Pieter Bruegel the Elder The Fall of the Rebel Angels 1562

Google translate from German. Long and good. Do read.

• Why Are The Covid Vaccines So Toxic? (AchGut)

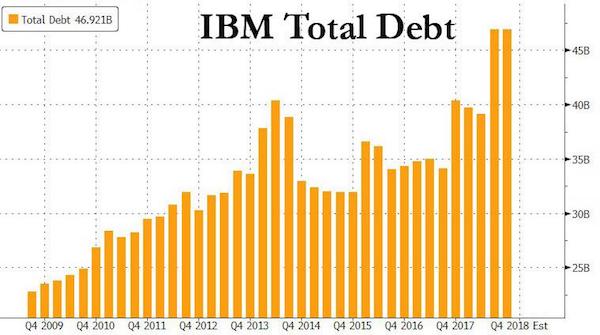

In calendar week 16/2021, more than 3,700 people in the USA had died in close connection with the vaccination with (biochemically very similar) SARS-CoV-2 mRNA vaccines from Pfizer / BioNTech or Moderna, with around 210 million inoculated doses. That’s 17 deaths for every million people vaccinated. AstraZeneca’s vaccine, which is based on an adenovirus, has 24 deaths per million vaccine doses in the UK and 18 in France, and 6 in Germany. On average, the mRNA vaccines bring about 20 deaths per million vaccinated, the AZ Vaccine on 10. The figures were compiled by the Rossiya Segodnya agency from Moscow, but we checked them on a random basis: they are correct. Of course, a causal relationship has not been proven in many cases, but such an accumulation of medical reports of deaths in connection with vaccinations has never occurred in the last few decades.

With conventional vaccines, one or two people vaccinated die for every 10 million people vaccinated. Even if you subtract half of the reported deaths in order to price in the spontaneous mortality rate of the sometimes very old vaccinated people, you still have to ask yourself: Why do the SARS-CoV-2 vaccines have such a high lethality? Two major causes of death stand out: anaphylactic shock and bleeding disorders. It has long been known that free mRNA in the extracellular space can trigger acute allergic reactions up to anaphylactic shock. In this syndrome, the immune system overreacts and there is massive release of vasodilating and bronchoconstricting substances. This leads to a general dilation of blood vessels (vasodilation) and bronchospasm with severe restriction of gas exchange in the lungs.

The blood fluid seeps into the periphery of the blood circulation, resulting in a lack of volume, as not enough blood fluid can be pumped back to the lungs and heart. At the same time, the little blood that is still available is no longer adequately supplied with oxygen. The heart begins to race, but the blood pressure drops: shock. The patient dies of cerebral hypoxia (insufficient oxygen supply to the brain) or heart failure. In many cases, the mRNA-carrying lipid particles that make up the vaccines from Pfizer/BioNTech and Moderna burst when passing through the logistics chain or are already defective from production. As a result, the naked mRNA is brought into the extracellular space (the space between the cells of the muscle into which the injection is made) during the injection. They cause anaphylactic shock in susceptible patients. The risk of anaphylactic reactions with mRNA vaccines is many times higher than with conventional vaccines. That explains some of the dead, probably just under half.

“..the question, from a pure cost benefit, is how many lives are saved as opposed to how many lives are damaged from the treatment..”

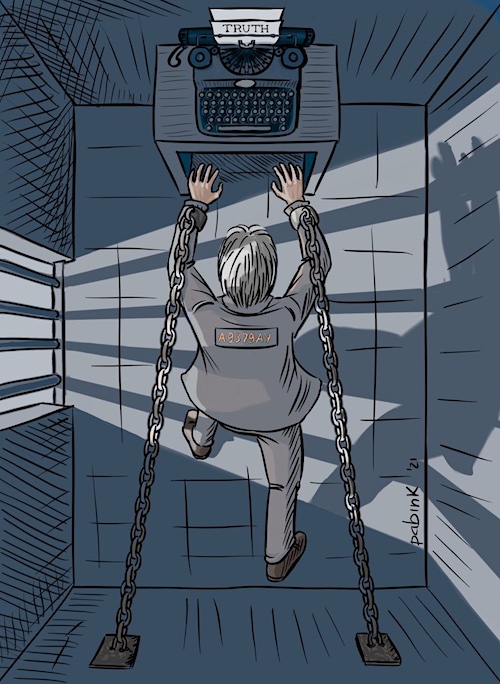

• Covid Lies Cost 100,000 US Lives – Mark Skidmore (USAW)

