Salvador Dali The Feeling of Becoming 1931

“..almost one-third of these delinquent owners had not paid the mortgage for at least five years..”

• Bubble-Era Home Mortgages Are A Disaster Waiting To Happen (Jurow)

Remember all those sub-prime mortgages that blew up in 2007 and popped the housing bubble? The widely-held consensus is that millions of them were foreclosed as housing markets cratered. [..] The truth is these mortgages are still dangerous and could soon undermine the housing recovery. Collectively, loans from the bubble period that were not guaranteed by Fannie Mae or Freddie Mac were called non-agency securitized mortgages. Researcher Black Box Logic had an enormous database of non-agency loans until it was sold to Moody’s three years ago. At the peak of the buying madness — November 2007 — its database showed 10.6 million loans outstanding with a total balance of $2.43 trillion.

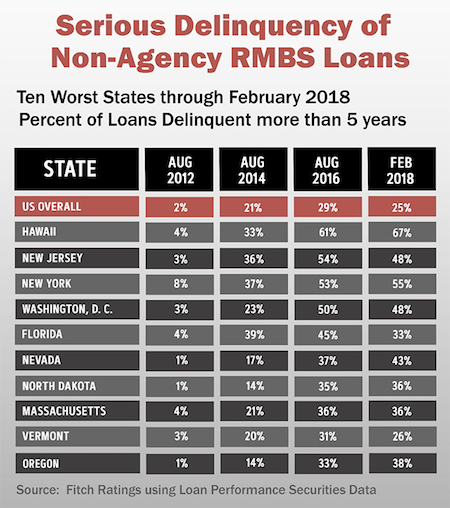

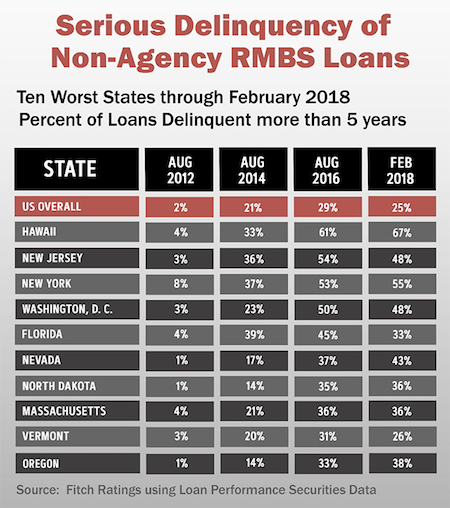

In 2016, Fitch Ratings first published a spreadsheet showing what percentage of these loans had been delinquent for more than three-, four-, or five years. Here is an updated table showing the 10-worst states and how the number of deadbeat borrowers has soared.

In 2012, just 2% of all these delinquent borrowers had not paid for more than five years. Two years later that number had skyrocketed to 21%. Why? Mortgage servicers around the country had discontinued foreclosing on millions of delinquent properties. Homeowners got wind of this and realized they could probably stop making payments without any consequences whatsoever. So they did. Take a good look at the figures for 2016. Nationwide, almost one-third of these delinquent owners had not paid the mortgage for at least five years.

