Edouard Manet Jeanne Duval, Baudelaire’s Mistress, Reclining (Lady with a Fan) 1862

Take away the political power of central banks.

• How To Make The Financial System Radically Safer (AM)

At the same time, the new financial reforms haven’t minimized risk. Moreover, they’ve set taxpayers – that’s you – up for a future fleecing. Congressman Robert Pittenger elaborated this fact in a Forbes article last year: “Even Dodd-Frank’s biggest selling point, that it would end “too big to fail,” has proven false. Dodd-Frank actually created a new bailout fund for big banks–the Orderly Liquidation Authority–and the Systemically Important Financial Institution designation enshrines “too big to fail” by giving certain major financial institutions priority for future taxpayer-funded bailouts.” What gives? Regulations, in short, attempt to control something by edict. However, just because a law has been enacted doesn’t mean the world automatically bends to its will. In practice, regulations generally do a poor job at attaining their objectives. Yet, they often do a great job at making a mess of everything else.

Dictating how banks should allocate their loans, as Dodd-Frank does, results in preferential treatment of favored institutions and corporations. This, in itself, equates to stratified price controls on borrowers. And as elucidated by Senator Wallace Bennett over a half century ago, price controls are the equivalent of using adhesive tape to control diarrhea. The dangerous conceit of the clueless… the house of cards they have built is anything but “safe” and they most certainly can not “fix anything”. Listening to their speeches that seems to be what they genuinely believe. A rude awakening is an apodictic certainty, but we wonder what or who will be blamed this time. Not enough regulations? The largely absent free market? As they say, “It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.” (this quote is often erroneously attributed to Mark Twain: we think it doesn’t matter whether he created it, it is often quite apposite and this is a situation that certainly qualifies).

The point is that planning for future taxpayer-funded bailouts as part of compliance with destructive regulations is asinine. In this respect, we offer an approach that goes counter to Fed Chair Janet Yellen and the modus operandi of all central planner control freaks. It’s really simple, and really effective. The best way to regulate banks, lending institutions, corporate finance and the like, is to turn over regulatory control to the very exacting, and unsympathetic, order of the market. That is to have little to no regulations and one very specific and uncompromising provision: There will be absolutely, unconditionally, categorically, no government funded bailouts. Without question, the financial system will be radically safer.

Want to bet it’ll be a lot more?

• Funding Battle Looms As Texas Sees Harvey Damage At Up To $180 Billion (R.)

U.S. Treasury Secretary Steven Mnuchin on Sunday challenged Congress to raise the government’s debt limit in order to free up relief spending for Hurricane Harvey, a disaster that the governor of Texas said had caused up to $180 billion in damage. Harvey, which came ashore on Aug. 25 as the most powerful hurricane to hit Texas in more than 50 years, has killed an estimated 50 people, displaced more than 1 million and damaged some 200,000 homes in a path of destruction stretching for more than 300 miles (480 km). As the city of Houston and the region’s critical energy infrastructure began to recover nine days after the storm hit, the debate over how to pay for the disaster played out in Washington. Texas Governor Greg Abbott estimated damage at $150 billion to $180 billion, calling it more costly than Hurricanes Katrina or Sandy, which devastated New Orleans in 2005 and New York in 2012.

The administration of President Donald Trump has asked Congress for an initial $7.85 billion for recovery efforts, a fraction of what will eventually be needed. Even that amount could be delayed unless Congress quickly increases the government’s debt ceiling, Mnuchin said, as the United States is on track to hit its mandated borrowing limit by the end of the month unless Congress increases it. “Without raising the debt limit, I am not comfortable that we will get money to Texas this month to rebuild,” Mnuchin told Fox News. Republican lawmakers, who control both houses of Congress, have traditionally resisted raising the debt ceiling, but linking the issue to Harvey aid could force their hand with people suffering and large areas of the fourth-largest U.S. city under water. Beyond the immediate funding, any massive aid package faces budget pressures at a time when Trump is advocating for tax reform or tax cuts, leading some on Capitol Hill to suggest aid may be released in a series of appropriations.

