Edouard Vuillard The two sisters 1899

Get the parties involved around a table before people get killed.

• Hong Kong Protesters Plan To Disrupt Airport After Night Of Chaos (R.)

Pro-democracy demonstrators planned on Sunday to choke travel routes to Hong Kong’s international airport after a chaotic night of running battles between police and masked protesters, the latest wave of unrest to hit the Chinese-ruled city. Protest organizers have urged the public to overwhelm road and rail links to the airport, one of the world’s busiest, on Sunday and Monday, potentially disrupting flights. People would begin gathering at 1 p.m. (0500 GMT), protest groups said. The airport closed one of its car parks and advised passengers to use public transport, without giving a reason.

A similar so-called “stress test” of the airport last weekend failed to gain momentum. Three weeks ago, some flights were delayed or canceled after protesters swarmed the airport. Late on Saturday and into the early hours, police fired tear gas, water cannon and rubber bullets and protesters threw petrol bombs, escalating clashes that have plunged the Asian financial center into its worst political crisis in decades. As government helicopters hovered overhead, protesters who had been banned from demonstrating set fires in the streets and threw bricks at police near government offices and Chinese military headquarters.

Officers fired two warning shots in the air to scare off a group of protesters who had them surrounded and were trying to steal their pistols, the police said, only the second time live rounds have been used in more than three months of unrest. Police sprayed demonstrators with blue-dyed water to make it easier to identify them later. Parts of the metro system ground to a halt as skirmishes spread to the subway, with television showing images of people being beaten as they cowered on the floor behind umbrellas. Police said they arrested 40 people inside Prince Edward metro station on suspicion of obstructing officers, unlawful assembly and criminal damage. Three stations stayed shut on Sunday.

“..the eight-word British constitution established in 1689 – What The Crown Assents In Parliament Is Law – is a decaying, time-worn construct on which to protect and advance today’s democracy..”

• The Sheer Scale Of The Crisis Facing Britain’s Decrepit Constitution (O.)

To prorogue parliament for no better reason than to avoid parliamentary scrutiny of a no-deal Brexit may have been an intolerable abuse of power, and an affront to democracy, but in Britain it is constitutionally possible. As a result, for all the threats of judicial review and court actions, it will be difficult, if not impossible, to challenge. For the prime minister controls everything, from the business of the House of Commons to the ability to prorogue it. He or she is lent monarchial sovereignty, the same sovereignty that Charles 1 tried to justify because the monarch was supposedly God’s representative on Earth: the divine right of kings, now transmuted into the divine right of Boris.

Part of the-then cleverness of the 17th-century deal was that it co-opted the crown into being the above-the-fray, holder-of-the-ring of proper parliamentary procedure and process. But today, that capacity has evaporated. So when Jacob Rees-Mogg travelled to Balmoral last week to ask the Queen to prorogue parliament, there was virtually no prospect of her refusing – as an elected head of state might have done. She did have the option of saying that on such a controversial use of prerogative power she wanted to go beyond the minimum quorate of three for a privy council meeting (the chief whip and leader of the House of Lords accompanied Rees-Mogg on a separate plane to Balmoral to avoid suspicion) and call for a full meeting including former ministers from other parties, purportedly the constitutional forum to advise her on use of the royal prerogative.

But that would have been seen as a political act. She folded. Exposed as a constitutional cipher, the case for an elected head of state has suddenly become unanswerable. It is but one of the many constitutional earthquakes triggered by Brexit whose aftershocks will be felt for decades. Even the character of the referendum itself is testament to our lack of a constitution. No super-majority was required for this fundamental change in Britain’s relationship with Europe, any more than it was for the Scottish referendum: amazingly, a 42-year and a 300-year union could be ripped apart by a majority of one citizen’s vote.

It is a peculiar chain of events no matter what you think of it.

• How A Secret Plan To Close Parliament Sparked Uproar Across Britain (O.)

