Blu Mural in Rome, Italy 2015 Click to enlarge See also here

Great cartoon.

– Global equities are retreating materially today on fears of a commensurate escalation in the burgeoning trade war between the U.S. and China. Specifically, the Trump administration released a list of goods that it may target w/ sanctions totaling some $200 billion, while China’s Commerce Ministry described the move as “totally unacceptable bullying”, and promised to lodge complaints at the WTO without detailing what its retaliatory steps would be. Are trade wars bad for growth? Of course they are. Does anyone really possess a reliable framework for quantifying the ultimate impact ex ante? Probably not.

This we do know, however: prior to the last Friday’s tit-for-tat escalation targeting $34 billion in Chinese goods and a list of [mostly] U.S. agricultural products, Export growth was trending lower in 70% of the near-50 economies we maintain detailed predictive tracking algorithms for, while 77% of Manufacturing PMI series were trending lower. This figures reflect data through MAY and JUN, respectively, and are supportive of our view that trade tensions aren’t the driving force behind Global #Divergences; they are merely adding fuel to the fire. Global equities peaked in late-JAN for a reason.

Anyone remember AAA?

• Corporate Bonds Are Getting Junkier (DDMB)

Life insurers invest heavily in high-grade corporate bonds to fund annuities, life insurance policies and other products. Here’s a look at the possibility that the issues might be affected by credit rating grade inflation… Much has been made of the degradation of the $7.5 trillion U.S. corporate debt market. High yield offers too little, well, yield. And “high grade” now requires air quotes to account for the growing dominance of bonds rated BBB, which is the lowest rung on the investment-grade ladder before dropping into “junk” status. And then there’s the massive market for leveraged loans, where covenants protecting investors have all but disappeared.

How does that break down? Corporate bonds rated BBB now total $2.56 trillion, having surpassed in size the sum of higher-rated debentures, which total $2.55 trillion, according to Morgan Stanley. Put another way, BBB bonds outstanding exceed by 50% the size of the entire investment grade market at the peak of the last credit boom, in 2007. But aren’t they still investment grade? At little to no risk of default? In 2000, when BBB bonds were a mere third of the market, net leverage (total debt minus cash and short term investments divided by earnings before interest, taxes, depreciation and amortization) was 1.7 times. By the end of last year, the ratio had ballooned to 2.9 times.

Given the marked deterioration in fundamentals, bond powerhouse PIMCO worries that “This suggests a greater tolerance from the credit rating agencies for higher leverage, which in turn warrants extra caution when investing in lower-rated IG names, especially in sectors where earnings are more closely tied to the business cycle.” [..] why not treat the BBB portion of the bond market for what it is: a high-risk slice of the corporate debt pie. Keeping count of “fallen angels,” or those investment-grade bonds that are downgraded into junk territory, will become a spectator sport.

“Except in the very tightest labour markets, workers simply don’t have the power to demand their fair share.”

• It’s Not Wage Rises That Are A Problem – It’s The Lack Of Them (Frank)

If you study the Bureau of Labor Statistics’ numbers on wages for nonsupervisory workers over the past few decades, you will notice that wage growth has been strangely slow to pick up. Hot economies usually drive wages up pretty promptly; this recovery has been running since 2009 and it has barely moved the needle. It’s even more perverse on the other side of the Atlantic. According to a 2017 story in the Financial Times, Britain was “the only big, advanced economy in which wages contracted while the economy expanded” – an amazing achievement if you think about it. And UK thinktank the Resolution Foundation has said this decade is “set to be the worst for pay growth since the Napoleonic wars”.

How could such a thing happen in this modern and enlightened age? Well, for starters, think of all that whining we’re hearing from the US’s management, who will apparently blame anyone and do anything to avoid paying workers more. Every labour-management innovation seems to have been designed with this amazing goal in mind. Every great bipartisan political initiative, from free trade to welfare reform, points the same way. When Republicans are in charge, it’s open season on working-class organisations. And you can forget about increases in the minimum wage, regardless of who’s in the White House.