Michigan State Economics Professor Mark Skidmore revealed more than three years ago, there was $21 trillion in what he called “Missing Money” from government books. He’s doing some new number crunching surrounding public policy and the effects on the Covid 19 (CV19) pandemic. It’s all laid out in a brand new report. What he found is appalling. One big fact his research revealed is up to 100,000 lives could have been saved by using Hydroxychloroquine (HCQ). Instead, the medical community and the mainstream media trashed it and told people it was “dangerous” and it “did not work.” That was a total lie. Dr. Skidmore explains, “So, we have all these countries that used it, and a number of countries, such as the United States, that for some reason did not use it and actually prevented it . . . claiming it was unsafe.

“So, our estimate is if the U.S. just allowed it and made it widely available from the beginning, we could have saved 80,000 to 100,000 lives.” Dr. Skidmore said medical officials such as Dr. Fauci, who serves as the director of the U.S. National Institute of Allergy and Infectious Diseases, knew HCQ worked well against Corona Virus. In fact, Dr. Skidmore goes on to point out, “There was a paper published in the Virology Journal in 2005 . . . this is the outfit that Dr. Fauci oversees . . . . So, their journal published this paper that said HCQ was effective in treating the Corona Virus. The people who authored this study had been a part of the CDC at the time. So, we have known this for a long time. . . .We also now know there are as many as 200 peer reviewed studies that say it is effective if taken early on when somebody gets sick. It’s pretty overwhelming evidence if you take it early on, it’s extremely effective.”

That’s not all that works, and this too was suppressed and trashed by most of the medical community. Ivermectin, Vitamin D, Vitamin C and Zinc are a few that are also proven scientifically effective to reduce or obliterate CV19. Dr. Skidmore says, “These are inexpensive ways to help protect yourself and your family. . . . It’s overwhelming evidence that these different types of treatments are very effective.” Another revelation of Dr. Skidmore’s study was the CDC changed the definition on how to count CV19 deaths. Skidmore says, “In the middle of the crisis last year, the CDC changed the definition on how you count fatalities, but they only did it for Covid. It amounts to this, basically, the way we counted how somebody died, was you ‘died of’ some disease of some condition. They changed the definition so that it was more characterized that you ‘died with.’ And, if the CDC would not have changed the definition for Covid deaths? Skidmore says, “I think we would have had far fewer deaths. The data suggests that. . . . If they used the old number, there would have been less (CV19 deaths).”

Dr. Skidmore’s study also points out that the vaccines were never approved by the FDA. Dr. Skidmore explains, “You can look it up. The vaccines are only authorized for emergency use, which means it’s experimental, and it’s still experimental. They are tracking it all. . . . The (vaccine) fatalities are now up to 3,000, and there are many strange and unusual side effects that have occurred. It’s the same thing in Europe and other places. There are many reports of neurological problems, blood clots and a range of related issues. . . . There are all kinds of negative reactions and the question, from a pure cost benefit, is how many lives are saved as opposed to how many lives are damaged from the treatment (vaccines), and we don’t really know what the injuries are, and we don’t know what the long run effects will be.”

“..we may be creating dangerously overactive immune systems in billions of unwitting subjects.”

