Pablo Picasso Don Quixote 1955

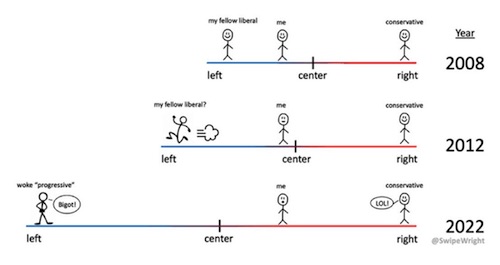

Far right

https://twitter.com/i/status/1771934645380100570

Mike Rowe

@NewsNation’s Mike Rowe (@mikeroweworks) puts Biden’s and Trump’s profound unfavorability in perspective: “If this country was a restaurant and 330 million people walked in, half of the country would be allergic to half of the menu.” #RFKJr #Kennedy24 pic.twitter.com/scUZZZI2uD

— Robert F. Kennedy Jr (@RobertKennedyJr) March 24, 2024

RFK

My friend Bobby Kennedy has produced the best political ad I have ever seen, a sustained argument of rare depth in our political discourse.

pic.twitter.com/iXqEiPbb7W— Aaron Kheriaty (@AaronKheriatyMD) March 23, 2024

Tucker Roseanne

https://twitter.com/i/status/1771622982630211703

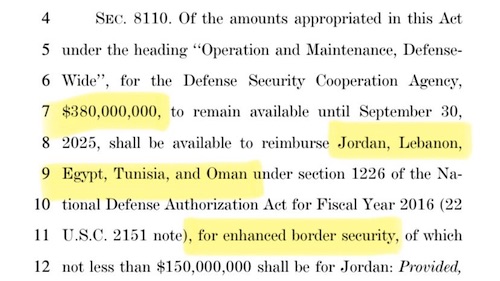

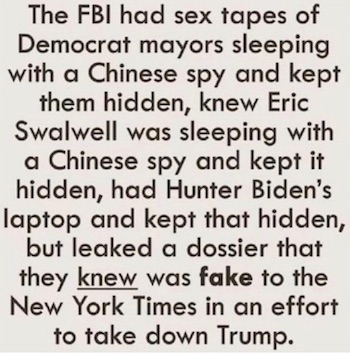

Stormy Daniels. Star witness: Michael Cohen.

• Trump Falsified Business Records Case May Be Delayed On Monday (Sp.)

Former US President Donald Trump is facing four separate criminal cases, two at the federal level and two brought by the States of New York and Georgia. Trump also leads US President Joe Biden in national polls and most swing states. Judge Juan Merchan will hold a pre-trial hearing in New York on Monday to determine if there should be further delays in former US President Donald Trump’s falsified business documents case, one of four criminal cases he is facing. The case was initially scheduled to begin on Monday but was delayed to at least April 25 after prosecutors released more than 100,000 pages of documents to Trump’s defense team. Prosecutor Alvin Bragg did not oppose the 30-day delay but argued that no further delays should be placed on the trial.

Of the criminal cases Trump is facing, this case was the most likely to conclude before the Presidential election in November, but a significant delay could push it past election day. Trump’s legal team is arguing that the prosecution intentionally held the documents back and included exculpatory evidence favorable to the defense. If Merchan agrees, he could throw the case out and possibly sanction Bragg for potential Brady violations, but he could also issue a delay in the case or keep the trial date, scheduled for March 25, as-is.

“The People have engaged in widespread misconduct as part of a desperate effort to improve their position at the potential trial on the false and unsupported charges in the Indictment,” Trump’s legal team argued in court filings. “[R]eports relating to statements by Cohen that are exculpatory and favorable to the defense.” Most legal experts quoted in US media predicted that a delay could happen but they doubt that the judge will throw out the case. The documents relate to federal investigations into Michael Cohen, Trump’s former fixer who is expected to be the prosecution’s star witness. The documents were not in Bragg’s office and were instead in different offices around the country. Bragg argues that the Trump team intentionally waited until January to ask for the documents to cause a delay in the trial.

“[T]he belated nature of the recent USAO productions is entirely the result of the defendant’s own inexplicable and strategic delay in identifying perceived deficiencies,” the prosecution argued. Prosecutors also claim that less than 300 of the documents are both new to the defense and related to Trump’s trial. Trump has been charged with 34 counts of falsifying business documents related to repayments he made to Cohen for hush money payments Cohen paid to adult film star Stormy Daniels who claimed she had an affair with then-candidate Trump in 2016. Trump pleaded not guilty but admits to making the payments. He also denies that the affair took place. Cohen was sentenced to three years in prison in 2018 after being convicted of campaign finance violations related to those payments and for lying to Congress about how long discussions about a potential Trump Tower in Moscow continued.

Trump OAN

No one in Big Media has any real contacts inside the Trump Machine.

And so Big Media play their egotistical selves by labeling “chaotic” anything they don’t understand.

Listen for it. You’ll hear it everywhere after this… @OANN #Trump pic.twitter.com/CBibgF4uHu

— Chanel Rion OAN (@ChanelRion) March 24, 2024

“What he’s talking about is the money reported on his campaign disclosure forms that he’s built up through years of owning and managing successful businesses,..

