Marc Chagall The soldier drinks 1912

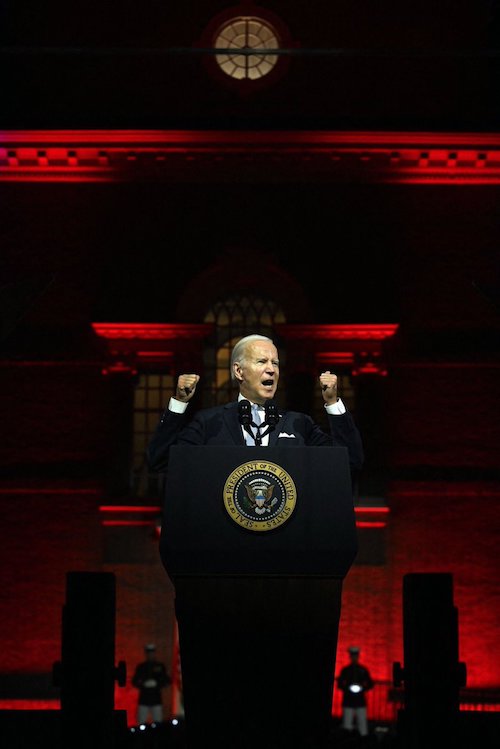

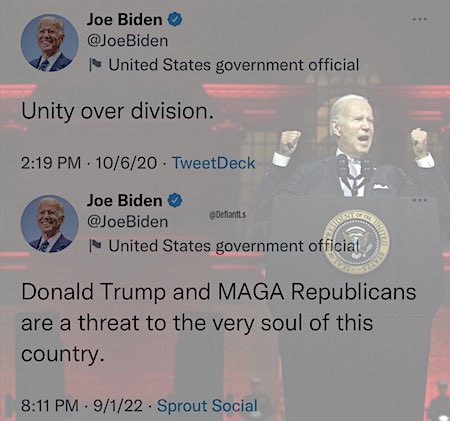

An American president attempting to incite a civil war. Never seen such a thing.

Tucker Biden

Joe Biden’s “The Enemy Within” speech is declaring an end to any kind of dissent or opposition to the entrenched bureaucratic establishment. It will use the full weight of the American government to persecute YOU — if you don’t fall in line.

— Gonzalo Lira (@GonzaloLira1968) September 2, 2022

Facebook fact check

Facebook is in BIG TROUBLE.

It has just been discovered that the Facebook Covid vaccine Fat-Checkers are funded by vaccine companies pic.twitter.com/gp3RKUDPBC

— .. (@Xx17965797N) August 31, 2022

Nothing accidental about the decor. But very wrong at the same time.

• These Are The Leaders Of Biden’s Revolution (Tucker Carlson)

If you’re watching this right now, you are missing a rare primetime address from Joe Biden. Biden doesn’t give a lot of those for obvious reasons, but tonight’s topic is worthy of the occasion. America, ladies and gentlemen, is under attack and not from our usual enemies. The threat we face tonight is existential, but it’s not coming from barefoot religious extremists living in caves. It’s not the Chinese government. It’s not even Vladimir Putin himself, the most diabolically evil man in history. No, ladies and gentlemen, this threat is worse than all of that and it’s homegrown. As they say in the horror movies, it’s coming from inside the house. The single greatest threat to America today is Republican voters, all 75 million of them. They are Nazis and destroyers of democracy. They must be stopped. That is the message of Joe Biden’s speech.

Just moments ago, he referred to MAGA forces who are apparently marshaling at Red Lobster near you, ready to take over this country. Now, to underscore how deeply Joe Biden means all of this, tonight’s address in Philadelphia is not being categorized as a campaign event ahead of the midterm elections, which is what it looks like. No. Instead, this speech has the full sponsorship of the White House. In other words, what Joe Biden is saying right now is the official position of the entire executive branch of the U.S. government. That would include the Justice Department, the various Intel agencies and the world’s most powerful standing military. Think about that. Does it make you nervous? You don’t have to be a Trump voter to see a speech like this as a turning point in American history. For hundreds of years, the U.S. has had a political system comprised of two competing parties. If you were to declare one of those parties criminal and illegitimate, what would you be left with?

Well, you will be left with a one-party state and that is what Joe Biden is calling for tonight, a one-party state. It’s shocking. You may have trouble believing it’s even happening and yet it is live on television right now, and yet and here’s what we’re here to tell you, believe it or not, there is an upside to this catastrophe. Even as you watch your beloved country take a turn you never imagined possible, there is reason for hope. American liberals may have obvious dictatorial ambitions. There’s no question they do. Only would-be dictators fear free speech and an armed population. But just because liberals long for a one-party state doesn’t mean they’re going to get one. They won’t. In the end, they don’t have the skills to pull that off. Liberals are too incompetent to overthrow democracy, and that’s obvious from history.

