Fritz Henle “Air raid rules”, West Danville, Vermont July 1942

My, what a lovely day. Summer’s here. Then again, not so great perhaps if yours is one of the 18,000 jobs lost at Microsoft. Then again again, at least the move made Microsoft shares rise. Not anywhere near great if you, or someone close to you, were among the 300 or so on the passenger plane from Amsterdam that got downed just now over Ukraine. Still don’t like the role the US is playing in that conflict. Not a great day either for investors, losses are starting to add up in the stock market. And you have to wonder what Janet Yellen thinks – and many with her – about the devastating free fall in US housing starts, which seems to lay to rest most – but never all – the talk about a recovery. Building permits fell as well. Bloomberg kind of suggests maybe Yellen already knew these numbers when she spoke to the Senate this week:

Housing Starts in US Decline Amid Plunge in the South

Beginning home construction unexpectedly declined in June to a nine-month low as a record plunge in the South swamped gains in the rest of the U.S. Housing starts fell 9.3% to an 893,000 annualized rate, from a 985,000 pace in May that was weaker than initially estimated, figures from the Commerce Department showed today. Construction slumped 29.6% in the South to a 375,000 pace, the weakest in almost two years. The figures, along with a decline in building permits, corroborate Federal Reserve Chair Janet Yellen’s view that progress in the housing market has been “disappointing” this year.

Must be winter in June. If you would go back to all the things that were written and said about how the pent-up demand would lift the US after its Siberian one in a lifetime winter, and how Q2 GDP numbers would rise like a phoenix from the ashes of the Q1 disaster, if you read all that again today, you would get a picture of just how distorted – or should we say non existent – predictive qualities among analysts and reporters have become. Predictions and estimates are now habitually so far off the mark it’s gotten absolutely embarrassing for those of us who follow them. Since most people don’t, the geniuses who produce them may not even care much.

Something else you can bet they’ll get painfully wrong, along with a vast majority of the investment world, is the future of the US dollar. They’ll undoubtedly say nobody could have possible seen this coming; we know the MO.

Since Janet Yellen, and her Fed colleagues, look determined to go ahead with the taper, and end it in a few months, it’s probably wise to take note of these words from Bloomberg:

“Almost 90% of the $5.3 trillion a day in foreign-exchange transactions last year involved the dollar, BIS data show. More than 80% of trade finance was done in dollars in 2013 … “

This is wise because while the Fed is set to substantially shrink the amount of dollars available in global markets, emerging economies have built their entire forward models on the dollar glut provided by QE3. And most world trade, obviously, is also still conducted in USD. This is not a margin call, it’s a margin scream. The demand for the US dollar will rise precipitously, at precisely the time that there’ll be far fewer of them available. This means mayhem in many developing nations, and it means the USD is set to surge. Ambrose Evans-Pritchard is dead on in that respect:

Fed Kicks Off Global Dollar Squeeze As Janet Yellen Turns Hawkish

The US Federal Reserve has begun to pivot. Monetary tightening is coming sooner than the world expected, with sober implications for overheated bourses, and for those in Asia, eastern Europe and Latin America that drank deepest from the draught of dollar liquidity. We can expect a blistering dollar rally, perhaps akin to the early 1980s or the mid-1990s. It is fortuitous that the BRICS quintet of Brazil, Russia, India, China and South Africa have just launched their $100bn monetary fund to defend each other’s currencies. Some of them may need it.

Since Fed chief Janet Yellen targets jobs above all else, this was bound to force capitulation by the Fed before long. It happened this week in her testimony to Congress. “If the labour market continues to improve more quickly than anticipated, then increases in the federal funds rate likely would occur sooner and be more rapid than currently envisioned,” she said. This is a policy shift. Mrs Yellen has admitted that the Fed misjudged the pace of jobs recovery. The staff did not expect unemployment to fall this low until late next year. The inflexion point has come 15 months early. [..] “They may have left it too late again: the risk is a reckoning point when rates rise abruptly,” said Jens Nordvig, from Nomura.

At first glance, it’s delightfully ironic that US manipulation of its own unemployment numbers would lead to this. But perhaps there’s more going on behind the veil.

