Edgar Degas Les repasseuses (women ironing) 1884

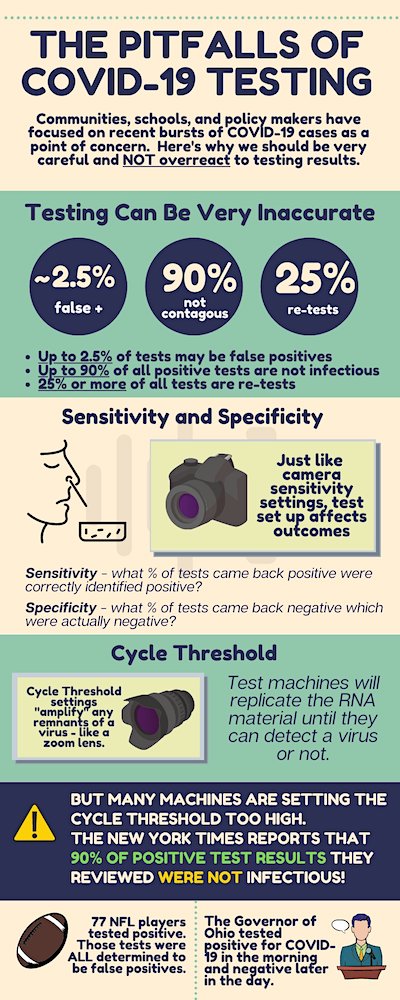

RFK vaccines

Childhood Vaccines

1983 = 10 vaccines

2013 = 32 vaccines

2022 = 74 vaccinesAutism Rates

1983 = 1 in 10,000

2013 = 1 in 88

2022 = 1 in 36

2025… estimates 1 in 2— Pelham (@Resist_05) June 9, 2023

RFK on Ukraine

Robert Kennedy Jr explains the Ukraine war: The US Govt toppled the democratically elected Ukrainian Govt in 2014, selected the new leader of Ukraine, funded a civil war against ethnic Russians in the east and provoked Russia into the ongoing US proxy war. pic.twitter.com/uMG1WffLPt

— Kim Dotcom (@KimDotcom) June 8, 2023

Chomsky China

Wow, this is exceedingly rare.

The immense Noam Chomsky was given a whole 8 minutes on Piers Morgan to explain how the US is provoking China into war, and he does a brilliant job at it.

An absolute must-watch if you want to understand what's happening.

He explains how the US… pic.twitter.com/WgfmxTPHA6

— Arnaud Bertrand (@RnaudBertrand) June 9, 2023

Tucker pedophilia

TUCKER CARLSON: Pedophilia Is Running Rampant in This Country, and No One In Power Is Doing Anything About It

“A generation ago, talking to someone else’s children about sex was widely considered grounds for a thrashing. Touching them sexually was effectively a death penalty… pic.twitter.com/VkCBl7sQia

— The Vigilant Fox 🦊 (@VigilantFox) June 8, 2023

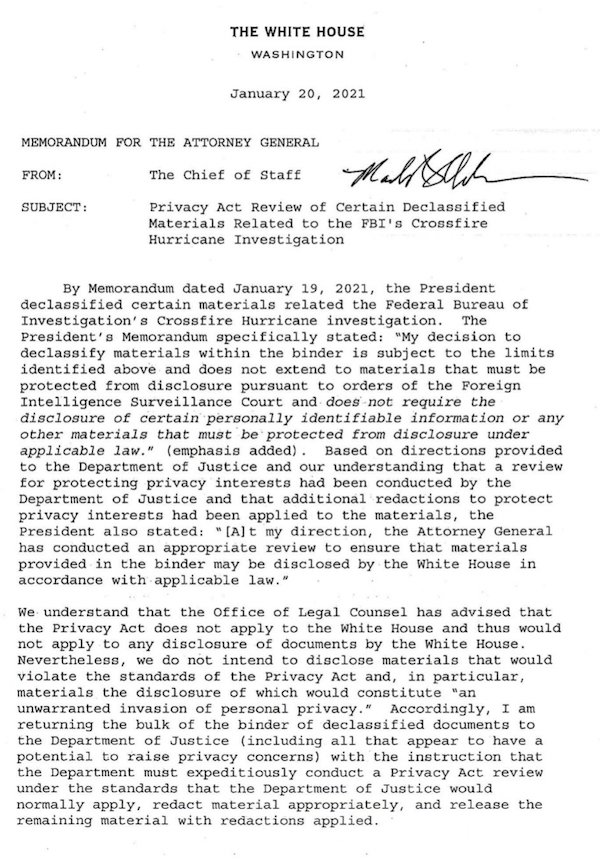

Sundance brings the receipts.

“President Trump declassified documents that show how the institutions within the U.S. government targeted him..”

“..if you peel away all the layers of lies, manipulations and corruption, what you find at the heart of their conduct is fear. The need for control is a reaction to fear. What do they fear most? …..THIS!”

• Reminder, What Was in The Mar-a-Lago Documents (CTH)

The NSA compliance officer notified NSA Director Admiral Mike Rogers of unauthorized use of the NSA database by FBI contractors searching U.S. citizens during the 2015/2016 presidential primary. That 2016 notification is a classified record. The response from Mike Rogers, and the subsequent documentary evidence of what names were being searched, is again a classified record. The audit logs showing who was doing the searches (which contractors, which agencies and from what offices), as noted by Director Rogers, were preserved. That is another big-time classified record. In addition, we would have Admiral Rogers writing a mandatory oversight notification to the FISA court detailing what happened. That’s a big and comprehensive classified record, likely contained in the documents in Mar-a-Lago… and then the goldmine, the fully unredacted 99-page FISA court opinion detailing the substance of the NSA compromise by FBI officials and contractors, including the names, frequency and dates of the illegal surveillance.

That is a major classified document the Deepest Deep State would want to keep hidden. These are the types of documents within what former ODNI John Ratcliffe called, “thousands of pages that were declassified by President Trump,” and given to both John Durham and Main Justice with an expectation of public release when the Durham special counsel probe concluded. That is why the DOJ has to make their moves now. The Durham probe has concluded. In short, President Trump declassified documents that show how the institutions within the U.S. government targeted him. However, the institutions that illegally targeted President Trump are the same institutions who control the specific evidence of their unlawful targeting.

