Henri Matisse Olive trees at Collioure 1906

OH SH*T, HERE WE GO (MacGregor)

What Becomes of NATO After The Loss In Ukraine

Trump Ukraine

Biden provoked Putin to start hostilities – Trump pic.twitter.com/0sTLP5eORq

— Ignorance, the root and stem of all evil (@ivan_8848) February 3, 2023

“..a defeat – if it is hypothetically possible – could provoke a destabilization of the country, accompanied by the disintegration of Russian statehood.”

• Building A New World Order Is Now An Existential Issue For Russia (Trenin)

Let us begin by assessing the current situation. One effect of the conflict has already been a fundamental change in the external environment in which Russia finds itself. Its political relations with the collective West, and its allies, have become openly hostile and the armed conflict in Ukraine is a proxy war by the West against Russia. Economic relations with this part of the world have been permanently undermined and are shrinking like Mars bars. Cultural, scientific, sporting and humanitarian ties have been severely curtailed, the information war has reached maximum intensity, and the Iron Curtain in Europe has been rebuilt – this time by the West. However, Russia is not completely isolated. It maintains and develops partnerships in many areas with the world’s new centers of power, and other countries in Asia, Africa and Latin America.

This part of the world community includes most of the world’s states, where the majority of the human population lives and where more than half of the global economy is concentrated. It can rightly be called a world majority with the clear understanding, of course, that this majority is not a bloc and that its members are not allies of Russia. They are guided primarily by national interests and are deeply integrated into the global economy and the Western-centric institutions that serve it, which significantly limits interaction with Moscow. The dramatic shift in the external cycle has led to profound changes within Russia. The old model of mainly exporting raw materials and importing technology no longer works. The political system, which was built on liberal American-French models and then adapted more or less successfully – in substance, not in form – to domestic traditions, is obviously in need of a profound overhaul.

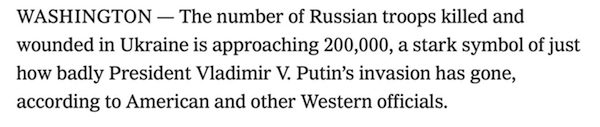

The quasi-ideology of pragmatism and the cult of money, which dominated the country after the collapse of the USSR, proved to be flawed and harmful. In short, the end of the historical orientation towards integration with the Western world logically requires Russia to reorient itself. But what does this mean? To which “self”? Soviet, tsarist or otherwise? A prerequisite for Russia’s long-term strategy is victory in the ongoing conflict in Ukraine. The most important criterion for such a victory is a state that is guaranteed not to lead to a renewed war after some time. On the contrary, a defeat – if it is hypothetically possible – could provoke a destabilization of the country, accompanied by the disintegration of Russian statehood. The stakes for Russia in the current conflict are therefore existential and fundamentally higher than those of the US and its allies. This in itself is a factor working in Russia’s favor, but it certainly does not guarantee its success.

“..It also sees the competition catching up, however, and is ready to use all means necessary, and to take massive risks, to prevent the rise of rival powers. ”

• US-China War By 2025: A Self-Fulfilling Prophecy? (Fomenko)

American Four-Star General Mike Minihan, head of the US Air Force Air Mobility Command (AMC) believes the US and China will go to war by 2025. “I hope I am wrong. My gut tells me we will fight in 2025,” Minihan reportedly wrote in a memo to his officers, obtained by media outlets. The message instructs AMC personnel to train and get their affairs in order so that they are “legally ready and prepared.” This prediction is the most direct and blunt yet from an American official on the prospect of a potential conflict between the US and China, besides President Joe Biden’s indications that the US would intervene on the side of Taiwan if China invaded.

Of course, Minihan is not a policymaker, and the memo is not an official statement of US military policy towards China. But the influence of the US military and by extension, the military-industrial complex, on US foreign policymaking and on the mood in Washington in general, should not be underestimated. The reality is, especially as seen in Ukraine, that the risk of a major-power conflict is arguably at the highest it has ever been since the end of World War II or the height of the Cold War. That is because the US sees itself as a rightful and permanent global hegemon. It also sees the competition catching up, however, and is ready to use all means necessary, and to take massive risks, to prevent the rise of rival powers. As such, the US and China risk falling into the so-called, “Thucydides Trap,” which is described as “an apparent tendency towards war when an emerging power threatens to displace an existing great power as a regional or international hegemon”.

