Eugene de Salignac Painters suspended on cables of the Brooklyn Bridge Oct 7 1914

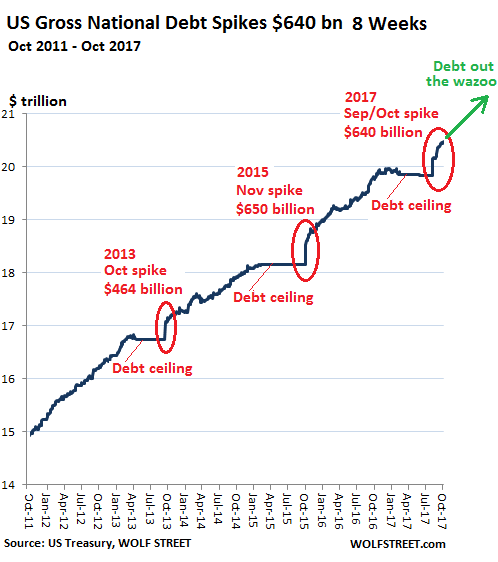

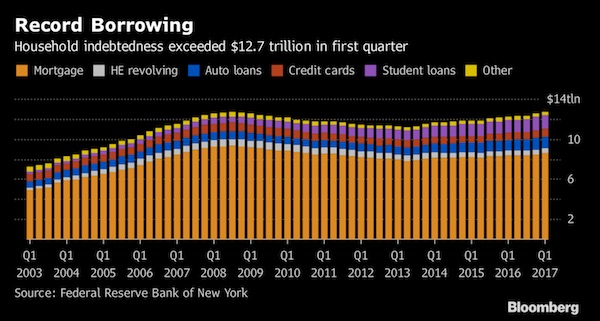

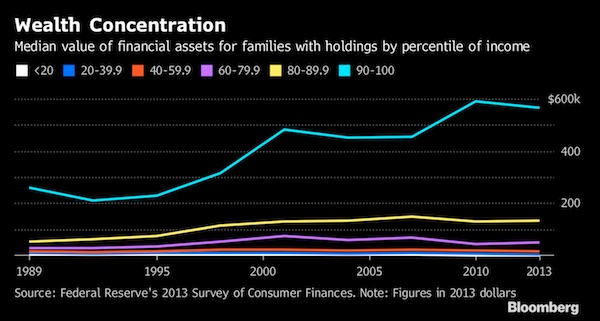

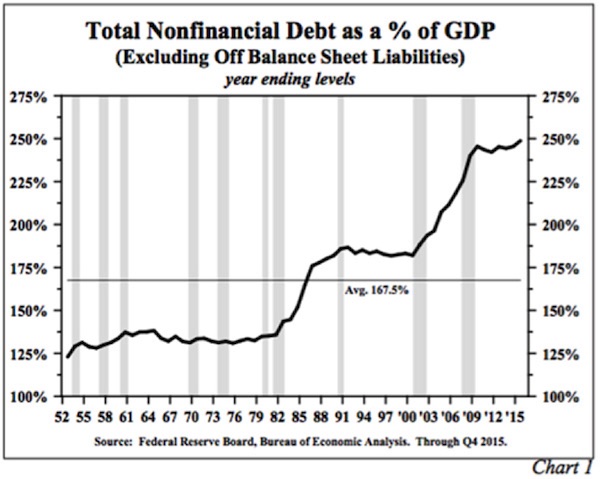

Blame the Everything Bubble.

• If Bull Market For Stocks Ends In 2018, Blame The Credit Market Bubble (MW)