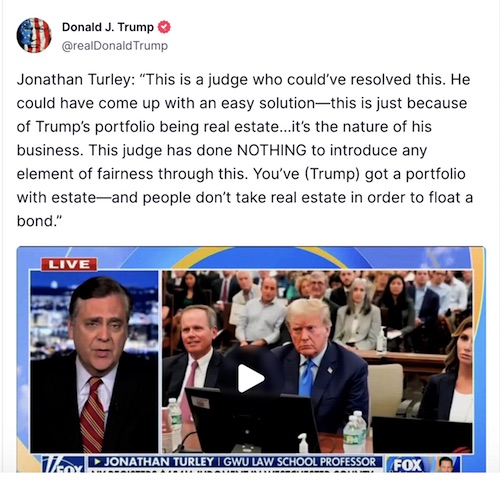

• Trump In Final Countdown To Post $464 Million Bond By Monday (ZH)

Donald Trump has until Monday to come up with more than $450 million to stop his properties from being seized by authorities following the results of his New York civil fraud trial. According to the ruling by Judge Arthur Engoron, Trump and executives at the Trump Organization inflated his assets. Initially, NY Attorney General Letitia James sought $250 million in damages – but later increased it to $370 million plus interest. Trump has been seeking a bond of $464 million ($454 million plus $10 million to cover his sons’ fines) in order to post bond and appeal the case. Last week, Trump said he had “almost $500 million” in cash, however his attorney Chris Kise told CNN that Trump wasn’t referring to cash he has on hand. “What he’s talking about is the money reported on his campaign disclosure forms that he’s built up through years of owning and managing successful businesses,” he said, which the outlet noted is “the very cash that Letitia James and the Democrats are targeting.”

Assets including buildings, houses, cars, helicopters and even Trump’s plane are on the chopping block if Trump can’t come up with the money. The former president has asked a state appeals court to allow him to post a smaller bond, or none at all, claiming that irreparable harm would be done if he was forced to sell properties in a ‘fire sale’ that can’t be undone if he wins his appeal against the amount due. The court has not come back yet with a ruling. If Trump can’t secure the bond, New York state officials can begin the arduous process of taking his assets. According to experts cited by a very giddy CNN, the first action should be seizing Trump’s bank accounts. “The banks are the easiest part, they’ll receive the judgment from the Attorney General – the court order – then the banks will enforce,” said former federal prosecutor Peter Katz, who has handled fraud cases. “They take the funds from the account and put it in the attorney general’s accounts. The other stuff is a little more challenging.”

According to debt collection expert Alden B. Smith, New York officials are “trying to get their ducks in a row,” adding “They want to find the most liquid of the assets they can restrain immediately. A bank account is the most effective way to do it.” Seizing Trump’s buildings and businesses is far more complicated. Once state prosecutors figure out which properties they want to take from Joe Biden’s chief political rival, they will give the sheriff an execution order, a $350 fee, and then the sheriff will post notice for the property in three places. The AG’s office must then advertise it four times, after which the property will be sold at public auction 63 days after the sheriff is given the execution order. According to Newsweek, the following Trump-owned properties had “fraudulent” and “misleading” values, and could be on the list (with New York properties taking priority, and those in other states being more complicated to seize).

Trump Park Avenue, New York, N.Y.

Trump Tower, New York City.

40 Wall Street, New York City.

Trump Seven Springs, Westchester County, N.Y.

Trump International Hotel, Las Vegas.

Mar-a-Lago, Palm Beach, Florida.

Trump National Golf Club Westchester, Briarcliff Manor, N.Y.

Trump National Golf Club Charlotte, Mooresville, North Carolina.

Trump National Golf Club Colts Neck, Colts Neck, New Jersey.

Trump National Golf Club, Washington D.C., Sterling, Virginia.

Trump National Golf Club Hudson Valley, Hopewell Junction, N.Y.

Trump National Golf Club Jupiter, Jupiter, Florida.

Trump National Golf Club Los Angeles, Rancho Palos Verdes, California.

Trump National Golf Club Philadelphia, Pine Hill, New Jersey.

Trump International Golf Links Scotland, Aberdeen.

Trump International Golf Links Scotland, Turnberry.

Trump has roughly $200 million in cumulative loans on his properties.

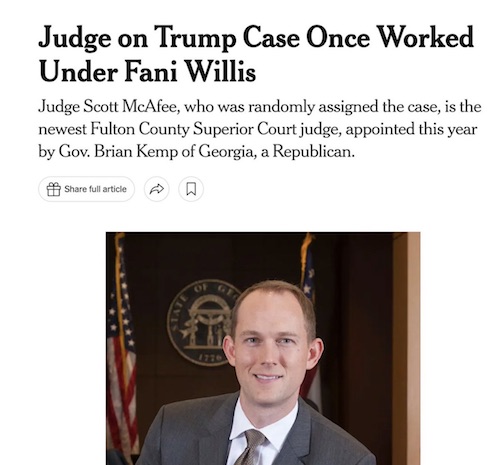

“I will certainly not be choosing to date people that work under me.”

• Fani Willis Goes Head to Head with Her Prior Self in Trump Case (Turley)

Fulton County District Attorney Fani Willis has finally broken her silence with CNN. Willis insisted that she has done nothing wrong while declaring that “the train is coming” for Donald Trump. On this occasion, CNN can be excused for not having an opposing view. Willis circa 2020 denounced Willis circa 2024. Willis told a CNN reporter “I don’t feel like my reputation needs to be reclaimed. I guess my greatest crime is I had a relationship with a man, that’s not something I find embarrassing in any way. And I know that I have not done anything that’s illegal.” The most obvious person to interview in rebuttal of that statement is Willis’s 2020 self. After all, she repeatedly declared that she would not have any romantic relationship with those in her office. Willis ran against her former boss Paul Howard, who was embroiled in a sexual harassment scandal involving his relationship with women in his office.

