G. G. Bain Temporary footpath, Manhattan Bridge 1908

More bailouts?!

• Fed Said To Have Emergency Plan To Intervene If US Defaulted On Debt (Reuters)

The Federal Reserve drew up extensive plans for handling a U.S. debt default that included scheduling deferred payments and lending cash to investors, according to a lawmaker who cited Fed documents. America courted disaster in 2011 and 2013 when political fights over the national debt nearly left the federal government unable to pay its bills. Analysts and officials warned that missing payments could lead to economic calamity, and details have only slowly emerged over how financial officials braced for the unthinkable. In a June 2014 letter to Treasury Secretary Jack Lew seen by Reuters on Monday, Republican Representative Jeb Hensarling of Texas said his staff had reviewed the Fed’s unclassified plans for how to handle a default.

The plans included scheduling new payment dates for defaulted securities, Hensarling said in the letter which was also signed by Republican Representative Patrick McHenry of North Carolina. The New York Fed, which carries out the will of the Fed in financial markets, would also conduct “business as usual” with regard to accepting Treasury securities as collateral, according to the letter. The plans continue to be relevant to investors because debt ceiling debates have become a perennial danger from Washington. The Treasury is currently scraping up against an $18.1 trillion borrowing cap, and the Congressional Budget Office estimates the government could struggle to pay bills by October or November if Congress and the White House do not agree to lift the cap.

Read more …

Let’s see prison terms.

• 5 Major Banks in Unprecedented Guilty Plea On Forex Rigging (Reuters)

The parent companies or main banking units of as many as five major banks, rather than their smaller subsidiaries, are expected to plead guilty to U.S. criminal charges over manipulation of foreign exchange rates, people familiar with the matter said. A handful of banks will likely resolve forex-rigging investigations by the U.S. Justice Department as soon as this week: JPMorgan Chase, Citigroup, British banks Royal Bank of Scotland and Barclays and Swiss bank UBS. It would be unprecedented for parent companies or main banking units, rather than smaller subsidiaries, of so many major banks, to plead guilty to criminal charges in a coordinated action, the people said.

If parent companies of U.S.-based JPMorgan and Citigroup plead guilty, it would be the first time in decades that a major American financial institution has done so. Last year, when Swiss bank Credit Suisse pleaded guilty in the United States to helping wealthy Americans evade taxes, it became largest institution in over 20 years to plead to criminal wrongdoing. It was soon followed by French banking giant BNP Paribas. U.S. authorities, fearing unintended reverberations such as the layoffs of innocent employees, have rarely sought criminal convictions against major global financial institutions and instead have allowed their smaller foreign subsidiaries to take the bullet.

Guilty pleas trigger a cascade of consequences. Banks may have to negotiate regulatory exemptions to avoid serious disruptions of business. It has been called the “Arthur Andersen effect” after the demise of the big 5 accounting firm after its indictment in 2002 over charges related to Enron’s accounting scandal. Some 28,000 employees at the firm lost their jobs.

Read more …

The US economy could use that cash, but “64% of the cash, or about $1.1tn, was held overseas..”

• US Companies Hoarding $1.7 Trillion In Cash (FT)

Just five US companies are hoarding nearly half a trillion dollars as the country’s tax code and a tepid global economy deter businesses from spending their overseas cash piles. Apple, Microsoft, Google, Pfizer and Cisco are sitting on $439bn of cash — accounting for more than a quarter of the total $1.73tn being held by US groups, according to Moody’s Investor Services. The top 50 together hold almost $1.1tn, with the iPhone maker alone accounting for more than a 10th of the cash reserves. The Moody’s analysis showed 4% growth in the cash on corporate balance sheets of the companies it covers, excluding the financial sector, over the past year. The growing cash piles underline the reluctance of boardrooms to repatriate money held abroad even as they tap debt markets to fund record spending on dividends, buybacks and acquisitions.

Moody’s estimated that 64% of the cash, or about $1.1tn, was held overseas, up from $950bn or 57% a year ago. “There has been little progress toward corporate tax reform that would incentivise US companies to permanently repatriate funds held overseas,” said Richard Lane of Moody’s. Economists with Goldman Sachs said they saw such reform as “unlikely” to happen this year or next. Cheap borrowing costs have kept companies from dipping into foreign cash, as executives seek to avoid a tax bill on profits earned abroad. Instead, Oracle, AT&T, AbbVie and Microsoft have completed multibillion-dollar debt issuances ahead of a recent sell-off in Treasury markets, as investors prepare for the Federal Reserve to lift rates. That could change if borrowing costs rise. Activist shareholders continue to press companies to return cash — in the form of buybacks and dividends — on which S&P 500 constituents are set to spend $1tn this year.

Read more …

“It’s still saying after being in crisis for so long, the economy cannot post any nominal growth over the next 10 years.”

• That Bond Selloff Cost How Much? (CNBC)

Amid a sharp selloff in the bond market, players in Europe’s low-yielding papers have gotten their fingers burned, big time. It’s “ugly bond math,” Hans Mikkelsen at Bank of America Merrill Lynch, said in a note last week. The 30-year German bund prices declined around 12% over a two-week period, with a 53-basis-point increase in yield, which tots up roughly 25 years’ worth of yield, he calculated. That compares with a typical high-yield bond, for which a 53-basis-point rise in yield would suggest an around 2.3% price fall, erasing only around a third of a year’s worth of yield, Mikkelsen said. Bond prices move inversely to yields. Bond yields have moved even further since that report was written.