For much of August the plan to shut down parliament for five weeks was kept a very tight secret at the heart of government. For the few Whitehall officials who were made aware of it early on, however, it was not difficult to decipher whose fingerprints were all over it. It was clear to that small group that the bombshell idea had been hatched by Boris Johnson’s closest adviser, Dominic Cummings, and No 10’s director of legislative affairs, Nikki da Costa. Cummings has long been known at Westminster for his disdain for Whitehall and the way the entire system of British government works. He doesn’t mince his words or tolerate those he regards as fools. “If he meets resistance from ministers or officials he will just tell them to fuck off, whoever they are,” said one Whitehall source, who has worked with him.

[..] Last Friday an email between a Whitehall official and No 10 was leaked to this newspaper. It made clear that Johnson had approached Cox for advice on a five-week suspension from around 9 September to 14 October. Cox’s initial view, the correspondence made clear, was that it would probably be legal, unless various court actions being planned by Remainers to block prorogation were successful. Downing Street’s official response when asked about the leak was, at first, muted. “No 10 officials ask for legal and policy advice every day,” said a government source.

But when the Observer story broke last Saturday evening, as Johnson and his team were in Biarritz for the G7 summit preparing for meetings with US president Donald Trump and EU council president Donald Tusk the next day, Downing Street changed tack and tried to dismiss the story in a way that was to backfire spectacularly. Johnson’s press team issued a statement saying that “the claim that the government is considering proroguing parliament in September in order to stop MPs debating Brexit is entirely false”. It did not deny that the attorney general had been consulted about prorogation but its intent was clear: to create the impression that shutting down parliament was not going to happen.

But less than 72 hours later more leaks were to follow from people inside the government machine to media organisations saying that the prime minister was to make an announcement about prorogation on Wednesday morning. After the BBC got wind of the new leaks, some senior staff were initially dubious that they were genuine, given No 10’s previous denials. When Johnson announced the exact same plan on which his team had poured buckets of cold water four days earlier, large sections of the media, as well as MPs and much of the country, were understandably furious.

Johnson is just a figurehead.

• British PM Johnson Challenges Lawmakers To Deliver Brexit (R.)

British Prime Minister Boris Johnson challenged lawmakers to deliver on the Brexit vote and not thwart his plans to take Britain out of the European Union on October 31. Johnson has pledged to deliver Brexit with or without a deal, but opposition lawmakers – and several lawmakers from Johnson’s Conservatives – want to act to rule out a no deal Brexit when parliament returns from recess on Tuesday. Previous votes have indicated a majority in parliament opposing a no-deal Brexit, but in a newspaper interview, Johnson said that backing opposition Labour leader Jeremy Corbyn risked there being no Brexit at all.

“The fundamental choice is this: are you going to side with Jeremy Corbyn and those who want to cancel the referendum? Are you going to side with those who want to scrub the democratic verdict of the people — and plunge this country into chaos?,” Johnson told the Sunday Times. “Or are you going to side with those of us who want to get on, deliver on the mandate of the people and focus with absolute, laser-like precision on the domestic agenda? That’s the choice.”

He’s seen enough.

• EU’s Barnier Not Optimistic About Avoiding A No-Deal Brexit (R.)

The European Union’s top Brexit negotiator Michel Barnier said he was not optimistic about avoiding a no-deal scenario as the EU could not meet Britain’s demands that the backstop for the Irish border is removed from the withdrawal agreement. Writing in the Sunday Telegraph, Barnier said that the so-called “backstop” had to stay to protect the integrity of the EU’s single market while ensuring an open border on the island of Ireland. “I am not optimistic about avoiding a no-deal scenario, but we should all continue to work with determination,” Barnier said, according to extracts of his article on the newspaper’s front page.

“The backstop is the maximum amount of flexibility that the EU can offer to a non-member state.” Prime Minister Boris Johnson has vowed to take Britain out of the EU with or without a deal on October 31. Opposition lawmakers plan to act next week to stop no-deal in parliament. Writing in the same newspaper, Johnson’s de facto deputy Michael Gove said that to remove the option of a no-deal Brexit on Oct 31 would “diminish” the “chances of securing changes” to the Brexit deal that could get it passed through parliament.

