Louise Rosskam General store in Lincoln, Vermont 1940

“Yellen is a lame-duck chair. And Trump is going to want to cook her goose. It isn’t going to be pheasant.”

• Janet Yellen Needs To Announce Her Resignation — Not A Rate Hike (Crudele)

If Janet Yellen had any class, she wouldn’t just be announcing an interest rate hike this week – she would also be offering her resignation. Yellen was appointed chair of the Federal Reserve by President Obama in 2014. While most heads of government agencies will soon be offering their resignations to President-elect Donald Trump, the Fed is not a government agency. It’s an independent entity. Which means Yellen doesn’t have to resign. Her term as chair – which makes her, perhaps, the second-most powerful person in Washington — doesn’t end until January 2018. And even then, she can hang around as a mere board member – one of 14 – until 2024. So, although Yellen and her colleagues have screwed things up, they get to keep their jobs. And boy has the Fed screwed things up — both before and since the financial crisis that started in 2007. [..]

It’s clear that Trump doesn’t like Yellen. And she hasn’t said anything nice about the incoming president or his policies either. So the two aren’t likely to get along. Yellen has shown no inclination to give up her job even though Trump has lashed out at her. “I think the Fed is being totally controlled,” Trump said during a campaign stop at the Economic Club of New York. “They’re not raising rates. And they’re being controlled politically.” Welcome to reality, Mr. Trump. The Fed lost its independence four decades ago. And you’ll be trying to control it soon. Yellen has hit back at Trump, saying that his pledge to spend $1 trillion on infrastructure to help the economy was dangerous. She said that after Trump spent that much money, there “is not a lot of fiscal space should a shock to the economy occur.”

Yellen also continued to assert her preposterous notion that the “economy is operating close to full employment.” If true, why hasn’t she already raised interest rates vigorously? And why, if the economy was doing so well, did the election go so badly for the incumbents — the Democrats? The Fed boss understands economics better than Trump. The higher borrowing costs that are already being seen (and which the Fed will pile onto this week) will automatically cause government borrowing costs – and therefore, spending – to increase and make US debt levels much worse. How much worse? That depends on how high rates go and how reluctant the Chinese are to continue to lend us money, especially now that Trump has picked a fight with Beijing. Yellen is a lame-duck chair. And Trump is going to want to cook her goose. It isn’t going to be pheasant.

Few people in the west know China the way Roach does.

• Stephen Roach Flags Trade, China Under Trump, Tillerson (CNBC)

Stock markets are euphoric after Donald Trump’s victory as pundits bet on U.S. economic growth based on the president-elect’s stimulus plans, but be aware of trade deficits and funding U.S. consumption, said Yale economist and noted author on China, Stephen Roach. “Given the overall savings of the U.S., that spells bigger trade deficits and for a president who is clearly raising some protectionist flags at a time when our trade deficits are going to widen, that’s a big disconnect,” Roach, a former chairman of Morgan Stanley Asia and chief economist, told CNBC’s “Squawk Box”. “The idea of larger trade deficits colliding with protectionist shifts in policy is a very worrisome development for the U.S. and for the broader global economy,” added Roach.

Roach’s comments come against a background of Trump having campaigned on remedying a wide trade gap in favor of Beijing that he said was spurred by moves to artificially weaken the yuan and restrict entry into home markets. He has also angered China by taking a congratulatory phone call from Taiwan President Tsai Ing-wen and calling into question the foundations of the “One China” policy. China is the world’s top holder of U.S Treasurys, and any major change in that stance would have broad macroeconomic impact. “The deeper question is less about the integrity of the leadership skills he can bring to the job, but how much scope for action he will have in the Trump administration … (after) Mr Trump has made some very strong statements about a number of critical foreign policy issues,” said Roach.

Roach also commented broadly on issues that will have to be resolved in the early phase of a Trump administration, including how a U.S. savings shortfall will be financed, suggesting choices of higher interest rates or a weak dollar as possibilities. He also expects a reassessment of Trump’s economic policies and outcomes in late 2017. As for Trump’s goals to shore up the battered manufacturing industries, Roach said Americans will have to pay a price for penalizing offshore operations. “As they bring those activities home, the cost of goods sold, the prices that go to American families who are hard strapped who voted for Mr. Trump, those prices are going to go up … We can’t have it both ways,”he said.