Katrina set the record by costing U.S. taxpayers more than $110 billion. In advocating for funds to help rebuild his state, Abbott said damage from Harvey would exceed that. Houston Mayor Sylvester Turner said the city expected most public services and businesses to be restored by Tuesday, the first day after Monday’s Labor Day holiday. “Over 95% of the city is now dry. And I‘m encouraging people to get up and let’s get going,” Turner told NBC News. Even so, Houston mandated the evacuation of thousands of people on the western side of town on Sunday to accommodate the release of water from two reservoirs that otherwise might sustain damage. The storm stalled over Houston, dumping more than 50 inches (1.3 m) on the region. Houston cut off power to homes on Sunday to encourage evacuations. The area was closed off on Sunday and military vehicles were stationed on the periphery to take people out.

What Canada learned from history.

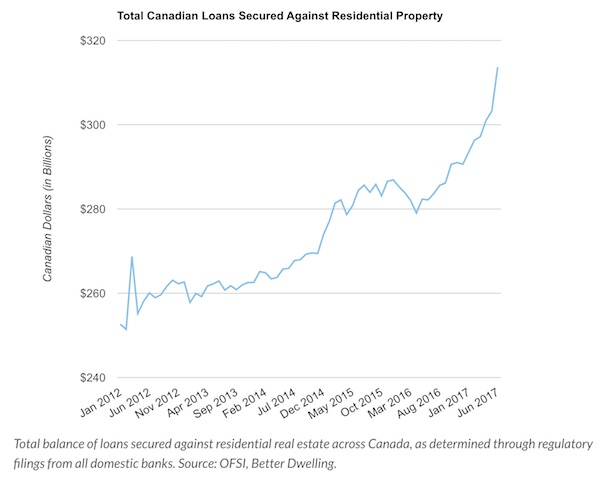

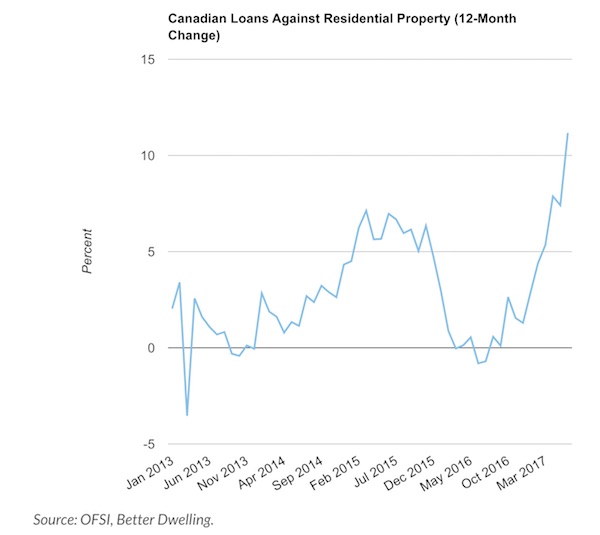

• Canadians Are Borrowing Against Real Estate At The Fastest Pace Ever (BD)

Canadian real estate prices have soared, and so did borrowing against that value. Our analysis of domestic bank filings from the Office of the Superintendent of Financial Institutions (OSFI) shows that loans secured against property has reached an all-time high. More surprising is the unprecedented rate of growth experienced this year.

Loans secured against residential real estate shattered a few records in June. Over $313.66 billion in real estate was used to secure loans, up 3.43% from the month before. The rise puts annual gains 11.16% higher than the same month last year, an increase of $31.51 billion. The monthly increase is the largest increase since March 2012. The annual gain is unprecedented according to an aggregate of domestic bank filings. Not all borrowing against residential property is all bad, sometimes it’s a calculated risk. For example, someone may need to secure a business loan, and use the loan for operating risks. It doesn’t mean the property is safe, but it’s a risk that could potentially boost the economy.

This is opposed to non-business loans, which is used as short-term financing. This type of financing is often used for things like renovations, and putting a fancy car in the driveway. Experts have observed that more homeowners are using these to prevent bankruptcy. Bottom line, it’s not typically healthy looking debt. So let’s remove loans obtained for business reasons, and take a peek at higher risk debt. The majority of these loans are non-business related according to bank filings. The current total is over $266 billion as of June 2017, a 1.01% increase from the month before. This is a 4.9% increase from the same month last year, which works out to $12.49 billion more. Fun fact, that’s around $23,763 per minute. The number is astronomical.

“..no country can have an open capital account, a fixed exchange rate and an independent monetary policy at the same time..”