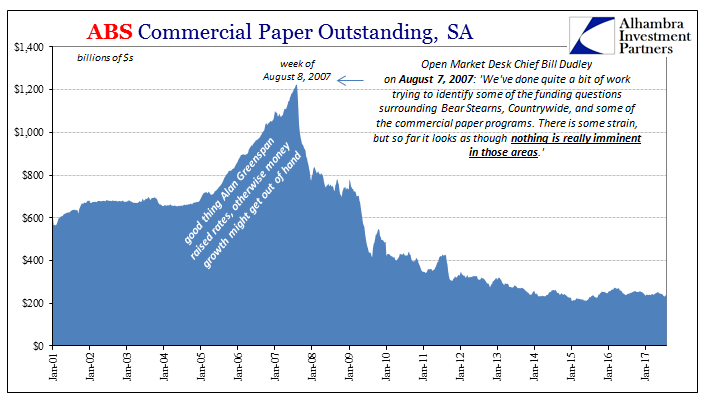

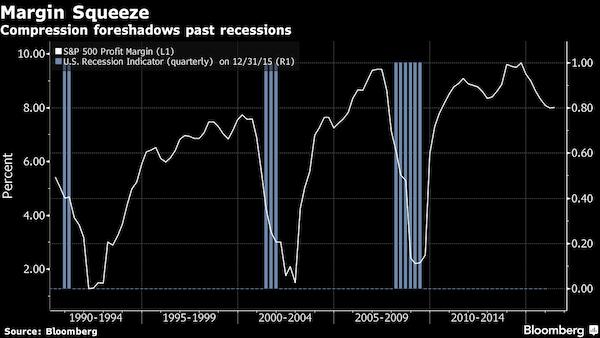

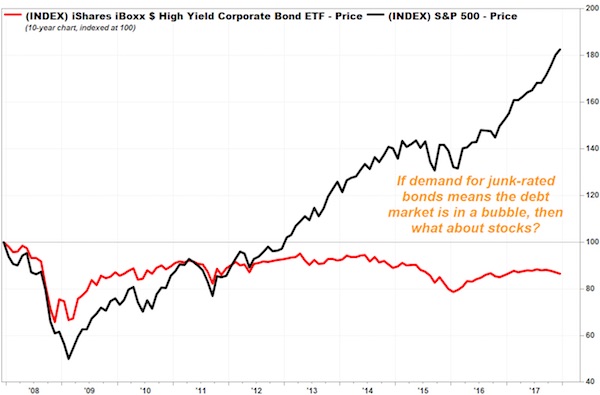

Will 2018 be the year the stock market rally screeches to a halt? It may be, if those analysts who are cautioning that a bubble is forming in credit markets are right and companies are overextending themselves to a degree that could spell trouble ahead. Most analysts agree that the credit market has been speeding ahead at a bubble-like pace. Companies have been piling on debt in recent years to take advantage of low interest rates, or more recently, to get ahead of a series of well-telegraphed interest-rate hikes. If their borrowing is simply to refinance existing debt at lower interest rates, it’s a positive for balance sheets. But many companies have borrowed to raise funds for shareholder rewards, and that may come back to bite them if rates were to spike.

For example, Apple debt may be highly rated, just two notches below triple-A at AA+ at S&P Global Ratings, but the technology giant continues to ride the borrowing bandwagon as it looks to fund its massive share buyback program. Apple issued $7 billion of debt in November, two months after selling $5 billion worth of corporate bonds and several months after adding more debt. The U.S. primary corporate bond market is currently at record levels. The investment-grade market saw $1.44 trillion of issuance in 2,127 deals through December 26, topping the record $1.34 trillion recorded in 2016, according to data analytics company Dealogic. The high-yield market has chalked up $266.3 billion of debt in 469 deals, making it the fourth-biggest year for issuance, according to Dealogic. The high-yield record goes to 2012 when issuers sold $321 billion of debt in 604 deals.

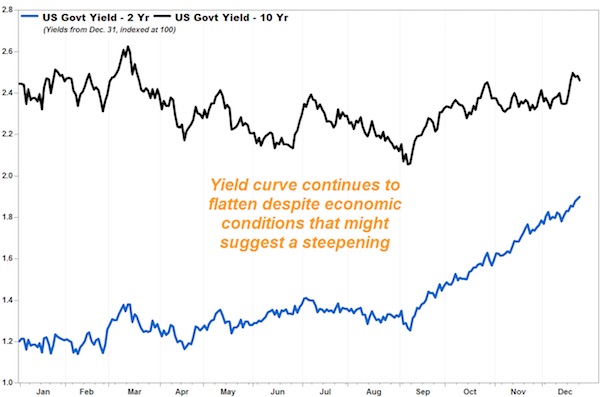

Combined investment-grade, high-yield and FIG issuance—FIG is financial institutions group—is a record $1.71 trillion, topping the previous record of $1.57 billion set in 2015. What’s starting to worry some analysts is that despite the fact that the Federal Reserve and other central banks are draining liquidity from the marketplace and the yield curve is flattening, near-record credit market valuations suggest investors haven’t prepared for any potential speed bumps. One sign of this complacency, is how narrow the spread is between yields on speculative grade, or “junk” bonds, and corresponding risk-free Treasury notes. S&P Global Ratings said Tuesday its speculative-grade composite spread tightened by three basis points (0.03 percentage points) to 399 basis points, well below the five-year moving average of a 528 basis-point spread.

How much longer can volatility remain ultra low?