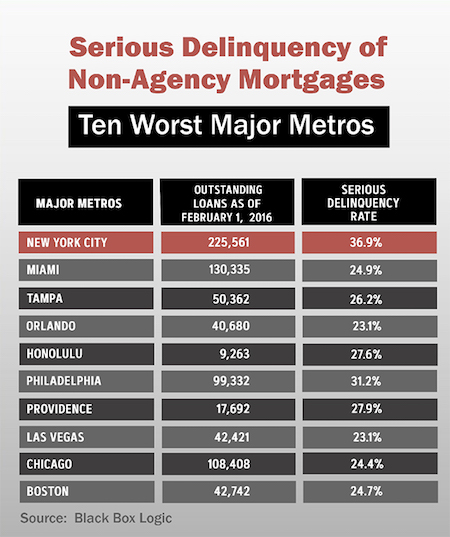

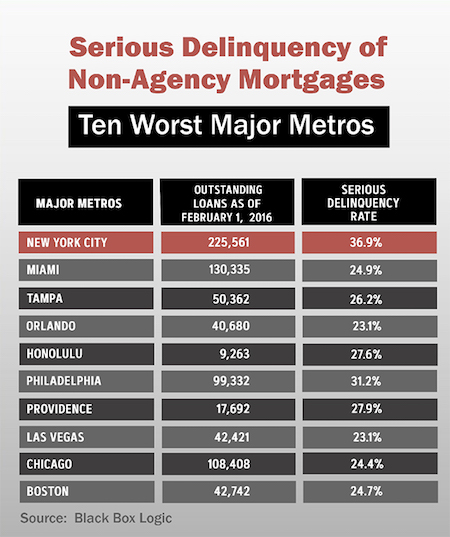

In the worst four states, more than half of them were long-term deadbeats. Notice also that four of the other states were those you would not expect to have this rampant delinquency — North Dakota, Massachusetts, Vermont, and Maryland. Another way to gauge the extent of the problem is to look at the major metros with the highest delinquency rate. Here is a table of the 10 metros with the worst delinquency rate in early 2016, taken from Black Box Logic’s database.

Within the last two years, important graphs and tables showing the extent of the delinquency mess have disappeared from reports issued regularly by Fannie Mae, mutual fund provider TCW, and data provider Black Knight Financial Services. According to a TCW spokesperson, the graph is no longer published in the firm’s Mortgage Market Monitor because there did not seem to be much demand for it. Really? This graph had appeared in their report for years and showed the extremely high percentage of modified non-agency loans where the borrower had re-defaulted. Meanwhile, the omitted Fannie Mae table also showed the rising percentage of modified Fannie Mae loans that had re-defaulted. Its last published table showed re-default rates of almost 40%. Do you think these important omissions are just coincidence?

Read more …

25% in 2019 alone?!

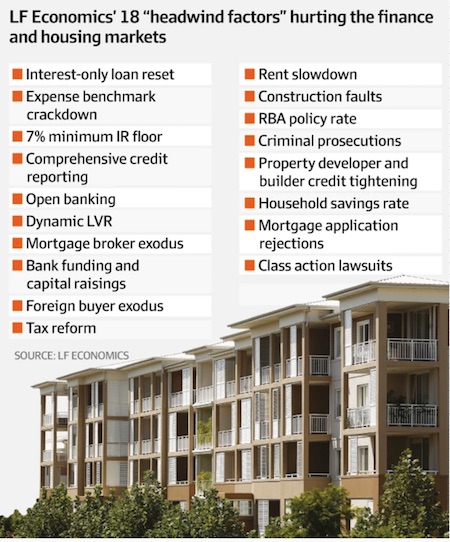

• 18 Reasons Why Australian Property Prices Will Fall Further (AFR)

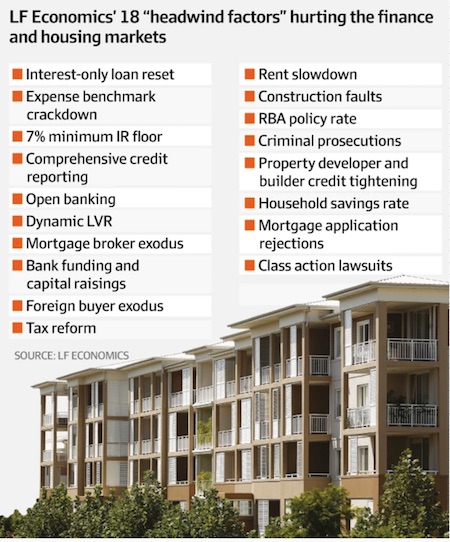

The housing market has taken a turn for the worse moving deeper into the decline of a debt-financed asset bubble, possibly driving house prices to fall by as much as 25 per cent in 2019 on nominal terms, according to housing bear and analyst LF Economics. The group made up of Lindsay David and Philip Soos, who have authored books on boom and bust in housing markets, lists 18 factors that are putting extreme pressure on the Sydney and Melbourne markets. Their baseline prediction is a 15 per cent to 20 per cent fall in prices just in 2019 although 25 per cent is possible.

One of the main factors driving the pressure is $120 billion worth of interest-only loans that are transitioning to principal and interest loans between now and 2021. “Banks and regulators have already softened their stance on these borrowers, allowing some greater time to sell or extending the interest-only period ,” LF Economics said in a new report “Let The Bloodbath Begin”. “Nevertheless, with debt repayments rising anywhere between 20 [per cent] to 50 per cent upon conversion, many recent borrowers will be placed under considerable financial stress.”