Of course it’s happening the same way in the UK; be it Thatcher’s war on unions or New Labour’s “third way”, Britain has followed the US model closely. Political decisions within both countries have had highly predictable results, and we are now fated to live with them. Good times aren’t really all that good for ordinary people any more, only for the people on top – the owners of companies, of real estate, of stocks. Except in the very tightest labour markets, workers simply don’t have the power to demand their fair share. If you ask me, this is the thing to panic about: not the possibility that workers might prosper, but that they’re not prospering yet.

“..ordinary life will grind to a halt. That is the extent to which our lives are intermeshed with the lives of our European partners..”

• Britain Facing ‘State Of Emergency’ If No Deal Reached – Grieve (Ind.)

Britain will face a “state of emergency” if no Brexit deal is reached by February, Dominic Grieve has warned at an exclusive event for Independent subscribers. Appearing on a stage with other key Brexit figures, including Jacob Rees-Mogg and Gina Miller, the leading Tory rebel said “ordinary life will grind to a halt” if the talks are still deadlocked as D-Day nears. The warning came as Mr Rees-Mogg launched his most outspoken attack yet on big businesses opposing a hard Brexit, claiming they have “got everything wrong in the whole of their history”. Andrea Leadsom, the Commons leader, suggested she would not accept any further “compromises” beyond the deal struck at Chequers by Theresa May – preferring a no-deal outcome. [..]

Last month, Mr Grieve, a former attorney general, led an aborted revolt to guarantee MPs a “meaningful vote” to prevent Britain crashing out of the EU without an agreement. In his most dramatic language yet, to underline the high stakes, Mr Grieve told the audience: “If by the end of February or early March it is clear that there is no deal on anything, there will be a declaration of a state of emergency in this country. “Actually, ordinary life will grind to a halt. That is the extent to which our lives are intermeshed with the lives of our European partners, and that is what will happen if there is no deal on anything.” Mr Grieve said hardline anti-Brexit MPs had “abdicated” their responsibilities to the public by boasting that they will do “absolutely nothing while we skated off the edge of the cliff into this major national crisis”. “That is the madness that has crept into some of the discourse in parliament,” he added.

They won’t.

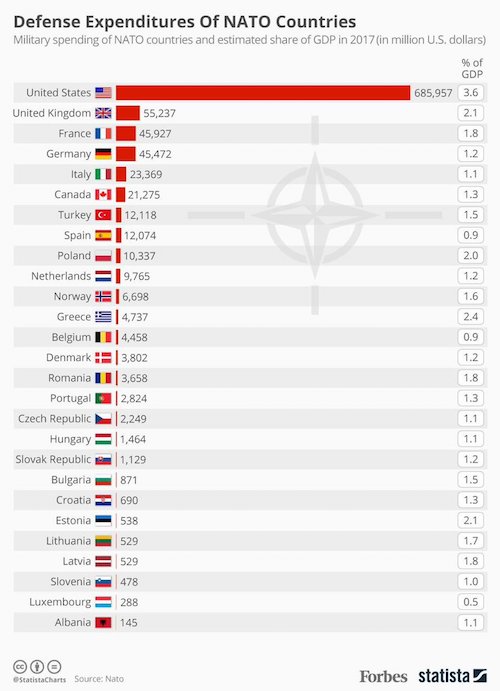

• Trump Tells NATO Allies To Spend 4% of GDP On Defence (G.)

Donald Trump left the opening day of the Nato summit in Brussels in disarray on Wednesday after making a surprise demand for members to raise their defence spending to 4% of GDP, and clashing with German chancellor Angela Merkel over a proposed pipeline deal with Russia. Trump left the assembled presidents and prime ministers floundering, unsure whether he was serious about the 4% target, double the existing Nato target of 2%, which many do not meet, or whether it was just a ploy. After making the announcement, Trump walked out.

The White House press secretary, Sarah Sanders, confirmed the 4% figure. “During the president’s remarks today at the Nato summit he suggested that countries not only meet their commitment of 2% of their GDP on defence spending, but that they increase it to 4%,” she said. Sanders added: “President Trump wants to see our allies share more of the burden and, at a very minimum, meet their already stated obligations.”