• Dramatic Stock Market Reversal Signals More Volatility Ahead (CNBC)

After a mostly one-way trade higher for weeks, Tuesdays’ dramatic stock market reversal signals the potential for more choppy trading ahead. The Dow rocketed 283 points Tuesday, before erasing those gains and heading down 100 points. It later recovered and closed just 10 points lower at 25,792 after its most volatile day since Dec. 1 and on the first day it traded above 26,000. Traders blamed Washington for some of the selling as lawmakers appeared to be having difficulty agreeing to a spending resolution and on reports that former White House advisor Steve Bannon will testify in the Russia investigation. But while the focus was on Washington, traders also looked at the morning market surge Tuesday as another sign that the market was getting too frothy and overbought.

“The healthiest thing would be some downward action for the next two or three sessions. Today you did have a somewhat bearish, outside reversal,” said Scott Redler, partner with T3Live.com, who follows the market’s short-term technicals. A reversal is when the market opens above a prior high and then closes below a prior low. “That happened in some sectors like small-caps. … You can’t get too bearish if you’re still above the 8- and 21-day moving average,” Redler said. Strategist Laszlo Birinyi on Tuesday said he expects a possible six weeks of consolidation and sideways trade, but he is not bearish on stocks. “Right now, the market is at the upper end of the trading range. It’s 5% over its 50-day moving average, and those are areas where the market tends to digest, consolidate, take a breather but not go down,” he said, as the market gyrated Tuesday.

Steve Massocca, managing director at Wedbush Securities, said the market has clearly become fatigued after its sharp move higher. The S&P 500 is up 4% since the beginning of the year and crossed above 2,800 for the first time Tuesday before closing down 9 at 2,776. “We’ve had a pretty significant move. It’s quite natural that this would be exhausted at some point. … A potential government shutdown is a handy excuse,” he said. But a government shutdown Friday is not likely, said Dan Clifton, head of policy research for Strategas. “My overall view on this is they’re preparing a temporary stop-gap measure. I just don’t think we’re going to shut down, but we’re trying to buy time until there could be a larger spending package. It was very much companies that were influenced by government spending that were selling off. The market is saying there is some risk of a government shutdown,” Clifton said.

Closing in on $10,000 as we speak. Is that a psychological barrier?

• Bitcoin, Ethereum Suffer Massive Drops, Many Crypto’s Fare Even Worse (CNBC)

Most major digital currencies sold off sharply on Tuesday, but the declines in bitcoin, ethereum and litecoin prices weren’t as bad as much of the rest of the market. All of the top 20 digital currencies — by market value — suffered double digit losses over the last 24 hours, according to data from industry website CoinMarketCap. For example, ripple was down 26%, bitcoin cash was down 24%, iota was down 27% and monero was down 22% as of 8:51 a.m. HK/SIN. In fact, at their low point on the day, many cryptocurrencies with large market caps saw their prices essentially halved. On the other hand, bitcoin was down 17% at that time, ethereum was down 19% and litecoin was down 19%, according to the same site.

The declines followed speculation in the market about what regulators in Asia may be planning for digital tokens. On Monday, a report from Bloomberg, citing unnamed sources, said Beijing plans to block domestic access to Chinese and offshore cryptocurrency platforms that allow centralized trading. Last week, South Korean Justice Minister Park Sang-ki said his ministry was preparing a bill that, if passed, could ban trading via cryptocurrency exchanges. His comments roiled the market and subsequently the justice ministry and other sections of South Korea’s government have softened their stance.

Just perfect.

• South Koreans Sign Petition To Stop Crackdown On Bitcoin ‘Happy Dream’ (CNBC)

A petition in South Korea against cryptocurrency regulation has reached the number of signatures that would induce a government response. As of Tuesday morning, ET, more than 212,700 had signed a petition launched Dec. 28 on the website of the South Korean presidential office. A Google translation of the website states that if more than 200,000 people support a petition within 30 days, officials will respond. “Our people have been able to make a happy dream that they have never had in Korea because of virtual money,” the anonymous author of the petition wrote, according to a Google translation. “People are not stupid. … virtual money is invested because it is judged to be the fourth revolution.” The petition did support South Korea’s recent actions on cryptocurrencies, such as banning anonymous trading accounts.

“However, I wish that the economy will not decline due to unjustifiable regulations in the present situation,” the Google translation of the petition said. Unemployment among South Korean youth, or those ages 15 to 29, is around 9%, nearly three times the national average, according to Statistics Korea. Young people are generally more interested in buying and selling digital currencies than their elders. In the last several months, South Korea has accounted for a significant portion of the trading volume in digital currencies such as bitcoin, ethereum and ripple. Earlier this month, ripple prices appeared to plunge in U.S. dollar terms after CoinMarketCap said it was excluding price information from some Korean exchanges due to “extreme divergences in price from the rest of the world.”

No kidding.