These examples of evidence held by President Donald Trump reveal the background of how the DC surveillance state exists. THAT was/is the national security threat behind the DOJ-NSD search warrant and affidavit. The risk to the fabric of the U.S. government is why we see lawyers and pundits so confused as they try to figure out the disproportionate response from the DOJ and FBI, toward “simple records”, held by President Trump in Mar-a-Lago. Very few people can comprehend what has been done since January 2009, and the current state of corruption as it now exists amid all of the agencies and institutions of government.

Barack Obama spent 8 years building out and refining the political surveillance state. The operators of the institutions have spent the last six years hiding the construct. President Donald Trump declassified the material then took the evidence to Mar-a-Lago. The people currently in charge of managing the corrupt system, like Merrick Garland, Lisa Monaco, Chris Wray and the Senate allies, are going bananas. From their DC perspective, Donald Trump is an existential threat. Given the nature of their opposition, and the underlying motives for their conduct, there is almost nothing they will not do to protect themselves. However, if you peel away all the layers of lies, manipulations and corruption, what you find at the heart of their conduct is fear. The need for control is a reaction to fear. What do they fear most? …..THIS!

People forget, and that’s ok, but prior to the 2015 MAGA movement driven by President Donald J Trump, political rallies filled with tens-of-thousands of people were extremely rare – almost nonexistent. However, in the era of Donald J. Trump the scale of the people paying attention has grown exponentially. Every speech, every event, every rally is now filled with thousands and thousands of people. The frequency of it has made us numb to realizing just how extraordinary this is. But the people in Washington DC are well aware, and that makes President Trump even more dangerous. Combine that level of support with what they attempted in order to destroy him, and, well, now you start to put context on their effort. The existence of Trump is a threat, but the existence of a Trump that could expose their corruption…. well, that makes him a level of threat that leads to a raid on his home in Mar-a-Lago.

“There is every reason to believe that the cover-up of this is why there is a war in Ukraine right now and is directly why tens of thousands are dead..”

• So About Trump’s Second Indictment (Denninger)

…. I don’t care. I should, of course. We all should. But I don’t. I don’t because nobody else has for thirty years when it comes to wild-eyed felony violations of the law, each carrying ten years in prison for each and every person involved, that occur by the tens of thousands every day. I’m talking about 15 USC Chapter 1 and violations that, collectively, amount to roughly 15% of the entire federal budget, all of which every one of us pays for, and another several trillion in “private” spending which we also pay for via crazily-hiked “insurance” premiums and similar. We pay for it in $500 medications that cost $10 anywhere else in the world, procedures that are billed at a thousand percent over what they cost anywhere else in the world, we’re billed at different rates depending on who your insurance carrier is, which for most people is not a choice they actually have (it comes through their job) and more.

I also don’t care because on the same day this indictment was announced it was also announced that the FBI has had hard evidence that both Hunter Biden and Joe Biden himself took $5m in bribes each and the target of same was explicit policy actions by the government which, I remind you, Joe Biden bragged about on national television — yet he still sits in the Oval Office. There is every reason to believe that the cover-up of this is why there is a war in Ukraine right now and is directly why tens of thousands are dead, infrastructure has been destroyed and tens of billions of dollars of taxpayer money have gone to waste prosecuting same. Never mind that Biden committed the very same offense according to the record, the FBI knew it, and covered it up before the midterm elections; they knew Biden had classified documents in multiple places he had no right to possess — including in his garage.

We, the people of this nation, have allowed this, along with the original coup, where literal murder took place at Maidan and members of our government, including sitting Senators, cheered same on, to occur — all while our current President was vice-President and Obama, who was President at the time presided over that entire sordid mess and he too is still a free man. So…… do I care that the government has done this? No. We didn’t care enough to do anything about any of the above for three decades, a million Americans are dead over the last three years because of said medical monstrosity, tens of thousands of Russians and Ukranians are dead because of what our government has done over there, we have a sitting Senator who on camera stated that the killing of Russian soldiers was a “great investment” and our current sitting President appears to have taken a five million dollar bribe which the FBI knew about three years ago, prior to the election for the specific purpose of actual corrupt purpose WHILE IN OFFICE, they have done nothing about it and the American people have let all this go on for decades.

Mark Levin

Mark Levin goes SCORCHED EARTH after the indictment of Donald Trump 🔥🔥 pic.twitter.com/uzRCzsyYka

— Benny Johnson (@bennyjohnson) June 9, 2023

“Then said Jesus unto him, put up again thy sword into his place: for all they that take the sword shall perish with the sword..”

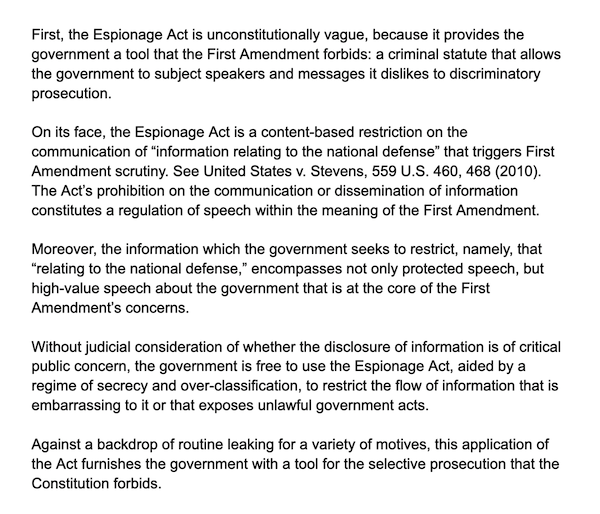

• Snowden Weighs In On Trump’s Classified Docs Indictment (RT)

Donald Trump’s alleged mishandling of state secrets is common behavior in Washington and typically goes unpunished, former NSA whistleblower Edward Snowden has argued in response to the former US president’s indictment. “All kidding aside, it’s not wrong to say that the indictment of Donald Trump for mishandling classified documents is a case of selective prosecution,” Snowden said on Friday in a Twitter post. “Spilled secrets are very much the currency of Washington, and Trump was not alone in splashing them around. He was just the least graceful.” Trump was charged with 37 felonies in a federal grand jury indictment that prosecutors unsealed on Friday. He’s accused of knowingly retaining classified documents after leaving office, conspiring to keep federal authorities from retrieving them and obstructing an investigation into their whereabouts.

