G.G. Bain Political museums, Union Square, New York 1909

Markets are now completely divorced from reality.

• Bank Earnings Loom Large As Stocks Near Record on Wall Street (R.)

The focus on Wall Street will shift to corporate earnings next week after a strong June jobs report on Friday gave investors confidence that the U.S. economy was on stable footing and left the S&P 500 within a whisper of a new closing record high. Earnings next week are expected from big banks JPMorgan, Citigroup and Wells Fargo as well as other financial companies such as BlackRock and PNC Financial Services. Earnings for the sector are expected to decline 5.4%. If bank earnings come in better than expected, the S&P 500 is likely to push through its record highs set in May 2015 after several failed attempts, as Friday’s jobs number helped push the benchmark index to less than one point from its closing record high of 2,130.82.

“Banks are definitely in the spotlight,” said Tim Ghriskey, CIO of Solaris Group in Bedford Hills, New York. “There is some trepidation in the market going into this earnings season, the quarter economically was not particularly strong.” Financials have been the worst performing of the 10 major S&P sector groups this year, down nearly 6%, as they were hit by reduced expectations for a U.S. interest rate hike by the Federal Reserve and uncertainty in the wake of “Brexit.” Second-quarter earnings overall are expected to decline 4.7%, according to Thomson Reuters data, the fourth straight quarter of negative earnings, but up slightly from the 5% decline in the first quarter.

Investors will be looking for confirmation this quarter that earnings are starting to turn, with analysts anticipating a return to growth in the back half of the year, starting with expectations for a 1.8% increase in the third quarter.

Two things still stuck in German media (Google translate for them is awful) as I write this: the chief economist for Deutsche Bank calls for a €150 billion bailout for European banks, and German top-economist Hans-Werner Sinn says Finland will be next to leave EU and first to leave eurozone.

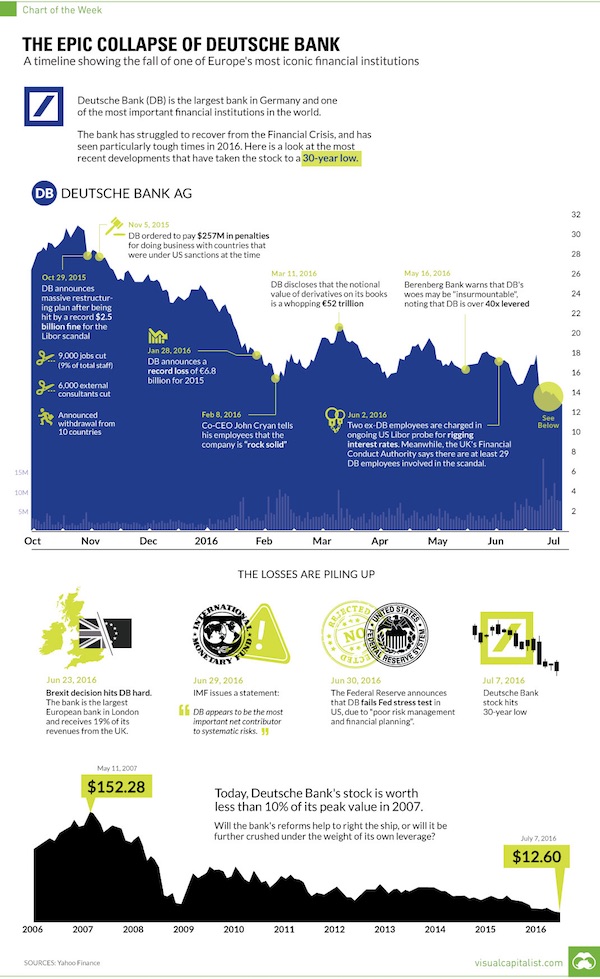

• The Epic Collapse Of The World’s Most Systemically Dangerous Bank (ZH/VC)

It’s been almost 10 years in the making, but the fate of one of Europe’s most important financial institutions appears to be sealed. After a hard-hitting sequence of scandals, poor decisions, and unfortunate events,Visual Capitalist’s Jeff Desjardins notes that Frankfurt-based Deutsche Bank shares are now down -48% on the year to $12.60, which is a record-setting low. Even more stunning is the long-term view of the German institution’s downward spiral. With a modest $15.8 billion in market capitalization, shares of the 147-year-old company now trade for a paltry 8% of its peak price in May 2007.