Mrs Yellen added the usual caveats about “false dawns”. Wages are barely rising. The jobs market is not yet drawing back the millions who dropped out of the system. [..] “The recovery is not yet complete. We need to be careful to make sure the economy is on a solid trajectory before we consider raising interest rates,” she said. Yet she has undoubtedly changed gear. She no longer dismissed rising inflation (1.8%) as “noise”. [..] “Valuations appear stretched. We are closely monitoring developments in the leveraged loan market …”

The critics may be getting to her. The Bank of International Settlements has rebuked the Fed for stoking asset bubbles. Some of her own voting committee are fretting. “I think we are going to overshoot on inflation,” said St Louis Fed chief James Bullard. Mrs Yellen is not as dovish as believed, in any case. Her lodestar is the “non-accelerating inflation rate of unemployment” (NAIRU), the point at which tight labour markets start to drive a wage-price spiral. She thinks this is near 5.4%.

I don’t know, Ambrose. A wage-price spiral for burger flippers and WalMart greeters? I mean, we saw today that it’s highly unlikely there’ll be one for construction jobs …

[..] … if America is strong enough to withstand rate rises, it is far from clear what this will do to the rest of the world. A vast wash of dollars flooded the global financial system when the Fed cut rates near zero and then bought $3.5 trillion of bonds. This may now go into reverse.

My guess is neither is strong enough for rate rises. Or, to be more specific, in both America and abroad, the more affluent will be fine, especially since they are the ones who raked in the “wash of dollars”. For the rest of us, rate rises will be an unmitigated disaster. Low rates are the only thing that has held this caboose together, or seemed to have done so. Low rates have propped up stock markets, mergers, the housing market, you name it.

When governments and companies and individuals, all of whom, certainly in the US and EU, are deeper in debt than ever before in history, by a wide margin, all have to start paying – much – higher interest rates on their debt, the impact will be scorched earth.

We still live in a dollarised world. Charles de Gaulle railed against the “exhorbitant privelege” of US dollar hegemony in the 1960s, but remarkably little has changed since. The BIS says global cross-border lending by banks alone has risen from $4 trillion to $10 trillion over the past decade, and $7 trillion of this is denominated in dollars. This does not include the dollar bond markets. What the Fed now does arguably has more amplified effects than at any time since the end of gold and the collapse of the fixed-exchange Bretton Woods regime in 1971. This is the paradox of 21st century globalisation.

Much of the dollar business is conducted through European and UK banks, leaving them acutely vulnerable to a dollar squeeze. Such episodes can be ferocious. It was a dollar liquidity shock that turned the Lehman affair into a global banking crisis, instantly engulfing Europe in October 2008. Emerging markets went into a tailspin last year at the first suggestion of Fed bond tapering. There was a sudden stop in capital flows. The “Fragile Five” (India, Indonesia, South Africa, Brazil and Turkey) were punished for current account deficits. The Fed backed down. The storm passed. There was a second “taper tantrum” earlier this year as the Fed finally began to pair back its $85bn monthly purchases under QE3. This too settled down.

When everyone save for America must pay – significantly – more for the US dollar, and more for the commodities – oil! – and loans and everything else that are denominated in dollars, the damage becomes hard to oversee. So much of this is conducted through short term loans – letters of credit come to mind – that must be rolled over all the time, and now almost all parties involved will increasingly have to scramble to find dollars somewhere, anywhere. Outright panics can easily follow.

[..] A study by the International Monetary Fund concluded that the Fed’s QE had pushed $470bn into emerging markets that would not otherwise have gone there. IMF officials say nobody knows how much of this hot money will come out again, or how fast. The BIS in turn said in its annual report two weeks ago that private companies had borrowed $2 trillion in foreign currencies since 2008 in emerging economies, lately at a real rate of just 1%. Loans to Chinese companies have tripled to $900bn – some say $1.2 trillion – mostly through Hong Kong and often disguised by opaque swap contracts in what amounts a dangerous carry trade. Countries do not borrow in dollars any longer (mostly) but their banks and industries certainly do.

China is, as we speak, seeing its second bond default in short order, with the added twist of this one taking place in the interbank market. There is no doubt the US dollar is heavily involved in that market. What happens in China’s opaque finance world when the dollar rises and rates go up must be keeping a few of the smarter people over there awake already.

The report said monetary largesse in the West has destabilised emerging economies in all kinds of ways. One of the worst – and least understood – ways is that they were forced to choose between internal credit bubbles or surging currencies. Most opted for bubbles as the lesser evil, holding their domestic interest rates at 300 basis points below the safe “Taylor Rule” level. This has driven their total debt levels to a record 175% of GDP. It may be even worse. China has thrown all caution to the wind, pushing credit from $9 trillion to $25 trillion since Lehman. Its debt levels have reached 220% by some estimates.