Willis offered both experience and ethical leadership, including pledging repeatedly that “I will certainly not be choosing to date people that work under me.” When confronted with this repeated campaign promise on the stand, Willis came up with a perfectly bizarre spin about Nathan Wade being literally “special” as a special prosecutor. While she hired him, supervised him, and controlled his continued employment with the office, she tried to suggest that he was not really part of the office in the same sense. Willis notably stressed that she did nothing “illegal.” She did not address whether she acted unethically. The court itself denounced her for unprofessional conduct in this controversy, including her speech at a church suggesting that racism was behind these allegations.

Moreover, it may be too early to tell if she is entirely free of criminal allegations. Many believe that both she and Wade gave knowingly false or misleading testimony. That is a problem not just for them as individuals but for the office in this case. Willis and Wade were both prosecuting people for the very same conduct of filing false statements with courts and making false statements. The two lawyers testified in tandem but only one was disqualified. While the Court casts doubt on Wade’s testimony on the relationship, it ignored that Willis effectively ratified those claims in her own testimony. Putting aside the pledge of a train coming for Trump, there is the problem that there are usually two tracks and another train may be coming for Willis as the state (and potentially the bar) looks into these allegations.

Bosi

Former Australian Army Special Forces Lieutenant Colonel Riccardo Bosi said if he had to think like Trump, Trump can’t just drop the hammer when there are still many Traitors. Trump is allowing for the traitors to reveal themselves… pic.twitter.com/LTFv8gynv5

— ꪻꫝể ꪻꫝể (@TheThe1776) March 25, 2024

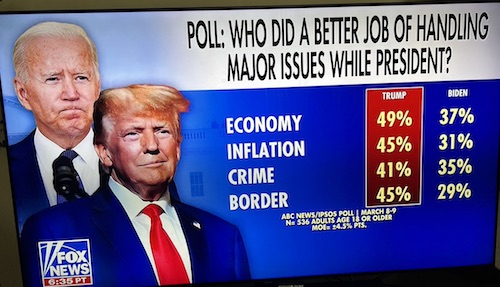

“In 2020, Biden carried 87% of the black vote. Now, he’s polling at just 63%, a sharp decline. Meanwhile four years ago he won hispanic votes by a ratio of 2 to 1. He now trails Trump in that bloc..”

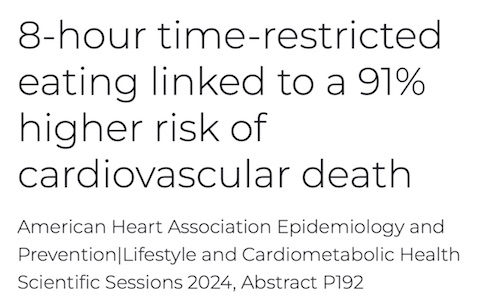

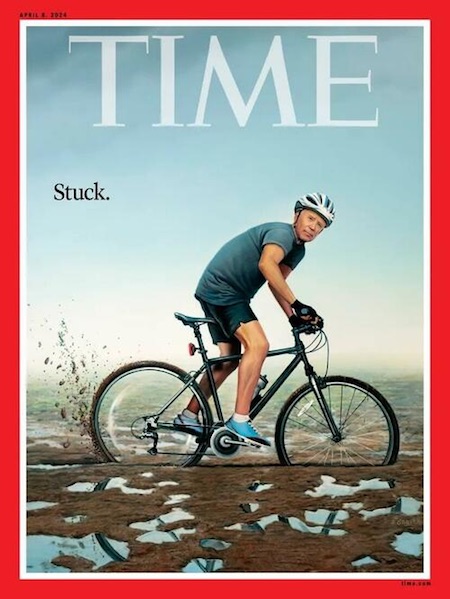

• TIME To Panic: Joe Biden’s Campaign “In Trouble” Despite Obama Warning (ZH)

“Don’t underestimate Joe’s ability to fuck things up.” -Barack Obama.

With less than eight months before the 2024 election, the Biden re-election campaign is in big trouble. Not only is Biden lagging in the polls vs. Donald Trump, the border crisis he created by shredding all of Trump’s Executive Orders on immigration has resulted in 10 million illegals flooding into the United States – which has left even Democrats livid. What’s more, Biden is quickly losing the support of young Americans, and the latino vote. Things are so bad that TIME magazine has just devoted 3,700 words to let us know that Barack Obama ‘warned’ the Biden campaign last June that defeating Trump would be harder in 2024 (because no pandemic or hoax dossier to set him up?). Six months later, Obama ‘saw few signs of improvement.’

Obama returned to the White House in December, with a ‘more urgent’ message: the re-election campaign was behind schedule in building out field operations, and that an ‘insular group of advisers’ in the West Wing was hamstringing the effort. Now, it’s really bad… “Three months later, the 2024 general election is under way, and Biden is indeed in trouble. His stubbornly low approval ratings have sunk into the high 30s, worse than those of any other recent President seeking re-election. He’s trailed or tied Trump in most head-to-head matchups for months. Voters express concerns about his policies, his leadership, his age, and his competency. The coalition that carried Biden to victory in 2020 has splintered; the Democrats’ historic advantage with Black, Latino, and Asian American voters has dwindled to lows not seen since the civil rights movement. -TIME

Meanwhile, Biden’s inner circle is “defiantly sanguine” as a “fog of dread” descends on Democrats. The rest of the TIME article is full of anecdotes of dissatisfied Democrats, particularly young voters such as 20-year-old Aidan Kohn-Murphy. It has nothing to do, as many assume, with the President’s age. With palpable frustration, Kohn-Murphy enumerates the list of perceived policy “betrayals” as though they were “tattooed on the back of my hand.” According to the report, GenZ voters “don’t understand why they should be compelled to cast their ballot for a candidate who has done so many things that are against their values,” said Kohn-Murphy.