The current distribution of power in the world is described as “emerging multipolarity”. Following three decades of American unipolarity, when the US ruled unchallenged, a number of emerging powers are changing the international order. Multipolarity differs from “bipolarity,” where two powers compete for hegemony, the best known example being the US and the Soviet Union during the Cold War. While bipolarity brings a form of stability, as the military capabilities of both powers are evenly matched and the stakes of a potential conflict are extremely high, history shows multipolarity typically brings instability as it creates an insecure, unpredictable, and competitive international environment. The world of 1914, where a theatre of competing European powers scrambled for international dominance, ultimately combusted into the First World War. As competing world powers expanded their imperialist ambitions, they sought to contain others by forming alliances and starting arms races.

Sounds familiar? It should. Today’s world has some disturbing parallels. The US – an insecure hegemon whose relative power is diminishing as other world powers emerge – is desperately seeking to degrade, undermine and contain its rivals by triggering arms races and expanding alliance systems. Already, the focus on expanding NATO has provoked the conflict in Ukraine, but worse still, the Biden administration is actively seeking to expand that model to East Asia against China, in the form of blocs such as the Quad and AUKUS.

“..Moscow will “push back” the Ukrainian troops to a range at which they will not be a threat.”

• Pentagon Allows Ukraine To Fire Long-range Missiles At Will (RT)

It is up to the government in Kiev to decide how to use the new rockets for the US-supplied HIMARS launchers, the Pentagon said on Friday, confirming that the latest batch of munitions the American taxpayers are funding will include Ground Launched Small Diameter Bombs (GLSDB).The Boeing-manufactured munitions consist of a rocket motor mated with an airplane bomb, with an estimated range of up to 150 kilometers. While Friday’s announcement listed “additional ammunition” for the HIMARS and “precision-guided rockets,” Brigadier-General Patrick Ryder told reporters that this indeed included the GLSDB, confirming the information leaked to Reuters earlier this week. Ryder also confirmed that the US won’t stand in the way of Ukrainians using the missiles to strike deep inside Russia.

“When it comes to Ukrainian plans on operations, clearly that is their decision. They are in the lead for those,” he said on Friday. “So, I’m not going to talk about or speculate about potential future operations, but again, all along, we’ve been working with them to provide them with capabilities that will enable them to be effective on the battlefield.” The GLDSB are produced by Boeing in cooperation with Swedish Saab AB, and combine the GBU-39 small-diameter bomb with the M26 rocket motor. It was unclear how many of the munitions the Pentagon intended to send, or whether they would come from the US military stockpile or need to be freshly produced. Reuters claimed to have seen a Boeing document saying the first deliveries could be “as early as spring 2023.”

Meanwhile, Bloomberg cited unnamed officials who said the timeline could be as long as nine months, depending on when the US Air Force issues the contract. Bloomberg also reported the GLSDB order would account for $200 million of the $1.75 billion in the Ukraine Security Assistance Initiative funding, referring to contracts for weapons and ammunition not coming out of the Pentagon stockpile. Whenever the missiles actually arrive, Russia has already hinted at how it will respond. On Wednesday, President Vladimir Putin tasked the military with “eliminating any possibility” of Ukrainian artillery strikes on Russian territory. Foreign Minister Sergey Lavrov said in an interview on Thursday that Moscow will “push back” the Ukrainian troops to a range at which they will not be a threat. “The longer range the weapons supplied to the Kiev regime have, the further the troops will need to be moved,” Lavrov said.

“the longer range the weapons supplied to the Kiev regime have, the further the troops will need to be moved.”

• Russia Responds To Latest US ‘Escalation’ (RT)

The decision to supply Ukraine with longer-range missiles marks a “deliberate escalation” by the United States, Russia’s ambassador to Washington has said, warning that Moscow would not tolerate strikes on Russian cities. In a statement on Friday evening, Ambassador Anatoly Antonov commented on the latest round of US military aid approved for Ukraine earlier in the day, which is set to include Ground Launched Small Diameter Bombs (GLSDB) – munitions with an operational range of 93 miles (150 kilometers). “Washington sees no boundaries in seeking to inflict a strategic defeat on Russia. The transfer of increasingly powerful weapons to the Kiev regime is a deliberate escalation of the conflict by the United States,” he said, adding “Any attempt to harm the Russian Federation is doomed to failure. The sooner the United States realizes this, the sooner the current conflict will end.”

Though the Pentagon did not mention the GLSDB by name in announcing the weapons transfer, Brigadier-General Patrick Ryder later confirmed that it would be included in the next round of aid, also noting that US officials would not stop Kiev from using the missiles to strike inside Russia. Fired from the US-supplied HIMARS missile launcher, the GLSDB is among the longest-range weapons authorized for Kiev to date, and could theoretically reach targets deep within Russian territory. Antonov went on to say the United States is “de facto inciting its proteges to attack Russian regions,” arguing that Moscow makes no distinction between newer territories which voted to join the Russian Federation last year and other Russian lands.

