Charles Sprague Pearce The Arab jeweler c1882

Habba

https://twitter.com/i/status/1779925234868470134

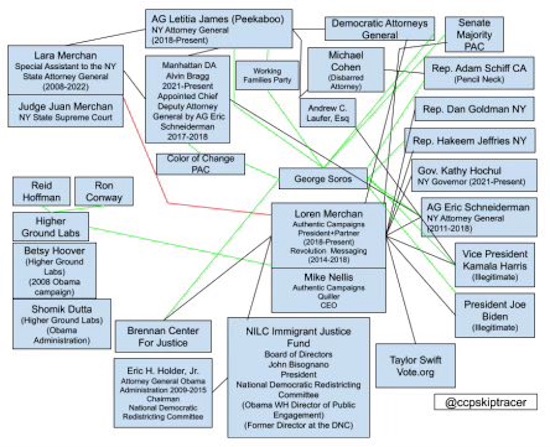

Trumps lawyer Alina Habba explains why Judge Merchan should be IMMEDIATELY removed from the case:

“In New York, which is different than most states, there’s actually a law against judges working on a trial where they or someone in their six degrees of separation has any… pic.twitter.com/ikHRokuxmJ

— Benny Johnson (@bennyjohnson) April 15, 2024

Look up Mary McCord

https://twitter.com/i/status/1779853383525933207

Jury

https://twitter.com/i/status/1779876987697295817

Pastor

Pastor John Hagee this am says Iran's missiles are the prophetic start of the "Gog and Magog" war from the Bible (that ends w/ Jesus returning and Jews killed or converted). Says he will travel to DC to lobby lawmakers not to "deescalate" and support Israel. Asks for money. pic.twitter.com/k47wU9fAk0

— Lee Fang (@lhfang) April 14, 2024

Dalton

Former UK Ambassador to Iran, Sir Richard Dalton,

"It was not only unlawful, it was a stupid thing to do, for Israel to trail its coat by attacking an Iranian consulate.. I don't know what the G7 have said, but they should be demanding restraint in the global interest from… pic.twitter.com/sgTz8ESvXK

— Farrukh (@implausibleblog) April 14, 2024

“..that I can’t go to my son’s graduation, or that I can’t go to the United States Supreme Court, that I’m not in Georgia or Florida or North Carolina campaigning like I should be..”

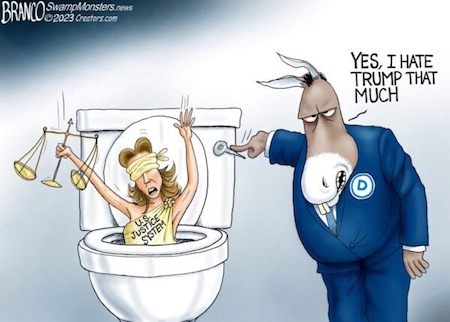

Engoron tried to take away his money. So Merchan takes his freedom instead. Count on this judge to lock him up at some point. He’ll find a reason.

• “I Can’t Go To My Son’s Graduation”: NY Judge Threatens Trump With Arrest (ZH)

Update (1750ET): The first day of Donald Trump’s ‘hush money’ trial was fairly uneventful – aside from the judge, a complete dick, barring the former President from attending his son’s graduation and threatening arrest if he does. Speaking after a long day of jury selection and ground rules (with more than 50 jurors dismissed), Trump walked out of the courtroom and expressed his obvious displeasure. “As you know my son is graduating from High School, and looks like the judge will not let me go to the graduation for a son who’s worked very, very hard,” Trump said, adding that he was “looking forward for years to having graduation with his mother and father there,” adding that the trial is a “scam” and a “political witch hunt.”

Judge Juan Merchan also won’t allow Trump to attend a Supreme Court hearing in DC regarding immunity. “We got a real problem with this Judge,” Trump continued, adding “that I can’t go to my son’s graduation, or that I can’t go to the United States Supreme Court, that I’m not in Georgia or Florida or North Carolina campaigning like I should be… it’s perfect for the radical left Democrats – that’s exactly what they want,” he continued, adding that it’s “election interference.”

Vivek

Alvin Bragg‘s case against Trump rests on the ludicrous legal premise that a candidate must use *campaign* funds to make personal hush money payments. Yet if Trump had done that, they’d undoubtedly be going after him for that. This isn’t the pursuit of justice, it’s a political… pic.twitter.com/PajtiLegIx

— Vivek Ramaswamy (@VivekGRamaswamy) April 15, 2024

The lawfare isn’t just limited to prosecutors. It’s trickling down to the entire administrative state. https://t.co/PouTEimh5F

— Vivek Ramaswamy (@VivekGRamaswamy) April 15, 2024

[..] The case stems from a $130,000 payment made by Trump’s former lawyer, convicted felon and admitted liar Michael Cohen, to adult film actress Stormy Daniels at the end of the 2016 election in an alleged scheme to buy her silence. Trump is required to be present for the trial, which will take place four days a week and could last up to two months. Judge Juan Merchan kicked off the day by refusing a request by Trump’s legal team to recuse himself from the case over an interview he gave to the press in which he mentioned the case, which Merchan said was within the law – while Merchan’s wife and daughter have worked for prominent Democrats and/or made anti-Trump statements.

Prosecutors sought to include evidence from the Access Hollywood ‘grab ’em by the pussy’ tape, as well as various sexual assault allegations from Trump accusers. Merchan allowed a transcript of the tape, and denied a request to present the other allegations in court. Next, prosecutor Joshua Steinglass asked Trump’s attorneys to explain how the former president shouldn’t be held in contempt for allegedly violating Merchan’s gag order – arguing that Trump’s efforts have continued to this day, and that witnesses in the case “have incurred the wrath of Trump supporters.” And now, jury selection begins… with Merchan telling the court that 500 prospective jurors are waiting.

Merchan

Judge Merchan Threatens President Trump with Arrest if Not in Court Every Single Day of Trial@mrddmia says Judge Merchan’s threat of arrest against President Trump shows his clear bias: “This whole process is clearly rigged against President Trump.”

Watch LIVE➡… pic.twitter.com/ecEG7DkvLl

— Real America's Voice (RAV) (@RealAmVoice) April 15, 2024

Good write-up from Turley. But it’s an indictment of the entire US legal system, not just New York.. Bragg and Merchan keep Trump from campaigning in 49 other states as well.

