Vincent van Gogh Landscape with Couple Walking and Crescent Moon 1890

Mauldin sees a Jubilee in your future.

• Train Crash Preview (Mauldin)

Unemployment may approach the high teens by the end of the decade and GDP growth will be minimal at best. What do you call that condition? Certainly not business as usual. Long before that happens, the Federal Reserve will have engaged in massive quantitative easing. There’s a lot of misunderstanding about QE, so let me clarify something important. Quantitative easing is not about “printing money.” It is buying debt with excess bank reserves and keeping that debt on the Fed’s balance sheet as an asset. The Bank of Japan is an example. They did not put currency (yen) into the market. That’s how Japan still flirts with deflation and its currency has gotten stronger. QE is the opposite of printing money, though there is a relationship. That’s one reason central bankers like it.

As this recession unfolds, we will see the Fed and other developed world central banks abandon their plans to reverse QE programs. I think the Federal Reserve’s balance sheet assets could approach $20 trillion later in the next decade. Not a typo—I really mean $20 trillion, roughly quintuple what they did after 2008. They won’t need to worry about the deflation that usually accompanies such deep recessions (dare we say depression?) because the Treasury will be injecting lots of high-powered money into the economy via deficit spending. But since we have never been in this territory before, I must say this is only my guess.

If that’s what they do, will it work? No. The world simply has too much debt, much of it (perhaps most) unpayable. At some point, the major central banks of the world and their governments will do the unthinkable and agree to “reset” the debt. How? It doesn’t matter how, they just will. They’ll make the debt disappear via something like an Old Testament Jubilee. I know that’s stunning, but it’s really the only possible solution to the global debt problem. Pundits and economists will insist “it can’t be done” right up to the moment it happens—probably planned in secret and announced suddenly. Jaws will drop, and net lenders will lose.

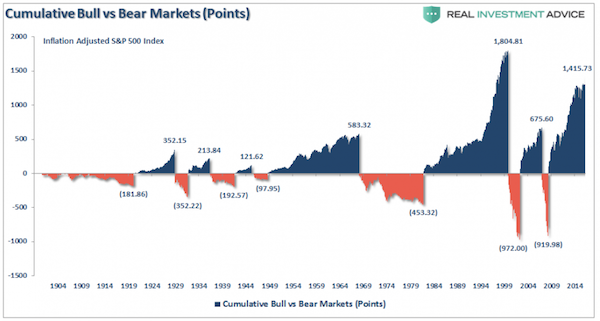

“A 50% decline wipes out 100% of the previous gain. ”

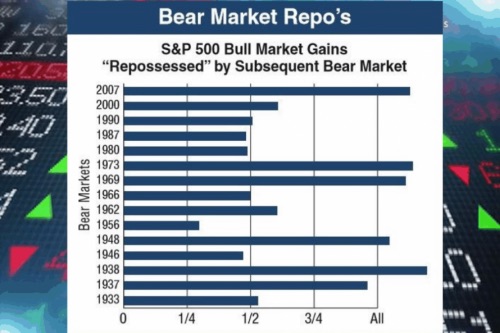

• Bear Market Repo’s (Roberts)

An interesting email hit my desk this morning: “The stock market goes up 80% of the time, so why worry about the declines?” Like a “bull” – rising markets tend to be steady, strong and durable. Conversely, “bear” markets are fast “mauling”events that leave you deeply wounded at best and dead at worst. Yes, the majority of the time the markets are “bullish.” It’s the “math” that ultimately gets you during a “bear” market. The real devastation caused by “bear market” declines are generally misunderstood because they tend to be related in terms of percentages. For example: “Over the last 36-months, the market rose by 100%, but has recently dropped by 50%.”