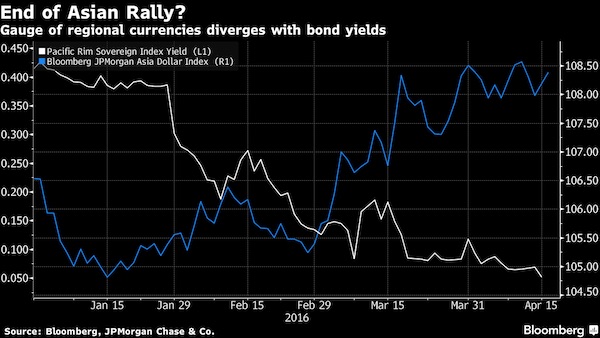

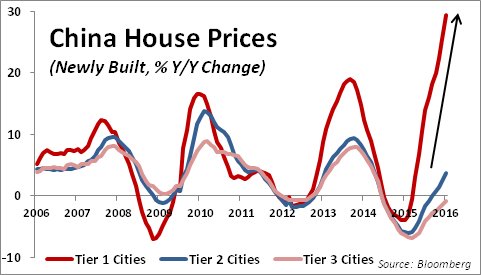

• ‘Black Swan’ Event Could Threaten China’s Financial Stability (R.)

China’s banking regulator chief warned that a “black swan,” or an unforeseen event could threaten the country’s financial stability, official People’s Daily reported on Wednesday. In an interview with the paper, Guo Shuqing said that while risks in the financial system are manageable, they are still “complex and serious.” Since his appointment as the head of the China Banking Regulatory Commission early last year, Guo has introduced a flurry of new rules to reign in lender risks including from curbs on shadow banking activities to the crackdown on loan fraud. Guo said the dangers stem from the pressure of rising bad debt, imperfect internal risk systems at financial institutions, the relatively high levels of shadow banking activities and rule violations.

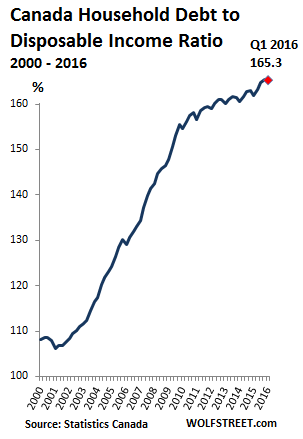

All of these risks could upend financial stability through a “black swan” event, Guo told the People’s Daily, referring to major, unexpected occurrences. “We need to focus on reducing the debt ratio of companies, restrict household leverage, strictly control cross-financial sector products, continue to dismantle shadow banking,” said Guo. China will step up oversight of the banking sector this year to reduce financial risks, the CBRC said on Monday, stressing that long-term efforts would be needed to control banking sector chaos.

A trade war wouldn’t qualify as a black swan.

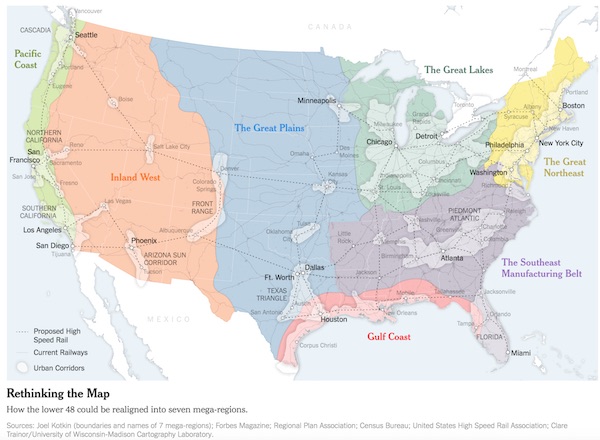

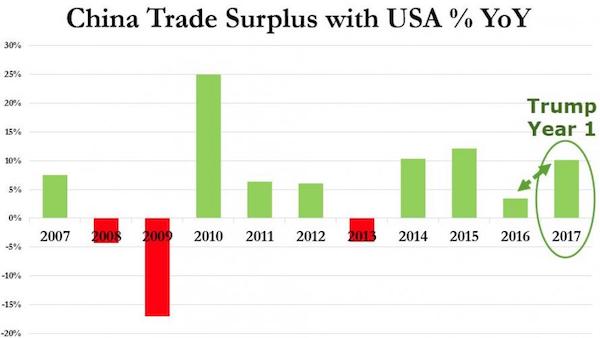

• US and China Brace For Trade War That Could Rattle Global Economy (ZH/WSJ)

Once under way, the repercussions of a trade war would be felt well beyond the combatants themselves. US friends and allies along Asian supply chains would be early collateral damage. China is still to a large extent the final assembly point for imported high-tech components from Japan, South Korea and Taiwan. Navigating increasingly complex global supply chains in a constant state of disruption would be hugely problematic for businesses across industries. Furthermore, if it escalated far enough, a trade war could take down the entire global trading architecture. That could be Trump’s goal. Many in his administration, including trade representative Robert Lightizer, believe the biggest mistake the US ever made was to usher China into the World Trade Organization in 2001. Aides say Trump regularly threatens to pull out of the rules-setting body.

