Pablo Picasso Absinthe Drinker 1901

Germans making fun of Trump and lauding Merkel. What else can they do? She’s as strong as ever. That’s why I added a second picture at the bottom. But someone should write “The Dark Side of Merkel”.

• The Body Language of Power (Handelsblatt)

Much about her unique style of power was already evident at the very moment she was closing in on the office of chancellor. It occurred on German television shortly after eight in the evening of September 18, 2005. Germans had just voted, and the polls showed Ms. Merkel’s center-right bloc falling far short of expectations with a tiny lead at 35 percent. The Social Democrats led by the incumbent chancellor Gerhard Schröder were in effect tied at 34 percent. As is customary in Germany, all the parties’ leaders gathered with two journalists to take stock on air. Ms. Merkel, with much larger hair than today, was the only woman among seven men. In the German parliamentary system, various coalition options were still open for either Mr. Schröder or Ms. Merkel to control a majority of the Bundestag. So Mr. Schröder, whom the German press called an “alpha animal”, decided to create facts on the ground.

He burst out with a forceful verbal barrage, insinuating that the moderators were biased, asserting that he was the real winner and disparaging Ms. Merkel. Constantly interrupting all his interlocutors as though in some dominance ritual, he blurted out, “Do you seriously think that my party will take up an offer of coalition talks from Ms. Merkel in this situation, in which she says she wants to be chancellor?” The other men in the round were not his primary targets, but they spent the following 40 minutes sparring with him. Ms. Merkel’s reaction was more interesting. Whenever the camera strayed from the dueling silverbacks and zoomed in on her, she had a neutral expression, or a look of mild puzzlement, but never one of anger or annoyance. Her hands mostly stayed folded on the table in front of her. She hardly spoke at all. In effect, she responded to Mr. Schröder by not reacting.

In the following hours and days, Mr. Schröder’s political career collapsed, as all of Germany wondered what demon had got into him. In at least one interview, he later had to deny that he was drunk during the debate. Meanwhile, Ms. Merkel quietly began coalition negotiations that led her to be sworn in as chancellor two months later, with the Social Democrats as her junior partners. Something had revealed itself that day on television between Mr. Schröder and Ms. Merkel. “When he entered the room, she had lost the election. When he left, she had won the chancellor’s office,” recalls Wolfgang Nowak, a former adviser to Mr. Schröder, who nowadays also has the ear of Ms. Merkel. “Nobody is like her,” says Gregor Gysi, who was opposition leader in parliament for much of Ms. Merkel’s current term. Mr. Gysi is widely considered the wittiest speaker in German politics, and his job in the Bundestag was to needle and provoke the chancellor. But all of his attacks fell flat. Merkel never took his baits; he never got a rise out of her.

Mr. Gysi, now retired, does not contest the point. Ms. Merkel, he says, reminds him of his experience in the 1970s, when he was a lawyer in the East German dictatorship. During interrogations he could always crack the men, he says, but against a certain kind of woman he had “no chance”, provided they did not make the mistake of trying to be like men. Hillary Clinton made that mistake, Mr. Gysi says. She blew a presidential election in America against a man who is almost comical in his pseudo-virility. By contrast, Mr. Gysi says, “Merkel’s secret is that she has found a method against the men, but the men have found no method against her.” “Merkel gets stronger by letting the men be men,” Mr. Nowak agrees. Many of these encounters resemble that televised encounter with Mr Schröder. “She let him do all his wrestling poses,” recalls Mr. Nowak. And in the end the macho always throws himself on the mat, with her left standing.

The flipside. Pic posted on Twitter with caption: “Don’t play with superglue”

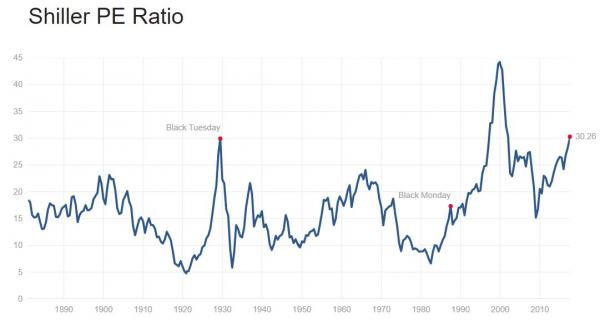

“People on Wall Street always tell you “this time is different,” but it never has been yet.”

