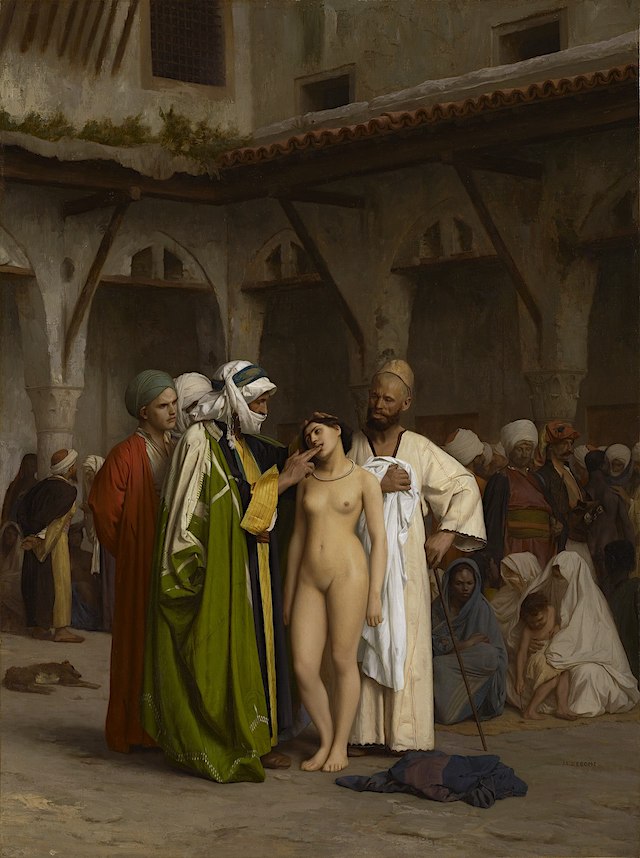

Jean-Léon Gérôme Slave market 1866

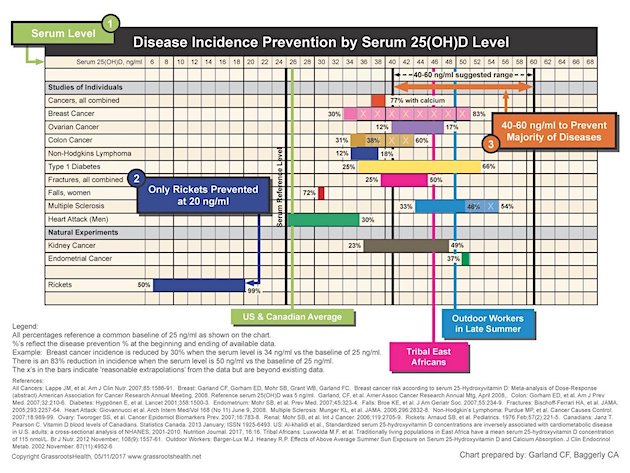

Benefits of boosting your vitamin D levels.

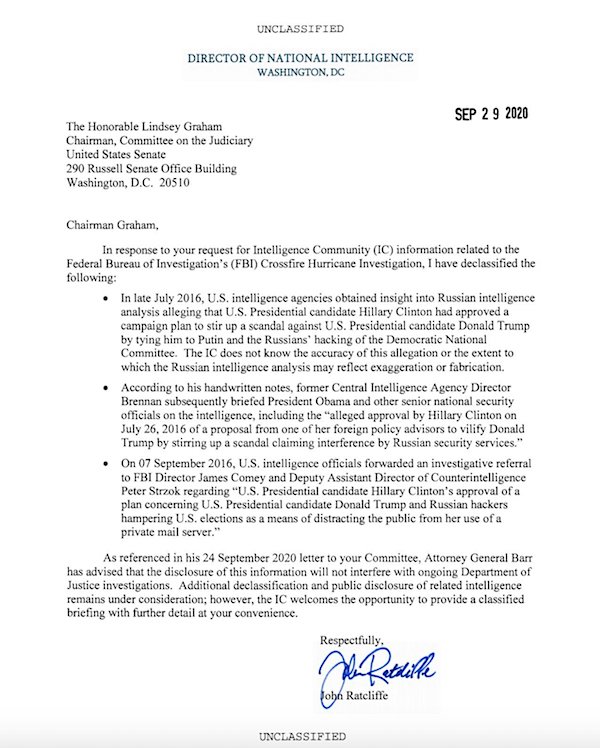

click to enlarge in new tab

UK Parliament: David Davis Vitamin D

Vitamin D could be one of the tools that helps turn the tide in the fight against this terrible virus. It is cheap. It is safe. It has many other proven health benefits. There is no more time to waste. The time to act is now. pic.twitter.com/fyYcf68hJt