“For us there is no difference when we talk about a possible attack by Kiev criminals on the Zaporozhye or Bryansk regions, the Crimea or the Smolensk region,” he continued. Though the new weapons could take up to nine months to reach the Ukrainian battlefield, Russia has already suggested how it might react, with President Vladimir Putin ordering the military to eliminate “any possibility” of Ukrainian strikes on Russian territory earlier this week. Foreign Minister Sergey Lavrov, meanwhile, said Russian forces would repel Ukrainian soldiers to a distance from which they would not pose a threat, declaring: “the longer range the weapons supplied to the Kiev regime have, the further the troops will need to be moved.”

“..Only through such a crushing defeat for Western hubris can further crazy adventures, including nuclear ones, be avoided.”

• From Imperial Failures to Imperial Excuses (Batiushka)

Western support for the Ukraine, the most corrupt country in Europe, has done nothing for America’s authority. It had already been undermined by war crimes, water-boarding, economic decline, a drugs epidemic, mass shootings, a trashed health system for 40 million in poverty and military debacles from Vietnam to Afghanistan. The ‘regime changes’, assassinations, electoral frauds, black propaganda (also called PR), massacres, torture in global black sites, proxy wars and military interventions carried out by the United States since 1945 have resulted in over 20 million dead and planetary revulsion for U.S. imperialism. ‘Yanks go home’. Blood lies on the US. Did they really expect to get away with this?

The conflict in the Ukraine is effectively World War III, or if you prefer, World War I, Part III. A proxy hot war between Washington and Moscow. Yes, the military phase is local, having started between Russia and the Ukraine in 2014. But the repercussions for Russia are enormous. They mark the end of a 300-year period when Russia was enamoured with the West. Now Western deceit means that Russians have lost their illusions and naivety for ever. Now Russia will fight on until the Armed Forces of Ukraine and all those who took up arms and have been fighting Russians for almost nine years are no longer a threat to anyone. The Kiev Army will be routed and Russia will return to its roots of over 300 years ago.

However, the political and economic repercussions for the Western world, held on a tight leash by its feudal US owner, are even more enormous: the end of the rule of the dollar. True, there are those who predict a second military phase between Iran and the US colony of Israel. And a third could be between China and the US, the pretext being the Chinese Ukraine, Taiwan. But nothing is certain. After the coming Russian victory in the Ukraine, all could still be averted, for that victory will be sobering for the Western world. This indeed is the last hope, that defeat here will at last bring the Western world back to its senses and reality. Only through such a crushing defeat for Western hubris can further crazy adventures, including nuclear ones, be avoided.

“..British armed forces “are smaller and less ready to fight than at any time in living memory.”

• UK MIlitary Could Run Out Of Ammo In Single Afternoon – Ex-commander (RT)

The UK could deplete its ammunition stocks in mere hours should it be drawn into large-scale fighting, a former British general warned on Thursday. This and other issues make the UK military unfit to be regarded as a “top tier” NATO member, he said. Retired General Richard Barrons, who formerly headed the UK’s Joint Forces Command, sounded the alarm in an op-ed published by The Sun in which he said the fighting force has been “hollowed out by spending cuts.” Barrons claimed that the British armed forces “are smaller and less ready to fight than at any time in living memory.” He also warned that the UK Army is on course to slip below 76,000 troops. However, even these service members often do not receive inadequate training, Barrons noted.

British tanks, armored vehicles, and artillery pieces mostly date to the previous century, while “years of cuts to ammunition production mean that, for some types of key weapons, the army would run out in a busy afternoon,” the general said. Barrons added that the Royal Navy and Air Force are “in better shape” and boast some “outstanding modern equipment,” but cautioned that without experienced personnel, ammunition, and spare parts they might turn out to be just a “glittering shop window” without much to show for it on the actual battlefield. The former commander said the UK should focus on Europe, arguing that the “tilt to Asia can wait.” He urged London to invest in modern capabilities, including drones, missiles, and cyber and electronic warfare capabilities.

Britain should also double its reserves to 60,000 troops, he said. Regarding Russia, Barrons estimated that to be able to handle a “surprise attack,” the British Army will need to spend “£3 billion ($3.67 billion) this year, and every year for the next ten years.” British Defence Secretary Ben Wallace admitted in the House of Commons on Monday that the military has been “hollowed out and underfunded.” His comments followed a Sky News report alleging that a top US general had told Wallace that British forces are “barely tier two” in terms of fighting capabilities.

