Jackson Pollock Reflection of the Big Dipper 1947

There are many voices saying crazy things in this North Korea thing, and I’m not even watching CNN. But this is the craziest thing of all: how to make money off a nuclear attack. These people are mentally blind.

• It’s Hard to Price an ‘Extinction Event’ Like a North Korea War (BBG)

Financial markets haven’t really reacted much to the escalation in tensions between the U.S. and North Korea, and some observers explain that it’s largely because in the worst-case scenario it’s impossible to guess the appropriate price for things like stocks and bonds. “It’s hard to price a potentially extinction event (at least for much of the Korean peninsula),” is how Timothy Ash, a senior strategist at Bluebay Asset Management in London, puts it. It’s a point also made by Mark Mobius, the Templeton Emerging Markets Group executive chairman and apostle for emerging-market investing. He said in a May interview about the prospect of a North Korean nuclear conflict: “there’s nothing you can do about it – if something breaks out, we’re all finished anyway.” Maybe that’s why the worst day this year for the Kospi index of South Korean stocks was July 28, which was all about a global tech-stock retreat and nothing to do with geopolitics.

“This increase in leverage has sapped our ability to spend,” Roberts said. “I think we’re stuck.”

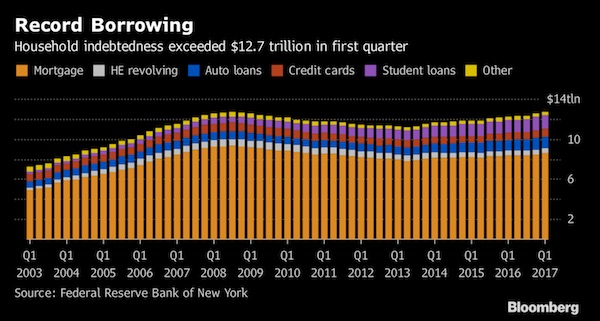

• In Debt We Trust for US Consumers With $12.7 Trillion Burden (BBG)

After deleveraging in the aftermath of the last U.S. recession, Americans have once again taken on record debt loads that risk holding back the world’s largest economy. Household debt outstanding – everything from mortgages to credit cards to car loans – reached $12.7 trillion in the first quarter, surpassing the previous peak in 2008 before the effects of the housing market collapse took its toll, Federal Reserve Bank of New York data show. To put the borrowing in perspective, it’s more than the size of China’s economy or almost four times that of Germany’s. People are borrowing more not necessarily because they’re confident about their financial prospects. They’re doing it for necessities like education or transportation and, in many cases, just to get by.

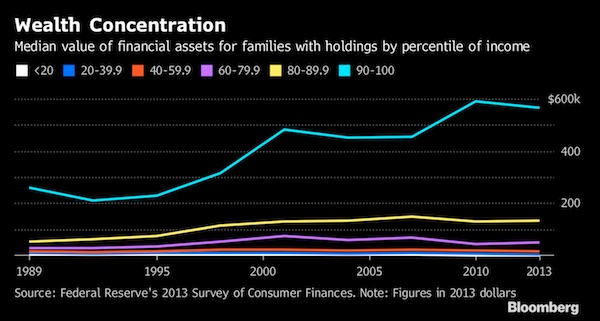

On the surface, liabilities at an all-time high aren’t alarming when the assets side of ledger is taken into account. Household net worth stands at a record $94.8 trillion, thanks to rebounding home values and soaring stock portfolios. But that increase has primarily benefited the nation’s wealthiest, said Lance Roberts, chief investment strategist at Clarity Financial in Houston and editor of the Real Investment Advice newsletter. “When you look at net worth, it’s heavily skewed by the top 10%,” Roberts said. “The average family of four is living paycheck to paycheck.” For most Americans, whose median household income, adjusted for inflation, is lower than it was at its peak in 1999, borrowing has been the answer to maintaining their standard of living. The increase in debt helps explain why the economy’s main source of fuel is providing less of boost than in the past.

Personal spending growth has averaged 2.4% since the recession ended in 2009, less than the 3% of the previous expansion and 4.3% from 1982-90. A look at worker pay presents a more dire backdrop for discretionary spending for those without a lot of assets. While the difference between income from wages and household debt has improved since the last recession, it’s been leveling off and remains at a depressed level. The improvement also reflects less mortgage debt because of increased home foreclosures, rather than a pickup in earnings. “This increase in leverage has sapped our ability to spend,” Roberts said. “I think we’re stuck.”