Read more …

Question: how are the shadow banks linked to international trade?

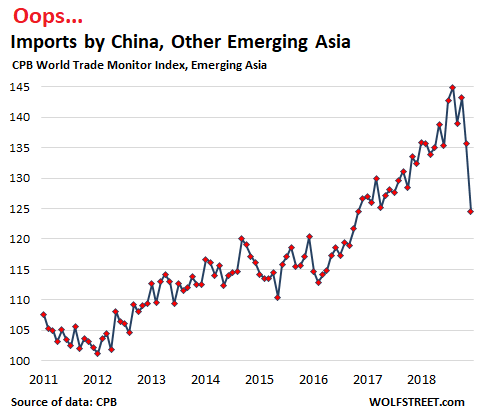

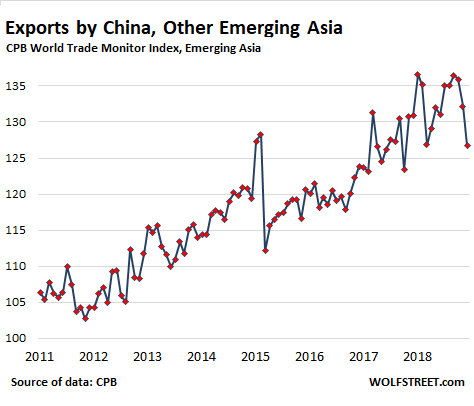

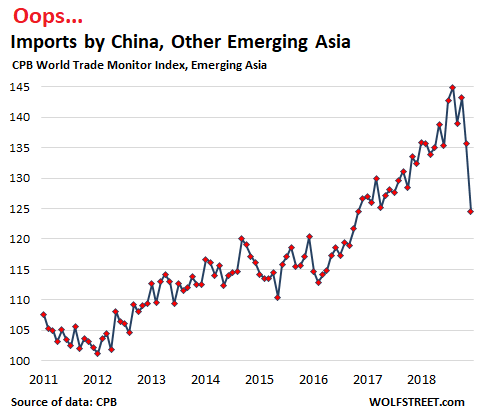

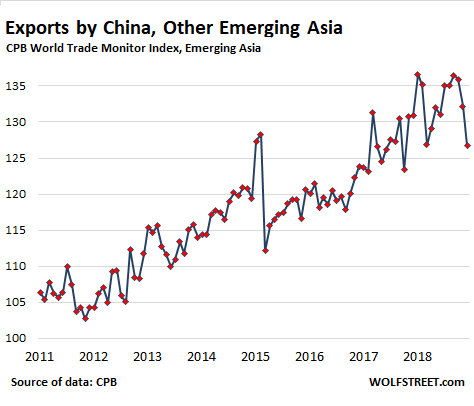

• Imports by China, Emerging Asia Plunge Most Since 2008 (WS)

Imports by China and other emerging Asian economies in December plunged to the lowest level in two years, in the steepest one-month plunge since 2008, after having already plunged in November, according to the Merchandise World Trade Monitor, released on Monday by CPB Netherlands Bureau for Economic Policy Analysis, a division of the Ministry of Economic Affairs. For November and December combined, imports by China and other Emerging Asian Economies plunged 13%, the steepest two-month plunge since November and December 2008 (-18%). In point terms, it was the largest plunge in the data going back to 2000. “Emerging Asia” includes China, Hong Kong, India, South Korea, Indonesia, Malaysia, Taiwan, Thailand, the Philippines, Pakistan, and Singapore. But China is by far the largest economy in the group, and by far the largest importer in the group.