• Perspectives on the Pandemic: “Blood Clots and Beyond” (JP)

In February, 2021, Professor Sucharit Bhakdi, M.D. and a number of his colleagues warned the European Medicines Agency about the potential danger of blood clots and cerebral vein thrombosis in millions of people receiving experimental gene-based injections. Since then, two of the four injections have been suspended or recalled in Europe and the United States for just that reason. In this episode of Perspectives, Professor Bhakdi explains the science behind the problem, why it is not just limited to the products already suspended, and why in the long term we may be creating dangerously overactive immune systems in billions of unwitting subjects.

Illegal as hell, but who cares anymore?

• Biden Mulls Vax Mandate For All US Military After Huge Numbers Refused (ZH)

President Biden told NBC News in an interview which broadcast Friday that he’s mulling ordering all US military personnel to get a COVID-19 vaccine as commander-in-chief. “I’m not saying I won’t” rule it out, he emphasized in the new interview. This would also mean that anyone wanting to enter military service would have to receive the jab as a requirement to get in, which would likely cause a blow to military recruitment in the near-term. However, he didn’t outright say he’s ready to pull the trigger on the policy, which if enacted would constitute the largest federal government-ordered mandate in terms of forcing the vaccine on some 1.3 million active duty service members, not to mention over one million more reserve personnel.

Describing the decision as a “tough call” he suggested it was being hotly debated. “I don’t know. I’m going to leave that to the military,” Biden told NBC News’s Craig Melvin. “I’m not saying I won’t. I think you’re going to see more and more of them getting it. And I think it’s going to be a tough call as to whether or not they should be required to have to get it in the military, because you’re in such close proximity with other military personnel.” In follow-up to Biden’s comments, national security advisor Jake Sullivan confirmed that a DoD-wide vaccine mandate is “something the Department of Defense is looking at in consultation with the interagency process and [I] don’t have anything to add on that subject today.”

The whole debate was sparked in earnest when multiple headlines earlier this month took note of the large numbers of military members who were rejecting the vaccine. For example, one recent USA Today report noted that nearly 40% of US Marines who have been offered a COVID-19 vaccine have refused to recieve it, according to Pentagon figures. And an earlier report in The Guardian described that “Reluctance to be vaccinated for Covid-19 is now rife in the US military, with about a third of troops on active duty or in the national guard refusing to be administered the vaccine.”

The new religion.

• It’s Time To Start Shunning The ‘Vaccine Hesitant’ (Stern)

For the better part of a year, as the coronavirus racked up hundreds of thousands of American deaths, the flickering light at the end of the tunnel was herd immunity — the antibody force-shield that comes when enough people have survived the illness or have been vaccinated against it. “Go get vaccinated, America,” President Biden said in his speech to Congress this week, referring to the shot as “a dose of hope.” Anthony Fauci, the nation’s top infectious disease doctor, suggested in December that if 75% to 85% of the population got vaccinated, we could reach herd immunity by June. And with herd immunity, we’d return to a measure of “normalcy,” meaning indoor dining, movie theaters and hugs.

But herd immunity is slipping away because a quarter of Americans are refusing to get the COVID-19 vaccine. Dr. Gregory Poland, director of the Mayo Clinic’s Vaccine Research Group recently said: “There is no eradication at this point, it’s off the table. …We as a society have rejected” herd immunity. Hmm, no! “We” have not rejected anything. A quarter of the country is ruining it for all of us. It’s not just wacky former rockers who have put herd immunity out of reach. It is white evangelicals (45% say they won’t get vaccinated). And it is Republicans (almost 50% are refusing the vaccine). In Texas, 59% of white Republicans have said “no” to the vaccine. You can slap the euphemism “vaccine hesitancy” on the problem, but in the end the G.O.P., and the children of G.O.D., are perpetuating a virus that is sickening and killing people in droves.