In 2020, Biden carried 87% of the black vote. Now, he’s polling at just 63%, a sharp decline. Meanwhile four years ago he won hispanic votes by a ratio of 2 to 1. He now trails Trump in that bloc. Biden’s support of Israel amid the Gaza war has “tanked his standing with Muslim and Arab voters,” particularly in “must-win Michigan.” Overall, Biden’s advantage over Trump among nonwhite Americans has shrunk from almost 50 points in 2020 to 12, according to the latest Times/Siena poll. “It boils down to voters of color, and those voters are pissed,” said one former Biden campaign and White House official, who spoke on condition of anonymity. “I think it’s very likely he’ll lose.”

“..they have all these specific details, but they were unable to give anything specific to the Russians. This all makes one think that something is very wrong.”

• Ukraine Likely Had Prior Knowledge of Moscow Terrorist Threat (Sp.)

A group of gunmen opened fire at a concert venue in Moscow on the evening of March 22, killing over 100 people and setting fire to the building. Eleven suspects have been detained by Russian security services in relation to the terrorist attack, including the four suspected perpetrators who were apprehended as they were trying to flee the country across the border with Ukraine. During an interview with Sputnik, political and military analyst Sergey Poletaev pointed out that the Russian Federal Security Service (FSB) officially announced that the suspected terrorists had contacts in Ukraine. According to Poletaev, even if the reports about the perpetrators being Tajikistani citizens are true, the attack in Moscow could have been masterminded either by some kind of Islamist terrorist organization that has ties with Ukraine, or even by Ukraine directly. In any case, he noted, it appears that the Ukrainian leadership had prior knowledge of this act of terror, “which makes them accomplices, at the very least.”

Poletaev also argued that while the attack was likely planned by professionals, it does not necessarily mean that the perpetrators were equally skilled, with the analyst observing how high school students sometimes kill dozens of people during shooting sprees. Commenting on the attempts by both Washington and Kiev to hastily deny Ukraine’s trace in this terrorist attack, Poletaev suggested that the West is going to insist that ISIS* alone was responsible. Thus, he postulated, there will be two narratives – the Russian and the Western – and it all comes down to whose side the “global majority” is going to take. “It is in our best interests to collate a convincing body of evidence for our case. It would greatly help us with diplomacy,” Poletaev remarked. “We’re talking about the ‘third countries,’ of course, as the West will most likely dismiss any talk of Ukraine’s involvement.”

Seyed Mohammad Marandi, a political analyst and professor at Tehran University, also found it curious that, even when “no real details” about the attack were known, the United States started insisting that Ukraine was not involved. “It is also very strange that the United States was able to give such a detailed travel advisory or warning about a terror attack naming concerts and giving specifics about an attack in Moscow and large gatherings and all that [previous to the attack],” he added. “So, they have all these specific details, but they were unable to give anything specific to the Russians. This all makes one think that something is very wrong.” Referring to claims about ISIS being responsible for the attack, Marandi argued that this theory does not necessarily rule out “cooperation between Ukraine and ISIS or the potential role of the United States.”

“The very fact that the United States, from the start, said that Ukraine wasn’t involved and the very fact that they gave such a detailed warning to their citizens is raising serious questions. But ISIS and the Ukrainian regime both have very strong connections with the West,” he elaborated. “ISIS has cooperated with NATO countries, it has cooperated with Israel, and it has cooperated with other American allies in Syria for years. And Ukraine is also deeply dependent on NATO countries. Marandi also pointed out that ISIS “has always been focused on the enemies of the United States” whereas the terrorist organization’s attacks on NATO countries or the Middle Eastern powers aligned with the West have been “very rare.”

Cactus City hall

https://twitter.com/i/status/1771960366140178439

https://twitter.com/i/status/1771954788789305698

“Attention, a question for the White House: are you sure it was ISIS, won’t you change your mind later?”

• US Bails Ukraine Out, Covering Zelensky With ISIS – Zakharova (TASS)

After the Crocus City Hall attack, the US tries to bail Ukraine out by mentioning the Islamic State (IS, ISIS) terror group, outlawed in Russia, and to cover itself and the Zelensky regime it created, Russian Foreign Ministry Spokeswoman Maria Zakharova said in an article for kp.ru. “The American political engineers cornered themselves with their tales that the Crocus City Hall attack was carried out by the ISIS terror group,” the diplomat noted. “Hence Washington’s daily bailing out of its wards in Kiev, and the attempt to cover itself and the Zelensky regime they created with the scarecrow of the outlawed ISIS.” Zakharova noted that a number of factors directly and indirectly indicate the US authorities’ involvement in sponsoring the Ukrainian terrorism.

