Vincent van Gogh Roofs of Paris � 1886

There goes Yellen’s reputation.

“By pulling tomorrow’s home sales and other economic activity forward via various policy manipulations, tomorrow is now light in terms of growth..”

• Volcker Rebukes Bernanke and Yellen Feds (Whalen)

Yellen worries that the rhetorical attacks on the central bank by President Donald Trump is “whittling away the legitimacy and stature of institutions the public has traditionally had some confidence in. I feel it ultimately undermines social and economic stability.” She then goes on to say that “Trump has the potential to undermine confidence in the Fed.” Former Chairman Alan Greenspan, the most politically astute Fed chief in half a century, puts such worries in perspective: “I don’t know a single President, and I worked for a lot of them, who don’t want lower interest rates. Now, obviously that’s not possible. You keep lowering them down to zero, where do you go from there?”

Like Yellen, many observers worry that criticism of the Fed will make it difficult for the central bank to act when necessary. The dual, conflicted political mandate of full employment and price stability created by the Humphrey Hawkins law is not possible to achieve in practice, thus the FOMC lurches from one extreme to the other, causing enormous collateral damage. Consider the effects of QE and Operation Twist on housing. Think about the thousands of people in the mortgage industry, for example, that have lost their livelihoods because the boom and bust policies followed by the Fed since 2008 and even before. Think about the millions of American families today that cannot afford to buy a home because asset prices have skyrocketed over the past five years.

By pulling tomorrow’s home sales and other economic activity forward via various policy manipulations, tomorrow is now light in terms of growth. Tomorrow also carries hidden market and credit risks caused by the Fed’s past actions. As we watch mortgage lending and home building volumes fall next year and thereafter thanks to the property price inflation created by the FOMC under Bernanke and Yellen, remember that Fed policy was explicitly meant to “help” the housing sector.

“..in normal times, the gold used to stay in London and New York. Now that gold is going via Switzerland to China and India and it will never come back.”

• China Takes Delivery Of Massive Amount Of Gold From London, New York (Greyerz)

“They’re all into gold. Absolutely. Yes, virtually all of them own gold. That’s what’s so interesting. The Chinese buying is continuously going up and up and up without stopping. The Chinese know what is happening. They know it and they will continue to buy gold. And one day that’s going to have a major influence on the gold price. And when the paper market breaks, and China dominates the gold market, it’s going to be very interesting because I really look forward to the West failing in their manipulation of the gold price through the various paper markets and through the interbank market. Again last month we saw imports of gold into Switzerland and then exports to Asia and India. Last month, over 70% of the gold import figures (into Switzerland) came from London and the United States.

We again see that Switzerland is buying the 400 ounce bars from the UK and US bullion banks and converting them into 1 kilo bars and then shipping them on to Asia. Last month there was hardly any buying from the mines. It all came out of London and New York. And that proves again, Eric, that central banks are either leasing their physical gold into the market or selling it covertly. And that gold that’s coming into the market in London and New York, before it used to stay in London and stay in New York and it would be traded between the various banks, these banks now get the gold from the central banks and then they give the central bank an IOU. Again, in normal times, the gold used to stay in London and New York. Now that gold is going via Switzerland to China and India and it will never come back. China is never going to send it back, nor is India.

One of my fave themes: of all the people who say they made so much money over the past 10 years, the very vast majority will be too late to get out.

• Getting Out: A Godfather Story (Ben Hunt)

“Just when I thought I was out, they pull me back in!” It’s one of the most famous quotes in movies, as Michael Corleone rages in Godfather III over the assassination he narrowly avoided and his inability to steer the family into legit businesses. Michael is what I like to call a coyote, someone who is VERY smart and VERY strategic. Actually, too smart and too strategic for his own good, what a Brit would call too clever by half. That’s in sharp contrast to his father, Vito Corleone, who is no less smart and no less strategic, but is somehow far less conniving and far more beloved. You see this difference in character most clearly in the deaths of Vito and Michael. How does Vito Corleone die? Playing in his vegetable garden with his grandson. At home. Surrounded by life and laughter and plenty of bottles of Chianti.