“..the West’s “biggest” political mistake because it effectively manages to “unite the Russians like never before.”

• Serbia Names ‘Greatest’ Mistake By West (RT)

The West’s recent announcement that it would be supplying Ukraine with main battle tanks marks a major miscalculation, Serbian president Aleksandar Vucic said on Friday. That’s as Moscow has threatened to burn any Western equipment that enters Ukraine and has vowed to retaliate “far beyond the scope of armored vehicles.” Vucic noted that the decision to supply Ukraine with tanks, especially with the “terrifying” German Leopard 2s, is the West’s “biggest” political mistake because it effectively manages to “unite the Russians like never before.” Last month, Germany and the US agreed to provide a number of heavy tanks to Kiev. Washington has promised between 30 and 50 of its M1 Abrams tanks, while Berlin pledged 14 Leopard 2A6s from the Bunderswehr’s own stocks.

An additional 51 of the same model and 88 of the older Leopard 1 model may also come from Rheinmetall as they get refurbished, Germany said. Berlin also gave the green light to countries that have expressed a desire to export their own Leopards to Ukraine. Those include Poland, Finland, Spain, Norway and the Netherlands. The UK and Canada have also said they would be sending their heavy equipment to Kiev. The decision has been heavily criticized by Russia, which has called it an “extremely dangerous” move that threatens to escalate the conflict in Ukraine. On Thursday, Russian President Vladimir Putin likened the new threat of “German Leopard tanks with crosses on their hulls” to the Soviet Union’s struggle against Hitler’s forces and warned that Moscow’s response would not be limited to weapons.

Other countries have also voiced their concerns about the West’s move. Turkish President Recep Tayyip Erdogan said that the delivery of NATO tanks to Ukraine was a “high-risk endeavor” that would fail to help end the conflict and only “line the pockets of gun barons.” Hungarian Prime Minister Viktor Orban also slammed Germany’s decision, noting that these Western countries are “drifting” towards becoming active participants in the conflict. Orban has insisted that instead of arming Kiev, the West should be pursuing “a ceasefire and peace talks” in Ukraine. Moscow has repeatedly objected to Western weapon deliveries to Ukraine, arguing that non-stop arms shipments only serve to prolong the conflict and risk direct confrontation with NATO. The Kremlin has also insisted that no amount of military aid will prevent Moscow from reaching its objectives and warned that the tanks would “burn like the rest of Western weapons” supplied to Kiev.

“morally repugnant Russian invasion”, “international community”, “illegitimate and illegal”, “aggression”, “humanitarian reasons”, “international norms.”

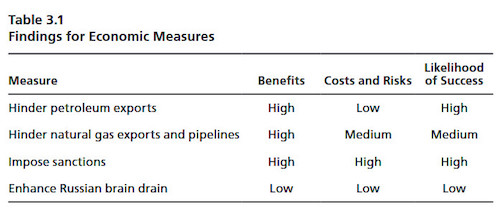

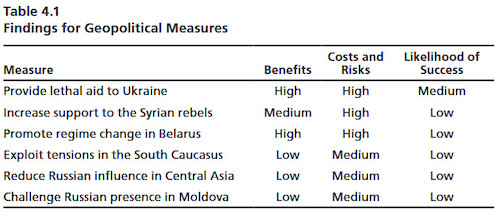

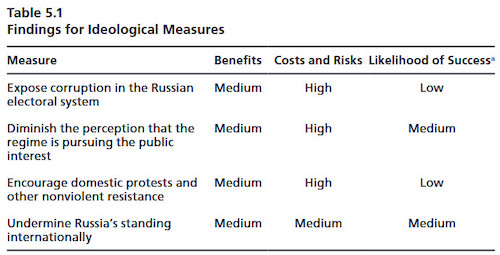

• RAND Gets It, Sort Of (Helmholtz Smith)

A few years ago RAND put out a report Overextending and Unbalancing Russia. “This brief summarizes a report that comprehensively examines nonviolent, cost-imposing options that the United States and its allies could pursue across economic, political, and military areas to stress—overextend and unbalance— Russia’s economy and armed forces and the regime’s political standing at home and abroad.” One of the things recommended was exploiting Russia’s “greatest point of external vulnerability” by “providing lethal aid to Ukraine.” (Only someone as paranoid as Putin, of course, could see any hostility in this). Well, they did it and it’s time for a new RAND report – Avoiding a Long War.