Tucker Biden

Biden compared millions of Americans to the monsters we shot, bombed, and later hung from the gallows in World War II. The children and grandchildren of Americans who died fighting Nazis are now themselves Nazis, says Biden. Because they vote Republican.https://t.co/fRzSoNNBZ2 pic.twitter.com/Mpc97B7oXi

— Tucker Carlson (@TuckerCarlson) September 1, 2022

Tucker Carlson reacts to Biden's speech:

"We made fun of it at the top of the show because we really didn't know how else to respond, but Joe Biden really has crossed over into a very dangerous—VERY dangerous—place." pic.twitter.com/zjKodgVD8S

— The Post Millennial (@TPostMillennial) September 2, 2022

No, he trumped that last night.

• Biden’s Most Enduring Legacy? (Rickards)

What are the advantages of a central bank digital currency? Well, the advantages are speed, cost, security and ease of use. Assume you buy a candy bar at a convenience store. You pay for it with a credit card, which begins a payment process involving maybe five parties including the merchant, the credit card company, the bank and an intermediary called a merchant acquirer (no need to list the details here, but it’s complicated). Ultimately the bank that issues your credit card sends you a bill and you pay it. You also pay a fee, maybe 3%, all to buy a candy bar. But with a central bank digital currency, you could simply pay for the candy bar with an account you have at the Fed. You would disintermediate the merchant acquirer, the banks and the credit card company. It would eliminate the fees we currently face. In a nutshell, the payment system will be faster, cheaper, easier, more streamlined and more secure.

The question is why are they doing this? Well, the banks and the government will tell you that it’s cheaper, faster and safer, so it makes sense. And that’s true, as far as it goes, but there are a lot of hidden agendas here. The first one is to eliminate cash. If you didn’t like the central bank digital currency system for privacy reasons, you might say, “Hey, I feel like I’m under surveillance. This is intrusive. I just don’t trust it. Where’s my alternative?” Particularly if they eliminate the traditional credit card payment system, you might buy your candy bar with cash. But if you’re the government and you want the central bank digital currency to succeed, you have to eliminate cash because it’s your competition. The government hates cash because it’s not traceable. If you spend it, they don’t know that you spent it or how you spent it. They can’t put you under surveillance with cash.

The other thing the government wants is the ability to impose negative interest rates. Instead of earning interest on your money in the bank, you’d be charged to keep it there. Cash stands in the way of negative interest rates because cash doesn’t have a negative interest rate. Assume you bury $100,000 in cash in your backyard. You come back a year later, you still have $100,000. You might not earn any interest on your money, but at least the government can’t take it away. But if all your money is in digital form within the banking system, they can impose negative interest rates on it. The government wants to use the banking system for a lot of other things. They might want to freeze your account, they might want to seize your assets, they might also want to put an expiration date on your money. sImagine you get paid and the government tells you, “That money is going to evaporate or disappear if you don’t spend it in the next six months.” How’s that for a stimulus program?

How can this woman still have a job this morning?

• German FM Made ‘Fantastic Admission’ – Lavrov (RT)

Russia’s Foreign Minister Sergey Lavrov has described as “fantastic” a recent comment by his German counterpart, Annalena Baerbock, about Berlin’s commitment to backing Kiev. The German official said on Wednesday that her country’s government would stand by Ukraine regardless of what German voters think about it. On Thursday, Lavrov delivered a speech at the Moscow State Institute of International Relations marking the start of the academic year. In it, he said that many Western politicians are in the grip of a “Russophobic obsession.” As a case in point, the minister cited Baerbock’s remark, which she made in Prague on Wednesday. According to Lavrov, what the German official said effectively boiled down to the following: “Yes, our citizens are suffering but they will have to suffer more because we will be supporting Ukraine no matter what.”

The Russian foreign minister described Baerbock’s statement as a “fantastic admission.” Speaking at a conference named ‘Democracy’s Clear and Present Danger: How Do We Respond?’ organized by the NGO Forum 2000, the top German diplomat said: “If I give the promise to people in Ukraine – ‘We stand with you, as long as you need us’ – then I want to deliver. No matter what my German voters think, but I want to deliver to the people of Ukraine.” Baerbock acknowledged that dissatisfaction with the German government among the country’s population would likely increase come winter. She did go on to explain that Berlin would not remain completely deaf to its citizens, though, promising “social measures” for those who “cannot pay [the] energy prices.”