Trump has in the past suggested that Chinese help on North Korea could head off US trade action. In a phone call with the US president on Tuesday, Xi suggested that trade issues should be resolved by “making the cake of cooperation bigger.” Meanwhile, Trump expressed disappointment that the US trade deficit with China has continued to grow” and made clear that “the situation is not sustainable.” In private, however, senior Chinese officials believe Beijing has many tactical advantages: Some are cultural – the Chinese people, one says, are more prepared to endure economic hardship. [..] Many US trade experts don’t mince words: They believe China would prevail in a trade war with the US, and that the US economy would suffer lasting damage.

Nicholas Lardy, a senior fellow at the Peterson Institute for International Economics, thinks China would win. Among his reasons: China’s ability to concentrate pain, and the outcry from affected businesses in America’s more open political system. He argues that “the political costs to the Trump administration of maintaining new protectionist measures will be much higher than the costs of retaliation to the Xi regime.” Derek Scissors, a trade expert at the American Enterprise Institute argues that the major US advantage is that China is far more dependent on trade for its financial health. “A shorter, smaller-scale trade conflict favors China due to its comparative agility,” he says. “The more serious it gets, the worse China would fare because it’s badly outmatched monetarily.”

Part of a podcast with America’s no.1 Russia scholar Stephen Cohen at TFMetalsReport.com.

• The New Cold War In 2018 (Stephen Cohen)

I’m not a Trump supporter and I didn’t vote for him. However, we can actually support Donald Trump’s campaign promise which I think he’s tried to act on since he’s been president that it’s necessary to cooperate with Russia. This is what was called detente in the 20th century. I don’t know why Trump doesn’t make this point. I don’t think he has very good advisors in regard to Russia either in terms of what’s going on in Russia or in terms of his own policy making but Trump might say in his own defense because they’re indicting him for simply saying I want to cooperate with Russia and with Putin in particular. He could say look, every Republican president of consequence in the 20th century pursued detente with Russia.

First Eisenhower, the first detente the spirit of Camp David with Khrushchev, then the Nixon Kissinger attempt at a grand detente with Brezhnev and finally above all Ronald Reagan a detente with Gorbachev the last Soviet leader Soviet Russian leader so great that Reagan and Gorbachev ended the cold war. Trump could put himself in that tradition and say “I’m the traditional Republican. This is what Eisenhower, Nixon and Reagan did. They did it wisely. They avoided nuclear war with Russia. We’re in a new Cold War. The dangers are grave. It’s not only my duty as the American president to pursue cooperation to ward off a catastrophe but I commend the honorable tradition of the Republican Party”. He doesn’t say that. I don’t know why as I say it because he doesn’t know what or because he wants to be the one and only I have no idea what he needs to say.

And if he said it it would compel a conversation in Washington that we’re not having. What’s happened to detente and what’s happened is we have if we ignore his own idiom and put it in again I speak as a story in the historical language of 20th century diplomacy. We have a pro-detente President who for the first time in history is not permitted to at least try because every time he has a sensible conversation with Putin, no matter whether it’s face to face or on the telephone, he’s accused not only by the traditionally crazies in American politics but by the New York Times of treason. So what we could do and it will be hard for a lot of people because of the loathing for Trump. Is so pervasive just and I didn’t vote for Trump is the fifth amendment I didn’t vote for Trump and I didn’t support President Trump. But about this he is not only right. He’s our only hope at the moment.

Caitlin Johnstone is a delight to read. Summary here: Putin is supposed to have paid out many billions when no-one believed Trump was a viable candidate. Was he psychic?

• The One Fact Which Disproves Russiagate (CJ)

Just a few days ago Russiagaters were having yet another “BOOM! We got him!” social media parade about an article from the Clinton-directed Daily Beast, claiming that a senior national security aide within the Trump administration had suggested scaling down the US troop presence along Russia’s border, a dangerous escalation which all peace advocates support eliminating. In the first sentence of the article’s second paragraph, the author Spencer Ackerman acknowledges that “the proposal was ultimately not adopted.” Huh? So President Trump, alleged to have been groomed early and at great expense by the Kremlin in anticipation of a presidential victory nobody else imagined possible at that time, was pitched a recommendation to scale down new cold war escalations with Russia… and he refused? That’s how you’re starting your article about the “return on Russia’s election-time investment in President Trump”?