• Trump Trial in Manhattan is an Indictment of the New York Legal System (Turley)

After an absurd $450 million decision courtesy of Attorney General Letitia James, Manhattan District Attorney Alvin Bragg will bring his equally controversial criminal prosecution over hush money paid to former porn star Stormy Daniels before the 2016 election. Lawyers have been scouring the civil and criminal codes for any basis to sue or prosecute Trump before the upcoming 2024 election. This week will highlight the damage done to New York’s legal system because of this unhinged crusade. They’ve charged him with everything short of ripping a label off a mattress. Just a few weeks ago, another judge imposed a roughly half billion dollar penalty in a case without a single victim who lost a single cent on loans with Trump. (Indeed, bank officials testified they wanted more business with the Trump organization). Now Bragg is bringing a case that has taken years to develop and millions of dollars in litigation costs for all parties. That is all over a crime from before the 2016 election that is a misdemeanor under state law that had already expired under the statute of limitations.

Like his predecessor, Bragg previously scoffed at the case. However, two prosecutors, Carey R. Dunne and Mark F. Pomerantz, then resigned and started a public pressure campaign to get New Yorkers to demand prosecution. Pomerantz shocked many of us by publishing a book on the case against Trump — who was still under investigation and not charged, let alone convicted, of any crime. He did so despite objections from his former colleague that such a book was grossly improper. Nevertheless, it worked. Bragg brought a Rube Goldberg case that is so convoluted and counterintuitive that even liberal legal analysts criticized it. Trump paid Daniels to avoid any publicity over their brief alleged affair. As a celebrity, there was ample reason to want to keep the affair quiet, and that does not even include the fact that he is a married man. It also occurred before the 2016 election and there was clearly a benefit to quash the scandal as a candidate. That political motivation is at the heart of this long-delayed case.

It is a repeat of the case involving former Democratic presidential candidate John Edwards. In 2012, the Justice Department used the same theory to charge the former Democratic presidential candidate after a disclosure that he not only had an affair with filmmaker Rielle Hunter but also hid the fact that he had a child by her. Edwards denied the affair, and money from donors was passed to Hunter to keep the matter quiet. The Justice Department spent a huge amount on the case to show that the third-party payments were a circumvention of campaign finance laws. However, Edwards was ultimately found not guilty on one count while the jury deadlocked on the other five. With Trump, the Justice Department declined a repeat of the Edwards debacle and did not bring any federal charge.

But Bragg then used the alleged federal crime to bootstrap a defunct misdemeanor charge into a felony in the current case. He is arguing that Trump intentionally lied when his former lawyer Michael Cohen listed the payments as retainer costs rather than a payment — to avoid reporting it as a campaign contribution to himself. Thus, if he had simply had Cohen report the payment as “hush money,” there would be no crime. Once again, the contrast to other controversies is telling. Before the 2016 election, Hillary Clinton’s campaign denied that it had funded the infamous Steele dossier behind the debunked Russian collusion claims. The funding was hidden as legal expenses by then-Clinton campaign general counsel Marc Elias. (The FEC later sanctioned the campaign over its hiding of the funding.). When a reporter tried to report the story, he said Elias “pushed back vigorously, saying ‘You (or your sources) are wrong.’” Times reporter Maggie Haberman declared, “Folks involved in funding this lied about it, and with sanctimony, for a year.”

Likewise, John Podesta, Clinton’s campaign chairman, was called before congressional investigators and denied categorically any contractual agreement with Fusion GPS. Sitting beside him was Elias, who reportedly said nothing to correct the misleading information given to Congress. Yet, there were no charges stemming from the hiding of the funding, though it was all part of the campaign budget. Making this assorted business even more repellent will be the appearance of Cohen himself on the stand. Cohen recently was denounced by a judge as a serial perjurer who is continuing to game the system. Cohen has a long record as a legal thug who has repeatedly lied when it served his interests. He has a knack for selling his curious skill set to powerful figures like Trump and now Bragg.

For those of us who have been critics of Cohen from when he was still working for Trump, it is mystifying that anyone would call him to the stand to attest to anything short of the time of day . . . and even then most of us would check our watches. Fortunately witnesses are no longer required to put their hand on the bible in swearing to testify truthfully in court. Otherwise, the court would need the New York Fire Department standing by in case the book burst into flames. So this is the case: A serial perjurer used to convert a dead state misdemeanor into a felony based on an alleged federal election crime that was rejected by the Justice Department. They could well succeed in a city where nine out of ten potential jurors despise Trump. Trying Trump in Manhattan is about as difficult as the New York Yankees going to bat using beach balls rather than baseballs. It is hard to miss.

https://twitter.com/i/status/1779874197918863646

Turley

Jonathan Turley on Alvin Bragg's "Frankenstein case":

"They took a dead misdemeanor, they attached it to a dead alleged federal felony and zapped it back into life. Many of us are just amazed to watch this actually walk into court because it's not a recognizable crime." pic.twitter.com/G4ltw2E5W6

— Charlie Kirk (@charliekirk11) April 15, 2024

“The trial will keep Trump at the Manhattan courtroom every day of the proceedings for the next six weeks or more, effectively taking him off the campaign..”

• Jury Selection Begins In Trump Hush-money Trial (RT)

Jury selection has begun for a trial at which former US President Donald Trump stands accused of falsifying records related to hush-money payments to a porn star during the 2016 election. Trump becomes the first former president to stand trial on criminal charges. Twelve jurors, along with six alternates, will be chosen from among hundreds of New Yorkers. The judge in the case has released the extensive questionnaire that potential jurors will have to fill out. “Nothing like this has ever happened before,” Trump told reporters outside the courtroom, calling the trial “political persecution” and “an assault on America.” Manhattan District Attorney Alvin Bragg, a Democrat, charged Trump last year with 34 counts of “falsifying business records,” alleging that the Republican politician sought “to conceal damaging information and unlawful activity from American voters before and after the 2016 election.”

The case is based on claims by Trump’s former lawyer, Michael Cohen, that he paid $130,000 to adult film actress Stormy Daniels, so she would keep quiet about an alleged affair with him. Trump has denied any relationship with Daniels. In 2018, Cohen pleaded guilty to charges of campaign-finance violations, tax and bank fraud, and spent two and a half years in a federal prison. He also lost his New York bar license. Judge Juan Merchan has granted Bragg’s request for a gag order, meaning that Trump can’t criticize the prosecutor or his staff. The trial will keep Trump at the Manhattan courtroom every day of the proceedings for the next six weeks or more, effectively taking him off the campaign. Trump was the 45th president of the US (2017-2021) and is currently the presumptive Republican nominee to challenge President Joe Biden in November.

Trump gives Johnson some loving.