Snowden marked the 10-year anniversary this week of his exposure of mass spying on US citizens by their government. He said Trump failed to fix the system that has now come back to haunt him. “It’s hard to feel sorry for a man who had four years in the White House to reform that broken system and instead left it in place to the detriment of the American public. He is caught within the same gears his own hands once turned,” Snowden tweeted. Some observers pointed out that Trump is being prosecuted under the same law – the Espionage Act – that Washington has wielded against Snowden and WikiLeaks co-founder Julian Assange. As president, Trump declined to issue pardons for both men, who were charged with crimes after exposing US government wrongdoing.

“Then said Jesus unto him, put up again thy sword into his place: for all they that take the sword shall perish with the sword,” Snowden said, using a Bible verse to point out the irony of Trump’s latest legal predicament. Snowden has railed against the US government’s abuse of secrecy since 2013, when he exposed the widespread NSA spying on American citizens. He was forced to seek refuge in Russia after Washington annulled his passport mid flight, eventually becoming a Russian citizen. Asked on Friday what he’d do if he were the US president, he said, “I’d surely reduce the number of things we classify by more than 99% – and you would not find the remainder in my bathroom or behind my Corvette.”

Snowden’s quip alluded to allegations that Trump had classified records stored in a bathroom at his Florida resort, as well as revelations earlier this year that President Joe Biden improperly kept secret documents and stored them in multiple locations, including the garage at his home in Delaware. Trump and his allies have argued that Biden weaponized the justice system to take out his top opponent in the 2024 presidential election, all while being excused for his own mishandling of state secrets. Trump also argued that he had the authority to declassify the records in his possession, unlike Biden, whose documents were acquired when he served as vice president. The former president blasted Jack Smith, the special counsel overseeing the indictment against him, as a “deranged lunatic” with a history of political bias.

“Unlike the Donald Trump werewolf hunt, the “Joe Biden” classified-docs-in-a-garage case is moving at the speed of an Amtrak train with a broken Johnson rod stuck on a sidetrack outside Joppatowne, Maryland, in a snowstorm on Christmas Eve.”

• The Great DOJ Werewolf Hunt (Jim Kunstler)

At long last you know what those plangent cries of Russia! Russia! Russia! ringing across the land signify: America has been turning into Russia, Joe Stalin-vintage, since 2016, just as Lon Chaney turned into a werewolf on-screen back in 1941. Trump Derangement turns out to be an extreme presentation of mass Species Identity disorder, a national altered state that (Wikipedia says): “…typically involves delusions and hallucinations with the transformation only seeming to happen in the mind and behavior of the affected person.”

Clinical lycanthropy is a very rare condition and is largely considered to be an idiosyncratic expression of a psychotic or dissociative episode caused by another condition such as Dissociative Identity Disorder, schizophrenia, bipolar disorder or clinical depression. It has also been associated with drug intoxication and withdrawal, cerebrovascular disease, traumatic brain injury, dementia, delirium, and seizures…. However, there are suggestions that certain neurological conditions and cultural influences may result in the expression of the human-animal transformation theme that defines the condition.”

So, now we are to have a grand show trial, in the Stalinist mode, of presidential candidate (and werewolf) Donald Trump on charges actually concocted off-site in the Lawfare laboratory of Commissar for Werewolf Activities Andrew Weissmann and sidekick, Brookings Institute fellow Norm Eisen, late counsel to the House Committee that impeached the werewolf with disappointing results over a telephone call to Ukraine in 2019. And, yes, that would be the same Andrew Weissmann who previously (but surreptitiously) led the team of intrepid Lawfare werewolf exorcists fronted by dementia victim Robert Mueller. Mr. Weissmann’s previous two-year-long werewolf hunt was a bust, too, of course. The werewolf slipped off into the moonstruck night to gnaw on Democrat loins again!

This time Mr. Weissman’s front-man is federal attorney Jack Smith, new to the werewolf hunting scene, packing a seven-shot indictment of silver bullets, aiming to show America how it’s done. And just in case he misses those shots, he’s got another gun strapped to his ankle chambering silver bullets engraved with “Jan 6” on the slugs. If you think our world has gotten interesting, better buckle into your Big Boy lounger because this werewolf movie is going places like none before. You may have noticed the timing of this new werewolf hunt has a near-magical synchronicity with oddly identical circumstances shimmering around the current occupant of the White House — another case of misplaced official papers. Unlike the Donald Trump werewolf hunt, the “Joe Biden” classified-docs-in-a-garage case is moving at the speed of an Amtrak train with a broken Johnson rod stuck on a sidetrack outside Joppatowne, Maryland, in a snowstorm on Christmas Eve.

But those purloined classified papers may be the least of “Joe Biden’s” concerns. Why, just the other day a single “whistleblower” document turned up in the House Oversight Committee’s SCIF — a special room for the performance of secret rituals — suggesting that “JB” was on the receiving end of $5 million gratis from some generous soul connected to a Ukrainian natgas company. That payday, for services left murky, when “JB” happened to be Barack Obama’s vice-president, came around the same period as yet other multi-million-dollar gift parcels from China, Russia, and Romania flew into a long list of companies operated by “JB’s” son Hunter, with no known business other than receiving large sums of money and then writing checks to various Biden family members. “Well Sonofabitch…!” as the president himself once said apropos of legal doings in Ukraine.

A tweet.

• To The Pompous But Dim-Witted Critics Of Russia (Medvedev)

To the pompous but dim-witted critics of Russia, and those who somehow managed to put all of their memory down the drain: let’s once again go through some of the major military operations of the U.S. and NATO after World War II.

1950 – The US is leading an intervention by the UN forces during the Korean War.

1954 – The US participates in the military coup in Guatemala and the follow-up intervention.1961 – The US is launching the Bay of Pigs Operation in order to overthrow Fidel Castro’s government in Cuba.

1964 – The US gets massively involved in the Vietnam war.

1981 – The US incites the civil war in Nicaragua.1989 – The US invades Panama.

1999 – NATO’s war against Yugoslavia.

2001 – The US starts a war in Afghanistan.

2003 – The US launches a war in Iraq.