A series of articles on today’s new marvels, Tesla, Uber, Amazon, Airbnb. They all fall to bits, one by one.

Tesla is a highly destructive company. All it takes is a basic understanding of thermodynamics. Strip-mining, cutting down forests, throwing the Congo into even deeper misery, just so you can fool yourself into thinking you’re clean.

• Tesla Cars Aren’t As Carbon (And Taxpayer) Friendly As You Think (FMS)

Tesla proponents love to remind people how their vehicles are “carbon free” (in spite of Tesla CEO Elon Musk’s own carbon profligate lifestyle): Fact: the Tesla Model S is an environmentally friendly, zero emissions electric vehicle that won’t pollute the air like gas-powered cars. Carbon emissions from a gas car’s tailpipe has a dangerous impact on global warming…. In addition, Tesla CEO Elon Musk explains that, “combustion cars emit toxic gases. According to an MIT study, there are 53,000 deaths per year in the U.S. alone from auto emissions.” But in reminding people about how they don’t burn fossil fuels, they make sure to omit and/or obfuscate all the other emissions-laden factors that go into production of Tesla automobiles, including the oft-unspoken costs of the vehicles to the taxpayer and to other auto manufacturers.

Start with the power source for the Tesla; their electric power plant uses lithium-ion batteries to store the electricity required to run the car. And while a good amount of lithium is produced at salt lake brines that use chemical processes to extract the requisite lithium… …a large (and growing) amount of lithium is sourced from hard-rock mining, which is also referred to as strip mining: This type of mining involves not just all the carbon used to extract the lithium from mines, it “strips” the land of its forests, which is far more environmentally (and carbon) detrimental. And while it is likely impossible to know exactly where Tesla sources its materials from, a closer examination on Tesla’s impact on the mining industry should paint a crystal clear picture:

Should the concept capture the imagination of Americans who are increasingly conscious of reducing their carbon footprint demand for these crucial elements could skyrocket in addition to the already robust global demand for lithium, nickel and copper. Major mining companies are already “future proofing” their businesses for climate change by focusing more investment into commodities that will be required by the renewable energy industry. You can’t make this stuff up – Tesla and other renewable energy industries are going to save the world by mining its natural resources to excess, without regard for the environmental impact and carbon emissions generated in the process. You shouldn’t be surprised to seldom hear this mentioned by Elon Musk, or the liberal crowd that champions electric vehicles.

This is too insane to be labelled a ‘business model’.

• Uber Gets Run Over by its Own Subprime Auto Leases (WS)

Uber, which has lost $3 billion last year and has gotten itself into a thicket of intractable issues and scandals that cost founder and CEO Travis Kalanick his job, is now facing a subprime auto-leasing crisis. Two years ago when these folks launched the subprime auto leasing program to put their badly paid drivers into new vehicles they couldn’t otherwise afford, they apparently didn’t do the math. In July 2015, when the “Xchange Leasing” program was announced, the company gushed: “We’re excited about how these new solutions meet drivers’ unique needs, and offer more and better choices and greater flexibility than ever before.” The leasing program would be “administered by an Uber subsidiary and designed to fit with the flexibility that drivers value most,” it said. This is how it would work:

Unlike most multi-year leases that have high fees for early termination, drivers who participate in Xchange for at least 30 days will be able to return the car with only two weeks notice, and limited additional costs. The program allows for unlimited mileage and the option to lease a used car, with routine maintenance also included. It wasn’t supposed to be a money maker – nothing at Uber is. But hey. And the company invested $600 million in the business, “people familiar with the matter” told the Wall Street Journal. This type of lease was offered to drivers with subprime credit ratings or no credit ratings who barely earned enough money to get by and make the payments, if they stuck around long enough. It allowed drivers to drive new cars. When it didn’t work out for them, they could return the cars after 30 days with two weeks’ notice.