To save you the bother of reading this trivial effort, I will summarize – they start with the usual posturing – “morally repugnant Russian invasion”, “international community”, “illegitimate and illegal”, “aggression”, “humanitarian reasons”, “international norms.” Then on to how Russia is losing – “Russia’s conventional capabilities have been decimated in Ukraine”, “the weakened state of Russia’s conventional military”, “It will take years, perhaps even decades, for the Russian military and economy to recover from the damage already incurred.” But, as you wade on, you begin to suspect that the authors aren’t as triumphant after all – perhaps victory is not quite so close “given the slowing pace of Ukraine’s counteroffensives in December 2022, restoring the pre-February 2022 line of control—let alone the pre-2014 territorial status quo—will take months and perhaps years to achieve” or even so certain “Continued conflict also leaves open the possibility that Russia will reverse Ukrainian battlefield gains made in fall 2022.”

The authors spend some space explaining why a long war is not to America’s advantage. So, RAND, they followed your advice but things aren’t going very well. Time to try and get out of it. “Since avoiding a long war is the highest priority after minimizing escalation risks, the United States should take steps that make an end to the conflict over the medium term more likely.”

“..the US armaments industry is effectively a modestly scaled high-end boutique..”

• The Arsenal of Democracy Isn’t (Schryver)

You see, for all its massive plunder of the public purse, the US armaments industry is effectively a modestly scaled high-end boutique. And there is simply no way this domestic US industry can expeditiously expand its production. It would literally take years – probably a full decade – for the US to expand its military production to a seriously potent industrial scale. For one, the labor pool for these industries is extremely finite and highly specialized. In the overwhelmingly financialized and service-oriented US economy, there is a shocking dearth of technical expertise of ALL kinds. It’s not simply a boomer cliché that “kids these days are innocent of almost any mechanical know-how”. If the US wants to staff new armaments factories any time soon, it will have to import the skilled labor from Russia, China, Iran, and North Korea.

Beyond that, the permitting of new factories, with the attendant bureaucratic delays, public hearings, environmental impact studies, and various special interest road-blocking … well, everyone knows how these things work now in America. It took five years to build the Hoover Dam in the early 20th century. It would take FIFTY here in the early 21st century – if it could be built at all. Those clamoring for the US to intervene in the Ukraine war in order to “teach those filthy Russians a lesson they’ll never forget” simply have no conception of the catastrophe that would ensue were their dreams to be fulfilled. If the Pentagon consented to such an undertaking, it could probably amass no more than 250,000 combat-capable troops in the theater, and to do so would entail the evacuation of virtually every major US military base on the planet (and most of the minor ones).

It could probably assemble an additional quarter million troops from the active reserves and National Guard units in the United States. That said, it is empirically impossible that 500,000 combat troops could be satisfactorily equipped for high-intensity conflict such as would be the scenario in a war between the US and Russia in eastern Europe. And even if they could be assembled and equipped, it would be an insufficient force to face over a million Russian troops, close to a third of which are already “battle-hardened” from almost a year of high-intensity combat in Ukraine. In anticipation of the casualties attendant to great power warfare, it would become necessary for the United States to reinstitute conscription almost immediately. If a strong anti-war movement had not already been incited by its previous actions, conscription in America would almost certainly induce a widespread political upheaval, with large and aggressive public protests cropping up in all the major cities of the nation.

“oil friendships are greasy”

• Sanctions On Russian Oil Not Working – Analysts (RT)

Sanctions imposed by the West on Russian crude oil exports have so far “failed completely,” and new price caps could also prove ineffective, according to a CNBC report on Friday, citing analysts. The conclusions come as the European Union plans to ban imports of Russian refined petroleum products, including diesel and jet fuel, from February 5. The bloc had already prohibited imports of seaborne crude oil from Moscow in December. The EU, G7 countries, and Australia have also set a $60-per-barrel price cap, which blocks Western companies from providing insurance and other services to shippers of Russian oil unless the cargo is purchased at or below the set price. The price cap “was invented by bureaucrats with finance degrees. None of them really understand oil markets,” Paul Sankey, president and lead analyst at Sankey Research, told CNBC.

“It’s been a total bomb; it has failed completely,” he stressed. According to Sankey, Russian oil supplies have not been significantly interrupted and “they’ve sustained exports at high levels.” “I heard it from a great source that the Saudis have been asking around as to how come Russian oil is still flowing,” he said. “That brings the question of what will happen with the sanctions coming up on products, because it just doesn’t seem to work.” The founder of analytics firm Vanda Insights, Vandana Hari, also told the US broadcaster she was skeptical about the upcoming restrictions on Russian refined oil products, noting that “the crude price cap was pretty inconsequential.” “I think the refined product caps that they’re planning – about a $100 [per barrel] for diesel and clean products and perhaps around $45 for dirty fuels like fuel oil – are probably going to be immaterial as well,” the analyst explained.