If the deaths of Lehman Brothers and Bear Stearns were quick and painless, the coming demise of Deutsche Bank has been long, drawn out, and painful. In recent times, Deutsche Bank’s investment banking division has been among the largest in the world, comparable in size to Goldman Sachs, JP Morgan, Bank of America, and Citigroup. However, unlike those other names, Deutsche Bank has been walking wounded since the Financial Crisis, and the German bank has never been able to fully recover. It’s ironic, because in 2009, the company’s CEO Josef Ackermann boldly proclaimed that Deutsche Bank had plenty of capital, and that it was weathering the crisis better than its competitors.

It turned out, however, that the bank was actually hiding $12 billion in losses to avoid a government bailout. Meanwhile, much of the money the bank did make during this turbulent time in the markets stemmed from the manipulation of Libor rates. Those “wins” were short-lived, since the eventual fine to end the Libor probe would be a record-setting $2.5 billion. The bank finally had to admit that it actually needed more capital. In 2013, it raised €3 billion with a rights issue, claiming that no additional funds would be needed. Then in 2014 the bank head-scratchingly proceeded to raise €1.5 billion, and after that, another €8 billion. In recent years, Deutsche Bank has desperately been trying to reinvent itself.

Having gone through multiple CEOs since the Financial Crisis, the latest attempt at reinvention involves a massive overhaul of operations and staff announced by co-CEO John Cryan in October 2015. The bank is now in the process of cutting 9,000 employees and ceasing operations in 10 countries. This is where our timeline of Deutsche Bank’s most recent woes begins – and the last six months, in particular, have been fast and furious. Deutsche Bank started the year by announcing a record-setting loss in 2015 of €6.8 billion. Cryan went on an immediate PR binge, proclaiming that the bank was “rock solid”. German Finance Minister Wolfgang Schäuble even went out of his way to say he had “no concerns” about Deutsche Bank. Translation: things are in full-on crisis mode.

Just in time delivery?!

• Bank of England Considers Curbs On Property Funds (R.)

The Bank of England is considering curbs on withdrawals from property investment funds after Britain’s vote to leave the EU roiled the sector, the Sunday Telegraph newspaper said late on Saturday. The paper said it understood that the BoE was considering “enforced notice periods before redemptions, slashing the price for investors who rush to the door, or additional liquidity requirements for funds”. Andrew Bailey, the head of Britain’s Financial Conduct Authority, told a BoE news conference on Tuesday that the structure of open-ended real estate funds needed to be reviewed, as investors rushed to cash in their investments.

The BoE – where Bailey was deputy governor until he moved to the FCA this month – last year expressed concern about funds that invest in assets which can become illiquid in a crisis, but allow investors to withdraw funds without notice. On Friday the FCA issued guidance to property funds to avoid disadvantaging investors who had not sought to redeem funds. The Telegraph said regulators were considering requiring funds to ask investors to give a notice period of 30 days to six months for redemptions, or to hold more liquid assets to meet withdrawals, such as cash or shares and bonds in property-related companies. More than six British property funds suspended withdrawals last week to tackle a tide of redemptions after the June 23 vote to leave the EU unnerved investors who are worried that the uncertainty will hit demand to rent and buy commercial property.

As I said, China’s entered deflation.

• China June Inflation Eases Further, More Policy Stimulus Anticipated (R.)

China’s June consumer inflation grew at its slowest pace since January as increases in food prices eased, while producer prices extended their decline, reinforcing economists’ views that more government stimulus steps will be needed to support the economy. The consumer price index (CPI) rose 1.9% in June from a year earlier, compared with a 2.0% increase in May, the National Bureau of Statistics said on Sunday. Analysts had expected a 1.8% gain, a Reuters poll showed. Consumer inflation has remained low compared with the official target of around 3% for this year, indicating persistently weak demand in the world’s second-largest economy. Food prices were up 4.6% in June, compared with a 5.9% gain in the previous month.

Prices of China’s staple meat pork rose 30.1%, compared with a 33.6% increase in May. But recent flooding in China “is likely to push vegetable and fruit prices higher in the coming months,” ANZ economists Raymond Yeung and Louis Lam wrote in a research note. Non-food prices inched up 1.2% in June versus May’s 1.1% gain. “In our view, while China reiterates the importance of supply-side reform due to debt and overcapacity concerns, the authorities still need to stimulate demand in order to achieve its growth target,” Zhou Hao, senior Asia emerging market economist at Commerzbank in Singapore, said in a note. The People’s Bank of China last cut interest rates on Oct. 23, the seventh time since late 2014, as the government took steps to counter slowing economic growth.