So there. WHy on earth would you need so many US bases?

• Germans Want Trump To Pull US Troops Out Of Germany (Ind.)

Germans would actually welcome the withdrawal of American troops stationed in their country, a new poll has found – as Donald Trump threatens to pull the plug on military support. The finding comes on the first day of a Nato summit in which the US president is urging Europe to spend more on defence if it wants to continue to receive American military protection. But far from being seen as a threat, a YouGov poll for the dpa news agency found that more Germans would welcome the departure of the 35,000-strong American force than would oppose it.

42% said they supported withdrawal while just 37% wanted the soldiers to stay, with 21% undecided. Last month the US media reported that the US government was in the process of assessing the cost of keeping troops in Germany ahead of a possible withdrawal, citing Pentagon sources. But the policy of actually pulling out of the country has not actually reached the negotiating table in his week’s Brussels summit and is not expected to be discussed as a possibility – for now.

At some point the Chinese will run into Americans there.

• China’s Silky Charming of Arabia (Escobar)

Under the radar, away from World Cup frenzy and the merger and acquisition of Cristiano Ronaldo Inc. and Fiat, the eighth ministerial meeting of the China-Arab States Cooperation Forum (CASCF), established in 2004, sailed on in Beijing, hosted by President Xi Jinping. Amid the torrential pledge of loans and aid, China committed to invest right across the Arab world in transportation infrastructure, oil and gas, finance, digital economy and artificial intelligence (AI). Significantly, Beijing will offer $15 million in aid for Palestinian economic development, as well as $91 million distributed among Jordan, Lebanon, Syria and Yemen.

A China-Arab bank consortium will be set up, with a dedicated fund of $3 billion tied up with the financial aid and loan package. Beijing also foresees importing a whopping $8 trillion from Arab states up to 2025. Predictably, once again Xi fully connected the whole Arab world with the expansion of the New Silk Roads, or Belt and Road Initiative (BRI). And careful to navigate the geopolitical minefield, he urged “relevant sides” to respect the international consensus in the Israel-Palestine confrontation, calling for justice. That may indicate a gradual, but sure departure from trademark Chinese passive or reactive policy across the Arab world, focused exclusively on energy and political non-interference.

Xi is now openly tying up Chinese financial aid and deals with nations across the Global South to an overall economic development drive; the only roadmap to solve intractable political and religious conflict. And that includes full respect of international deals. As much as the Arab world, Iran is in Southwest Asia. A day before the China-Arab forum, Premier Li Keqiang, in Berlin, was warning of “unforeseeable consequences” if the Iran nuclear deal, known as JCPOA, were to be discarded, as the Trump administration wants.

Stating the obvious.

• The Supreme Court Is Much Too Powerful (Mises.org)

The current frenzy over the vacancy on the Supreme Court in the wake of Justice Kennedy’s retirement highlights just how much power has been centralized in the hands of a small number of people in Washington, DC. The left has grown positively hysterical over the thought of yet another Trump-appointed judge being installed, who could potentially serve on the court for decades. Right-wingers who claim the left is overreacting, however, are unconvincing. One can only imagine the right’s reaction were Hillary Clinton president. She would have already had the opportunity to appoint Scalia’s replacement, and we might now be talking about her nominee to replace Justice Ginsberg.

The right-wing media would be filled with article after article about how the new court would be a disaster for health-care freedom, private gun ownership, and, of course, the unborn. But, as it is, we live in a country where five people on a court decide what the law is for 320 million people. And for some reason, many people think this is entirely normal. It’s our own American version of the Soviet politburo, but few are even bothering to ask whether it’s a good idea. After all, if it makes sense for a small handful of people to decide law for the entire country, why even bother with a House of Representatives? Even the Senate — composed primarily of multimillionaires living full-time in Washington, DC, is [by comparison] extravagantly “democratic.”

“be fair to those who care”

• New Zealand Hospitals In Chaos As 30,000 Nurses Strike (G.)