Germany’s bonds have taken the brunt of the selloff, with the 30-year yielding around 1.22%, up from 0.436% on April 20, while the benchmark 10-year’s yield is around 0.603%, up from around 0.077% on April 20. That’s not terribly surprising, Bastien Drut, a strategist at Amundi, said in a blog post last week. “After more than five quarters of declining German yields, it is logical to be seeing some profit-taking,” he said. “This is even easier to understand since long-term rates were quickly moving towards negative territory.” Players in negative-yield bonds are also smarting. While bondholders may hold those securities for a variety of reasons, some clearly bought in hopes their yields would get even more negative.

It’s essentially a buy high and sell higher play. Or in less flattering terms, it could be called a greater fool theory. But the greater fool may have left the building. Switzerland’s 10-year bond has a bid-ask spread of 0.053-0.087%, turning positive after trading around a negative 0.184% on April 20. “For me, it has seemed strange why people would give money to a government and say ‘please lose money for me and I’ll take it back five years later,'” Nizam Idris, head of strategy, fixed income and currencies at Macquarie, said. “It’s still saying after being in crisis for so long, the economy cannot post any nominal growth over the next 10 years.”

Read more …

“.. the evidence from the past suggests there could be a strong rebound [..] A lot depends on how the transition is managed.“

• The Lessons For Greece’s Economy From 70 Currency Union Breakups (Bloomberg)

The hardliners in Athens may have a point. History suggests Greece leaving the euro wouldn’t make catastrophe inevitable, suggests Adam Slater at Oxford Economics. More than 70 countries and territories have quit currency unions since 1945 and yet only a small minority have then suffered large losses in output, he said in a recent study. Most of these, such as in the former Yugoslavia, can be explained by other shocks like civil war. While Greece’s gross domestic product could still slump about 10%, the decline could be limited and the economy may have undetected advantages that allow a decent recovery. “The most likely outcome if it leaves is that there will be a significant initial drop in GDP, but the evidence from the past suggests there could be a strong rebound,” said Slater. “A lot depends on how the transition is managed.”

Czechoslovakia, for example, dissolved its monetary union in 1993 over the span of just five weeks. The output of Slovakia fell less than 4% that year and was 10% higher than it had been in 1992. Slater’s calculations show that in economies changing currency unions, median growth averaged 2.7% in the year of the breakup and 3.2% from the year before cessation to the year after it. Overall, growth was positive in about two-thirds of the exits and negative in about a third for the year it occurred. Very negative outcomes with output crashing 20% or more occurred just 8% of the time. Latvia suffered the most when it went solo from the Soviet Union. Oman fared the best. “Output can be surprisingly resilient in the face of currency union exits and the severe financial crises that sometimes accompany them,” said Slater.

So how would Greece fare? Slater reckons it would benefit as a weaker exchange rate spurs exports and monetary conditions loosen. By defaulting, the government could also find fiscal space to recapitalize banks and any stock slide is unlikely to hurt households given just 2% of their financial assets are in equities. Once the shock of Grexit has passed, markets could even rally. Such an argument gives support to those Greeks who argue they could walk from the euro with little long-term cost to their economy. “There is an upside risk — if reasonably well organized, historical experiences suggest Grexit might see a much smaller initial drop,” said Slater. “There could also be some upside in financial markets.”

Read more …

“The road to growth is through a managed bankruptcy and fresh start.”

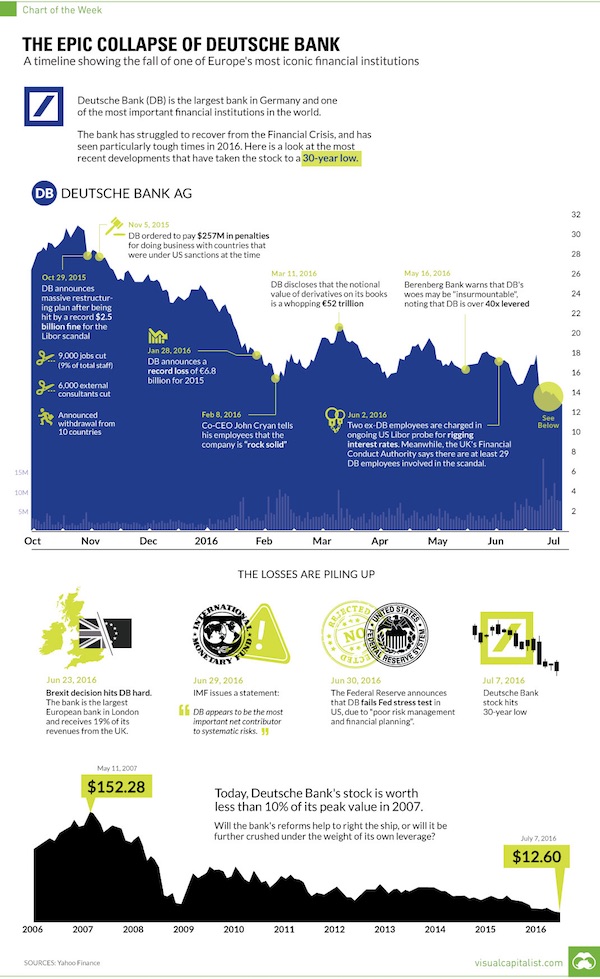

• This One Chart Proves The Grexit Is Desirable, And Inevitable (Raas)