• Let This Be Your Final Warning On US Stocks’ Overvaluation (MW)

The Shiller PE [..] compares stocks against the average earnings of the past 10 years, rather than just one year, as Wall Street likes to do. The argument is that longer-term measures smooth out the distortions of booms and busts. Shiller has tracked his data back to 1881. The stock market’s average reading has been about 16 over that time. But that’s masked a wide range, from the single digits all the way up to 45 in early 2000. Critics sometimes like to argue that the reading of late has been distorted because it includes the abysmal corporate earnings during the 2008-2009 crash. So I decided to exclude those, and just compare stock prices to the average of the past five years, rather than 10, to see how that affected the measure. And, yes, it does. But it only cuts the reading from 31 to 25.5.

For reference, it’s only reached a level of about 25 on five previous occasions: 1901, 1928-9, 1966, 1996-2002 and 2003-2007. Each one ended with a crash. People on Wall Street always tell you “this time is different,” but it never has been yet. The “new era” of the 1920s, the “Nifty Fifty” stocks of the 1970s, the “new economy” of the 1990s. Investors in those eras have been told to ignore the lessons of the past and look only to the bright and unprecedented future. Each time they’ve lost their shirts. Other metrics with long-term records are also flashing yellow or red. Those include the so-called Tobin’s q, which compares stock valuations to how much it would cost to rebuild all those companies from scratch; and the Warren Buffett indicator, which compares the value of the stock market to the size of the national economy. (Buffett himself has somewhat backed away from that measure recently.)

“As the indexes continue to produce a series of higher highs, subsurface conditions are painting an entirely different picture..”

• Beneath The Glow Of Stock-Market Records Lurk Darkly Bearish Trends (MW)

Major U.S. stock-market indexes are trading near record levels, but does that statistic simply mask an ominous picture that’s being painted behind the scenes? Market breadth, a measure of how many stocks are rising versus the number that are dropping, has turned “exceedingly negative,” according to Brad Lamensdorf, a portfolio manager at Ranger Alternative Management. Lamensdorf writes the Lamensdorf Market Timing Report newsletter and runs the AdvisorShares Ranger Equity Bear, an exchange-traded fund that “shorts” stocks, or bets that they will fall. “As the indexes continue to produce a series of higher highs, subsurface conditions are painting an entirely different picture,” Lamensdorf wrote in the latest edition of the newsletter. He noted that the year-to-date advance in equities — the S&P 500 is up 10.6% in 2017 — has been driven by outsize gains in some of the market’s biggest names.

Most notably, the so-called FAANG stocks, which refers to a quintet of technology and internet names, have by themselves contributed more than 28% of the benchmark index’s gain. Separately, megacap names like Boeing and Johnson & Johnson have also outperformed the broader market. “The good performance of these large companies is masking the fact that many stocks, including REITs and those in the retail sector, have already entered bear-market territory,” Lamensdorf wrote, referring to real estate investment trusts. According to an analysis of FactSet data, 79 components of the S&P 500 are trading at least 20% below their 52-week high; a bear market is typically defined as a 20% drop from a peak. However, more than half the components are in what could be deemed bull market territory — at least 20% above their 52-week low.

Lamensdorf also cited a measure that compares market volume on advancing days to volume on days when the major indexes decline. This is a volatile metric, one that has both spikes and pronounced dips. However, since mid-2016, the spikes have topped out at progressively smaller highs. “This situation has occurred while the indexes have simultaneously hit higher highs; a classic negative divergence illustrating that large institutional sponsorship has not been following the indexes,” he wrote.

Wait. Wasn’t that my line?

• Albert Edwards: Central Banks To Blame For Impending Disaster (CW)

Notoriously bearish strategist Albert Edwards believes the UK is sitting on a ‘massive credit bubble that is primed to burst’ as another recession looms. The Société Générale global strategist said the recent sharp decline in household saving ratios (SR) in the UK and the US was last seen in 2007 just before the global financial crisis. This week, the US saw a substantial downward revision to its SR, with 1.5% lopped off the estimates taking the ratio to 3.8%, a level which Edwards claimed was last seen prior to the recession. In the UK, household SR slumped in the first quarter of this year to 1.9%, which he said was ‘shockingly low’. He said: ‘I’m genuinely getting tired of bashing the major central banks, but every day more evidence mounts that almost exactly the same debt excesses that caused the global financial crisis in 2008 are present today.

‘The UK Bank of England and US Federal Reserve deserve particular vilification for failing to remove the monetary punchbowl quickly enough just like the 2003-2007 period, allowing grotesque debt excesses to build.’ Edwards previously said he believed the US corporate sector ‘borrowing binge’ will take ‘centre stage in the next credit crisis’, but now thinks the household sector will play a bigger part thanks to the latest SR data. Blaming the Fed, he said: ‘QE has not only inflated corporate debt to grotesque levels, but finally the US SR has responded to the surge in household paper wealth that QE has produced. ‘Typically the SR always declines with rising wealth. Why do you need to bother saving if interest rates are close to zero and house and stock prices are rising?’

