Pieter Bruegel the Elder� Children’s games �1560

They are only boom times BECAUSE the debt rises so fast.

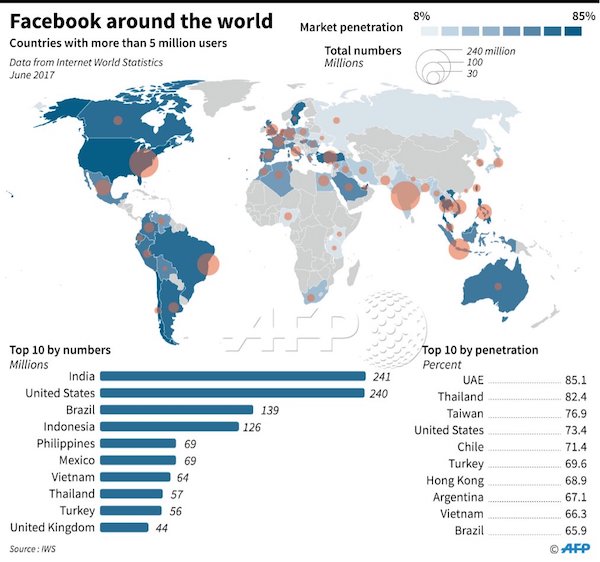

• US Gross National Debt Hits $21.5 Trillion in Fiscal 2018 (WS)

But wait — these are the Boom Times!

The US gross national debt jumped by $84 billion on September 28, the last business day of fiscal year 2018, the Treasury Department reported Monday afternoon. During the entire fiscal year 2018, the gross national debt ballooned by $1.271 trillion to a breath-taking height of $21.52 trillion. Just six months ago, on March 16, it had pierced the $21-trillion mark. At the end of September 2017, it was still $20.2 trillion. The flat spots in the chart below, followed by the vertical spikes, are the results of the debt-ceiling grandstanding in Congress: These trillions are whizzing by so fast they’re hard to see. What was that, we asked? Where did that go?

Over the fiscal year, the gross national debt increased by 6.3% and now amounts to 105.4% of current-dollar GDP. But this isn’t the Great Recession when tax revenues collapsed because millions of people lost their jobs and because companies lost money or went bankrupt as their sales collapsed and credit froze up; and when government expenditures soared because support payments such as unemployment compensation and food stamps soared, and because there was some stimulus spending too. But no – these are the good times.

Over the last 12-month period through Q2, the economy, as measured by nominal GDP grew 5.4%. “Nominal” GDP rather than inflation-adjusted (“real”) GDP because the debt isn’t adjusted for inflation either, and we want an apples-to-apples comparison. The increases in the gross national debt have been a fiasco for many years. Even after the Great Recession was declared over and done with, the gross national debt increased on average by $954 billion per fiscal year from 2011 through 2017.

Katsenelson.

• Average Stock Is Overvalued Somewhere Between Tremendously And Enormously (MW)

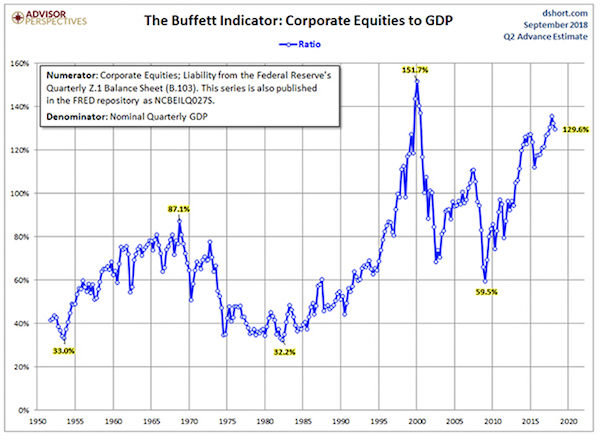

Here’s another, called the “Buffett Indicator.” Apparently, Warren Buffett likes to use it to take the temperature of market valuations. Think of this chart as a price-to-sales ratio for the entire U.S. economy, that is, the market value of all equities divided by GDP. The higher the price-to-sales ratio, the more expensive stocks are.