Russiagate is so weird. You need to plug yourself into Louise Mensch and Rachel Maddow ramblings so extensively that you can contort your sense of reason to the point where it looks perfectly rational to believe that Putin was omniscient enough to know that Trump could defeat all primary opponents and take the fight to the heir apparent Hillary Clinton back when virtually no one else imagined such a thing was possible, recruited his team reportedly at the cost of billions of dollars, poured all kinds of intel and resources into ensuring Trump’s election using hackers and bots to influence American opinion, only to get a US president who is, when it comes to facts in evidence, already just a year into his administration demonstrably more hawkish towards Russia than his predecessor was. Again: huh?

Nobody wants to think about this because it doesn’t fit in with America’s stale partisan models; Democrats would have to admit that their best shot at getting a rival president impeached is pure gibberish, and Trump supporters would have to acknowledge that their swamp-draining populist hero is actually just one more corrupt globalist neocon like his predecessors.

The next Carillion is already in sight: Interserve. The British privatization model is failing spectacularly. That will cost a lot of jobs.

• Carillion’s Failure: The Many Questions That Need Answers (Coppola)

Britain is reeling from the shock collapse of one of its largest corporations, the giant construction and services company Carillion Group plc. In talks over the weekend, Carillion’s management was unable to persuade its lenders to provide any more funds, and the U.K. government refused to help. Carillion was left with no options. On Monday morning, Carillion filed for compulsory liquidation. This was a completely unexpected move. Discussions about Carillion’s fate over the previous week had centered around restructuring, bail-in of creditors and perhaps placing the company into administration, the U.K.’s equivalent of Chapter 11 bankruptcy protection. No one expected the company to be wound up. But that is what will now happen to it.

As Carillion has extensive U.K. Government construction and services contracts, the U.K.’s High Court appointed the Government’s Official Receiver to manage the liquidation. Among other things, the Official Receiver will be responsible for ensuring that public sector services currently provided by Carillion continue to run, and the staff providing them continue to be paid. Without this assurance, meals to hospital patients and schoolchildren might not be delivered, and prisons might not be staffed. But the future of Carillion’s 19,000 employees in the U.K. (43,000 worldwide) is still highly uncertain. Staff working on U.K. public sector service contracts are protected for the moment, but those working on other projects could lose their jobs within days.

The Official Receiver will be supported by six insolvency specialists from the accountancy firm PWC, who will act as “special managers”. PWC’s message to Carillion’s shareholders was blunt and immediate: Unfortunately, as a result of the liquidation appointments, there is no prospect of any return to shareholders. At least shareholders know where they stand. They have been wiped. Trading in Carillion’s shares has been suspended, of course.

I see trouble in your future.

• After Carillion How Many Firms Can UK Pensions Lifeboat Rescue? (G.)

The pensions lifeboat that comes to the rescue when firms go bust is about to get a lot more crowded following the collapse of Carillion. The sprawling construction and outsourcing firm had a pension deficit of £580m but is now likely to rise to at least £800m because it no longer has a solvent business standing alongside it. The company’s crash into liquidation has thrown the spotlight on other firms with huge pension scheme deficits such as IAG, BT and BAE. It has also raised questions about how many more big company failures the Pension Protection Fund (PPF) can absorb, and why companies with big deficits are allowed to pump out bumper dividend payouts to shareholders.

It is almost certain that the fund will now have to step in and bail out workers at Carillion, which has more than 28,000 defined-benefit – in this case, final salary – pension scheme members. Those already taking pensions will be protected, but those members below retirement age will face cuts of 10-20% because there is a cap on payouts to higher earners. It’s been a busy time for the PPF: in the spring, roughly 20,000 members of the British Steel pension scheme will start moving into the fund. They will eventually be joined by about 2,000 former BHS workers (the vast majority of the retailer’s staff chose to move their retirement funds into a new pension scheme).

Carillion’s liquidation has fuelled concern about the financial stability of other big companies. Last year a report by JLT Employee Benefits put the total deficit in FTSE 100 pension schemes at the end of 2016 at £87bn – £17bn worse than a year earlier, even though firms paid in around £11bn. 66 companies had deficits – ie their liabilities to pension scheme members were greater than their assets. Booming stock markets in 2017 helped narrow the gap. Mercer, the leading pensions consultancy, said deficits at the biggest 350 firms fell to £76bn from £84bn the year before. But even with the FTSE at a new peak, the deficits remain alarmingly high.

Pensions, Social Security, it’s all stupidly overpromised. And that will remain so until it’s too late.