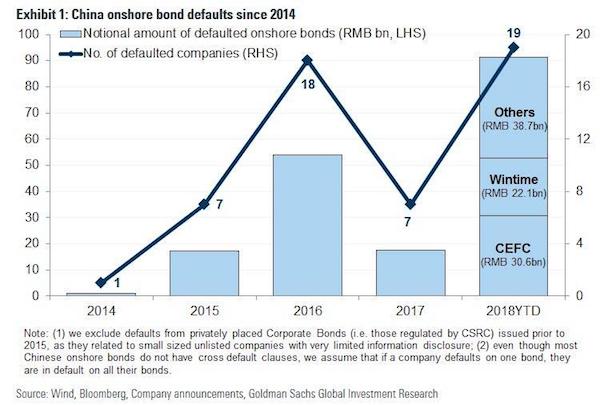

The fact that imports into Emerging Asia are plunging is a sign of suddenly and sharply weakening demand in China. This type of abrupt demand-downturn was clearly visible in the double-digit plunge in new-vehicle sales in China over the last four months of 2018, plunging demand in many other sectors in China, and record defaults by Chinese companies. When it comes to China, “plunge is no longer an exaggeration. So the US trade actions against China – the variously implemented, threatened, or delayed tariffs – was largely geared toward hitting exports by China to the US. But it was imports that plunged! Exports from Emerging Asia too dropped in November and December, but not nearly as brutally as imports, down by 6.7% over the two months combined. And these drops were not all that unusual in the export index:

Read more …

Xi has lost control. There are reports about him being replaced, but that would be way into the future, if it happens.

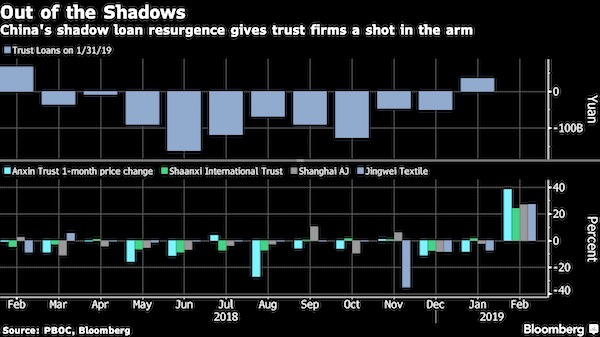

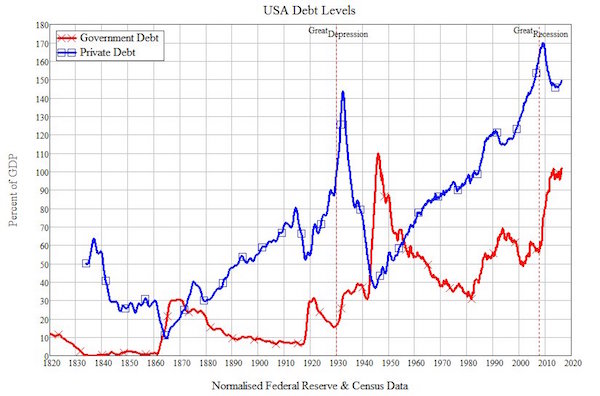

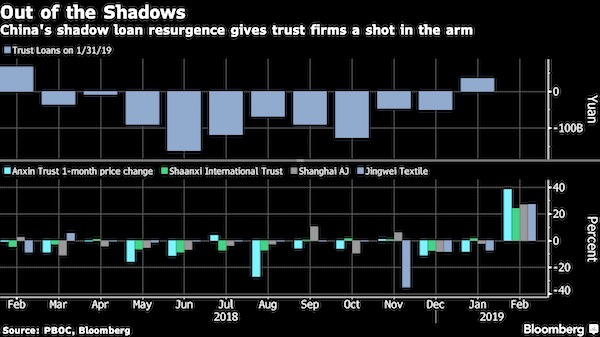

• Debt Roars Back in China, Deleveraging Is Dead (BBG)

For almost two years, the question has lingered over China’s market-roiling crackdown on financial leverage: How much pain can the country’s policy makers stomach? Evidence is mounting that their limit has been reached. From bank loans to trust-product issuance to margin-trading accounts at stock brokerages, leverage in China is rising nearly everywhere you look. While seasonal effects explain some of the gains, analysts say the trend has staying power as authorities shift their focus from containing the nation’s $34 trillion debt pile to shoring up the weakest economic expansion since 2009.

The government’s evolving stance was underscored by President Xi Jinping’s call for stable growth late last week, while on Monday the banking regulator said the deleveraging push had reached its target. “Deleveraging is dead,” said Alicia Garcia Herrero, chief Asia Pacific economist at Natixis in Hong Kong. Investors reacted positively to the official remarks, with the more than 30 brokerages listed in Shanghai and Shenzhen up by the 10 percent daily limit on Monday, according to data compiled by Bloomberg. Industrial & Commercial Bank of China Ltd., the world’s biggest lender by assets, rose 6.3 percent.