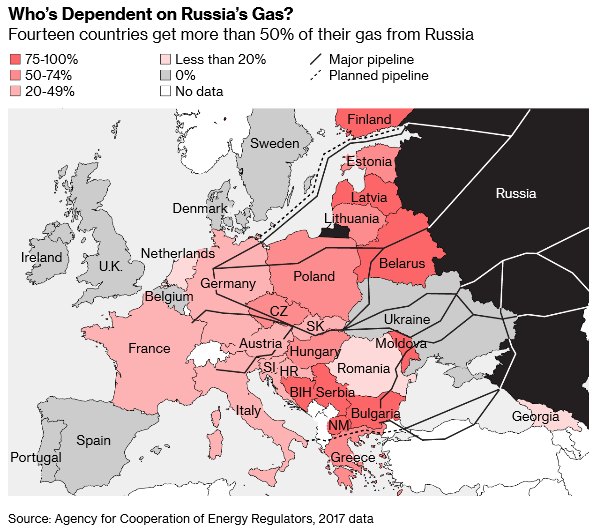

However, the official made it clear that the “sanctions [against Russia] will stay also in winter time, even if it gets really tough for politicians.” Since the start of Russia’s military offensive against Ukraine in late February, and in light of the Western sanctions against Moscow that followed, energy prices in Europe have climbed to historic highs. This has pushed inflation up significantly across the EU, and in Germany in particular. On Wednesday, gas prices surged again on the spot market after the operator of the Nord Stream 1 gas pipeline announced the beginning of a three-day shutdown for maintenance.

German FM: I will put Ukraine first “no matter what my German voters think” or how hard their life gets. pic.twitter.com/GwAqIZ2jL7

— Ignorance, the root and stem of all evil (@ivan_8848) August 31, 2022

Will Schryver @imetatronink:

“The AFU clown show in southern Ukraine scales new heights. In arguably the most embarrassing debacle of the war yet for Ukraine, they apparently permitted themselves to attempt an MI6-designed and directed commando operation to seize the Zaporozhye nuclear power plant. The would-be commandos, 64 in number, recently “trained” in the UK, set out across the Kakhovskoye reservoir in seven high-speed boats, landed on the opposite shore 3 km from the NPP, where they were immediately met by a Russian ambush.”

“Apparently Russian intelligence was fully aware of their plans and had monitored the debutante commandos from the time they left Poland to pursue their ostensibly glorious operation – allegedly advocated by the corpulent Boris Johnson himself in his recent visit to Kiev.” “Of the 64 “commandos”, at least 47 are now dead, a few wounded, and a dozen trapped with no means of escape, all seven of their boats having been destroyed. The entire undertaking has been an unmitigated amateurish disaster.”

“Apparently, there were also two barges with 320 additional troops that attempted to cross the reservoir, but were sunk en route — all presumably drowned. In fact, some Ukrainian Telegram channels reported that 700 troops were involved. A joke of military planning / execution.”

• Ukrainian Troops Captured During Raid On Nuclear Plant – Official (RT)

Three Ukrainian soldiers, who participated in a botched attempt to capture the Russian-controlled Zaporozhye Nuclear Power Plant on Thursday morning, have been taken alive, Vladimir Rogov, a council member in the Moscow-allied administration of Ukraine’s Zaporozhye Region, has claimed. Of the three, two have been injured and are in serious condition, the official said in an interview with Russian television. Doctors are fighting to save them, he added. An estimated 12 Ukrainian troops are still fighting against Russian forces, he claimed. The Russian Defense Ministry previously claimed that early in the morning, Kiev launched an operation apparently aimed at taking the nuclear site ahead of an inspection by the International Atomic Energy Agency (IAEA).

Some of the Ukrainian troops failed to reach the southern bank of the Dnepr when their vessels were hit and sank, the ministry stated. Up to 60 commandos used speedboats to make a landing, before Russian forces engaged them, the report said. The power plant and the surrounding city of Energodar have been under Russian control since March. Throughout August, it came under regular fire, which Kiev and Moscow blamed on each other. Ukrainian officials also accused Russia of stationing heavy weapons at the nuclear facility. The IAEA’s fact-finding mission is expected to arrive in Energodar later in the day, though there were reports that their progress was interrupted by military activity. Russia and Ukraine have accused each other of attempting to derail the inspection.

“..I felt sorry for them and I started wondering if this was worth doing at such a cost,” the WSJ quoted a doctor in an intensive care unit as saying..”

• Ukraine Suffers Heavy Losses In Failed Offensive – Moscow (RT)

Kiev’s attempts to take the initiative and advance in the south of the country have failed and resulted in heavy losses, the Russian Defense Ministry reported on Thursday. The Ukrainian forces lost over 350 personnel, as Russian warplanes and artillery were used for kinetic action against Kiev’s forces over the last 24 hours, the ministry’s spokesman said during a daily briefing. Kiev also lost 31 tanks, 22 infantry fighting vehicles, 18 of other types of armored vehicles, eight armed pickup trucks, and 17 of other types of military vehicles, the statement said. This week, Ukraine launched a long-touted offensive to reclaim territories in the south of the country controlled by Russia. Kiev reported capturing some villages, but officials were mostly tight-lipped about the details of the operation, including its cost, citing secrecy.