— David Davis (@DavidDavisMP) January 15, 2021

A lot of all this appears to be fear-mongering blown up to 11. I’ve so far seen reports from Connecticut, Utah, Florida, Mass. state capitols, and everything’s more than quiet.

• Thousands Of Troops Dig In For Inauguration (Hill)

The National Guard is playing a leading role as the country confronts a domestic terrorism threat following the deadly insurrection at the U.S. Capitol. The Capitol is now crawling with more troops than in the United States’s main theaters of war in Afghanistan, Iraq and Syria combined as the National Guard fortifies key areas around Washington, D.C., for President-elect Joe Biden’s inauguration. The Secret Service is even referring to the new perimeter around the Capitol as the “Green Zone” — the same name used for secure zones in Iraq and Afghanistan’s capital cities. And it’s not just D.C. Amid FBI warnings of the potential for violence at all 50 state Capitols, governors in roughly a dozen states have called up their National Guards to bolster law enforcement.

But there are also worries the military is part of the problem, as several veterans have been arrested in connection with the Capitol riots. And at least one person arrested is a current member of the National Guard in Virginia. Following heavy criticism of the Guard’s response to last summer’s racial justice protests in the city, D.C. and Pentagon officials had originally sought to minimize its role in security surrounding the inauguration. In June, hundreds of guardsmen from around the country poured into the nation’s capital at President Trump’s request, despite objections from local authorities. A National Guard helicopter also hovered over protesters in the way the military does to insurgents overseas as a show of force, a move that drew widespread scrutiny and rebuke.

After that, as officials anticipated protests when Congress met to certify Biden’s electoral victory, D.C. officials requested and the Pentagon approved just 340 unarmed guardsmen to help the city with traffic control. Defense officials have said Capitol Police turned down offers of Guard help before the riots. That all changed after the Capitol siege. As of Friday, more than 7,000 guardsmen from across the country were in Washington, D.C., with up to 25,000 from all 50 states, three territories and D.C. expected to be in the city by Inauguration Day. Troops have erected 7-foot “non-scalable” fences around the Capitol and other nearby government buildings and set up checkpoints with military vehicles and concrete barriers on streets throughout the area.

Sacredest place

“This is like the sacredest place” pic.twitter.com/sv7zBEFMYA

— Max Blumenthal (@MaxBlumenthal) January 17, 2021

Tweet: “The beauty of this claim is it’s perfect. If something happens, no matter how small, they can use it to target Trump supporters. And if nothing happens, they can credit their vigilance and… use it to target Trump supporters.”

• FBI Vetting Guard Troops In DC Amid Fears Of Insider Attack (AP)

U.S. defense officials say they are worried about an insider attack or other threat from service members involved in securing President-elect Joe Biden’s inauguration, prompting the FBI to vet all of the 25,000 National Guard troops coming into Washington for the event. The massive undertaking reflects the extraordinary security concerns that have gripped Washington following the deadly Jan. 6 insurrection at the U.S. Capitol by pro-Trump rioters. And it underscores fears that some of the very people assigned to protect the city over the next several days could present a threat to the incoming president and other VIPs in attendance.

Army Secretary Ryan McCarthy told The Associated Press on Sunday that officials are conscious of the potential threat, and he warned commanders to be on the lookout for any problems within their ranks as the inauguration approaches. So far, however, he and other leaders say they have seen no evidence of any threats, and officials said the vetting hadn’t flagged any issues that they were aware of. ”We’re continually going through the process, and taking second, third looks at every one of the individuals assigned to this operation,” McCarthy said in an interview after he and other military leaders went through an exhaustive, three-hour security drill in preparation for Wednesday’s inauguration. He said Guard members are also getting training on how to identify potential insider threats.