This chart tells a similar story to the first one. Though I was not around in 1929, we can imagine there were a lot of bulls celebrating and cheerleading every day as the market marched higher in 1927, 1928, and the first 10 months of 1929. The cheerleaders probably made a lot of intelligent, well-reasoned arguments, which could be put into two buckets: First: “This time is different” (it never is). Second: “Yes, stocks are overvalued, but we are still in the bull market.” (They were right about this until they lost their shirts.)

I was investing during the 1999 bubble. I vividly remember the “This time is different” argument of 1999. It was the New Economy vs. the old, and the New was supposed to change or at least modify the rules of economic gravity. The economy was now supposed to grow at a much faster rate. But economic growth over the past 20 years has not been any different than in the previous 20. Actually, I take that back — it’s been lower. From 1980 to 2000 the U.S. economy’s real growth was about 3% a year, while from 2000 to now it has been about 2% a year.

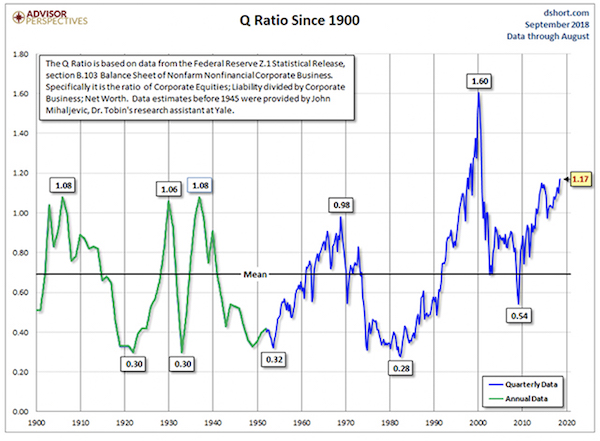

Finally, let’s look at a Tobin’s Q Ratio chart. This chart simply shows the market value of equities in relation to their replacement cost. If you are a dentist, and dental practices are sold for a million dollars while the cost of opening a new practice (phone system, chairs, drills, x-ray equipment, etc.) is $500,000, then Tobin’s Q Ratio is 2.0. The higher the ratio the more expensive stocks are. Again, this one tells the same story as the other two charts: U.S. stocks are extremely expensive — and were more expensive only twice in the past hundred-plus years.

China foreign reserves under threat.

• A Three-Way Train Wreck Is About to Derail the Markets (Rickards)

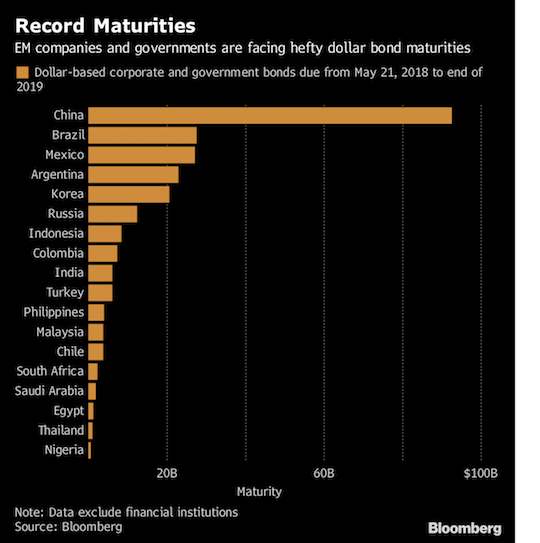

The U.S. trade war with China and China’s daunting debt problems are well understood by most investors. Coming U.S. sanctions on Iran and Iran’s internal economic problems are also well understood. What is not understood is how these two bilateral confrontations are intimately linked in a three-way tangle that could throw the global economy into complete turmoil and possibly escalate into war. Untangling and understanding these connections is one of the most important tasks for investors today. Let’s begin with the China debt bomb. As is apparent from the chart below, China has the largest volume of dollar-denominated debt coming due in the next 15 months.