• Johnson, Trump Announce Election Integrity Bill (ET)

House Speaker Mike Johnson (R-La.) and former President Donald Trump are urging support for a bill aimed at preventing non-citizens from voting in federal elections. At a Friday, April 12, press conference at the former president’s Mar-a-Lago residence, the Republican leaders announced the bill as part of larger efforts to bolster election integrity. “What we’re going to do is introduce legislation to require that every single person who registers to vote in a federal election must prove that they are an American citizen first,” Mr. Johnson said. Though some jurisdictions allow noncitizens to participate in local elections, it is illegal for them to vote in all state and federal elections. However, the United States’ federal voter registration form does not require documentary proof of citizenship, and states’ efforts to impose such a requirement have been challenged by the Biden administration.

The new legislation, the speaker said, would establish new safeguards to ensure only citizens can vote. The provisions would require states to remove noncitizens from their voter rolls and would provide them with access to Department of Homeland Security and Social Security Administration databases to help them do so. “Congress has this responsibility. We cannot wait for widespread fraud to occur … especially when the threat of fraud is growing with every single illegal immigrant that crosses that border,” the speaker said. He added that he expected the bill to receive widespread Republican support while also forcing Democrats to go on record with where they stand. The push to secure elections from illegal votes comes amid the flood of illegal immigrants pouring across the southern border.

Illegal immigration, though a persistent problem for decades, has exploded to unprecedented levels under the Biden administration. The deluge has included individuals on the United States’ terror watch list and others with prior convictions for violent crimes. Republicans have repeatedly said that President Joe Biden has the power to end the crisis but simply chooses not to. President Trump repeated that claim Friday, asserting that the president could and should “close the border immediately.”

Will the loving remain?

• US House Speaker To Put Ukraine Aid Bill To A Vote (RT)

US House Speaker Mike Johnson has promised to finally advance the long-stalled Ukraine aid bill sought by President Joe Biden, multiple news outlets reported on Monday. The proposed legislation has been stuck in Congress for months due to the bitter in-fighting between Democrats and Republicans. According to reports, Johnson told Republican colleagues at a closed-door meeting that he intends to allow the House to vote on a standalone bill this week that would ensure additional military aid to Kiev. The House will also be expected to vote on separate bills providing more aid to Israel and Taiwan. “We know that the world is watching us to see how we react,” Johnson told reporters after a meeting with GOP legislators, as quoted by the New York Times. He added that the leaders of Russia, China and Iran are “watching to see if America will stand up for its allies and our interests around the globe – and we will.”

House Republicans have previously refused to back the omnibus foreign aid bill unveiled by Biden in October, which includes $61 billion worth of assistance to Ukraine. The legislation stalled for months because the GOP was trying to force the White House to crack down on the influx of illegal migrants across the border with Mexico. The Republicans were encouraged by Biden’s reelection rival, former president Donald Trump, who argued against unchecked aid to Ukraine. The delay in approving more weapons for Ukraine rattled President Vladimir Zelensky and other officials in Kiev, who are blaming mounting battlefield losses on the increasing shortages of foreign-supplied ammunition and air defenses. “If Congress does not help Ukraine, Ukraine will lose the war,” Zelensky warned last week. Russia, meanwhile, has repeatedly stated that no amount of foreign help will change the course of the conflict, and accused the West of escalation.

“This was a highly choreographed show. Multiple early warning signs gifted Tel Aviv with plenty of time to profit from US intel and evacuate fighter jets and personnel..”

• How Iran’s ‘Strategic Patience’ Switched To Serious Deterrence (Pepe Escobar)

A little over 48 hours before Iran’s aerial message to Israel across the skies of West Asia, Russian Deputy Foreign Minister Sergey Ryabkov confirmed, on the record, what so far had been, at best, hush-hush diplomatic talk: The Russian side keeps in contact with Iranian partners on the situation in the Middle East after the Israeli strike on the Iranian consulate in Syria. Ryabkov added, “We stay in constant touch [with Iran]. New in-depth discussions on the whole range of issues related to the Middle East are also expected in the near future in BRICS.” He then sketched The Big Picture: “Connivance with Israeli actions in the Middle East, which are at the core of Washington’s policy, is in many ways becoming the root cause of new tragedies.” Here, concisely, we had Russia’s top diplomatic coordinator with BRICS – in the year of the multipolar organization’s Russian presidency – indirectly messaging that Russia has Iran’s back.

Iran, it should be noted, just became a full-fledged BRICS+ member in January. Iran’s aerial message this weekend confirmed this in practice: their missile guidance systems used the Chinese Beidou satellite navigation system as well as the Russian GLONASS system. This is Russia–China intel leading from behind and a graphic example of BRICS+ on the move. Ryabkov’s “we stay in constant touch” plus the satellite navigation intel confirms the deeply interlocked cooperation between the Russia–China strategic partnership and their mutual strategic partner Iran. Based on vast experience in Ukraine, Moscow knew that the biblical psychopathic genocidal entity would keep escalating if Iran only continued to exercise “strategic patience.”

The morphing of “strategic patience” into a new strategic balance had to take some time – including high-level exchanges with the Russian side. After all, the risk remained that the Israeli attack against the Iranian consulate/ambassador’s residence in Damascus could well prove to be the 2024 remix of the killing of Archduke Franz Ferdinand. Tehran did manage to upend the massive Western psychological operations aimed at pushing it into a strategic misstep. Iran started with a misdirecting masterstroke. As US–Israeli fear porn went off the charts, fueled by dodgy western “intel,” the Islamic Revolutionary Guard Corps (IRGC) made a quick sideways move, seizing an Israeli-owned container ship near the Strait of Hormuz.

That was an eminently elegant manoeuvre – reminding the collective west of Tehran’s hold on the Strait of Hormuz, a fact immeasurably more dangerous to the whole western economic house of cards than any limited strike on their “aircraft carrier” in West Asia. That did happen anyway. And once again, with a degree of elegance. Unlike that ‘moral’ army specialized in killing women, children, and the elderly and bombing hospitals, mosques, schools, universities, and humanitarian convoys, the Iranian attack targeted key Israeli military sites such as the Nevatim and Ramon airbases in the Negev and an intel center in the occupied Golan Heights – the three centers used by Tel Aviv in its strike on Iran’s Damascus consulate. This was a highly choreographed show. Multiple early warning signs gifted Tel Aviv with plenty of time to profit from US intel and evacuate fighter jets and personnel, which was duly followed by a plethora of US military radars coordinating the defense strategy.

“Ultimately, there is no alternative to the full implementation of the two-state solution, the only way to end the vicious circle of the Palestinian-Israeli conflict once and for all..”

