Harris & Ewing Crescent Limited train wreck near Kenilworth, DC August 1933

First, let me take a second to get back to my article yesterday, Optimism Bias Squared , because I got a mail from someone at the IMF (who requests anonymity), which refers to a working paper that was released by the IMF at the same time I wrote my article:

Howdy, long-time [Automatic Earth] reader (and listener and note-taker) here, just wanted to share a serendipitous artifact:

The meat in a single sentence: “Further, by comparing the IMF’s World Economic Outlook forecasts with actual growth outcomes, we show that optimism bias is greater the longer the forecast horizon.”

From the Introduction to the paper (which you can download by clicking the title/link):

Optimism bias and wishful thinking about the future are well documented human tendencies. A specific manifestation of optimism bias is the overestimation of the relevance of recent positive outcomes when predicting future outcomes. Economic growth forecasts are no exception [..] Drawing on these observations, Pritchett and Summers (2013) have recently argued that, for example, most medium- and long-term economic growth forecasts available at the time of writing for China and India – where growth has been exceptionally high for more than a decade – are overly optimistic. [..]

In this paper, we gauge the degree of optimism bias—and the extent to which the persistence of strong growth may be overestimated—in economic forecasts at horizons of increasing length. We are especially interested in projections made over longer-term horizons; thus, we analyze economic growth forecasts for horizons of up to twenty years, which we draw from the debt sustainability analysis (DSA) exercises routinely undertaken by IMF and World Bank teams for a large sample of countries. Projecting a country’s economic growth into the medium term and beyond is notoriously difficult.

At the same time, getting the growth projections wrong has major adverse consequences. For example, overestimating future economic growth implies underestimating the government debt-to-GDP ratio that will be reached at the end of the projection period (in the absence of corrective policy measures). As a result, either the country will end up with a higher-than-expected debt ratio, which could result in a debt crisis, or future policymakers will have to tighten fiscal policy abruptly – with disruptive consequences – at a later stage.

So now we know that there are people at the IMF who A) read The Automatic Earth and B) do work on optimism bias (though they’re not necessarily the same people). And that made me return to an optimism bias piece I wrote on November 18, 2012, in which I focused on our talent and penchant for telling lies, and said for instance:

Optimism Bias: What Keeps Us Alive Today Will Kill Us Tomorrow

When Jack Nicholson said you don’t want the truth because you can’t handle the truth, he was talking to a much wider audience than we would like to acknowledge. And so we get what we get. Still, you can’t always get what you want. In the end, all that’s left is what you need. And we know that, unconsciously. It’s just that in the meantime we like to be sitting pretty. And not think about the fact that this very attitude of ours will hasten and worsen the end. We’re creatures bent on instant gratification. Which is, come to think of it, precisely why we have our optimism bias in the first place.

Whatever it is that’s going wrong, and there’s more of that than we can summarize right here and now, the tragedies we create rival those of the ancient Greeks, which in and of itself shows that we never learned much. Voltaire in his 1759 Candide told us to replace “all is for the best in the best of all possible worlds” with “we must cultivate our garden”. Never took that to heart either. Like all those before us, we’ll walk right into our tragic futures thinking everything will be alright. ‘Cause that’s who we are. Our tragedies will be as over the top bloody and deadly too as the Greeks’ were.

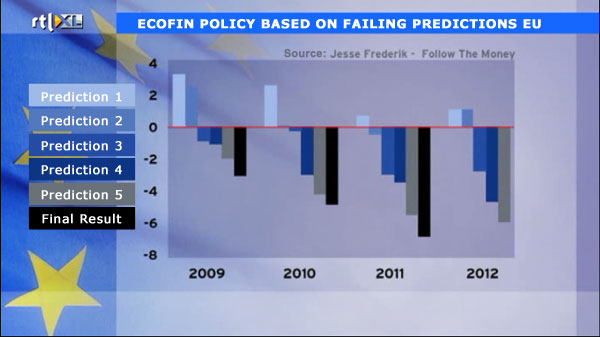

It also contains this great graph that shows by how much EU GDP growth predictions are habitually off. Initial predictions come in 6%-8% too optimistic.

I don’t believe this is a methodology going wrong, it’s too systematic and too similar for that. I think this is established policy, and not just for the EU. The difference between initial and ‘final’ numbers for US Q1 GDP was also some 5%-6%. The way it functions is that by the time the real numbers come in, they’re so far back in the rearview mirror, people see them as hardly relevant anymore. And you can bet your donkey that the BEA’s first Q2 estimate, due July 30, will come in glorious and shining, only to be revised along the trajectory of a falling brick in subsequent ‘estimates’. It’s not an error, it’s a tried and tested MO.

As for today’s great BLS jobs numbers, they exhibit the exact same underlying line of reasoning. 288.000 new jobs sounds great, and so does a drop to a 6.1% unemployment rate, but when it comes to government numbers, things are never even close to what they seem. And besides, we still have a number of grandiose discrepancies. Like the -2.96% US Q1 GDP negative growth. And the not positive at all small business sentiment, as expressed in last month’s National Federation of Independent Business (NFIB) news release, which said among other things that ” … the Index is still far below readings that have normally accompanied an expansion” and “… the four components most closely related to GDP and employment growth (job openings, job creation plans, inventory and capital spending plans) collectively fell 1 point in May. So the entire gain in optimism was driven by soft components such as expectations about sales and business conditions … “

And as should by now be obvious, we need to peek behind the veil(s) of the BLS’ own numbers as well. As Tyler Durden did just now:

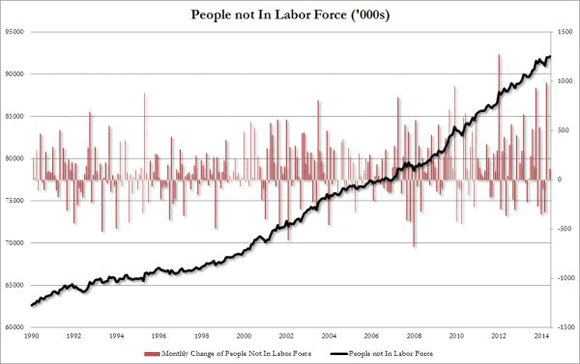

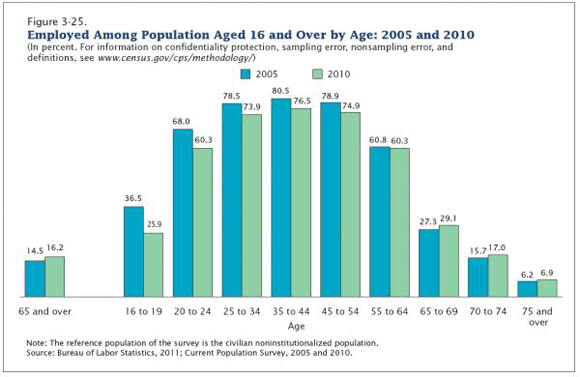

People Not In Labor Force Rise To New Record, Participation Rate Remains At 35 Year Lows

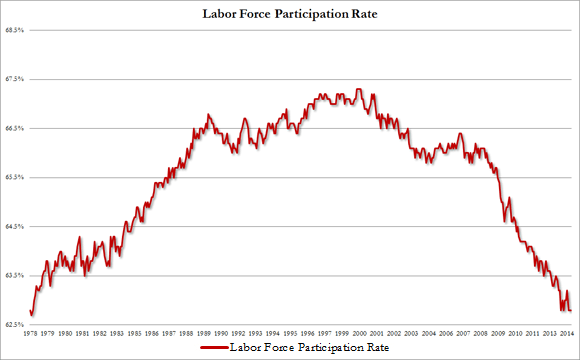

Those following the labor force participation rate (which as even the Census Bureau showed is declining not so much due to demographics but due to older people working longer and pushing younger people out of the labor force as we showed yesterday) will hardly be surprised to learn that alongside today’s impressive NFP print, the reason why the unemployment rate took another big step lower from 6.3% to 6.1%, was once again as a result of the number of people not in the labor force, which in June rose to a fresh record high of 92,120K, up 111K from May.

[..] … the labor force participation rate remained flat at 62.8%, matching the lowest print since 1978.

Do we still realize at all (or have we become too apatetic?) what it means that over 92 million working age Americans are not counted as being in the labor force? That’s almost 30 million more than in 1990, not far shy from a 50% increase in just 25 years. And we nevertheless feel optimistic about this ‘recovery’ we’ve been hearing about for years now, that’s just behind the corner? You know where I’m pretty sure that recovery really is? Just behind the horizon. Durden fished out another dubious stat from the BLS report:

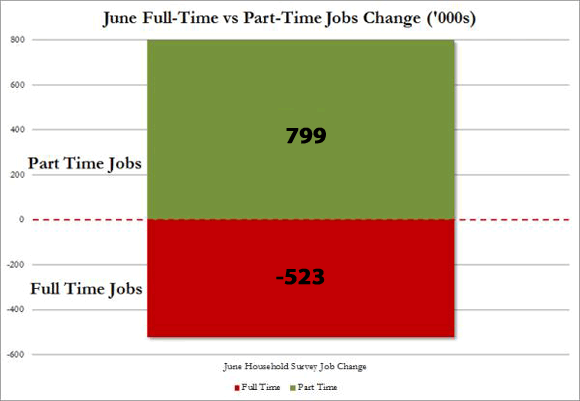

June Full-Time Jobs Plunge By Over Half A Million, Part-Time Jobs Surge By 800K, Most Since 1993

Is this the reason for the blowout, on the surface, payroll number? In June the BLS reports that the number of full-time jobs tumbled by 523K to 118.2 million while part-time jobs soared by 799K to over 28 million! [..] Something tells us that the fact that the BLS just reported June part-time jobs rose by just shy of 800,000 the biggest monthly jump since 1993, will hardly get much airplay today. Because remember: when it comes to jobs, it is only the quantity that matters, never the quality.

To summarize, in today’s BLS report, which is of course subject to several revisions to be announced later, we see 288,000 new jobs. But full time jobs fell by almost double that number, 523,000. Only to be ‘replaced’ by 799,000 part time jobs. Then we also see a falling unemployment rate, but that’s largely because 111,000 additional people are no longer counted as being in the labor force.

I humbly suggest you get up out of your chair, find yourself a mirror to look in, and tell the you that you see there exactly how optimistic you feel. And I know stocks are up again, but by now it should dawn upon us all that this is being achieved solely by gutting our entire societies. And what are we going to do when that is our new reality?

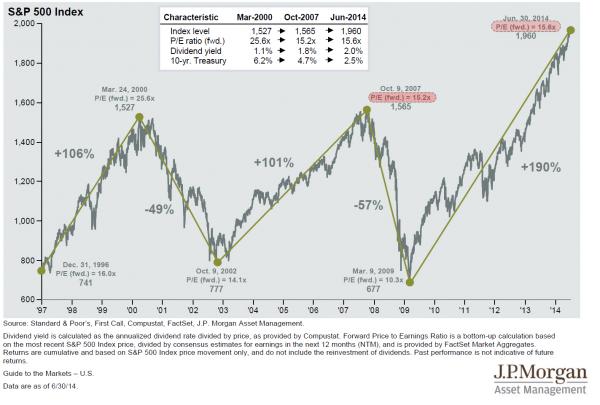

• Stocks Are Officially More Overvalued Than In Last Bubble Peak (Zero Hedge)

Over the weekend we showed that when it comes to fugding what one means by EPS (GAAP, non-GAAP, Pension accounting adjusted, etc), there is a virtually endless spectrum how one can make what is now effectively a 20x LTM P/E market appear as a “reasonably” valued 16.5x. But while fudging snapshot earnings is one thing, presenting an “apples-to-apples” valuation trend based on any one given methodology is something different, and provides a much needed continuum of (over) valuation. Which is why we go to the just released Q3 Guide to the Markets released by JPM Asset Management where we read the following:

- Current forward S&P 500 P/E: 15.6x

- Forward S&P 500 P/E on October 9, 2007: 15.2x

Needless to say, this assumes the current consensus for Non-GAAP earnings growth is accurate, which as we explained previously is driven almost entirely by “one-time charge” addbacks: addbacks which traditionally peak just before recessions strikes. But all of the above is “noise” to quote Janet Yellen. One quick look at the chart below and it becomes immediately clear that the 190% surge in the S&P since the 2009 lows has been entirely on the $10 trillion (excluding China’s $25 trillion in new financial debt) in central bank created liquidity.