Only, the author doesn’t really say how.

• Trump May Be Turning China’s $1.16 Trillion Of Treasuries Into A Weapon (F.)

When Donald Trump talks about China devaluing its currency it’s difficult for investors to figure out exactly what he’s trying to convey. China, in fact, is trying to strengthen its own currency against the dollar as part of an effort to prevent capital from leaving the country. It leaves people uncertain whether Trump–who has access to people who know the capital markets and can point out his mistake–simply misunderstands what’s happening in global capital markets, or if he’s picking a fight with China. Trump’s decision to take a phone call Dec. 2 from Taiwan’s President, Tsai Ing-wen, sent off alarms in Beijing, and leaders there appear to be moving toward the conclusion that Trump is picking a fight. Trump’s response that the longstanding U.S. “one China” policy may be a bargaining chip in potential trade negotiations made matters worse.

China subsequently sent a bomber capable of carrying a nuclear payload outside its borders over the contested South China Sea in a show of force aimed at expressing displeasure with Trump’s posture. China held $1.16 trillion of U.S. government debt as of September, according to the most recent data available from the Treasury. That’s down by $100 billion from the year before. During that period Treasuries have actually rallied, with the benchmark 10-year note yield falling to 1.60% from 1.99%. China’s reduction in holdings didn’t hurt the bond market, as the economic stresses that led them to allocate cash away from Treasuries led other investors to seek out safety in the debt. China is well-positioned to use the bond market to show its displeasure with the U.S. in a manner that would be more than symbolic: it could sell more Treasuries. For the President-elect, who has plans to borrow to pay to ramp up infrastructure spending, that could cause real pain. The 10-year note yield has risen to a two-year high of 2.49% up from 1.88% on election day.

For more than a decade, politicians have expressed concern that China and other foreign government could use their significant stakes in Treasuries against the U.S. by dumping them on the market. Such a move would potentially drive borrowing costs throughout the U.S. sharply higher. Bond market conventional wisdom has been that this would be unlikely because it would reduce the value of the seller’s remaining reserves, weakening it’s own capital bulwarks against a future crisis. Trump’s pugnacity mixed with his seeming willingness to ignore facts contrary to his argument make it hard to assess his motives, which may scramble conventional thinking and raise the risks of an unorthodox response from China.

Let the games begin.

• China To Fine Unnamed US Automaker For ‘Monopolistic Behavior’ (R.)

China will soon slap a penalty on an unnamed U.S. automaker for monopolistic behavior, the official China Daily newspaper reported on Wednesday, quoting a senior state planning official. News of the penalty comes at a sensitive time for China-U.S. relations after U.S. president-elect Donald Trump called into question a long-standing U.S. policy of acknowledging that Taiwan is part of “one China”. Beijing maintains that self-ruled Taiwan is a wayward province of China and has never renounced the use of force to take it back. Investigators found the U.S. company had instructed distributors to fix prices starting in 2014, Zhang Handong, director of the National Development and Reform Commission’s price supervision bureau, was quoted as saying.

In an exclusive interview with the newspaper, Zhang said no one should “read anything improper” into the timing or target of the penalty. China, the world’s largest auto market, has become crucial to the strategies of car companies around the world, including major U.S. players General Motors and Ford. “We are unaware of the issue,” said Mark Truby, Ford’s chief spokesman for its Asia-Pacific operations. In a statement, GM said: “GM fully respects local laws and regulations wherever we operate. We do not comment on media speculation.”

There’s just so much borrowing going on. And that was never the Chinese way.

