent record predicting the winner during the modern era. But, when the polls err, non-polling metrics do not; the latter have a 100 percent record. Every non-polling metric forecast Trump’s reelection. For Trump to lose this election, the mainstream polls needed to be correct, which they were not. Furthermore, for Trump to lose, not only did one or more of these metrics have to be wrong for the first time ever, but every single one had to be wrong, and at the very same time; not an impossible outcome, but extremely unlikely nonetheless.

@KateAronoff: “Historic times, ladies: a woman is going to collect surveillance data leading to a targeted drone strikes. Another woman will tell the press that 14 dead civilians is the price of freedom, and yet another woman will say there’s no money left for healthcare”

• Biden To Tap Career Russiagater For Top Budgeting Post (RT)

An Obamacare architect, former Hillary Clinton adviser and career Russiagater, Neera Tanden, has been tapped as potential budget office director under Biden, setting Twitter on fire with recollections of her toxic track record. Tanden was a healthcare adviser under the Barack Obama administration and helped draft his brainchild the Affordable Care Act. A close ally of Hillary Clinton during her unsuccessful 2016 presidential run, she currently heads the pro-Clinton think tank Center for American Progress. Although born and raised in the United States, Tanden’s parents are immigrants from India. The mainstream media have praised her potentially becoming “the first woman of color and the first South Asian American to lead the Office of Management and Budget.”

Known for her combative tweeting, Tanden seems to have a habit of clashing with anyone who questions the wisdom of the Democratic Party’s political machine. Journalist Vincent Bevins joked that her potential nomination should be seen as an inspiration which “shows that a lifetime of posting cringe is not a barrier to higher office.” Grayzone writer and assistant editor Ben Norton labelled Tanden a “neoliberal troll” who “hates the left with a burning passion and spends all her time on here attacking leftists.” In fact, Tanden was openly hostile towards supporters of Vermont senator and two-time presidential hopeful Bernie Sanders. The left-leaning lawmaker accused Tanden last year of “maligning my staff & supporters and belittling progressive ideas.”

Her hostility towards those critical of Clinton reportedly even led to physical scuffles. In 2008, Tanden is said to have assaulted a staffer after he asked Clinton a critical question about the Iraq war. Conservative pundit Mike Cernovich described Tanden as a “garden variety resistance troll,” although this description arguably doesn’t do justice to her impressive output of Russiagate-related outbursts. She was a militant disciple of the debunked theory that Donald Trump’s presidential campaign was in cahoots with Moscow, floating countless bizarre allegations, including, but certainly not limited to, the proposition that Russian hackers had infiltrated Florida’s voting system with Trump’s full knowledge during the 2016 election.

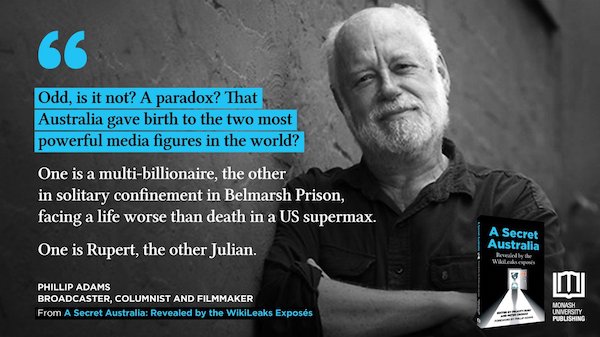

Tanden provocatively alleged that WikiLeaks co-founder Julian Assange engaged in “fascist behavior” by publishing leaked State Department emails and other US documents. Her foreign policy views have also raised eyebrows. She (in)famously suggested Libya should provide compensation, in the form of oil, to the US as a means of repayment for its “liberation.” A US-led NATO intervention in 2011 turned the North African nation into a safe haven for warlords, terrorists and human traffickers. “Given tonight’s news, I hope oil-rich countries around the world are increasing the security on their rigs and drilling sites,” journalist Glenn Greenwald quipped, citing an email of Tanden’s that was leaked to the Intercept.

We can thank Julian Assange for exposing that Neera Tanden — now Joe Biden’s budget director — wanted to take Libya’s oil as “payback” for the US overthrowing Gaddafi and bombing the country to smithereens, leaving it riddled with open air slave markets.

— Sarah Abdallah (@sahouraxo) November 29, 2020

A decades-long development.

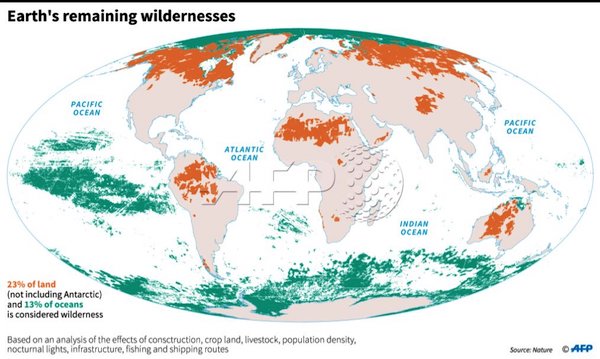

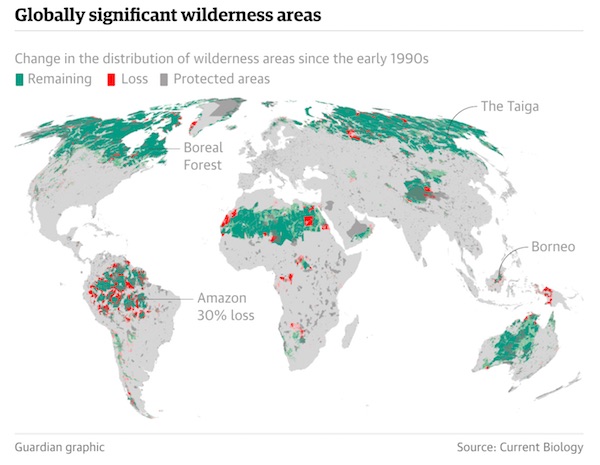

• One Of America’s Great Wildernesses Being Destroyed In A Silent Massacre (LAT)