• Iranian Strikes On Israel Represent ‘Spillover’ Of Gaza Conflict – China (RT)

Iran’s retaliatory strikes on Israel constitute an “adverse spillover” of the Gaza conflict, China’s ambassador to the United Nations has said, warning that it could spread further and make the entire Middle East even more unstable. Dai Bing made the remarks after Tehran launched a series of airstrikes on Israel over the weekend in retaliation for the bombing of an Iranian consular compound in Syria, which killed seven military personnel, including two generals. Israel has not commented on the incident since Iran accused it of conducting an extraterritorial assassination. Speaking at a UN Security Council emergency meeting on Sunday, Dai condemned Israel’s “vicious attack,” which he described as a “grave violation of the UN Charter and international law, and a breach of the sovereignty of both Syria and Iran.”

The war in Gaza “bears on the peace, stability and long-term security in the [Middle East] region,” he added, and called for an immediate end to the hostilities. Dai warned that if “the flames of the Gaza conflict are allowed to continue raging, the adverse spillover is set to spread still further” across the entire region. The Chinese envoy also called for “maximum calm and restraint” from Israel and Iran to prevent further escalations. “Ultimately, there is no alternative to the full implementation of the two-state solution, the only way to end the vicious circle of the Palestinian-Israeli conflict once and for all,” Dai said.

China has called on the international community, particularly countries with influence, to play a “constructive role for the peace and stability of the region,” the ambassador added. UN Secretary General Antonio Guterres also warned at Sunday’s emergency meeting that the entire Middle East is on the brink of a full-scale war in the wake of Iran’s strike on Israel. Meanwhile, Russia’s ambassador to the global body, Vassily Nebenzia, told members of the UN Security Council that the retaliatory strike “did not happen in a vacuum.” He claimed that the West had helped give rise to Iran’s attack by failing to take action over the illegal bombing of Tehran’s consulate in Damascus that provoked the latest violence in the region.

On Saturday, I said: “And you bet they gave advance notice”. Here is more: “..announcing it fired the drones hours before they reached Israeli territory, and Tehran said it gave other regional countries a 72-hour notice..”

• Biden Tells Netanyahu US Won’t Support Attack on Iran (Antiwar)

President Biden told Israeli Prime Minister Benjamin Netanyahu that the US wouldn’t join Israel in any offensive action against Iran, multiple media outlets have reported. US officials are touting Israel’s defense of Iran’s attack as a victory, and that’s the message Biden conveyed to Netanyahu, a sign the US doesn’t want the situation to escalate. Iran fired over 300 missiles and drones at Israel, which was a response to Israel’s bombing of Iran’s consulate in Damascus on April 1. “Israel really came out far ahead in this exchange. It took out the IRGC [Islamic Revolutionary Guard Corp] leadership in the Levant, Iran tried to respond, and Israel clearly demonstrated its military superiority, defeating this attack, particularly in coordination with its partners,” a senior Biden administration official told reporters, according to The Times of Israel.

In a statement on the attack released by the White House, Biden said he would convene with other G7 leaders to “coordinate a united diplomatic response to Iran’s brazen attack.” Israeli officials claimed 99% of the Iranian missiles and drones were intercepted by Israeli air defense systems and with assistance from the US, Britain, and Jordan. Some missiles got through and damaged the Nevatim Airbase in southern Israel. Only one person was injured in the attack, a seven-year-old Bedouin girl in the Negev, and nobody was killed. Iran gave Israel plenty of time to respond to the attack by announcing it fired the drones hours before they reached Israeli territory, and Tehran said it gave other regional countries a 72-hour notice. Iranian officials said the attack was “limited” and made clear they do not seek an escalation with Israel.

But Tehran is also warning it will launch an even bigger attack if Israel responds. “If the Zionist regime or its supporters demonstrate reckless behavior, they will receive a decisive and much stronger response,” Iranian President Ebrahim Raisi said in a statement on Sunday. While the US is signaling it seeks de-escalation and won’t support a potential Israeli attack on Iran, it’s unclear what Israel will do next. The Israeli war cabinet convened to discuss the situation on Sunday, and Israeli media reports said they agreed a response would come but didn’t decide on where or when. Israeli War Cabinet Minister Benny Gantz vowed Israel would respond but signaled it wouldn’t be imminent. Gantz said the “event is not over” and that Israel should “build a regional coalition and exact a price from Iran, in a way and at a time that suits us.”

White House National Security Council spokesman John Kirby said that Biden also told Netanyahu “that the United States is going to continue to help Israel defend itself,” signaling the US would intervene again to help Israel if it does choose to escalate the situation and comes under another attack. Israel’s bombing of the Iranian consulate in Syria killed 13 people, including seven members of the IRGC. Israel has a history of conducting covert attacks inside Iran and killing Iranians in Syria, but the bombing of the diplomatic facility marked a huge escalation.

Toothless.

• US Mulling New Sanctions Against Iran Over Attack on Israel – Scalise (Sp.)

Members of the US Congress plan to consider a number of draft laws on new sanctions against Iran after the latter’s attack on Israel, US House Majority Leader Steve Scalise said, adding that the first bill could be submitted to the House of Representatives as early as Monday night. “It’s a growing sentiment in the Congress that we need to increase sanctions. So we’re going to be bringing a number of bills to ratchet those up and raise the stakes against Iran for their actions,” Scalise told The Jerusalem Post newspaper on Sunday. The US Congress will also consider a number of bills that are related to the country’s alleged use of oil sales income to fund Palestinian movement Hamas, the lawmaker was cited as saying by the newspaper. The first bill could be submitted to the House on Monday evening, Scalise said.

On Saturday night, Iran’s Islamic Revolutionary Guard Corps launched over 300 drones and missiles at Israel in its first-ever direct attack on Israeli territory, the Israel Defense Forces (IDF) said. The attack came in response to Israel’s airstrike on the Iranian consulate in Damascus on April 1. Iranian state media reported that Iran had fired at least seven hypersonic missiles at Israel, with none of them intercepted. Meanwhile, CNN reported, citing US officials, that the US military had intercepted more than 79 drones and at least three hypersonic missiles during the attack. IDF spokesman Daniel Hagari said Israel had intercepted 99% of the aerial targets fired by Iran, including all drones.

“I was in Washington last week in a meeting with top administration officials. They are appalled by this government: The irresponsibility, the lack of professionalism, the failed management, the ingratitude..”

• Netanyahu a Threat for Israel, Opposition Leader Says (TASS)

Israeli Prime Minister Benjamin Netanyahu and his cabinet pose a threat to their own country, Yair Lapid, leader of the Israeli opposition, said, calling to hold new elections. Speaking before reporters after his trip to Washington, the politician said that the US Administration is “appalled” by the behavior of the Israeli government, led by Netanyahu, according to The Jerusalem Post. “This government, this prime minister, has become an existential threat against Israel,” Lapid said. “They destroyed Israeli deterrence. Our enemies look at this government, smell weakness, and raise their heads.” According to Lapid, Israeli allies “smell this weakness,” too.