Farrell’s take on politics and markets.

• The Great Obama Bull Market Will Roar Till 2016 (Paul B. Farrell)

Yes, it’s time to celebrate. We’re in a historic bull market. GOP conservatives keep fighting the wrong war, against the Obama economy. Meanwhile, the Obama bull market keeps roaring ahead!. And the long term looks even better: Bullish pundits predict stocks will continue climbing into the 2016 presidential election. Folks, this stock market has been roaring since March 2009 when the DJIA bottomed at 6,547, a painful 53.9% drop from the October 2007 high of 14,164 during the Wall Street bank credit crash in Bush’s last year as president. The S&P 500 also bottomed, at 676, a 56.6% drop. However, since March 2009 the stock market has been steadily climbing. Over five years.

And the DJIA’s made a remarkable recovery, to just under its next big milestone, 17,000. While the S&P500 is nearing 2,000, headed up. Yes, market gains over 250% … and still climbing! So what can we expect from the stock market by 2016 and the election of the next American president? More! Fabulous 250% gains so far. And bigger gains possible coming in the next couple years till we elect a new president. Maybe over 300%. Gains likely to favor a Democrat. Get it? GOP conservatives may have been successful in slowing America’s economic recovery. But the stock market is actually getting surprisingly stronger from this political war. With every Obama progressive move — Obamacare, ERA regulations, equal pay for women, gay rights, minimum wages, stem-cell research, immigration, Osama bin Laden, deficit cuts and so much more — GOP conservatives and the tea party learn little, only hear enough for another attack on Obama, offer no solutions, just opposition.

But the bull market keeps roaring and roaring. Get it? As the war against all-things-Obama accelerates, as the economic recovery slows, as the GOP fights infrastructure funding, as they fail to pass jobs stimulus programs … the stock market gets stronger, roars bullishly ahead.

Two pieces on how US law bankrupts nations. Better change that law fast. Or the consequences won’t be pretty.

• Why The World Is Choking On Debt (Roubini)

Like individuals, corporations, and other private firms that rely on bankruptcy procedures to reduce an excessive debt burden, countries sometimes need orderly debt restructuring or reduction. But the ongoing legal saga of Argentina’s fight with holdout creditors shows that the international system for orderly sovereign-debt restructuring may be broken. Individuals, firms, or governments may end up with too much debt because of bad luck, bad decisions, or a combination of the two. If you get a mortgage but then lose your job, you have bad luck. If your debt becomes unsustainable because you borrowed too much to take long vacations or buy expensive appliances, your bad behavior is to blame. The same applies to corporate firms: some have bad luck and their business plans fail, while others borrow too much to pay their mediocre managers excessively.

Bad luck and bad behavior (policies) can also lead to unsustainable debt burdens for governments. If a country’s terms of trade (the price of its exports) deteriorate and a large recession persists for a long time, its government’s revenue base may shrink and its debt burden may become excessive. But an unsustainable debt burden may also result from borrowing to spend too much, failure to collect sufficient taxes, and other policies that undermine the economy’s growth potential. When the debt burden of an individual, firm, or government is too high, legal systems need to provide orderly ways to reduce it to a more sustainable level (closer to the debtor’s potential income). If it is too easy to default and reduce one’s debt burden, the result is moral hazard, because debtors gain an incentive to indulge in bad behavior. But if it is too difficult to restructure and reduce debts when bad luck leads to unsustainable debts, the result is bad for both the debtor and its creditors, who are better off when a reduced debt ratio is serviced than when a debtor defaults.

TEXT

• How Bankruptcy Laws Are Bankrupting States (RT)

Just about the first thing any law student learns about contracts is the rule “Pacta sunt servanda,” which means, “Agreements must be kept.” The second thing they learn are all the exceptions to this rule, because the truth is that you can take a good thing too far. While honoring obligations to the full is certainly a good thing, it might not be the best in all circumstances. Law does not concern itself solely with what’s fair for the individual, but also with what’s best for society. To this end, modern bankruptcy laws (also sometimes known as insolvency laws, but I am going to stick with bankruptcy here for the sake of simplicity) not only salvage as many assets for creditors as possible, they also seek to allow all parties involved a fresh start financially.

This happens, for example, when the bankrupt person is discharged, usually after having made repayments for a certain number of years (but not necessarily amounting to the total amount owed) or when an insolvent company is wound up, in which case it ceases to exist and no further claims are possible. Of course, a bankruptcy of any kind is hard on creditors. They typically receive only a fraction of monies owed, often well under 10%. However, it is important to remember that the creditor almost invariably sets all conditions for the loan, including whether to make it in the first place. Earned interest protects them against the losses from any one loan going bad and they are also free to secure their loans. So while it might initially seem unfair to discharge bankrupts who have not paid off their debts in full, it actually strikes a very good balance between the interests of both parties. Irresponsible lending and irresponsible borrowing are but two sides to the same coin. But what happens when the borrower is not a person or a company, but a country?

When money is free, when one doesn’t have to work for it, the entire economy falls to pieces.