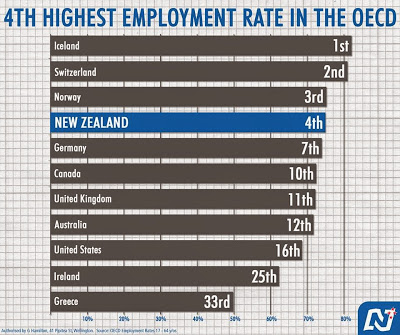

Saturday 9th May, or as I’ve been calling it, G-Day, has come and gone without the invasion of Europe by the New Drachma. Having predicted May 9 as the day, I now say “I was wrong … about the date.” Yet the conditions for a Greek Exit from the Euro are as strong today as they ever were, and getting stronger by the day. In my previous post predicting May 9 as G-Day, I listed six reasons why Grexit is inevitable. The passing of the 9th without a Grexit does not in any way invalidate any of those reasons. Now I’ll add another reason; it is the only way that Greece will rebuild the Greek economy and get the country back to work. And until the country gets back to work, there will be no future for Greece. This chart, from the National Party (the ruling party) of New Zealand shows why Greece must leave the Euro, and why it will be a good thing. Look closely at this chart:

Now what does this tell us? Here are some quick observations:

• New Zealand almost when broke in 1984, and in the space of 3 – 4 years, after restructuring its economy, went from being the 24th least open economy in the OECD to being the 1st, most open economy. And the economy grew nicely, after weathering the terrible pain of the restructuring.

• Ireland has stuck with the Troika’s demands and programme, and remains in trouble.

• Iceland, after defaulting and being locked out of the international capital markets and the initial pain, has now enjoyed multiple years of solid economic growth, and is now #1 on this chart of levels of employment.

• Meanwhile Greece is right there at the bottom. It knows that it can follow Ireland and spend another decade handing over assets to the loan sharks, sorry, the Troika and the loan sharks they represent, or it can take the Iceland approach and see renewed economic growth, quickly.

The road to growth is through a managed bankruptcy and fresh start. People can do this, and so can companies. As for lending to people, in the United Kingdom the FCA (Financial Conduct Authority) requires lenders to ensure that their clients are actually able to repay, and to ensure that the loan will not result in undue hardship. So why didn’t those lending to Greece, or to be more accurate, buying Greek bonds and therefore making an affirmative investment, confirm that their investment would be able to be repaid without undue hardship?

Read more …

Before June 1.

• Greece Two Weeks From Cash Crisis – Yanis Varoufakis (BBC)

Greece’s finance minister says his country’s financial situation is “terribly urgent” and the crisis could come to a head in a couple of weeks Yanis Varoufakis gave the warning after eurozone finance ministers met in Brussels to discuss the final €7.2bn tranche of Greece’s €240bn EU/IMF bailout. Ministers said Greece had made “progress” but more work was needed. The Greek government is struggling to meet its payment obligations. Earlier, Greece began the transfer of €750m in debt interest to the IMF – a day ahead of a payment deadline. “The liquidity issue is a terribly urgent issue. It’s common knowledge, let’s not beat around the bush,” Mr Varoufakis told reporters in Brussels. “From the perspective [of timing], we are talking about the next couple of weeks.”

Greece has until the end of June to reach a reform deal with its international creditors. Its finances are running so low that it has had to ask public bodies for help. The crisis has raised the prospect that Greece might default on its debts and leave the euro. The eurozone is insisting on a rigorous regime of reforms, including cuts to pensions, in return for the bailout, but Greece’s anti-austerity Syriza-led government is resisting the tough terms. In a statement, the eurozone finance ministers said they “welcomed the progress that has been achieved so far” in the negotiations, but added: “We acknowledged that more time and effort are needed to bridge the gaps on the remaining open issues.”

Eurogroup chairman Jeroen Dijsselbloem said there had to be a full deal on the bailout before Greece received any further payments. “There are time constraints and liquidity constraints and hopefully we will reach an agreement before time runs out and before money runs out,” he said. There had been fears that Greece would default on its IMF debt repayment due on Tuesday. However, a Greek finance ministry official was quoted as saying that the order for repayment had been executed on Monday. Almost €1bn has been handed over to the IMF in interest payments since the start of May. It is unclear how the government came up with the funds, but the mayor of Greece’s second city Thessaloniki revealed last week that he had handed over cash reserves in response to an appeal for money.

Read more …

Whaddaya know, a useful article from the Economist.

• Of Rules And Order: German Ordoliberalism (Economist)

“No matter what the topic, it’s four to one against me,” laments Peter Bofinger, one of the five members of Germany’s Council of Economic Experts, which advises the government. The other four, he says, consider deficits and debt bad, oppose the European Central Bank’s quantitative easing as “monetary meddling” and believe austerity is the answer to the euro crisis. In Germany, says Mr Bofinger, “I’m the last Keynesian—and I feel like the last Mohican.” The relationship between Mr Bofinger and his colleagues mirrors the gap that exists between German and Anglo-Saxon (or Latin) views of economics. German thinking on economics has long differed from the mainstream in other countries, including other euro-zone members.

In the past six years of euro crisis, the gap has become larger, more visible and more controversial. Sebastian Dullien of the European Council on Foreign Relations, a think-tank, says that this amounts to a “decoupling” of Germany from the rest of the world. Such a stance leaves economists outside Germany bewildered. Why are Germans sceptical of attempts by the ECB to pep up Europe’s economies? Why do they insist on fiscal austerity in countries where demand is collapsing? And why are they obsessed with rules for their own sake, as opposed to their practical effects? The answers are rooted in German intellectual history, especially in ordoliberalism.