About 25,000 members of the National Guard are streaming into Washington from across the country — at least two and a half times the number for previous inaugurals. And while the military routinely reviews service members for extremist connections, the FBI screening is in addition to any previous monitoring. Multiple officials said the process began as the first Guard troops began deploying to D.C. more than a week ago. And they said it is slated to be complete by Wednesday. Several officials discussed military planning on condition of anonymity. “The question is, is that all of them? Are there others?” said McCarthy. “We need to be conscious of it and we need to put all of the mechanisms in place to thoroughly vet these men and women who would support any operations like this.”

“He pulled Formosus out of his tomb, propped him up in court, and convicted him of variety of violations of canon law. Formosus was then taken out, three fingers cut off, and eventually thrown in the Tiber River.”

• The Senate’s Cadaver Synod: The Trial Of Citizen Trump (Turley)

With the second impeachment of President Donald Trump, the Congress is set for one of the most bizarre moments in constitutional history: the removal of someone who has already left office. The retroactive removal would be a testament to the timeliness of rage. While it is not without precedent, it is without logic. The planned impeachment trial of Donald Trump after he leaves office would be our own version of the Cadaver Synod. In 897, Pope Stephen VI and his supporters continued to seethe over the action of Pope Formosus, who not only died in 896 but was followed by another pope, Boniface VI. After the brief rule of Boniface VI, Pope Stephen set about to even some scores. He pulled Formosus out of his tomb, propped him up in court, and convicted him of variety of violations of canon law. Formosus was then taken out, three fingers cut off, and eventually thrown in the Tiber River.

While some may be looking longingly at the Potomac for their own Cadaver Synod, Speaker Nancy Pelosi and other Democrats have stated that their primary interest is in the possible disqualification of Trump from holding future federal office. Disqualification however is an optional penalty that follows a conviction and removal. It may be added to the primary purpose of removal referenced in the Constitution. The Trump trial would convert this supplemental punishment into the primary purpose of the trial. This did happen before but that precedent is only slightly better than the Cadaver Synod. That case involved William Belknap who served as Secretary of War to President Ulysses S. Grant. Belknap resigned after allegations of corruption — just shortly before a House vote of impeachment.

The Senate held a trial but acquitted him. Twenty nine of 66 voting senators disagreed in a threshold motion that Belknap was “amenable to trial by impeachment . . . notwithstanding his resignation.” In fairness to the Democrats, I have long rejected the argument that there comes a point when it is too late to impeach a president while he is in office. As I said in both the Clinton and Trump impeachment hearings, the House is under a duty to impeach if it believes that a president has committed a high crime and misdemeanor. If that occurred on the last day of a term, it would still be warranted.

My objection to this second impeachment was that it proceeded without any deliberation of the traditional impeachment process. It was a snap impeachment, which is to the Constitution what Snapchat is to conversations. It reduces the process to a raw, brief and partisan vote. This could have been avoided. A hearing could have been held in a day to allow the language of the article to be amended and the implications of the impeachment considered. It would also have allowed for a formal demand for a response from the president. Instead, the impeachment was pushed through on a partisan muscle vote with only ten Republicans supporting the single article.

This is exactly what Merkel doesn’t want. It has to be done according to laws, not political preferences.

• Trump Social Media Ban Sparks Calls For Action vs Other Populist Leaders (G.)

“I do not celebrate or feel pride,” the Twitter boss Jack Dorsey said this week after banishing Donald Trump. But for many around the world the decision brought hope: might similar action soon be taken against other populist provocateurs they accuse of using social media to stir chaos? “I have to follow YouTube’s rules when I post my videos, or I get banned. Journalists have to obey their outlet’s rules when they publish a story. So why shouldn’t presidents have to obey any rules when they publish something online?” wondered Felipe Neto, one of Brazil’s most famous and politicized online celebrities. “It’s as simple as that.” From Rio to Delhi, activists and academics have been asking similar questions following the US president’s suspension from platforms including Twitter, YouTube, Facebook, Snapchat and Instagram.

