Edourd Manet A Bar at the Folies-Bergère 1882

Suramin

Suramin – conspiracy theory or… pic.twitter.com/NIrMBwNAuJ

— Husserl (@husserl80) July 5, 2021

VanDen Bossche?

• Israel Sees Plunge In Pfizer Vaccine Efficacy Rate Due To Delta Variant (BBG)

Israel has recorded a steep drop in the efficacy rate of the Pfizer-BioNTech vaccine in preventing coronavirus infections, due to the spread of the Delta variant and the easing of government restrictions, Ynet news website reported, citing Health Ministry data. At the same time, the decline in protection against serious cases and hospitalisation is considerably milder, the website said. The figures show that between May 2 and June 5, the vaccine had a 94.3 per cent efficacy rate. From June 6, five days after the government cancelled coronavirus restrictions, until early July, the rate plunged to 64 per cent. A similar decline was recorded in protection against coronavirus symptoms, the report said. At the same time, protection against hospitalisation and serious illness remained strong.

From May 2 to June 5, the efficacy rate in preventing hospitalisation was 98.2 per cent, compared with 93 per cent from June 6 to July 3. A similar decline in the rate was recorded for the vaccine’s efficiency in preventing serious illness among people who had been inoculated. These figures are in line with ministry data that show many of the new cases are among people who have been vaccinated, while the number of serious cases is rising much more slowly, Ynet said. Last Friday, 55 per cent of the newly infected had been vaccinated, the website said. As at July 4, there were 35 serious cases of coronavirus in Israel, compared with 21 on June 19. [..] Israel had one of the world’s most effective coronavirus inoculation drives. Some 57 per cent of the general population is fully vaccinated, including 88 per cent of the population above the age of 50 – the group considered most at risk for serious cases.

The more vaccinations, the higher the chance for more variants. The official narrative has this completely upside down, but it will take a lot for them to declare defeat. Booster shots sounds a lot better to them.

• Lambda Covid-19 Variant From Peru May Be Resistant To Vaccines (NYP)

Scientists fear that a highly contagious new COVID-19 variant that is ravaging Peru may be resistant to vaccines. The Lambda mutation, or C.37, appears to have emerged in Peru last August — and is now being blamed for the country having the highest pandemic death rate in the world. The concerning strain has since spread to around 30 countries, mostly in Latin America — but also as far as the UK, which has recorded at least eight cases, according to government figures. There are no known cases of the Lambda strain in the US, according to the Centers for Disease Control and Prevention. In Peru, Lambda has accounted for 81 percent of new infections tested for variants since April, according to the World Health Organization.

The South American nation currently has by far the highest mortality rate in the world, according to Johns Hopkins University data. There, nearly 10 percent of those recorded as being infected end up dying — with the death rate of nearly 600 for every 100,000 citizens almost double that of the next nation, Hungary, the data shows. The US is 21st with just under 185 deaths per 100,000. Lambda was last month declared a Variant of Interest by the World Health Organization (WHO), which noted that it was “associated with substantive rates of community transmission in multiple countries.” “Lambda carries a number of mutations” that may have led to “potential increased transmissibility or possible increased resistance to neutralizing antibodies,” the WHO said.

Scientists in Chile — where Lambda is blamed for more than a third of the country’s infections — also warned in a recent study, published in a preprint last week, that it appears to evade vaccines better than other strains. “Our data show for the first time that mutations present in the spike protein of the Lambda variant confer escape to neutralizing antibodies and increased infectivity,” wrote the researchers from the University of Chile in Santiago. That could explain why it has been able to take hold despite Chile “undergoing a massive vaccination program,” the study warned.

McCullough is clear and concise. Wonder how long LinkedIn will keep this up.

• 9 Reasons Not to Support, Mandate Investigational COVID19 Vaccines (McCullough)

1. COVID-19 vaccination is voluntary research. The COVID-19 public vaccination program operated by the CDC and the FDA is a clinical investigation and under no circumstance can any person receive pressure, coercion, or threat of reprisal on their free choice of participation. Violation of this principle of autonomy by any entity constitutes reckless endangerment with a reasonable expectation of causing personal injury resulting in damages.