See, nothing to worry as an investor would still be ahead by 50%, right? Nope. A 50% decline wipes out 100% of the previous gain. This is why looking at things in terms of percentages is so misleading. A better way to examine bull and bear markets is in terms of points gained or lost. Notice that in many cases going back to 1900, a large chunk of the previous gains were wiped out by the subsequent decline. (A function of valuations and mean reversions.) Recently Upfina posted a great chart on “Bear Market Repo’s” which illustrates this point very well. To wit:

“Many confuse bear markets with being black swan events that cannot be predicted, however, this is a faulty approach to investing. The economy, market, and nature itself move in cycles. Neither a bear market nor a bull market last forever and are actually the result of one another. That is to say, a bear market is the author of a bull market and a bull market is an author of a bear market. Low valuations lead to increased demand, and high valuations lead to less demand.”

“I won’t be completely satisfied until the editors of The New York Times have to answer to charges of sedition in a court of law.”

• Mushrooming Matrix of Scandals (Jim Kunstler)

[..] a great deal is already known about the misdeeds surrounding Hillary and her supporters, including Mr. Obama and his inner circle, and some of those incriminating particulars have been officially certified — for example, the firing of FBI Deputy Director Andrew McCabe on recommendations of the Agency’s own ethics committee, with overtones of criminal culpability. There is also little ambiguity left about the origin of the infamous Steele Dossier. It’s an established fact that it was bought-and-paid-for by the Democratic National Committee, which is to say the Hillary campaign, and that many of the dramatis personae involved lied about it under oath.

Many other suspicious loose ends remain to be tied. Those not driven insane by Trumpophobia are probably unsatisfied with the story of what Attorney General Loretta Lynch was doing, exactly, with former President Bill Clinton during that Phoenix airport tête-à-tête a few days before FBI Director Jim Comey exonerated Mr. Clinton’s wife in the email server “matter.” One can see where this tangled tale is tending: to the sacred chamber known as the grand jury. Probably several grand juries. That will lead to years of entertaining courtroom antics at the same time that the USA’s financial condition fatefully unravels.

That event might finally produce the effect that all the exertions of the so-called Deep State have failed to achieve so far: the discrediting of Donald Trump. Alas, the literal discrediting of the USA and its hallowed institutions — including the US dollar — may be a much more momentous thing than the fall of Trump. Personally, I won’t be completely satisfied until the editors of The New York Times have to answer to charges of sedition in a court of law.

The EU will not like this.

• Italy’s New Parallel Currency Plan (ZH)

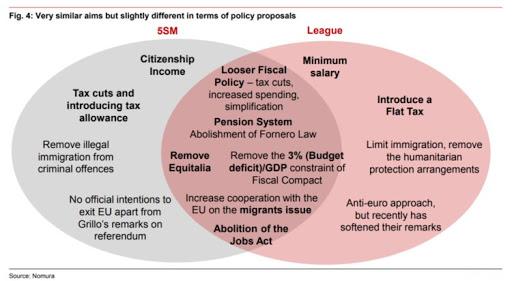

In 2009/10, squeezed by insolvency, a lack of liquidity, and Federal limitations, the California government began to issue a ‘parallel currency’ in IOUs in lieu of payment on everything from supplies to contracted services and health-care costs, so it can actually preserve cash to make payments to its generous debtors. Now, eight years later, despite all the talk of ‘recovery’ and ‘global synchronous growth’ and ‘normalization’, Italy’s newly-formed coalition of The League and Five Star (which some have likened to Trumpian ‘nationalist’ Republicans merging with Bernie leftists) have put forward a plan that, among other things, includes the introduction of a parallel currency for Italy – ‘mini-BOTs’. The chart below, created by analysts at Nomura, shows where both stand on key policy issues, highlighting both their similarities and their differences as they prepare to govern together.

It is the Italian euroskepticism that dominates market concerns. Investors were initially spooked by a section where the nascent coalition floated plans to ask for €250 billion in debt forgiveness for the country. But, as Credit Suisse argued, “A markedly Eurosceptic prime minister… as well as concrete support for the introduction of a parallel currency (so-called Mini-BOTs’), would be major negatives, in our view.” So what are ‘Mini-BOTs’? In order to settle bills with suppliers or creditors the state might consider “instruments such as mini-government notes” which may also be used in turn to repay tax arrears, says the government program agreed by the two parties’ representatives and leaders. Earlier this year, outgoing Economy Minister Pier Carlo Padoan described the proposal as “a plan to circulate a disguised parallel currency”.