Hmmm. Which other country does this remind you of? Official data show up to 44% of families pushed into poverty were impoverished by illness. Does that sound like communism to you?

• China Healthcare Costs Forcing Patients Into Crippling Debt (R.)

As China’s medical bills rise steeply, outpacing government insurance provision, patients and their families are increasingly turning to loans to pay for healthcare, adding to the country’s growing burden of consumer debt. While public health insurance reaches nearly all of China’s 1.4 billion people, its coverage is basic, leaving patients liable for about half of total healthcare spending, with the proportion rising further for serious or chronic diseases such as cancer and diabetes. That is likely to get significantly worse as the personal healthcare bill soars almost fourfold to 12.7 trillion yuan ($1.9 trillion) by 2025, according to Boston Consulting Group estimates. For many, like Li Xinjin, a construction materials trader whose son was diagnosed with leukemia in 2009, that means taking on crippling debt.

Li, from Cangzhou in Hebei province, scoured local papers and websites for small lenders to finance his son’s costly treatment at a specialist hospital in Beijing, running up debts of more than 1.7 million yuan, about 10 times his typical annual income. “At that time, borrowing money and having to make repayments, I was very stressed. Every day I worried about this,” said Li, 47, adding that he and his wife had at times slept rough on the streets near the hospital. “But I couldn’t let my son down. I had to try to save him,” he said. Li’s boy died last year. The debts will weigh him down for a few more years yet. Medical loans are just part of China’s debt mountain – consumer borrowing has tripled since 2010 to nearly 21 trillion yuan, and in eight years household debt relative to the economy has doubled to nearly 40% – but they are growing.

That is luring big companies like Ping An Insurance, as well as small loan firms and P2P platforms, as China’s traditional savings culture proves inadequate to the challenge of such heavy costs. The stress is particularly apparent in lower-tier cities and rural areas where insurance has failed to keep pace with rising costs, said Andrew Chen, Shanghai-based healthcare head for consultancy Parthenon-EY. “It’s a storm waiting to happen where patients from rural areas will have huge financial burdens they didn’t have to face before,” he said, adding people would often take second mortgages on their homes or turn to community finance schemes.

“..In the current situation…all political, economic, diplomatic and cultural forces should be engaged to pacify the world..”

• Gorbachev: ‘The Next War Will Be the Last’ (Sputnik)

Former Soviet President Mikhail Gorbachev declared in an interview with radio station Echo Moskvy that if the crisis escalates to another war, this war will be the last. NATO leaders agreed on Friday to deploy military forces to the Baltic states and eastern Poland while increasing air and sea patrols to demonstrate readiness to defend eastern members against the alleged ‘Russian aggression.’ Mikhail Gorbachev reportedly said after the summit that the decisions made at NATO summit in Warsaw should be regarded as a preparation for a hot war with Russia. On Saturday, Gorbachev told Echo Moskvy in an interview that he sticks to what he had said earlier and that he considers NATO decisions short-sighted and dangerous.

“Such steps lead to tension and disruption. Europe is splitting, the world is splitting. This is a wrong path for the global community” He said. “There are too many global and individual crises to abandon cooperation. It is essential to revive the dialogue.” According to the ex Soviet President, by irresponsibly deploying four multinational battalions to Russian borders, “within shooting distance”, the alliance draws closer another Cold War and another Arms Race. “There are still ways to…avoid military action.” Gorbachev stressed. “I would say that UN should be called upon on that matter.” He also called on Moscow not to respond to provocations but to come to the negotiating table. “In the current situation…all political, economic, diplomatic and cultural forces should be engaged to pacify the world. Mind you, the next war will be the last.”

Closing the net on Tony.

• Blair’s Deputy PM Says Iraq Invasion Broke International Law (BBC)

John Prescott, who was deputy prime minister when Britain went to war with Iraq in 2003, says the invasion by UK and US forces was “illegal”. Writing in the Sunday Mirror, he said he would live with the “catastrophic decision” for the rest of his life. Lord Prescott said he now agreed “with great sadness and anger” with former UN secretary general Kofi Annan that the war was illegal. He also praised Labour’s Jeremy Corbyn for apologising on the party’s behalf. Lord Prescott also said Prime Minister Tony Blair’s statement that “I am with you, whatever” in a message to US President George W Bush before the invasion in March 2003, was “devastating”.