[..] China’s overall leverage ratio stood at 243.7 percent at the end of 2018, with corporate debt reaching 154 percent, household borrowings at 53 percent and government leverage at 37 percent, according to Zhang Xiaojing, deputy head of the Institute of Economics at the Chinese Academy of Social Sciences. Before that, the nation’s leverage ratio climbed at an average 12 percentage points each year between 2008 and 2016. China’s total debt will rise relative to GDPthis year, after a flat 2017 and a decline in 2018, Wang Tao, head of China economic research at UBS in Hong Kong, predicted in a report this month. While Wang cautioned that “re-leveraging” may increase concerns about China’s commitment to ensuring financial stability, investors have so far cheered the prospect of easier credit conditions.

Read more …

The shadows reign supreme in China.

“..a rally that added more than $1 trillion to stock values since the start of 2019.”

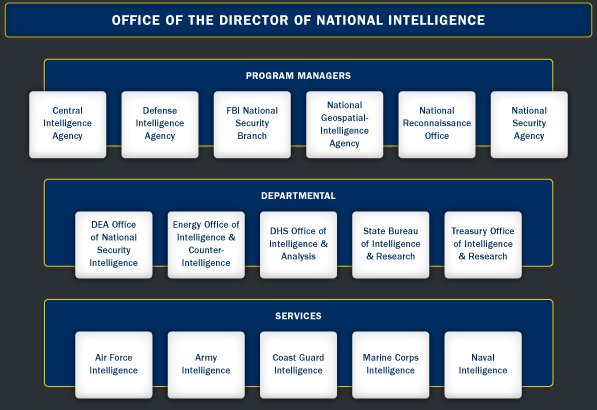

• With 10-to-1 Leverage, Shadow Banks Fuel China’s Huge Stock Boom (BBG)

Eager to pile into the world’s most-volatile major stock market with 10-to-1 leverage? China’s shadow bankers are happy to help – and that has the nation’s policy makers worried. Just hours after China’s CSI 300 Index notched a 6 percent surge on Monday, its biggest gain in more than three years, the country’s securities regulator warned of a rise in unregulated margin debt and asked brokerages to increase monitoring for abnormal trades. The China Securities Regulatory Commission’s statement followed a pickup in advertising by margin-finance platforms, which operate with little to no supervision and offer far more leverage than the country’s regulated securities firms.

While margin debt in China is much lower today than when it helped precipitate a market collapse in 2015, investors are taking on leverage quickly as they chase a rally that added more than $1 trillion to stock values since the start of 2019. The risk is that a sudden reversal would force leveraged traders to sell, exacerbating volatility in a market that posted bigger swings than any of its peers over the past 30 days. That prospect may unnerve Chinese policy makers, who have a history of trying to protect the nation’s 147 million individual investors from outsized losses. “If the market continues to go up, the situation will get worse and so will the risks,” said Yang Hai, an analyst at Kaiyuan Securities Co. in Shanghai. “Under the current regulatory scope, investors have to shoulder risks themselves.”

Read more …

Finally someone talks to Volcker and he doesn’t say anything.

• Paul Volcker Is Worried About the ‘Culture of the Financial System’ (Fortune)

Former Federal Reserve chairman Paul Volcker has some serious fears about the banking industry. And he believes supporting regulators to combat those fears is imperative. Speaking to analyst Mike Mayo in a CFA Enterprising Investor interview published on Monday, Volcker said that he’s “concerned” about the current “culture of the financial system, banking in particular.” He told Mayo that banks have been dominated by “how much profit the firm (and you) make.” And he believes that the focus on profitability could ultimately affect corporate oversight. “What’s the role of directors in keeping culture under control?” he asked. “Can the directors of a big bank really do an effective job of overseeing an institution? Or do they see their job as protecting the CEO who they appointed?

Or maybe the CEO appointed them, so there is a certain amount of built in mutual interest in ducking emphasis on internal controls.” Volcker, who served as Fed chairman during the Carter and Reagan administrations, has been one of the more vocal supporters of controlling and regulating banks. He’s the namesake for the Volcker Rule, which aims at limiting banking activity and bank interaction with hedge funds and private equity funds. It also puts the onus on banks to protect customers. In his interview with Mayo, Volcker talked about the importance of banks protecting their customers. He said that a right and good banking culture is one where “the customer comes first.” The issue, however, is that banks sometimes fail in doing that, Volcker said.

