Marjory Collins “Crowds at Pennsylvania Station, New York” Aug 1942

I collected so many “corona”-related articles over the past 24 hours, I’ll do a separate thread with them, because this one would get too long. It’ll be up in a few hours.

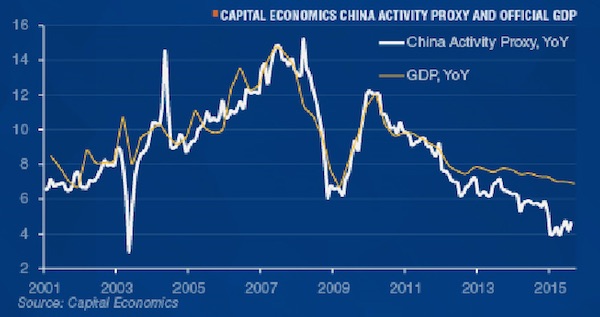

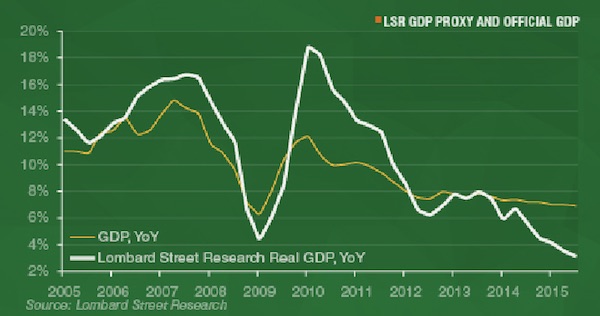

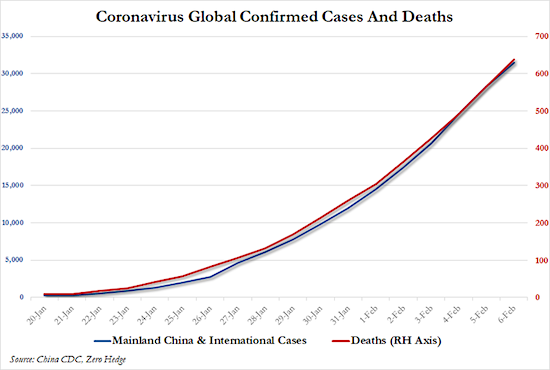

China is making an effort to make it seem like they have things under control to the extent that numbers are rising less. Don’t trust them. For one thing, it’s not reflected at all in this graph. For another, Xi is real anxious to get the economy restarted. But that’s not possible while the lockdowns remain. Nice quote I heard: if even just 1% of your car parts are from China, and you can’t get them anymore, you can’t build a car.

Asking myself: why are there practically no children infected? Does anyone know?

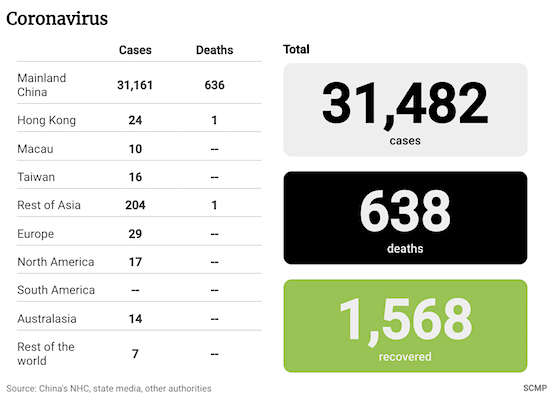

Numbers today:

• China reports 73 new deaths from coronavirus and 3,143 new cases (from 3,797 yesterday)

• Hubei province reports 69 new deaths and confirms 2,447 new cases

• 185,555 people under medical observation, down from 186,354 yesterday

• Japan says 41 new infections on board Yokohama cruiseliner, total now 61 out of 273 tested

Most interesting here is XI: “We are fully confident and capable of fighting the epidemic. The long-term trend of China’s economic development will not change.”