Record debt levels encouraged by cheap and readily available dollars. Which will now become less available and much less cheap.

[..] .. there is no denying that a long string of countries are in structural crisis, ensnared by the middle-income trap. They have exhausted the low-hanging fruit of catch-up growth. They failed to carry market reforms to varying degrees. [..] .. these countries – and many others with parallel problems, must brace for a secular rise in global borrowing costs, and as the BIS warns, the world is today more sensitive to interest rates than ever before. As yields on two-year US Treasuries ratchet higher, the US currency will inevitably ratchet with it. “I am convinced that we are close to a major cyclical recovery for the dollar,” said Nomura’s Mr Nordvig.

The BRICS, the mini-BRICS and much of global finance have taken out a colossal short position on the US dollar. Mrs Yellen has just issued the first margin call.

What else is there to say? Welcome to the new world order?! Europe may have long been complaining about the high euro, but is it ready for the super dollar? I think not. How many dollar denominated potential problems are there in Greek, Spanish. Italian banks? Do the ECB stress tests include a rate rise to 5% from 1%? A dollar on par with the euro? China has all the potential for 1001 smaller crashes adding up to a major bust. Beijing won’t be able to keep track of every single problem anymore, but every single one may grow from level 1 to 10 in no time. Most emerging nations are just plain toast.

Ambrose is right: the entire world has survived – even thrived – on a huge short on the US dollar for the past 5 years or so. And now the punch bowl threatens to be kicked away from right under their thirsty slurping snouts. Are we to think the Fed never saw this coming? What if they did? Is there a plan here?

• Fed Kicks Off Global Dollar Squeeze As Janet Yellen Turns Hawkish (AEP)

The US Federal Reserve has begun to pivot. Monetary tightening is coming sooner than the world expected, with sober implications for overheated bourses, and for those in Asia, eastern Europe and Latin America that drank deepest from the draught of dollar liquidity. We can expect a blistering dollar rally, perhaps akin to the early 1980s or the mid-1990s. It is fortuitous that the BRICS quintet of Brazil, Russia, India, China and South Africa have just launched their $100bn monetary fund to defend each other’s currencies. Some of them may need it. America’s unemployment rate has fallen from 7.5pc to 6.1pc in 12 months. The country has been adding 230,000 jobs a month in the first half of this year.

Since Fed chief Janet Yellen targets jobs above all else, this was bound to force capitulation by the Fed before long. It happened this week in her testimony to Congress. “If the labour market continues to improve more quickly than anticipated, then increases in the federal funds rate likely would occur sooner and be more rapid than currently envisioned,” she said. This is a policy shift. Mrs Yellen has admitted that the Fed misjudged the pace of jobs recovery. The staff did not expect unemployment to fall this low until late next year. The inflexion point has come 15 months early. To some it feels like 2004, when the Greenspan Fed found itself badly behind the curve, suddenly switching from nonchalance in May to rate rises in June. “They may have left it too late again: the risk is a reckoning point when rates rise abruptly,” said Jens Nordvig, from Nomura.

• Dollar Dominance Intact as U.S. Fines on Banks Raise Ire (Bloomberg)

The record fine imposed on France’s largest bank over transactions in U.S. dollars revived European complaints about the greenback’s pre-eminence in global finance. History shows calls to supplant the currency will be futile. The dollar hasn’t budged from its top spot for the past three decades, withstanding repeated efforts to unseat it. Almost 90% of the $5.3 trillion a day in foreign-exchange transactions last year involved the dollar, the same share as in 1989, data from the Bank for International Settlements show. More than 80% of trade finance was done in dollars in 2013, according to Swift, a global financial-messaging network. Companies, consumers and central banks around the world prefer the dollar to other currencies, including the euro and yen, because they trust the Federal Reserve and the U.S. government to back it, according to Marc Chandler, the chief currency strategist at Brown Brothers Harriman & Co.

“There are always people who say the dollar is going to be replaced, but it hasn’t happened,” said Chandler, who’s based in New York. “The biggest threat to the dollar’s dominance is the U.S. deciding to abdicate one day, not others complaining about it for this reason or that.” As long as the dollar maintains its central role, banks around the world will have to bow to U.S. rules and oversight. BNP Paribas SA, the French firm hit with a $9 billion fine last month, also agreed to suspend clearing dollar transactions related to oil and gas trading when it pleaded guilty to violating U.S. sanctions against transferring cash for Iranian and Sudanese entities. New rules introduced this year tightened the regulation of foreign lenders’ U.S. units.