Translation: the new ECB head does not have confidence in free markets. She thinks central bankers can do a better job.

• Lagarde Says Negative Rates Have Helped Europe More Than They’ve Hurt (MW)

The next head of the European Central Bank, Christine Lagarde, appears to be as much of a fan of negative interest rates as the current chief, Mario Draghi. In written answers provided to the European Parliament that were released on Thursday, Lagarde said negative interest rates have helped Europe. The ECB’s deposit rate is negative 0.4%. “On the one hand, banks may decide to pass the negative deposit rate on to depositors, lowering the interest rates the latter get on their savings,” she wrote. “On the other hand, the same depositors are also consumers, workers, and borrowers. As such they benefit from stronger economic momentum, lower unemployment and lower borrowing costs.

“All things considered, in the absence of the unconventional monetary policy adopted by the ECB – including the introduction of negative interest rates – euro area citizens would be, overall, worse off.” European banks have complained about the impact on profitability, but even there the current managing director of the International Monetary Fund defended the move. “With regard to the impact of negative rates on banks’ profitability, empirical analysis suggests that the negative effects on banks’ net interest income have been so far more than offset by the benefits from more bank lending and lower costs for provisions and impairments due to the better macroeconomic environment, which to a significant extent is a result of accommodative monetary policy,” she wrote.

“..Trump is “going to eleven” on trade: He’s going to turn it up so high that there is going to have to be a deal. That’s the way he wants to do this. He will just make it intolerable so everybody has to sit down and cut a deal.”

• Bianco Warns “Negative Rates Are Extremely Toxic” (Gisiger)

Jim Bianco, President of Bianco Research, cautions against evermore unconventional monetary policy interventions. He fears that the global slowdown is going to get worse and he spots opportunities in long-term bonds and gold. The global economy is on the brink: Europe is headed for recession, Japan as well and China’s growth rate is the slowest in almost thirty years. Only the economy in the United States seems to hold up. But for how long? «We live in a global world and if Japan and Europe are struggling and the world has a problem it’s going to come to the US eventually», says Jim Bianco. According to the internationally renowned macro strategist, the biggest threat to the US economy is the inverted yield curve.

«This is the market’s way of saying the Federal Funds Rate is too high and must come down», Mr. Bianco is convinced. Against this backdrop, the founder and President of Chicago based Bianco Research argues that the Federal Reserve should cut its target rate by 50 basis points at the next FOMC meeting. He also cautions against introducing negative interest rates in the United States during the next recession because in his view that would cripple the global financial system.

[..] First, the trade and currency wars where the situation reminds me somewhat of «This Is Spinal Tap». It’s a cult satire movie from the eighties about a rock band and they coined the phrase «up to eleven» because that’s how high their amplifier went. So the expression «turning it up to eleven» refers to the act of taking something to an extreme. I’m saying this because I think Trump is “going to eleven” on trade: He’s going to turn it up so high that there is going to have to be a deal. That’s the way he wants to do this. He will just make it intolerable so everybody has to sit down and cut a deal.

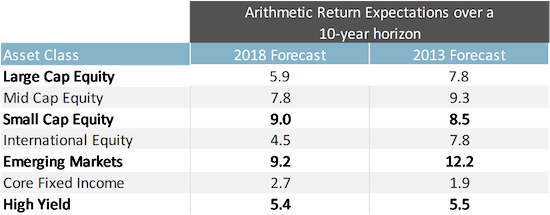

Pension funds are dead.

• Low Interest Rates Compound The Big Problems Facing Pension Funds (MW)

The largest public pension funds have over $1 trillion in aggregate unfunded liabilities. Low interest rates are going to make it harder for these and other pension plans to rely on investment returns alone to meet their obligations to retirees. Interest rates in the U.S. have been declining for over 20 years, and short-term rates have been hovering close to zero over the last decade. Negative interest rates in Japan and Europe and mounting expectations of rate cuts by the Federal Reserve have expanded the pool of bonds with negative yields to more than $16 trillion, or around 27% of the global bond market. Initially, low interest rates are good for asset prices.