A big part of the problem stems from the cultish relationship many evangelicals and Republicans have with former President Donald Trump. They absorbed his endless efforts to downplay the danger of the virus and turn public health precautions into a political freedom movement. But the time for analyzing why these human petri dishes have chosen to ignore the medical science that could save them, and us, is over. We need a different strategy. I propose shunning. Biden’s wildly successful vaccine rollout means that soon everyone who wants a vaccine will have one. When that happens, restaurants, movie theaters, gyms, barbers, airlines and Ubers should require proof of vaccination before providing their services.

And it shouldn’t stop there. Businesses should make vaccination a requirement for employment. A COVID outbreak can shut down a business and be financially devastating. And failure to enforce basic health and safety measures is not fair to employees who have to work in offices, factories, and stores where close contact is required. Things should get personal, too: People should require friends to be vaccinated to attend the barbeques and birthday parties they host. Friends don’t let friends spread COVID.

“hacking the software of life.”

Good overview of history of legal implications of gene tech.

• Supreme Court: Pfizer, Moderna et al. May Own Your Genes Once Injected (CB)

Yes, this article contains a lot of scientific and legal mumbo-jumbo. But in a nutshell, biotechnology companies can own living things if said things are genetically-modified and not naturally-occurring. No mouse is born in nature like the OncoMouse. It is thus patentable. Oil-eating bacteria come from genetic manipulation, thus patentable. Notice how all these so-called doctors and scientists avoid pointing fingers at Pfizer, Moderna, Johnson & Johnson et al. when someone dies within hours, days or weeks of receiving their shots. It’s almost as if said doctors and scientists are carefully navigating the trademark and patent landscape. They don’t want to trespass on someone else’s property, if you will. Moderna owns several mRNA patents. Doctors and hospitals wanting a piece of the mRNA pie cannot bite the hand that feeds them.

The synthetic mRNA of Pfizer and Moderna, along with the viral vector DNA delivery systems of Johnson & Johnson and AstraZeneca, change your genetic code, making you “genetically-modified.” Granted mainstream media say the foregoing is “conspiracy theory.” But Moderna Chief Medical Officer Tal Zaks tells you straight up that 1) the shots change your genetic code and 2) the shots do not stop the spread of COVID-19. He says the Moderna shot is “hacking the software of life.” Viral vectors do the same thing. So do these companies “own you” once you get the shots? Well, they own mice and bacteria created with their inventions. Once you get these shots, you are no longer a “naturally-occurring” human being. Prosthetic limbs, breast implants, etc. are not “natural” per se. But they are removable and not part of what fundamentally makes you human. Gene therapy is irreversible. Do the math yourself.

“And that’s how creeping banana republic socialism comes at you: first slowly, then fast.”

• Record 34% Of US Household Income Now Comes From The Government (ZH)