2. COVID-19 vaccines do not work well enough. The current COVID-19 vaccines are not sufficiently protective against contracting COVID-19 to support its use beyond the current voluntary participation in the CDC sponsored program. A total of 10,262 SARS-CoV-2 vaccine breakthrough infections had been reported from 46 U.S. states and territories as of April 30, 2021. Among these cases, 6,446 (63%) occurred in females, and the median patient age was 58 years (interquartile range = 40–74 years). [..]

3. COVID-19 vaccines have a dangerous mechanism of action. The Pfizer, Moderna, and JNJ vaccines are considered “genetic vaccines” or vaccines produced from gene therapy molecular platforms.[i] [ii] They have a injurious mechanism of action in that they all cause the body to make an uncontrolled quantity of the pathogenic spike protein from the SARS-CoV-2 virus. This is unlike all other vaccines where there is a set amount of antigen or live-attenuated virus. This means for the Pfizer, Moderna, and JNJ vaccines it is not predictable among patients who will produce more or less of the spike protein. The spike protein itself has been demonstrated to injure vital organs such as the brain, heart, lungs, as well as damage blood vessels and directly cause blood clots. Additionally, because these vaccines infect cells within these organs, the generation of spike protein within heart and brain cells in particular, causes the body’s own immune system to attack these organs. [..]

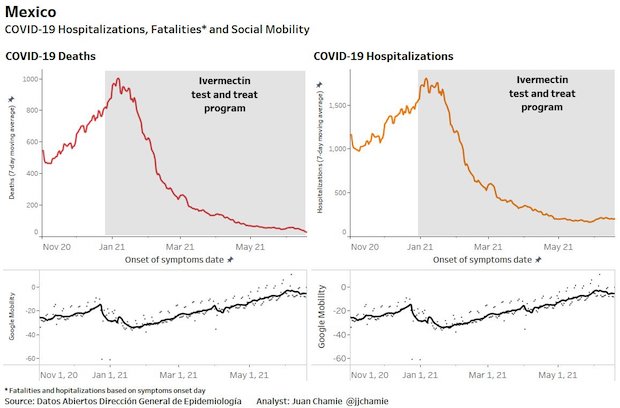

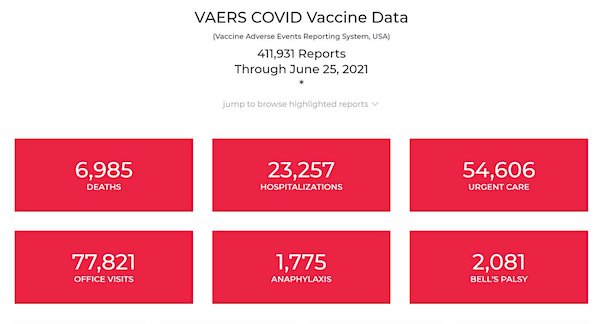

7. People are dying and being hospitalized in record numbers in the days after COVID-19 vaccination. Based on VAERS as of June 25, 2021, there were 6,985 COVID-19 vaccine deaths reported and over 23,257 hospitalizations reported for the COVID-19 vaccines (Pfizer, Moderna, JNJ). By comparison, from 1999, until December 31, 2019, VAERS received 3167 death reports (158 per year) adult death reports for all vaccines combined. Thus, the COVID-19 mass vaccination is associated with at least 39-fold increase annualized vaccine deaths reported to VAERS. COVID-19 vaccine adverse events account for 98% of all vaccine-related AEs from Dec 2020 through present in VAERS.

Bell’s palsy

— Nashville Angela (@Angelasfreenews) July 5, 2021

VanDen Bossche reacts to the CNN article I cited on July 4, Unvaccinated People Are “Variant Factories” – Infectious Diseases Expert.

“..not the non-vaccinated individuals but the vaccinees are now responsible for driving Sars-CoV-2 evolutionary dynamics..”