• No Way Around Sorry Shape Social Security Is In (Newsmax)

If you want to know what makes people worry, here are four facts to make you lose your sleep whatever your age:

1. The Social Security Shortfall Is Growing Three Times Faster Than the US Economy. The imbalance of Social Security is measured by its shortfall, or the amount of money, that with interest earned, would enable the program to pay benefits over the next 75 years. That hole in the program’s finances is growing at three times the rate of our ability to fill it. Here are the numbers. Over the past 15 years, the system’s liabilities have grown at 9.6% compounded annually, while the trustees expect that even in a robust year real economic growth will not break 3%. Moreover, the trustees believe that the long-term growth rate of the economy is 2.1%. At the end of 2001, the Social Security shortfall was $3.157 trillion. At the end of 2016, it was $12.5 trillion. With the passage of yet another year of inaction on the program’s finances, the figure is more than $13 trillion.

2. People Turning 70 Today expect to Be Alive When Benefits are Reduced. If you think the problems of Social Security are limited to people under the age of 40 —think again. That assessment has not been a realistic concern in nearly two decades. The Social Security Administration believes that more than half of the people turning 70 today will be alive and well when the trust fund is exhausted. The exhaustion of the trust fund means that benefits will be reduced to the level of revenue collected. At this point, the trustees of the Social Security Trust Funds believe that benefits will fall by 23% in 2034, with cuts rising over time. The CBO believes that the reductions will rise to 30% over time.

3. In 2016, the Program Lost More Money than It Collected. Over the course of 2016, the program’s unfunded liabilities rose by nearly $1.2 trillion. That is a breathtaking jump considering that the program only collected about $950 billion in revenue. Mechanically, Social Security takes in money in exchange for the promise of future benefits. In the case of 2016, for every $1 that the program took in, the system generated more than $1.20 of promises that no one expects it to keep. In English, we could have reduced benefits to zero for the entire year of 2016, and the program would have finished the year in worse shape than it started.

4. Dependency on Social Security Rises with Age. Typically, worriers about Social Security say that Social Security accounts for 90% of the income of more than one-third of seniors. Politifact has largely confirmed this statistic.

It’s a zombie nation.

• Britain Is Being Stalked By A Zombie Elite (G.)

Britain in 2018 is stalked by zombie ideas, zombie politicians, zombie institutions – stripped of credibility and authority, yet somehow still presiding over our lives. Nowhere is this more true than in the way we run our economy. This September marks the 10th anniversary of the death of Lehman Brothers. In autumn 2008, the banks broke, the governments stepped in – and the cast-iron premises that underpin our economic system were exposed as fiction for all to see on the Ten O’Clock News. Yet a decade later, those dead ideas still walk among us. They form what John Quiggin at the University of Queensland terms zombie economics – dogmas now cracked beyond repair, but which continue to shape British society.

Austerity – the policy that more than any other will define this decade – was lifted by George Osborne straight out of Margaret Thatcher’s handbag. He justified it with zombie rhetoric about how business was being “crowded out” by childcare centres and the rest of the public sector, and how 21st-century sovereign countries could be run just like household budgets. Tax cuts for “wealth creators” and privatisations of the few remaining national assets: all utter zombie-ism. And this was no one-party game. Labour frontbenchers from Andy Burnham to Chuka Umunna spent the first half of this decade pleading guilty to the trumped-up charge of creating a debt crisis.

Labour councils are among those pursuing outrageous privatisations. And over the past four decades both sides have adopted as an article of faith the idea that politics is about What Works – and that What Works is a mix of Potemkin markets and crude managerialism. From Tony Blair to David Cameron and Nick Clegg, politics was no longer about left battling right – but technocrats and open-necked Oxford philosophy, politics and economics graduate special advisers who “got it” versus the dinosaurs and well-meaning naifs. In this way, a broken economy has been force-fed more of the same ideas that helped to break it. The outcome has been almost predictably dire.

Yeah, let’s get Greece to pay up for that. Show us some solidarity!

• Dutch Say Nations Hit By Brexit Shouldn’t Plug EU Budget Hole (BBG)

Dutch Finance Minister Wopke Hoekstra said European Union countries that are set to suffer the most from Brexit shouldn’t also have to help plug the hole it will tear in the bloc’s budget. “A small group of countries on the west coast of Europe is hit very hard in the economy by Brexit, which applies primarily to Ireland, but also to the Netherlands, Denmark, Spain and a number of other countries,” Hoekstra said in interview with Dutch TV station RTL Z. “It cannot be the intention that those who already experience the damage of Brexit will also pay the bill.” While the remaining 27 EU countries are maintaining a united front in Brexit talks, national interests diverge when it comes to the future trading relationship and splits are starting to emerge.