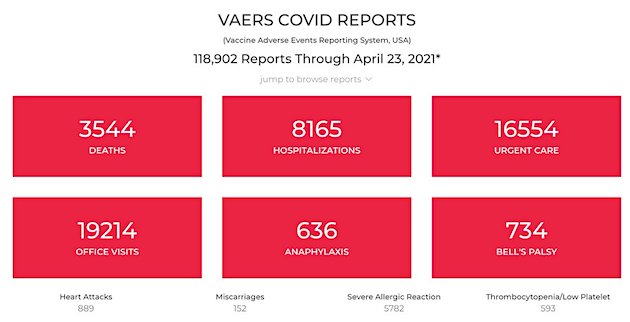

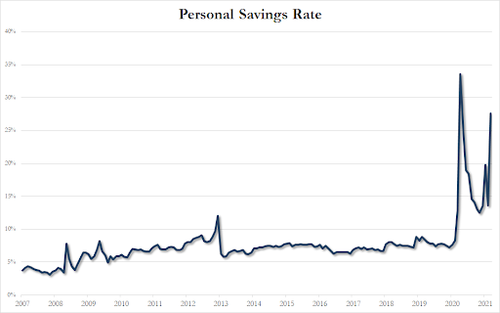

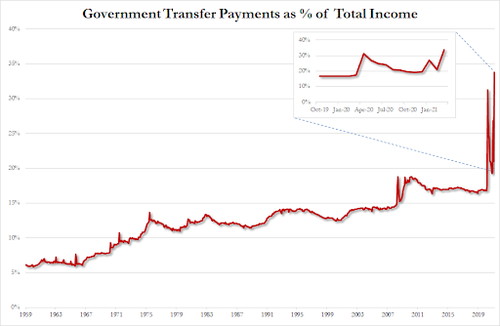

Following today’s release of the latest Personal Income and Spending data, Wall Street was predictably focused on the changes in these two key series, which showed a modest jump in personal spending, which however was dwarfed by a record surge in personal income, to be expected in the month when Biden’s latest $1.9 trillion stimmy hit. But while the change in the headline data was notable, what was far more remarkable was data showing just how increasingly more reliant on the US government the population has become. We are referring, of course, to Personal Current Transfer payments which are essentially government sourced income such as unemployment benefits, welfare checks, and so on. In March, this number exploded to a mind-blowing $8.1 trillion annualized, which was not only double the $4.1 trillion from February, but was also $5 trillion above the pre-Covid trend where transfer receipts were approximately $3.2 trillion.

This means that excluding the $8.1 trillion surge in govt transfers, personal income excluding government handouts would be virtually unchanged from a year ago level at $16TN. [..] government stimulus checks hitting personal accounts [..] in turn helped double the savings rate to a whopping 27.6% from 13.6% in February.

Stated simply, what all this means is that the government remains responsible for a third of all income, or 33.8 to be precise! Putting that number in perspective, in the 1950s and 1960s, transfer payment were around 7%. This number rose in the low teens starting in the mid-1970s (right after the Nixon Shock ended Bretton-Woods and closed the gold window). The number then jumped again after the financial crisis, spiking to the high teens. And now, the coronavirus has officially sent this number to a record 34%! And that’s how creeping banana republic socialism comes at you: first slowly, then fast.

And then prices start soaring.

• US Household Income Soared 21% In March, Largely Due To Stimulus Checks (JTN)

U.S. household income spiked an astronomical 21% in March, due in large part to the $1,400 coronavirus stimulus checks that went out that month, the government said on Friday. A press release from the Bureau of Economic Analysis said that, in the U.S., “personal income increased $4.21 trillion (21.1 percent) in March,” while disposable personal income increased by an even higher 23.6%. The spike “largely reflected an increase in government social benefits,” the BEA said, noting that the American Rescue Plan Act “established an additional round of direct economic impact payments to households.” The BEA also noted a rise in personal consumption expenditures, one that appears to be tied to the ongoing reopening of major swaths of the U.S. economy, particularly restaurants. “Within services, the largest contributor to the increase was spending for food services and accommodations,” the press release said.

“One of the number one selling objects in Europe is a safe. People are storing cash. Biden was the straw that broke the camel’s back.”

• Election Panic Coming in 2022 – Martin Armstrong (USAW)

According to a recent poll, 51% of Americans think Joe Biden cheated to get into the White House. The breakdown is 74% Republicans and an astounding 30% Democrats think cheating played at least a part of the 2020 Election outcome. In Arizona, the 2020 Election ballots are finally being audited as court battles to stop it continue. Legendary financial and geopolitical cycle analyst Martin Armstrong is predicting an election “panic in 2022.” Armstrong explains, “It means extremely high volatility. Despite whatever they want to say, there is a large proportion of the population that do not believe the election. Polls are saying it’s at 51%, but it’s probably close to 60% or 70%. You are also seeing that 60% of Americans want a third party, and you are talking about Democrats and Republicans. . . .

I think because we have such a high number of people who do not trust the election results, I don’t think they are going to be able to get away with rigging the elections again. It’s going to turn into violence. There is no question about that.” Armstrong also sees Biden Administration tax plans on things like capital gains causing problems in the not-too-distant future. Armstrong says, “If they eliminate capital gains, I don’t care if you are Republican or Democrat, you are going to have to sell. Your accountant is going to say if you don’t sell, you going to pay twice or three times as much in taxes next year. So, they can create a serious, serious collapse in the world economy. This is in addition to all this Covid nonsense that they have created.”