• The Chicken-and-Egg Problem (Which Came First?) (VanDen Bossche)

As already mentioned on multiple occasions, molecular epidemiologists have shown that population-level S protein-directed immune pressure is now driving the propagation of variants that are increasingly evolving mutations enabling resistance to S-specific antibodies (as now massively induced by the ongoing vaccination campaigns). As more infectious variants bind to the cellular Ace-2 receptor with enhanced binding strength, the Ace-2 receptor more readily outcompetes S-specific antibodies for binding to these variants. Consequently, these variants gain a competitive advantage when replicating in individuals who exert strong S-directed immune pressure on the virus (i.e., in vaccinees!), especially upon incorporating additional mutations (within the RBD) that prevent direct binding of S-specific vaccinal antibodies.

Variants that are increasingly resistant to S-specific antibodies (e.g., delta and delta plus variant) can only adapt to the population provided the S-directed immune pressure is widespread in the population. This is, of course, the case if larger parts of the population get vaccinated and when vaccinees can easily transmit the variant due to relaxation of infection prevention measures. In principle, non-vaccinated individuals who are in good physical and mental health can deal with all variants, provided the infectious viral pressure does not exceed a certain threshold. This is because their innate antibodies have relatively lower affinity for the virus.

However, breeding of more infectious and more anti-S antibody-resistant variants in vaccinees will inevitably enhance viral replication and transmissibility in vaccinees, thereby raising the infectious pressure and increasing the likelihood for non-vaccinated subjects to become re-infected while their natural/ innate antibodies (Abs) are being suppressed by short-lived S-specific Abs (elicited as a result from previous asymptomatic infection). So, ‘yes’, some non-vaccinated people will become susceptible to the disease and then contribute to further propagation of these variants. It’s important to note, however, that this is a result and not the source of the enhanced evolution of the virus.

So, not the non-vaccinated individuals but the vaccinees are now responsible for driving Sars-CoV-2 evolutionary dynamics. It’s also important to note that non-vaccinated people will not contribute to natural selection as they will either eliminate the virus (thanks to their innate antibodies in synergy with natural killer cells) or become susceptible to Covid-19 disease due to suppression of their innate immune defense. Short-term shedding of low concentrations of viral variants by asymptomatically infected, non-vaccinated people is a direct consequence of shifting natural immune selection forces that are increasingly coming into play as a result of mass vaccination. This will ultimately put the vaccinees in much worse shape than the non-vaccinated as the latter will still be able to rely on their innate Abs.

For 10 years, Moderna could get no approval for anything. Then it got one in weeks. Pfizer may have played a key role in that.

• How the Moderna Covid-19 mRNA Vaccine Was Made So Quickly (CNBC)

Almost all people hospitalized for Covid-19 are not vaccinated — 99.9% as of May to be exact, according to a recent Associated Press report. Yet 13% of U.S. adults said they will “definitely not” get a COVID-19 vaccine as recently as late May, according to Kaiser Family Foundation COVID-19 Vaccine Monitor. Another 12% wanted to “wait until it has been available for a while to see how it is working for other people.” Vaccinating the majority of the population is the best way to help avoid further surges from constantly evolving variants, like the current delta variant, which is quickly spreading in the U.S. and other countries. Still, Moderna co-founder Noubar Afeyan understands the hesitation to get a new vaccine.

“The vaccines came out in such a [short] timeframe that people assumed automatically, it can’t possibly be safe,” Afeyan said during a talk at Massachusetts Institute of Technology in May. “In fact, many, many people were on television espousing the view that — experts for that matter — that if it’s done in less than five years, it’s got to be unsafe, all of which is untrue. “Nevertheless, people get confused.” What people might not understand is that extensive research was being done on mRNA technology and other mRNA vaccines for years. That decade plus of experience and the innovation of mRNA technology itself is what allowed Moderna to produce its Covid mRNA vaccine so quickly as the pandemic struck. And it could also change the future of medicine.