2011 – NATO’s first intervention in Libya.

2014 – The US and its allies invade Syria.

2015 – NATO’s second intervention in Libya.The list is far from complete but quite telling. None of the major regional conflict of the past decades did without either direct or indirect involvement of American “benefactors.” The outcome is millions of dead people. Their blood is on the hands of ALL the American presidents, of various corrupted bastards, and other demented old men from the US Administration and US Congress. And yet, after all this, some seniles like Biden and other hypocrites have the nerve to criticize Russia for its actions aimed at protecting its own compatriots and defending its historical territories? Who are you to open your foul mouths? Just zip it up!

“NATO expansion was a cash bonanza for a weapons industry that originally saw destitution as the fruit of the Cold War’s end..”

• A War Long Wanted (Matthew Hoh)

At the end of the Cold War, the military-industrial complex faced an existential crisis. Without an adversary like the Soviet Union, justifying massive arms spending by the United States would be difficult. NATO expansion allowed for new markets. Countries coming into NATO would be required to upgrade their armed forces, replacing their Soviet-era stocks with Western weapons, ammunition, machines, hardware and software compatible with NATO’s armies. Entire armies, navies and air forces had to be remade. NATO expansion was a cash bonanza for a weapons industry that originally saw destitution as the fruit of the Cold War’s end. From 1996–1998, US arms companies spent $51 million ($94 million today) lobbying Congress. Millions more were spent on campaign donations.

Beating swords into plowshares would have to wait for another epoch once the weapons industry realized the promise of Eastern European markets. In a circular and mutually reinforcing loop, Congress appropriates money to the Pentagon. The Pentagon funds the arms industry, which, in turn, funds think tanks and lobbyists to direct Congress on further Pentagon spending. Campaign contributions from the weapons industry accompany that lobbying. The Pentagon, CIA, National Security Council, State Department and other limbs of the national security state directly fund the think tanks and ensure that any policies promoted are the policies the government institutions themselves want.

It is not just Congress that is under the sway of the military-industrial complex. These same weapons companies that bribe members of Congress and fund think tanks often employ, directly and indirectly, the cadre of experts that litter cable news programs and fill space in news reporting. Rarely is this conflict of interest identified by American media. Thus, men and women who owe their paychecks to the likes of Lockheed, Raytheon or General Dynamics appear in the media and advocate for more war and more weapons. These commentators and pundits seldom acknowledge that their benefactors immensely profit from the policies of more war and more weapons.

The corruption extends into the executive branch as the military-industrial complex employs scores of administration officials whose political party is no longer in the White House. Out of government, Republican and Democratic officials head from the Pentagon, the CIA and the State Department to arms companies, think tanks and consultancies. When their party retakes the White House, they return to the government. In exchange for bringing their rolodexes, they receive lavish salaries and benefits. Similarly, US generals and admirals retire from the Pentagon and go straightto arms companies. This revolving door reaches the highest level. Before becoming Secretary of Defense, Secretary of State and Director of National Intelligence, Lloyd Austin, Antony Blinken and Avril Haines were employed by the military-industrial complex. In Secretary Blinken’s case, he founded a firm, WestExec Advisors, devoted to trading and peddling influence for weapons contracts.

There is a broader level of commercial greed in the context of the Ukraine War that cannot be dismissed or ignored. The US fuels and arms the world. US fossil fuel and weapons exports now exceed its agricultural and industrial exports. Competition for the European fuel market, particularly liquid natural gas, has been a primary concern over the last decade for both Democratic and Republican administrations. Removing Russia as the key energy supplier to Europe and limiting overall Russian fossil fuel exports worldwide has greatly benefited American oil and gas companies. In addition to wider commercial trade interests, the sheer amounts of money the American fossil fuel business makes as a result of denying Europeans the option of buying Russian fossil fuels cannot be disregarded.

Not true. The Biden team has been busy covering their hurt butts from day one. They will simply blame Zelensky. “We gave you everything and you f*cked up!”

• Biden’s Reputation Hinges On Kiev’s Counteroffensive – Politico (RT)

Washington’s future military support for Ukraine and President Joe Biden’s reputation depend largely on the outcome of Kiev’s counteroffensive against the Russian forces, senior American officials have told Politico. The White House “anxiously watches” Kiev’s attempts to retake territories it lost to Russia, the US outlet reported on Thursday. If the counteroffensive succeeds, Ukraine would be able to count on additional military and economic assistance from the US and its allies, but if it fails, Western support may dry up, with Kiev facing calls to find a swift diplomatic resolution to the conflict, the report said. Five US officials, who spoke to Politico on condition of anonymity, acknowledged that they weren’t sure if lawmakers would vote for more aid for President Vladimir Zelensky’s government when funds approved last year are depleted.

The House Republicans may use any setbacks of the Armed Forces of Ukraine (AFU) to derail the efforts of the Democrats to boost military aid, they pointed out. According to the outlet, Washington has been increasingly unhappy about Ukrainian attacks inside Russia such as an attempted drone strike on the Kremlin in early May and the assassinations of military blogger Vladlen Tatarsky and journalist Darya Dugina. Those moves by Kiev have led to “several private, stern admonishments in diplomatic backchannels,” it added. The political uncertainty in the US and developments on the ground in Ukraine are among “mounting concerns that could sully Biden’s hoped-for triumphant return to the world stage” at the NATO summit in Vilnius in July, the officials stressed.

The gathering in the Lithuanian capital will be a “key moment” for the American leader, who’ll face questions about US security guarantees for Kiev, the deliveries of F-16 fighter jets to Ukraine and its potential membership in NATO, Politico pointed out. During his meeting with British Prime Minister Rishi SuNak on Thursday, Biden expressed belief that the administration will “have the funding necessary to support Ukraine as long as it takes” and that this support will be “real.” Earlier that day, senior US officials told CNN that the AFU had suffered “significant” casualties in its unsuccessful attempts to mount a counteroffensive against the Russian forces over the past week. Kiev’s troops have been met with “greater than expected resistance” when trying to break through Russian lines, they said. According to Russian Defense Minister Sergey Shoigu, Ukraine has lost around 5,000 soldiers and 100 tanks in combat since Sunday.

“..such a scenario is fraught with a “very rapid collapse” of the Zelensky regime because it can no longer exist without Western assistance..”