Read more …

No kidding.

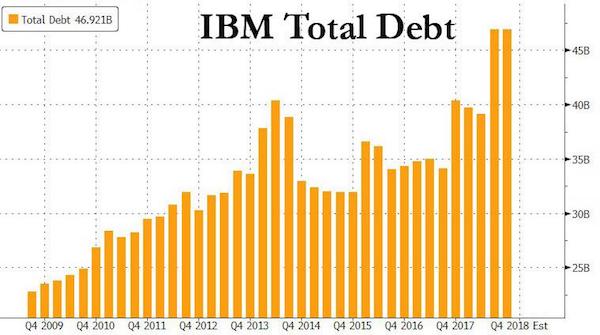

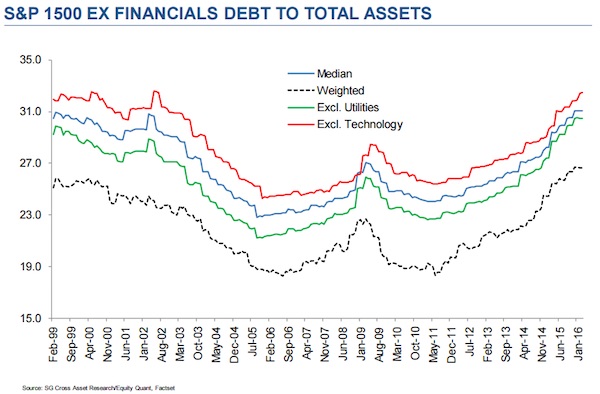

• Rising Level Of Corporate Debt A Risk To Global Economy – OECD

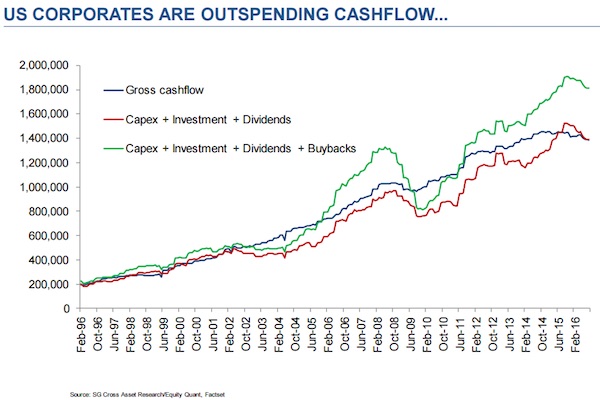

The global economy faces escalating risks from rising levels of corporate debt, with companies around the world needing to repay or refinance as much as $4tn (£3.1tn) over the next three years, according to the OECD. Sounding the alarm over the scale of the debt mountain built up over the past decade since the last financial crisis, the Paris-based Organisation for Economic Co-operation and Development found that global company borrowing has ballooned to reach $13tn by the end of last year – more than double the level before the 2008 crash. Nearly the equivalent of the entire US Federal Reserve balance sheet – roughly $4tn – will need to be repaid or refinanced over the coming years, the report said. However, the task is complicated by cooling economic growth from trade tensions and a slower rate of expansion in China ..

Financial market investors have grown increasingly concerned that high debt levels in the US could turn a looming slowdown for the world’s largest economy into a full-blown recession. High debt levels in several other nations as the Federal Reserve raises interest rates has also rattled financial markets in recent months. According to research from the Economist Intelligence Unit, a potential meltdown in the US bond market is the second biggest risk to the world economy after the US-China trade standoff, amid a combination of global economic headwinds “more wide-ranging and complex than at any point since the great recession”. The IMF has previously warned of gathering “storm clouds” for the world economy, including from trade tensions and heightened levels of debt – particularly in China.

Read more …

.. since 1999, Germans on average cumulatively richer by $26,120. Italians poorer by $84,000.

• Germany & Netherlands The Only Real Euro Winners (RT)

The eurozone’s single currency, the euro, has been a serious drag on the economic growth of almost every member of the bloc, according to a study by German think tank, the Centre for European Politics (CEP).