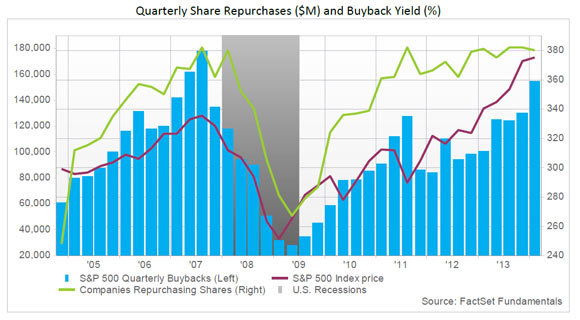

• Buyback Mania Cuts Growth And Leaves Financial Wrecks Behind (Stockman)

Janet Yellen is a chatterbox of numbers, but most of them are ‘noise’. And that’s her term. Yet here is a profoundly important set of numbers that you haven’t heard boo about from Yellen and her mad money printers. To wit, during the ‘difficult’ economic times since the financial crisis began gathering force in Q1 2008, the S&P 500 companies have distributed $3.8 trillion in stock buybacks and dividends out of just $4 trillion in cumulative net income. That s right, 95 cents of every dollar they earned including the huge gains from restructurings, downsizings and job terminations was flushed right back into the Wall Street casino.

Self-evidently, the corporate form of business organization is designed such that some considerable portion of net earnings should be returned to their owners each year. But a 95% rate of distribution is a giant aberration. Were this outcome to occur on the undisturbed free market, for example, it would signal an economy that is dead in the water and that participating companies face a dearth of opportunities to reinvest profits in future growth. Needless to say, that is the opposite of the ‘growth’ and ‘escape velocity’ story that currently excites stock market punters, and is wildly inconsistent with present capitalization rates in the stock market. That is, in a world of permanent zero growth and nearly 100% earnings distribution, the S&P 500’s current 19X PE on reported earnings would be wildly too high. The more appropriate PE would be in high single digits.

So the $3.8 trillion of dividends and buybacks since Q1 2008 reflects not the natural economics of the market at work, but the artificial regime of monetary central planning and the tax-advantaged treatment of corporate debt. Corporations are eating their seed corn because boards and CEO’s function in a Fed-created financial casino where they are massively incentivized to feed the fast money beast with ever larger share buyback programs in order to shrink the float and goose per share earnings. Doing so generates plump stock option gains, and failure to do so will bring on the black plague of shareholder “activists” agitating for big stock buybacks with borrowed money, and a new CEO and board, too.

Once and for all.

• The ‘Plunging Labor Force Participation Rate’ Debate Ends Here (Zero Hedge)

And to think we have none other than the US Commerce Department to thank for issuing the one report which not only refutes all wrong “explanations” of the collapsing labor force participation rate, propagated by the Bureau of Labor Statistics and the Fed itself. that blame said plunge on demographics, but once and for all slams the door shut on any future debate about just the New Normal secular shifts within the aging US population truly are. From: “65+ in the United States: 2010”:

On the one hand, the recession forced some workers to retire sooner than planned. On the other hand, the declines in housing and financial asset prices pushed many workers to delay retirement. The decision of when to retire was being influenced by opposing factors: (1) the decline in stock market prices and lowered housing values supported retirement delays, and (2) the rise in unemployment and greater difficulty among older adults in finding another job supported earlier retirement (Hurd and Rohwedder, 2010b). Among those nearing retirement age (age 50 to 61), 63% reported pushing back their expected retirement date as a result of economic conditions (Taylor et al., 2009a).

In 2010, 16.2% of the population aged 65 and over were employed, up from 14.5% in 2005. In contrast, 60.3% of the 20 to 24 age group were employed in 2010, down from 68.0% in 2005. Employment shares declined from 2005 to 2010 for all age groups younger than age 55. There was no statistical change in the employment share for workers aged 55 to 64 nor those aged 70 to 74. Engemann and Wall (2010) found that more people aged 55 and over were employed during the recession than would have been if there was no recession. Using the Bureau of Labor Statistics employment data, Engemann and Wall found that during the 2007–2009 period, employment grew by 7.4% for the population aged 55 and over. Based on trends prior to the recession, employment for this age group was expected to grow by only 6.1%. All younger age groups experienced a decline in employment during the same 2007 to 2009 period.

Oh, we almost forgot the punchline: dear US “retirees” – if you want to mitigate the impact of the US depression and the loss of savings income courtesy of the Fed’s ZIRP policy, all you have to do is, well, work until you die.

Many older workers managed to stay employed during the recession; in fact, the population in age groups 65 and over were the only ones not to see a decline in the employment share from 2005 to 2010 (Figure 3-25)… Remaining employed and delaying retirement was one way of lessening the impact of the stock market decline and subsequent loss in retirement savings.

Bubble, bubble, bubble.

• How Wall Street Manipulates The Entire US Housing Racket Market (TPit)

Private equity firms are the ultimate smart money on Wall Street; they know how to wring out the last dime from their own clients, such as pension funds and rich individuals, through hidden fees, obscure expenses, elaborate expense shifting, lackadaisical disclosure, and “zombie advisers,” to the point where SEC Inspection Chief Andrew Bowden singled them out in a speech in May. Now the lawyers are circling. And these PE firms invented a whole new business: buying vacant homes out of foreclosure and from banks and renting them out. Flush with the Fed’s nearly free money, Blackstone Group ended up spending $8.6 billion in two years on 45,000 homes, spread helter-skelter across 14 cities. Another PE product, American Homes 4 Rent, which went public last summer as a highly leveraged REIT, bought 25,000 homes. Firms sprouted like mushrooms, spending $50 billion to acquire 386,000 homes.