Calls for action have been particularly loud in Brazil, which has been led since 2019 by Jair Bolsonaro, a far-right tweeter-in-chief who basks in portrayals as the “tropical Trump”. “Twitter has put a muzzle on Trump. We’ll need another for Brazil,” tweeted Marcelo Freixo, one of several political rivals urging sanctions. Critics accuse Bolsonaro of repeatedly using social media to undermine democracy and incite violence. In an incendiary YouTube broadcast on the eve of his 2018 election he promised a historic “cleanup” of “red” rivals. In office, Bolsonaro has refused to moderate, using social media to encourage anti-democratic protests and urge “upstanding” supporters to buy guns to avoid being “enslaved”. In recent months Bolsonaro has questioned Brazil’s electronic voting system, convincing many that if he loses the next election he will reject its results as Trump has done – with unpredictable consequences for a young democracy.

“His obsession with arming the greatest possible number of his followers has an obvious goal,” warned Neto, who has 41m YouTube followers. “Bolsonaro and his family are preparing the ground not to accept election defeat – and things promise to be far worse than in the US [Capitol invasion].” Pedro Doria, a technology columnist, said he felt uneasy that unelected big tech bosses had the power to silence presidents. But he was also deeply troubled by Bolsonaro’s unchecked use of social media to preach political rupture. “If Trump was expurged from Twitter because he incited a mob against the Capitol, well, Bolsonaro is preparing himself to do the same … It makes no sense to wait for him to actually act on trying to overthrow the Brazilian democratic regime.”

In India, many have called for similar sanctions against the prime minister, Narendra Modi, and figures from his ruling Hindu nationalist Bharatiya Janata Party (BJP). While Modi’s regular use of Twitter is largely anodyne and uncontroversial, numerous senior and mid-level BJP politicians have been accused of politically motivated hate speech on their social media accounts.

One last chance for Julian.

• Trump To Issue Around 100 Pardons And Commutations Tuesday (CNN)

President Donald Trump is preparing to issue around 100 pardons and commutations on his final full day in office Tuesday, according to three people familiar with the matter, a major batch of clemency actions that includes white collar criminals, high-profile rappers and others but – as of now – is not expected to include Trump himself. The White House held a meeting on Sunday to finalize the list of pardons, two sources said. Trump, who had been rolling out pardons and commutations at a steady clip ahead of Christmas, had put a pause on them in the days leading up to and directly after the January 6 riots at the US Capitol, according to officials Aides said Trump was singularly focused on the Electoral College count in the days ahead of time, precluding him for making final decisions on pardons.

White House officials had expected them to resume after January 6, but Trump retreated after he was blamed for inciting the riots. Initially, two major batches had been ready to roll out, one at the end of last week and one on Tuesday. Now, officials expect the last batch to be the only one — unless Trump decides at the last minute to grant pardons to controversial allies, members of his family or himself. The final batch of clemency actions is expected to include a mix of criminal justice reform-minded pardons and more controversial ones secured or doled out to political allies. The pardons are one of several items Trump must complete before his presidency ends in days. White House officials also still have executive orders prepared, and the President is still hopeful to declassify information related to the Russia probe before he leaves office.

But with a waning number of administration officials still in jobs, the likelihood that any of it gets done seemed to be shrinking. The January 6 riots that led to Trump’s second impeachment have complicated his desire to pardon himself, his kids and personal lawyer Rudy Giuliani. At this point, aides do not think he will do so, but caution only Trump knows what he will do with his last bit of presidential power before he is officially out of office at noon on January 20. After the riots, advisers encouraged Trump to forgo a self-pardon because it would appear like he was guilty of something, according to one person familiar with the conversations. Several of Trump’s closest advisers have also urged him not to grant clemency to anyone involved in the siege on the US Capitol, despite Trump’s initial stance that those involved had done nothing wrong.

“There are a lot of people urging the President to pardon the folks” involved in the insurrection, Trump ally Sen. Lindsey Graham said Sunday on Fox News. “To seek a pardon of these people would be wrong.” One White House official said paperwork had not yet been drawn up for a self-pardon. Still, Trump is expected to leave the White House on January 20 and could issue pardons up until noon on Inauguration Day. Other attention-grabbing names, like Julian Assange, are also not currently believed to among the people receiving pardons, but the list is still fluid and that could change, too.

“Greenwald warned that Biden could set the stage for a “smarter, more stable version” of Trump to take power.”