“Billions of dollar and an unprecedented amount of weapons, invested without accountability and with use of corruption schemes into the Kiev regime, the aggressive rhetoric regarding Russia, the rabid nationalism, the ban for peace talks on Ukraine, the endless calls for a force resolution of the conflict, the refusal to condemn the years-long terror attacks, carried out by the Kiev regime, and the massive informational and political support of any, even the most atrocious actions of Zelensky,” she listed. The spokeswoman also noted that previously, the US intervention in Middle Eastern affairs has led to the emergence, strengthening and institutionalization of a number of radical and terrorist groups that remain active in the region even today. “What is the logic, you may ask? Money and power. And, considering the international legal ban on direct interventions, it is also about sowing a ‘controlled chaos’ and reshaping the world order by the hands of terrorists,” she continued. “Attention, a question for the White House: are you sure it was ISIS, won’t you change your mind later?”

“..the European Union, which was conceived as an entirely peaceful organization, becomes one of the world’s most implacable warring empires..”

“Later, these weapons will be used against “undemocratic” countries, whose leaders happen to be at odds with the EU and the US.”

An EU army is idiotic. Who will be in command? France or Germany? How about Hungary?

• Militaristic Revolution in the EU Paves Legal Way for Warmongering (Babich)

During the last few days, the European Union went through a real militaristic revolution. A special “legal task force” is working on allowing the use of EU funds for war. The so-called European Peace Facility (EPF), officially stewarded by Josep Borrell, will get its money from the EU funds (and not individual states) after reporting the transfer of thousands of weapons systems to Kiev. EPF also reported having trained more than 40,000 Ukrainian military to use them. The Financial Times chose a somewhat routinely sounding lead for its story on the EU’s decision to legally stop being an “oasis of peace”: “Brussels proposes ‘legal task force’ to explore ways to use the common budget for defense. The headline, however, was more disturbing: “EU looks to bypass treaty ban on buying arms to support Ukraine.”

The reality described in the FT’s story, however, is more dramatic than the headline and the lead taken together: the European Union, which was conceived as an entirely peaceful organization, becomes one of the world’s most implacable warring empires – by law. Very soon the EU’s Union Treaty will no longer have a provision prohibiting “any expenditure arising from operations having military or defense implications.” (Article 41, point 2 of the Treaty on European Union.) Or, at best, this provision will be made devoid of legal force by some new additions to the EU’s legislation. FT reports, confirming its story by eyewitness accounts, that the European Commission is creating a “legal task force,” that would allow the EU to finance wars and military production by European money. In all likelihood, the first “beneficiary” of this financing will be NATO’s proxies in Ukraine, waging a war against Russia and Russians since 2014. At a recent conference of the EU’s 27 members in mid-March, 2024, it was decided to create within the framework of the so-called European Peace Facility (EPF) a special fund for financing Ukrainian armed forces (Ukraine Assistance Fund).

What the relation is between the word “peace” and the system of buying and transporting weapons to the zone of conflict, remains unclear. Ukraine Assistance Fund (UAF) will be financed by donations from EU member states to the tune of €5 billion a year. At least €500 million from that sum will be spent on training Ukrainian servicemen to use the EPF-provided weapons. The weapons will mostly be European-made (such was the requirement of France), but not only. Weapons from “third countries” can be bought and sold, creating opportunities for the spread of dangerous weapons around the world. Judging by the recent EU summit on Thursday, which discussed the ways of stealing “immobilized” Russia’s foreign assets and pouring its money into the UAF “for military support to Ukraine,” no law is an obstacle for the EU’s “legal task forces.” Was such an evolution of the EU unexpected? Not entirely.

The EU’s quasi-pacifist image started to crumble not now, but back in the 1990s. It transpired back then that the real European Union went a long way from the lofty ideas of the EU’s founders. Only naïve people can trust the EU’s claims, that it is a purely “soft power-based institution.” In 1995-1999 the EU’s member countries participated in military interventions against the former Yugoslav republics, later almost all EU members made their “military contributions” to the occupations of Afghanistan, Iraq and Libya. However, as more and more “crusades” by individual Western countries or American-British alliances ended in defeats (one can cite Afghanistan in 2001-2021 or the French intervention in West Africa after the coup in Libya in 2011), the dreams about a “collective war chest” of the EU started to take shape In 2020 the so-called European Defense Fund (EDF) and later, in March 2021, the European Peace Facility (EPF) started operating at the EU level. Their aim was clear from the start: to collect money from member countries and to buy arms for this money.

Later, these weapons will be used against “undemocratic” countries, whose leaders happen to be at odds with the EU and the US. Real European pacifists immediately smelt the rat and protested both against EDF and especially against EPF, which after the escalation of the Ukrainian conflict became one of the main sponsors of Zelensky’s military machine. Back in 2021, 40 pro-peace NGOs, headed by the German group Brot für die Welt (Bread for the World) came out with a statement denouncing the EPF as an instrument “which brings arms into wrong hands” and “allows to use the EU money to train the military cadres for dictatorial regimes.” Now, however, Brussels uses widespread anti-Russian prejudice in the EU, as well as constant reminders about the “threat from Putin” to justify the final destruction of the dream of “peaceful Europe,” which once inspired the pioneers of European integration. In comparison to 2021 critics are fewer and quieter. In this way, Russophobia was spiritually destructive for Europe, stealing its dream of “world peace.”

“..once sanctions on Russia are eased or lifted, they could face decades of legal action.”