Here’s what you need to know about how the Moderna Covid-19 mRNA vaccine was developed. It is true that Moderna’s mRNA vaccine was ready remarkably fast, as was Pfizer’s. Chinese scientists put the genetic sequence of the novel coronavirus online on Jan. 11. Over the next two days, the NIH and Moderna used it to plot out a vaccine. Afeyan remembers getting a key call about the development of the Covid-19 vaccine. “January 21st, my daughter’s birthday…. I got a call from Davos [during The World Economic Forum] from the CEO of Moderna,” he says. Bancel had been approached by a number of public health groups at the conference “urging” him to work on a vaccine. “We literally Decided overnight…to try and do this,” Afeyan said at MIT.

Moderna delivered the first doses of its Covid-19 vaccine to the NIH for testing on Feb. 24, 2020, and “the first Moderna shot went into a volunteer’s arm in Seattle on March 16, 2020,” according to Afeyan. After testing the Moderna vaccine on 30,000 volunteers, on Dec. 18, 2020, the FDA authorized it for emergency public use, and three days after that, the first Moderna vaccines were administered to front-line health workers, according to Afeyan. One of the reasons Moderna’s mRNA Covid vaccine development moved so quickly is because scientists had been working with mRNA for years. [..] And Moderna has been working with mRNA technology “since its inception in 2010 for myriad therapeutic areas,” including cancer therapies, Afeyan tells CNBC Make It (by way of a publicist), and with clinical development of mRNA-based antiviral vaccines since 2015.

Science Mag sees testing protocols primarily as a nuisance because proven vaccines are now available. Proven before they were tested, that is. With a vague bit about T cells thrown in.

• Can Immune Responses Alone Reveal Which Covid-19 Vaccines Work Best? (Smag)

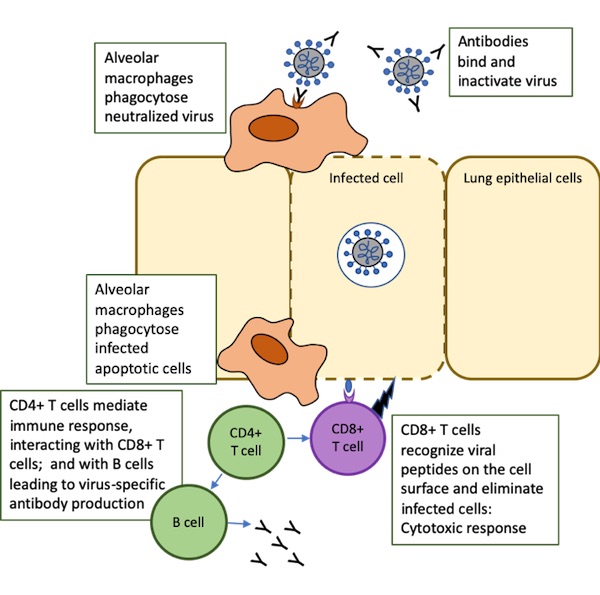

Other than running a placebo-controlled, clinical trial lasting many months and involving tens of thousands of people, is there any way to be sure a COVID-19 vaccine will work? Many researchers contend that the success of several vaccines now widely in use offers a shortcut: Simply gauge a vaccine’s ability to elicit so-called neutralizing antibodies, which bind to the virus and prevent it from entering cells. But several recent studies, the latest published as a preprint on 24 June, point to other “correlates of protection”: “binding” antibodies—which latch on to the virus but don’t block entry—and another set of immune warriors called T cells.

Vaccine decisions may soon depend on a better understanding of these supporting actors. Several companies are developing updates of their COVID-19 vaccines tailored to protect against new viral variants, and they hope regulatory agencies won’t require that they show efficacy in big clinical trials, which are not only time-consuming and expensive, but also increasingly ethically fraught because some of the participants receive a placebo even though proven vaccines are now available. With an established correlate of protection, trials can give an updated vaccine to a much smaller group of participants and then check whether they produce the telltale immune responses. (That’s how the annual updates of flu vaccines are approved.) Health officials may also turn to correlates when they consider prioritizing existing COVID-19 vaccines, authorizing new “mix and match” combinations, or even when making decisions about entirely new vaccines.