• China Reports 73 New Deaths From Coronavirus, 3,143 New Cases (SCMP)

Health authorities in China pegged deaths caused by the novel coronavirus epidemic on Thursday at 73, with 69 in Hubei province, according to official figures released early Friday. The updated numbers raise the death toll in mainland China to 636. Newly confirmed cases rose by 3,143, a second consecutive daily drop, bringing the total to 31,161 cases in the country, according to data released on Friday morning by China’s National Health Commission (NHC). Most the deaths came from Hubei province, epicentre of the outbreak, where 69 new fatalities from the epidemic were reported on Thursday, one less fatality compared with the day before. The total death toll in Hubei rose to 618, the province’s health commission said.

[..] Chinese President Xi Jinping told his US counterpart Donald Trump on Friday that China’s economic development would not be affected by the outbreak, according to CCTV, China’s state broadcaster. CCTV reported that, in a phone conversation with Trump, Xi said the Chinese government and people had put their fullest efforts into containing the outbreak since it had started. “We have adopted the most comprehensive and strictest prevention and control measures through mobilising and rapid responses. We have declared a people’s war against the epidemic through prevention and control,” Xi was quoted as saying. “We are fully confident and capable of fighting the epidemic. The long-term trend of China’s economic development will not change.”

After closing the borders.

• Trump Expresses Confidence In China’s Confronting Its Coronavirus Outbreak (R.)

U.S. President Donald Trump expressed confidence in China’s strength and resilience in confronting its coronavirus outbreak during a conversation with President Xi Jinping on Thursday, a White House spokesman said. The two leaders agreed to continue extensive communication and cooperation between both sides, the spokesman, Judd Deere, added. Trump and Xi also reaffirmed their commitment to implementing Phase 1 of the trade deal between the United States and China, he added.

Honest question: what do you think is more dangerous, RussiaRussiaRussia or the coronavirus?

• Texas Congresswoman Says Russia Responsible For Iowa Caucus Mess (WE)

Rep. Sheila Jackson Lee, a Texas Democrat, suggested during an FBI oversight hearing on Wednesday that Russia is responsible for the vote-reporting issues from Tuesday’s Iowa caucuses. “I hope that the Iowa Democrats will ask for an FBI investigation on the app,” the Texas Democrat told FBI Director Christopher Wray. “I believe that Russia has been engaged in and interfering with a number of our elections dealing with the 2016 election.” Wray responded by reassuring Jackson Lee that the FBI shares her concern about Russian interference. “Certainly, we are also concerned about potential Russian interference with our elections,” Wray said. “That’s why I created the foreign influence task force, which is acutely focused on that topic among other nation-states that are attempting to influence our elections.”

Democrats have faced criticism for not properly testing the voting system in Iowa, which includes an app the Iowa Democratic Party spent $60,000 to implement. “How can anyone trust you now?” a reporter yelled at the chairman of the state’s Democratic Party after reporting issues had still not been cleared up the day after voters caucused. An official winner has still not been announced as of Thursday evening. Democratic National Committee Chairman Tom Perez expressed his frustration on Thursday by calling for a recanvassing. “Enough is enough. In light of the problems that have emerged in the implementation of the delegate selection plan and in order to assure public confidence in the results, I am calling on the Iowa Democratic Party to immediately begin a recanvass.”

Excuse me, what the fuck?@iowademocrats #iowacaucases

Snipped from https://t.co/S3jpTegC8b where a lot more of this is going on pic.twitter.com/obU3Sal0oH— Overreaction Shark (@ovrreactionguru) February 5, 2020

Starting to feel Turley is writing more than he should.

• The GIGO Impeachment (Turley)

Every line of work — from law to carpentry to software — has its own house rule about how bad results come from bad beginnings. There is even an initialism for this: GIGO, or garbage in, garbage out. Unless senators use their closing arguments this week to clarify that they are not endorsing either the prosecution or defense premises in reaching their verdicts, this will go down as the GIGO impeachment: precedent created by false assumptions in both houses. The House blundered in rushing an impeachment by Christmas rather than waiting a couple of months to submit a more complete case with added witnesses, court orders and evidence.

Instead of seeking to compel such direct evidence, the House pushed the vote to impeach on the basis of what my co-witnesses called by the Democrats admitted was an inferential case. There is no question that you can make an inferential case for impeachment, but it is the difference between a strong and a weak case. Rather than wait a couple months to strengthen that record (as I suggested at the Judiciary hearing), the House muscled through an impeachment after the shortest investigation of a president in history. The greatest concern in the House’s case was always the obstruction-of-Congress charge. The House declared that the administration’s failure to yield to demands for witnesses and evidence was by itself a high crime and misdemeanor.