It is this section of the Five Star-League Accord that raised eyebrows… “Something must be done to resolve the problem of the public administration debts to taxpayers.” Claudio Borghi, the League’s economic chief who helped write the government plan, told la Verita newspaper that the new securities “could be spent anywhere, to buy anything”. Mike Shedlock previously noted that ‘Mini-Bots’ are a parallel currency based on future tax receipts, similar to the plans proposed by Yanis Varoufakis in Greece. The minibot was in the Lega’s election manifesto. Five Star is far less radical on the eurozone, having dropped the idea of a referendum, but also seeks changes that are incompatible with the the EU fiscal rules. A parallel currency stands a much greater chance of success in Italy, and it would go some way to solving the government’s fiscal dilemmas. The open question is whether it would constitute a slippery slope towards euro exit.

Hard to find a headline on this, let alone an article, that does not mention ‘populist’.

• Italy’s Populist Coalition Government Poses New Threat To Eurozone (Ind.)

Two Italian, populist, eurosceptic parties have reached an agreement to form a government of the eurozone’s third largest economy, setting up the single currency bloc for a possible new crisis. March’s national elections in Italy delivered a hung parliament, but also left the virulently anti-immigrant Lega Nord and the radical anti-establishment Five Star Movement as the two parties with the most seats. After a week of intense wrangling, the leaders of the two parties – which have sharply divergent outlooks in a host of areas – announced on Friday that they had agreed upon a common programme.

“This government contract binds two political forces that are and remain alternative, to respect and achieve what they promised to citizens,” said the Five Star leader Luigi Di Maio. Both parties ran on electoral platforms that threatened conflict with the eurozone and the EU, in areas ranging from busting national budget deficit rules, to clamping down on immigration to lifting sanctions on Russia. The two parties will stage informal ballots of their supporters on the programme over the next three days, meaning the coalition could take office early next week. Italian 10-year borrowing costs spiked above 7% in 2011 and 2012, threatening a fiscal crisis for Rome, as traders panicked that the the single currency could be on the verge of splitting apart.

They have since come down dramatically as the European Central Bank has been heavily buying up the country’s sovereign bonds as part of its money printing programme, with the country’s borrowing costs hitting a low of 1.051% in 2016. On Friday 10-year bond yields, which move in the opposite direction to prices, on Friday rose to 2.2%, the highest since October 2017, although the markets still seem generally unperturbed by the prospect of a Five Star-Lega Nord coalition. The common programme, published online on Friday, promises a universal basic income of €780 per person per month, which it says should be part funded by the EU. It wants “limited deficit spending” to boost GDP growth and a review of the EU’s fiscal rules. Sanctions on Russia should be lifted immediately, its says.

Macron as Napoleon.

• Trump Drives Wedge Between Germany and France (Spiegel)

The French president has recognized the opportunity that opposition to the U.S. sanctions presents. It provides him with a perfect chance to prove to the French people why they really need Europe. He believes that only Europe can stand up to the deal-breaking Americans. In Berlin, meanwhile, the focus is on “realpolitik” — the notion that there isn’t much Europe can do to oppose Trump. Officials in the German capital believe that the U.S. president will play hardball when it comes to Iran. What really appears to be the problem, however, is a lack of political will. When push comes to shove, the Iran deal is likely less important to Altmaier than the dispute over the Trump administration’s threat of punitive tariffs on steel and aluminum imports from Europe.

He wants to prevent the dispute from boiling into a full-fledged trade war that would spread to the heart of the German economy — the automobile industry. As a major exporter, America’s punitive tariffs would hit Germany much harder than they would France. “The U.S. can’t be the world’s economic police,” French Economy Minister Bruno Le Maire said earlier this month. Le Maire and French Foreign Minister Jean-Yves Le Drian called a demonstrative joint press conference inside the monumental Finance and Economics Ministry in Paris looking like they were ready go toe-to-toe with Washington. Le Drian spoke of “our determination to fight to ensure that the decisions taken by the United States don’t have any repercussions on French businesses.” Le Maire added: “All of Europe is faced with the challenge of asserting its economic sovereignty.”