This is an offshoot of classical liberalism that sprouted during the Nazi period, when dissidents around Walter Eucken, an economist in Freiburg, dreamed of a better economic system. They reacted against the planned economies of Nazi Germany and the Soviet Union. But they also rejected both pure laissez-faire and Keynesian demand management. The result was a school that was close both in personal contacts and in its content to the Austrian school associated with Friedrich Hayek. The two shared a view that deficit spending for demand management was foolish. Ordoliberalism differed, however, in believing that capitalism requires a strong government to create a framework of rules which provide the order (ordo in Latin) that free markets need to function most efficiently.

Read more …

Quite a few, actually.

• Some Eurozone Banks ‘Just As Likely To Fail’ As Before 2008 Crisis (Guardian)

Almost eight years after the collapse of Lehman Brothers some eurozone banks are just as vulnerable to collapse as they were before crisis hit in 2008, according to research by a UK-based academic published on Tuesday. “Our findings indicate that despite all the efforts to improve the resilience of banking, some banks are as vulnerable today as they were before the last banking crisis, they are just as likely to fail,” said Nikos Paltalidis, of the University of Portsmouth Business School. “In case of a financial or economic shock, we found that banks would experience losses big enough to reduce their capital below the required regulatory minimum, because the quality of equity on the biggest European lenders is not sufficient to mitigate systemic crisis,” he said.

In the immediate aftermath of the collapse of Lehman in September 2008, a number of governments bailed out their banks, including in the UK where Lloyds Banking Group and Royal Bank of Scotland received a £65bn capital injection . Paltalidis did not scrutinise the UK banking sector but found that a shock in sovereign debt markets across the eurozone would spread fastest around the system to cause losses for the banking industry. He said holdings of government bonds inside eurozone banks were now the biggest proportion of their assets since 2006. The report concludes: “It is evident from the results that the European banking system remains highly vulnerable and conducive to financial contagion implying that the new capital rules have not substantially reduced systemic risks, and hence, there is a need for additional policies in order to increase the resilience of the sector”.

Read more …

$28 trillion in debt.

• China’s Banks Obscure Credit Risk, Face “Insolvency” In Property Downturn (ZH)

Data released on Friday by state regulators showed that China’s non-performing loans rose 141 billion yuan during Q1, marking the sharpest quarterly increase on record and bringing the total to 983 billion. NPLs have been on the rise in China for quite some time, and as we discussed at the end of March, the pace at which loans to the manufacturing sector have sourced has quickened in the face of the country’s slumping economy, leading the nation’s largest lenders to slash payout ratios. Anxiety over bad debt has only increased in recent weeks after a subsidiary of state-run China South Industries Group was allowed to default without government intervention suggesting that Beijing is willing to let small state-affiliated companies go if the risk to the system is deemed appropriately negligible.

The trend is especially worrisome given the sheer size of China’s debt load (a topic we first discussed years ago) which, at $28 trillion, totals more than 280% of GDP. Among that debt is some $364 billion in property loans (i.e. debt backed by property collateral) and according to Fitch, that’s not necessarily a good thing given the country’s slumping real estate sector, which saw developer Kaisa default earlier this year. The worry is that the preponderance of property loans on banks’ books serves to spread real estate risk to the economy writ large. In fact, Fitch says a lengthy downturn for China’s property market could render some large lenders insolvent given their exposure. Via Fitch:

Property exposure is the biggest threat to the viability of China’s banks because of the banking system’s reliance on real estate collateral and the strong linkages between property and other parts of the economy, Fitch Ratings says in a new special report. The agency estimates that for Fitch-rated banks, loans secured by property – residential mortgages and corporate loans backed by property – have increased 400% since end-2008, compared with 260% for loans overall. Loans secured by property now make up 40% of total loans in these banks. Residential mortgages have more than tripled since end-2008, and corporate loans secured with property have increased almost five-fold in the same period.

Read more …

That’s what the shadow banks do…

• Next Up for China’s Central Bank: How to Get Loans to Small Firms (WSJ)

Having delivered an interest-rate cut to help big state-owned companies and local governments cope with debilitating debt, China’s central bank is grappling with another thorny task: how to steer credit to the private businesses Beijing deems crucial to growth. The quarter-percentage-point reduction in benchmark lending and deposit rates on Sunday was primarily aimed at addressing debt-repayment problems that are increasingly weighing on the Chinese economy. But the rate action is likely to bring less benefit to the small companies that Beijing is counting on to shift to a more sustainable growth path, largely because Chinese banks remain reluctant to lend to them.

To prod banks to make credit more accessible for borrowers the government wants to promote, the People’s Bank of China will speed up “targeted” measures in the coming months, according to PBOC officials and economists, giving banks more liquidity on the condition that they lend more to these groups. Looking ahead, “targeted policy tools will likely play a bigger role,” said China economist Haibin Zhu at J.P. Morgan. But even within the central bank, it’s an open question how effective such measures will be. For most of last year, the PBOC had resisted “big-bang” stimulus such as interest-rate cuts to avoid adding to China’s debt burdens. Instead, it took a number of tailored measures such as cutting the amount of rainy-day reserves and providing lower-interest-rate loans only for banks that cater to small and agricultural businesses.