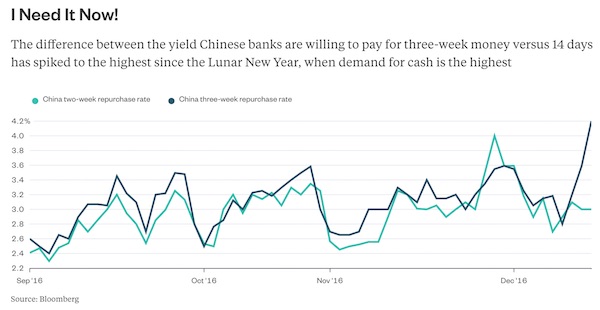

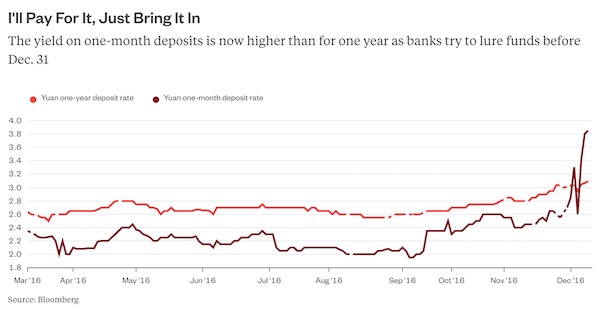

• Just Another Chinese Cash Crunch, But Bigger (BBG)

In markets where investors are highly leveraged, things tend to happen slowly at first, then fast. China is having one of those moments, and as with the 2008 crisis, it can’t be pinned on one event. On Monday, the Shanghai Composite Index sank 2.5%, then extended that decline Tuesday before rebounding to close little changed. The one-year government note yield rose 7 basis points to 2.72%, on top of Monday’s 15 basis-point increase. The root cause may be banks. There’s clearly a liquidity squeeze on Chinese lenders. Nothing new there: Financial institutions tend to face higher demand for cash in December, and this year that’s been exacerbated because Chinese New Year falls early – the holiday, when many people withdraw deposits to buy gifts and travel, begins Jan. 28.

Perhaps more important, banks also want to boost the deposits they can account for as of Dec. 31, when they close their books. Financial institutions struggled to meet a loan-to-deposit ratio ceiling of 75%, and that cap was scrapped in June. None of the banks wants to show that the amount they lend is completely disconnected from what they have in the coffers, however. Which may explain why short-term deposit rates are far higher than longer-term ones. In simple terms, this is a seasonal cash crunch. The issue is that this time it’s on steroids, because it comes after several months when the People’s Bank of China increased short-term rates. This boosted funding costs for wealth-management products and for investors using leverage to buy everything from stocks to bonds to iron ore. As some of the trades begin to offer negative returns, these investors are selling.

Curiously, Hong Kong is going through a similar issue because of the impending Federal Reserve rate increase. Then the vicious circle of leverage begins: Assets being sold drop below agreed levels, triggering margin calls – or the requirement that someone borrowing money to buy securities post more cash to back up the loan. To meet those calls, investors sell more of their securities, putting further pressure on prices and prompting new margin calls. The slump in Chinese stocks last year was exacerbated by just such a dynamic. Investors must now hope that China has learned the lesson from that rout and will use its pension funds to steady the market. Otherwise, if this selloff really is the result of a liquidity squeeze, it’s unlikely to stop before February, when people return from the holiday.

And neither has the FBI.

• Top US Spy Agency Has Not Embraced CIA Assessment On Russia Hacking (R.)

The overseers of the U.S. intelligence community have not embraced a CIA assessment that Russian cyber attacks were aimed at helping Republican President-elect Donald Trump win the 2016 election, three American officials said on Monday. While the Office of the Director of National Intelligence (ODNI) does not dispute the CIA’s analysis of Russian hacking operations, it has not endorsed their assessment because of a lack of conclusive evidence that Moscow intended to boost Trump over Democratic opponent Hillary Clinton, said the officials, who declined to be named. The position of the ODNI, which oversees the 17 agency-strong U.S. intelligence community, could give Trump fresh ammunition to dispute the CIA assessment, which he rejected as “ridiculous” in weekend remarks, and press his assertion that no evidence implicates Russia in the cyber attacks.