Vito got out. How does Michael Corleone die? Sitting in a stony Sicilian courtyard as two skinny dogs scurry around. Struggling to peel an orange. All dressed up and no place to go. Alone. Utterly alone. For all his smarts and strategy and cleverness, Michael NEVER got out. How did Vito get out, while Michael failed? I think it’s the whole too-clever-by-half coyote thing. Michael never trusted ANYONE in the way that Vito did. Michael was obsessed with finding the Answer, an impossibility in the game of organized crime. Or the game of markets. Michael was a maximizer. Which is another way of saying that, like most coyotes, he wasn’t very good at the metagame. Do you want OUT from the game of markets? I do.

Am I good at the game? Yeah. Do I enjoy it? Not really. I used to. But ever since Lehman it’s been mostly a drag. And that’s okay! The game of markets is a means to an end. It’s a really big, important game, but it’s only one of several big important games within the larger metagame of life and doing. My goal in doing is to have a happy ending. I want the Vito ending, not the Michael ending. How do we get there? We keep our eye on the prize – the happy ending – and we work backwards. We maintain our vision on the metagame and its outcome even while we play the immediate game. My goal as an investor is NOT to maximize my investment returns or to maximize my personal wealth. That’s myopic thinking. That’s coyote thinking. That’s the sort of thinking that ruined Michael.

Remember: we don’t have functioning markets.

• Why Do Investors Hate Everything? Maybe Paranoia (BBG)

Only during the 1970s stagflation period and the global financial crisis have so many asset classes had negative returns in a year. The latter may have a lot to do with why it’s happening again. Investors now overreact to even modest changes late in cycles after not foreseeing the financial crisis, JPMorgan Chase & Co. strategists led by John Normand wrote in a note Friday. Other plausible explanations could be that the global economy and earnings have reached a turning point, or that the Federal Reserve is committing a policy error, they added. “The percentage of asset classes that has generated positive returns this year is only 20 percent, a share that has never been so low outside of 1970s stagflation episodes and the Global Financial Crisis,” the strategists wrote.

“Every market but the Nasdaq, Commodities and U.S. Leveraged Loans has underperformed USD cash in 2018.” The strategists have “no argument with the obvious statement” that markets are tumbling because global growth and U.S. earnings are peaking. However, they said slower growth on those fronts, at least if it remains around long-term-average levels, usually hasn’t been a sufficient condition for investors to turn defensive. “We had expected outperformance for another two to three quarters given near-neutral Fed policy, record share buybacks and significant deleveraging” by some equity investors before earnings season began, the strategists wrote. “This month markets clearly don’t share our time-limited optimism, perhaps given growing fear that the Fed is committing a policy mistake by tightening to restrictive levels eventually.”

When dinosaurs invest.

• Desperate IBM Buys Red Hat For $34 Billion In Largest Ever Acquisition (ZH)

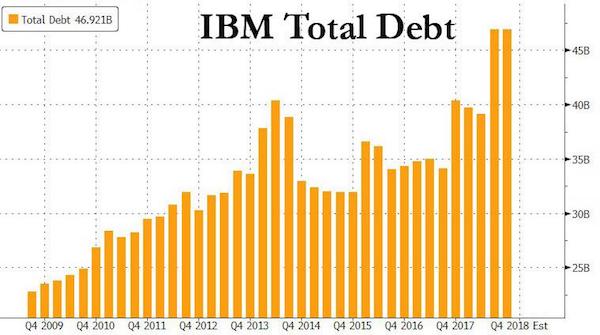

The bad news is that in its desperation for growth at what amounts to be any price, IBM is almost certainly overpaying for Red Hat. This was confirmed by Rometty’s preemptive defense, telling Bloomberg that IBM “paid a very fair price. This is a premium company. If you look underneath, this is strong revenue growth, strong profit strong free cash flow” she said, adding that IBM will not cut jobs as a result of the deal: “this is an acquisition for revenue growth, this is not for cost synergies.” Perhaps, but the bigger question is what the deal means for IBM’s balance sheet. In the press release, IBM said that “the company has ample cash, credit and bridge lines to secure the transaction financing. The company intends to close the transaction through a combination of cash and debt.” In other words, no IBM stock, which is already at the lowest level this decade.