The only penalty for the early return is that Uber keeps the $250 deposit. And these leases came with “unlimited miles.” No one in the car business would ever conceive of such a thing. But Uber is different. It defies the laws of economics. Or so it thought at the time. Now, the 14-member executive committee that is running the show looked at the math and was horrified. “According to people familiar with the matter,” cited by The Journal, executives had briefed the committee in July: “The Xchange Leasing division had been estimating modest losses of around $500 per auto on average, these people said. But managers recently informed Uber executives that the losses were actually about $9,000 per car — about half the sticker price of a typical leased vehicle.”

So your ass can shoot roots into your couch. Yeah, that’s a valid business model.

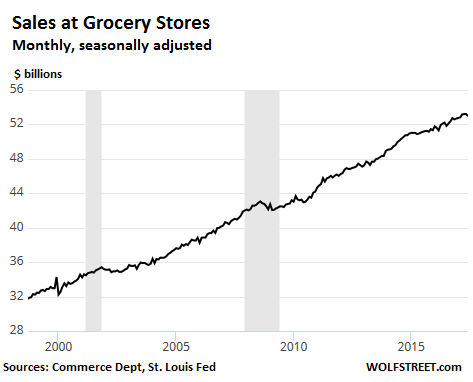

• Amazon Online Grocery Boom? Not So Fast… (WS)

Maybe Amazon has figured out that you’re not the only one who isn’t buying groceries online. Maybe it has figured out, despite all the money it has thrown at it, that selling groceries online is a very tough nut to crack. And no one has cracked it yet. Numerous companies have been trying. Safeway started an online store and delivery service during the dotcom bubble and has made practically no headway. A plethora of startups, brick-and-mortar retailers, and online retailers have tried it, including the biggest gorillas of all — Walmart, Amazon, and Google. Google is trying it in conjunction with Costco and others. It just isn’t catching on. And this has baffled many smart minds. Online sales in other products are skyrocketing and wiping out the businesses of brick-and-mortar retailers along the way. But groceries?

That’s one of the reasons Amazon is eager to shell out $14.7 billion to buy Whole Foods, its biggest acquisition ever, dwarfing its prior biggest acquisition, Zappos, an online shoe seller, for $850 million. Amazon cannot figure out either how to sell groceries online though it has tried for years. Now it’s looking for a new model — namely the old model in revised form? This is why everyone who’s online wants to get a piece of the grocery pie: The pie is big. Monthly sales at grocery stores in June seasonally adjusted were $53 billion. For the year 2016, sales amounted to $625 billion: But it’s going to be very tough for online retailers to muscle into this brick-and-mortar space, according to Gallup, based on its annual Consumption Habits survey, conducted in July. Consumers just aren’t doing it:

Only 9% of US households say they order groceries online at least once a month, either for pickup or delivery. Only 4% do so at least once a week. By contrast, someone in nearly all households (98%) goes to brick-and-mortar grocery stores at least once a month, and 83% go at least once a week. Gallup summarizes the quandary: At this point, online grocery shopping appears to be an adjunct to retail shopping rather than a replacement, as most shoppers whose families purchase groceries online once or twice a month or more say they still visit a store to buy groceries at least once a week. But there are some differences by age group – and maybe that’s where Amazon sees some distant hope: Of the 18-29 year olds, 15% shop for groceries on line at least once a month. For 30-49 year olds, this drops to 12%. For 50-64 year olds, it drops to 10%. For those 65 and older, it essentially fades out (2%).

No profit, just working on a monopoly. Cut it down.

• Amazon Paid Just £15 Million In Tax On European Revenues Of £19.5 Billion (G.)

Amazon paid just €16.5m (£15m) in tax on European revenues of €21.6bn (£19.5bn) reported through Luxembourg in 2016. The figures, published in Amazon’s latest annual accounts for its European online retail business, are likely to reignite the debate about US tech companies using complex crossborder arrangements to minimise the tax they pay across the continent. Separately, Amazon UK Services – the company’s warehouse and logistics operation that employs almost two-thirds of its 24,000 UK staff – more than halved its declared UK corporation tax bill from £15.8m to £7.4m year-on-year in 2016. The cut came despite turnover at the UK business, which handles the packing and delivery of parcels and functions such as customer service, rising from £946m to £1.46bn.