Trump’s rejection of the CIA’s judgment marks the latest in a string of disputes over Russia’s international conduct that have erupted between the president-elect and the intelligence community he will soon command. “ODNI is not arguing that the agency (CIA) is wrong, only that they can’t prove intent,” said one of the three U.S. officials. “Of course they can’t, absent agents in on the decision-making in Moscow.” The FBI, whose evidentiary standards require it to make cases that can stand up in court, declined to accept the CIA’s analysis – a deductive assessment of the available intelligence – for the same reason, the three officials said. [..] In October, the U.S. government formally accused Russia of a campaign of cyber attacks against American political organizations ahead of the Nov. 8 presidential election. President Barack Obama has said he warned Vladimir Putin about consequences for the attacks.

That’s quite the claim. Especially since all western reporting contradicts even the possibility.

• Lavrov Hints ISIS Recapture Of Palmyra Orchestrated By US (R.)

Foreign Minister Sergei Lavrov said talks with the United States on Syria were at a dead end, and Islamic State’s advance to Palmyra may have been staged by the United States and its regional allies to allow Syrian rebels in Aleppo a respite. During a visit to Belgrade, Lavrov said Russia was ready to quickly negotiate with the United States the opening of corridors for the pullout of rebels from Aleppo, but said these would have to be agreed before any ceasefire happened. “Our American colleagues do, so to speak, agree with that, and from Dec. 3 when we met John Kerry in Rome they supported such a concept and even gave us their approval on paper,” Lavrov told reporters at a news conference with his Serbian counterpart on Monday.

“But after three days they revoked that agreement and returned to their old, dead-end position which comprises this: Before the agreement on corridors there has to be a truce… as I understand, this would just mean the rebels would get a break,” he said. Earlier in the day, a military source said the Syrian army was on the verge of announcing victory in its battle to retake rebel-held eastern Aleppo. The Syrian army made new advances on Monday after taking the Sheikh Saeed district, leaving rebels trapped in a tiny part of the city. Lavrov also said he believed that Islamic State’s seizure of Palmyra might have been engineered by the U.S.-led coalition to divert attention from Aleppo. “That leads us to a thought – and I am sincerely hoping I am wrong, that this is all orchestrated, coordinated to give a break to those bandits that are in eastern Aleppo,” he said.

Robert Fisk suggests Lavrov may be on to something.

• There Is More Than One Truth To Tell In The Awful Story Of Aleppo (Fisk)

[..] it’s time to tell the other truth: that many of the “rebels” whom we in the West have been supporting – and which our preposterous Prime Minister Theresa May indirectly blessed when she grovelled to the Gulf head-choppers last week – are among the cruellest and most ruthless of fighters in the Middle East. And while we have been tut-tutting at the frightfulness of Isis during the siege of Mosul (an event all too similar to Aleppo, although you wouldn’t think so from reading our narrative of the story), we have been willfully ignoring the behaviour of the rebels of Aleppo. Only a few weeks ago, I interviewed one of the very first Muslim families to flee eastern Aleppo during a ceasefire. The father had just been told that his brother was to be executed by the rebels because he crossed the frontline with his wife and son.

He condemned the rebels for closing the schools and putting weapons close to hospitals. And he was no pro-regime stooge; he even admired Isis for their good behaviour in the early days of the siege. Around the same time, Syrian soldiers were privately expressing their belief to me that the Americans would allow Isis to leave Mosul to again attack the regime in Syria. An American general had actually expressed his fear that Iraqi Shiite militiamen might prevent Isis from fleeing across the Iraqi border to Syria. Well, so it came to pass. In three vast columns of suicide trucks and thousands of armed supporters, Isis has just swarmed across the desert from Mosul in Iraq, and from Raqqa and Deir ez-Zour in eastern Syria to seize the beautiful city of Palmyra all over again.

It is highly instructive to look at our reporting of these two parallel events. Almost every headline today speaks of the “fall” of Aleppo to the Syrian army – when in any other circumstances, we would have surely said that the army had “recaptured” it from the “rebels” – while Isis was reported to have “recaptured” Palmyra when (given their own murderous behaviour) we should surely have announced that the Roman city had “fallen” once more under their grotesque rule. Words matter. These are the men – our “chaps”, I suppose, if we keep to the current jihadi narrative – who after their first occupation of the city last year beheaded the 82-year-old scholar who tried to protect the Roman treasures and then placed his spectacles back on his decapitated head.