However, those efforts haven’t paid off in any meaningful way, say bankers and analysts, as small corporate borrowers still find it hard to get loans, especially from large banks that see them as riskier than bigger companies. Li Qiang, at Guangrao Rural Commercial Bank in Shandong province, which specializes in lending to private businesses, said big banks in the region have all but stopped making new loans to factory owners and other private companies, and their reluctance has also made smaller banks like his more cautious. “Banks are worried about rising credit risks,” he said. These days, Mr. Li is spending most of his time persuading his clients to pay back loans on time. “It’s very difficult for businesses to obtain new credit.”

Read more …

Insane.

• During One Hour Every Day, China’s Stock Rally Falls Apart (Bloomberg)

It’s the most dangerous hour in the Chinese stock market – when the world’s biggest boom suddenly goes bust. The time is 1:20 to 2:20 p.m., and its losses stand out in a rally that added 545 points, or 15%, to the Shanghai Composite Index over the past 30 days. In that hour alone, the equity gauge dropped 359 points. It fell in 19 of 30 sessions, the most consistent declines among rolling one-hour periods when the Shanghai bourse was open for trading. So what’s behind the losses? Hao Hong at Bocom International says large Chinese institutions are probably choosing that time to place sell orders as they gradually re-balance portfolios to accommodate a 109% surge in Shanghai shares over the past year.

A competing theory comes from William Wong at Chinese brokerage Shenwan Hongyuan. He says overseas investors may be reducing their positions, with orders getting executed late in the Shanghai day as European money managers start to wake up. Of course, patterns like these tend to eventually self-correct as more investors catch on. “Definitely people are looking at it,” said Brett McGonegal at Reorient Group, a Hong Kong-based advisory firm. “Once the needle moves, you have a lot more that goes behind it. Computers pick it up very quickly.”

The declines may lure traders of index futures, contracts that make it easy to place leveraged bets on intraday swings, according to Bocom’s Hong. In China’s cash equities market, where the Shanghai Composite rose 3% on Monday, investors aren’t allowed to trade the same shares more than once in a single day. Whatever the trend’s staying power, it’s yet another example of how volatile Chinese stocks have become as investors grapple over what’s in store for the nation’s longest bull market.

Read more …

Expected. But a great risk this will backfire. See Nicola Sturgeon’s demand for a double-lock.

• David Cameron May Bring EU Referendum Forward To 2016 (Guardian)

David Cameron is drawing up plans to bring forward an in/out referendum on Britain’s membership of the European Union by a year to 2016 in order to avoid a politically dangerous clash with the French and German elections in 2017. As the prime minister declared that he had a mandate from the electorate to renegotiate the terms of Britain’s membership, government sources said Downing Street was keen to move quickly on the timing of the referendum. “The mood now is definitely to accelerate the process and give us the option of holding the referendum in 2016,” one source said. “We had always said that 2017 was a deadline rather than a fixed date.”

George Osborne, the chancellor, will meet other European finance ministers at a summit in Brussels on Tuesday. The issue of Britain’s membership of the EU is not on the official agenda, but it is expected to be raised informally. A parliamentary bill to approve the referendum will be included in the Queen’s speech on 27 May. The bill will be formally tabled in the House of Commons shortly afterwards to ensure that the prime minister has the option of holding the referendum next year. Government sources say there are key factors that could accelerate the momentum towards a 2016 referendum. The early introduction of the bill – and the Tories’ surprise parliamentary majority – will mean that it could enter the statute book by the end of this year if it is given a reasonably easy ride in the House of Lords.

If peers break with the Salisbury convention, which says that the upper house should not delay measures in the winning party’s election manifesto, then the government would have to force the bill through using the Parliament Act. This would take place a year after the bill’s second reading in the Commons which means the prime minister could override the Lords in June 2016. This means the referendum could be held in July or after the summer break in September 2016.

Read more …

“They believe, as Musk himself often avers, that Tesla cars “don’t burn hydrocarbons.” That statement is absurd, of course, and Musk, who holds a degree in physics from Penn, must blush when he says that. ”

• Muskular Magic (Jim Kunstler)

Elon Musk, Silicon Valley’s poster-boy genius replacement for the late Steve Jobs, rolled out his PowerWall battery last week with Star Wars style fanfare, doing his bit to promote and support the delusional thinking that grips a nation unable to escape the toils of techno-grandiosity. The main delusion: that we can “solve” the problems of techno-industrial society with more and better technology. The South African born-and-raised Musk is surely better known for founding Tesla Motors, maker of the snazzy all-electric car. The denizens of Silicon Valley are crazy about the Tesla. There is no greater status trinket in Northern California, where the fog of delusion cloaks the road to the future. They believe, as Musk himself often avers, that Tesla cars “don’t burn hydrocarbons.” That statement is absurd, of course, and Musk, who holds a degree in physics from Penn, must blush when he says that.

After all, you have to plug it in and charge somewhere from the US electric grid. Only 6% of US electric power comes from “clean” hydro generation. Another 20% is nuclear. The rest is coal (48%) and natural gas (21%) with the remaining sliver coming from “renewables” and oil. (The quote marks on “renewables” are there to remind you that they probably can’t be manufactured without the support of a fossil fuel economy). Anyway, my point is that the bulk of US electricity comes from burning hydrocarbons, and then there is the nuclear part which is glossed over because the techno-geniuses and politicians of America have no idea how they are going to de-commission our aging plants, and no idea how to safely dispose of the spent fuel rod inventory simply lying around in collection pools. This stuff is capable of poisoning the entire planet and we know it.