But finding robust correlates has been challenging. During the megatrials that led to the authorization of COVID-19 vaccines, investigators monitored antibody responses and tried to correlate them with their odds of participants getting sick. Different trials, however, used different antibody assays and different definitions of mild COVID-19, the main endpoint in the trials. “It’s anarchy because it’s always been anarchy,” says John Moore, an immunologist at Weill Cornell Medicine. “You’re dealing with different academic labs and different companies, and companies tend not to talk to each other.” Many trials also lacked the statistical power to measure protection from hospitalization and death, arguably a COVID-19 vaccine’s most important task. And few trials even looked carefully at T cells, which are far more cumbersome to measure.

[..] Penny Moore and colleagues also found support for a role for T cells. In an 11 June preprint, they reported that 96% of participants in an efficacy trial of the COVID-19 vaccine produced by Johnson & Johnson (J&J) made antibodies that neutralized a viral strain from early in the pandemic but only 19% had antibodies that neutralized the Beta variant, which is widespread in South Africa and infamous for dodging neuts. Yet despite the variant, the vaccine remained protective against moderate and severe COVID-19. “I think it’s entirely plausible … that T cells are doing something really useful here,” Penny Moore says.

And you thought spike proteins were bad…

https://twitter.com/i/status/1412287378568384515

I was reading this yesterday (twice), how the immune system fights off Covid.

• T Cells: Why Immunity Is About More Than Antibodies (CEBM)

The CD4+ T cell response in COVID-19 Some studies have shown that in patients with severe COVID-19 there is evidence of impaired function of CD4+ T cells, including reduced IFN ɣ production [16], while others seem to suggest over-activation of these T cells [17]. Overall, the CD4+ T cell response in acute SARS-CoV-2 infection, whether impaired, over-activated, or inappropriate, and how this relates to disease outcomes, remains to be elucidated and is an important question. A particularly high frequency of CD4+ T cell responses specific to virus spike protein has been observed in patients who have recovered from COVID-19, which is similar to what has been reported for influenza virus infections [11]. In one small study of 14 patients, circulating virus-specific CD4+ T cells were identified in all of those who recovered from SARS- CoV-2, which also suggests the potential for developing T cell memory [18] and perhaps longer-term immunity.

The CD8+ T cell response in COVID-19 There appears to be heterogeneity in the immune response between patients. Some studies have reported that CD8+ T cells from patients with severe COVID-19 had reduced cytokine production following in vitro stimulation, and some have shown evidence of possibly exhausted T cells; in contrast, other studies have reported an overaggressive CD8+ T cell response or highly activated CD8+ T cells with increased cytotoxic response in patients with COVID-19 [14]. It is still unclear how the heterogeneity of the CD8+ T cell response relates to disease features, which could be driven by, for example, patient immunotypes [17,19] or the nature of the interaction between respiratory epithelial cells and cytotoxic T cells and the level of response.

Several chemokine receptor genes (including CCR9, CXCR6, and XCR1) and the locus controlling the ABO blood type have been identified as being associated with severe disease; however, whether these genes are directly or indirectly related to T cell responses in COVID-19 remains unknown [14]. A higher proportion of CD8+ T cell responses was observed in patients who only developed mild disease, suggesting a potential protective role of CD8+ T cell responses [11]. Most of the CD8+ T cell responses were specific to viral internal proteins, rather than spike proteins, which should be considered in vaccine development [4]. SARS-CoV-2-specific CD8+ T cells are present in about 70% of patients who have recovered [18], which is evidence of a virus-specific CD8+ T cell response and the presence of CD8+ T cell memory. However, the ability of these cells to protect from future infection remains to be determined.

Role of T cells in response to COVID-19 infection: adapted from The trinity of COVID-19: immunity, inflammation and intervention. Nat Rev Immunol. 2020 Jun;20(6):363-374. doi: 10.1038/s41577-020-0311-8.

How clear is the bible on this?