• When Could West Pull the Plug on Military Assistance to Kiev? (Sp.)

Touching upon Kiev’s chances to get the F-16s, Podolyaka suggested that “If the so-called counteroffensive ends up at least in a draw, or with some small victories for the AFU, then, of course, the fighter jets will be in place in Ukraine.” But if the AFU sustains a defeat, then “it is quite possible” that the Americans and Europeans will think that the supply of the F-16s to Kiev is irrelevant, he said, adding “everything will depend on the results of the battle that is now unfolding.” When asked if the West will continue increasing its military supplies to Kiev given the AFU’s stuttering attempts to launch a counteroffensive, the military expert referred to what he described as Americans and Britons’ practical approach to things.

“They are business people. They understand that if the project is unsuccessful, then it is not worth investing in it. And they are already directly saying and hinting to the Kiev regime that ‘if you don’t achieve any significant results as a result of the counteroffensive, […] then there will be a decrease in investments,” according to Podolyaka. He explained that such a scenario is fraught with a “very rapid collapse” of the Zelensky regime because it can no longer exist without Western assistance.

“Militarily, the Ukrainian state would have been destroyed long ago but for the West’s aid. […] The Zelensky regime will fall or [be] significantly weakened as soon as Western assistance dries up, something that Kiev is afraid of. That is why they have launched this suicidal counteroffensive, knowing about all the risks related to the decision,” Podolyaka noted. Giving his insight into when it is relevant to expect the above-mentioned “significant results,” he underlined that one should wait and see how developments will further unfold given the fact that the AFU will almost certain try to reverse the tide of the battle in its favor in the coming days.

[..] Deputy chief of the Russian Security Council Dmitry Medvedev also commented on the matter, writing on his Telegram page that “While Fogh Rasmussen previously was not a very smart person, he has now completely fallen into doctrinaire dementia.” He also warned that a possible scenario of NATO forces being deployed to Ukraine may have a negative impact on the US. “What does Uncle Sam think about this? After all, they’ll be impacted too. […] This is what happens when one becomes a freelance adviser to all sorts of greedy scumbags like former Ukrainian President Petro Poroshenko and other corrupt Nazis at an inappropriate time,” Medvedev added.

Dwelling on the issue, Podolyaka, in turn, said that he was “sure that Poland will try to seize a significant piece of land from Ukraine”, something that he added cannot be resolved without the Polish entering Ukrainian soil. He added that while the probability of the scenario of Polish forces being stationed in Ukraine remains, this won’t take place right now because Warsaw “will wait for the Armed Forces of Ukraine to fall apart” as a result of the Russian special military operation. At the same time, Poland hopes that Russia will be purportedly weakened due to NATO’s actions and that it will allow Warsaw to claim and annex the territory of Western Ukraine in line with the 1939 borders,” he concluded.

Losing on one front is not enough?!

• West Planning ‘Second Ukraine’ In Moldova – Moscow (RT)

The US and its allies are looking to use the former Soviet Republic of Moldova to contain Russia and turn it into “a second Ukraine,” Russian Deputy Foreign Minister Mikhail Galuzin has warned. “Absolutely irresponsible, absolutely short-sightedly, the West is eyeing Moldova for the role of a second Ukraine, and, unfortunately, the current Moldovan leadership is actively involved in this,” Galuzin told Rossiya 24 broadcaster on Thursday. The government in Chisinau “walks the path of a pro-Western policy; takes part in the anti-Russian policy of the US and its satellites; follows the path of initiating that same escalation in relations with Russia” as Kiev did in the years leading up to its current conflict with Moscow, he pointed out.

According to the diplomat, the Russian side is not doing anything to stoke tensions with the people of Moldova – a small nation of 2.6 million people, sandwiched between Ukraine and Romania. “Those are not our methods,” he insisted. In May, the EU launched a partnership mission in Moldova under its Common Security and Defense Policy (CSDP), with the proclaimed aim of helping the country with crisis management and tackling hybrid threats. The bloc’s foreign policy chief, Josep Borrell, said the move was necessary due to “continued Russian attempts to destabilize Moldova with hybrid actions.” Galuzin also said the EU’s mission was anti-Russian in its very essence, as it is designed to further strengthen Chisinau’s pro-Western course and direct the country towards confrontation with Moscow. While pursuing closer ties with the West, the country’s officials are ignoring the interests of a large portion of Moldova’s population, who want good relations with Russia and don’t believe in stories about the perceived “Russian threat,” the deputy FM added.

Earlier this week, Moldova’s parliament terminated agreements on military cooperation and tackling the aftermath of natural disasters with the Commonwealth of Independent States (CIS) – an organization comprised of Russia and most other former Soviet republics. Last month, President Maia Sandu claimed that membership in the CIS was “not beneficial to the citizens of Moldova, and we proceed from the interests of the citizens.” In late May, NATO said it had “mutually beneficial” relations with Moldova, as the US-led military bloc has been helping the country “with efforts to reform and modernize its defense and security structures and institutions.” NATO also described Chisinau as a “valued contributor” to the NATO-led peacekeeping force in Kosovo, where 40 Moldovan troops are deployed.

Keep them out of Crimea!

• Ukraine Shifts Timeline For Crimean Incursion (RT)

A spokesman for Ukraine’s Main Directorate of Intelligence (GUR) has downplayed a failed prediction made by his boss, Kirill Budanov, who had claimed that Ukrainian troops would enter Crimea by the end of spring. The new target is sometime this year before the weather turns cold, the official insisted. When asked about Budanov’s inaccurate assessment by the Ukrainskaya Pravda newspaper on Friday, spokesman Andrey Yusov said it was not “a bookmaker’s bet or a date on a tear-off calendar.” “But the overall situation and the wider assessment remain the same: Ukraine will definitely return Crimea. And then Budanov’s words would be prophetic,” Yusov claimed. He declined to set a more specific deadline, citing battlefield uncertainties, but suggested that the touted breakthrough would happen “while it is warm.”