The Russian side described the action as disastrous for Kiev. A previous Russian military briefing on Wednesday said Ukraine lost over 1,200 soldiers and dozens of pieces of military hardware to Russian fire in a single day. The fact that Ukraine was paying a heavy toll was corroborated by some Western news outlets, including the Wall Street Journal. The newspaper spoke to some of the Ukrainian soldiers injured on the battlefield and medics treating them to glimpse into the situation on the frontline. “When they started bringing in such a large number of wounded, then, honestly, I felt sorry for them and I started wondering if this was worth doing at such a cost,” the WSJ quoted a doctor in an intensive care unit as saying.

“..we fully understand the complete silence of all Western sponsors of the Zelensky regime..”

• Ukraine Planned To Use IAEA Team As ‘Human Shields’ – Russia (RT)

Kiev forces wanted to seize the Zaporozhye Nuclear Power Plant in a daring military raid and use the personnel of the UN nuclear watchdog as “human shields” to maintain control over the facility, the Russian Defense Ministry claimed on Thursday. The botched raid came shortly before a team of experts with the International Atomic Energy Agency (IAEA) – including the organization’s head, Rafael Grossi – arrived at the plant for an inspection. According to the Russian military, multiple Ukrainian “saboteur groups” crossed the Kakhovka Reservoir in speedboats and barges near the plant early in the morning, but were intercepted and destroyed by Russian troops and National Guard forces.

“Obviously, if the operation of the Kiev regime to seize the station was a success, the head of the IAEA, [Rafael] Grossi, and the experts of the mission would become a ‘human shield’ for Ukrainian saboteurs to prevent any attempts to destroy them by the Russian armed forces,” the Russian MoD said in a statement. The operation aimed at capturing the nuclear power plant appears to have been “planned in advance by Zelensky’s regime,” the Russian military suggested. Moreover, the delay in Grossi’s visit to the installation, originally planned for August 31, stemmed from the Ukrainians’ need for more time to get ready for that “military provocation,” it alleged.

The ultimate goal of the operation was seizing control of the plant, while the presence of the IAEA team would have allowed the “saboteurs”to not only take cover from any potential Russian actions, but also to cement the new “status quo,” the military said. The success of the operation would have likely been reinforced by a “new wave of loud statements from Washington and European capitals, calling upon Russia to establish a ‘demilitarized zone’ around the nuclear plant, with IAEA observers guarded by Ukrainian troops,” it asserted. “In this regard, we fully understand the complete silence of all Western sponsors of the Zelensky regime, which de-facto confirms their tacit participation in the preparation of today’s provocation at the Zaporozhye plant,” the military concluded.

“..neither Arkin nor his editorial bosses at Newsweek felt any need to explain how Russia could be losing the war twice..”

• Getting it Wrong on Ukraine (Scott Ritter)

Six months into Russia’s “Special Military Operation,” fact-challenged reporting that constitutes Western media’s approach to covering the conflict in Ukraine has become apparent to any discerning audience. Less understood is why anyone would sacrifice their integrity to participate in such a travesty. The story of William Arkin is a case in point. On March 30 (a little more than a month into the war), Arkin penned an article which began with the following sentence: “Russia’s armed forces are reaching a state of exhaustion, stalemated on the battlefield and unable to make additional gains, while Ukraine is slowly pushing them back, continuing to inflict destruction on the invaders.” Arkin went on to quote a “high-level officer of the Defense Intelligence Agency,” who spoke on condition of anonymity, who declared that “The war in Ukraine is over.”

A little less than three months later, on June 14, Arkin wrote a piece for Newsweek with the headline: “Russia Is Losing the Ukraine War. Don’t Be Fooled by What Happened in Severodonetsk.” Apparently neither Arkin nor his editorial bosses at Newsweek felt any need to explain how Russia could be losing the war twice. Anyone who has been following what I’ve been writing and saying since the beginning of Russia’s “Special Military Operation” in Ukraine knows I hold the exact opposite view. Russia, I maintain, is winning the Ukraine conflict, in decisive fashion. But I don’t write for Newsweek. William Arkin does.

Arkin proclaims that Russia is losing though it had, at the time the article was published, just taken the strategic city of Severdonetsk, killing and capturing thousands of Ukrainian forces, and rendering thousands more combat ineffective since they had to abandon their equipment to flee for their lives. (Russia has since captured all of the territory encompassing the Lugansk People’s Republic, including the city of Lysychansk, inflicting thousands of additional casualties on the Ukrainian military.) “The Russian army’s so-called victory,” Arkin proclaimed at the time, “is the latest installment in its humiliating military display and comes with a crushing human cost.” The humiliating display instead is Arkin’s lack of acumen in conducting an independent assessment of the military situation on the ground in Ukraine.