The problem is that other administrations have raised the presidential immunity claims made by the Trump administration, and those claims were supported by legal opinions from the Justice Department. Both Richard M. Nixon and Bill Clinton were able to litigate their privilege claims all the way to the Supreme Court before facing impeachment. [..] This is a great case marred by passion and distortion. What is surprising is that both blunders were not “accidental” but premeditated by the two parties. It undermined the legitimacy and authenticity of the actions in both chambers. Even if the senators cannot agree on what is appropriate for impeachment, they should at least agree on what is not appropriate.

Who supports those terrorists? Is it Turkey or the US?

• Russian, Turkish Military Among 100s Killed & Injured In Idlib Terrorism (RT)

Terrorists took over the Idlib de-escalation zone and carried out thousands of attacks in the last two months, Russia’s Foreign Ministry said in a statement, adding that the West is portraying them as “moderate opposition.” Idlib governorate, the last stronghold of anti-government forces in Syria, saw a surge of violence by radical jihadists who have no desire for a peaceful resolution to the almost nine-year-long conflict, the Russian Foreign Ministry said on Thursday. Most of the attacks are carried out by Hayat Tahrir al-Sham, the latest iteration of al-Qaeda in Syria. The area was proclaimed a de-escalation zone under the Russia-Turkey agreements. In mid-January, Russian and Turkish forces tried to impose a ‘regime of silence’ there, but the attacks only escalated.

In December 2019 there were over 1,400 terrorist attacks staged from Idlib, with some operations seeing the use of armor and even tanks. The scale of violence remains high, with over 1,000 attacks recorded in the last two weeks of January. Hundreds of Syrian civilians and government troops have been killed, as well as “Russian and Turkish military specialists.” “The relocation of some armed groups out of the de-escalation zone to northeastern Syria and later to Libya has boosted the concentration of radical extremists over the boiling point,” the ministry said. This situation was recently discussed during an interview with Russian Foreign Minister Sergey Lavrov. He explained that Turkey needed to separate the armed opposition it is working with from the Hayat Tahrir al-Sham terrorists, saying that it has failed to do so.

Retracted now, but still illustrative of post-Brexit Britain. Ruled by white guys from the 18th century.

• UK Town Halls Told To Fly Union Jack For Prince Andrew’s Birthday (Ind.)

Town halls across the UK have been officially reminded they must fly the Union Jack flag on 19 February, to celebrate Prince Andrew’s 60th birthday. Politicians and public alike have slammed the Whitehall order, which they say puts protocol before principles. The prince is not currently performing royal duties amid an ongoing scandal over his friendship with millionaire paedophile Jeffrey Epstein, and claims that then-teenager Virginia Roberts was coerced into having sex with Prince Andrew in 2001 and 2002. He denies the allegation, saying he was at a birthday party at the Woking branch of Pizza Express on one of the nights the pair are said to have slept together.

However, the order is now likely to be withdrawn, after the prime minister’s spokesman described it as “an administrative email about a longstanding policy”. “I understand that DCMS [the digital, culture and media department] and the royal household are considering how the policy applies for changed circumstances, such as when members of the Royal Family have stepped back from public duties,” the spokesman said – in a clear hint it will be pulled. The instruction had drawn heavy criticism, Labour MP and deputy leadership candidate Ian Murray saying: “This protocol has to be binned given the allegations against the prince.” [..] ..a council source said: “It seems ridiculous. The government doesn’t appear to be noticing what has happened recently, or factoring in the mood of the nation.”

And that’s before the virus halted 10s of 1000s of flights.

• Boeing’s Fraying 737 MAX Suppliers See Capacity Crunch (R.)