According to Hari, Russian oil will find its way into the markets that are “still welcoming it” such as China and India. “China and India have benefited quite a big deal last year from heavily discounted Russian crude prices and the same’s going to happen to Russian refined products,” Hari predicted, adding that it could be more complicated for Moscow to find markets for such products. Paul Sankey also noted that “oil friendships are greasy” and there’s a lot of different ways to move Russian oil around the world, bypassing the price caps. Meanwhile, the EU has been struggling to agree on the price cap for Russian oil products, with some members reportedly claiming the proposed level is too generous for Moscow, and seeking a lower ceiling. The measures are expected to come into effect on February 5 after gaining the approval of all 27 EU member states.

“..The USA has tossed its national identity on the garbage barge of “diversity, equity, and inclusion..”

For those of you not paying attention the past thirty-odd years, Russia, incorporated as the Soviet Union, collapsed in 1991. The USSR was a bold experiment based on the peculiar and novel ill-effects of industrialism, especially gross economic inequality. Alas, the putative remedy for that, advanced by Karl Marx, was a despotic system of pretending that individual humans had no personal aspirations of their own. That business model could be reduced to the comic aphorism: We pretend to work and they pretend to pay us. It failed and the USSR gurgled down history’s drain. Russia reemerged from the dust, minus many of its Eurasian outlands. Remarkably little blood was shed in the process. Mr. Orlov’s book points to some very interesting set-ups that softened the landing. There was no private property in the USSR, so when it collapsed, nobody was evicted or foreclosed from where they lived.

Very few people had cars in the USSR, so the city centers were still intact and people could get around on buses, trams, and trains. The food system had been botched for decades by low-incentive collectivism, but the Russian people were used to planting gardens — even city dwellers, who had plots out-of-town — and it tided them over during the years of hardship before the country managed to reorganize. Compare that to America’s prospects. In an economic crisis, Americans will have their homes foreclosed out from under them, or will be subject to eviction from rentals. The USA has been tragically built-out on a suburban sprawl template that will be useless without cars and with little public transport. Cars, of course, are subject to repossession for non-payment of contracted loans. The American food system is based on manufactured microwavable cheese snacks, chicken nuggets, and frozen pizzas produced by giant companies.

These items can’t be grown in home gardens. Many Americans don’t know the first thing about growing their own food, or what to do with it after it’s harvested. There’s another difference between the fall of the USSR and the collapse underway in the USA. Underneath all the economic perversities of Soviet life, Russia still had a national identity and a coherent culture. The USA has tossed its national identity on the garbage barge of “diversity, equity, and inclusion,” which is actually just a hustle aimed at extracting what remains from the diminishing stock of productive activity and giving the plunder to a mob of “intersectional” complainers — e.g. the City of San Francisco’s preposterous new plan to award $5-million “reparation” payments to African-American denizens of the city, where slavery never existed.

As for culture, consider that the two biggest cultural producers in this land are the pornography and video game industries. The drug business might be a close third, but most of that action is off-the-books, so it’s hard to tell. So much for the so-called “arts.” Our political culture verges on totally degenerate, but that is too self-evident to belabor, and the generalized management failures of our polity are a big part of what’s bringing us down — most particularly the failure to hold anyone in power accountable for their blunders and turpitudes. This might change, at least a little bit, as the oppositional House of Representatives commences hearings on an array of disturbing matters. Meanwhile, be wary of claims in The New York Times and other propaganda organs that our Ukraine project is a coming up a big win, and that the racketeering operations of the Biden family are a right-wing conspiracy theory. These two pieces of the conundrum known as reality are blowing up in our country’s face. It will be hard not to notice.

“… Nancy, we’ll get you, and we’ll fly you back from Italy once you’re the ambassador.”

• Republicans to Force Nancy Pelosi to Testify About Jan 6 (TP)

As the Biden Documents Scandal continues to build and the Chinese spy balloon over Montana dominates the headlines, some Republicans are still focused on holding Nancy Pelosi to account for the failures of security at the US Capitol on January 6th, failures to which they claim she is connected. One such Republican is Rep. Jim Jordan (R-OH), who said: “The reason there wasn’t a proper security presence on that day goes right to the speaker’s staff and the speaker’s office. As you go back and look at the communications, there’s this pattern that develops where the Sergeant of Arms is meeting with Pelosi’s staff. Many of those meetings, Republican staff wasn’t allowed to be there, but they had this pattern where everything had to run through her office, her staff, before the Sergeant of Arms could make a decision.”