This was again reinforced last week when Arkin penned another article in which he helps disseminate the outlandish claims of his Pentagon sources. “[F]rom late February through August, with only a moderate infusion of weapons from the West, some supportive declarations from Western leaders and a smattering of ‘We Stand with Ukraine’ signs on U.S. lawns,” Arkin writes, Ukraine has been able to “hold at bay the mighty Russian military,” something apparently none thought it could do.

Putin global inflation

Putin explains the origins of global inflation. pic.twitter.com/vM0aNFYpB6

— Putin Direct (@PutinDirect) September 1, 2022

More death coming.

• More Ukraine Military Aid Coming, White House Says (RT)

US National Security Council spokesman John Kirby said on Wednesday that the Biden administration was preparing to announce more packages of military aid for Kiev’s beleaguered forces. Kirby’s statement came a week after US President Joe Biden authorized a record arms shipment worth nearly $3 billion. “There will be announcements of future security assistance in coming days,” Kirby said at a press conference. The upcoming packages will likely be drawn from the $40 billion allocated to Ukraine in a military and economic aid bill passed by Congress in May. The US has doled out this aid in near-weekly installments since the bill’s passage, with last week’s package the largest yet, totaling $2.98 billion. President Biden has promised to keep bankrolling Ukraine’s military for “as long as it takes,” although the US’ end goal in the conflict is unclear.

While Biden wrote earlier this summer that the US does “not want to prolong the war just to inflict pain on Russia,” he has spoken of a desire to affect regime change in Moscow, and his own secretary of defense has stated that weakening Russia is a core US objective. Furthermore, Biden’s officials said that they are willing to risk “a global recession and mounting hunger” just to oppose Russia, the Washington Post stated in June. It is unclear to what extent the supply of American weapons has helped Ukraine hold off Russian forces. A long-awaited counter-offensive in the south of the country ended in dismal failure for Ukraine earlier this week, with Moscow claiming to have destroyed more than 130 Ukrainian tanks and armored vehicles and killed more than 1,200 troops in a single day.

“There is work on emergency measures on electricity prices. There might be also something on demand reduction for electricity.”

• Wholesale Gas Prices Fall On Europe’s Plan To Avert Winter Energy Crisis (G.)

Wholesale gas prices have tumbled amid signs that European leaders’ plans to avert a winter energy crisis are taking shape. The price of gas for delivery on Friday dropped 21% from last night’s price of 405p per therm to 320p, as the European Commission confirmed it is working on “emergency measures” and the German government said it is “prepared” for the winter. The British wholesale gas price for delivery next week fell 9% to 350p while the month-ahead price fell 6% to 431p on Thursday. Earlier this week the day-ahead price fell from 447p a therm after the European Commission said it was working “flat out” on an emergency package as well as examining structural reform of the electricity market.

The European Commission said on Thursday it was looking into options to cap energy prices and cut electricity demand as part of its upcoming proposals to tackle soaring energy costs. Mechthild Wörsdörfer, deputy director general of the commission’s energy department, told a meeting of European parliament’s energy committee: “There is work on emergency measures on electricity prices. There might be also something on demand reduction for electricity.” The European Commission chief, Ursula von der Leyen, will outline the commission’s ideas on capping energy prices in a speech on 14 September. European countries have rushed to fill up gas storage facilities after Russia cut supplies into Europe. Germany is among the nations most exposed to potential shortages of gas and there are fears that – if the Kremlin switched off supplies altogether – its economy could tumble into recession.

[..] Gas market traders are on tenterhooks to see whether Russia state-owned gas giant Gazprom returns the Nord Stream 1 pipeline under the Baltic Sea back to service after a three-day maintenance shut down, which began on Wednesday. European gas storage facilities are now almost 80% full on average, nearing an EU target for countries to hit 80% full by 1 November. Researchers at Wood Mackenzie predicted high natural gas prices will drive down European demand to 7% below the five-year average in the months through to March, leaving a “best-case scenario” of storage levels at 31% at winter’s end.

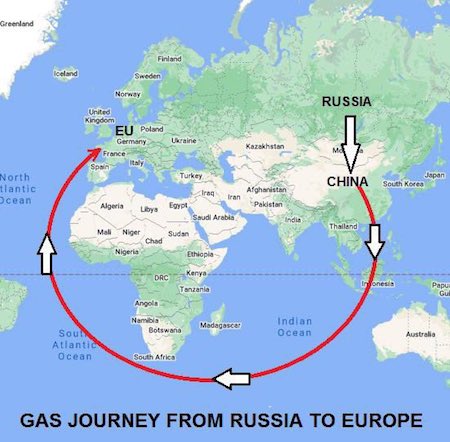

Russian gas journey to Europe… Same gas as before, but now liquefied, and routed via China, at much higher price and transport costs…

“Our opponents have issued so many sanctions-related documents that they created a situation which could be called sanctions confusion..”