Boeing Co suppliers are shedding jobs and capacity to cope with a halt in 737 MAX output, but while that staves off chaos, aerospace executives worry the industry might be unable to ramp factories quickly enough when the plane wins approval to fly again. Boeing, struggling to restore public confidence and recover from the biggest crisis since its founding in 1916, has halted production of the once fast-selling 737 MAX, which was grounded in March following two deadly crashes. As a result, industrial heavyweights like fuselage maker Spirit Aerosystems have already laid off workers. Now a cluster of other crucial companies small and big that forge metal, assemble and paint 737 MAX winglets, and build data systems have followed suit with no indication that Boeing will offer a lifeline, people familiar with the matter said.

Losing payments and workers in a tight labor market heaps pressure on Boeing’s U.S.-dominated 737 MAX supply chain, which involves hundreds of suppliers of more than half of the roughly 400,000 parts for each 737 built in the Seattle-area. “One of the main questions is how much capacity will be lost in the supply chain by the time production resumes at significant rates,” said an industry executive with knowledge of Boeing’s industrial network. Such concerns dominated the Pacific Northwest Aerospace Alliance conference north of Seattle this week, where some executives vented frustration over what they called Boeing’s lack of financial support. One executive from a supplier that derives a quarter of its business from the MAX said Boeing has treated his company like “a commodity” in a “transactional” relationship. He predicted Boeing would let some suppliers fail.

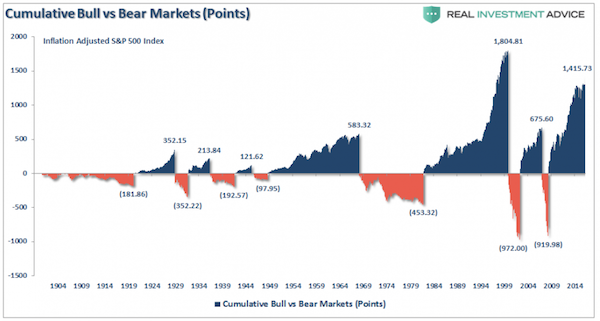

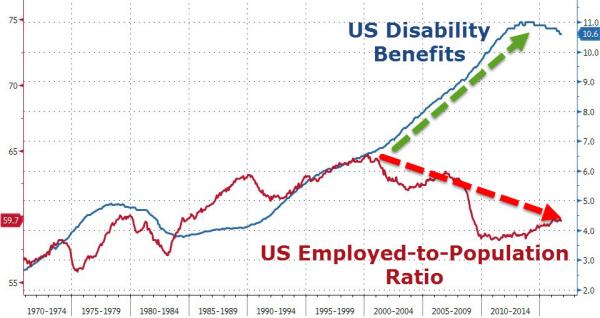

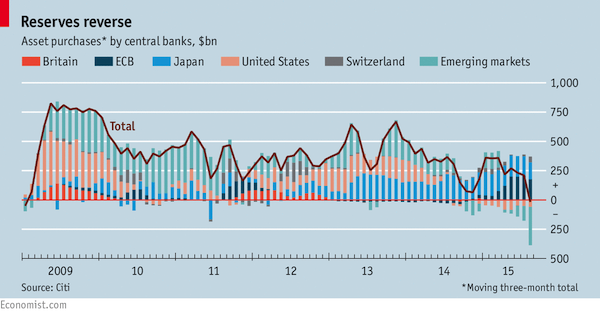

The Fed’s (and ECB’s) ultra-low interest rates killed all pension systems. We just don’t -want to- realize it yet.

• Ohio Pension System Slashes Health-Care Benefits To Stave Off Insolvency (ZH)

For the first time in years, a major public pension system has slashed benefits for retirees: The Ohio Public Employees’ Retirement System voted last week to cut health care benefits provided to the pension’s current and future retirees beginning in 2022 to try and prevent the fund from plunging into insolvency in the not-too-distant future. It’s just the latest reminder that America’s ‘pension timebomb’ isn’t as far off into the future as many retirees, investors and public officials would like to believe. According to Chief Investment Officer and the Bond Buyer, if these changes had not been enacted, the fund would run out of money in about 11 years, executive director Karen Carraher said during a board meeting. The measure passed by a 9-2 vote.