“I was in Washington last week in a meeting with top administration officials. They are appalled by this government: The irresponsibility, the lack of professionalism, the failed management, the ingratitude,” he claimed. He pointed out that Netanyahu previously called himself “Mr. Security,” promising to guarantee order in Israel. Instead, the current authorities have brought the country to the opposite: a “wasteland from Kiryat Shmona [a city on the Lebanese border – TASS] to Beeri [a settlement on the Gaza Strip border], violence by Jewish settlers [in the West Bank – TASS] that is out of hand, and a complete loss of Israeli deterrence.” “Our problem is Iran, but our problem is also here. […] It is time for an election now,” Lapid believes.

BREAKING: Israeli opposition leader Yair Lapid calls Netanyahu and his government an "existential threat to Israel":

"Violence by Jewish terrorists has gotten out of control and there's a complete loss of Israeli deterrence.

If we do not remove this government in time, it will… pic.twitter.com/QGkzZ6qUav

— Double Down News (@DoubleDownNews) April 15, 2024

“You don’t matter to us. You’re not Israel. You don’t own us. We’re not going to fight and die for you. I hope I made that clear..”

• Ukraine ‘Owned’ by US, US ‘Owned’ by Israel – Scott Ritter (Sp.)

President Zelensky took to X on Sunday to plead with US lawmakers not to forget about Ukraine, saying “it is critical that the United States Congress make the necessary decisions to strengthen America’s allies in this critical time” by delivering on the aid package promised by President Biden six months ago. Zelensky’s comments were echoed by Foreign Minister Dmytro Kuleba, who told reporters on Monday that Ukraine also needs help from its Western partners, even if it’s not in the form of direct military help – like Israel got. “All we ask our partners is, even if you cannot act the way you act in Israel, give us what is needed, and we will do the rest ourselves,” Kuleba urged. “Let me make this very clear to the Ukrainian crowd. You see, the difference between Israel and Ukraine is that, whether you like it or not, Israel has bought and paid for the United States’ support,” while Ukraine hasn’t, Scott Ritter told Sputnik.

“Israel, through its political action committee, AIPAC, in the United States, has pretty much bought the United States Congress. They’ve bought the United States presidency. They control American media. And as a result, America comes to the defense of Israel because we’ve been paid to do so,” Ritter said. With Ukraine, it’s the other way around, the observer said. “America, on the other hand, has bought and paid for Ukraine.You’re not a friend. You’re not an ally. You’re a tool being used by the United States for its larger foreign policy and national security objectives vis-à-vis Russia. We provide you weapons only so far as it facilitates our objective of creating a problem for Russia. We don’t want you to win. We don’t care about you. We give you just enough to keep you going. And then we stand by and watch you bury your dead. Because we don’t care,” Ritter said, channeling the sentiments of the American establishment.

“You’ve done your ‘duty’. You created a problem for the Russians. But now you’ve become inconvenient. And we’re going to stand by and let the Russians finish the job without spending any more money or providing you with much more assistance. You don’t matter to us. You’re not Israel. You don’t own us. We’re not going to fight and die for you. I hope I made that clear,” Ritter summed up.

“This is an ultimatum without alternatives for either Moscow or Kiev. In electric war, are there any alternatives?”

• De-electrification And Unconditional Surrender Of The Kiev Regime (Helmer)

It was a relatively bright day, November 21, 1920, when Vladimir Lenin, having won the civil war and driven off the American, British, French, Canadian, and Australian invasion forces, announced: “Communism is Soviet power plus the electrification of the whole country, since industry cannot be developed without electrification.” Come November 2024 it will be a century and four years to count what Lenin meant, and how Russia is proving itself against everything which the military industries, special forces, weapons, intelligence so-called, operations, and plans of the old invasion coalition, plus Germany, can throw at it. So on November 21, 2024, it will be time to revise Lenin’s maxim to read: Russia is military power plus the de-electrification of the countries which attack it. This is electric war.

To make the war aim unambiguously clear, President Vladimir Putin ordered his ambassador to the United Nations (UN), Vasily Nebenzya, to read out a paper at his desk in the UN Security Council chamber on April 11: “very soon, the only topic for international meetings in Ukraine will be the unconditional surrender of the Kiev regime.” Note what the terms “unconditional surrender of the Kiev regime” mean: total military defeat of the Ukrainian, American, British, French, Polish, and other forces on the Ukrainian territory and in the air surrounding; surrender of the municipal administrations of the east-bank cities, including Kharkov, Dniepropetrovsk, and Odessa; disarmament and demilitarization of the territory between Kiev and the Polish border; exit of every member of the regime, starting with Vladimir Zelensky. This is an ultimatum without alternatives for either Moscow or Kiev. In electric war, are there any alternatives?

Nebenzya was making his announcement on the evening of Thursday, April 11, Kiev time. In the time it took for his text to be drafted, edited by the Foreign Ministry, authorized at the Kremlin, and Nebenzya given the go-ahead, it had been only a few hours after the lights of Kiev went out when the Tripolskaya power station was destroyed by a new Russian missile, the X-69.

“..parents will be allowed to make a request to change the gender of a child as young as five, with the consent of the child present..”

• Germans Can Now Change Gender Every Year (RT)

German citizens will be able to change their sex on legal documents without undergoing surgery or hormone therapy, under a new bill passed by the Bundestag last Friday. It stipulates that an oral request is sufficient, eliminating the need for expert assessment, which was previously mandatory. The law comes into effect in November. The legislation on ‘self-determination’ in gender was backed by 374 MPs, mostly from the ruling ‘traffic-light’ coalition, with another 251 lawmakers against and the remaining 11 abstaining. The current regulations date back to 1981, and state that individuals wishing to change their gender must first undergo two psychological evaluations. The final decision under that law rests with a district court. Chancellor Olaf Scholz’s ruling coalition argued that the existing procedures were degrading toward transgender individuals, as they had to share intimate details with officials.

Under the new law, parents will be allowed to make a request to change the gender of a child as young as five, with the consent of the child present. Minors over 14 will be able to change their first name and gender alone, as long as they have the consent of their parents or legal representatives. Individuals will be allowed to make a change once per year. Germans will also have the right to replace the words ‘mother’ and ‘father’ in the family register with the neutral term ‘parent.’ Non-binary individuals can register as ‘diverse’ instead of having to choose between ‘male’ and ‘female.’ Under the recently passed legislation, anyone who attempts to expose an individual’s past gender identity can be fined up to €10,000 ($10,630). The law leaves it up to saunas, swimming pools, gyms, and other sports facilities to decide whether to allow biological males into women’s changing rooms and toilets.