• Sanctions Hinder Russian Gas Flow To EU – Gazprom (RT)

Western sanctions could obstruct Siemens Energy from carrying out regular maintenance of equipment for the Nord Stream 1 gas pipeline, Gazprom CEO Alexey Miller said on Wednesday. “Our opponents have issued so many sanctions-related documents that they created a situation which could be called sanctions confusion,” Miller told Russia 1 TV. “And today Siemens has practically no opportunity to provide regular major overhauls of our gas-pumping equipment. Siemens simply has nowhere to carry out this work.” German manufacturer Siemens Energy, which normally services the turbines, said earlier on Wednesday it was not involved in the latest maintenance work being carried out by Gazprom at the compressor station. Russian gas flows via the Nord Stream 1 pipeline to Germany have been suspended from August 31 until September 3 for repairs.

Since July, the Nord Stream 1 pipeline has been operating at reduced capacity due to the shutdown of several gas turbines. One of them was sent to Montreal for repairs and became stuck there due to Canadian sanctions on Russia over the conflict in Ukraine. At Germany’s request, Ottawa announced an exemption for the turbines in July, and sent one of them over, but Gazprom refused to take delivery, citing irregularities in the documentation. Gazprom has cited faulty or delayed equipment as the main reason for the 80% reduction of deliveries via the pipeline. The Kremlin said on Tuesday that only sanctions prevent Nord Stream 1 from working at full capacity.

Putin EU

Putin: The EU has lost its political sovereignty. European elites are pursuing policies that are detrimental to the welfare of their own people, businesses, and economies. pic.twitter.com/PptZN9YIMA

— Putin Direct (@PutinDirect) September 1, 2022

“There cannot be a crisis next week. My schedule is already full.” – Henry Kissinger

In the United Kingdom, a grassroots protest movement has broken out in response to the ongoing energy crisis. With the bill from its failed national policies coming due, ordinary citizens are organizing campaigns to ensure they are not the ones left holding the bag. The mission of Don’t Pay UK is to gather at least one million commitments from Her Majesty’s loyal subjects to simply stop paying their energy bills as of October 1, 2022. At the time of this writing, Don’t Pay UK has passed 130,000 signatures. We expect that number to grow. In reading a recent profile of the movement by Euronews Green, we were struck by the framing of the crisis by some of the movement’s organizers. This quote from the piece and the photo we have reproduced below caught our attention (emphasis added throughout):

“Lewis Ford, an organiser from Hull, agrees the movement is ‘a lot about solidarity’, especially for those forced to choose between heating their home and feeding their family. ‘We’re already talking about the idea of setting up warm banks, which is an absolutely preposterous idea,’ the 31-year-old IT consultant tells Euronews Green. ‘We’re one of the richest nations. So, it’s not like there’s no money, it’s the fact that the money is being kept in one space.’” Sadly for Mr. Ford and the well-intended but totally naïve young woman holding out hope that the unicorn concept of “cheaper cleaner greener” energy is actually a thing, they are both victims of insidious propaganda. As reality will soon demonstrate, if a country can’t afford to keep its citizens warm during the winter, then that country is poor, not rich. And if the proposed solution to this crisis is to double down on the same crazy policies that caused it in the first place, then we should expect the problem to get worse, not better.

As longtime readers of Doomberg will know, we’ve been fascinated by the European energy situation for the better part of the past year, long before the true potential for a crisis was considered acceptable mainstream thought. In re-reading a piece we wrote last October called “Putin’s Fools Rush In,” we correctly predicted who held the real power in the developing conflict. We also badly overestimated the willingness of Western political leaders to recognize reality. Here are two quotes revealing the miscalculation: “The prize Putin will soon collect is the inevitable go-ahead by Germany to begin operating the Nord Stream 2 pipeline, an act that will decisively and irreversibly conclude a years-long struggle between the United States and Russia in Putin’s favor.” s“Energy is life. Those projects will get developed. The geopolitical power vacuum we are creating will get filled. We might not be serious, but our enemies are ruthlessly so. They raise a toast to our self-inflicted demise.”

“The hit on the Moskva was a NATO operation, ordered by the US. The Russian Ministry of Defense knows – and the Americans know they know. Retaliation will come – in the time and place of Moscow’s choosing.”