And home prices soared. Year-over-year increases of over 20% suddenly appeared in the data. Housing Bubble 2 was born. That’s how the Fed “healed” the housing market. Yet numerous economists claimed that buying 386,000 homes over two years in a market where about 5 million existing homes change owners every year could not possibly have had much impact on price. Turns out, that meme is awfully close to propaganda. The smart money on Wall Street had a goal. And a system – aided and abetted by the banks. Homebuyers today are, literally, paying the price. The goal was to progressively drive up home prices to book near-instant paper profits on the units they had already bought. According to a source at one of the GSEs (Government Sponsored Enterprise), whose work is focused on residential real estate, they did it by constantly laddering their purchases. And in some markets, like Las Vegas, they achieved price increases of 100%. The multiplier effect. He explains:

A multiplier of roughly 60 times is placed on one sale in a market. In other words, one sale affects the value of 60 homes. So the 386,000 homes adjusted the price on roughly 23 million homes. There are 78 million homes in America with 35 million first-lien mortgages. This happened in about 8-12 markets nationwide. The West Coast was leading the charge back up. Last fall, two investment houses announced they were going to sell out of their inventory and today three others announced the same. Reason: prices have more than met their goal. Since real estate is a commodity, the rule of price elasticity applies. A very small number of sales can have extreme consequences in price for the rest.

The problem with that strategy? It drove up prices so far and so fast that the business model of buying these homes, fixing them up, and renting them out at a profit has hit a wall. So the dynamics of the market are changing. From gobbling up and finding renters to … Selling, securitizing, and consolidating. But selling them to first-time buyers at these prices – well, forget it. So Waypoint Real Estate Group is trying to “quietly” unload half its inventory of 4,000 homes in California to another company. It also manages another 7,000 homes that an affiliated REIT owns. Och-Ziff Capital Management Group and Oaktree Capital Management have already started selling their homes. Other firms, including Blackstone Group and American Homes 4 Rent have pulled back from buying homes as prices have soared.

‘The SEC rarely denies such waivers because such a move risks destabilizing financial firms.’

• Too Big To BNProsecute: Another Criminal Bank Gets Away (Zero Hedge)

Remember when the DOJ’s banker lackey, assistant attorney general Lanny Breuer admitted to PBS that the US Department of Justice (sic) does not prosecute big banks because they are too systematically important and thus, above the law? Breuer was promptly fired (only to rejoin Covington & Burling as vice chairman and head the firm’s white collar defense practice) and with his departure the DOJ was said to have “fixed” its practice of giving banks, the more massive and insolvent the better, not only a “get out of jail” card but “do not even enter the courtroom” card. Ironically, all of the DOJ’s subsequent wrath fell mostly on foreign banks (with domestic banks actually benefiting from the addback of “one-time, non-recurring” legal charges to their non-GAAP bottom line).

It goes without saying, that not a single banker has still gone to jail since the infamous Too Big To Prosecute incident, suggesting it was all, once again, merely lip service to so-called justice. But nowhere is it clearer that nothing at all has changed when it comes to crony capitalist behind the scenes muppetry, than in the latest Reuters exclusive of the white glove treatment “evil” BNP got in order to make sure the full wrath of US justice doesn’t damage the criminal money launderer too severely.

An official at the U.S. Securities and Exchange Commission (SEC) broke ranks with other commissioners, and voted against granting BNP Paribas a critical waiver to continue operating several investment advisory units in the United States. Kara Stein, a Democratic SEC commissioner who has recently demanded more accountability for big banks who break the law, was the sole dissenting vote on Monday on the temporary waiver, according to a document made public this week. BNP’s application was granted the same day that BNP, France’s largest bank, pleaded guilty to criminal charges it violated U.S. sanctions. The temporary waiver will become permanent, unless an “interested person” in the matter is granted a hearing. The deadline for requesting a hearing is July 25. The SEC rarely denies such waivers because such a move risks destabilizing financial firms.

Which all leads us to this:

The New York state banking regulator on Monday separately decided not to pull BNP’s banking license in the state, despite a criminal guilty plea, because of the risk it could put BNP out of business.

And as is well known, we can’t risk a bank going out of business because of its criminal actions, now can we. As for actually sending someone to jail? Don’t make us laugh.

Yellen really is incompetent.

• Yellen Drives Wedge Between Monetary Policy, Financial Bubbles (Reuters)

Monetary policy faces “significant limitations” as a tool to counter financial stability risks, Federal Reserve Chair Janet Yellen said on Wednesday, adding that heading off the U.S. housing bubble with higher interest rates would have caused major economic damage. Weighing in on a global debate, Yellen reiterated her view that regulation – not rate policy – needs to play the lead role in combating excessive financial risk-taking. “The potential cost … is likely to be too great to give financial stability risks a central role in monetary policy discussions,” Yellen said at an event sponsored by the International Monetary Fund. She didn’t close the door entirely, however, and she cited some areas that bore monitoring with an eye toward a possible tightening of regulation.

Analysts said Yellen was pushing back against some Fed officials who believe financial stability should be given a more prominent place in formulating monetary policy. Jeremy Stein, who stepped down as a Fed governor in May, had sparked the debate by arguing higher rates should at least be considered to help stamp out possible asset bubbles, and a number of regional Fed bank presidents have warned of the dangers of keeping rates near zero for too long. But Yellen made clear she did not see a need for the U.S. central bank to alter its current course. “I do not presently see a need for monetary policy to deviate from a primary focus on attaining price stability and maximum employment,” she said.

The U.S. stock and bond markets have soared on the back of the Fed’s money-printing and near-zero rates, prompting warnings from some economists that new bubbles are forming. The IMF said last month a prolonged period of ultra-low U.S. rates – they have been near zero since late-2008 – had prompted a weakening in lending standards and risky behavior by investors. For her part, Yellen pointed to unusually narrow corporate bond spreads, a lack of financial volatility and weak lending standards in the leveraged-loan market as areas of concern. “It is critical for regulators to complete their efforts at implementing a macroprudential approach to enhance resilience within the financial system,” she said.

• Yellen Warns Of Pockets Of Increased Risk-Taking (CNBC)

Falling corporate bond spreads and volatility indicators are signs that investors may not fully appreciate the risk of future losses, Fed Chair Janet Yellen warned on Wednesday. Taking a variety of factors into consideration, “I do not presently see a need for monetary policy to deviate from a primary focus on attaining price stability and maximum employment, in order to address financial stability concerns,” she said. “That said, I do see pockets of increased risk-taking across the financial system, and an acceleration or broadening of these concerns could necessitate a more robust macroprudential approach,” Yellen said in prepared remarks for a speech at the International Monetary Fund.