• Western Banks Warn Against EU Plans to Give Russian Funds to Ukraine (Antiwar)

Some Western banks are lobbying against an EU plan to use profits made by Russian central bank funds that are frozen in Europe to arm Ukraine, Reuters reported on Thursday. The European Commission has proposed sending up to 3 billion euros to Ukraine per year using the revenue. About 90% would go to a fund called the “European Peace Facility” that can be used to buy weapons for Ukraine, and the remaining funds would go to the EU’s central budget for other types of aid. Russia has slammed the plan and has vowed to respond. “This is outright banditry and theft. These actions are a gross and unprecedented violation of basic international norms. We said that we would respond, and so we shall,” Russian Foreign Ministry spokeswoman Maria Zakharova said on Wednesday. Sources told Reuters that banks fear they could be held liable by Russia in the future for being involved in the transaction. The report said once sanctions on Russia are eased or lifted, they could face decades of legal action.

The banks also worry the move would erode trust in the Western banking system. One source said it would set a bad precedent and that stealing the funds would amount to the “weaponization of foreign-held reserves and assets.” The US is looking to take an even more extreme measure by giving all of the Russian funds to Ukraine, not just the profit and interest. Last month, Treasury Secretary Janet Yellen came out strongly in favor of the idea. “It is necessary and urgent for our coalition to find a way to unlock the value of these immobilized assets to support Ukraine’s continued resistance and long-term reconstruction,” Yellen said. Legislation to give the Russian money to Ukraine has been introduced in Congress and has received bipartisan support, but the bills have yet to be voted on. About $67 billion in Russian central bank funds are held in the US, while over $200 billion is held in Europe.

“..it is taking you to the point where I truly believe they will only stop when they find that you will swing from a tree.”

• Mob Rule Versus Survival of the West (Susan D. Harris)

It’s been hard to watch the effects of forced diversity, multiculturalism, and mass immigration on the tiny island of Great Britain—the most densely populated nation in Europe. At least in America we still have so much land area that most people are not yet feeling the effects of large-scale population displacement stemming from all forms of immigration. In the UK, however, every day feels like an episode of “Survivor” as people who are being crammed in like sardines are increasingly made to fear that they’ll be voted off the island. Recently, protests surrounding the Israel–Hamas war have exposed the fragility of a British culture—and nation—on the verge of capsizing from the weight of immigration and cultural divides. Well-known British YouTuber Paul Joseph Watson has been covering events there, addressing the British prime minister’s remarks that his country is descending into “mob rule” and that the situation is urgent. The prime minister was referring to pro-Palestinian protesters currently flooding the streets of Britain.

Mr. Watson shared a genius chart from a user on social media platform X supposedly detailing the rise of mob rule in London. The user commented, “HOW DID WE GET HERE? After importing millions of people from countries with a culture of mob rule into London, mob rule has taken over London. Experts are crunching the numbers to figure out if systematically undermining basic law and order could have affected basic law and order.” Meanwhile, Pro-Palestinian protesters across Britain vowed more marches, ostensibly to protest Israeli attacks in Gaza. Mr. Watson has also been covering reactions to another member of parliament recently claiming there were “no-go zones” in Birmingham. To support the existence of “no-go zones,” Mr. Watson cited the Birmingham Mail newspaper, which reported that “due to soaring crime being committed by ‘urban youths,’ parts of the city center are no-go zones and the areas immediately surrounding Birmingham are no-go areas for the same reason,” according to Mr. Watson.

All of this comes after a huge blow-up about a comment made by a Conservative member of parliament on conservative-leaning GB News. Lee Anderson told the news outlet (where he also hosts his own show) that “I don’t actually believe that the Islamists have got control of our country, but what I do believe is they’ve got control of [Mayor of London Sadiq] Khan and they’ve got control of London. … He’s actually given our capital city away to his mates.”

Mayor Khan then responded with three strikes against Mr. Anderson, saying his remarks were “Islamophobic, anti-Muslim and racist” and poured “fuel on the fire of anti-Muslim hatred.” It was all downhill from there. Mr. Anderson was suspended from the Conservative Party after refusing to apologize and later defected to the Reform UK party. After that, a GB News guest said Mayor Khan was “not British. He doesn’t support Britain.” Which led to calls for GB News to be investigated by Ofcom, Britain’s communications regulator, similar to our FCC. And it won’t be the first time; Ofcom seems to be targeting GB News for investigations quite a lot lately.Another British YouTuber who’s been weighing in on the ongoing cancel culture wars in her country is Katie Hopkins. In a video titled, “How cancel culture (evisceration) REALLY works,” Ms. Hopkins outlines what she believes is “currently being done to GB News by those that want to see it done away with.” She also claims that “Ofcom is the weapon wielded in a war of attrition against GB News.” And she should know. The controversial celebrity, journalist, and comedian has done her share of shocking the public and angering many over these last many years, but she’s also become quite the conservative hero. She’s been re-tweeted by President Donald Trump multiple times, banned from Twitter, reinstated on Twitter (now X), and thrown out of Australia for mocking quarantine lockdowns. She’s called Islam the “single biggest threat” to Europe and was named as a target in a planned terror attack by ISIS supporters. Most recently, she’s done a hilarious must-see YouTube short dedicated to all the people who “pushed the jab.” It currently has over 1 million views.

In 2020, Ms. Hopkins told conservative host Candace Owens that her situation in Britain was so much more than the cancel culture that was overtaking America. She explained that in the UK it had become “acceptable” to think that a targeted physical attack against her would be “welcomed and applauded.” She continued to explain to Ms. Owens that she lost her jobs, her home (which she said had to be sold due to litigation), and even experienced having her children reported to social services with the intent to have them taken away. She concluded by saying that, in the UK, “[T]he darkness is that when they come, it’s not something flippant that is cancel culture, it is taking you to the point where I truly believe they will only stop when they find that you will swing from a tree.” Her fundamental commitment, she added, was to not allow that to happen.