My guess is the pipeline will be built.

• Putin Seeks Common Cause With Merkel Over Trump (R.)

Russian President Vladimir Putin said at a meeting with German Chancellor Angela Merkel on Friday that he would stand up to any attempts by U.S. President Donald Trump to block a Russian-German gas pipeline project. Berlin and Moscow have been at loggerheads since Russia’s annexation of Crimea four years ago, but they share a common interest in the Nordstream 2 pipeline project, which will allow Russia to export more natural gas to northern Europe. A U.S. government official this week said Washington had concerns about the project, and that companies involved in Russian pipeline projects faced a higher risk of being hit with U.S. sanctions.

“Donald is not just the U.S. president, he’s also a good, tough entrepreneur,” Putin said at a news conference, alongside Merkel, after the two leaders had talks in the Russian Black Sea resort of Sochi. “He’s promoting the interests of his business, to ensure the sales of liquefied natural gas on the European market,” Putin said. “I understand the U.S. president. He’s defending the interests of his business, he wants to push his product on the European market. But it depends on us, how we build our relations with our partners, it will depend on our partners in Europe.” “We believe it (the pipeline) is beneficial for us, we will fight for it.”

A bridge too far for Juncker?

• EU Considers Iran Central Bank Transfers To Beat US Sanctions (R.)

The European Commission is proposing that EU governments make direct money transfers to Iran’s central bank to avoid U.S. penalties, an EU official said, in what would be the most forthright challenge to Washington’s newly reimposed sanctions. The step, which would seek to bypass the U.S. financial system, would allow European companies to repay Iran for oil exports and repatriate Iranian funds in Europe, a senior EU official said, although the details were still to be worked out. The European Union, once Iran’s biggest oil importer, is determined to save the nuclear accord, that U.S. President Donald Trump abandoned on May 8, by keeping money flowing to Tehran as long as the Islamic Republic complies with the 2015 deal to prevent it from developing an atomic weapon.

“Commission President Jean-Claude Juncker has proposed this to member states. We now need to work out how we can facilitate oil payments and repatriate Iranian funds in the European Union to Iran’s central bank,” said the EU official, who is directly involved in the discussions. The U.S. Treasury announced on Tuesday more sanctions on officials of the Iranian central bank, including Governor Valiollah Seif. But the EU official said the bloc believes that does not sanction the central bank itself.

We use so many chemicals so much, we’ll end up eradicating ourselves. No caution, no precautionary principle.

• Common Fungal Infections Becoming Incurable (Ind.)

Common fungal infections are “becoming incurable” with global mortality exceeding that for malaria or breast cancer because of drug-resistant strains which “terrify” doctors and threaten the food chain, a new report has warned. Writing in a special “resistance” edition of the journal Science, researchers from Imperial College London and Exeter University have shown how crops, animals and people are all threatened by nearly omnipresent fungi. “Fungal infections on human health are currently spiralling, and the global mortality for fungal diseases now exceeds that for malaria or breast cancer,” the report notes.

While the problem of bacteria becoming resistant to commonly used antibiotics has been widely reported on, and likened to the “apocalypse” by medical leaders, the risks of disease-causing fungi have received far less recognition. Fungicides share a problem with antibiotics in that the organisms they aim to kill are becoming resistant to treatments faster than they can be developed, and there are growing numbers of people vulnerable to infection. “We’ve got increasing numbers of immunosuppressed patients, that’s what fungi love to parasitise,” Matthew Fisher, professor of fungal disease epidemiology at Imperial, told The Independent.

“Half a million people a year probably die from fungal meningitis in Africa, which wouldn’t affect them if they didn’t have Aids. “Similarly in the UK we have transplant patients as well, as soon as you whack them on immunosuppressants they start coming down with fungal infections.” “Transplant doctors are absolutely terrified of these fungal infections,” he added, and the same issues arise in cancer patients, or people whose immune systems are destroyed by disease or age – leaving them unable to fight off infection on their own.