Ana Arendar, Oxfam’s head of inequality, said: “Despite some action by ministers and companies, widespread corporate tax avoidance continues to cost both rich and poor countries billions every year that could pay for schools and lifesaving healthcare. “We urgently need comprehensive public country-by-country reporting for multinationals to ensure they pay their fair share of tax – the UK government should implement this by the end of 2019 – unilaterally if necessary.” Amazon Europe, which is based in Luxembourg and aggregates the billions of pounds of sales the retailer makes from individual countries across the continent, reported a pre-tax profit of €59.6m last year. As a result the company, which clocked up €21.6bn in sales across Europe last year, had a tax bill of just €16.5m.

This seems the easiest thing to contain. 90% of it is advertized online. Take average occupancy in a city, at average prices, and tax them on it.

• Airbnb Faces EU Clampdown For Not Paying ‘Fair Share’ Of Tax (G.)

EU finance ministers will discuss how to force home-sharing platforms such as Airbnb to pay their fair share of taxes and in the right tax domains next month after the French minister for the economy described the current situation as “unacceptable”. The European commission announced on Thursday that a joint proposal from France and Germany would be discussed at a meeting in Tallinn, Estonia, on 16 September. Brussels will also advise on how best to deal with the so-called sharing economy, in which Airbnb is a major player. It was revealed this week that Airbnb paid less than €100,000 (£90,336) in French taxes last year, despite the country being the room-booking firm’s second-biggest market after the US.

In response, the French economy minister, Bruno Le Maire, informed the national assembly that the EU’s Franco-German axis would be proposing a pan-European clampdown. “These digital platforms make tens of millions of sales and the French treasury gets a few tens of thousands,” the minister said, adding that the current setup was “unacceptable”. Le Maire further claimed in parliament that an ongoing consultation being led by the commission and the OECD to address the tax question were “taking too much time, it’s all too complicated”. Many digital platforms operating in the EU have a base in Ireland, including Airbnb, where they can exploit a low corporation tax regime. Le Maire said: “Everybody has to pay a fair contribution.”

I[..] Paris city council has already voted to make it mandatory from 1 December to obtain a registration number from the town hall before posting an advertisement for a short-term rental on its website. The ruling potentially makes it harder for property owners using Airbnb to exceed the 120 days a year legal rental limit for a main residence, and easier for the authorities to collect local taxes. In Barcelona, where tensions have been rising for years over the surge in visitors, the impact of sites such as Airbnb on the local housing market has led to anti-tourist protests. In Mallorca and San Sebastián, an anti-tourism march is being planned for 17 August to coincide with Semana Grande, a major festival of Basque culture.

In Ibiza, the authorities are placing a cap on the number of beds for tourists. Owners will also be banned from renting their homes, or rooms within them, via websites such as Airbnb and Homeaway unless they obtain a licence. Owners face fines of up to €400,000 if they break the law. The websites face the same fine for letting people advertise without a valid licence number.

Cut out the stupid pharma ads and you’re halfway there.

• Trump Will Soon Declare State Of Emergency Over Opioid Crisis (G.)

Donald Trump signaled he could soon declare a state of emergency in an attempt to deal with America’s opioid overdose crisis. A commission reporting to the president said recently that declaring a state of emergency was its “first and most urgent recommendation”. But Trump, in his first remarks on the subject, appeared to set his face against treating the epidemic as a health emergency – calling instead for tougher prison sentences and “strong, strong law enforcement”. However, returning to the issue on Thursday, Trump seemed to have changed his tone. “We’re going to draw it up and we’re going to make it a national emergency,” he said, adding the administration is “drawing documents now to so attest”. “It is a serious problem the likes of which we have never had,” Trump said at his Bedminster, New Jersey, golf resort, where he is on a “working vacation”.

The president can declare a state of emergency two legal ways: he could use the Stafford Act, or the Public Health Service Act, which is specific to health emergencies and can be declared by the health secretary. “When I was growing up they had the LSD, and they had certain generations of drugs,” Trump said. “There’s never been anything like what’s happened to this country over the last four or five years. And I have to say this in all fairness, this is a worldwide problem, not just a United States problem. This is happening worldwide.” In fact, while drug overdoses happen all over the world, the US leads by a significant margin. Though the nation has just 4% of the world’s population, the US also has 27% of the world’s drug overdose deaths, according to the UN’s 2017 World Drug Report. For example, for every million Americans between 15 and 64 years old, 245 people per year die of drug overdoses. In Mexico, 4 people per million die of drug overdoses.

Best friends.