Simplistically, this is because investors seeking similar returns as before are now forced to take capital that they would have otherwise invested in safe government bonds and deploy it into riskier assets (equities, high yield bonds, etc.), thereby driving up prices of these assets. In addition to stronger economic growth coming out of the 2008 financial crisis, this is one of the factors leading to strong performance of equities over the past decade. However, going forward it is unlikely that asset returns are going to be similar to what we witnessed over the last decade. One of the reasons is that risky asset returns are generally priced as a spread over risk-free real returns (i.e. inflation-adjusted returns). This makes intuitive sense, as investors would demand additional return for taking on risk.

If the risk-free rate is low, and there is high demand for risky assets, then the total investment return (risk free rate + risk premia/spread) will likely be lower than in a scenario with higher interest rates, all else being equal. According to Voya Investment Management’s capital market assumptions, expected returns for equities over the next 10 years is likely to be around 1.50 percentage points to 3.3 percentage points lower than assumptions in 2013.

Like with student debt, helping only some people appears counter-productive.

• Bernie Sanders Proposes Canceling $81 Billion US Medical Debt (R.)

U.S. presidential contender Bernie Sanders proposed a plan on Saturday to cancel $81 billion in existing past-due medical debt for Americans, but offered no details on how it would be financed. Sanders, an independent U.S. senator from Vermont, said in a statement that under his plan, the government would negotiate and pay off past-due medical bills that have been reported to credit agencies. The proposal, he said, would also repeal some elements of the 2005 Bankruptcy reform bill and allow other existing and future medical debt to be discharged. “In the United States of America, your financial life and future should not be destroyed because you or a member of your family gets sick,” said Sanders.

“That is unacceptable. I am sick and tired of seeing over 500,000 Americans declare bankruptcy each year because they cannot pay off the outrageous cost of a medical emergency or a hospital stay.” According to Sanders, medical debt is the leading cause of consumer bankruptcy, with more than half a million Americans filing due to medical expenses each year. He said the 2005 Bankruptcy reform bill made it difficult to discharge medical debt by imposing strict means tests and eliminated fundamental consumer protections for Americans. “It also trapped families with medical debt in long-term poverty, mandated that they pay for credit counseling before filing for bankruptcy, and increased the need for expensive legal services when filing a case for medical bankruptcy,” the senator said.

“..the strategy of the powerful appears to be to know as much as possible about the rest of us while ensuring that we know as little as possible about them and how they operate..”

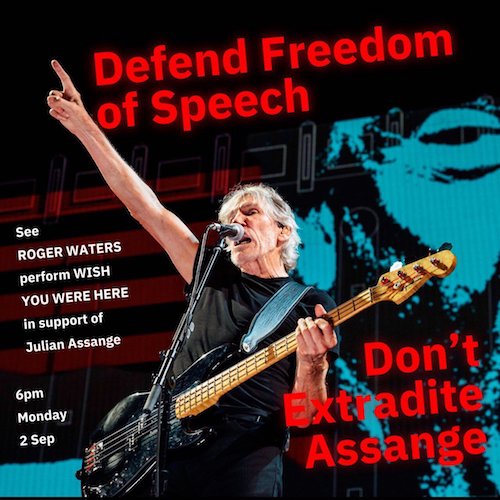

• Breaking The Media Blackout on the Imprisonment of Julian Assange (MPN)

The role of journalism in a democracy is publishing information that holds the powerful to account — the kind of information that empowers the public to become more engaged citizens in their communities so that we can vote in representatives that work in the interest of “we the people.” There is perhaps no better example of watchdog journalism that holds the powerful to account and exposes their corruption than that of WikiLeaks, which exposed to the world evidence of widespread war crimes the U.S. military was committing in Iraq, including the killing of two Reuters journalists; showed that the U.S. government and large corporations were using private intelligence agencies to spy on activists and protesters; and revealed how the military hid tortured Guantanamo Bay prisoners from Red Cross inspectors.