“A day doesn’t go by when I don’t think of the decision we made to go to war. Of the British troops who gave their lives or suffered injuries for their country. Of the 175,000 civilians who died from the Pandora’s Box we opened by removing Saddam Hussein,” he went on. Lord Prescott said he was “pleased Jeremy Corbyn has apologised on behalf of the Labour Party to the relatives of those who died and suffered injury”. He also expressed his own “fullest apology”, especially to the families of British personnel who died. The former deputy PM said the Chilcot report had gone into great detail about what went wrong, but he wanted to identify “certain lessons we must learn”.

“My first concern was the way Tony Blair ran Cabinet. We were given too little paper documentation to make decisions,” he wrote. No documentation was provided to justify Attorney-general Lord Goldsmith’s opinion that action against Iraq was legal, he added.

…and taking all his money too…

• Families Of Soldiers Killed In Iraq Vow To Sue Blair For ‘Every Penny’ (Tel.)

Tony Blair will be pursued through the courts for “every penny” of the fortune he has earned since leaving Downing Street, the families of soldiers killed in Iraq vowed. Mr Blair faces a civil law suit over allegations he abused his power as prime minister to wage war in Iraq. The damages, according to legal sources close to the case, are unlimited. A well-placed source told The Telegraph that the Chilcot report appeared to provide grounds for the launch of a lawsuit. “It gives us a lot of threads to pursue and those threads make a powerful rope to catch him,” said the source. So far 29 families of dead soldiers have asked the law firm McCue & Partners to pursue a claim against Mr Blair. Others are expected to come on board.

The firm is looking at bringing a civil case of misfeasance in public office, which would see Mr Blair dragged through the courts for the first time over his decision to take the UK to war. Legal sources say for any case to be successful, lawyers would have to show that Mr Blair “had acted in excess of his powers” and that in doing so “harm has been caused and that the harm could have been predicted”. Sir John Chilcot, in his findings published on Wednesday, said Mr Blair should have seen the problems that resulted from the invasion in 2003 and came as he could to suggesting the military action was illegal.

Mr Blair has earned a fortune estimated at as much as £60 million since resigning as prime minister in 2007, largely through a complex network of companies that offers investment and strategic advice to private companies and international governments. Reg Keys, whose son Tom was one of six Royal Military Police killed at Majar al-Kabir in 2003, said: “Tony Blair has made a lot of money from public office which I believe he misused. He misused the powers of that office and has gone on to make a lot of money after leaving that office, a lot of it from the contacts he made while in Downing Street.”[..] “I would like to see him stripped of every penny he has got. I would like to see him dragged through the civil courts.”

Runs along the entire south coast of the continent.

• Australia’s Other Great Reef Is Also Screwed (Atlantic)

Imagine arriving at a region famed for its forests—the Pyrenees or the Rockies, perhaps—and discovering that all the trees had vanished. Where just a few years ago there were trunks and leaves, now there is only moss. That’s how Thomas Wernberg and Scott Bennett felt in 2013, when they dropped into the waters of Kalbarri, halfway up the western coast of Australia.

They last dived the area in 2010. Then, as in the previous decade, they had swum among vast forests of kelp—a tagliatelle-like seaweed whose meter-tall fronds shelter lush communities of marine life. But just three years later, the kelps had disappeared. The duo searched for days and found no traces of them. They only saw other kinds of seaweed, growing in thin, patchy, and low-lying lawns. “We thought we were in the wrong spot,” says Bennett. “It was like someone had bulldozed the reef. It was like a moonscape underwater—scungy, brown, and empty.”

The culprit—surprise, surprise—is climate change. The waters near western Australia were already among the fastest-warming regions in the oceans before being pummeled by a recent series of extreme heat waves. In the summer of 2011, temperatures rose to highs not seen in 215 years of records, highs far beyond what kelps, which prefer milder conditions, can tolerate. As a result, the kelp forests were destroyed. Before the heat wave, the kelps stretched over 800 kilometers of Australia’s western flank and cover 2,200 square kilometers. After the heat wave, Wernberg and Bennett found that 43% of these forests disappeared, including almost all the kelps from the most northerly 100 kilometers of the range. “It was just heartbreaking,” says Bennett.

“It really brought home to me the impact that climate change can have on these ecosystems, right under our noses.” “They have provided alarming and detailed evidence for one of the most dramatic climate-driven ecosystem shifts ever recorded,” adds Adriana Verges from the University of New South Wales.