“There is no available funding for health care,” a report from the board said. “All of the employer contribution[s] must be allocated to pension funding until that funding improves. Based on current projections, no funding will be available for health care for 15 or more years.” The vote, which was undertaken after polls showed members would be open to the changes to preserve their retirement benefits, eliminated the system’s group health-care plan and replaced it with stipends that will defray costs for members who purchase plans on the state ObamaCare exchange. Beneficiaries will receive a wide variety of quantitative cuts, depending on their age of retirement, the year in which they retired, and the number of years working in the state.

“Surveys indicate members willing to accept changes/reductions in health care in the interest of preserving it,” the board’s report said. Nearly everyone in OPERS likely will be affected by these changes. The board’s vote constituted the elimination of the pension’s healthcare group plan, and replaced it with a stipend that will help supplement for some members the cost of a new healthcare plan on the marketplace. “Pre-Medicare group plan is unsustainable for OPERS and members as risk core and costs continue to increase,” the report said. The board “needs to reduce the cost of health care to preserve current health care trust fund until such time funding can resume.”

Protesting what your own employer supports, and after the damage is done. Lovely.

• Interest Rate Controls Could Reduce Real Per Capita Growth (IMF)

With the surge in public debt in the wake of the global financial crisis, financial repression—administrative restrictions on interest rates, credit allocation, capital movements, and other financial operations—has come back on the agenda. In our recent working paper, we argue that countries would be better-off without financial repression. By distorting market incentives and signals, financial repression induces losses from inefficiency and rent-seeking that are not easily quantified. Losses from rent-seeking might occur when administrative restrictions reduce access to certain financial services (such as credit) and improve the benefits (e.g., through low interest rates) for the selected users (at the cost of those excluded), and when these lead to wasteful competition among potential users for such gains.

Using an updated index of interest rate controls covering 90 countries over 45 years, this IMF staff study estimates that financial repression in the form of interest rate restrictions could reduce real per capita growth by about 0.4–0.7 percentage points, on average, with the effect being larger in countries with larger financial systems. The study also finds that a full liberalization of interest rates is necessary to significantly increase growth, and changes in interest rate restrictions short of full liberalization have a limited impact. The case studies suggest that interest rate controls may also disrupt financial stability and may reduce access to financing for small enterprises.

The Fed should take care of people, not banks, by now. No body has ever been more destructive to a society.