When it comes to competitive sports, individual associations may decide if biological males identifying as women can compete against females. The bill faced heated debate in the Bundestag on Friday, with the government’s commissioner for LGBTQ+ issues, Sven Lehmann, hailing it as historic and ending “human rights abuse.” However, opposition parties were largely unconvinced, with a lawmaker from the Christian Democratic Union (CDU), Mareike Wulf, describing the legislation as “irresponsible” and “socially explosive.” Wulf also argued that criminals could use the new regulations to obscure their identity. Sahra Wagenknecht, a former leader of the Left Party who now leads her own party, warned that with males now allowed to proclaim themselves female, “women’s protection rights and women’s protection shelters [are] a thing of the past.” A representative of the far-right Alternative for Germany (AfD) party said the bill poses a threat to young people, denouncing it as “trans-hype.”

“..and call for solidarity with the Palestinians, and so on, right here in the middle of Berlin, the epicenter of European democracy, as if they thought they had a right to do that..”

• The Palestine Congress (CJ Hopkins)

Thank God for the German Hate Police! Or heil … or whatever the appropriate salutation is for these unsung heroes. They just saved us all from “hate” again! Yes, that’s right, once again, democracy-loving people here in New Normal Berlin and all across the New Normal world were right on the brink of being exposed to “hate,” and would have been exposed to “hate,” had the Hate Police not sprang into action. You probably have no idea what I’m talking about. OK, what happened was, some pro-Palestinian activists organized a “Palestine Congress,” and attempted to discuss the situation in Gaza, and call for solidarity with the Palestinians, and so on, right here in the middle of Berlin, the epicenter of European democracy, as if they thought they had a right to do that. The German authorities were clearly intent on disabusing them of that notion.

Early Friday morning, hundreds of black-clad Hate Police descended on the congress location. Reinforcements were called in from throughout the nation. Metal barricades were erected on the sidewalks. Hate Police stood guard at the entrance. The German media warned the public that a potential “Hate-Speech” attack was now imminent. Berliners were advised to shelter in place, switch off their phones and any other audio-receptive communication devices, and wad up little pieces of toilet paper and ram them deep into their ear canals to prevent any possible exposure to the “hate.” Sure enough, minutes into the congress, the anticipated “Hate-Speech” attack was launched! A Palestinian activist — Salman Abu Sitta — who had written an article that allegedly “expressed understanding of Hamas,” and thus had already been placed on the official German “No-Speak” list, started speaking to the congress on Zoom or whatever.

Or … it isn’t quite clear whether he actually started speaking. According to a Hate Police spokesperson, they raided the congress because “there [was] a risk of a speaker being put on the screen who in the past made anti-Semitic and violence-glorifying remarks.” Anyway, the Hate Police stormed the venue, pulled the plug, dispersed the crowd, and banned the rest of the “Palestine Congress,” which was scheduled to continue on Saturday and Sunday. Then they arrested a Jewish guy who was wearing a Palestinian-flag-kippah, presumably out of an abundance of caution. But the “Hate-Speech” attack wasn’t over yet. It was one of those multi-pronged “Hate-Speech” attacks, or at least it involved one other prong. Earlier that morning, or perhaps while the Hate Police were still neutralizing the threat at the venue, Dr. Ghassan Abu Sitta, a prominent British surgeon, who had volunteered in Gaza and was due to speak at the congress, was intercepted by the Berlin Airport Hate Police, refused entry into Germany, and forced to return to the UK.

The Airport Hate Police informed the doctor that he was being denied entry in order to ensure “the safety of the people at the conference and public order,” Abu Sitta told the Associated Press. Kai Wegner, Berlin’s mayor, presumably feeling a bit nostalgic for the fanatical days of 2020 to 2023 when one could persecute “the Unvaccinated” with total impunity, took to X to celebrate the Hate Police’s thwarting of this “Hate event.” The pro-Palestinian activist community also took to X and expressed their displeasure. Yanis “Vaccinate Humanity” Varoufakis, who was one of the organizers and was scheduled to speak, was particularly incensed over the new German “fascism,” which apparently he has just now noticed, despite the fact that it has been goose-stepping around in a medical-looking mask for the last four years.

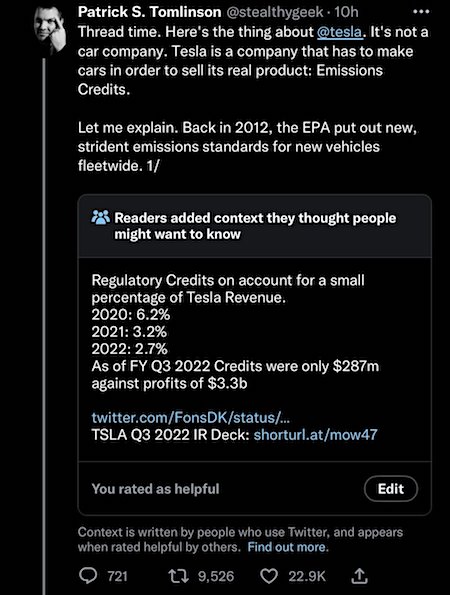

Not as bad as it looks.

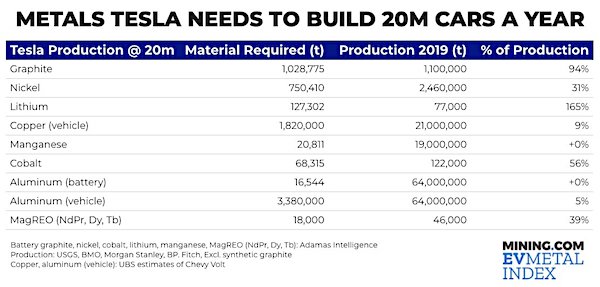

• They grew (too?) fast: “Tesla has around 140,000 employees, nearly double the 2020 level.”

• China’s BYD Co. delivered just 300,114 battery-electric vehicles in the first quarter, down 43% from the final three months of last year.

• Volkswagen AG, General Motors Co. and Ford Motor Co. have delayed, dialed back or altogether scrapped EV projects.

• Two Senior Tesla Executives Leave Amid 14,000 Global Layoffs (ZH)

The Wall Street Journal reports Tesla plans to reduce 10% of its global workforce, approximately 14,000 employees, confirming an earlier report by the EV blog Electrek. Tesla Chief Executive Elon Musk sent a letter to employees detailing how the company needed to reduce costs and increase productivity. WSJ obtained a copy of the email. “As part of the effort, we have done a thorough review of the organization and made the difficult decision to reduce our headcount by more than 10% globally,” Musk wrote in the letter, adding, “There is nothing I hate more, but it must be done. This will enable us to be lean, innovative, and hungry for the next growth phase cycle.” Separately, Bloomberg journalists on X reported that Tesla Senior Vice President Drew Baglino and Tesla Vice President of Public Policy and Business Development Rohan Patel are leaving the company. And… Bloomberg noted, “The departure of Baglino is likely to reinforce concerns among some investors about succession planning at Tesla, where Musk has been CEO since 2008.” We suspect Musk will be commenting on these reports sometime today.