The chart shows China with almost $100 billion of external dollar-denominated liabilities maturing before the end of 2019. But this debt wall is just the tip of the iceberg. This chart does not include amounts owed by financial institutions nor does it include intercompany payables and receivables. China’s total dollar debt burden is over $200 billion and towers over other emerging-market economy debt burdens. This wall of maturing debt might not matter if China had easy access to new finance with which to pay the debt and if its economy were growing at a healthy clip. Neither condition is true.

China has entered a trade war with the U.S., which will reduce the prospects of many Chinese companies and hurt their ability to refinance dollar debt. At the same time, China is trying to get its debt problems under control by restricting credit and tightening lending standards. But this monetary tightening also hurts growth. Selective defaults have already emerged among some large Chinese companies and certain regional governments. The overall effect is tighter monetary conditions, reduced access to foreign markets and slower growth all coming at the worst possible time.

Yeah, sure, the PBOC may cut reserve requirement ratios, but there’s a reason for those requirements: shaky banks.

• China Says Its Economy Is Slowing. PBOC May Be Preparing To Intervene (CNBC)

Beijing will likely take steps to mitigate the impact of the trade war with the U.S. as recent economic indicators from China point to a slowdown, an economist said on Monday. “We were calling for some slowdown, but the degree is much more than what we expected,” said Jeff Ng, chief economist for Asia at Continuum Economics, a research firm. Over the weekend, a private survey showed growth in China’s factory sector stalled after 15 months of expansion, with export orders falling the fastest in over two years, while an official survey confirmed a further manufacturing weakening. The official manufacturing index fell to a seven-month low of 50.8 in September, from 51.3 in August and below a Reuters poll forecast of 51.2.

That index has stayed above the 50-point mark for 26 straight months. A reading above 50 indicates expansion, while a reading below that signals contraction. But the Caixin/Markit Manufacturing Purchasing Managers’ Index (PMI) fell more than expected to 50.0 in September, from 50.6 in the previous month. Economists polled by Reuters had forecast 50.5 on average. “I think we are expecting some more triple-R cuts by the end of the year … I think one more triple-R cut by end of the year,” Ng said, referring to possibility that the People’s Bank of China may cut reserve requirement ratios for banks in order to boost liquidity and growth.

That should help.

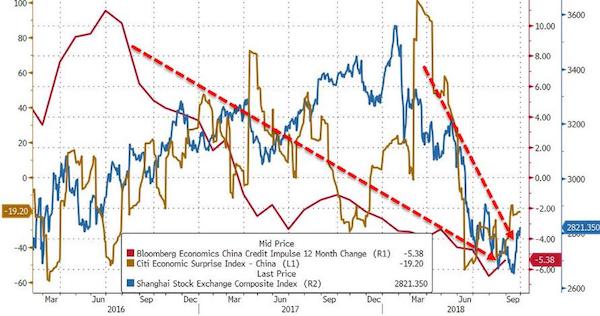

• China Blocks Bad Economic News As Economy Slumps (ZH)

China’s Shadow-banking system is collapsing (and with its China’s economic-fuel – the credit impulse), it’s equity market has become a slow-motion train-wreck, its economic data has been serially disappointing for two years, and its bond market is starting to show signs of serious systemic risk as corporate defaults in 2018 hit a record high. But, if you were to read the Chinese press, none of that would be evident, as The New York Times reports a government directive sent to journalists in China on Friday named six economic topics to be “managed,” as the long hand of China’s ‘Ministry of Truth’ have now reached the business media in an effort to censor negative news about the economy.

The New York Times lists the topics that are to be “managed” as: • Worse-than-expected data that could show the economy is slowing. • Local government debt risks. • The impact of the trade war with the United States. • Signs of declining consumer confidence • The risks of stagflation, or rising prices coupled with slowing economic growth • “Hot-button issues to show the difficulties of people’s lives.”