Armstrong has been saying for months that deflation would be the overarching theme in the economy. Is that going to continue or has there been a change? Armstrong says, “Deflation is now over. People have to understand. It has nothing to do with the supply of money. . . . If you don’t see a bright rosy future, what do you do? You save your money. . . . One of the number one selling objects in Europe is a safe. People are storing cash. Biden was the straw that broke the camel’s back. People are now seeing that things are going to cost more in the future than they do today. They have also created shortages because of these lockdowns. The inflation is just beginning to start now. It’s based on shortages, and it will continue going into about 2024.”

The bottom line on the cause of inflation, according to Armstrong, is “a loss of confidence in government.” Armstrong also predicts, “We are looking at the prospect of a serious war between 2025 and 2027. All this is completely because of this great reset nonsense. They have been using the Corona Virus as an excuse to try and shut down the economy. If you look at rents in New York City, they are in a freefall. Real estate is going crazy outside of the urban centers. In Florida, what was a $500,000 house last year is now more than $1 million.” On Trump, Armstrong says, “I don’t see him returning to office before 2024.” But, if massive ballot fraud is proven with the Arizona audit going on right now, Armstrong predicts, “The state legislature can recall a Senator” who won by election rigging.

“There’s no Heimlich maneuver for a nation choking on debt.”

• Rudderless, Leaderless, and Drifting (Kunstler)

The numbers are already pretty grim: 70 percent of Republicans and 30 percent of Democrats say they doubt the veracity of the 2020 election. Will the discovery that massive, widespread election fraud actually occurred lead to a constitutional crisis? How will Joe Biden survive in office if a growing percentage of the public sees him as illegitimate? And what might happen if the establishment attempts to blow the whole matter off? Can they still say “nothing to see” when the public has seen so much that they can’t unsee? None of that will happen in a vacuum. Plenty of other events are roiling in the background with the potential to go critical.

Joe Biden’s proposals to jack the US economy by $5-plus-trillion won’t be very good for the credibility of the US dollar, with other countries already eager to dissociate themselves from dollar-based global trade payment arrangements. But that’s just financial esoterica compared to what’s happening on-the-ground across America, with households running on debt and back payments for rent and mortgages piling up, and landlords and banks taking the hit in the meantime. There’s no Heimlich maneuver for a nation choking on debt. And that plan to become the Big Rock Candy Mountain, where they hung the jerk who invented work, is liable to disappoint even the mesmerists in the Bureau of Labor Statistics.

If you don’t allow markets to function, they cannot be efficient, either.

• The Myth of “Efficient Markets” (Rickards)

Mainstream economists have insisted for decades that markets are highly efficient, and they do a nearly perfect job of digesting available information and correctly pricing assets today to take account of future events based on that information. In fact, nothing could be further from the truth. Markets do offer valuable information to analysts, but they are far from efficient. Markets can be rational or irrational. Markets can be volatile, irrationally exuberant, or in a complete state of panic depending upon the emotions of investors, herd behavior, and the specific array of preferences when a new shock emerges. If markets were so efficient, why was Wall Street surprised when it was obvious to anyone paying attention that Biden was going to raise the capital gains tax?

The capital gains tax increase information had been there for all to see for six months, but it took a press release to get Wall Street to sit up and take notice. It should have been priced in long before, and the announcement just would have confirmed market expectations. So the next time you hear about efficient markets, take it with a large grain of salt. But my forecast from six months ago was wrong in one respect. I said the tax rate on capital gains would almost double from 20% to 39.6%. It turns out the rate will actually be 43.4% once a 3.8% investment income surtax is added on top. That surtax is a holdover from Obamacare.