• Refusing To Be Vaccinated Against Covid A ’Sin’ – Russian Orthodox Church (RT)

Those who refuse to be vaccinated against Covid-19 are committing a sin they will have to repent for the rest of their lives. That’s according to the Russian Orthodox Church, whose spokesman said rejecting a jab is selfish. Speaking to TV channel Russia 24, the head of the Russia Orthodox Church’s Department for External Church Relations, Metropolitan Hilarion, explained that his parishioners regularly repent to him for not being vaccinated. They feel guilty because they passed the virus on to someone else who eventually died, he claimed. “They come and say, ‘How am I supposed to live with this now?’ And it’s hard for even me to say how to live with it,” he explained. “All your life, you have to make up for the sin you committed.”

The sin is thinking about yourself instead of thinking about other people,” the metropolitan said. “We are responsible – each of us – not only for ourselves and not only for our loved ones, but also for all those who come into contact with us.” In recent months, the Church has been more vocal about its support for the government’s vaccination program. Metropolitan Hilarion has regularly spoken on TV about the need to follow the rules and take precautions to avoid infection. In June, the cleric revealed his “positive attitude” towards the government initiative to impose compulsory vaccination on those working in the service sector. “Of course, it is desirable to observe the principle of voluntariness in relation to vaccinations – the principle that was stated from the very beginning,” he explained. “But there is also the principle of people’s responsibility for the lives of other people.”

Seen this a lot in the UK: people who say it’s criminal to expose kids to Covid, and therefore they should be injected. How do you get the world so wrong side up?

• Relaxing Of Covid Restrictions In England Sparks Social Media Meltdown (Clark)

Boris Johnson has announced that masks and social distancing are likely to end on July 19, which has, predictably, been met with a hysterical, irrational response by those who don’t seem to want life ever to return to normal. Talk about being triggered. Boris Johnson’s press conference on Monday sent #wearamask Twitter into a hyperbolic meltdown of epic proportions. The PM announced that the public would have independence from burdensome domestic Covid restrictions- which were supposed to have lasted for only three weeks but instead have lasted for sixteen months- on 19 July 19, with confirmation of this coming on July 12. The relaxing of restrictions had been foreshadowed in an article in the Mail on Sunday by the new UK Health Secretary Sajid Javid, in which he said Britain would need to learn to live with Covid.

While we should all remain cynical about what the government may have planned for the autumn, Javid declared –rightly, in my view– that opening the country up would actually make us healthier, physically and mentally. Cue the most incredible Twitter meltdown ever seen. What the government was proposing was ‘genocide.’ “Why are the British people accepting this? We need to close borders, effective test and trace, social distancing (through bi-weekly remote and in person education) in schools, masks indoors, work from home and vacs until infections are really low. Then re-cover (sic), slowly” opined one Tweeter ironically with the moniker ‘Freedom.’ Citing Orwell (again, who said satire was dead?), the Observer’s Carole Cadwalladr tweeted “War is peace. Freedom is slavery. Health is the deliberate mass infection of an entire nation’s children with a novel & mutating virus with unknown long-term consequences.”

The hashtag #WearAMask was trending with a whole succession of self-righteous virtue signallers telling the world that they would continue to mask up after July 19, whatever the government announced. Repeat after Me: People who wear masks are Good People, People who don’t are Bad People (and probably supporters of Brexit and Donald Trump). “The thing about mask wearing is it protects others more than you” declared Liberal Democrat MP Layla Moran, who piously informed us she’d continue to wear a mask indoors after July 19. As if we had to know. The Liberal Democrat-supporting author Emma Kennedy tweeted: “In a nutshell, post July 29 there will be people prepared to wear masks because they care about other people. And those who don’t. And that’s it, isn’t it.”

If it doesn’t have any mRNA, we’re not interested.

• HIV Vaccine Trial Launched At Oxford In Bid To End ‘40-Year Wait’ (RT)

Researchers at the UK’s University of Oxford have administered the first doses of a potential HIV vaccine to participants, as part of a Phase-One clinical trial launched on Monday. The trial, called HIV-CORE 0052, aims to evaluate the safety, tolerability, and immunogenicity of the HIVconsvX vaccine, the University said. The project is part of the European Aids Vaccine Initiative, funded by the European Commission. The jab is known as a “mosaic,” meaning it can target a broad range of HIV-1 variants and potentially become a suitable vaccine for use around the world. Scientists will give two doses of the vaccine four weeks apart to 13 healthy, HIV-negative adults, aged between 18 and 65, who are not considered at risk of infection. “An effective HIV vaccine has been elusive for 40 years,” Tomas Hanke, the trial’s lead researcher and Professor of Vaccine Immunology at the University of Oxford’s Jenner Institute, said in a statement.