The PowerWall roll out highlighted the “affordability” of the sleek lithium battery at $3,500 per unit. The average cluck watching Musk’s TED-like performance on the web was supposed to think he could power his home with it. Musk left out a few things. Such as: you need the rooftop solar array to feed the battery. Figure another $25,000 to $40,000 for that, depending on whether they are made in China (poor quality) or Germany, or in the USA (and installation is both laborious and expensive). Also consider that you need a charge controller and inverter to manage the electric flow and convert direct current (DC) from the sun into usable alternating current (AC) for your house — another $3,500. So, the cost of hanging a solar electric system on your house with all its parts is more like fifty grand.

What happens when the solar panels, battery, etc., reach the end of their useful lives, say 25 years or so, when there is no more fossil fuel (or an industry capable of providing it economically). How will you fabricate the replacement parts? By then the techno-wizards will have supposedly “come up with” a magic energy rescue remedy. Stand by on that, and consider the possibility that you will be disappointed with how it works out.

Read more …

If they can, they will..

• NSA Surveillance Is Worse Than You’ve Ever Imagined (Reuters)

Last summer, after months of encrypted emails, I spent three days in Moscow hanging out with Edward Snowden for a Wired cover story. Over pepperoni pizza, he told me that what finally drove him to leave his country and become a whistleblower was his conviction that the National Security Agency was conducting illegal surveillance on every American. Thursday, the Second Circuit Court of Appeals in New York agreed with him. In a long-awaited opinion, the three-judge panel ruled that the NSA program that secretly intercepts the telephone metadata of every American — who calls whom and when — was illegal. As a plaintiff with Christopher Hitchens and several others in the original ACLU lawsuit against the NSA, dismissed by another appeals court on a technicality, I had a great deal of personal satisfaction.

It’s now up to Congress to vote on whether or not to modify the law and continue the program, or let it die once and for all. Lawmakers must vote on this matter by June 1, when they need to reauthorize the Patriot Act. A key factor in that decision is the American public’s attitude toward surveillance. Snowden’s revelations have clearly made a change in that attitude. In a PEW 2006 survey, for example, after the New York Times’ James Risen and Eric Lichtblau revealed the agency’s warrantless eavesdropping activities, 51% of the public still viewed the NSA’s surveillance programs as acceptable, while 47% found them unacceptable. After Snowden’s revelations, those numbers reversed. A PEW survey in March revealed that 52% of the public is now concerned about government surveillance, while 46% is not.

Given the vast amount of revelations about NSA abuses, it is somewhat surprising that just slightly more than a majority of Americans seem concerned about government surveillance. Which leads to the question of why? Is there any kind of revelation that might push the poll numbers heavily against the NSA’s spying programs? Has security fully trumped privacy as far as the American public is concerned? Or is there some program that would spark genuine public outrage? [..] One reason for the public’s lukewarm concern is what might be called NSA fatigue. There is now a sort of acceptance of highly intrusive surveillance as the new normal, the result of a bombardment of news stories on the topic.

I asked Snowden about this. “It does become the problem of one death is a tragedy and a million is a statistic,” he replied, “where today we have the violation of one person’s rights is a tragedy and the violation of a million is a statistic. The NSA is violating the rights of every American citizen every day on a comprehensive and ongoing basis. And that can numb us. That can leave us feeling disempowered, disenfranchised.”

Read more …

” When you teach your students that it’s “economically rational” to commit crimes where the fines for misconduct are lower than the expected return on the crime, you instill a professional ethic that has no room for morals.”

• Finance Deserves Its Corrupt Reputation (Doctorow)

Harvard/Chicago economist Luigi Zingales published a sharply argued, searing paper about the finance industry’s reputation for corruption and social uselessness, concluding that it’s largely deserved and that academic economists have a role to play in reforming it. It’s not just that finance is corrupt, or that it captures its regulators, or that it routinely bilks its least-sophisticated customers, and is complicit in frauds perpetrated by politicians against the taxpayer. Lots of industries fit that bill – but finance is much better at it than those industries, and they do it more, and more egregiously.

Implicit in Zingales’s paper is that it’s not good for finance to be universally loathed and mistrusted. It’s the same specter that haunts Piketty’s Capital, the threat of the guillotines, or at least, Glass–Steagall. Most refreshing is the prescription for academia, to be “watchdogs, not lapdogs” to finance, to be bold about policy prescriptions even if they are politically inconceivable. He cites research that puts the “Efficient Market Hypothesis” at the core of financial malfeasance. When you teach your students that it’s “economically rational” to commit crimes where the fines for misconduct are lower than the expected return on the crime, you instill a professional ethic that has no room for morals.

As finance academics, we should care deeply about the way the financial industry is perceived by society. Not so much because this affects our own reputation, but because there might be some truth in all these criticisms, truths we cannot see because we are too embedded in our own world. And even if we thought there was no truth, we should care about the effects that this reputation has in shaping regulation and government intervention in the financial industry. Last but not least, we should care because the positive role finance can play in society is very much dependent upon the public perception of our industry.

When the anti-finance sentiment becomes rage, it is difficult to maintain a prompt and unbiased enforcement of contracts , the necessary condition for competitive arm’s length financing. Without public support, financiers need a political protection to operate, but only those financiers who enjoy rents can afford to pay for the heavy lobbying. Thus, in the face of public resentment only the noncompetitive and clubbish finance can survive.