• Despair, Depression, And The Inevitable Rise of Trump 2.0 – Greenwald (RT)

“I don’t think it’s particularly difficult… to know what to expect from the Biden administration,” the acclaimed American journalist told Chris Hedges, host of RT’s On Contact, on Sunday. Biden, Greenwald continued, has enjoyed a five-decade career in Washington and made his policy priorities well known over these years. Biden is “somebody who has repeatedly supported militarism and imperialism” and “one of the crucial leading advocates of the invasion of Iraq,” he said. On the domestic front, Biden is “a loyal servant of the credit card and banking industry” and the “architect of the 1994 crime bill,” the latter of which has been blamed for dramatically upping the incarceration rate of black men in the US.

That leftists involved in Black Lives Matter protests rallied around Biden, given his involvement in passing the crime bill (he was one of 61 senators who voted for it) is “ironic,” Greenwald told Hedges, but also serves as an example of how the Democratic Party operates. “Democrats are very good at creating a brand that is radically different than the reality, but essentially the Democratic party serves militarism, imperialism, and corporatism,” he said. “That’s who funds them, that’s what they believe in. It’s why you see neocons migrating so comfortably back to the Democratic Party, why you see Bush and Cheney operatives cheering for Joe Biden, why Wall Street celebrated when he picked Kamala Harris.”

Biden’s campaign didn’t only draw support from the left – who Biden then spurned by packing his cabinet with Obama administration alumni while giving progressives like Bernie Sanders the cold shoulder. The former vice president was also supported by Republican hawks like Bill Kristol and Max Boot, as well as the much-maligned ‘Lincoln Project’ Republicans, who fundraised $67 million to shoot attack ads against Trump in the runup to November’s election. The rallying of the establishment – Democrat and Republican alike – behind Biden could have far-reaching consequences, Greenwald warned. “It’s not a coincidence that after eight years of Obama and Biden, we got Donald Trump,” he said. “Obviously, if you go back and do exactly the same thing that the ‘Obiden’ administration did for 8 years, which is what Biden’s preparing to do, any rational person has to expect the same outcome.”

Is this legal? How about the Logan Act? What about Michael Flynn?

• Biden Team Already Holding Talks With Iran On US Return To Nuclear Deal (ToI)

Officials in the incoming Biden administration have already begun holding quiet talks with Iran on a return to the 2015 nuclear deal, and have updated Israel on those conversations, Channel 12 News reported Saturday. The network gave no sourcing for the report, and no details on what was allegedly discussed. US President-elect Joe Biden has indicated his desire to return to the accord, while Israel is pushing for any return to the deal to include fresh limitations on Iran’s ballistic missile program and support for terror and destabilization around the world. On Wednesday, Walla News reported that Israeli Prime Minister Benjamin Netanyahu is assembling a team to strategize for the first talks with the Biden administration on Iran’s nuclear program.

The team will include officials representing national security elements, the Foreign Ministry, the Defense Ministry, the military, the Mossad spy agency, and the Atomic Energy Commission, the report said, citing unnamed sources in the Prime Minister’s Office. Netanyahu is considering appointing a senior official to head the team and to serve as an envoy in talks with the US on the Iranian nuclear program, the report said. A possible candidate to head the team is Mossad chief Yossi Cohen, the report said. Channel 12 reported Saturday that Cohen was in Washington this week to meet with officials in the outgoing and incoming administrations.

US President-elect Joe Biden is expected to take a more conciliatory approach to Iran than the Trump administration and has said that if Iran returns to the terms of the 2015 nuclear agreement, he too would rejoin, removing the crushing economic sanctions that have wreaked havoc on the Iranian economy over the past two years. The US president-elect has indicated that he wants to negotiate more broadly with Tehran if Washington returns to the deal, notably over its missiles and influence across the Middle East. Iran has said it could welcome the return of the Americans to the agreement, but only after they lift sanctions. It has rejected negotiation on other issues. Former US president Barack Obama, with Biden as his vice president, signed the Iran nuclear deal with world powers in 2015.