So let’s do the math: IBM ended Q3 with cash of $14.7 billion, and a record $46.9 billion in debt. Which means that IBM will likely incur at least $20 billion in additional debt, and as a result IBM’s already shaky A+/A1 rating could soon be downgraded to BBB. So what is IBM buying for this $34 billion and $20 billion in debt? According to its LTM financials, Red Hat has $3.2BN in revenue and $603MM in EBITDA. These numbers are expected to grow to $3.9BN by 2020, when EBITDA will hit $1 billion. In other words, on an EV basis, IBM is paying roughly 31x (net of $2.2BN in cash) Red Hat’s 2020 forward EBITDA.

Of course, if one assumes continued EBITDA growth for the foreseeable future, this acquisition could make sense. The problem is that between the threat of a recession in the next few years, and aggressive competition from Amazon, Microsoft and others for cloud market share, this is a very aggressive assumption. Meanwhile, in exchange for this $1 billion in EBITDA, IBM’s net debt will grow from $32.5 billion currently to $52 billion, almost doubling IBM’s net leverage from 1.7x level to a whopping 3.2x, and well on its way to a BBB rating if not worse. Which is why IBM promise that it will “target a leverage profile consistent with a mid to high single A credit rating” is, with all due respect, laughable.

“Harsh adjustment programs do not make unsustainable debt sustainable. They just create misery for the population while making the debt burden even worse.”

• The IMF Has Learned Nothing From The Greek Crisis (Coppola)

The IMF has just published a new review of Argentina’s economy. It is grim reading. Argentina is in trouble: economic conditions have worsened considerably since the last IMF review, back in June 2018. But the review also reveals that the IMF could be in even bigger trouble. It is repeating the same mistakes it made in the Greek crisis – but with a much larger amount of money at stake. Argentina has been struggling all year. A drought has severely curtailed agricultural production, widening the current account deficit and triggering a mild recession. Concurrently, Fed interest rate rises and a booming U.S. economy have driven up the U.S. dollar, making it ever more expensive for Argentina to obtain the dollars needed to pay interest on its massive dollar-denominated debt pile.

The central bank has been printing money to finance the government’s growing deficit, but this has helped to fuel inflation that now runs at over 40%. In June, the IMF agreed a standby credit arrangement of $50 billion with Argentina, the largest in the Fund’s history. $15 billion would be drawn immediately and the remainder would be made available as needed over the next three years. Half of the $15 billion would be used for government budget support. But it quickly became apparent that, enormous though this financing agreement was, it would be nowhere near enough. In September, as the peso crashed and Argentina stared default in the face, the IMF hastily agreed to front-load the credit arrangement, so that the Argentine government could immediately draw an additional $13.4 billion (making a total of $28.4 billion).

A further $22.8 billion would be drawn in 2019 and $5.9 billion in 2020-21. This is no longer a “standby” arrangement. It is a full financing agreement. Argentina has now become dependent on IMF funding – and the IMF has committed to lend by far the largest amount of money in its history. [..] The fundamental problem that the IMF made in Greece was lending to an insolvent country. Harsh adjustment programs do not make unsustainable debt sustainable. They simply create misery for the population while making the debt burden even worse. The IMF should not have lent to Greece at all. It should have faced down Greece’s creditors and insisted on orderly debt restructuring right from the start.

Greece wants over 1000 times what Germany has paid.

• Greece Reiterates €288 Billion Claim For Damages Under Nazi Occupation (G.)

Greece says it will pursue its quest for second world war damages and repayment of a loan forcibly extracted during Nazi occupation with renewed zest, despite Germany openly rejecting the claims. Less than two weeks after German president, Frank-Walter Steinmeier, used a state visit to apologise for atrocities committed by his forefathers, Athens vowed to relaunch the campaign while hailing the onset of a new era in bilateral ties. “This is an issue that psychologically still rankles, and as a government we are absolutely determined to raise it,” said Costas Douzinas, who heads the Greek parliament’s defence and foreign relations committee.

“Obviously Greece couldn’t do that when it was in a [bailout] programme receiving loans from the EU and Berlin. It would have been totally contradictory.” The leftist-led government is expected to press ahead with the claims after MPs debate what has been described as the first all-inclusive parliamentary inquiry into the damage wrought under Nazi occupation. The report, compiled by a cross-party committee over several years, estimates that compensation of €288bn (£256bn) remains outstanding for the destruction Greece sustained between 1941 and 1944, the years the country was subject to Third Reich rule. It also calculates that a further €11bn is owed for a 476m Reichsmark loan Hitler’s forces seized from the Greek central bank in 1943.