Read more …

Kerry kowtows and Bloomberg cites Breedlove on new Russian offensives? Whatever. “Kerry last met with Putin in May 2013, before relations took a turn for the worse when Russia gave asylum to Edward Snowden.”

• Kerry to Meet Putin in Russia for the First Time in Two Years (Bloomberg)

U.S. Secretary of State John Kerry will fly to Russia to meet with President Vladimir Putin for their first direct talks after two years filled with tension over Ukraine and other conflicts. Putin plans to receive Kerry on Tuesday in Sochi, the site of the 2014 Winter Olympics, the U.S. State Department announced on Monday. The top U.S. diplomat will have an opportunity to probe Putin, whose actions are drawing more attention to the inner workings of the Kremlin than at any time since the end of the Cold War. U.S. officials and analysts are trying to assess how much muscle-flexing the Russian leader plans in Europe and elsewhere as he seeks to reestablish Russia as a major power.

“Putin wants to end his isolation, this is not something which he feels comfort about,” Alexander Baunov, a senior associate at the Carnegie Moscow Center, said by e-mail. “Kerry’s goal is to see whether Putin is serious about peace in Ukraine.” In addition to Ukraine, Kerry and Putin are likely to discuss the negotiations for an Iran nuclear deal, efforts to end civil wars in Yemen and Syria, where Russia is embattled ruler Bashar al-Assad’s staunchest ally, and counterterrorism activities. Kerry will stop in Sochi on his way to a NATO foreign ministers meeting in Turkey, where the allies’ discussion will include the prospects for a new flare-up of fighting in Ukraine and steps to prevent alliance members such as the Baltic states from facing aggression by Russia.

U.S. officials such as Air Force General Philip Breedlove, NATO’s top commander, have said Russian-backed Ukrainian rebels have been using a lull in fighting under a cease-fire agreed to in February to prepare for a possible new offensive. Breedlove said the U.S. needs to increase its deterrence efforts in order to manage Putin’s “opportunistic confidence.” The U.S.’s intelligence assessment is that a renewed offensive by Ukrainian rebels is coming, and could be aimed at the southeastern port city of Mariupol, said U.S. officials who spoke on condition of anonymity to discuss classified assessments. Kharkiv in the northeast, Ukraine’s second-largest city, is also also a possibility because attention is so focused on the land corridor to Crimea, the officials said.

Read more …

Girl Power!

• Sri Lanka First Nation In The World To Protect All Its Mangroves (Guardian)

More than half the world’s mangroves have been lost over the last century but all of those surviving in Sri Lanka, one of their most important havens, are now to be protected in an unprecedented operation. The organiser of the project, the biggest of its kind, see the role of women as the key to its success. Mangroves are an important protection against climate change as they sequester up to five times more carbon than other forests, area for area. They protect coastlines against flooding, including tsunamis, and provide vital habitat for marine animals, especially crabs, shrimp and juvenile fish. In an initiative designed to prevent any more being cut down in Sri Lanka and to boost some of the poorest communities in the world, women will be offered small loans and training to start businesses.

In return for the microloans, 15,000 women – including thousands of widows from the civil war – will be expected to stop using the trees for firewood and to guard the forests near their homes. Conservationists behind the scheme, which is backed by the Sri Lankan government, believe the focus on the women will bring huge benefits to living standards in coastal communities. Moreover, they are convinced it is the most effective way to get the coastal communities to care for their mangroves instead of hacking them down for firewood. “We have discovered that if you want a project to succeed, have the women of the community run it,” said Anuradha Wickramasinghe, chairman of the Sri Lankan NGO Sudeesa. “Other conservation organisations have found the same thing. “It’s in our culture. The mother is the central. Even in my own family, my mother and my wife, it’s the same.

Read more …

“..the western part of Antarctica is losing mass at 121 billion tons (gigatons) a year..”

• Ice Loss In West Antarctica Is Speeding Up (Guardian)

As I’ve previously noted, one of the most challenging problems in climate science deals with how to measure the Earth’s system. Whether ocean temperatures, atmospheric temperatures, sea level, ice extent or other characteristics, measurements have to be made with sufficient accuracy and geographical coverage so that we can calculate long-term trends. In some parts of the planet, the measurements are particularly daunting because of the ruggedness of the terrain and the hostility of the environment. This brings us to a new study just published on Antarctic ice loss by Christopher Harig and Frederik Simons of Princeton. They work in the Princeton Polar Ice program. This study used satellite measurements to determine the rate of mass loss from this large ice sheet.

The ice sheet has two parts, a stable and large eastern part and a smaller and less stable western portion. The impact of climate change on these portions is different. The western part is losing mass at an increasing rate over the past years. In the east, however, the information is less clear. Increased precipitation (snowfall) is adding to the ice there, even while portions of the ice are warming. The satellite method that these authors used actually measures the gravitational pull of the ice on two orbiting satellites. The huge ice sheet has such a large mass that it attracts objects toward it. As the ice melts and flows into the oceans, the attraction decreases – it is this change that is measured. The satellites are part of the Gravity Recovery and Climate Experiment (GRACE) project.