Yellen noted that monetary policy was limited in its ability to promote financial stability, and that low rates can raise incentives to take on risk. She also cautioned about easier terms in the leveraged loan market as investors chase higher yields. “To date, we do not see a systemic threat from leveraged lending,” Yellen said, adding that borrowers do not appear to be taking on excess debt and that lenders appear resilient to potential losses. But she said it was important to monitor the steps already taken to build resilience, to ensure they are still working, and to be flexible about using monetary policy if conditions change.

Ugly Abe.

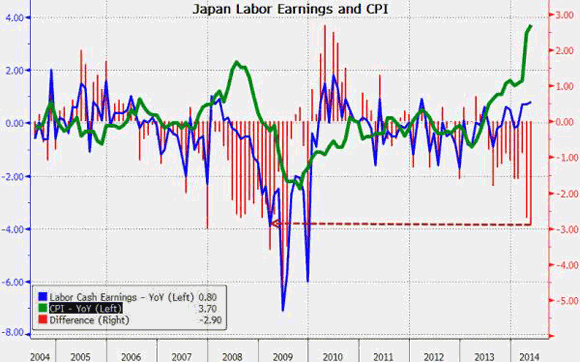

• Japanese Real Wages Tumble Most Since Lehman (Zero Hedge)

Just when you thought things could not get any worse for Abe and his experimentation in monetary policy alchemy… it does. Between surging inflation and stagnant wage growth, real wages for the Japanese fell by their most since the collapse of Lehman. Even the break of a 23-month streak of base wage drops was dismissed by the government as “expected to be revised lower.” As Goldman warns, downside economic risks remain high, the J-curve is ‘delayed’, and with tumbling cabinet approval ratings and soaring personal disapproval ratings, Abe has a major problem on his hands…

Ambrose does a nice take down of Juncker. Britain will leave the EU, they have no alternative. And it won’t just be Britain.

• Juncker Is Galling For Britain, Life-Threatening For France And Italy (AEP)

The sovereign parliaments of Europe are victims of a constitutional sleight of hand, though some acquiesce more easily than others. The Cromwellian method by which Jean-Claude Juncker was foisted upon the nation states is a breach of the Treaties. The episode clarifies the need for British withdrawal from the Union, or the withdrawal of France or any other country that wishes to remain self-governing under a rule of law. The Lisbon Treaty did not create a European state in any shape or form. France and Britain fought ferociously to stop this happening when the text was drafted, in its original form as the European Constitution. They insisted that the EU remain an “intergovernmental” treaty club, and rightly so. To do otherwise would eviscerate national democracies without putting anything workable in their place.

Germany’s push for an EU federal state – idealistic and dangerous in equal measure – was defeated. The canny duet of Valery Giscard d’Estaing and Lord Kerr saw off the threat. The Treaty that emerged did not give the European Parliament powers to pick the head of the Commission. The prerogative lies entirely with elected EU leaders accountable to their own voters, a safeguard that anchors authority in the sovereign states. Euro-MPs have the right to turn down the Commission. They may not appoint it. Yet that is exactly what they have just done. A clique of hardliners in Strasbourg rammed through Mr Juncker on a series of spurious claims. Craven EU leaders accepted the fait accompli, either to trade concessions or to curry favour with Berlin. These Rump Parliamentarians clothe their office-seeking and grasp for patronage in the bunting of democracy, asserting that the centre-Right group (EPP) has the authority to impose its choice because it “won” the European elections.

Yet the earthquake upset in May went entirely in the opposite direction, a primordial scream by Europe’s peoples against EU overreach and the job destruction of crude austerity. The Front National won in France with calls for euro-exit and a visceral rejection of the EU Project, a watershed event in a country that is still the beating heart of Europe. You have to be politically unhinged to think it wise or proper now to entrust the EU machinery to an arch-insider, as responsible as any man alive for the calamitous decisions that have led Europe into its current cul de sac, and a master of the Monnet Method to boot. “We take a decision, then put it on the table and wait to see what happens. If there is no protest, because most people have no idea what we are doing, we take step after step until we are beyond the point of no return,” he once told Der Spiegel.

He is a gift to the Front’s Marine Le Pen, now vowing to boycott the Strasbourg ratification as her first act of protest. “I will not participate in a vote for the prison gaoler: I will try the escape the prison,” she said. He is a gift too to the Five Star Movement of Italy’s Beppe Grillo, seizing on Mr Juncker as the face of the scorched-earth policies that have trapped Europe in a Lost Decade. “Wherever Juncker goes in Europe, the grass no longer grows,” he said. The EPP suffered the biggest proportional fall in the elections. Almost nobody voting for Greece’s New Democracy knew they were at the same time picking Mr Juncker to oversee their fate for five years, the same man who played such a large role in their own national drama as head of the Eurogroup. How many Irish voted for the EPP’s Fine Gael because they wanted further leaps in EU integration?

• Premier Li Says Downward Pressure Continues For Chinese Economy (Reuters)

China’s Premier Li Keqiang said on Wednesday downward pressure still existed in its economy despite it operating within a reasonable range and some leading indicators demonstrating a positive trend. China’s factory activity hit multi-month highs in June, official and private surveys showed on Monday, reinforcing signs that the world’s second-largest economy is steadying as the government steps up policy support. Li gave no figures or details and few direct quotes in the comments on the Chinese government’s official website, but also addressed the disconnect between government finances and the difficulty of business getting financing. “Our local and central governments have amassed a large amount of funds,” Li said. “Some have been idle for a long time and must be used … to promote economic development and improve people’s lives.”