[..] Greeks put up heroic resistance to their German occupiers, but the price was heavy. Tens of thousands were killed in reprisals for a guerrilla campaign against the Wehrmacht, and at least 300,000 died of famine. About 40,000 people are thought to have starved to death in the first year of occupation alone, and Greece’s Jewish community was almost entirely wiped out. “Germany has never properly assumed its historical responsibility for the wholesale destruction of the country,” said Stelios Koulouglou, who represents Greece’s governing Syriza party in the European parliament. “It was a catastrophe that was so complete it played a major part in delaying our country’s development as a modern European state.”

[..] The German government strenuously rejects charges that it owes anything to Greece, or Poland which also suffered greatly, for the wartime horrors. It says the chapter was closed in 1960 when it paid Athens 115m deutschmarks, roughly equivalent to £205m today.

Ain’t that the truth.

• There Aren’t Enough Lifeboats For Everyone (CHS)

[..] the status quo is fragile, and everyone’s grip on the crumbling cliff-edge of “prosperity” is precarious–and we all sense it. The security we all took for granted is turning to sand as the system breaks down. Job security–you’re joking, right? Pension security–you take us for chumps? Sure, your bank account is guaranteed by the FDIC, but nobody’s guaranteeing your income, your purchasing power or the security of your grasp on the good life. Everyone knows the markets are as precarious as the rest of the status quo, and the rational response is to limit exposure to risk by selling at the first signs that the herd is nervous.

Switching metaphors, we all know the global economy scraped alongside an iceberg in 2008, and those who look beneath the reassuring rah-rah know that the hull of the global economy was sliced open just like the Titanic’s. Central banks have created the illusion that the damage was limited by printing money and using the freshly created currency to buy bonds and stocks to prop up the markets.

But even the passengers who accept the authorities’ reassurances sense something is wrong with the ship. The bow is slowly sinking, the engines are straining to power the pumps, the First Class passengers are either already in lifeboats or huddling nervously by the davits, and the ship’s officers are openly wielding pistols to control panic. Nobody dares discuss it openly for fear of triggering a panic, but there aren’t enough lifeboats for everyone. A great many passengers are going to find themselves in the icy waters when the great global economic ship finally founders, and humanity’s finely tuned instinct is alerting us to the restless nervousness of the herd.

A fully adequate picture of my faith in mankind. It costs $2-4 million per ship to cheat the system, and it’s worth it.

• Thousands Of Ships Could Dump Pollutants At Sea To Avoid Dirty Fuel Ban (G.)

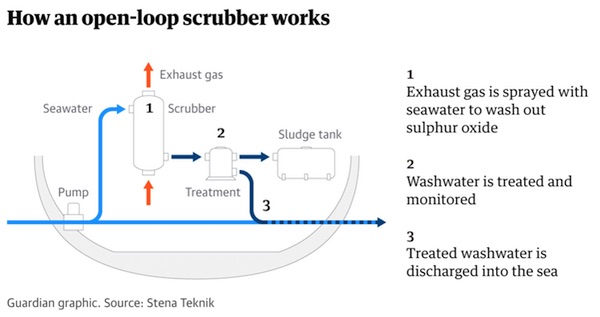

Thousands of ships are set to install “emissions cheat” systems that pump pollutants into the ocean to beat new international rules banning dirty fuel. The global shipping fleet is rushing to meet a 2020 deadline imposed by the International Maritime Organization (IMO) to reduce air pollution by forcing vessels to use cleaner fuel with a lower sulphur content of 0.5%, compared with 3.5% as currently used. The move comes after growing concerns about the health impacts of shipping emissions. A report in Nature this year said 400,000 premature deaths a year are caused by emissions from dirty shipping fuel, which also account for 14 million childhood asthma cases per year. But the move to cleaner fuel could see harmful pollutants increasingly dumped at sea.

According to industry analysis seen by the Guardian, between 2,300 and 4,500 ships are likely to install an exhaust gas cleaning system known as a scrubber to meet the regulations on low-sulphur fuel instead of buying the more expensive clean fuel. The scrubbers allow ship owners to continue buying cheaper high-sulphur fuel, which is washed onboard in the scrubber. In the case of the most used system, known as open loop, the waste water is discharged into the ocean. Although expensive at around $2-4m per ship fitting, the cost of buying and fitting a scrubber would be recovered in the first year, the industry analysis says. Cleaner low-sulphur fuel is likely to cost between $300 and $500 more a tonne, according to analysts.