“This trial is the first in a series of evaluations of this novel vaccine strategy in both HIV-negative individuals for prevention and in people living with HIV for cure.” The Oxford solution works by stimulating the body’s immune response via T cells which kill specific pathogens, unlike most other HIV vaccine candidates, which induce antibodies created by B-cells to fight the virus. HIV attacks the body’s immune system and can develop into life-threatening AIDS if left untreated. In 2014 the UN announced a ‘fast-track’ target of decreasing the number of people newly-infected with the virus to 500,000 by 2020. However, last year there were approximately 1.5 million new cases. The Oxford team expects to report its results by April next year. There are also plans to start similar trials in Europe, Africa and the US.

Always amusing. But mostly led by what people wish for, not what is reality.

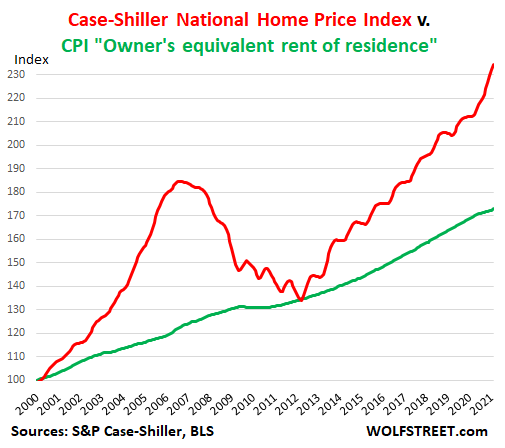

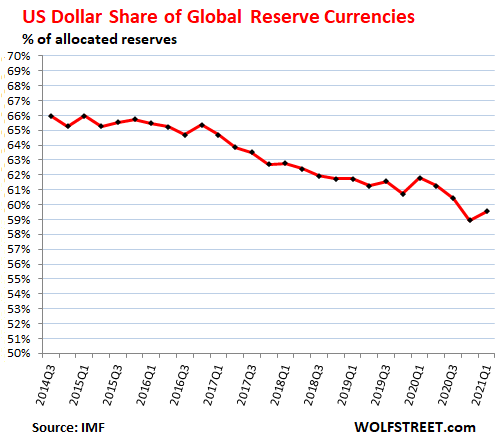

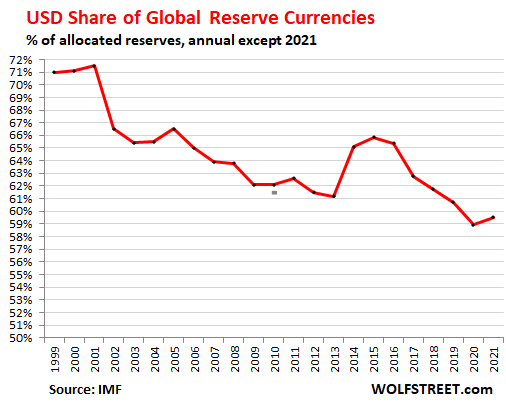

• The Dollar’s Declining Status as Dominant “Global Reserve Currency” (WS)