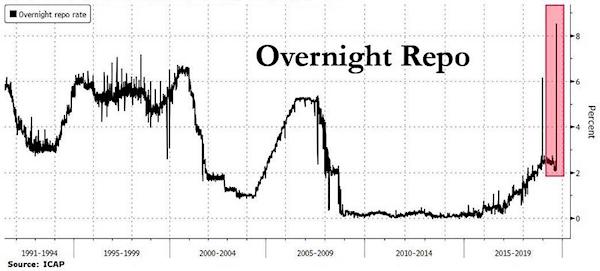

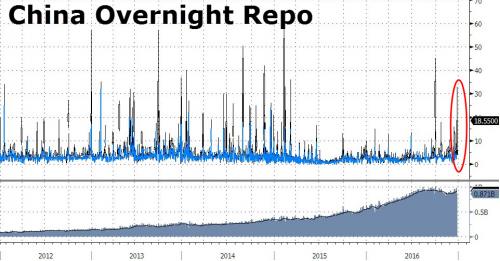

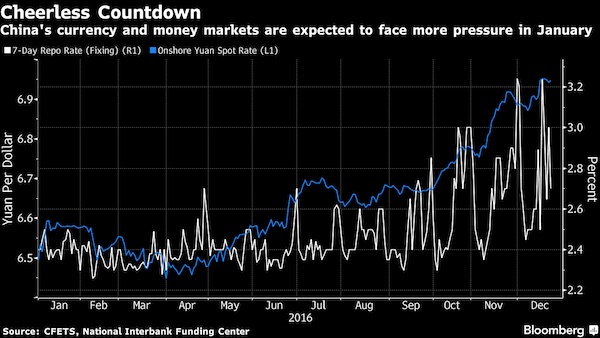

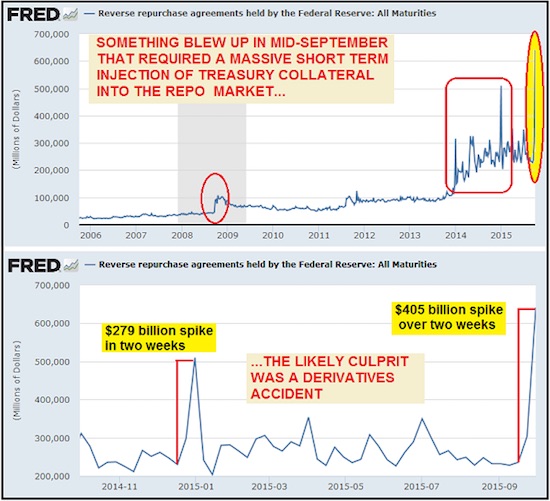

• Encourage Banks To Tap Discount Window To Prevent Repo Freeze – Quarles (MW)

The Federal Reserve could encourage banks to tap a key funding source that has been scarcely used since the financial crisis as a solution to the September dislocations in short-term lending markets, said Fed Vice Chairman for Supervision Randal Quarles on Thursday. Quarles said financial institutions should not be afraid of accessing the discount window, where banks have historically borrowed funds from the Fed in return for collateral during short-term liquidity shortages, in a speech held at an event by the Money Marketeers of New York University. The use of the window, however, has been stigmatized following the financial crisis amid worries that tapping the window could end up creating the perception that a bank was in precarious shape and could even be insolvent, precipitating further outflows.

He noticed that despite the equivalence between Treasurys and reserves as sources of capital that could meet the Fed’s liquidity coverage regulations, which are designed to ensure banks can meet sudden cash outflows, the reality was banks would prefer to hold cash reserves as banks could struggle to sell government bonds swiftly if it wanted to raise funds. Quarles’ remarks come as investors and bank executives have pointed to the preference of reserves over Treasurys as one factor that contributed to the surge in overnight repo rates in September, which briefly pushed the benchmark fed funds rates above its target range and raised questions whether the Fed was losing its grip on a key monetary policy tool.

Pushing banks to use the discount window during stress scenarios could help resolve the issues in money markets, as it gave banks sufficient time to sell high-quality capital like Treasurys and raise cash, diminishing the need to accrue reserves as a way of handling liquidity issues. “I think it is worth considering whether financial-system efficiency may be improved if reserves and Treasury securities’ liquidity characteristics were regarded as more similar than they are today,” said Quarles.

Stupid games. Close it down or it will destroy you.

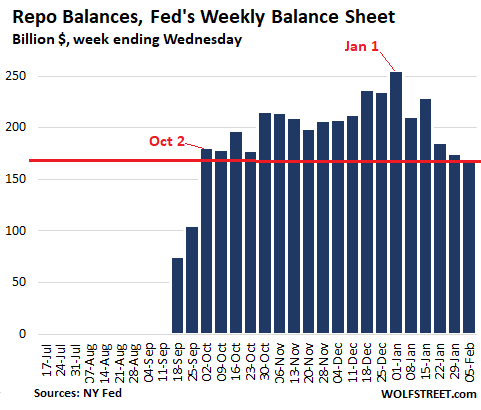

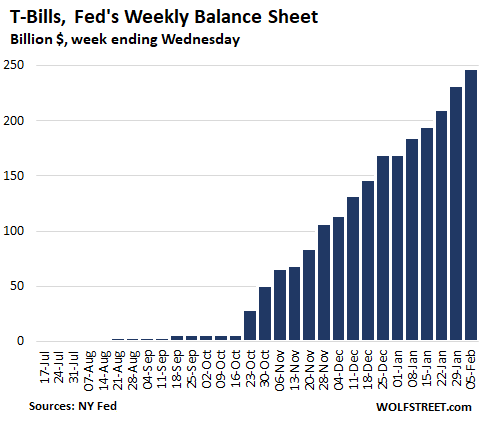

• End of QE-4: Fed’s Repos Drop Below Oct 2 Level, T-Bills Balloon (WS)

Under these “repurchase agreements,” the Fed buys Treasury securities and mortgage-backed securities (MBS), guaranteed by Fannie Mae and Freddie Mac, or Ginnie Mae, whereby the counterparties commit to buy back these securities at a fixed price on a specific date, such as the next day (overnight repo) or a longer period, such as 14 days (term repo). Repos are by definition in-and-out transactions. When a repo matures and unwinds, the Fed gets its money back, and the repo on the Fed’s balance sheet goes to zero. By buying these securities, the Fed adds liquidity to the market for the duration of the repo. When the repo matures and unwinds, the liquidity gets drained from the market. When a new repo transaction occurs, the process starts over again, but with a different amount and with a different maturity date.