• China Battles “Impossible Trinity” (Rickards)

The Impossible Trinity theory was advanced in the early 1960s by Nobel Prize-winning economist Robert Mundell. It says that no country can have an open capital account, a fixed exchange rate and an independent monetary policy at the same time. You can have one or two out of three, but not all three. If you try, you will fail — markets will make sure of that. Those failures (which do happen) represent some of the best profit-making opportunities of all. Understanding the Impossible Trinity is how George Soros broke the Bank of England on Sept. 16, 1992 (still referred to as “Black Wednesday” in British banking circles. Soros also made over $1 billion that day). The reason is that if more attractive total returns are available abroad, money will flee a home country at a fixed exchange rate to seek the higher return.

This will cause a foreign exchange crisis and a policy response that abandons one of the three policies. But just because the trinity is impossible in the long run does not mean it cannot be pursued in the short run. China is trying to peg the yuan to the U.S. dollar while maintaining a partially open capital account and semi-independent monetary policy. It’s a nice finesse, but isn’t sustainable. China cannot keep the capital account even partly closed for long without drying up direct foreign investment. Similarly, China cannot raise interest rates much higher without bankrupting state-owned enterprises. China is buying time until the Communist Party Congress in October. It’s important to realize that for Beijing, the Chinese economy is more than about jobs, goods and services. It’s a means of ensuring its legitimacy.

The Chinese regime is deeply concerned that a faltering economy and mass unemployment could threaten its hold on power. Chinese markets are wildly distorted by the actions of its central bank. Given the problems inherent in trying to manage an economy without proper price signals, the challenge facing Beijing gets harder by the day. China has a long history of violent political fracturing, and the government is deeply worried about regime survival if it stumbles. Many in the West fail to appreciate Beijing’s fears and overestimate the support it has among the disparate Chinese people. What does China do next? Under the unforgiving logic of the Impossible Trinity, China will have to either devalue the yuan or see its reserves evaporate. In the end, China will have to break the yuan’s peg to the dollar in order to stop capital outflows without killing the economy with high rates. The Impossible Trinity really is impossible in the long run. China will find this out the hard way.

How do we make government independent?

• Socialism For The Best Of Us, Capitalism For The Rest Of Us (CC)

To the elected darlings of the free market: I hate to burst your bubble but – you have been living a lie. Your lifetime government pensions: socialism. Overly generous retirement packages, Superannuation and 401ks: socialism. Travel budgets, expense accounts, access to private drivers and town cars, government reimbursement for travel and living arrangements: socialism, socialism, socialism, socialism, socialism. Central banking: socialism. Not to mention fossil-fuel & mining subsidies and tax concessions: socialism, socialism, socialism. The bank bail-outs of 2008: One of the greatest acts of socialism of all time. Where were our free-market representatives then? When the financial system went into melt-down, the banks were not told to suck it up and stand on their own two feet. More than a trillion dollars were poured into the banks, most of which went towards profit margins and CEO bonuses.

These so-called champions of capitalism have the nerve to claim that it is social welfare recipients that are a drain on the system while government representatives take home all kinds of state-provided benefits the rest of us could only dream of: the best health insurance the country has to offer, lifetime pensions and generous retirement packages which drain many more billions from the economy than social welfare ever will. Moreover, corporate welfare pales in comparison to either. The private sector has its own dole system paid for by Federal Governments. Yet many Congressmen, Representatives and MPs still have the nerve to stand before the people who elected them and rail against social spending, claiming people ought to pull themselves up by their bootstraps when no such obligation has ever existed for the corporate sector. Most of the world’s most successful corporations don’t get out of bed without a subsidy.

If it makes you feel better: Britain’s not alone.

• Britain’s Addicted To Debt And Headed For A Crash (G.)

[..] if the debtors at the bottom aren’t at crisis point yet, the signs of a surfeit of debt are everywhere. Alex Brazier, executive director of financial stability at the Bank of England, warned last month that consumer loans had gone up by 10% in the past year, with average household debt having already eclipsed 2008 levels. He warned against the economy having to sit through “endless repeats of the ‘Debt Strikes Back’ movie”. There is something obscurely insulting about being warned about household debt by the Bank of England. It never warns employers about stagnant wages, or the government about the benefit freeze. It only ever mentions these in terms of the impact of inflation, as if any consideration of the human decisions behind them are too political for comment. But personal debt, miraculously, isn’t political at all.