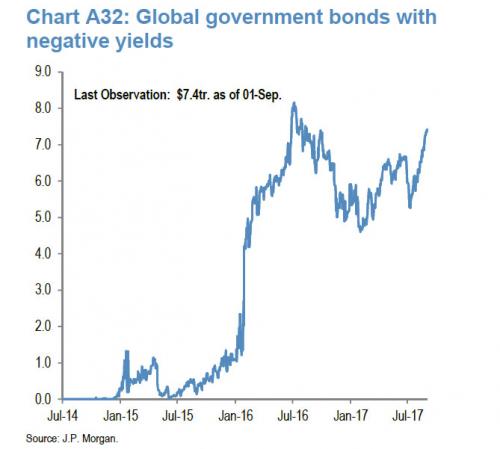

Yes, the Fed is a drunken reckless money-printer, and the US government has been high for years on deficit spending, but other major central banks and governments do the same or worse. The long-term trends are clear, however. The global share of US-dollar-denominated exchange reserves ticked up to 59.5% in the first quarter of 2021, after having dropped to a 25-year low in Q4 2020, according to the IMF’s Composition of Official Foreign Exchange Reserves (COFER) data released at the end of June. Dollar-denominated foreign exchange reserves are Treasury securities, US corporate bonds, US mortgage-backed securities, US Commercial Mortgage Backed Securities, and other dollar-denominated financial assets held by foreign central banks. Q1 was a ripple in the long-term trajectory.

Since 2014, the dollar’s share has dropped 6.5 percentage points, from 66% to 59.5%, on average 1 percentage point per year. At this rate, the dollar’s share would fall below 50% over the next decade. Since 1999, when the euro arrived, the dollar’s share of foreign exchange reserves has dropped 11.5 percentage points, from 71% to 59.5% (year-end shares, except Q1 2021):

Exchange rates between the dollar and other currencies change the valuations expressed in dollars of non-dollar reserves, such as German government bonds. Yes, but… The Dollar Index (DXY) moved substantially since 1999, up and down, but it is now roughly back where it was in 1999. This means that nearly all of the decline in the share of the dollar as foreign exchange reserves since 1999 was due to central banks unloading dollar-denominated assets, and not due to exchange rates.

“..decoding the foreign policy moves signified in “Joe Biden’s” ice-cream flavor choices. (Rocky Road means: Oh, let China have that….)”

• The Ice-Cream Flavor Next Time (Kunstler)

A nation mesmerized by its own weakness wanly celebrated the long-ago and faraway memory of standing up for itself, while it passively endures the current orgy of tyrannical cancellation and suppression of anyone talking back to the present folks-in-charge. Over just a few years, this tyranny has grown like a toxic slime mold from such an unlikely place, the Internet social app ecology of Facebook, Twitter, and Google, as they took over the public arena — where the battle of ideas is supposed to live — and did the government’s dirty work, complete with adorable emojis. You’re fired! Who will stand up to Zuck, Jack, and Sundar Pichai? Who elected these megalomaniacs boss of the USA? What will it take to end their reign of terror? Some sort of… revolution? (Shhhh! That must be a dirty word, even considering we just celebrated the high point of the American Revolution: The Declaration of Independence, signed July 4, 1776.)

Don’t look to “Joe Biden,” the nation’s putatively elected leader — about whose election back in November, 2020, you are liable to hear more about as the summer stickily unspools. Zuck, Jack, and Sundar managed to protect “Joe Biden” from the stupendous depredations of his offspring, Hunter Biden, recorded in explosive detail on a laptop the public was not allowed to hear about. Don’t look to the Department of Justice, supposedly “investigating” that horde of memos and emails detailing the Bidens ’influence-peddling to the CCP and others — they’re busy surveilling “white supremacists” on the apps run by Zuck, Jack, and Sundar. And for sure don’t look to the news media, that coalition of sell-outs and quislings, busy decoding the foreign policy moves signified in “Joe Biden’s” ice-cream flavor choices. (Rocky Road means: Oh, let China have that….)

Wondering who is actually running the “Joe Biden” government? Some of us out here are. (Do you think we’re allowed to say that?) For instance, have you tried googling the name Susan Rice lately? Remember her? Maybe not. “Joe Biden” appointed her Director of the White House Domestic Policy Council. From the looks of things across the country, you’d think her plate would be heaped mighty high, what with “insurrection” and other white mischief threatening to take down the republic. Anyway, I googled “news” for her. Hardly a goshdarn thing came up that wasn’t from months ago, and most of that was sheer puffery about how accomplished she is, and what a fabulous person. Don’t you wonder what her phone log looks like? All those calls to the Obama residence, day after day, hour after hour?

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

Support the Automatic Earth in virustime. Click at the top of the sidebars to donate with Paypal and Patreon.