“As soon as we arrived at the Elysee, the staff responsible for the president’s security were immediately doubled..”

• Macron Obsessing Over Personal Security Amid Ukrainian Conflict (RT)

French president Emmanuel Macron’s concerns for his own personal safety are being amplified by his public statements and tough stance on the Ukraine conflict, Marianne magazine reported on Sunday. The magazine spoke to multiple sources within Macron’s security detail, the country’s Interior Ministry, and to his notorious ex-bodyguard Alexandre Benalla. During his time with Macron’s security team, Benalla became embroiled in multiple scandals, including beating up demonstrators alongside riot police during the Yellow Vest protests. Macron has always been concerned with his personal security, Benalla claimed, revealing the president had bolstered the ranks of his guard right after assuming office. “As soon as we arrived at the Elysee, the staff responsible for the president’s security were immediately doubled compared to those responsible for that of [predecessor] Francois Hollande,” the disgraced bodyguard explained.

The Yellow Vests protests, which have plagued Macron’s presidency throughout his first term and beyond, have left a dent. Macron’s spouse Brigitte has been particularly concerned that her husband would ultimately end up assassinated, Benalla claims. “She was always very worried about him. At home, there is the fear of ‘Kennedy syndrome,’ that he will end up assassinated,” the insider reportedly claimed. The situation has deteriorated further as a result of Macron’s determination to present himself as a hawk on the conflict between Moscow and Kiev. The president’s security team has been working in “red” mode since at least last summer, an unnamed source “at the heart” of Macron’s guard system told the magazine.

“Recently, he is provoking so much that he is afraid,” a source at the heart of the Macron security system confided. “Since last summer, he has taken on some big guys to accompany him. They are more visible and also more effective in intervening in the event of a crowd movement.” The French president is apparently not afraid of facing off angry citizens as is, but rather fears the alleged Russian “hybrid threat,” the report suggested. He has repeatedly voiced concerns over “state-level” threats emanating from abroad, while in private blaming the alleged threat exclusively on Moscow, and creating a special taskforce to tackle it. “Macron is totally freaked out by the Russians. One morning, he arrived at the intelligence services and requested the creation of a special task force on Russian interference overnight. Colleagues have to hold a meeting daily, it doesn’t excite them much,” a senior official with the Interior Ministry told Marianne.

25 years ago NATO bombed Yugoslavia. Guterres was Portugal PM.

• Guterres, the UN, Might, Wise Guys’ ‘Wisdom’, and Right (Graça)

António Guterres, according to what I have read somewhere, has formally and publicly protested the fact that the people of the newly incorporated regions of Russia participate in the latter’s presidential elections. The reason, he claimed, was that it had been an illegal incorporation, based on an also illegal invasion. Russia would thus have in this case the might, Guterres argued, but she would not have on her side the right. Does this sit well with a UN Secretary-General? It certainly does, the unaware reader will likely say. That’s precisely what the UN exists for: to show everyone that, beyond might, irreducible to it, there is always (and there will be) the right. The problem with this – formally impeccable – argument resides, however, elsewhere. Do you remember Kosovo? It was occupied by NATO in 1999, after this alliance bombed the then Yugoslavia, on various pretexts that later were revealed to be false, forcing it (without a UN mandate, by sheer military might) to withdraw from that territory.

Yugoslavia held out for almost three months of relentless bombardment, but eventually withdrew, albeit grudgingly and only against written assurances that Kosovo would remain Yugoslav territory, only provisionally occupied: “we didn’t give away Kosovo, we don’t give away Kosovo”, Slobodan Milosevic then declared publicly. Kosovo was part of a Yugoslav republic, Serbia, and remained so even when this and the other remaining Yugoslav republic, Montenegro, later legally ‘divorced’, thus ending the very existence of the ‘once upon a time’ Country of the South Slavs. Serbia does not recognize the right to secession of her provinces, and so she did not recognize the secession of Kosovo when this territory subsequently (in 2008, still under NATO occupation and without holding a referendum with that purpose) proclaimed its independence.

She complained about this to the International Court of Justice, but the ICJ did not grant the Serbian complaint, arguing that, while it was true that on the latter’s side was the UN’s principle of protection of the integrity of states’ borders, on the side of Kosovar independence was the also UN’s principle of the defense of peoples right to self-determination. That being the case, and although admittedly in a situation of mon coeur balance, the august Court decided by a majority to give the right to Kosovo’s independence, and the wrong to Serbia. The rejection of a region’s independence could be valid internally, but not internationally. Was the secession of Kosovo illegal from the point of view of Serbian law? Perhaps. But not, the ICJ declared, from the point of view of international law.

Now, with things admittedly at this point, the obvious question is: have Crimea, the Donbass, plus the other two provinces of Novorossiya, legally seceded from Ukraine? From Kiev’s point of view, of course not. But from the point of view of international law? When faced with the problem of the secession of countries de facto in a colonial situation, but formally only provinces of another (as was the case with the then Portuguese overseas provinces in Africa), the UN had already decided, in 1970, that the decisive criterion was the existence or not of negative discrimination against certain groups. If the Portuguese state practiced negative discrimination against African ‘indigenous’ people, this would be an irrefutable indication of colonialism, even if the Portuguese Constitution of the time did not openly proclaim it. Therefore, Angola and Mozambique would have the right to secede.