The government’s new directive betrays a mounting anxiety among Chinese leaders that the country could be heading into a growing economic slump. Even before the trade war between the United States and China, residents of the world’s second-largest economy were showing signs of keeping a tight grip on their wallets. Industrial profit growth has slowed for four consecutive months, and China’s stock market is near its lowest level in four years. “It’s possible that the situation is more serious than previously thought or that they want to prevent a panic,” said Zhang Ming, a retired political science professor from Renmin University in Beijing. Mr. Zhang said the effect of the expanded censorship strategy could more readily cause people to believe rumors about the economy. “They are worried about chaos,” he added. “But in barring the media from reporting, things may get more chaotic.”

The Chinese think their property should hold value or gain. And of not, Beijing should make it.

• Real Estate Rage Signals Turn in Chinese Housing Market (IICS)

Chinese homebuyers have demanded to return their housing in 2008, 2011 and 2014: each time the market price declined, but real estate rage first appeared in 2011. There was a report of real estate rage in Shanghai. The developer had slashed prices by one-third and homebuyers who purchased days or weeks responded by smashing up the sales office. “My house’s value has dropped by as much as one-third, and we have lost some 10,000yuan,” a homeowner surnamed Yang told Shanghai Daily. Real estate rage returned in early 2014. Angry homeowners in Hangzhou were upset for the same reason as those in Shanghai: the developer slashed prices. They flooded the developer’s office, but police were quickly on the scene.

“In 2008, 2011, 2014, there were three rounds of very obvious check-outs in the country. As long as the house price fell, the pre-purchasers began to reduce their prices.” Chongyuan Real Estate pointed out that the phenomenon of price reduction “rights” It has appeared from time to time, with 2011 being the most typical. According to public information, since September 2011, Beijing, Shanghai, Nanjing, Ningbo and other places have continued to reduce prices and defend their rights. The sales offices of various projects such as Vanke, Longhu and Hesheng have been destroyed, and some project owners have also physical conflict with security guards.

In September, there were several reports of “real estate rage” across the country. Instead of smashing offices, homeowners are protesting outside to “protect their rights” but the cause of their anger is the same: developers slashing prices to move inventory. While this evidence is anecdotal, there have been many reports about developers moving inventory to recoup cash. More importantly, both the 2011 and 2014 “real estate rage” incidents were coincident indicators of a housing market top.

He’s at least partly right.

• Di Maio Accuses EU Of Market ‘Terrorism’ Over Italy Budget (R.)

Italian Deputy Prime Minister Luigi Di Maio on Monday accused European Union officials of deliberately upsetting financial markets by making negative comments about Italy’s budget plans. “Some European institutions are playing … at creating terrorism on the markets,” said Di Maio, who is the head of the anti-establishment 5-Star Movement. He specifically took aim at European Economic Affairs Commissioner Pierre Moscovici, saying he had deliberately “upset the markets” with earlier comments on Italy.

Pension cuts may not be needed, but the IMF demands them regardless.

• Greece Tests Creditors And The Markets With Its 2019 Spending Plans (CNBC)

Greece could be about to start another fight with its creditors and the financial markets. The government unveiled last evening the first draft of its 2019 budget plan in which two scenarios were put forward for its spending plans and economic targets for the coming year. One of them included planned and pre-legislated pension cuts, in line with its creditors’ expectations. The other spending plan does not include pension cuts, however, indicating that the Greek government is willing to make changes to reforms that it had previously agreed with its creditors.

The pension cuts were due to start in January and were one of the most difficult reforms to come to an agreement. Potential changes to pensions, or to other reforms, could spark confrontations with European institutions and the IMF. The IMF said last month that the 2019 pension cuts are part of the reforms that the Greek government agreed to, and that Greece needs to show it is investor-friendly. The 2019 budget is the first in nearly a decade without Greece being subject to a bailout program. Nonetheless, Athens promised on Monday to stick to fiscal targets that had agreed with its creditors. In fact, Greece has said it will over-deliver when it comes to its primary budget surplus.

Iran gets desperate. But this may still work.