Crimea rejoined Russia in 2014, after the local population voted overwhelmingly in favor of the move following a Western-backed armed coup in Kiev. The Ukrainian government and its supporters rejected the outcome of the plebiscite, and claim that the territory is illegally occupied. Budanov has made several predictions on when Ukrainian troops would supposedly enter Crimea. In May 2022, he set the end of the year as the deadline, while in October he claimed Kiev would “liberate” Crimea in the spring of 2023. He publicly expressed confidence in that time frame as late as April. Russian officials have warned that an attempted military invasion of Crimea would be countered with major resistance. The pushback would “obviously involve the use of all defensive measures, including those articulated in the nuclear doctrine,” Dmitry Medvedev, the deputy chair of the Security Council and former Russian president, told journalists in March.

“Did any of the U.S. or NATO leaders really think that the Ukrainian forces would have a f***ing chance by senselessly running into well prepared Russian defenses?”

• Media: One Side “Says” – The Other “Provides No Evidence” (MoA)

“Ukraine Mounts Multiple Attacks on Russian Occupiers” – New York Times – June 8, 2023. On one side – just flat out statements taken for granted: “Three senior U.S. officials, as well as military analysts, said that a long-awaited major Ukrainian counteroffensive appeared to be underway, after months spent mobilizing and training new units, and arming them with advanced Western weapons … Kyiv said little about the intensified fighting, neither confirming nor denying Russian claims, and Ukrainian officials have said they will not discuss details for reasons of operational secrecy. A Ukrainian deputy defense minister, Hanna Malyar, said a battle was underway in the area of a larger town about 10 miles away in the neighboring Donetsk region, Velyka Novosilka, but it was unclear if she was referring to the same clash.

The other side’s claims are depicted as dubious: “The Russian war bloggers, who have become a major source of information from the front lines, said Ukraine’s forces had suffered heavy losses, though such claims could not be confirmed and in the past have often been exaggerated. The Russian account, like most claims about what was happening at the front, could not be confirmed independently, but videos verified by The New York Times showed a Ukrainian armored vehicle near Velyka Novosilka hitting a land mine.” I could add a dozen more pieces that follow the scheme. Ukrainian or U.S. claims lead the piece without being put into doubt. Russian counterclaims come a few paragraphs down and are immediately said to lack any evidence.

By the way: What the New York Times claims to have confirmed via video is just one of many screw ups on the Ukrainian side that can be seen these days. Over the last 48 hours I have watched half a dozen drone videos of Ukrainian vehicles rumbling in tight columns over open fields, without minesweepers, without smokescreen or artillery cover, only to get blown up in minefields and massacred by anti-tank missiles. No seasoned platoon or company leader would plan and execute attacks like that but, watching those videos, I doubt that the Ukraine still has any of those. Then we have this:

“Ukrainian forces have suffered losses in heavy equipment and soldiers as they met greater than expected resistance from Russian forces in their first attempt to breach Russian lines in the east of the country in recent days, two senior US officials tell CNN. One US official described the losses – which include US supplied MRAP armored personnel vehicles as “significant.” Did any of the U.S. or NATO leaders really think that the Ukrainian forces would have a f***ing chance by senselessly running into well prepared Russian defenses? Really???

“.. a couple of landmark events at the 2023 edition. Perhaps the most interesting was Chinese Defence Minister Li Shangfu’s refusal to meet Pentagon chief Lloyd Austin on the margins..”

• Asia, Not Europe As A Laboratory For The Multipolar World (Lukyanov)

Last week, Singapore hosted the annual Asian Shangri-La Dialogue security conference. It has been organized for over 20 years by the London-based International Institute for Strategic Studies. It’s probably the most representative forum in the region, even though the agenda is set by Westerners. It’s also arguably still the most accurate indicator of the general Asian mood and is now beginning to dictate the general global atmosphere. There were a couple of landmark events at the 2023 edition. Perhaps the most interesting was Chinese Defence Minister Li Shangfu’s refusal to meet Pentagon chief Lloyd Austin on the margins. The démarche was quite clear, although both ministers’ speeches expressed the unacceptability of confrontation, the consequences of which could be catastrophic.

Washington and Beijing have opposing visions in their assessment of future possibilities. In the US, there is a clear and almost unanimous view that Beijing is a rival that must be reined in at almost any cost. And those that shape opinion believe it will get worse. China is outraged that the US itself is dismantling a system of relations that has enriched both sides to their mutual satisfaction for decades. In Beijing’s view, the Americans are overstepping the bounds of reason by demanding that their Asian partners submit to their interests – or even whims. From Washington’s point of view, allowing China to continue to rise means having a challenger for world domination in the near future, with whom a clash is inevitable. Not a good position to be in. Thus, the paradox is that while both sides are openly preparing for confrontation, they are very wary of it.

Neither side is confident of imminent success. Logically, China’s primary interest is to postpone the moment of conflict as long as possible, if it is to be seen as inevitable. After all, Beijing has always been a catch-up actor, and on the military side it has much less experience than the Americans. The latter, on the other hand, may assume that the sooner the relationship is clarified, the better their chances of success. Of course, the US is now involved in a confrontation with Russia in Ukraine, and the prospect of a second front in Asia is worrying. This would not necessarily be a direct military engagement (no one believes this is likely in the short term), but a general increase in politico-military tensions, draining resources in that direction. The recent dangerous proximity of warships in the South China Sea is a familiar sight to the various Baltic and Black Sea confrontations. At the same time, diplomatic and intelligence contacts are taking place to “keep the lines of communication open.” However, these are much less busy than in the recent past.

Biden has no idea how the world has changed. He goes in there and says: You ungrateful desert rat! I remember what we did for you! And MbS will say: I’m too young to remember, but I still do know what WE did for YOU!.

• Saudi Crown Prince Threatened To Damage US Economy – Media (RT)

Crown Prince Mohammed bin Salman privately threatened to harm the American economy after President Joe Biden warned Saudi Arabia of “consequences” for agreeing an oil production cut with Russia, the Washington Post reported, citing leaked material. The Biden administration had said it would re-evaluate relations with the kingdom following a decision by Riyadh to slash crude production against the wishes of the US.The Crown Prince, who is widely referred to as MBS, warned that he would not deal with the US administration anymore if Biden penalized Saudi Arabia. He also promised “major economic consequences for Washington,” the Post reported on Thursday. The threat was contained in a classified document that was leaked on a Discord server, but it was not clear whether the remark was part of intercepted communications or a message sent privately to the US.