Hidden away in the heart of the Deep South, one of the nation’s greatest wildernesses is being destroyed, bit by bit, in a silent massacre. You won’t find people chaining themselves to trees to protect this place, or national environmental groups using pictures of it to sign up new members, because few know it exists. And yet, here it is — the Mobile River Basin, one of the richest in the world in terms of the sheer number of species and types of habitat. The major rivers and thousands of creeks feeding into this basin together form the largest inland delta system in the United States, second only to the Mississippi in how much water it dumps into the Gulf of Mexico.

The river system, the fourth-largest in the country in terms of water flow, stretches from the northern edge of Alabama to the Gulf, draining parts of four states, and encompassing hundreds of thousands of acres of forest, from Appalachian hardwood stands to haunted cypress swamps. A dedicated band of locals know it for the incredible hunting and fishing it affords. But few know it for its greatest distinction. That’s a shame, for this is America’s Amazon, far and away the most biodiverse river network in North America. There are more species of oaks on a single hillside on the banks of the Alabama River than you can find anywhere else in the world. The Mobile River Basin makes Alabama home to more species of freshwater fish, mussels, snails, turtles and crawfish than any other state. The contest isn’t even close.

For instance, Alabama is home to 97 crawfish species, while California, three times the size of Alabama, has but nine. There are 450 species of freshwater fish in the state, or about one-third of all species known in the entire nation. The system’s turtle population is even more singular. The Mobile-Tensaw Delta estuary system has 18 turtle species, more than any other river delta system in the world — more than the Amazon and more than the Mekong, both extraordinarily biodiverse ecosystems. Unlike most of the nation’s great river systems, the Mobile Basin — along with its wetlands, floodplain forests and estuary — has survived with its biological community mostly intact. That is due in large measure to an odd combination of benign neglect and the mixed blessing of being located in the heart of Alabama.

Tragically, it now sits on the cusp of decline, facing death by a thousand cuts, just as the scientific community has begun to appreciate its riches. Habitat destruction, development and lax enforcement of environmental regulations conspire to take an increasing toll, making the area a global hot spot for extinctions, particularly of aquatic creatures. In fact, nearly half of all extinctions in the continental United States since the 1800s have occurred among creatures that lived in the Mobile River Basin, according to records maintained by Endangered Species International and the U.S. Fish and Wildlife Service.

“The problems are deep and structural – not the type that the tedious process of democratic change can fix in time to forestall mayhem.”

• The Next Decade Could Be Even Worse (Wood)

Peter Turchin, one of the world’s experts on pine beetles and possibly also on human beings, met me reluctantly this summer on the campus of the University of Connecticut at Storrs, where he teaches. Like many people during the pandemic, he preferred to limit his human contact. He also doubted whether human contact would have much value anyway, when his mathematical models could already tell me everything I needed to know. [..] The year 2020 has been kind to Turchin, for many of the same reasons it has been hell for the rest of us. Cities on fire, elected leaders endorsing violence, homicides surging – to a normal American, these are apocalyptic signs. To Turchin, they indicate that his models, which incorporate thousands of years of data about human history, are working. (“Not all of human history,” he corrected me once. “Just the last 10,000 years.”)

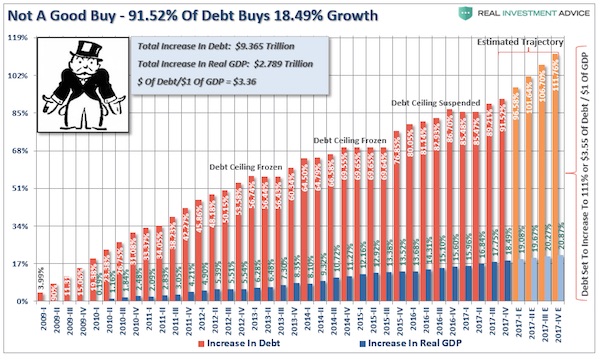

He has been warning for a decade that a few key social and political trends portend an “age of discord,” civil unrest and carnage worse than most Americans have experienced. In 2010, he predicted that the unrest would get serious around 2020, and that it wouldn’t let up until those social and political trends reversed. Havoc at the level of the late 1960s and early ’70s is the best-case scenario; all-out civil war is the worst. The fundamental problems, he says, are a dark triad of social maladies: a bloated elite class, with too few elite jobs to go around; declining living standards among the general population; and a government that can’t cover its financial positions. His models, which track these factors in other societies across history, are too complicated to explain in a nontechnical publication.

But they’ve succeeded in impressing writers for nontechnical publications, and have won him comparisons to other authors of “megahistories,” such as Jared Diamond and Yuval Noah Harari. [..] The fate of our own society, he says, is not going to be pretty, at least in the near term. “It’s too late,” he told me as we passed Mirror Lake, which UConn’s website describes as a favorite place for students to “read, relax, or ride on the wooden swing.” The problems are deep and structural – not the type that the tedious process of democratic change can fix in time to forestall mayhem. Turchin likens America to a huge ship headed directly for an iceberg: “If you have a discussion among the crew about which way to turn, you will not turn in time, and you hit the iceberg directly.”

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site.

Click at the top of the sidebars for Paypal and Patreon donations. Thank you for your support.

Support the Automatic Earth in virustime, election time, all the time. Click at the top of the sidebars to donate with Paypal and Patreon.