• Why Saudi Arabia And Israel Have United Against Al-Jazeera (FIsk)

Being an irrational optimist, there’s an innocent side of my scratched journalistic hide that still believes in education and wisdom and compassion. There are still honourable Israelis who demand a state for the Palestinians; there are well-educated Saudis who object to the crazed Wahhabism upon which their kingdom is founded; there are millions of Americans, from sea to shining sea, who do not believe that Iran is their enemy nor Saudi Arabia their friend. But the problem today in both East and West is that our governments are not our friends. They are our oppressors or masters, suppressors of the truth and allies of the unjust.

Netanyahu wants to close down Al Jazeera’s office in Jerusalem. Crown Prince Mohammad wants to close down Al Jazeera’s office in Qatar. Bush actually did bomb Al Jazeera’s offices in Kabul and Baghdad. Theresa May decided to hide a government report on funding “terrorism”, lest it upset the Saudis – which is precisely the same reason Blair closed down a UK police enquiry into alleged BAE-Saudi bribery 10 years earlier. And we wonder why we go to war in the Middle East. And we wonder why Sunni Isis exists, un-bombed by Israel, funded by Sunni Gulf Arabs, its fellow Sunni Salafists cosseted by our wretched presidents and prime ministers. I guess we better keep an eye on Al Jazeera – while it’s still around.

And these guys are still seen as authorities. They may be dumb, but they’re not the dumbest.

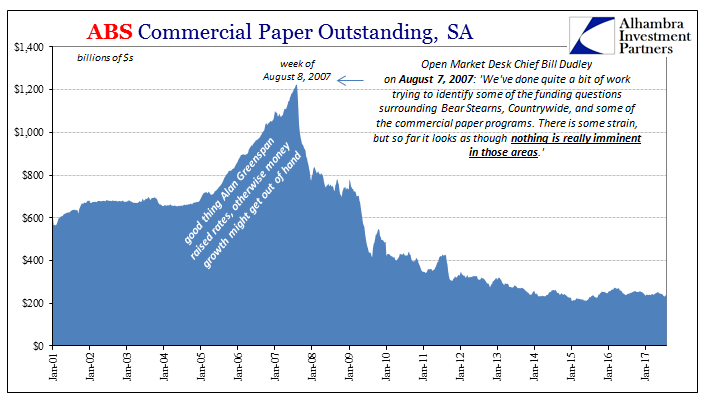

• ‘Subprime Is Contained’ -They Really Don’t Know What They Are Doing (Snider)

Ben Bernanke, then Chairman of the Federal Reserve, told Congress in March 2007 that subprime was contained. He will rightfully be remembered in infamy for that, but that wasn’t the most egregious example of being wrong. Even putting it in those terms risks understating the problem and why it stubbornly lingers. Being really wrong is claiming that IOER will establish a floor for money market rates, and then finding out it actually doesn’t. No, what policymakers did especially in the early crisis period was altogether worse; they demonstrated conclusively that though they shared this world with the rest of us, they inhabited and continue to inhabit a totally different planet. Given the anniversary date and our human affinity for round numbers (ten years or a lost decade), there is a desire to revisit some of the worst of the list which happened just before August 9, 2007. My favorite has always been Bill Dudley, as I recounted last at the ninth anniversary of nothing being done:

As far as the issue of material nonpublic information that shows worse problems than are in the newspapers, I’m not sure exactly how to characterize that because I guess I wouldn’t know how to characterize how bad the newspapers think these problems are. [Laughter] We’ve done quite a bit of work trying to identify some of the funding questions surrounding Bear Stearns, Countrywide, and some of the commercial paper programs. There is some strain, but so far it looks as though nothing is really imminent in those areas.” [emphasis added]

He spoke those words, recorded for posterity, on August 7, 2007, at the regular FOMC policy meeting. As noted earlier today, both Countrywide and the whole commercial paper market would be decimated really within hours from his “inspiring” confidence. What really stands out is for Dudley to have been the one who said them, because as head of the Open Market Desk he had to be technically proficient in a way that the others could avoid (and why so often in its history policy discussions especially about these great things would often flow through whomever was the Open Market Desk chief at that moment in time). He proved still to be an empty suit like the rest, but he was always that much less of one. So if the best the Fed had to offer was so thoroughly unaware, is it any wonder what happened then and continues to happen now?