That’s no mean achievement.

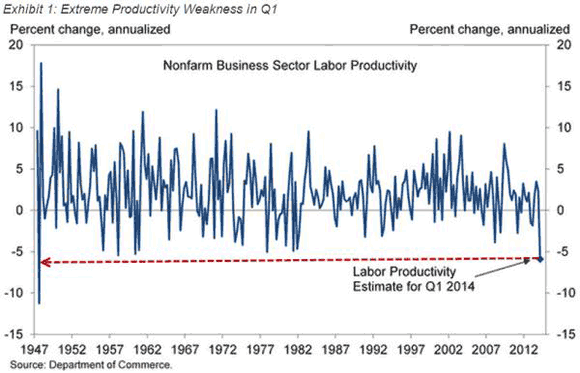

• US Q1 Productivity Collapsed Most In Over 60 Years (Zero Hedge)

The official measure of Q1 productivity growth currently looks likely to be revised down to almost -6% (annualized) – the worst in almost 70 years. As Goldman points out, even on a longer-term basis, the 4-, 8-, and 12-quarter trends are all in a 0.2%-0.6% range when the Q1 estimates are included, dramatically below consensus 2% estimates of the long-term trend. While Goldman notes productivity is a very noisy series, because it is calculated as the difference between noisy GDP numbers and noisy hours worked numbers; if these numbers are an accurate representation of the long-term trend, the implications for the long-term growth in US living standards would be very negative. Weather?

Of course, it wouldn’t be Jan Hatzius if Goldman didn’t end on an optimistic note…

There are good reasons to expect further improvement in productivity growth over the next few years. In particular, stronger business investment is likely to boost the growth rate of the capital stock and therefore the contribution of capital deepening to productivity growth. Whether this will be enough to boost the productivity trends over the cycle as a whole to our longer-term estimate of 2% or a slightly lower number is admittedly less clear.

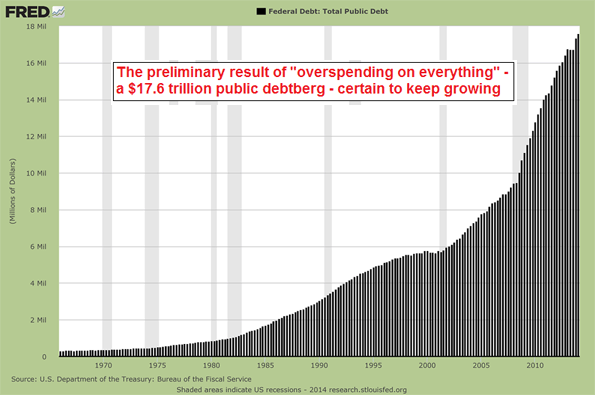

Like the word Debtberg.

• When The Price Of Money Is Zero: The Federal Debtberg (Bill Bonner)

When we left off yesterday, we were explaining how the feds had unlearned the three critical lessons of more than 2,000 years of market history:

- Make sure the money is backed by gold (otherwise it loses its buying power).

- Don’t let the government spend too much money it doesn’t have (otherwise it will cause havoc).

- Don’t try to centrally plan an economy… especially not with fixed prices (or you’ll soon have a wealth-destroying mess on your hands).

The US took gold out of the global monetary system through two closely related measures: the first, taken by President Johnson, in 1968, when he removed the requirement of the dollar to be backed by physical gold; the second, taken by President Nixon, in 1971, when he ended the direct convertibility of the dollar to gold. The US federal budget was last balanced (not counting Social Security contributions) under President Carter. It hasn’t been balanced since. And after 1980, when the Republican Party became the Party of Big Spenders, there was no hope of controlling federal deficits. Since then, the only two electable political parties were in favor of spending more than the government collected in taxes. Republicans wanted to spend on an activist agenda overseas. Democrats wanted to spend on an activist agenda at home. In the resulting compromise, they agreed to overspend on both.

The government, meanwhile, manipulated prices lightly before… then heavily after… the Black Monday crash in 1987. Nixon had tried general price controls in 1971. Those were quietly abandoned and quickly forgotten. But after the October 1987 crash, the new Fed chairman, Alan Greenspan, began to closely manage and grossly distort the single most important price in capitalism: the price of credit. As political appointees with a mandate to make life as easy as possible for their masters in Washington, naturally, Greenspan and his successors had a bias to fix the price of credit ever lower… until it finally hit zero in 2009. That’s where the Fed funds rate – the rate at which banks lend money on deposit with the Fed to each other overnight and the base rate for all other credit – has been for the last five and a half years.