Sugar addiction.

• Big Food’s Poisonous Propaganda (Lustig)

Human brain scans demonstrate that glucose activates the cerebral cortex (the “cognitive” part of our brains), while fructose suppresses that signal and instead lights up the limbic system (your “lizard” brain). Moreover, while sugar does not exhibit classic withdrawal symptoms, it does lead to tolerance and dependence that can cause bingeing, craving, and cross-sensitization to narcotics. These are some of the reasons why the World Health Organization and the US Department of Agriculture recommend that people reduce the amount of sugar in their diets. The addictive qualities of sugar are embedded in its economics. Like coffee, sugar is price-inelastic, meaning that when costs increase, consumption remains relatively constant.

Purchases of soft drinks and other sweetened foods are not dramatically affected by taxes or fluctuating prices. Not everyone who is exposed to sugar becomes addicted; but, as with alcohol, many do. While refined sugar is the same compound found in fruit, it lacks fiber and has been crystallized for purity. It is this process that turns sugar from a “food” into a “drug,” allowing the food industry to “hook” unsuspecting consumers. The evidence is visible in every aisle of every grocery store, where a staggering 74% of all food items are spiked with added sugar. In fact, sugar’s allure is a big reason why the processed food industry’s current profit margin is 5% (up from 1%), and why so many of us are sick, fat, stupid, broke, depressed, and just plain miserable.

One queston: why?

• EU Air Pollution Improves, Causes Only 500,000 Early Deaths A Year (AFP)

Air pollution is slowly easing in EU countries but still causes nearly half a million early deaths each year, the European Environment Agency (EEA) said in its annual report published Monday. Although pollution levels dropped slightly in 2015, they remain far higher than standards set by both the EU and the World Health Organization, the report said. The findings come just weeks after an EU watchdog said most member states fail to meet the bloc’s air quality targets, warning that the toll on health in eastern European countries was even worse than in China and India. The EEA said on Monday that exposure to fine pollution particles known as PM2.5 was responsible for around 391,000 premature deaths in the 28-nation bloc in 2015.

The report also found that 76,000 early deaths were linked to nitrogen dioxide and some 16,400 to ground-level ozone in EU countries in the same year. Fine pollution particles have been linked to respiratory illnesses and heart problems, with PM2.5, the smallest, posing the greatest health risks as they can penetrate deep into the lungs. The EEA said a wider assessment included in the report found that early deaths each yer due to PM 2.5 have been cut “by about half a million” since 1990.

Book review. How much do you know about genes?

• Race Doesn’t Come Into It (LRB)

Before I got pregnant, I thought I understood how DNA works: parents pass on some combination of their DNA, which codes for various heritable traits, to their children, who pass on some combination to their children, and so on down the neat branching lines of the genealogical tree. What I didn’t know was that women can also receive DNA from their children. During pregnancy, foetal cells get into the mother’s bloodstream, mixing freely with her own cells and resulting in what scientists call a ‘microchimera, a single organism harbouring a small number of cells from another individual. Microchimerism is the reason doctors can use my blood to do genetic testing that looks for markers of disease in the DNA of the growing foetus.

And while the number of foetal cells in my bloodstream will drop after birth, some could stay there for decades, even for the rest of my life. These foetal cells may even sense the tissues around them and develop into the same types of cell, becoming an integral part of my body, which may have both positive and negative effects on my health – a sort of backwards inheritance. Foetal cells have been shown to regenerate a mother’s diseased thyroid gland and to help her body fight breast cancer. If a virus enters her body, even years after pregnancy, cells from the foetus may be among the first to attack it. But they may also make her more vulnerable to autoimmune diseases such as arthritis and scleroderma.

And this DNA transfer works both ways: a pregnant woman’s cells – with her complete set of DNA – can enter the foetus, eventually becoming part of her child’s body and living on long after her own death. With a second pregnancy, foetal cells from the first could colonise the new foetus, turning the second infant who emerges blinking into the sharp light of a new day into a microchimera of mother, father and sibling. So much for the neat branching lines of vertical heredity.