Biden made his dissatisfaction with Riyadh clear last October after the OPEC+ group of major oil producers including Russia agreed to cut production by two million barrels a day. Washington was working to punish Moscow with sanctions on its oil trade over the conflict in Ukraine. “There’s going to be some consequences for what they’ve done with Russia,” the US president said in an interview with CNN at the time, without specifying any possible measures. On the campaign trail before his election, Biden vowed to make Saudi Arabia a “pariah” over the Crown Prince’s alleged role in the 2018 murder of Washington Post columnist Jamal Khashoggi, which Riyadh blamed on rogue agents.

This threat never materialized, with White House insiders indicating that the Biden administration had opted against jeopardizing bilateral relations. Under a decades-old arrangement, the US provides security to Saudi Arabia, and in exchange retains access to its oil, which the kingdom trades for dollars, propping it up as a global currency. A number of top US officials recently traveled to Saudi Arabia, including Secretary of State Antony Blinken. These relations contrast with the reportedly poor personal chemistry between Biden and MBS, who have not met since last July. The 37-year-old Saudi Crown Prince, who is responsible for the day-to-day affairs of the kingdom in lieu of his father, King Salman, reportedly mocks Biden in private, making fun of his gaffes and mental lapses. Critics of the US president have accused him of caving in to Saudi pressure.

“It is the height of hypocrisy to pretend that solar panels and wind turbines will save us from ‘evil’ fossil fuels..”

• Ban Use Of Fossil Fuels In Making Wind Turbines And Solar Panels (CSD)

New York state Sen. George Borrello, R-Wyoming County, has introduced a bill to require that all wind turbines, solar collectors and infrastructure for producing green energy be manufactured and constructed without the use of fossil fuels. His bill would also apply to the manufacture and distribution of electric vehicles. If the bill were to become law, it would be the end of renewable energy. There’s no feasible way to manufacture and transport wind turbines, solar panels and electric vehicles without fossil fuels. Borrello is well aware of this fact and said he suspects most of his colleagues in the New York Legislature do too.

Like a resolution that was introduced in the last Wyoming legislative session earlier this year that would’ve banned auto dealerships from selling electric vehicles, the goal of Borrello’s bill is to get people thinking a bit harder about the outcomes of extreme green energy policies. “The intent of the bill is to start an honest conversation about the reality of wind turbines and solar panels,” Borrello told Cowboy State Daily. “These energy sources are praised as the answer to reducing emissions and saving the planet. However, rarely discussed is the environmental damage that results from the manufacture, transport and installation of these systems.” In the last session of the Wyoming Legislature, Sen. Jim Anderson, R-Casper, sponsored a resolution requiring the state’s auto dealerships to phase out the sale of electric vehicles by 2035.

Anderson and the co-sponsors never intended the resolution to pass. They only wanted to start a conversation about bans on the sale of gas-powered vehicles that were adopted in California and considered in Colorado. He was successful. After Cowboy State Daily first reported on the measure, Anderson was interviewed on Fox News, Fox Business and Newsmax, as well as news outlets in New York, Pennsylvania, Illinois, Florida and Pennsylvania. “It was successful at starting the conservation and getting a lot of comments from the ignorant,” Anderson told Cowboy State Daily. He said it’s possible he’ll pursue similar legislation in future sessions, perhaps a bill rather than a resolution, which is nonbinding. With bans on the sale of gas-powered cars in California and New York, along with bans on natural gas hookups in new construction, Anderson said more conversation is needed.

“There’s so many of these stupid laws being passed. It’s really getting out of hand,” Anderson said. Borrello said solar panels require the mining of rare earth metals, which is done with diesel-powered machinery, and they are typically manufactured with coal-fired electricity. Likewise, metallurgical coal is burned to forge steel for the foundations of wind towers. Diesel-powered heavy equipment, Borrello continued, transports the components, prepares the sites and assembles the structures. “It is the height of hypocrisy to pretend that solar panels and wind turbines will save us from ‘evil’ fossil fuels, when the reality is that renewables — just like modern life as we know it — cannot exist without them,” Borrello said.

Patrick Moore

Greenpeace co-founder, Dr. Patrick Moore:

"The scientific method has not been applied in such a way as to prove that carbon dioxide is causing the Earth to warm… I am firmly of the belief that the future will show that this whole hysteria over climate change was a complete… pic.twitter.com/mcVXrrhx1e

— Wide Awake Media (@wideawake_media) June 9, 2023

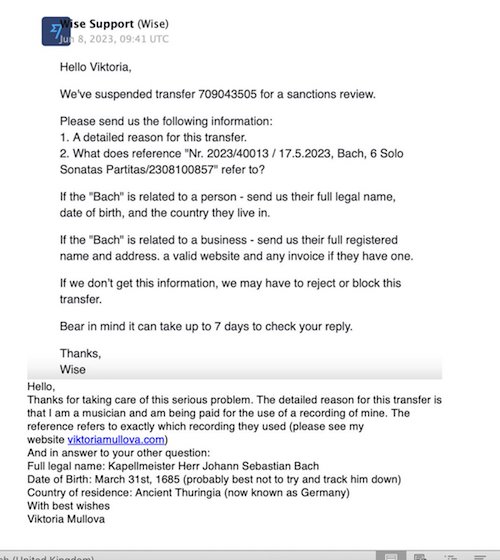

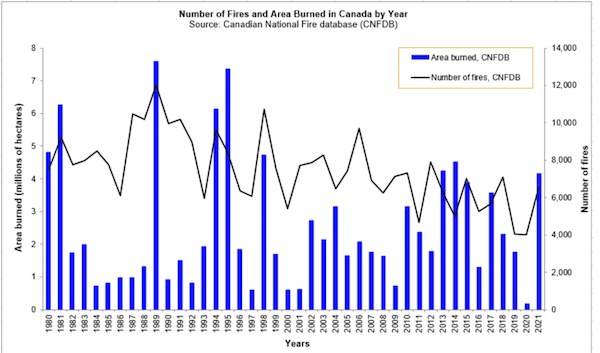

“..statistics from Canadian National Fire Database reveal that wildfires across Canada have decreased in recent years, having peaked in 1989..”