But that doesn’t make Brazier wrong. Edward Smythe of the campaign group Positive Money, breaks it down: “If you look at total outstanding consumer loans, in July, they’re at £200bn, an £18.5bn net increase every year.” Households spent more than their income by £17.5bn in the first quarter of this year. Economists are interested in where that money comes from – whether it’s access to credit, selling assets or spending savings. The government is presumably, in some dusty corner, interested in why that money is needed, whether it is a result of pauperised wages– real wage growth is negative and looks set to decrease – benefit changes, or some rush of blood to the head where we all suddenly need Sky Sports and cigarettes but aren’t prepared to work for them.

The sources of all this debt are changing: about half the net increase was in personal contract purchase car loans. Four in five new cars are now bought by PCP – an inherently unstable system that leaves both consumers and car manufacturers exposed. It’s a bit like a mortgage system for cars, except you don’t own it at the end, ideally you wouldn’t be living in it, and while a housing crash has been seen before, nobody yet knows what a car crash would look like. Student loan debt is counted separately from consumer loans, and stands at £13bn a year. However much you think you’ve accommodated student fees into your picture of Britons’ finances, it is always astounding to consider how life-changing that decision has been for the younger generation.

“What global recovery?!”

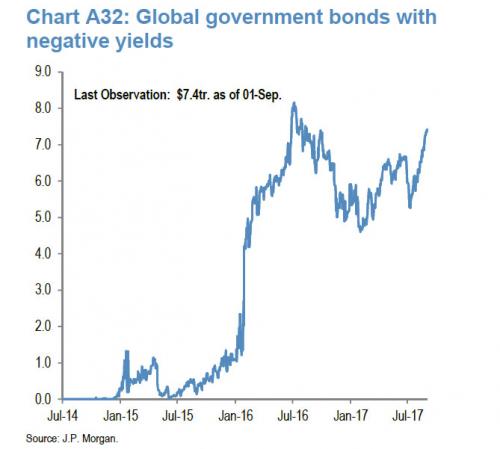

• Global Negative Yielding Debt Hits One Year High Of $7.4 Trillion (ZH)

Two weeks ago, we were surprised to find that despite the recent “growth promise” of what has been called a coordinated global recovery, the market value of bonds yielding less than 0% had quietly jumped by a quarter in just one month to the highest since October 2016. Since then, the paradoxical divergence between the reported “strong” state of the “reflating” global economy and the amount of negative yielding debt, has only grown, and as JPM reports as of Friday, Sept. 1, the global market value of government bonds trading with negative yield within the JPM GBI Broad index rose to $7.4 trillion, up 60% from its low of $4.6 trillion at the beginning of the year. Some more details from JPM:

We calculate the market value by multiplying the dirty price with the amount outstanding for each bond within JPM GBI Broad Index and then convert it to US dollars at today’s exchange rate. The market value of bonds trading with negative yield,including central banks’ purchases, stands at 30% of the total JPM GBI Broad index. What makes the latest rise in negative yielding debt especially bizarre is that it was mainly driven by Japan, where 10-year government bond yields have fallen significantly over the past month and have turned negative this week for first time since the US presidential election, even as the Bank of Japan has twice in the past month reduced the amount of JGB debt it purchases in the open market in the 5-to-10 year bucket, following on Friday, by a 30BN yen reduction of buying in the 3-to-5 year debt range.

As a result, the total universe of Japanese bonds trading with negative yield within the JPM global government bond index (GBI Broad) now stands at $4.6tr, or 62% of the outstanding amount. The remaining government bonds trading with negative yields worth $2.8 trillion are from Europe, of which more than half are from France and Germany.

Capital destruction 101 (thanks, Schaeuble!):

“..the stock of unsold properties of all types comes to 270,000-280,000, in a market with no more than 15,000 transactions per year..”

BTW, the only buyers left are those who want to profit from Airbnb. Mostly foreigners.

• Greece Property Auctions Certain To Drive Market Prices Even Lower (K.)

Professionals in the property sector are warning that the auctioning of tens of thousands of buildings in the next few years could evolve into an unknown – probably negative – factor regarding the course of prices in the market. It is estimated that a wave of auctions expected to begin soon will see market rates drop at least 10%. Clearing firms are currently involved in an extensive program of property valuations to establish starting prices for the auctions. Ilias Ziogas, head of property consultancy company NAI Hellas and one of the founding members of the Chartered Surveyors Association, said that the property market is certain to suffer further as a result of the auctions: “The impact on prices will be clearly negative, not because the price of a property will be far lower at the auction than a nearby property, but because it will diminish demand for the neighboring property.”