* * *

Shares of Tesla Motors are muted in the early premarket trading hours in New York after a report from the EV blog Electrek cited an “internal company-wide email” detailing layoffs at the EV company amounting to more than 10% of its global workforce. Electrek alleges that Elon Musk sent an email to staff explaining a “duplication of roles and job functions in certain areas” as the main reason for the layoffs, which could affect as many as 14,000 employees. Here’s the full text of the email (courtesy of Electrek):

“Over the years, we have grown rapidly with multiple factories scaling around the globe. With this rapid growth there has been duplication of roles and job functions in certain areas. As we prepare the company for our next phase of growth, it is extremely important to look at every aspect of the company for cost reductions and increasing productivity. As part of this effort, we have done a thorough review of the organization and made the difficult decision to reduce our headcount by more than 10% globally. There is nothing I hate more, but it must be done. This will enable us to be lean, innovative and hungry for the next growth phase cycle. I would like to thank everyone who is departing Tesla for their hard work over the years. I’m deeply grateful for your many contributions to our mission and we wish you well in your future opportunities. It is very difficult to say goodbye. For those remaining, I would like to thank you in advance for the difficult job that remains ahead. We are developing some of the most revolutionary technologies in auto, energy and artificial intelligence. As we prepare the company for the next phase of growth, your resolve will make a huge difference in getting us there. Thanks, Elon”

The latest data from Bloomberg shows that Tesla has around 140,000 employees, nearly double the 2020 level. Electrek noted, “We don’t know which specific teams will be most or least affected by Tesla’s layoffs.” The alleged layoffs come after the company recorded its first quarterly decline in four years and delivered 386,810 vehicles in the first quarter, far below the Bloomberg consensus of 449,000. Slowing EV demand has weighed on Tesla shares this year, down 31%, and one of the worst performers in the S&P 500 Index. As Bloomberg notes, the EV slowdown has hit other automakers: The EV slowdown Tesla has felt of late has been widespread. China’s BYD Co. delivered just 300,114 battery-electric vehicles in the first quarter, down 43% from the final three months of last year, when it briefly pulled ahead as the world’s top EV seller. Manufacturers including Volkswagen AG, General Motors Co. and Ford Motor Co. have delayed, dialed back or altogether scrapped EV projects as consumers balk at still-high prices and a dearth of charging stations.

On Tesla’s most recent earnings call, Chief Financial Officer Vaibhav Taneja said, “We just have to chase down every penny possible.” Tesla will report next Tuesday, April 23. Wall Street analysts expect the company to turn a profit of about 50 cents a share, down from around 85 cents a share in the first quarter of 2023. If Electrek’s report is correct, Elon appears to be tightening Tesla’s belt, suggesting broader troubles are ahead for the US economy.

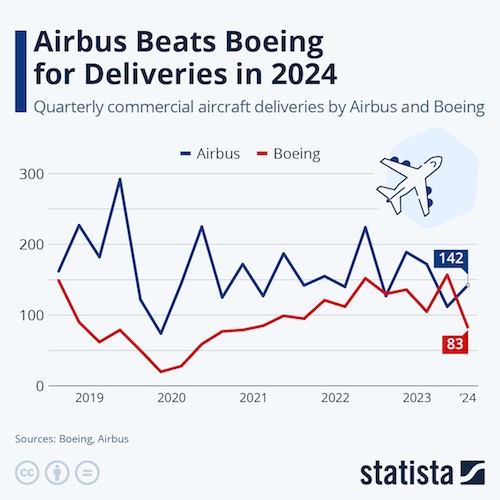

“Airbus and Boeing continue to have a long backlog of orders (8,598 at the end of 2023 for Airbus; 5,591 at the end of March for Boeing)..”

• Airbus Beats Boeing For Deliveries In 2024 (ZH)

Boeing’s deliveries of commercial aircraft have faltered in the first three months of the year, according to the company’s reports, published this week. The U.S. aircraft manufacturer delivered just 83 planes in Q3, down from 130 in the same three-month period of last year. In the meantime, its sole major competitor, Europe’s Airbus, saw an uptick in Q1, having delivered 142 of their planes, marking an increase from their Q1 2023 figure of 127. Boeing has been mired in a series of safety issues since the start of the year, following a mid-air panel blowout on an Alaska Airlines 737 MAX 9 jet in January. This has led to a slowdown in production for the U.S. company, which is now limited to producing 38 of the 737 planes per month until it is clear that quality and safety procedures are being properly adhered to, as per the advisory of the U.S. Federal Aviation Administration (FAA).

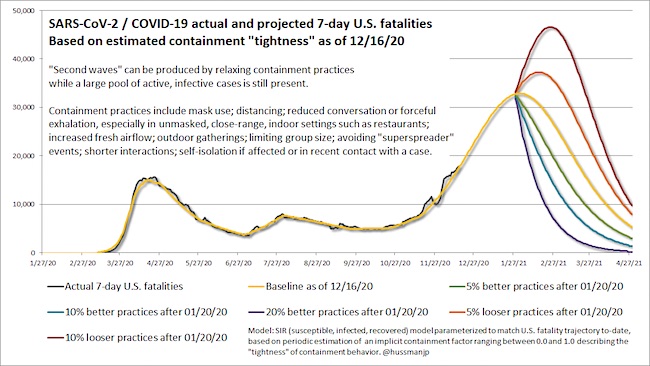

Boeing has slowed production even below this limit, with the company’s Chief Financial Officer Brian West stating that once the company has it “right” it will ramp up production, expecting to see figures improve in the latter half of the year. Prior to 2019, Boeing had been in the lead for deliveries out of the two companies, but this changed following the two deadly 737 MAX 8 crashes of 2018 and 2019, and the ensuing temporary production halt of the model. While the same family, these were different planes than those involved in the more recent incidents and they were caused by different issues. As Statista’s Anna Fleck shows in the following chart, both companies saw dips in deliveries in 2020 with the Covid pandemic.

Boeing and Airbus are the world’s two major competitors when it comes to commercial plane manufacturing. While other manufacturers exist, they produce far lower numbers of aircraft than either of these two giants. In a report by CNN, writer Allison Morrow explains that since pilots are trained in either Boeing or Airbus operating systems, it is difficult for airlines to switch planes. With few companies having the capacity to produce large jets, both Airbus and Boeing continue to have a long backlog of orders (8,598 at the end of 2023 for Airbus; 5,591 at the end of March for Boeing).