The Fed raised the interest rate at which it offered the repos – for borrowers, the money is getting a little less cheap. Through January 29, the Fed’s average offering rate for overnight repos was 1.55%. On January 30, this increased to 1.60%. And the rate for 14-day repos increased from 1.58% effective through January 29, to about 1.61%. The Fed had been the lender-of-first-resort in the repo market, by offering to lend at these low rates. By increasing the rate, the Fed is gradually making the cash it is handing out less cheap and less attractive compared to what banks might offer, and more of the demand is switching over to banks. Overnight repos have been undersubscribed all year, so there is less and less demand for them at this rate. But the 14-day term repos are often oversubscribed, meaning there is more demand for this two-week cash at 1.61% than the amount the Fed is offering.

[.] The Fed continued to increase its ballooning stash of T-bills (Treasuries with maturities of one year or less) at a rate of about $60 billion per month. To increase its stash, the Fed has to buy the amount of the maturing T-bills, and it has to buy the amounts needed to obtain the targeted increase of about $60 billion a month. Over the five weekly balance sheets since January 1, the Fed has added $78 billion in T-bills, and the total amount of T-bills on the Fed’s balance sheet has now ballooned to $248 billion: These T-bills are a major part of the Fed’s strategy to bail out the repo-market. The purpose is to increase Excess Reserves that banks have on deposit at the Fed. The Fed blames low Excess Reserves last September for the banks’ refusal to lend to the repo market, which then caused the repo market to blow out. So bringing up Excess Reserves to an “ample” level is the goal of these T-bill purchases.

Greece is being hit hard by the virus’s effect on tourism. But that’s just the icing on the cake.

• Seven In 10 Greeks Threatened By Poverty (K.)

Almost seven in every 10 Greeks are in a dire financial situation, according to data compiled by the Organization for Economic Cooperation and Development (OECD). The figures published in the bulletin of the Hellenic Federation of Enterprises (SEV) indicate that 68.3 percent of the population in Greece are living close to or below the poverty line, with 12.9 percent already having to make do with an income below that line and 55.4 percent categorized as vulnerable, as they too could drop below the poverty line if they miss out on three months’ salary.

The proportion of Greeks who are unable to make a decent living is far above the OECD average, which stands at 50.4 percent. In the United States, which also shows high levels of inequalities, the rate comes to 55.5 percent, while in Denmark it stands at 36.3 percent. Greece’s rate is second only to Latvia’s in the European Union. SEV commented that Greece is among the European countries with the greatest inequalities in incomes, a situation that has been aggravated by the financial crisis of the 2010s, which hurt lower incomes in particular.

This sounds too bland for me. Been there done that. And I don’t think suggesting that it’s all climate change is all that smart. If only because it isn’t. Chemicals still play a major role.

• Bumblebee Survival Chances In EU, US Drop 30% In Single Generation (Hill)

Bumblebee populations are in decline across North America and Europe due to hotter and more frequent extremes in temperatures, and climate change is playing a big role, according to a recently released study. The study by researchers from the University of Ottawa published in the journal Science examined changes in the populations of 66 bumble species across the two continents, and compared them with climate changes. The research found that in the course of one human generation, the likelihood of a bumblebee population surviving in a given place in North America and Europe declined by an average of over 30 percent.

“We’ve known for a while that climate change is related to the growing extinction risk that animals are facing around the world,” lead author of the study Peter Soroye said in a statement. “Bumblebees are the best pollinators we have in wild landscapes and the most effective pollinators for crops like tomato, squash, and berries,” Soroye said. “Our results show that we face a future with many less bumblebees and much less diversity, both in the outdoors and on our plates.” Researchers used data collected over a 115-year period showing where bumblebees have been found over the decades. They mapped the places the bees lived and how their distribution changed over time. They found the bees were disappearing in areas that had gotten hotter, and some are colonizing in new areas that were previously too cold.