• Which Crime Syndicate Murdered Darya Dugina? (Escobar)

Disclosure: I prize my friendship with Alexander Dugin – we met in person in Iran, Lebanon and Russia: a towering intellectual and extremely sensitive spirit, eons away from the crude stereotype of “Putin’s brain” or worse, “Putin’s Rasputin” slapped on him by Western media sub-zoology specimens. His vision of Eurasianism should be granted the merit of an ample intellectual discussion, a real dialogue of civilizations. But obviously the current woke incarnation of the collective West lacks the sophistication to engage in real debate. So he’s been demonized to Kingdom Come. Darya, who I had the honor to meet in Moscow, was a young, shining star with an ebullient personality who graduated in History of Philosophy at Moscow University: her main research was on the political philosophy of late Neoplatonism.

Obviously that had nothing to do with the profile of a ruthless operative capable of “compromising” money flows. She did not seem to understand finance, much less “dark” financial ops. What she did understand is how the Ukrainian battlefield mirrored a larger than life clash of civilizations: globalism against Eurasianism. Back to the assertions by the Russian intel agent, they cannot be simply dismissed. For instance, at the time he came up with the definitive version of the hit on the Moskva – the flagship of the Russian Black Sea fleet. As he emailed to a select audience, “the destruction of the flagship of the fleet was planned as a strategic task. Therefore, the operation of delivering the PKR [anti-ship missile] to Odessa took place in strict secrecy and under the cover of electronic warfare. As the ‘killer’ of the cruiser, they chose the PKR, but not the Neptune, as spread by Ukrainian propaganda, but the fifth-generation NSM PKR (Naval Strike Missile, range of destruction 185 km, developed by Norway-USA).

The NSM is able to reach the target along a programmed route thanks to the GPS-adjusted INS, independently find the target by flying up to it at an altitude of 3-5 meters. When reaching the target, the NSM maneuvers and puts electronic interference. A highly sensitive thermal imager is used as a homing system, which independently determines the most vulnerable places of the target ship. A stationary container installation secretly delivered to Ukraine was used as a launcher. Thus, after the damage to the cruiser Moskva, which led to its flooding (…) the Black Sea Fleet, unfortunately, no longer has a single ship with a long-range anti-aircraft missile system. But not everything is so bad. A three-band radar ‘Sky-M’ is located in Crimea, which is capable of tracking all air targets at a range of up to 600 km.” So there you go. The hit on the Moskva was a NATO operation, ordered by the US. The Russian Ministry of Defense knows – and the Americans know they know. Retaliation will come – in the time and place of Moscow’s choosing.

“..and took all the money and the lands of the little prince and broke all the guns that the Kingdom of the West had sent him.”

• A Story for Children (Batiushka)

Once upon a time there was a world where there were four Kingdoms. These were called the Kingdom of the North, the Kingdom of the East, the Kingdom of the South and the Kingdom of the West. Now the smallest Kingdom by far was the Kingdom of the West, which was only a tiny part of the whole. But it was by far the richest of the four Kingdoms. This was because it kept stealing things with guns and with cunning from the other three Kingdoms. But it turned out to be by far the stupidest Kingdom. This was because it loved itself so much that it could no longer see in front of its nose. Now it all happened in this way.

First of all, the wizards of the Kingdom of the West created a nasty illness called a Pestilence. They wanted to kill the people in the other three Kingdoms. In fact, the other three Kingdoms threw off the Pestilence. And because they were cowards, the rulers of the Kingdom of the West scared themselves and made themselves very ill and very poor instead. Then the Kingdom of the West said: ‘We will start a War with the Kingdom of the North because that is the Kingdom that is the closest to us. Then we will be able to take all their lands and all their money. And in that way we shall get back all the money we lost in our Pestilence and we will all be happy again’. So the Kingdom of the West found a little prince in the Kingdom of the North, whose country was next to the Kingdom of the West. And they paid him and all the rich people there lots of money and sent them lots of guns to fight against the very big Kingdom of the North.

And then the Kingdom of the West added, ‘To make sure we win, we will not buy any things from the Kingdom of the North any more and so they will have no money, but we will be richer and richer’. However, made blind by their love for themselves, the Kingdom of the West had not seen that the Kingdom of the North was much bigger, much richer and much stronger than it was. And as well as that, the Kingdom of the North was helped by the Kingdom of the East and the Kingdom of the South. And those two Kingdoms very much wanted all the things the Kingdom of the North had to sell. So the Kingdom of the North sold all its things to the Kingdom of the East and the Kingdom of the South and became rich. Then the Kingdom of the North conquered the little prince, making his rich people run away, and took all the money and the lands of the little prince and broke all the guns that the Kingdom of the West had sent him.

Don’t piss off the German media. You can’t afford to.

• Greece’s Slide Toward Authoritarianism (Spiegel)

Once again this summer, millions of Europeans were able to experience the pleasant side of Greece: the sun, the beaches and the hospitality. Greece is, with good reason, a favorite destination for holidaymakers in Europe. Which perhaps helps explain why governments in other European capitals seem happy to overlook the more unpleasant aspects of their EU partner. The European Commission and various courts have long been focused on the erosion of democracy in Hungary and Poland. But thus far, nobody in Brussels, Berlin or Paris has seemed particularly concerned that Greece, under the leadership of Prime Minister Kyriakos Mitsotakis, has also been increasingly drifting toward autocracy.