• Bubble Paranoia Setting in as S&P 500 Surge Stirs Angst (Bloomberg)

Two years of uninterrupted gains in U.S. stocks are sowing anxiety among financial professionals, with three in five saying the market is on the verge of a bubble or already in one, the Bloomberg Global Poll found. 47% of those surveyed said the equity market is close to unsustainable levels while 14% already saw a bubble, according to a quarterly poll of 562 investors, analysts and traders who are Bloomberg subscribers. Almost a third of respondents called the market for lower-rated corporate debt overheated and most said stock swings will increase within six months, the July 15-16 poll showed. With biotechnology stocks trading at more than 500 times earnings, mega-deals resurfacing and bond sales at a record, concern prices are too high is growing amid a rally that has pushed the Standard & Poor’s 500 Index almost 30% above its peak in 2007.

The view isn’t shared by the Federal Reserve, which said this week that while valuations are stretched in smaller biotechnology and social media companies, asset prices in general are in line with historical levels. “It’s like a storm coming,” Dane Fulmer, a poll respondent who has traded stocks and bonds for more than 40 years and runs Dane Fulmer Investments in Fort Smith, Arkansas, said in a phone interview yesterday. “You don’t have to be a weatherman to see clouds.” More than $15 trillion has been added to U.S. equity values and the S&P 500 is up 193% since the bull market began in March 2009. The benchmark gauge trades for 18.1 times profit, the highest level since 2010, according to data compiled by Bloomberg.

Yeah, but how much longer? And what about diminishing returns?

• No Stock Shock as Central Bank Holdings Keep Ballooning (Bloomberg)

For all the talk of central bankers hitting the brakes, their policies will keep inflating their balance sheets — sustaining support for global equities. As the Federal Reserve prepares to end its third round of bond-buying as soon as October, the combined accounts of the central banks in the U.S., Japan and euro area could still swell another 20% in dollar terms by the end of 2015, according to Cornerstone Macro LP, an investment-research company in Washington. That should negate concerns among investors that the end of the Fed’s quantitative easing will roil financial markets. “The flow of global liquidity is nowhere near a stopping point,” Cornerstone economists including Roberto Perli, a former Fed official, said in a July 15 report. “If investors want to look for reasons why stocks should roll over soon, they should look elsewhere – global central bank policies are unlikely to be the culprit.”

Expanding balance sheets has become a pivotal tool of monetary policy since the 2008 financial crisis, as policy makers bought assets and lent cash to banks to fight the subsequent recession and speed recovery. The Fed alone now holds more than $4 trillion of assets such as Treasuries. The balance sheets of the big three central banks have swelled to the equivalent of about 12.5% of global gross domestic product from about 6% in 2007, according to Cornerstone’s estimates. The 20% growth in the next 18 months would push that proportion to 14.5%. Even as the Fed ceases buying bonds it is unlikely to start paring its balance sheet for about 18 months. One reason is it’s planning to reinvest the proceeds of maturing securities and will likely do so until after the first interest-rate increase, said Cornerstone, which assumes a June rise. Fed officials also have suggested they will be slow to sell their bonds for fear of undermining the economy by boosting long-term interest rates.

Meantime, the European Central Bank’s balance sheet of €2 trillion should increase as it looks to extend as much as €1 trillion in fresh lending to banks. It also may start buying asset-backed securities and could go even further by conducting quantitative easing for the first time if deflation threatens. As for the Bank of Japan, its continued bond-buying is enough to lift its balance sheet to 70% of GDP from 53% in Cornerstone’s view. Like the Fed, the BOJ may keep its balance sheet large even after hitting its inflation goal. “The expansion of the ECB’s and BOJ’s balance sheets will more than make up for the stagnation of the Fed’s balance sheet,” said Perli and colleagues. “That should alleviate concerns of those who fear the end of QE would bring about a reversal in U.S. and global markets.”

Big deal. Many more to follow.

• China Faces Second Bond Default Amid World’s Biggest Debt (Bloomberg)

China faces what would be the second default in the nation’s onshore bond market after a builder said it may fail to make a payment next week, the latest sign of stress in the world’s biggest corporate debtload. Huatong Road & Bridge Group Co., based in the northern province of Shanxi, said it may miss a 400 million yuan ($64.5 million) note payment due July 23, according to a statement to the Shanghai Clearing House yesterday. Chairman Wang Guorui is assisting authorities with an official investigation, it said, without elaborating. Wang was removed from the Chinese People’s Political Consultative Conference Shanxi Committee on July 9 for suspected violations of the law, according to an official statement and media report last week.