Joining Rep. Jim Jordan was Rep. Troy Nehls, who said “And Nancy Pelosi. You do have questions you need to answer … Nancy, we’ll get you, and we’ll fly you back from Italy once you’re the ambassador.” The statements from Jordan and Nehls follow a late-December of 2022 report released by Republicans that blamed Pelosi for the security failures at the Capitol on that day, faulting her for creating “political pressures” that led to lackluster security and inadequate preparations. The New York Post, reporting on that report, said: “Leadership and law enforcement failures within the U.S. Capitol left the complex vulnerable on January 6, 2021,” says the report, which is based on a trove of texts and email messages, and testimony from Capitol Police leaders and rank-and-file officers.

House Sergeant at Arms Paul Irving, who answered to Pelosi as one of three voting members of the Capitol Police Board, “succumbed to political pressures from the Office of Speaker Pelosi and House Democrat leadership,” was “compromised by politics and did not adequately prepare for violence at the Capitol.” Pelosi and her staff “coordinated closely” with Irving on security plans for the Joint Session of Congress on Jan. 6, but Republicans were deliberately left out of “important discussions related to security.” And, in an apparent attempt to hide from Republicans the fact that they were being excluded from discussions, Irving asked a senior Democratic staffer to “act surprised” when he sent “key information about plans for the Joint Session on Jan. 6, 2021, to him and his Republican counterpart.”

“..Musk testified that the “funding secured” tweet was “absolutely truthful..”

• Musk Wins Lawsuit Over ‘Funding Secured’ Tweet (ZH)

Having previously noted the absurdity of the trial, Elon Musk has defeated a shareholder lawsuit alleging that tweets claiming he had the “funding secured” to take Tesla private cost investors billions of dollars in losses. As The Wall Street Journal reports, the nine-person San Francisco-based jury said the investors who brought the class-action case failed to prove that Mr. Musk hurt them by tweeting about a possible deal. “The jury got it right,” Alex Spiro, a lawyer for Musk, said after the verdict. Musk testified that the “funding secured” tweet was “absolutely truthful,” touting what he described as an “unequivocal” commitment by Saudi Arabia even though he had nothing in writing. As Bloomberg reports, Musk gave jurors other reasons to believe him.

He said he felt compelled to reveal that he was considering taking Tesla private because earlier that day, the Financial Times reported that Saudi Arabia was building a sizable stake in Tesla. He testified he was afraid his going-private plans might also be leaked, and that he wanted to put all Tesla investors on equal-footing by broadcasting his plans on Twitter. Musk also said that if required, he could’ve divested his ownership stake in his closely held rocket-ship company, SpaceX, to fund the transaction. This case is unusual for having gone to trial. From 1997 to 2001, less than 0.2% of federal securities class-action cases, excluding those involving mergers or acquisitions, were tried to a verdict, according to Cornerstone Research.

Musk, who had taken the stand as a witness in the case, was present in court during closing arguments. As The FT reports, the “funding secured” tweet has already proven costly for Musk. He and Tesla each paid $20mn to settle legal action from the Securities and Exchange Commission. Musk also had to resign as the carmaker’s chair, although he kept his position as chief executive. However, Musk has criticized the SEC in the years since, saying he felt pressured to settle and suggesting that doing so made him appear guilty. This case, he said in a deposition, was an opportunity to “clear the record.” And now he has!

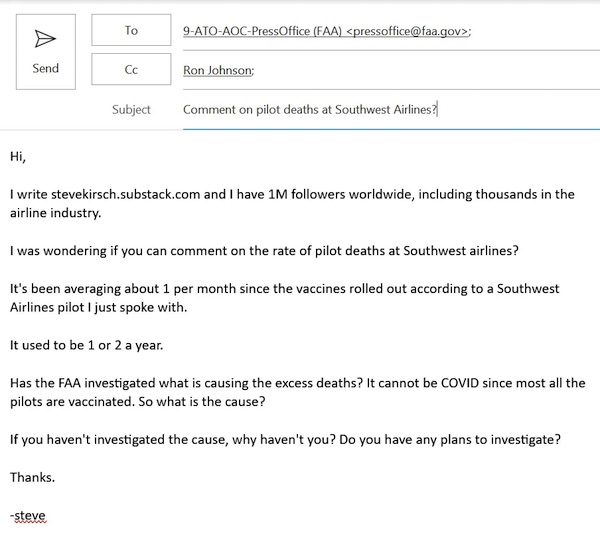

“.. Pfizer BioNTech is going to have to pay back those billions to Thailand, with which Thailand will recompensate those peoples that have lost their existence…”