• Media Blames Climate Change For Canada Wildfires Despite Multiple Arrests (LSN)

Despite the arrest of multiple arsonists, the mainstream media in Canada seems intent on attributing the nation’s recent wildfires to “climate change.” As wildfires continue to spread across western, and now central and eastern Canada, burning forestland and homes, the mainstream media continues to imply that climate change is the main culprit, despite a growing number of reports showing that arsonists have been arrested for allegedly setting dozens of fires. “Several arsonists have been arrested in the past weeks in different provinces for lighting forest fires,” People’s Party of Canada leader Maxime Bernier tweeted. “But the lying woke media and politicians keep repeating that global warming is the cause.”

The severe nature of the wildfires has caused Canadians to wonder why they have spread so rapidly, especially as many of the affected areas are not typically impacted by wildfires of this degree or at this time of the year. In the past months, Royal Canadian Mounted Police (RCMP) have arrested several arsonists who have been charged with lighting fires across several provinces including Nova Scotia, Yukon, British Columbia, and Alberta. The motive behind lighting the fires is unclear. One Albertan, John Cook, has been arrested and charged with 10 counts of arson after setting a string of wildfires in and around Cold Lake, a hamlet near Edmonton. In addition to damaging vehicles and structures, Cook was charged with setting aflame the Church of Jesus Christ of Latter Day Saints in Cherry Grove, Alberta.

A Vancouver man charged with arson has been released until his trial on October 9, with Cpl. Michael Gauthier asserting that he is not a risk to light further fires. “This incident was not random in nature and we do not believe there is risk to other members of the public or businesses from the individual who was arrested,” Gauthier stated. Despite the numerous arrests, mainstream media outlets continue to publish articles attributing the wildfires to climate change. “Rise in extreme wildfires linked directly to emissions from oil companies in new study,” the Canadian Broadcasting Corporation (CBC) reported. “Canadian forest fires are the latest costly climate disaster that public accounts fail to capture,” another CBC headline read.

“Climate change is increasing the risks of wildfires in the country, experts say,” Global News attested. Despite these claims, statistics from Canadian National Fire Database reveal that wildfires across Canada have decreased in recent years, having peaked in 1989. Notably, the mainstream media outlets attributing the increase of wildfires to climate change have received funding from the Liberal government of Prime Minister Justin Trudeau, which is actively pushing for increased bans on using natural resources in Canada to combat “climate change.”

“the electric grid is operating ever closer to the edge” resulting in higher chances of “more frequent and more serious disruptions.”

• Over 66% Of US At Risk Of Power Outages Due To Green Transition (JTN)

At least two-thirds of America is expected to be hit with summer blackouts due to President Joe Biden’s push to end the use of fossil fuels, according to the organization that oversees the nation’s power grid stability. A 2023 “Summer Reliability Assessment” published by North American Electric Reliability Corporation (NERC) cites “new environmental rules” cracking down on power plant emissions as a culprit. In May, the Environmental Protection Agency (EPA) threatened to shut down coal plants that fail to meet an effective zero-carbon emissions mandate by 2038. The problem, according to NERC, is that the U.S. government is creating greater energy demand by pushing out traditional energy sources (coal, natural gas and nuclear) for less reliable and insufficient alternatives like solar and wind power.

“Natural gas supply and infrastructure is vitally important to electric grid reliability even as renewable generation satisfies more of our energy needs,” NERC wrote in the assessment. NERC’s president, James B. Robb, warned Senate Energy and Natural Resources Committee members that “the electric grid is operating ever closer to the edge” resulting in higher chances of “more frequent and more serious disruptions.” Robb also referred to natural gas as “fuel that keeps the lights on” and said improving its infrastructure is “required” to keep America’s grid afloat.

“..authentic news outlets and reporters who cover the conflict with a pro-Russian stance are unlikely to be found in violation of our rules..”

• New Twitter Files: FBI Worked With Ukraine To Censor Twitter Accounts (Fox)

The latest Twitter Files uncovered the FBI requesting the social media company to censor accounts accused of spreading misinformation about the Ukraine-Russia war and collect their personal information. A special agent from the FBI reached out to Twitter with a list of accounts according to The Grayzone News host Aaron Maté, who reported on the latest Twitter Files. “The FBI is helping Ukraine censor Twitter users, including journalists,” Maté reported. “The FBI aided a Ukrainian intelligence effort to ban Twitter users and collect their data. Twitter declined to censor journalists targeted by Ukraine.” Maté was included on the list of accounts.

FBI Special Agent Aleksandr Kobzanets, the assistant legal attaché at the U.S. Embassy in Kiev, reportedly contacted a pair of Twitter executives in March 2022 on behalf of Ukraine’s intelligence agency, the SBU. The agent reportedly sent a list of 163 Twitter accounts, stating that “These accounts are suspected by the SBU in spreading fear and disinformation.” Along with the list of accounts, the agent also reportedly forwarded a request from Ukraine’s SBU, which said, “we kindly ask you to take urgent measures to block these Twitter accounts and provide us with user data specified during registration.” However, Yoel Roth, Twitter’s Head of Trust and Safety at the time, responded to the FBI about how they would check the authenticity of some of the accounts listed, but he shared concerns with censoring American and Canadian journalists.

“In an initial look, they do appear to be a mix of individual accounts (that may or may not be authentic), some official Russian accounts (including state media accounts which are already labeled under our policies), and even a few accounts of American and Canadian journalists (e.g. Aaron Mate),” Roth wrote. “Our reviews are going to focus first and foremost on identifying any potential inauthenticity,” he continued. “In general, though, authentic news outlets and reporters who cover the conflict with a pro-Russian stance are unlikely to be found in violation of our rules absent other context that might establish some kind of convert/deceptive association between them and a government.”

Mantis

Mantis shrimp hold the world record for the most complex visual system. They have up to 16 photoreceptors and can see UV, visible and polarised light being the only animals known to detect circularly polarised light

[📹 MJ Ogata: https://t.co/gj0gAzzm1p]pic.twitter.com/JKKAXrOfOQ

— Massimo (@Rainmaker1973) June 9, 2023

Doggo tornado

doggo uses tornado!

it’s not very effective… pic.twitter.com/xkovUV5KAa

— Shibetoshi Nakamoto (@BillyM2k) June 9, 2023

Awwww

https://twitter.com/i/status/1666906748806914053

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.