If, on the other hand, it was a question of territories where the populations enjoyed the same rights as the ‘normal’ nationals of their respective countries, such as the Corsicans vis-à-vis the other French, or the Sardinians in relation to the other Italians, there would be no right of secession. Corsica and Sardinia would therefore not have the right to secede from France and Italy, respectively. The point is that, precisely, Kosovo was not the target of any derogatory treatment by Serbia. On the contrary, there was positive discrimination, with the right to use Albanian as a regional co-official language, just as it is today in Spain with Basque, Galician and Catalan in the Basque Country, Galicia and Catalonia, respectively. And yet, the ICJ ruled against Serbia’s claim! That is, giving an additional right to the centrifugal political tendencies, when compared to the position of the UN General Assembly back in 1970…

Given this, the question inevitably arises: have the inhabitants of the Donbass, who revolted and organized secessionist referendums as early as 2014, and since then saw the Russian language banned, and were the target of indiscriminate bombardment by Kiev’s troops and paramilitary, and suffered all kinds of other atrocities, not much more right to secession than the Kosovars – to whom, for example, the use of Albanian had never been forbidden by Belgrade? On the contrary, the entire Albanian cultural legacy was always carefully protected by Yugoslavia’s emphatically multi-ethnic Constitution, and the ethnic Albanian population benefited from various forms of positive discrimination. And yet, the ICJ rejected Serbia’s complaint!

What led to Putin. “If I had accepted Gore’s terms, I would have been a real traitor..”

• ‘U-Turn Over Atlantic’ (Sp.)

Sunday marks the 25th anniversary of then-Russian Prime Minister Yevgeny Primakov’s famous “U-turn” over the Atlantic, an event that grabbed global headlines at the time. On March 24, 1999, Primakov was on a flight to the United States to negotiate a $5 billion IMF loan for Russia. But after then-US Vice President Al Gore informed Primakov that NATO had launched a bombing campaign against Yugoslavia, Primakov decided to turn his plane around and return to Moscow. Witnessing the Primakov-Gore conversation was the now-deputy head of Russia’s upper chamber of parliament, Konstantin Kosachev, who served as an assistant for international affairs to the prime minister in the late 1990s. Kosachev was among the members of a Russian government delegation on board Primakov’s plane when the incident took place. The Federal Council deputy head later recalled that Gore told Primakov about the beginning of NATO’s military operation and the alliance’s decision to start bombing Yugoslavia “in these very minutes.”

According to Kosachev, Primakov reacted by telling Gore that such a development means that the Russian delegation’s visit to the US “becomes impossible.” The lawmaker added that the plane turned around after Primakov received the go-ahead from then-Russian President Boris Yeltsin. When asked by reporters why Primakov’s move was so significant for history, Kosachev stressed that “it was the first sign of Russia’s disagreement as a state with the policies that the US and its NATO allies were pursuing in a world which seemed to have changed since the end of the Cold War, but in fact which had not changed at all.” “As I see it, the decision proved to be a turning point both literally and figuratively in relations between Russia and the West, something that reflected our country’s utter disagreement with the West’s line on building a unipolar world,” Kosachev underscored.

It predetermined the entire course of subsequent events, the lawmaker went on, noting that Russia and the West “could have come out of all this by preserving partnership in those issues that unite both sides.” “The two, however, continued to move in opposite directions because the West refused to reconsider its policy line with regard to the outside world and Russia. What’s more, the West in many situations further aggravated the situation,” Kosachev pointed out. As for Primakov, needless to say he was shocked after hearing the news about a European country being bombed for the first time since the end of the Second World War. Despite Gore’s desperate attempts to persuade Primakov to backtrack on his decision and come to Washington, the Russian prime minister was undeterred. “If I had accepted Gore’s terms, I would have been a real traitor,” Primakov later said.

Bhakdi

https://twitter.com/i/status/1771608859221619053

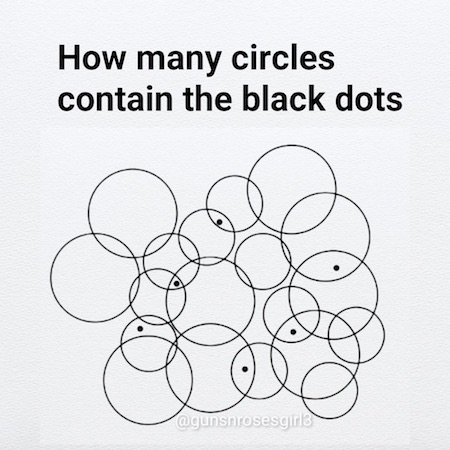

Parakeet

Smart parakeet

pic.twitter.com/N39sAHZleg— Science girl (@gunsnrosesgirl3) March 24, 2024

Tiger

The tiger stopped and waited until the elephants crossed the road. pic.twitter.com/rnuojTrhFB

— Nature is Amazing ☘️ (@AMAZlNGNATURE) March 24, 2024

China 2019-24

https://twitter.com/i/status/1771858094030565756

Bird dog

https://twitter.com/i/status/1771934010643451957

Giraffe

https://twitter.com/i/status/1771923520995340738

Whales

https://twitter.com/i/status/1772141576900214974

Love

All living things need love.pic.twitter.com/GR9Hi4fbTT

— Figen (@TheFigen_) March 24, 2024

Gravity

Unbelievable! They defy gravity!pic.twitter.com/8cphwRCSA6

— Figen (@TheFigen_) March 24, 2024

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.