Germany and the Netherlands, however, have benefited enormously from the euro over the 20 years since its launch, the study showed. The currency triggered credit and investment booms by extending the benefits of Germany’s low interest-rate environment across the bloc’s periphery. However, those debts became hard to sustain after the 2008 financial crisis, with Greece, Ireland, Spain, Portugal and Cyprus forced to seek financial aid as growth slowed and financing became scarce.

According to CEP, over the entire period since 1999, Germans were on average estimated to be cumulatively richer by €23,000 ($26,120) than they would otherwise have been, while the Dutch were €21,000 ($23,850) wealthier. To compare, Italians and French were each €74,000 ($84,000) and €56,000 ($63,600) poorer, respectively. The survey did not include one of Europe’s fastest-growing economies, Ireland, due to a lack of appropriate data. [..] In the first few years after its introduction, Greece gained hugely from the euro but since 2011 has suffered enormous losses,” the authors wrote, explaining that over the whole period, Greeks were each €190 ($216) richer than they would have been.

The study concluded that since the loser countries could no longer restore their competitiveness by devaluing their currencies, they had to double down on structural reforms. Spain was highlighted as a country that was on track to erase the growth deficit it had built up since the euro’s introduction. “Since 2011, euro accession has resulted in a reduction in prosperity. Losses reached their peak in 2014. Since then, they have been falling steadily,” said the report, adding: “The reforms that have been carried out, are paying off.”

Read more …

Corbyn should have been much more concerned about his credibility. This late in the game, does it even matter anymore?

• Jeremy Corbyn: We’ll Back A Second Referendum To Stop Tory No-Deal Brexit (G.)

Jeremy Corbyn has finally thrown his party’s weight behind a second EU referendum, backing moves for a fresh poll with remain on the ballot paper if Labour should fail to get its own version of a Brexit deal passed this week. The decision to give the party’s backing to a second referendum follows a concerted push by the shadow Brexit secretary, Sir Keir Starmer, and deputy leader, Tom Watson, who fear any further delay could have led to more defections to the breakaway Independent Group (TIG), whose members all back a second referendum. Although the move has delighted MPs who are backing the People’s Vote campaign, Corbyn is likely to face determined opposition from dozens of MPs in leave seats if the party whips to back a second referendum, including a significant number of frontbenchers.

The former shadow minister Lucy Powell said she believed at least 25 MPs would vote against any whip to back a second referendum, meaning that it would face an uphill struggle to pass the Commons without significant Conservative support. A private briefing sent to Labour MPs on Monday night and seen by the Guardian makes it clear that Labour’s policy would be to include remain as an option in any future referendum. “We’ve always said that any referendum would need to have a credible leave option and remain,” the briefing said. “Obviously at this stage that is yet to be decided and would have to be agreed by parliament.”

The briefing also makes it clear that the party would not support no deal being included on the ballot paper. “There’s no majority for a no-deal outcome and Labour would not countenance supporting no deal as an option,” the briefing says. “What we are calling for is a referendum to confirm a Brexit deal, not to proceed to no deal.”

https://twitter.com/i/status/1100294356706168832

Read more …

No matter how big the political mess,

• UK and US Agree Post-Brexit Derivatives Trading Deal (G.)

The US has lent its backing to Britain to protect the City from losing trillions of pounds of complex financial derivatives business after Brexit, warding off a potential banking industry land grab by the EU. In a joint announcement heralded as a sign of the special relationship between the UK and the US, the two countries said they would take every step to ensure the continued trading of derivatives across the Atlantic under every Brexit eventuality. Derivatives are financial contracts widely used by companies to manage risks, ranging from hedging against changes in central bank interest rates to fluctuations in commodity prices. Brexit threatens to unpick trading in the UK, even with the US, as City banks currently operate under EU rules while Britain is a member of the bloc.

Under the steps announced by the Bank of England, the Financial Conduct Authority and the US Commodity Futures Trading Commission, firms working in the US and the UK will continue to meet the requirements required to operate in both countries, even if Britain leaves the EU without a deal. London and New York sit at the centre of the world’s multitrillion-pound derivatives market, with the US and the UK controlling 80% of the $594tn (£454tn) a year business – worth more than five times world GDP. About a third of the £230tn of derivatives contracts traded in the UK every year come from US companies, more than any other jurisdiction. The development comes as Brussels prepares rules that would force clearing houses – financial institutions key to the trading of derivatives – outside the EU to come under the supervision of its regulators.