The Trump administration withdrew from the accord in 2018 and pressured Iran with crippling economic sanctions and other measures. Obama signed the agreement despite fierce protest from Israel, and had a rocky relationship with Jerusalem and Netanyahu, while the premier and Trump have been in lockstep on most Middle East policy issues. The prospect of the US reengaging with Tehran has drawn warnings and alarm from Netanyahu and his allies. Last week, speaking alongside US Treasury Secretary Steve Mnuchin in Jerusalem, Netanyahu warned against the US rejoining the nuclear agreement, also known as the Joint Comprehensive Plan of Action (JCPOA). “If we just go back to the JCPOA, what will happen and may already be happening is that many other countries in the Middle East will rush to arm themselves with nuclear weapons. That is a nightmare and that is folly. It should not happen,” Netanyahu said.

Hardly a time to open new pipelinnes.

• Biden May Cancel Keystone XL Pipeline Permit On First Day In Office (R.)

U.S. President-elect Joe Biden is planning to cancel the permit for the $9 billion Keystone XL pipeline project as one of his first acts in office, and perhaps as soon as his first day, according to a source familiar with his thinking. President Donald Trump, a Republican, had made building the pipeline a central promise of his presidential campaign. Biden, who will be inaugurated on Wednesday, was vice president in the Obama administration when it rejected the project as contrary to its efforts to combat climate change. The words “Rescind Keystone XL pipeline permit” appear on a list of executive actions likely scheduled for the first day of Biden’s presidency, according to an earlier report by the Canadian Broadcasting Corp (CBC).

Biden, a Democrat, had earlier vowed to scrap the oil pipeline’s presidential permit if he became president. Canada’s ambassador to the United States said she would continue to promote a project that she said fit with both countries’ environmental plans. “There is no better partner for the U.S. on climate action than Canada as we work together for green transition,” Ambassador Kirsten Hillman said in a statement. The project, which would move oil from the province of Alberta to Nebraska, had been slowed by legal issues in the United States. It also faced opposition from environmentalists seeking to check the expansion of Canada’s oil sands by opposing new pipelines to move its crude to refineries. Alberta Premier Jason Kenney said on Twitter that cancellation would eliminate jobs, weaken U.S.-Canada relations and undermine American national security by making the United States more dependent on OPEC oil imports.

Covid triggers diabetes?

• 3rd of Recovered Covid Patients Return To Hospital In 5 Months, 1 In 8 Die (Y!)

Almost a third of recovered Covid patients will end up back in hospital within five months and one in eight will die, alarming new figures have shown. Research by Leicester University and the Office for National Statistics (ONS) found there is a devastating long-term toll on survivors of severe coronavirus, with many people developing heart problems, diabetes and chronic liver and kidney conditions. Out of 47,780 people who were discharged from hospital in the first wave, 29.4 per cent were readmitted to hospital within 140 days, and 12.3 per cent of the total died. The current cut-off point for recording Covid deaths is 28 days after a positive test, so it may mean thousands more people should be included in the coronavirus death statistics.

Researchers have called for urgent monitoring of people who have been discharged from hospital. Study author Kamlesh Khunti, professor of primary care diabetes and vascular medicine at Leicester University, said: “This is the largest study of people discharged from hospital after being admitted with Covid. “People seem to be going home, getting long-term effects, coming back in and dying. We see nearly 30 per cent have been readmitted, and that’s a lot of people. The numbers are so large. “The message here is we really need to prepare for long Covid. It’s a mammoth task to follow up with these patients and the NHS is really pushed at the moment, but some sort of monitoring needs to be arranged.”

The study found that Covid survivors were nearly three and a half times more likely to be readmitted to hospital, and die, in the 140 days timeframe than other hospital outpatients. Prof Khunti said the team had been surprised to find that many people were going back in with a new diagnosis, and many had developed heart, kidney and liver problems, as well as diabetes. He said it was important to make sure people were placed on protective therapies, such as statins and aspirin. “We don’t know if it’s because Covid destroyed the beta cells which make insulin and you get Type 1 diabetes, or whether it causes insulin resistance, and you develop Type 2, but we are seeing these surprising new diagnoses of diabetes,” he added.

PanQuake looks more interesting. The roll-out is a bit chaotic, but some good people involved.

• Parler Resurfaces On Web, Promises Platform To Be Revived Soon (JTN)

The website of the social media platform Parler has resurfaced after going offline earlier this month. While the platform still has not become operational again, the message indicates that it will revive “soon.” “Now seems like the right time to remind you all — both lovers and haters — why we started this platform,” the website says. “We believe privacy is paramount and free speech essential, especially on social media. Our aim has always been to provide a nonpartisan public square where individuals can enjoy and exercise their rights to both. We will resolve any challenge before mli us and plan to welcome all of you back soon. We will not let civil discourse perish!”