Edwards also believes the Bank of England (BoE) should have normalised rates ‘long ago’ and thinks it is ‘100%’ the BoE’s ‘own responsibility’ if credit growth spirals out of control. Comparing the UK to SR data from other European countries, Edwards said huge swings in the SR, representing credit booms and busts, are most apparent in the UK – ‘especially relative to the stability of somewhere like France.’ He added: ‘But the recent decline in the UK SR is almost without historical precedent. It is a credit disaster waiting to happen.’

“..most fiscal and monetary policymakers’ knowlege of the world is somewhere between “close to nothing” and “way less than zero..”

• Paul Singer Rages Against Everything From Passive Investing To Safe Spaces (ZH)

On Central Bankers: The combination of central banker-applied brute force (buying everything in sight) and deity-like central banker pronouncements has dampened market volatility and frisky free-lancing, but at the same time it has encouraged risk taking (in market positioning, not it business formation). We have thought, and still think, that confidence in central banks and policymakers has been unjustified and thus could erode or collapse at any time. Since the major financial institutions which comprise the financial system are still way overleveraged and opaque (in fact with record amounts of debt and derivatives at present), such a break in confidence could happen abruptly and without warning. Investors should come to grips, intellectually and viscerally, with the likelihood that most fiscal and monetary policymakers’ knowlege of the world is somewhere between “close to nothing” and “way less than zero,” and that their pronouncements and policies usually range from “silly but harmless” to “dumb and dangerous.

On whether labor markets are tight: Short answer: no. Programs which foster long-term dependency are not creating social justice; rather, they are creating demeaned citizens and preventing people from experiencing the dignity and contribution to society of work. Given record stock prices and low unemployment rates, the slow rate of increases in wages is “surprising.” But it clearly demonstrates that there is something wrong with the existing prosperity-delivering mechanism. In this regard, America is catching up (but not in a good way) with Europe, which long has lived with much higher rates of unemployment and long-term dependency.

On Chinese Debt: In response to the world economic slowdown after the GFC, China undertook a large debt-fueled stimulus. In 2008, it had a non-financial sector debt-to-GDP ratio of 141% or $6.6 trillion; by 2016 that number was 257% or $27.5 trillion. Combined with wild real estate booms and overbuilding, plus an unhealthy dose of corruption and severe neglect in “rule of law” infrastructure, a serious economic dislocation (or crash) is the obvious (but not necessarily correct) expectation based on the numbers, the leverage, the interconnectivity and the likely quality of debt. A Chinese financial market collapse would likely push the global economy into a deep recession.

Whether they will succeed or fail is completely unknown as this letter is written. A reasonable conclusion about China is that it is foolish to ignore the signs of developing storm but also ill-advised to put a “clock” on it or deem it to be inevitable. Our instinct is that close to perfection will be required to avoid a very painful sequence of events in the global financial system and hence the world economy.

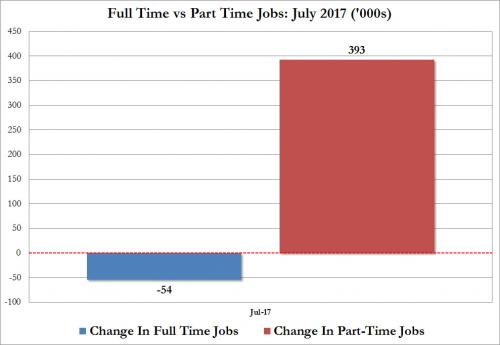

Still haven’t got a serious way to measure job quality. A job is a job is a job is nonsense.

• The Amazon Effect: Part Time Jobs Soar By 393K, Full Time Jobs Slide (ZH)

On the surface the July jobs report was solid, with 209K jobs added, more than the expected, as the recent auto sector slowdown appears to skip the labor market (for now), with Trump quick to take credit for the report. However, digging through the numbers reveals some troubling features: while the Household survey reported that an impressive 345K jobs were added, more than 50% higher than the Establishment survey, the bulk of these jobs was part-time. According to the BLS, in July 393,000 part time jobs were added, offset by a drop of 54,000 full-time workers.