It has been getting harder and more expensive to finance firms in the real economy, Li said. These costs must be decreased, especially for small and medium enterprises, he added. The government has unveiled a series of modest stimulus measures in recent months to give a lift to economic growth, which dipped to an 18-month low of 7.4% in the first quarter, China’s slowest annual growth since the third quarter of 2012. Such measures have included targeted reserve requirement cuts for some banks to encourage more lending, quicker fiscal disbursements and hastening construction of railways and public housing projects.

Nice read on China’s history with capitalism.

• China In The Golden Age Of Central Bankers – “Whatever It Takes” (Ben Hunt)

Deng Xiaoping and his ally/mentor, Zhou Enlai, are the architects of modern China, of China as a Great Power. For 30 years Zhou tempered the Maoist ideology of permanent revolution, preserving the kernel of a stable army and stable government bureaucracy, setting the stage for a pragmatic successor to Mao. But it was Deng who was able to out-maneuver the Gang of Four and seize control of the Army and the Party after Mao’s death (and Zhou’s) in 1976, replacing that Maoist ideology of permanent revolution with a market-driven ideology of modernization and economic growth. Deng wasn’t interested in political purity, but in economic results. It’s not the color of the cat, as he famously said, but its ability to catch mice. Deng’s political genius – the core attribute that made him such a consummate survivor – was his ability to sell his vision of economic modernization and growth as an end in itself to other political and military leaders. Permanent revolution is … tiring … and doesn’t really pay that well.

Deng offered a vision of stability and wealth, and by 1979 that vision proved to be enormously successful in uniting what Clausewitz called the iron triangle of a Great Power – Army, Government, and People, acting as one for a common goal. Economic growth was, to paraphrase “The Big Lebowski”, the rug that tied the whole room together. Importantly, Deng’s unifying vision of economic growth and modernization was socialist and nationalist in nature, not liberal and individualistic. Deng was no petty oligarch, stashing away billions in foreign bank accounts during his tenure as Paramount Leader, and this was a big part of what made his transformation of the Chinese nation so successful. Deng was authentic. He was a survivor and he was a patriot. He was a Dude, enforcing at the highest levels of the Party and the Army an understanding that economic growth was (primarily) in the service of the nation rather than (primarily) in the service of personal aggrandizement.

Sure, there might be the occasional provincial governor egregiously lining his family’s pockets rather than kicking up to the central authorities in Beijing, but this has only been a problem for the Chinese government for … oh, the past 3,000 years or so, and it’s nothing that a few show trials and public executions can’t bring back in line. No, the important thing was that China’s top political and military leaders shared Deng’s vision of market-oriented AND socialist/nationalist ideologies existing hand-in-hand. And for a while there, they did. Today, however, the Chinese State faces two existential threats, each stemming from or accelerated by the Great Recession and Western policy responses to that crisis of market confidence. First, QE and other “emergency” Western monetary policies of the past five years threaten the grand political unification of Deng Xiaoping from without. Second, massive wealth inequality and concentration driven largely by those same monetary policies threaten it from within.

This has been looming for a while.

• Australian Economic Boom Ending (RT)

A common misconception about lemmings is that they commit collective suicide during migration. Fuelled by a 1958 Disney film called White Wilderness, stage-trickery gave the impression that the rodents jumped to their deaths off cliffs. In reality, the producers (who won an Oscar) launched the helpless creatures off a turntable to their demise in order to fuel a myth and presumably give the audience what they wanted to see. The same principle is frequently applied to economics during boom cycles by local mainstream media in whichever nation the apparent economic growth is taking place. Instead of responsibly using their influence to warn the populace that the prosperity mightn’t be solid, the media generally become the chief cheerleaders for the bubble, serving to inflate the percolation even more.

Frequently, they even try to make the boom look ‘boomier’ by comparing salaries/property-prices in their country to another nation which has historically been wealthier, but is on a more regular and sane economic path at the point in time. There are myriad reasons for this phenomenon. Sometimes, media-proprietors need ‘confidence’ to keep other businesses they may own on a ‘growth path’ and often individual editors, dizzy as their house price keeps rising and creates paper-wealth, block dissent in order to maintain the feel-good factor. There is also the commercial imperative that advertisers may baulk if the media-outlet is considered to be ‘too negative’ and the fact that huge revenue streams can be tapped, particularly by newspapers, during a housing bubble via property advertising.

• BRICS Is Morphing Into An Anti-Dollar Alliance (VOR)

Before the crucial visit to Beijing next week, the governor of the Russian Central Bank, Elvira Nabiullina met Vladimir Putin to report on the progress of the upcoming ruble-yuan swap deal with the People’s Bank of China and Kremlin used the meeting to let the world know about the technical details of its international anti-dollar alliance. On June 10th, Sergey Glaziev, Putin’s economy advisor published an article outlining the need to establish an international alliance of countries willing to get rid of the dollar in international trade and refrain from using dollars in their currency reserves. The ultimate goal would be to break the Washington’s money printing machine that is feeding its military-industrial complex and giving the US ample possibilities to spread chaos across the globe, fueling the civil wars in Libya, Iraq, Syria and Ukraine.

Glaziev’s critics believe that such an alliance would be difficult to establish and that creating a non-dollar-based global financial system would be extremely challenging from a technical point of view. However, in her discussion with Vladimir Putin, the head of the Russian central bank unveiled an elegant technical solution for this problem and left a clear hint regarding the members of the anti-dollar alliance that is being created by the efforts of Moscow and Beijing: We’ve done a lot of work on the ruble-yuan swap deal in order to facilitate trade financing. I have a meeting next week in Beijing , she said casually and then dropped the bomb: “We are discussing with China and our BRICS parters the establishment of a system of multilateral swaps that will allow to transfer resources to one or another country, if needed. A part of the currency reserves can be directed to [the new system]”.