If one were to add state and local income taxes, the combined rate on capital gains could exceed 50%, depending on the jurisdiction. Of course, capital gains taxes are imposed on investments you make from after-tax dollars, so even the initial investment has already been taxed. And the corporations whose stock you buy pay corporate income tax too. When those burdens are included, you’re lucky to get even 25% of your gains back net of taxes. This will be a headwind to stock markets for the foreseeable future.

“The US company could be slapped with fines of as much as 10% of its global turnover.”

• EU Charges Apple With Breach Of Competition Law (DW)

EU antitrust regulators on Friday charged Apple with illegally distorting competition in the music-streaming market through restrictive App Store rules. It is one of the biggest-ever competition cases against the US tech giant and could lead to hefty fines. An Apple spokesperson rejected the accusations, saying the EU’s case was “the opposite of fair competition.” The charges follow an EU investigation stemming from a complaint by the popular music-streaming service Spotify. “Our preliminary conclusion: Apple is in breach of EU competition law,” EU Competition Commissioner Margrethe Vestager said in a statement.

The European Commission, the EU’s executive arm, said Apple’s App Store rules force rival developers to use its in-app payment system — which charges up to 30% commission — and prevent them from informing users of cheaper payment methods. Vestager said this ultimately raised the cost for consumers and limited their choice. “By setting strict rules on the App Store that disadvantage competing music streaming services, Apple deprives users of cheaper music streaming choices and distorts competition,” the commissioner’s statement said. “This is done by charging high commission fees on each transaction in the App Store for rivals and by forbidding them from informing their customers of alternative subscription options.”

This is the first EU antitrust charge targeting Apple. It follows an investigation by the bloc, launched in June, which found that the App Store commission fees are passed on to consumers. The probe was launched after Swedish music streaming app Spotify, which competes with Apple Music, lodged a complaint about the company’s rules two years ago. The European Commission said Apple now has the chance to respond to the allegations and present its case in a hearing before a final ruling is handed down. The US company could be slapped with fines of as much as 10% of its global turnover.

Biden’s Promise: Moratorium on deportations for the first 100 days of his administration.

Biden’s Reality: Over 300,000 deported in 3 months.

• First 100 Days: 300,000 Deportations (CD)

Rights group United We Dream warned Tuesday that unless he takes immediate steps to improve his administration’s treatment of immigrants, President Joe Biden is at serious risk of repeating the destructive failures of former President Barack Obama, who deported roughly three million people during his eight years in office. Despite Biden’s characterization of Obama’s mass deportations as a “mistake” and pledge to usher in a more humane immigration system, United We Dream estimates that the administration has deported just over 300,000 people since January—largely using a Trump-era policy called Title 42.

The policy was first issued by the Centers for Disease Control and Prevention (CDC) last March—at the start of the coronavirus pandemic—and has been kept in place by the Biden administration. As Human Rights Watch (HRW) explained earlier this month, “The Title 42 expulsion policy has effectively closed the U.S. border to nearly all asylum seekers based on the misapplication of an obscure, 75-year-old public health law.” “That law, the Public Health Service Act of 1944, was designed to confer quarantine authority to health authorities that would apply to everyone, including U.S. citizens, arriving from a foreign country,” HRW noted. “Quarantine authority was never meant to be used to determine which noncitizens could or couldn’t be expelled or removed from the U.S.”

In a statement on Monday, Cynthia Garcia of United We Dream stressed that “Title 42 was designed under one of the most anti-immigrant administrations in modern history.” “President Biden and the Department of Homeland Security must be reminded that their inaction to protect vulnerable immigrant communities seeking refuge in the U.S. is not only putting lives on the line; it upholds a white nationalist immigration system that seeks to expel and keep Black and brown immigrants out at any cost,” said Garcia, who voiced dismay at the Biden administration’s deportation of vulnerable Haitians and others.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

Support the Automatic Earth in virustime. Click at the top of the sidebars to donate with Paypal and Patreon.