Wonder what Trump thinks of this.

• Trump Biopic To Compete At Cannes Film Festival (RT)

A biopic about the formative years of former US President Donald Trump will premiere at the Cannes Film Festival next month. Directed by acclaimed Iranian-Danish filmmaker Ali Abbasi, ‘The Apprentice’ tells the story of how young Trump got started in the real estate business in New York in the 1970s and 1980s and met his mentor Roy Cohn. The film is among the 18 entries competing for Palme d’Or, the festival’s main award. “The Apprentice is a dive into the underbelly of the American empire. It charts a young Donald Trump’s ascent to power through a Faustian deal with the influential right-wing lawyer and political fixer Roy Cohn,” according to the film’s official description.

First look at Sebastian Stan as Donald Trump in ‘THE APPRENTICE’. pic.twitter.com/ylmvQGB2us

— DiscussingFilm (@DiscussingFilm) April 11, 2024

Sebastian Stan – the star of Marvel superhero movies and the 2022 mini-series ‘Pam & Tommy’ – plays Trump, while Emmy-winning ‘Succession’ actor Jeremy Strong portrays Roy Cohn, a high-profile lawyer. “His playbook has a tentacular reach that is staggering – the most fascinating person I’ve ever tried to inhabit,” Strong told the New York Times. “So while I personally might have a lot of judgment about Roy Cohn, that is not the part of me that engages in creative work.” Bulgarian actress Maria Bakalova plays Ivana Zelnickova, Trump’s first wife and the mother of his daughter Ivanka and sons Donald Jr. and Eric.

The film is set to depict Trump’s early business ventures and rise after he joined and subsequently took over his father’s real-estate empire. Under his leadership, the company branched out from residential housing to casinos and hotels, including the famous Trump Tower in Manhattan and other Trump-branded properties. Trump shocked the world by beating Hillary Clinton in 2016 and becoming the 45th president of the United States. He left office after losing the 2020 election to Joe Biden. He is currently the presumptive Republican presidential nominee for the 2024 election.

Kid judge

Judge let's kid decide her Mom's punishment pic.twitter.com/5hENilp3mc

— Historic Vids (@historyinmemes) April 14, 2024

From Elon

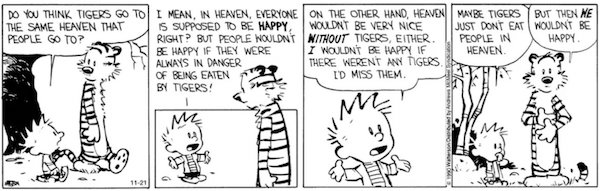

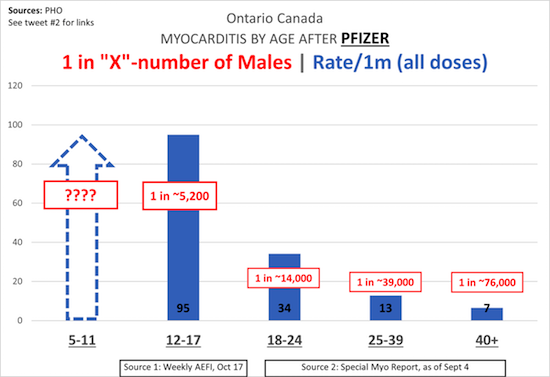

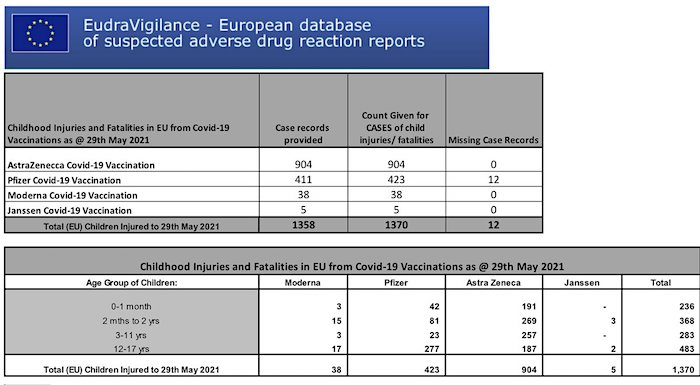

Russell

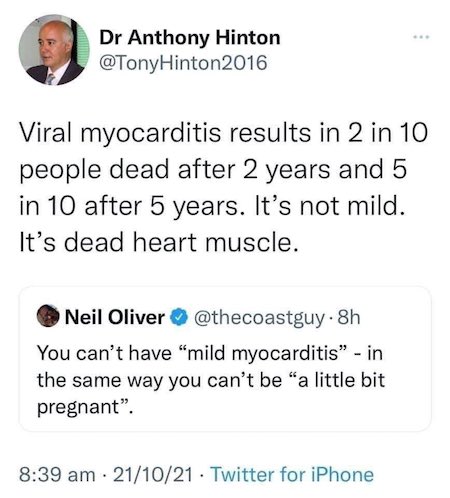

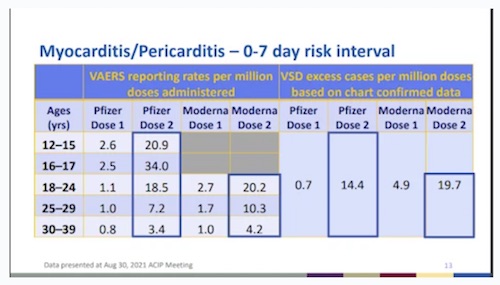

Russell Brand about excess deaths: "We are unlikely to receive the truth until is too late. In fact the example of the information about myocarditis being withheld to a people who'd taken the vaccinations is probably a pretty good metaphor for how those things are generally… pic.twitter.com/kn2b4KbSYN

— Camus (@newstart_2024) April 15, 2024

UFO

SHOCK VIDEO: ⚠️ Unidentified Object with humanoid characteristics caught on camera slowly descending in the skies of Sequoia Park, California..

VIDEO: @528vibes

— Chuck Callesto (@ChuckCallesto) April 15, 2024

Shop dog

This is why dogs are our best friends. ❤️pic.twitter.com/k7qQax0zZ7

— Figen (@TheFigen_) April 14, 2024

Koala

https://twitter.com/i/status/1779619528743211352

Sun fish

The ocean sunfish is the world's heaviest known bony fish: it reaches up to 2,300 kg of weight and 4.2 meters of size across the fins.pic.twitter.com/IgyJvA3reX

— Massimo (@Rainmaker1973) April 16, 2024

Wooden post

Revealing the age of an ancient wooden postpic.twitter.com/1Ri4qoEX0I

— Massimo (@Rainmaker1973) April 14, 2024

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.