He added that a market with already reduced demand that receives more supply at more attractive rates through auctions will definitely see buyers turn to the latter. He also said that they will only look at other buildings if they are not satisfied with what the auctions have to offer. This view is also shared by Giorgos Litsas, head of the GLP Values chartered surveyor company, which cooperates with PQH. He told Kathimerini that the only way is down for market rates. “I believe that unless there is an unlikely coordination among the parties involved – i.e. the state (tax authorities, social security funds etc.), the banks and the clearing firms – in order to prevent too many properties coming onto the market at the same time, rates will go down by at least 10%.”

He noted that “we estimate the stock of unsold properties of all types comes to 270,000-280,000, in a market with no more than 15,000 transactions per year. Therefore the rise in supply will send prices tumbling.” Yiannis Xylas, founder of Geoaxis surveyors, added, “I fear the auctions will create an oversupply of properties without the corresponding demand, which translates into an immediate drop in rates that may be rapid if one adds the portfolios of bad loans secured on properties that will be sold to foreign funds at a fraction of their price.”

He sounds confused.

• Italy FinMin Says The Euro Zone Still Faces Problems – Even In Germany (CNBC)

Italy’s finance minister delivered an upbeat tone on his country’s banking sector but highlighted that major hurdles still remain in the euro zone, including in Germany. Germany might be known as the powerhouse of the euro zone economy but it has its own banking problems to deal with, Pier Carlo Padoan told CNBC on the sidelines of the Ambrosetti Forum on Sunday. “I think that there are some German banking problems and I’m confident the German authorities will deal with them,” Padoan said when asked about remarks made by former Prime Minister Matteo Renzi last year. “Germany has been the country that has by far poured much more public money into the banking sector in terms of the hundreds of billions of euros in the past when the rules where different of course.

This is a sign that maybe we all have to recognize that we have problems and we all have to recognize that we need to cooperate much more effectively to provide European solutions to those problems,” he said. Though Italy keeps making headlines due to its financial sector, analysts have also warned on banking problems in Germany. These include the reliance on the shipping industry, which used to be a stable investment before the euro zone debt crisis. Other issues include the sheer number of banks in Germany with very little consolidation. There are approximately 2,400 separate banks with more than 45,000 branches throughout the country and over 700,000 employees, according to Commercial Banks Guide, an industry website.

As such, Padoan told CNBC that it is crucial to conclude the banking union – a project created in 2012 in response to the sovereign debt crisis that aims to have one single set of rules for all banks across the European Union. He told CNBC that so far the banking union hasn’t been fully implemented, not because of resistance from certain countries, but because of different national perspectives. “We are however making progress in one thing: That we are building trust among ourselves and we are also recognizing that we have to reconcile historically-driven different traditions in banking sectors and they have to merge into a new European banking culture,” Padoan said.

He sounds like Varoufakis.

• Italy’s 5-Star Says Euro Referendum Is ‘Last Resort’ (R.)

A referendum on Italy’s membership of the euro currency would be held only as a “last resort” if Rome does not win any fiscal concessions from the European Union, a senior lawmaker from the anti-establishment Five-Star Movement said on Sunday. Luigi Di Maio’s comments reflect a striking change of tone by some senior officials in the party in recent months as they have retreated from 5-Star’s original pledge. Seeking to reassure an audience of bankers and business leaders, Di Maio – widely tipped to be 5-Star’s candidate for prime minister at a general election due by next year – played down the referendum proposal, calling it a negotiating tool with the EU. “Austerity policies have not worked, on monetary policy we deserve the credit for triggering a debate… this is why we raised the issue of a referendum on the euro, as a bargaining tool, as a last resort and a way out in case Mediterranean countries are not listened to,” he said.

Two years ago the party gathered the signatures from the public needed to pave the way for a referendum that it said was vital to restore Italy’s fiscal and monetary sovereignty. But now, running neck-and-neck with the ruling Democratic Party (PD) in opinion polls and with the election in sight – scheduled to be held by May 2018 – it is hitting the brakes on the idea. This underlines the crucial challenge facing the party as it seeks to please some core supporters, while trying to shed its populist image and convince foreign capitals and financial markets that it can be trusted in office. [..] The party wants several changes to the euro zone’s economic rules to help its more sluggish economies, like Italy. These include stripping public investment from budget deficits under the EU’s Stability Pact and creating a European “bad bank” to deal with euro zone lenders’ bad loans.