Ideal world: “There are very substantial reductions in unemployment, the human poverty index and the debt to GDP ratio. Greenhouse gas emissions are reduced by nearly 80%. This reduction results from the decline in GDP and a very substantial carbon tax.”

• Can We Have Prosperity Without Growth? (New Yorker)

“If growth were to be abandoned as an objective of policy, democracy too would have to be abandoned,” Wilfred Beckerman, an Oxford economist, wrote in “In Defense of Economic Growth,” which appeared in 1974. “The costs of deliberate non-growth, in terms of the political and social transformation that would be required in society, are astronomical.” Beckerman was responding to the publication of “The Limits to Growth,” a widely read report by an international team of environmental scientists and other experts who warned that unrestrained G.D.P. growth would lead to disaster, as natural resources such as fossil fuels and industrial metals ran out. Beckerman said that the authors of “The Limits to Growth” had greatly underestimated the capacity of technology and the market system to produce a cleaner and less resource-intensive type of economic growth—the same argument that proponents of green growth make today.

Whether or not you share this optimism about technology, it’s clear that any comprehensive degrowth strategy would have to deal with distributional conflicts in the developed world and poverty in the developing world. As long as G.D.P. is steadily rising, all groups in society can, in theory, see their living standards rise at the same time. Beckerman argued that this was the key to avoiding such conflict. But, if growth were abandoned, helping the worst off would pit winners against losers. The fact that, in many Western countries over the past couple of decades, slower growth has been accompanied by rising political polarization suggests that Beckerman may have been on to something.

Some degrowth proponents say that distributional conflicts could be resolved through work-sharing and income transfers. A decade ago, Peter A. Victor, an emeritus professor of environmental economics at York University, in Toronto, built a computer model, since updated, to see what would happen to the Canadian economy under various scenarios. In a degrowth scenario, GDP per person was gradually reduced by roughly fifty per cent over thirty years, but offsetting policies—such as work-sharing, redistributive-income transfers, and adult-education programs—were also introduced. Reporting his results in a 2011 paper, Victor wrote, “There are very substantial reductions in unemployment, the human poverty index and the debt to GDP ratio. Greenhouse gas emissions are reduced by nearly 80%. This reduction results from the decline in GDP and a very substantial carbon tax.”

More recently, Kallis and other degrowthers have called for the introduction of a universal basic income, which would guarantee people some level of subsistence. Last year, when progressive Democrats unveiled their plan for a Green New Deal, aiming to create a zero-emission economy by 2050, it included a federal job guarantee; some backers also advocate a universal basic income. Yet Green New Deal proponents appear to be in favor of green growth rather than degrowth. Some sponsors of the plan have even argued that it would eventually pay for itself through economic growth.

Upside down world. You now have to pay for what nature provides for free. Pay people not to pollute. You want less pollution? Sure, but it’s going to cost you… Nice place you got there. You wouldn’t want anything to happen to it, would you?

• Canada To Aid Alberta As Deadline For Massive Oil Sands Project Nears (R.)

Canada is preparing an aid package for Alberta, heart of the country’s struggling oil industry, that would help dull the pain if it blocks an oil sands project that could create thousands of jobs, sources familiar with the matter said this week. Ottawa must decide by end-February if Teck Resources Ltd can build the C$20.6 billion ($15.7 billion) Frontier mine in northern Alberta despite climate and wildlife concerns. The decision is a major test of Prime Minister Justin Trudeau’s 2019 election pledge to put Canada on the path to reach net zero greenhouse gas emissions by 2050. Complicating the decision, unhappiness with the government’s energy and pipeline policy cost Trudeau’s Liberals all their Alberta seats in October 2019 elections.

“There will be a big fight inside cabinet over this,” said one source directly familiar the matter who requested anonymity given the sensitivity of the situation. “Rejecting Teck without providing Alberta something in return would be political suicide,” the source added. In Alberta, the project is considered essential for employment and growth. Teck says it would eventually create 7,000 jobs, although the company’s chief executive recently questioned whether it will ever be built. About 20 oil sands projects currently sit dormant despite receiving approval.

Please donate what you can.