Shanghai Chaori Solar Energy Science & Technology Co. marked China’s first onshore corporate bond default in March when it missed a coupon payment. Huatong Road would be the first to fail to pay both interest and principal, and would also be the first default in the interbank note market, the nation’s biggest bond bourse. Chinese firms have the most debt globally after increasing borrowings to $14.2 trillion as of Dec. 31, surpassing the U.S.’s $13.1 trillion, Standard & Poor’s said in a June 15 report. “It’s very likely the company will default,” said Xu Hanfei, a bond analyst at Guotai Junan Securities Co., the nation’s third-biggest brokerage. “If it does, the event will have a big impact on investors’ risk sentiment.”

• What to Fear If China Crashes (Bloomberg)

Few moments in modern financial history were scarier than the week of Sept. 15, 2008, when first Lehman Brothers and then American International Group collapsed. Who could forget the cratering stock markets, panicky bailout negotiations, rampant foreclosures, depressing job losses and decimated retirement accounts — not to mention the discouraging recovery since then? Yet a Chinese crash might make 2008 look like a garden party. As the risks of one increase, it’s worth exploring how it might look. After all, China is now the world’s biggest trading nation, the second-biggest economy and holder of some $4 trillion of foreign-currency reserves. If China does experience a true credit crisis, it would be felt around the world. “The example of how the global financial crisis began in one poorly-understood financial market and spread dramatically from there illustrates the capacity for misjudging contagion risk,” Adam Slater wrote in a July 14 Oxford Economics report.

Lehman and AIG, remember, were just two financial firms out of dozens. Opaque dealings and off-balance-sheet investment vehicles made it virtually impossible even for the managers of those companies to understand their vulnerabilities — and those of the broader financial system. The term “shadow banking system” soon became shorthand for potential instability and contagion risk in world markets. Well, China is that and more. China surpassed Japan in 2011 in gross domestic product and it’s gaining on the U.S. Some World Bank researchers even think China is already on the verge of becoming No. 1. China’s world-trade weighting has doubled in the last decade. But the real explosion has been in the financial sector. Since 2008, Chinese stock valuations surged from $1.8 trillion to $3.8 trillion and bank-balance sheets and the money supply jumped accordingly. China’s broad measure of money has surged by an incredible $12.5 trillion since 2008 to roughly match the U.S.’s monetary stock.

It’s all they have left.

• China Finds Debt Addiction Hard to Break in Growth Quest (Bloomberg)

China’s leaders are having trouble breaking their addiction to debt-fueled investment. Outstanding credit rose to 206.3% of gross domestic product last quarter from 202.1% in January-to-March, according to data compiled by Bloomberg from government releases the past two days. Investment in fixed assets, a typical outlet for loans, accelerated in June for the first time since August. President Xi Jinping’s government is aiming for about 7.5% economic expansion this year, and a deeper slowdown could complicate structural changes he’s implementing — such as bringing more private capital into state-owned enterprises. The central bank has eased constraints on bank lending in recent months and ceased referring to a November projection that China might undergo an unwinding of its debt build-up.

“There are reasons to continue wondering how this is going to end,” said Louis Kuijs, Royal Bank of Scotland Group Plc’s chief Greater China economist in Hong Kong, who formerly worked at the World Bank. “Clearly they have made the decision that growth is still so important and we notice that they cannot meet their growth target at the moment without adding on more credit.” China will continue targeted measures to manage the economy and must meet the economic development goal, according to a government statement last night after a State Council meeting led by Premier Li Keqiang. [..] “If the Chinese want to avoid a painful correction, they have to keep pulling these levers,” said Yao Wei, China economist at Societe Generale in Paris. “Debt has been growing very fast. There potentially can be a lot of defaults and systemic risk if growth also slows. They don’t want to risk that. This is actually a fear of the unknown.”

• China Rallying for All Wrong Reasons to Top-Rated Analyst (Bloomberg)

The more China does to boost economic growth, the more bearish David Cui gets on the nation’s stock market. The Bank of America strategist, ranked No. 1 by Institutional Investor magazine, says the state spending and monetary stimulus that drove a 14% rally in the Hang Seng China Enterprises Index (HSCEI) from this year’s low in March are only making equities less appealing as leverage rises and free cash flow dwindles. He predicts the gauge will drop to 9,600 by year-end, or 8.4% below yesterday’s close.