“We are not against the European Union, we want to remain in the EU and discuss some of the rules that are suffocating and damaging our economy,” said Di Maio, who serves as deputy speaker of the Chamber of Deputies. An opinion poll in La Stampa daily on Sunday had 24% of respondents saying Di Maio most deserved to run the country in the next five years, against 17% for former PD Prime Minister Matteo Renzi and 12% for center-right leader Silvio Berlusconi.

Schulz and Merkel are the same person.

• Turkey Will Never Become EU Member, Says Angela Merkel (Ind.)

Germany’s Chancellor, Angela Merkel, has said Turkey should categorically not become a member of the European Union in comments that are expected to further inflame tensions between the Nato allies. Speaking at a televised election debate with her rival, Martin Schulz, she said she would seek a joint EU position with other leaders to ensure Turkey never became a member. “The fact is clear that Turkey should not become a member of the EU,” she said after Mr Schulz said he would stop Turkey’s bid to join the EU if he was elected chancellor. “Apart from this, I’ll speak to my colleagues to see if we can reach a joint position on this so that we can end these accession talks,” she added.

[..] Her comments are likely to worsen already strained ties between the countries after Ms Merkel said Berlin should react decisively to Turkey’s detention of two more German citizens on political charges. It comes just weeks after German Foreign Minister Sigmar Gabriel told Turkey it will never become a member of the EU as long as it is governed by the current president, Recep Tayyip Erdogan. “It is clear that in this state, Turkey will never become a member of the EU,” Mr Gabriel said. Mr Erdogan has urged German Turks to boycott Germany’s main parties in next month’s general election.

Good to know. Still, if people really want to go, maybe we should just let them.

• How Our Immune Systems Could Stop Humans Reaching Mars (Tel.)

The astrophysicist Neil DeGrasse Tyson commented that ‘dinosaurs are extinct today because they lacked the opposable thumbs and brainpower to build a space programme’ Yet although we now have the technological ability to leave Earth, scientists have found another stumbling block to colonising new worlds – our own immune system. Although it is said we are all made of ‘star stuff’ when it comes to travelling away from our home planet humans are far more vulnerable to the rigours of space than our interstellar origins might suggest. Billions of years of evolution has effectively backed mankind into a corner of the Solar System that it may be now be tricky to leave. A team of scientists from Russia and Canada analysed the effect of microgravity on the protein make-up in blood samples of 18 Russian cosmonauts who lived on the International Space Station for six months.

They found alarming changes to the immune system, suggesting that they would struggle to shake off even a minor virus, like the common cold. “The results showed that in weightlessness, the immune system acts like it does when the body is infected because the human body doesn’t know what to do and tries to turn on all possible defense systems,” said Professor Evgeny Nikolaev, of Moscow Institute of Physics and Technology and theSkolkovo Institute of Science and Technology. The effects of spaceflight on the human body have been studied actively since the mid-20th century and it is widely known that microgravity influences metabolism, heat regulation, heart rhythm, muscle tone, bone density, the respiration system. Last year research from the US also found that astronauts who travelled into deep space on lunar missions were five times more likely to have died from cardiovascular disease than those who went into low orbit, or never left Earth.

Astronauts are fitter than the general population and have access to the best medical care, meaning that their health is usually better than the general population. Those of comparable age but who never flew, or only achieved low Earth orbit, had less than a one in 10 chance of death from cardiovascular disease. [..] To gain a deeper understanding of the changes in human physiology during space travel, the research team quantified concentrations of 125 proteins in the blood plasma of cosmonauts. Proteins change as the immune system alters and so can be used as a measure of how it is functioning. Blood was taken from the cosmonauts 30 days before they travelled to the ISS and then on their immediate return to Earth. They were also tested seven days after touchdown. Individual proteins were then counted using a mass spectrometer.

”When we examined the cosmonauts after their being in space for half a year, their immune system was weakened,” said Dr Irina Larina, the first author of the paper, a member of Laboratory of Ion and Molecular Physics of Moscow Institute of Physics and Technology. “They were not protected from the simplest viruses. We need new measures of disorder prevention during a long flight.