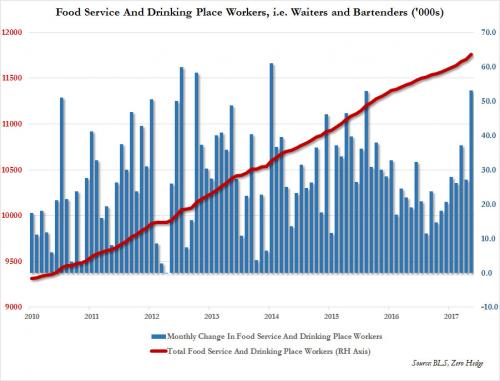

Most jobs now go to people with high school or less.

• Where The Jobs Were: Waiters And Bartenders Topped The List (ZH)

We already showed that contrary to the strong headline payrolls print, the sole source of job gains in July was part-time jobs, which rose by 393K in the month, the biggest monthly increase since September 2016, as full-time jobs sunk by 54K. Which is why it should not surprise that of the 209K jobs added according to the Establishment survey, the sector that added the most jobs was the “food services and drinking places”, i.e. “waiters and barenders” category, which added 53,000 jobs, the highest monthly increase since March 2014. There have now been 89 consecutive months without a decline for waiter and bartender jobs, the strongest sector for US employment. Needless to say, these jobs fall within leisure and hospitality, that sector pays the worst wages, an average of $13.35 an hour, and $331.08 a week.

Will the others pick a plea deal as well now?

• Volkswagen Executive Pleads Guilty In US Emissions Cheating Scandal (R.)

Volkswagen executive Oliver Schmidt pleaded guilty on Friday in U.S. District Court in Detroit in connection with a massive diesel emissions scandal that has cost the German automaker as much as $25 billion. Under a plea agreement, Schmidt faces up to seven years in prison and a fine of between $40,000 and $400,000 after admitting to conspiring to mislead U.S regulators and violating clean air laws. Schmidt will be sentenced on Dec. 6. In March, Volkswagen pleaded guilty to three felony counts under a plea agreement to resolve U.S. charges it installed secret software in vehicles to evade emissions tests. U.S. prosecutors have charged eight current and former Volkswagen executives.

Earlier this year, Schmidt was charged with 11 felony counts and federal prosecutors said he could have faced a maximum of up to 169 years in prison. As part of his guilty plea, prosecutors agreed to drop most of the counts and Schmidt has consented to be deported at the end of his prison sentence. After being informed of the existence of the emissions software in the summer of 2015, according to the agreement, Schmidt conspired with other executives to avoid disclosing “intentional cheating” by the automaker in a bid to seek regulatory approval for its model 2016 VW 2 liter diesel vehicles. During the period in question, Schmidt was working at the companys Wolfsburg, Germany, headquarters as one of three subordinates to the head of engine development. He was arrested when he traveled to the United States in early January.

“..if you think a man is unfit, you vote against him. But you don’t remove him from office..”

• Krauthammer Warns Impeachment Would Be “A Catastrophic Mistake” (ZH)

“I think [impeaching Trump] would be a catastrophic mistake,” warned outspoken conservative, and Fox News contributor, Charles Krauthammer, noting that there’s no evidence Trump has committed any crime. As The Hill reports, Krauthammer stressed that he doesn’t defend Trump, but only thinks that impeachment is a mistake. “Again, I think he’s unfit,” Krauthammer said, “but that’s not the grounds for removal.” “I don’t think he’s very well fit for the presidency. But fitness is not a reason for impeachment and removal.” Crucially, Krauthammer notes, as demonstrated by last night’s rally in West Virginia… Trump’s base is still firmly behind him and worries “I think we’re really headed into very choppy and dangerous constitutional waters” “Here’s a guy whose numbers are down in the 30s,” Krauthammer said on Fox News’s “Tucker Carlson Tonight.”

“He’s got this grand jury, reports of a grand jury being convened, he’s got the walls kind of closing in on him in Washington. And here he’s going out into the country and saying ‘These are my people. These are real people. Forget about the numbers. Forget about the chatter in Washington. Forget about the stories about Russia – which he spent a lot of time on – but I represent a huge constituency of tremendous support and enthusiasm.’” Townhall notes that Krauthammer then stressed the importance of our democratic process. “Again, I think he’s unfit but that’s not the grounds for removal,” Krauthammer said. What it means is, if you think a man is unfit, you vote against him. But you don’t remove him from office and that’s where I’m afraid we are headed given the forces that are surrounding the president. I just hope that cooler heads prevail. There will be another election – there always are – people can make their choices.”

“All of this psychotic political behavior screams for the rise of a new party, or more than one new party..”