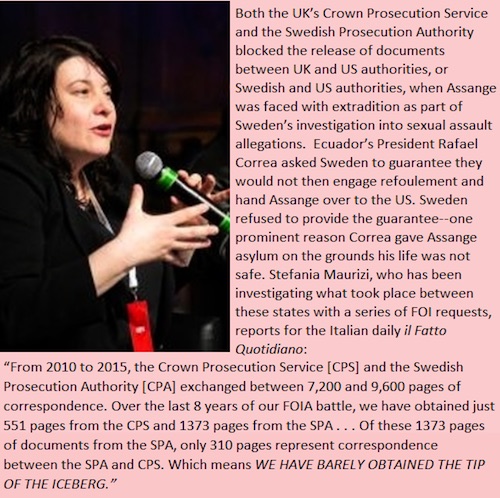

• Thai Princess Coma Mystery – World Expert Says It’s A Covid Jab Injury (DTNZ)

44 year old Princess Bajrakitiyabha of Thailand collapsed while out walking her dogs on 14 december last year. According to sources she had not felt well after receiving her 3rd booster. After her collapse she lost consciousness and remains in a coma. According to a report in The Independent, she is ‘on medical equipment supporting her heart, lungs and kidneys.’ Princess Bajrakitiyabha is the eldest child of current King Rama X. The law graduate is a senior diplomat in the Thai government. The Thai palace confirmed she had suffered a ‘heart issue’. But the explanation given by the authorities and a local university that it was caused by a bacterial infection has been called ‘ridiculous’ by medical expert Professor Sucharit Bhakdi.

Thai-born Bhakdi, a former professor of microbiology at the University of Mainz in Germany had a celebrated career in medical science as a world expert on the immune system and arterial disease, until mainstream narratives and ‘fact checkers’ labelled him a ‘conspiracy theorist’ for his strong opposition to the COVID ‘vaccines’. According to Bhakdi, who claims he and his contacts have been in direct contact with the Thai Royal Family over the matter, the princess’ collapse was an adverse reaction to the COVID jab. She was previously healthy with no known medical conditions. Speaking on the ‘neutralswiss‘ Rumble channel yesterday, Bhakdi said:

“This whole COVID-19 agenda is a fake… And I was able to lay out for them the proof that the COVID vaccinations were based on fraud… The EMA declared that safety pharmacological studies were never performed – never. And they were never deemed necessary. So now we have it. So, when I told the Thais this, you know guys, they jumped up. They jumped up in the room. And so they said to me ‘we will see to it that Thailand is the first country in the world that is going to declare this contract null… Which means that Pfizer BioNTech is going to have to pay back those billions to Thailand, with which Thailand will recompensate those peoples that have lost their existence…”

“‘One daughter of the present king Rama X collapsed and is in a coma… within 23 days after the third shot, 44 years old, never been seriously ill, collapsed and is now in a coma. The diagnosis that was given by the authorities and by the university is so ridiculous – she’s supposed to have a bacterial infection that will never do what she suffered from. And so we are determined, and the activists in Thailand who have been on this many many months now – great guys, also a professor from the University of Bangkok, he’s gotten in touch with the Royal Family, and we are sending information to the Royal Family to alert them to the fact that in all probability the princess is suffering as a victim of this jab, as so many people around the world have been suffering.’

Whenever a story this crazy comes along, we suspect something’s hiding behind it.

• Biden Announces U.S. Surrender To Chinese Balloon (BBee)

In a surprise statement to the world from the White House Situation Room, President Biden has announced America’s unconditional surrender to the Chinese Spy Balloon. “Listen, folks, it’s over,” said Biden as a single tear ran down his face. “We’re outgunned here. There’s no hope that we can match the awesome power of this giant balloon.” Biden’s voice was drowned out by the dozens of weeping journalists gathered outside the room. “I urge you all to hug your loved ones and embrace your children, for the end is near. God help us all,” Biden finally said before signing off for the last time. At publishing time, Americans had been urged by the administration to start learning Mandarin.

Sika deer

https://twitter.com/i/status/1621524781127573509

Water is life

https://twitter.com/i/status/1621438461151526912

Gallop croc

https://twitter.com/i/status/1621580255835181064

Dog doc

https://twitter.com/i/status/1621730772670349313

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.