Cui’s pessimistic outlook for the largest emerging market puts him at odds with bulls at some of the biggest banks and money-management firms, including Goldman Sachs Group Inc. and BlackRock Inc. He says policy makers’ unwillingness to endure the “short-term pain” of slower growth, needed to cut debt and shift the economy toward a consumption-based model, will prevent a sustainable rally. “Given that growth is still being driven by the usual factors, it means the core issue is getting worse as people are building up debt,” Cui said in a phone interview on July 14. “The issue is whether this growth is good quality and sustainable. My belief is that it’s not.”

Got to cover your friends, right?

• Yellen Says Fed Won’t Rule Out Broker Support in Banking Crisis (Bloomberg)

Federal Reserve Chair Janet Yellen said she wouldn’t rule out expanding access to the central bank’s discount window to broker-dealers and other non-banks under certain circumstances during a financial crisis. “It depends what the circumstances are,” Yellen said today in response to questions from the House Financial Services Committee during her semi-annual testimony. “A broad- based scheme in a situation of systemic risk is a possibility but it is something that would have to be very serious to consider.”

Responding to Representative Scott Garrett, a New Jersey Republican sponsoring a bill to require the Financial Stability Oversight Council to hold open meetings, Yellen said the circumstances would have to be “unusual and exigent,” citing the terms used in Section 13.3 of the Federal Reserve Act. “Under the terms of the Dodd-Frank Act, the Federal Reserve is barred from extending discount window lending to an individual firm and we are confined to broad-based facilities,” Yellen said. Lending to broker-dealers may be possible “if there were a general financial disruption and we were in a situation of systemic risk similar to what we saw during the financial crisis where we have a general panic.”

And that’s a big Kool Aid problem.

• Money Managers Aren’t Ready for a Bear Market (Bloomberg)

The people and companies who manage the world’s assets are flush with cash, for now. Asset managers brought home $93 billion in profit last year, according to a new Boston Consulting Group report, up 17% from 2012. In a world where banks routinely pay multi-billion-dollar fines, asset managers’ growing profits are one of the few bright spots in the financial industry, says BCG Partner Gary Shub. Except that those profits are almost entirely based on rising markets and not organic growth. Very little net new money is turning up in investment accounts. Net flows into U.S. investment accounts were just 1% last year. That could create problems when, inevitably, stocks cool off. And if a bear market comes along, managers of funds may face a true reckoning.

The hardest hit will likely be traditional active money managers. They’re being underpriced by cheap passive strategies that hold stocks and bonds based on indexes in mutual funds or exchange-traded funds. Managers of mutual funds are also getting squeezed by a variety of new, more sophisticated strategies, which BCG calls “solutions.” These are options like target-date funds, income funds and global asset allocation funds that operate pretty much on autopilot. The result is that an elite group of big asset managers, who provide such alternatives, are winning the lion’s share of new dollars. In the U.S., Vanguard Group, famous for its cheap index funds and ETFs, and BlackRock, the world’s largest money manager, together get two of every five new dollars that get invested in the U.S. BCG says the top 10 asset managers make up almost three-quarters of new investment flows.

• Russia Sanctions Hit Stocks; Escalation Eyed (CNBC)

Russian stock markets were sharply lower on Thursday morning following the announcement of new sanctions by the U.S and the European Union, and analysts warned that tougher penalties were expected in the coming months. U.S. President Barack Obama announced the fresh sanctions on Wednesday evening, amid fears that tensions between pro-Russian separatists and Ukraine’s military could escalate further following the annexation of Crimea by Russia back in March. The package was the most wide-ranging round of penalties so far, with Russia’s state oil producer Rosneft hit. Other energy, financial and defense firms were also targeted, including Vnesheconombank, Gazprombank, gas producer Novatek and weapons maker Kalashnikov Concern.

Lending to these companies has now been prohibited in the U.S., meaning they will lack access to the country’s debt markets. This builds on the financial and travel limits imposed earlier in the year. Russian President Vladimir Putin responded to the most recent sanctions, saying that relations between the U.S. and Russia were in danger of reaching a “dead end” and could damage U.S. business interests in his country, according to reports. On Thursday morning, Reuters reported that the Russian Foreign Ministry said it would not tolerate “U.S. sanction blackmail” and reserved the right to retaliate.