It seems that Kremlin chose the all-in-one approach for establishing its anti-dollar alliance. Currency swaps between the BRICS central banks will facilitate trade financing while completely bypassing the dollar. At the same time, the new system will also act as a de facto replacement of the IMF, because it will allow the members of the alliance to direct resources to finance the weaker countries. As an important bonus, derived from this “quasi-IMF system”, the BRICS will use a part (most likely the dollar part ) of their currency reserves to support it, thus drastically reducing the amount of dollar-based instruments bought by some of the biggest foreign creditors of the US.

Sure, energy is Moody’s strong point.

• Moody’s Says UK Energy Crunch Will Be Temporary (Guardian)

The wholesale price of electricity should remain flat and could even fall, according to new research from the rating agency Moody’s which will be welcomed by government and consumers. New offshore wind farms, better insulated houses and the possibility of weaker gas prices are likely to combine to help halt what many expected to be a steady rise in retail prices. The ratings agency also believes that a much-feared energy crunch which could take the lights out as soon as this winter or next will be temporary, with capacity margins rising to reach almost 20% by 2020. “We believe that widely expected tightness will be shortlived as energy efficiency gains, the rollout of offshore wind power and the return of mothballed gas plants will keep prices in check”, said Scott Phillips, Moody’s vice president and senior analyst. “Our view is that power prices will stay around current levels, or £48-53 per megawatt hour, through the end of the decade”, he added.

The assessment by Moody’s runs counter to the message put out by the energy sector, which has warned that prices are on an ever rising trajectory made worse by government environmental and social obligations. Moody’s does not look to predict the retail price but says “we do not fully share this view” of the power industry that UK prices will rise sharply due to the retirement of old coal and oil plants, the government’s introduction of a minimum carbon price and increasing commodity costs. “While the reserve margin will likely tighten in 2015, which is positive for prices, we see it widening out again from 2016. Our view reflects a large amount of renewable capacity to be added onto the electricity grid, particularly in offshore wind (reaching 10GW by 2020) and solar photovoltaic (reaching 7GW by 2020).

• US And Germany Want Gas Hub In Ukraine (RT)

German and US companies want to start using Ukraine as a gas hub, according to Aleksandr Todiychuk, Deputy Chairman of the country’s national oil and gas company Naftogaz. “For them [Germany and the US] it’s an opportunity to gain a foothold in the region. Our underground gas storage is interesting for both sellers and buyers of gas. This is why potentially everybody who’s interested in creating a hub, are talking about our high potential in this field,” Todiychuk said in an interview with the Russian daily Kommersant.

Gazprom, the world’s largest producer of natural gas, has stopped using Ukraine as a transit route for gas deliveries, worried the indebted country will start to siphon off deliveries intended for Europe. Because of its $4.5 billion debt, Gazprom switched Ukraine to a prepayment system in June. Europe depends on Russian gas via Ukraine for 15% of its energy needs. Ukraine borders seven European countries – Belarus, Poland, Slovakia, Hungary, Romania, Moldova, and Russia. Its location on the Black Sea also creates a water border with Bulgaria, Turkey, and Georgia. Ukraine will develop a plan to change its underground gas storage system in the fall, which will increase the convenience and flexibility for gas consumers, including a rapid injection feature and gas lift, said Todiychuk.

Yeah, blow it all over the place. Easier than not polluting in the first place.

• Beijing To Build ‘Wind Passage’ To Blow Away Smog (MarketWatch)

To tackle Beijing’s notorious air pollution, characterized by frequent thick smog hanging over the city, local authorities have come up with a possible solution: funneling wind through the streets to blow away the dirty air. The national and municipal governments’ respective weather bureaus are studying the feasibility of creating an “urban wind passage,” a Beijing News report Wednesday quoted a senior Beijing city environmental researcher, Liu Chunlan, as saying. The wind corridor would allow air from the suburbs to blow through the urban center and, hopefully, remove the air pollutants, Liu said.

She said the city government is currently revising its urban planning to include specific details on the wind passage, which could be ready by the end of the year. Specifically, the planning department would control the density and height of buildings to channel air pollutants and urban heat and create room for them to disperse. Beijing may not be the only Chinese city considering this method to attack China’s nationwide air-quality problem. A number of major Chinese cities — including Shanghai, Hangzhou and Nanjing — have thought about the possibility of building such wind passages, Beijing News said.

Deeply sad.

• Indonesia Has World’s Highest Deforestation Rate (MongaBay)

Despite a high-level pledge to combat deforestation and a nationwide moratorium on new logging and plantation concessions, deforestation has continued to rise in Indonesia, according to a new study published in Nature Climate Change. Annual forest loss in the southeast Asian nation is now the highest in the world, exceeding even Brazil. The study, led by researchers at the University of Maryland (UMD), is based on analysis of high resolution satellite data. Unlike previous research, the new paper distinguishes between loss of natural forest – which it calls “primary forest” – and cyclical harvesting of industrial plantations. The study finds that Indonesia lost more than 6 million hectares of natural forest between 2000 and 2012. Worryingly, forest loss is trending upwards in the country despite hundreds of millions of dollars being spent by donors and the government on programs to cut deforestation. Deforestation was highest in 2012, the last year of the study.

Indonesia lost 15.79 million hectares of forest between 2000 and the end of 2012, according to the study. Of that area, 38% or 6.02 million hectares consisted of natural or “primary” forest. “We quantified increasing loss of primary forest during the moratorium, meaning the moratorium has not yet slowed clearing and may in fact have accelerated it,” Belinda Margono of UMD and the Ministry of Forestry told Mongabay.com. “Forest loss in 2012 was higher in Indonesia [840,000 ha] than it was in Brazil [460,000 ha].” The results contrast sharply with the Indonesian government’s claims that deforestation has declined rapidly in recent years. Part of the reason for the discrepancy stems from how Indonesia’s Ministry of Forestry classifies forest cover and loss. The ministry counts industrial plantations as forest cover and only measures loss in areas that are designated as being part of the “forest estate”, which covers more than two-thirds the country’s land mass. Forest clearing that occurs outside the official forest estate is therefore not included in official estimates.

Home › Forums › Debt Rattle Jul 3 2014: Optimism Bias Cubed