In the past, the satellites could only be used to make gross measurements over large areas. Their ability to separate what is happening in different regions is very limited. For such local measurements, other techniques had to be used. The new paper provides an improvement to the resolution of GRACE. They find that the western part of Antarctica is losing mass at 121 billion tons (gigatons) a year. This rate has increased recently. In particular, in one region (the Amundsen Sea coast, the ice loss has doubled in the past six years). In the east, there is a small mass gain (approximately 30 gigatons a year). This mass gain partially offsets what is happening in the west but there is still a large loss of water to the sea each year.

Read more …

“the industry of death, the greed that harms us all, the desire to have more money.”

• ‘Many Powerful People Don’t Want Peace,’ Pope Tells Children (RT)

The “industry of death” exists in the world as many people in power live off war, Pope Francis told Italian schoolkids in the Vatican on Monday. “Many powerful people don’t want peace because they live off war,” the Pontiff said as he met with pupils from Rome’s primary schools in the Nervi Audience Hall. Talking to children during the audience organized by the Peace Factory Foundation, he explained that every war has the arms industry behind it. “This is serious. Some powerful people make their living with the production of arms and sell them to one country for them to use against another country,” the Pope was cited by AGI news agency as saying. The head of the Catholic Church labeled the arms trade “the industry of death, the greed that harms us all, the desire to have more money.”

“The economic system orbits around money and not men, women,” he told 7,000 kids present at the audience. Despite the fact that wars “lose lives, health, education,” they are being waged to defend money and make even more profit, the Pope said. “The devil enters through greed and this is why they don’t want peace,” 78-year-old Francis said. “There can be no peace without justice,” the Pope said and asked the children to repeat those words out loud three times. “Peace must be built day by day and even if, one day in the future, we can say that there will finally be no more wars, then too peace will be built day by day because peace is not an industrial product, it is artisanal: it is built day by day through our mutual love, our closeness,” he said.

Read more …

FYI.

• Water: The Weirdest Liquid On The Planet (Guardian)

Water is the only substance on Earth whose chemical formula has entered the vernacular. We all know H2O, even if we don’t understand precisely what it means. But if it sounds simple, the reality is different. This common, seemingly boring substance baffles and confuses anyone who peers at it for long enough. Water breaks all the rules. Since the 19th century, chemists have developed a robust framework to describe what liquids are and what they can do. Those ideas are almost useless at explaining the weird behaviour of water. Its strangeness underlies what happens every time you drop an ice cube into a drink. Think about it for a moment: in front of you is a solid, floating on its liquid. Solid wax doesn’t float on melted wax; solid butter doesn’t float on melted butter in a hot saucepan; rocks don’t float on lava when it spews out of a volcano.

Ice floats because water expands when it freezes. If you’ve left a bottle of fizz in the freezer overnight, you’ll know that this expansion is a powerful force: strong enough to shatter glass. This seems like a small and inconsequential curiosity, but this anomaly – one of water’s plethora of strange and unique behaviours – has shaped our planet and the life that exists on it. Through aeons of cycles of freezing and melting, water has seeped into giant boulders, cracked those rocks apart and broken them up into soil. Ice floats in our drinks, but also across our oceans as sea ice and glittering icebergs. In frozen lakes and rivers, the ice does more than decorate the surface; it insulates the water underneath, keeping it a few degrees above freezing point, even in the harshest of winters.

Water is at its most dense at 4C and, at that temperature, will sink to the bottom of a lake or river. Because bodies of water freeze from the top down, fish, plants and other organisms will almost always have somewhere to survive during seasons of bitter cold, and be able to grow in size and number. Over geological time, this oddity has allowed complex life to survive and evolve despite the Earth’s successive ice ages, periods when fragile life forms would have otherwise been wiped out on the desiccated, frozen ground and – if water behaved like a normal liquid – in solidified seas, too. This, though, is just the start. Take a glass of water and look at it now. Perhaps the strangest thing about this colourless, odourless liquid is that it is a liquid at all.

If water followed the rules, you would see nothing in that glass and our planet would have no oceans at all. All of the water on Earth should exist as only vapour: part of a thick, muggy atmosphere sitting above an inhospitable, bone-dry surface. A water molecule is made from two very light atoms – hydrogen and oxygen – and, at the ambient conditions on the surface of the Earth, it should be a gas. Hydrogen sulphide (H2S), for example, is a gas, even though it is twice the molecular weight of water. Other similar-sized molecules – such as ammonia (NH3) and hydrogen chloride (HCl) – are also gases. If you thought that was strange, how about this: hot water freezes faster than cold water. It’s a peculiarity known as the Mpemba effect, after a Tanzanian high-school student named Erasto B Mpemba, who found in 1963 that hot ice-cream mix froze faster than a colder mix in a classroom experiment. Though ridiculed by his teacher, Mpemba was not alone in noticing this peculiar effect of water – Aristotle, Francis Bacon and René Descartes have all written about it.

To understand why water bends all the rules, think about how an insect – a water strider, say – can zip along the surface of a pond. It doesn’t fall into the depths because of the water’s surface tension, which is immense when compared with that of other liquids. This comes about because of the intriguing ability of water molecules to stick to each other. In the liquid form, the hydrogen atoms of one water molecule are attracted to the oxygen atom of another molecule. Each water molecule can form up to four of these hydrogen bonds and, collectively, they give water a cohesiveness unique in liquids. This explains why water is a liquid on the surface of the Earth: the hydrogen bonds hold the molecules together in such a way that more energy than normal is needed to separate them, for example if you want to boil the liquid into a gas.

Read more …