• Iran “Finalizing” Mechanism To Bypass SWIFT In Trade With Europe (ZH)

Just days after Europe unveiled a “special purpose vehicle” meant to circumvent SWIFT and US monopoly on global dollar-denominated monetary transfers – and potentially jeopardizing the reserve status of the dollar – Iran said it was finalizing mechanisms for the oil trade to bypass US sanctions against the country, said Iranian Deputy Foreign Minister Abbas Araghchi. According to RT, Araghchi said that Tehran is not ruling out the possibility of setting up an alternative to the international payments provider SWIFT to circumvent sanctions imposed by Washington. “As we know, Europeans are also trying to see how SWIFT can continue working with Iran, or if a parallel [financial] messaging system is necessary… This is something that we are still working on,” Araghchi said.

According to the Iranian diplomat, the independent equivalent of the SWIFT system that was earlier suggested by the EU to protect European firms working in Iran from US sanctions will be available for third countries. “This is the important element in SPV (Special Purpose Vehicle) that it is not only for Europeans but other countries can also use this. We hope that before the re-imposition of the second part of the US sanctions [from November 4], these mechanisms can be in place and be functional,” said the official. One can see why: the Iranian economy has been hit hard in recent days, and the Rial has plunged to all time lows, amid fears that the sanctions will cripple Iran’s most valuable export resulting in a shortage of hard currency, eventually leading to a replica of Venezuela’s economic collapse.

Points also to Paypal’s de facto monopoly.

• Alex Jones Sues Paypal For Infowars Ban (ZH)

Alex Jones’s company, Free Speech Systems, LLC, has sued PayPal for the its ban of Infowars because the controversial website “promoted hate and discriminatory intolerance against certain communities and religions.” In the complaint filed by Jones’s lawyers, Marc Randazza Legal group, they accuse PayPal of banning Infowars “for no other reason than a disagreement with the message plaintiff conveys” and call ban “unconscionable” because PayPal has never advised users that “it might ban users for off-platform activity.”

“It is at this point well known that large tech companies, located primarily in Silicon Valley, are discriminating against politically conservative entities and individuals, including banning them from social media platforms such as Twitter, based solely on their political and ideological viewpoints,” Jones’ lawyers claim in the 15-page complaint. Jones claims PayPal’s decision was based purely on “viewpoint discrimination.” He also says the decision was made based on conduct that “had nothing to do with” the PayPal platform, which purportedly violates Infowars’ contract with the payment-processing giant. If PayPal’s decision were allowed to stand, it would set “a dangerous precedent for any person or entity with controversial views,” the lawsuit alleges.

A few days old, and an odd one out for a Debt Rattle, I know. But Las Vegas police have yesterday involved re-opened the file. This comes after Ronaldo called the Spiegel article fake news, and one of the journalists posted 24 tweets detailing their investigation, saying they worked on it with 20 people for a long time, and have a strong legal team. Spiegel first opened the case in 2009, but the woman didn’t want to talk. She refused to name Ronaldo to police at the time as well.

• The Woman Who Accuses Ronaldo of Rape (Spiegel)

She was supposed to be invisible, damned to silence. Forever. Nobody was to ever learn about that night in Las Vegas back in 2009, especially not her version of events. She even signed a settlement deal and received a payoff ensuring that she would never give voice to the accusations. She signed, she says, out of fear for herself and her family. And out of impotence, the inability to stand up to him. And out of the hope that she could finally put the incident behind her. But, says Kathryn Mayorga, she was never able to close that chapter. The American is a slender 34-year-old with long, dark hair and green eyes. Until recently, she worked at an elementary school. But she quit, she says, “because I need all my strength now.”

She needs the strength to stand up to the man who she accuses of having raped her nine years ago — accusations that he denies. The man isn’t just anybody. It is Cristiano Ronaldo, arguably the best soccer player in the world, with vast amounts of success, money and adoration from the fans. An anonymous woman versus Ronaldo — the discrepancy could hardly be greater. They met on June 12, 2009 in a Las Vegas nightclub. Ronaldo was there on vacation with his brother-in-law and cousin. It was the summer when the star, then 24, would transfer from Manchester United to Real Madrid for a then-record sum of 94 million euros.