One day after Dudley’s private embarrassment, one Bank of England governor and future chief perhaps joined his level in the Hall of Fame of Famous Last Words. Meryn King remarked on August 8, 2007: “So far what we have seen is not a threat to the financial system. It’s not an international financial crisis.” He said these words at the behest of the ECB in front of the assembled press ostensibly to impart calm. Also noted earlier today, it was the European Central Bank that made the first crisis move the very next day in a record liquidity injection.

“There’s nothing like it. Get on the wrong side of time, and you are out of luck.”

• What Went Wrong With the 21st Century? (Bonner)

And it’s Time Time Time

And it’s Time Time Time

And it’s Time Time Time

That you love

And it’s Time Time Time

To bring readers fully up to speed, the 21st century has been a flaming dud. In practically every way. Despite more new technology than ever… more PhDs… more researchers… more patents… more earnest strivers than ever before sweating to move things ahead… and despite more “stimulus” from the Fed ($3.6 trillion) than ever in history…U.S. GDP growth rates are only half of those of the last century. And household incomes, after you factor in inflation, are flat. In fact, by some calculations – using non-fiddled measures of inflation – growth has been negative for the whole 21st century. Meanwhile, there are more people tending bar or waiting tables… and fewer people with full-time breadwinner jobs. And productivity and personal savings rates have collapsed.

And those are only the measurable trends. Political and social developments have been similarly dud-ish – including the longest, losingest war in U.S. history… the biggest government deficits… the most vulgar public life… the least personal freedom… and, in our hometown, Baltimore, a record murder rate. What went wrong? Herewith, a hypothesis. It suggests three “causes,” all three linked by a single shared element: time.

[..] Fake money causes people to waste time and money. And central bank policies discourage savings by lowering interest rates… even pushing them into negative territory. Instead of saving them for the future… resources are consumed today. These mistakes accumulate as debt… which then forces people to spend more time servicing the mistakes of the past. Meanwhile, the internet gives people a new way to waste time. At home. At work. On the high plains. Or in the lowlife back alleys. People spend their precious time on idle distractions and entertainments. That leaves fewer people doing the real work that progress requires – saving, investing, and working for the future. Time is always the ultimate constraint. You can substitute one resource for another. You can switch from oil to solar… or copper to aluminum. But there’s no swapping out time. There’s nothing like it. Get on the wrong side of time, and you are out of luck.

Oh please, can I include this? Just so Nassim Taleb knows black swans get lonely?! Like they’re unqiue but they do come in pairs… Philosophical intrigue galore.

• Black Swan At Bavarian Palace Seeks Partner (DW)

The Rosenau Palace in southern Germany has published a lonely hearts ad on behalf of its resident black swan. Ground keepers believe the bird’s former companion was eaten by a fox. The department that oversees state-owned palaces, gardens and lakes in the southern state of Bavaria sent out its rather unusual appeal to the public on Thursday. “The sex of the animal isn’t important,” a message on the department’s website read. “Ideally it should be more than three years old, but this isn’t an absolute must.” The department has been on the lookout for a match since May, when one of the two black swans that lived in the palace grounds disappeared. Palace gardeners later found bones and feathers in one of the park’s bushes. “He was probably eaten by a fox,” the department concluded.

Rosenau garden department head Steffen Schubert has been sending out enquiries every day to try and locate a candidate – without success. Finding a replacement isn’t just about sparing the surviving swan from loneliness, he says. “Swans have a special significance in the history of Rosenau Palace and park,” he said. Black swans were reportedly first introduced to the palace grounds by Britain’s Queen Victoria as a symbol of mourning following the premature death of her husband Prince Albert, who was born at Rosenau Palace in 1819. The royals visited the palace together in 1845, five years after they were married. In her memoirs, the queen wrote: “If I were not who I am, this would be my real home.” The palace, near the town of Coburg in northern Bavaria, is home to Swan Lake and Prince’s Pond.

In its statement, the department said the new swan would have a good life, with a 2-hectare lake and a newly built “swan house” at its disposal. In the chillier months, the birds also have winter quarters with water access and are fed every day. The department said it would go itself to pick up the bird if a member of the public was willing to donate a swan to the grounds. “We hope our swan does not have to be alone for too long,” a spokeswoman for the palace management told German news agency DPA.