The Netherlands is one of the EU countries keenest on securing a trade deal with the U.K. that doesn’t harm crucial commercial trade ties between the two countries, whose ports face each other across the North Sea. Hoekstra met his Spanish counterpart Luis de Guindos last week and the pair agreed they both wanted a Brexit deal that keeps the U.K. as close to the EU as possible, according to a person familiar with the situation. A Spanish economy ministry official said last week the two finance chiefs had underlined the importance of U.K. ties for both countries, and agreed to keep track of their common interests. The U.K. will continue to pay into the current budget until the end of 2020; after that a new seven-year budget cycle comes into effect. The U.K. is a net contributor to the current budget, which redistributes funds across the bloc.

The real collusion.

• Nomi Prins’ New Book: Central Banks Have Become the Markets (Martens)

Nomi Prins’ latest book, Collusion: How Central Bankers Rigged the World, ensures her place as one of this century’s most informed Wall Street historians. It’s the perfect segue from Prins’ earlier “It Takes a Pillage,” and her 2014 book All the Presidents’ Bankers. If you are serious about understanding the corrupting influences that have left the U.S. vulnerable to another epic financial crash, buy all three books and read them as one. Prins is a veteran of Wall Street who has now written six books and dozens of articles to help Americans navigate the snake pit that has replaced the financial system of the United States. It all started with her first book in 2004, Other People’s Money: The Corporate Mugging of America, where she explained her motivation as follows:

“When I left Wall Street, at the height of a wave of scandals uncovering scores of massively destructive deceptions, my choice was based on a very personal sense of right and wrong…So, when people who didn’t know me very well asked me why I left the banking industry after a fifteen-year climb up the corporate ladder, I answered, ‘Goldman Sachs.’ “For it was not until I reached the inner sanctum of this autocratic and hypocritical organization – one too conceited to have its name or logo visible from the sidewalk of its 85 Broad Street headquarters [now relocated to 200 West Street] that I realized I had to get out…The fact that my decision coincided with corporate malfeasance of epic proportions made me realize that it was far more important to use my knowledge to be part of the solution than to continue being part of the problem.”

In Collusion, Prins walks us through the critically-important events occurring during the 2007-2009 financial crash, many of which would have been relegated to the dust bin of history if not for this book. Prins makes the case that the U.S. is headed toward another epic financial crash as a result of the unchecked powers of the U.S. central bank (the Federal Reserve) and its global counterparts who are creating dangerous new asset bubbles in an effort to paper over the last ones. Prins convincingly shows that colluding central bankers have effectively become the markets through a never-ending flow of cheap money to the mega banks which have deployed that cheap money to buy back and inflate their own stock – with a green light from their own regulator and money pimp (our term, not hers) – the U.S. Federal Reserve.

The new PM should jump on this. She cannot afford to let this stand.

• New Zealand Fisheries Want Images Of Dead Penguins Caught In Nets Censored (G.)

The seafood industry in New Zealand has asked the government to withhold graphic video of dead sea life caught in trawler nets as they are potentially damaging to fisheries and to brand New Zealand. A letter from five seafood industry leaders to the Ministry of Primary Industries highlights the fisheries’ growing unease with the government’s proposal to install video cameras on all commercial fishing vessels to monitor bycatch of other species and illegal fish dumping. The letter requests an amendment to the Fisheries Act, so video captured onboard cannot be released to the general public through a freedom of information request, frequently used by the media, campaign groups and opposition parties.

“They [the proposed videos] also raise significant risks for MPI and for ‘New Zealand Inc'”, the letter reads, also citing concerns about invading the privacy of employees onboard, and protecting commercial and trade secrets. There are no reliable figures on the numbers of penguins, sea lions, dolphins and seals that die in fishing nets or longlines in New Zealand, but according to some researchers and environmental groups the commercial fishing industry is the main culprit for declining populations of endangered sea lions and yellow-eyed penguins. Only 25% of deepwater trawlers in New Zealand have government observers onboard to record bycatch and discards, according to the National Institute of Water and Atmospheric Research [Niwa], which relies on statistical modelling techniques to generate bycatch estimates for the 75% of boats that work unobserved.

Niwa estimates for every kilogram of reported target catch (what the fishing boat aims to catch ) there is 0.2 kg of bycatch. “These are the images the fishing industry doesn’t want you to see”, said Forest & Bird’s chief executive Kevin Hague. “What they [the seafood industry] are saying is catching endangered penguins, dumping entire hauls of fish overboard and killing Hector s dolphins looks really bad on TV. Well, the solution is to stop doing it, not to hide the evidence. It’s hard to think of a more credibility damaging activity than trying to change the law so the rest of us can’t see what’s really happening out there.” Deepwater fishing vessels account for 80% of New Zealand’s annual catch and earn NZ$650m per annum in export dollars.