• Emerging Markets Reserves Break $3 Trillion Mark (Bloomberg)

Developing nations from Colombia to South Korea have accumulated so many dollars through intervening to curb currency gains that their foreign reserves now exceed $3 trillion for the first time. The 12 emerging nations with the biggest holdings outside of China added $49 billion in April, May and June, more than any quarter since September 2012, data compiled by Bloomberg show. Of 23 major developing-nation currencies, 18 are forecast by analysts to drop by year-end, suggesting the strategy is proving effective in keeping exchange rates competitive. Bigger reserves also help governments defend their currencies from an emerging-market rout of the sort they suffered in mid-2013, when their coffers were depleted by $57 billion in just two months. Nations are filling up with dollars while they can, before a boost in U.S. interest rates reduces the yield advantage their assets enjoy.

“It’s a window of opportunity for them,” Nicolas Jaquier, an economist in London at Standard Life Investments Ltd., which oversees about $425 billion, said by phone on July 14. “The central banks have to defend the stability of their markets and they’re happy to mop up the inflows.” The opportunity may soon run out as developing nations look toward an eventual increase in global interest rates and an end to the monetary stimulus that has supported their assets. While a Bloomberg survey suggests the first increase in U.S. rates will come in the second quarter of 2015, Federal Reserve Chair Janet Yellen said this week that borrowing costs may rise faster than investors expect. Developing nations are able to build their reserves because investors are flocking to their financial assets after governments cleaned up their finances. China isn’t included in Bloomberg’s aggregate figures because its $3.99 trillion of reserves are larger than all its peers combined.

Sobering.

• Renewable Energy Growth in Perspective: A Very Long Way to Go (Andrews)

… while renewables generation has grown, so has electricity consumption, and when this is taken into account we find that increased contributions from solar, wind and biomass have been offset by the declining overall contribution from hydro to the point where the percentage of the world’s electricity supplied by renewables is only marginally higher now than it was in 1985 (BP doesn’t provide global electricity consumption data before 1985).

Figure 3: percentage of Global Electricity Generated by Renewables, 1965-2013

And because electricity supplies only about 40% of world energy consumption the percentage of world energy consumption supplied by renewables is correspondingly lower. Electricity consumption, on the other hand, has grown faster than energy consumption, so renewables do supply a higher percentage of world energy consumption than they used to – up from 5.6% in 1965 to 8.9% in 2013, with increased “market penetration” by wind, biomass and solar responsible for most of the increase:

Figure 4: percentage of Global Energy Generated by Renewables, 1965-2013

Figure 4 in fact provides a reasonably good perspective on the actual contribution of renewables to global energy supply since 1965. Expanding the Y-scale to 100%, however, gives a better perspective on the size of the contribution:

Figure 5: percentage of Global Energy Generated by Renewables, 1965-2013

There’s also the question of where hydro fits in. Unlike solar, wind and biomass its market share hasn’t increased much since 1965 and isn’t thought likely to increase at all in the future (the IEA projects that hydro’s share of global electricity generation will in fact decrease from ~17% to ~14% by 2050). So while we can expect that hydro will continue to provide most of the energy generated by renewables for some time to come it isn’t likely to contribute to decarbonizing global energy generation any more than it already has. If decarbonization is to be achieved by expanding renewables the expansion will have to come in wind, solar and biomass. So let’s take hydro out and see how far growth in wind, solar and biomass has carried us along the decarbonization path so far:

Figure 6: percentage of Global Energy Generated by Wind, Solar & Biomass, 1965-2013

Clearly they still have a long way to go.

They’re taking over.

• Australia Kills Off Carbon Tax (Guardian)

Australia’s carbon price has been repealed, leaving the nation with no legislated policy to achieve even the minimum 5% greenhouse emissions reduction target it has inscribed in international agreements. After eight years of bitter political debate, during which climate policy dominated three election campaigns and contributed to the demise of two prime ministers, after last week’s Senate drama in which the repeal was again defeated and this week’s lengthy last gasp debate, the Senate has now finally voted to make good Tony Abbott’s “pledge in blood” to “axe the tax”. [..]

Leader of the government in the Senate and former climate change minister Penny Wong said repealing the bills meant “this nation will have walked away from a credible and efficient response to climate change”. Wong said the prime minister Tony Abbott had “staked his political career … on fearmongering and scaremongering and that is what this debate has been about for years”. “I think future generations will look back on these bills and they will be appalled … at the short-sighted, opportunistic selfish politics of those opposite and Mr Abbott will go down as one of the most short-sighted, selfish and small people ever to occupy the office of prime minister.”

Home › Forums › Debt Rattle Jul 17 2014: The Rise Of The Super Dollar