The platform vanished earlier this month after a move by Amazon Web Services. Buzzfeed reported that in a letter to Parler, the AWS Trust and Safety Team had stated “we cannot provide services to a customer that is unable to effectively identify and remove content that encourages or incites violence against others.”

Introducing PanQuake: Revealing Project X (full censored event) #TalkLiberation from PanQuake – Talk Liberation on Vimeo.

Global AND national.

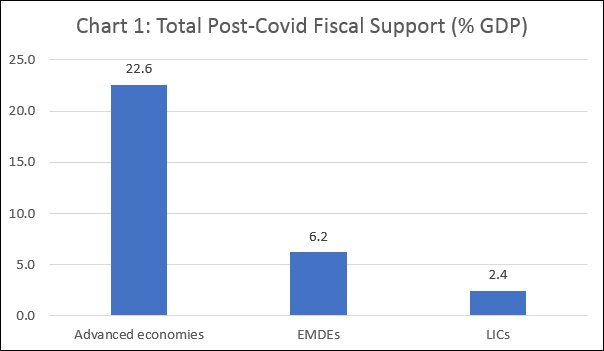

• Prepare For A Surge In Global Inequality (RWER)

The United States prepares for moving out of the Trump era with the incoming President promising more rounds of stimulus spending to revive an economy ravaged by Covid-19. Other members of the Organisation of Economic Cooperation and Development, a predominantly rich nation’s club, have also been generous with their spending and signalled that they are willing to keep their wallets open to spend more if necessary. The evidence clearly is that the Covid-crisis has upended the fiscal conservatism that has been the hallmark of the neoliberal era since the 1980s. However, not all nations seem to display this ability to depart from the prevailing orthodoxy. Where this weakness is most visible is the developing world, where governments, with very few exceptions, have not been loosening their purse strings to deal with the health emergency, throw out a safety net to protect devastated citizens, and stall and reverse the recession to restore livelihoods and normal economic activity.

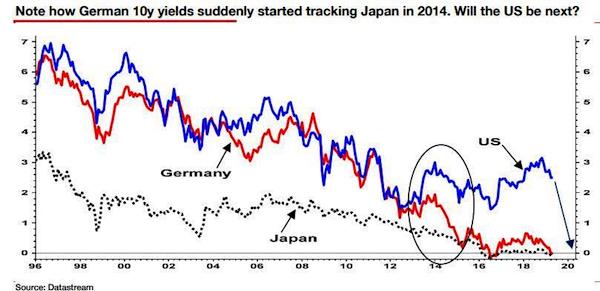

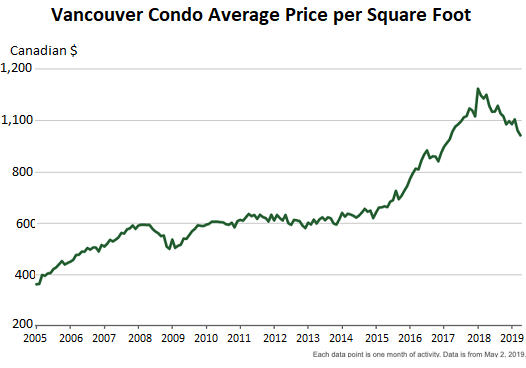

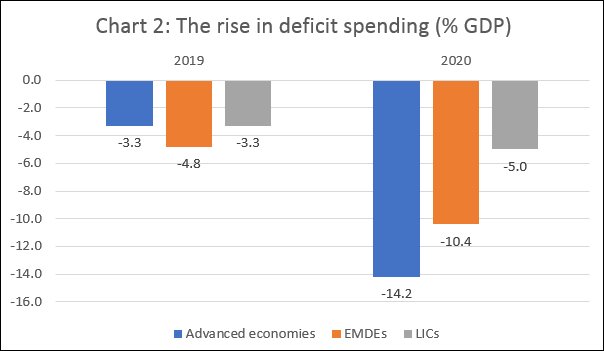

Estimates from the World Bank in the January 2021 edition of its flagship Global Economic Prospects (GEP) report point to stark differences across countries at different levels of development in the level of fiscal support governments have provided in the wake of the Covid-shock (Chart 1). While planned and under-consideration measures in the advanced economies (AEs) are expected to have taken fiscal support spending to 22.6 per cent of their GDP, the comparable figures in emerging market and developing economies (EMDEs) as a group and low income economies (LICs) among them are placed at 6.2 and 2.4 per cent respectively (Chart 1). Government spending in 2020 was needed not just to address the immediate crisis, but to revive employment, investment and growth in the medium and long term.