Read more …

This is getting awfully close to class justice. Monsanto has hundreds of the top lawyers, and what do the plaintiffs have?

• Judge Threatens To ‘Shut Down’ Cancer Patient’s Lawyer in Monsanto Case (G.)

Monsanto is facing its first federal trial over allegations that its Roundup weedkiller causes cancer, but a US judge has blocked attorneys from discussing the corporation’s alleged manipulation of science. In an extraordinary move in a packed San Francisco courtroom on Monday, US judge Vince Chhabria threatened to sanction and “shut down” a cancer patient’s attorney for violating his ban on talking about Monsanto’s influence on government regulators and cancer research. “You’ve completely disregarded the limitations that were set upon you,” the visibly angry judge said to attorney Aimee Wagstaff, threatening to prevent her from continuing. “If you cross the line one more time … your opening statement will be over … If I see a single inappropriate thing on those slides, I’m shutting you down.”

The unusual conflict in the federal courtroom has fueled concerns among Monsanto’s critics that the trial may be unfairly stacked against the plaintiff, Edwin Hardeman, a 70-year-old Santa Rosa man who alleges that his exposure to Roundup over several decades caused his cancer. Building on longstanding allegations, Hardeman’s lawyers and other critics have argued that Monsanto has for years suppressed negative studies and worked to promote and “ghostwrite” favorable studies about its herbicide to influence the public and regulators.

In a blow to the plaintiffs, Chhabria this year approved Monsanto’s request to prohibit Hardeman’s attorneys from raising allegations about the corporation’s conduct, saying issues about its influence on science and government were a “significant … distraction”. That means jurors must narrowly consider the studies surrounding Roundup’s cancer risks, and if they rule that Monsanto caused Hardeman’s illness, then in a second phase the jury would learn about the company’s conduct when assessing liability and punitive damages.

[..] Wagstaff told the Guardian last week before trial began that the limitations on evidence in the first phase meant the “jury will only hear half of the story”. “The jury will hear about the science, but they won’t get to hear about how Monsanto influenced it,” she said. “The jury won’t have a complete understanding of the science. If we win without the jury knowing the complete science, that’s a real problem for Monsanto.” Chhabria repeatedly interrupted Wagstaff’s opening statement Monday morning, reminding jurors that her comments did not constitute evidence and should be taken with a “grain of salt”. He also asked her to speed up when she was introducing Hardeman and his wife and discussing how they first met in 1975.

Wagstaff spoke in detail about the research on cancer and glyphosate, about some of Monsanto’s involvement in studies, and about the company’s communications with the Environmental Protection Agency. [..] The restrictions on testimony about Monsanto’s conduct and alleged manipulation of science is likely to be a major detriment to Hardeman and future plaintiffs, said Jean M Eggen, professor emerita at Widener University Delaware Law School. “It was a brilliant move on the part of the defendant Bayer to try to keep [out] all of that information,” she said. “And it may pay off for them.”

Read more …

We paved paradise. Which is a much wider and bigger issue than just a climate one.

• Concrete Is Tipping Us Into Climate Catastrophe. It’s Payback Time (Vidal)

Because of the heat needed to decompose rock and the natural chemical processes involved in making cement, every tonne made releases one tonne of C02, the main greenhouse warming gas. Including the new Crossrail line through London, the building of Britain’s four largest current construction projects will, if completed, together emit more than 10m tonnes of CO2 – roughly the same amount as a city the size of Birmingham, or what 19 million Malawians emit in a year. Nearly 6% of all UK greenhouse gas emissions, and up to 8% of the world’s, are now sourced from cement production. If it were a country, the cement industry would be the third largest in the world, its emissions behind only China and the US.

So great is its carbon footprint that unless it is transformed and made to adopt cleaner practices, the industry could, on its own, jeopardise the whole 2015 Paris agreement which aims to hold worldwide temperatures to a 2C increase. To bring it into line, the UN says its annual emissions need to fall about 16% in the next 10 years, and by far more in the future. While some of the biggest cement companies have reduced the carbon intensity of their products by investing in more fuel-efficient kilns, most improvements gained have been overshadowed by the massive increase in global cement and concrete production. Population increases, the urban explosion in Asia and Africa, the need to build dams, roads and houses, as well as increases in personal wealth have stoked demand.

Read more …