Soon, Australia will have only barren coasts left.

• 10,000 Hectares Of Mangroves Die Across Northern Australia (ABC.au)

Close to 10,000 hectares of mangroves have died across a stretch of coastline reaching from Queensland to the Northern Territory. International mangroves expert Dr Norm Duke said he had no doubt the “dieback” was related to climate change. “It’s a world-first in terms of the scale of mangrove that have died,” he told the ABC. Dr Duke flew 200 kilometres between the mouths of the Roper and McArthur Rivers in the Northern Territory last month to survey the extent of the dieback. He described the scene as the most “dramatic, pronounced extreme level of dieback that I’ve ever observed”.

Dr Duke is a world expert in mangrove classification and ecosystems, based at James Cook University, and in May received photographs showing vast areas of dead mangroves in the Northern Territory section of the Gulf of Carpentaria. Until that time he and other scientists had been focused on mangrove dieback around Karmuba, Queensland, at the opposite end of the Gulf. “The images were compelling. They were really dramatic, showing severe dieback of mangrove shoreline fringing — areas just extending off into infinity,” Dr Duke said. “Certainly nothing in my experience had prepared me to see images like that.”

Dr Duke said he wanted to discover if the dieback in the two states was related. “We’re talking about 700 kilometres of distance between incidences at that early time,” he said. The area the Northern Territory photos were taken in was so remote the only way to confirm the extent and timing of the mangrove dieback was with specialist satellite imagery. With careful analysis the imagery confirmed the mangrove dieback in both states had happened in the space of a month late last year, coincident with coral bleaching on the Great Barrier Reef. “We’re talking about 10,000 hectares of mangroves were lost across this whole 700 kilometre span,” Dr Duke said.

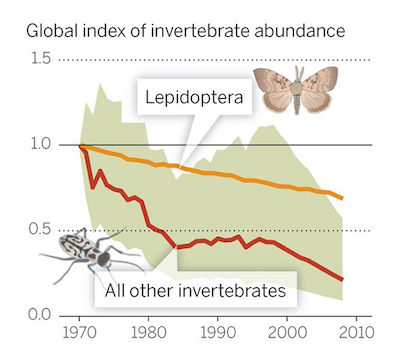

It doesn’t get much scarier than this, without insects mankind doesn’t stand a chance: ”..out of 3,623 terrestrial invertebrate species on the International Union for Conservation of Nature [IUCN] Red List, 42% are classified as threatened with extinction.”

• Global Insect Populations Fall 45% In Past 40 Years (e360)

Every spring since 1989, entomologists have set up tents in the meadows and woodlands of the Orbroicher Bruch nature reserve and 87 other areas in the western German state of North Rhine-Westphalia. The tents act as insect traps and enable the scientists to calculate how many bugs live in an area over a full summer period. Recently, researchers presented the results of their work to parliamentarians from the German Bundestag, and the findings were alarming: The average biomass of insects caught between May and October has steadily decreased from 1.6 kilograms (3.5 pounds) per trap in 1989 to just 300 grams (10.6 ounces) in 2014.

According to global monitoring data for 452 species, there has been a 45% decline in invertebrate populations over the past 40 years.

“The decline is dramatic and depressing and it affects all kinds of insects, including butterflies, wild bees, and hoverflies,” says Martin Sorg, an entomologist from the Krefeld Entomological Association involved in running the monitoring project. Another recent study has added to this concern. Scientists from the Technical University of Munich and the Senckenberg Natural History Museum in Frankfurt have determined that in a nature reserve near the Bavarian city of Regensburg, the number of recorded butterfly and Burnet moth species has declined from 117 in 1840 to 71 in 2013. “Our study reveals, through one detailed example, that even official protection status can’t really prevent dramatic species loss,” says Thomas Schmitt, director of the Senckenberg Entomological Institute.

Declines in insect populations are hardly limited to Germany. A 2014 study in Science documented a steep drop in insect and invertebrate populations worldwide. By combining data from the few comprehensive studies that exist, lead author Rodolfo Dirzo, an ecologist at Stanford University, developed a global index for invertebrate abundance that showed a 45% decline over the last four decades. Dirzo points out that out of 3,623 terrestrial invertebrate species on the International Union for Conservation of Nature [IUCN] Red List, 42% are classified as threatened with extinction.

Home › Forums › Debt Rattle July 10 2016