It’s this kind of real journalism that our First Amendment was meant to protect but engaging in it has instead made WikiLeaks publisher Julian Assange the target of a massive smear campaign for the last several years — including false claims that Assange is working with Vladimir Putin and the Russians and hackers, as well as open calls by corporate media pundits for him to be assassinated. The allegations that Assange conspired with Putin to undermine the 2016 election and American democracy as a whole fell completely flat earlier this month when a U.S. District Court for the Southern District of New York dismissed this case as “factually implausible,” with the judge noting that at no point does the prosecution’s “threadbare” argument show “any facts” at all, and concluding that the idea that Assange conspired with Russia against the Democratic Party or America is “entirely divorced from the facts.”

[..] It is important to ask ourselves what Julian Assange’s real crime is. In an era, dubbed the Information Age, where the strategy of the powerful appears to be to know as much as possible about the rest of us while ensuring that we know as little as possible about them and how they operate, Assange worked to prevent that imbalance from becoming a rout, and stuck like a bone in the throat of the mighty.

Interesting take for sure.

• Fifty Shades of Epstein (Hope Kesselring)

A few weeks ago, half the top ten Amazon best sellers in romantic erotica were based around the trope of the BDSM billionaire, with Grey by E. L. James holding firm in the top ten. In the world of erotic romance, the 50 Shades of Grey series has been a continuous presence for over seven years. Thousands of riffs on the sexy and sadistic billionaire exist: Russian billionaire, billionaire blackmailer, billionaire stepbrother. I’m not trying to kink shame, but it would take a lot of money to convince me to write detailed descriptions of torture sessions in a gilded dungeon. This is especially true in the shadow of financier Jeffrey Epstein’s death. Mental and sexual abuse by an obscenely wealthy man now just seems, well, obscene.

I should point out that James’ character, Christian Grey, strikes me as more a domestic abuser than a real BDSM enthusiast. He is a billionaire in the tech industry who fixates on Ana, a 21-year old virgin. He puts surveillance software on her phone. He harasses her to sign a submissive’s contract, and even though she never signs it, he still treats her like a sex slave. He manipulates Ana into doing sex acts for which she doesn’t give consent. Blatant consumerism sits on the page in stark contrast to real life. 50 Shades of Grey eroticizes money and abuse. The writing is universally panned and mocked by critics, yet it’s sold 125 million copies. How in the world of publishing did it even come to be? Let’s go back to 2008. That year the economy was melting down, Jeffrey Epstein pleaded guilty to a felony sex offense, and the Twilight series of vampire romance novels for teen girls were bestsellers.

Twilight was a young adult twist on the long-popular vampire romance, which had flourished in that market since Anne Rice’s Interview With the Vampire appeared. Probably some of Epstein’s victims read the Twilight books. 50 Shades of Grey marks a shift in the erotic romance genre from vampires to billionaires. In 2009, E. L. James started publishing her version of Twilight on fanfiction websites, churning out a chapter every couple of days. Master of the Universe, as it was called then, was popular but criticized for being too racy, so she moved it to her own website and renamed the characters. James didn’t know it yet, but she was about to be catapulted to international fame by some upper middle class moms in the suburbs of New York City.

[..] In the autumn of 2011, news about Occupy Wall Street, a movement that began in reaction to the deeds of the predatory class, dominated headlines. Posters portrayed the 1% as greedy Monopoly men, far from sexy. Occupy protesters had the media’s attention for a short time before the idea was squashed. That November, Jeffrey Epstein registered as a sex offender in New York after completing his jail term and moving back into his Manhattan mansion, free to continue abusing girls. 2012 was E. L. James’ year. A prominent lifestyle blog (started by an NYU communications graduate married to a talent manager) promoted James’ fanfiction novel as sexually liberating to fashion-conscious moms in upscale suburban New York. James got a book deal and “mommy porn” was born. Paperbacks with necktie covers appeared on bookshelves and in beach bags everywhere.