Hospitals in New Zealand have cancelled elective surgeries and discharged patients early after 30,000 nurses walked off the job in the first such nationwide strike in 30 years. The 24-hour strike began on Thursday, and comes after months of negotiations between the government and nurses broke down on Wednesday, leaving hospitals to battle winter illnesses without crucial staff. Long delays at hospital emergency departments are expected around the country. Striking nurses held rallies in major cities, chanting “be fair to those who care” in the largest public demonstrations by the health sector ever seen on the country’s streets. Nurses said they were overworked and underpaid, with unsafe working conditions leading to burnout and exhaustion.

Patient care and staff wellbeing were routinely compromised, they said. Acting prime minister Winston Peters said the government was “very, very disappointed” that its latest offer of a 12.5% increase had been rejected, and that it would take time to address nine years of neglect under the previous National government. Although the May budget delivered a surplus, Peters said the extra funds were needed to handle unforeseen spending, such as managing the spread of mycoplasma bovis, a cow disease. “We are saying give us some time … it’s not that we’re not willing to, we haven’t got the money,” said Peters. “We’ve gone as far as we can go as a government. We got hold of a negotiated arrangement which we inherited – the nurses have had a raw nine years.”

Straight jacket.

• EU Approves ‘Enhanced Surveillance’ for Post-Bailout Greece (GR)

The European Commission on Wednesday said Greece will remain under an “enhanced surveillance framework” to ensure that it meets ambitious budget targets through 2022. The country will still be subject to quarterly inspections from creditors after the bailout program ends in late August. “Greece is now able to stand on its own two feet but that doesn’t mean it has to stand alone … The reform era has not ended,” EU Financial Affairs Commissioner Pierre Moscovici said. “Enhanced surveillance is not a fourth program: it involves no new commitments or conditions. It is a framework to support the completion and delivery of ongoing reforms,” he added.

Despite returning to growth after a massive recession, Greece leaves the program still facing major difficulties. Banks are struggling to deal with a high rate of bad loans. At over 20%, Greece has the highest unemployment rate in the euro currency union. Government bonds remain below investment grade even though their yields have fallen to manageable rates. And to help reduce its debt, Greece has committed to punishingly high primary budget surpluses — that is, the budget excluding the cost of debt servicing — of above 3.5% through 2022. “Enhanced surveillance is there to help Greece build confidence with markets, investors and companies,” Commission Vice-President Valdis Dombrovskis said. “They all want stability and predictability.”

They’ll find a new dump.

• Trash Piles Up In US As China Closes Door To Recycling (AFP)

For months, a major recycling facility for the greater Baltimore-Washington area has been facing a big problem: it has to pay to get rid of huge amounts of paper and plastic it would normally sell to China. Beijing is no longer buying, claiming the recycled materials are “contaminated.” For sure, the 900 tons of trash dumped at all hours of the day and night, five days a week, on the conveyor belts at the plant in Elkridge, Maryland – an hour’s drive from the US capital – are not clean. Amid the nerve-shattering din and clouds of brown dust, dozens of workers in gloves and masks – most of them women – nimbly pluck a diverse array of objects from the piles that could count as “contaminants.”

That could be anything from clothes to cables to tree branches to the bane of all recyclers: plastic bags, which are not supposed to go in recycling bins because they snarl up the machinery. “We’ve had to slow our machinery, and hire more people” to clean up the waste, says Michael Taylor, the head of recycling operations for Waste Management, the company that runs the plant. At the end of the sorting line is the end product — huge bales of compacted waste containing paper, cardboard or plastics. These have been bought up for decades by businesses, most of them based in China, which clean them up, crush them and transform them into raw materials for industrial plants.

Last year, China bought up more than half of the scrap materials exported by the United States. Globally, since 1992, 72% of plastic waste has ended up in China and Hong Kong, according to a study in the journal Science Advances. But since January, China has closed its borders to most paper and plastic waste in line with a new environmental policy pushed by Beijing, which no longer wants to be the world’s trash can, or even its recycle bin. For other waste products such as cardboard and metal, China has set a contamination level of 0.5% — a threshold too low for most current US technology to handle. US waste handlers say they expect China will close its doors to all recycled materials by 2020 — an impossibly short deadline.