So what exactly was Mr. Trump thinking when he signed the “deeply flawed” (his words) Russian Sanctions bill coughed up like a hairball by congress? It’s a ridiculous piece of legislation from any angle. It limits the president’s own established prerogatives for negotiating with foreign nations (probably unconstitutionally), and will only provoke economic warfare (at least) against the US that can easily lead to shattering global trade relations entirely. Some observers say he had to sign it because the vote for it in congress was so overwhelming (419 to 3) that they would only override a Trump veto. But the veto would have had, at least, symbolic value in the Jacksonian spirit that Trump pretended to want to emulate at the outset of his term. Perhaps he sees the Deep State endgame and is tired of resisting.

On the home front, Russia paranoia is at the center of Robert Mueller’s intensifying probe of Trump and his political associates as he calls a federal grand jury to hear testimony — which implies that he some lined up. This opens up all kinds of opportunities for prosecutorial mischief, for instance going after every business transaction Trump made as a private citizen before he ran for president, and coercing Trump intimates into immunization deals in exchange for testimony, real or cooked-up, to enable the establishment’s ultimate goal of shoving Trump out. The “Russian meddling in our election” story hasn’t produced any credible evidence after a full year — and speaking to foreign diplomats is not a crime — but the Russian meddling juggernaut rolls on perfectly well, and might accomplish its ends, without it.

Just repeating “Russian meddling” five thousand times on CNN has surely induced many poorly-informed citizens to believe that Russia changed the numbers in American voting machines though, in fact, voting machines are not connected to the Internet. All of this psychotic political behavior screams for the rise of a new party, or more than one new party, composed of men and women who have not lost their minds. I’m sure they’re out there. Plenty of traces on the Internet attest to the existence of a higher and better political consciousness in this country. It just hasn’t found a way to congeal. Yet.

It’s still a godalmighty mess. And we can thank Merkel for that, too.

• Greece Erasing Asylum Backlog (K.)

Greece has taken a significant step toward restoring the credibility of its asylum system as – according to the latest data from sources within the Migration Policy Ministry – authorities have processed 97.5 percent of a backlog of about 84,000 claims submitted under the old procedure in place before 2011. Progress has been achieved mostly thanks to an amendment to Law 4375/2016. Adopted in the wake of an EU-Turkey deal aimed at stemming the flow of migrants into Europe, the law introduced a series of changes to the institutional framework. Now applicants for international protection who lodged a claim more than five years ago, have a pending appeal and possess a valid asylum seeker’s permit are granted a residence permit on humanitarian grounds. The measure affects about 800 cases.

“It’s a fair decision as these people have lived in the country for many years with no final decision on their cases without it being their fault. They have become integrated and grown ties with Greece and the people. Some may have even made a family here,” Maria Stavropoulou, head of the Greek Asylum service, told Kathimerini. “It would be harsh and unfair to demand after all those years that these people return to their country of origin,” she said. With the same amendment that was voted in Parliament early last week, individuals with pending appeals under the old system who have not appeared before the Greek authorities to renew their asylum-seeker permit for a minimum of eight months are considered to have implicitly withdrawn their applications – and their claims are thereby discontinued.

Another case of non-existent collusion, played out in the media for political reasons.

• Italy Seizes Refugee Rescue Ship (Ind.)

Italian authorities have seized a refugee rescue ship operated by a German charity over allegations volunteers had contact with Libyan smugglers. Prosecutors in Trapani said an investigation started in October had uncovered evidence suggesting that the Iuventa was used “to aid and abet illegal immigration”. The vessel, operated by Jugend Rettet, was seized on the island of Lampedusa on Wednesday after it was ordered to take rescued migrants to shore there and its crew have been interviewed by police. Ambrogio Cartosio, a public prosecutor from Trapani, said there was evidence some members had contact with smugglers during one incident in September and two others in June. “There were contacts, meetings, understandings,” between the group’s boat and the smugglers, he said.

The prosecutor alleged that migrants were “handed over” to the Iuventa by smugglers rather than being “rescued”, and later transferred to other ships to be taken ashore in Italy. “The evidence is serious,” Mr Cartosio said. “We have evidence of encounters between traffickers, who escorted illegal immigrants to the Iuventa, and members of the boat’s crew.” But the prosecutor stressed that there was no evidence of Jugend Rettet receiving any money from Libyan traffickers and no indication of a wider conspiracy between the two groups – a favourite theory of the European far-right. “My personal conviction was that the motive is humanitarian, exclusively humanitarian,” Mr Cartosio said. “It would be fantasy to say there was a coordinated plan between the NGOs and the Libyan traffickers.”