Mitsotakis poses as a liberal reformer who has improved his country’s financial and economic prospects. But he isn’t quite as fond of talking about the countless legal violations that Greek civil servants have committed on his watch. In migration policy, especially, the Greek government has essentially abrogated international and European law. In the last two years, Greek security personnel have intercepted thousands of refugees and violently forced them to return to Turkey. They have also used other migrants as slaves to assist in these illegal pushbacks. In other instances, Greek officials have towed asylum-seekers out to sea and abandoned them on unsafe inflatable rafts. Almost never is a Greek official forced to answer for crimes committed on the country’s borders. What does frequently happen, by contrast, is that those who document such crimes come under intense pressure.

The NGO Josoor, for example, a group that has spent two-and-a-half years helping pushback victims, recently suspended operations after months of harassment by Greek agencies. Members of other aid groups have been persecuted as migrant smugglers. And DER SPIEGEL reporter Giorgos Christides has been vilified as a Turkish agent in pro-government Greek media outlets. After DER SPIEGEL published a report last week about Greek officials declining to provide any assistance to a five-year-old Syrian girl who lay dying on an island in the Evros River, which demarcates part of the Turkish-Greek border, the government in Athens eschewed any self-criticism. Instead, they assailed Christides for allegedly using illegal methods to establish contact with the victim’s parents. It is precisely this kind of guilt reversal that has become common practice in Athens.

“Gorbachev’s spouse, Raisa, asserted the resulting deaths of 200 Armenian protestors in a crackdown ordered by Gorbachev left him tormented and never the same.”

• How Mikhail Gorbachev Became the Most Reviled Man in Russia (CP)

[..] it was not only in the economic realm that Gorbachev’s reforms caused chaos. Liberated from decades of control from an overbearing state, Gorbachev’s perestroika untied the heretofore tightly wrapped package of nationalism that Lenin and Stalin previously contained. Nationalists in the republics came to hate Gorbachev for his attempt at retaining the USSR, even a democratized one with autonomous republics. Meanwhile, Great Russian chauvinists despised Gorbachev for letting the Soviet system unwind and failing to use state power to keep the empire intact. One notable exception on the latter was in Armenia, where protests were causing an uncontrolled opening of the Soviet border with Iran. Gorbachev’s spouse, Raisa, asserted the resulting deaths of 200 Armenian protestors in a crackdown ordered by Gorbachev left him tormented and never the same.

Yet, this limited use of force in Armenia was largely the exception to Gorbachev’s refusal to use violence against protestors. The Balts were also having none of Gorbachev’s attempts to reform the Soviet system. Gorbachev’s reforms gave them an opening to bolt for the exit, and they ran. Ukrainian, along with Russian, nationalists also awoke under Gorbachev. Many in the Russian and Ukrainian republics also backed independence from the USSR for economic reasons. Why? Russians assumed they were rich and were held back by parasite Soviet republics draining their wealth. Likewise, Ukrainians pitched independence as the road to milk and honey. Ukraine’s vast black earth belt and formidable industry in the Donbas surely would make it rich once liberated from the Soviet Union, so they thought.

Walls closing in

Are the walls closing in?

Is this the end for Donald Trump?

Left-wing activists and the never-Trumpers seem to think that the FBI's latest court filing is the nail in the coffin for 45.@LarryOConnor and @jasoninthehouse say it's just a PR stunt to save a flailing narrative. pic.twitter.com/WYDxJov4cx

— Townhall.com (@townhallcom) August 31, 2022

Tucker Desmet

Professor Mattias Desmet: How totalitarian states emerge through mass formation pic.twitter.com/fbUBlUN2wo

— Wittgenstein (@backtolife_2023) September 1, 2022

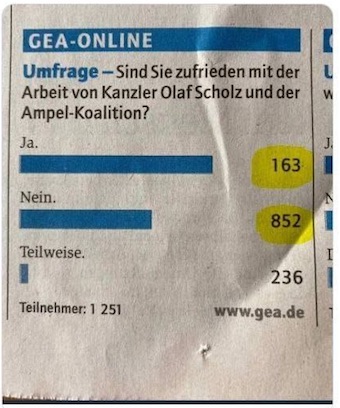

“Are you happy with the Chancellor’s work?” Find the trick.

Hanson Smollett

This is the most accurate, but also hilarious, summary of the Jussie Smollett affair. This should be in history books. They should make it mandatory to watch this video in high schools. pic.twitter.com/m4nTdPahKX

— ArXilocus (@ArXilocus) August 19, 2022

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.