If poorer countries have spent and are likely to spend less, while richer countries pump-prime their economies, the damage inflicted by the crisis is bound to worsen preexisting inequalities. Those inequalities are bound to increase, though the performance of a few exceptional cases like China, which influences the EMDE total, may conceal the magnitude of change in the aggregate figures. Underlying the difference in spending levels are the willingness and ability to resort to enhanced deficit spending, or expenditure financed with borrowing. Not that government debt has not risen in the poorer countries, albeit to a smaller extent than in their advanced counterparts. While the fiscal deficit in the AEs is estimated to have risen from 3.3 per cent of GDP in 2019 to 14.2 per cent in 2020, that in the EMDEs has moved from 4.8 per cent to 10.4 per cent and in the LICs from 3.3 to 5 per cent (Chart 2).

“Almost one in three households suffers hunger, regularly. Almost half of black and hispanic households. Households with children are most vulnerable to the government policies. So half of the kids in the U.S. have inadequate nutrition.”

• Anteroom of Our Own Extinction (Steppling)

This is now about a year into the pandemic and there have still been no debates, no public roundtables and no referendums. Nothing. Just decrees by the government. I honestly have given up trying to make sense of statistics, really. But a couple of things have not changed; the fatality rate if you catch Covid 19 is under 1% (and yes, case fatality is different than infectious mortality and that in turn is different from mortality rate). And depending on how it is being counted, it is often a good deal less than that. And yet the entire planet has been subjected to severe restrictions on travel, and coerced to follow pseudoscientific behaviour like mask wearing and social distancing. Today in many places there is what amounts to martial law. Police or national guard patrol the streets after dark. Many countries have banned public events, closed restaurants and nightclubs, and limited any public gatherings. Many schools remain closed or only partially open.

The economic consequences of these non-debated government policies have been catastrophic. In the U.S. something like 60 million jobs have been lost, many never to return. A hundred and fifty thousand restaurants have gone bankrupt. Only one in three museums will ever reopen. In San Francisco they decided NOT to count the numbers of new homeless. No reason was given but one can guess. The homeless situation in the U.S., in big cities in particular, was critical even before the pandemic. Now the numbers are unprecedented. Not even during the ‘Great Depression’ was there anything like the current level of those without basic shelter. Food insecurity is at a crisis level. Feeding America, the largest hunger relief organization in the US, estimates over 50 million people go hungry every night including something close to twenty million children.

“Since mid-March 2020, numerous surveys have documented unprecedented levels of food insecurity that eclipse anything seen in recent decades in the United States, including during the Great Recession. Over the past five years, US Department of Agriculture (USDA) estimates of food insecurity in the United States have hovered around 11% to 12%. As of March and April 2020, national estimates of food insecurity more than tripled to 38% In a national survey we fielded in March 2020 among adults with incomes less than 250% of the 2020 federal poverty level (based on thresholds from the US Census), 44% of all households were food insecure including 48% of Black households, 52% of Hispanic households, and 54% of households with children.” – American Public Heath Association (Dec 2020)

And yet, congress just passed another defense budget increase. According to Defense News… “..the final version of the 2020 defense appropriations bill, part of a broad $1.4 trillion spending deal to finalize federal spending for 2020 and avert a government shutdown. The defense bill would provide $738 billion.” Almost one in three households suffers hunger, regularly. Almost half of black and hispanic households. Households with children are most vulnerable to the government policies. So half of the kids in the U.S. have inadequate nutrition. Half will suffer long term developmental problems, almost guaranteed.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

Just the roads built by the Roman Empire

Support the Automatic Earth in 2021. Click at the top of the sidebars to donate with Paypal and Patreon.