By their own admission, the Russians flew 64 bombing sorties against the Isis attackers outside Palmyra. But given the huge columns of dust thrown up by the Isis convoys, why didn’t the American air force join in the bombardment of their greatest enemy? But no: for some reason, the US satellites and drones and intelligence just didn’t spot them – any more than they did when Isis drove identical convoys of suicide trucks to seize Palmyra when they first took the city in May 2015. There’s no doubting what a setback Palmyra represents for both the Syrian army and the Russians – however symbolic rather than military. Syrian officers told me in Palmyra earlier this year that Isis would never be allowed to return. There was a Russian military base in the city. Russian aircraft flew overhead. A Russian orchestra had just played in the Roman ruins to celebrate Palmyra’s liberation.

The craziest thing I’ve seen in a long time.

• How To Make A Profit From Defeating Climate Change (Carney/Bloomberg)

From rising sea levels to more severe storms and more intense droughts, climate change will present serious risks to, and create major opportunities for, nearly every industry. Citizens, consumers, businesses, governments, and international organisations are all taking action. And entrepreneurs are developing disruptive technologies that will create and destroy value. The challenge is that investors currently don’t have the information they need to respond to these developments. This must change if financial markets are going to do what they do best: allocate capital to manage risks and seize new opportunities. Without the necessary information, market adjustments to climate change will be incomplete, late and potentially destabilising.

Public policy, consumer demand and technological innovation are driving a shift towards a low-carbon economy. Which companies and industries are most, and least, dependent on fossil fuels? And who stands ready to provide resilient and sustainable infrastructure? Which financial institutions are best positioned to gain and which to lose? In every case, which firms have the governance, resources and the strategy to manage, and profit from, these major shifts? We believe that financial disclosure is essential to a market-based solution to climate change. A properly functioning market will price in the risks associated with climate change and reward firms that mitigate them. As its impact becomes more commonplace and public policy responses more active, climate change has become a material risk that isn’t properly disclosed.

In response to a G20 request to consider the financial stability risks, the Financial Stability Board created a taskforce on climate-related financial disclosures. Its purpose is to develop voluntary, consistent disclosures to help investors, lenders and insurance underwriters manage material climate risks. As befits a solution by the market for the market, the taskforce is led by members of the private sector from across the G20, including major companies, large investors, global banks and insurers. After a year of intensive work and widespread consultation its recommendations are now publicly available. They concentrate on the practical, material disclosures most relevant to investors and creditors and which can be compiled by all companies that raise capital as well as financial institutions.

Poul Thomsen was always a disgrace.

• Greece ‘Boxed In’ as EU and IMF Fight Over Nation’s Debt Relief Plan (G.)

The row over how to stabilise the indebted Greek economy has resurfaced with renewed vigour after the European Union on Tuesday angrily rejected charges by the IMF that its current rescue programme is “not credible”. The spectre of the country’s economic crisis flaring up again deepened as the extent of the differences between creditors was laid bare. Caught in the middle, Athens also ratcheted up the rhetoric, as its finance minister told the Guardian that the IMF was “economising with the truth”. “Greece is being boxed into a corner,” said Euclid Tsakalotos, claiming that the country was under intense pressure to specify new austerity measures that made “no economic or political sense”. The war of words intensified after the IMF issued a 1,300-word statement distancing itself from the economic policies underpinning the nation’s latest bailout.

The adjustment programme agreed last summer in exchange for €86bn (£72bn) worth of rescue loans – a plan the IMF has so far refused to support – was based on measures that were “unfriendly to growth”, wrote Poul Thomsen, who directs the IMF’s European department, and Maurice Obstfeld, its chief economist. “It is not the IMF that is demanding more austerity,” the officials argued in a blog published late on Monday. “If Greece agrees with its European partners on ambitious fiscal targets, don’t criticise the IMF … when we ask to see the measures required to make such targets credible.” Athens, they said, had agreed to achieve a budget surplus – where state tax income exceeds expenditure – of 3.5% of GDP once the bailout expired in 2018, a feat that was not feasible without further cuts, said the IMF.

On Tuesday, the European commission hit back, insisting that the economic fundamentals were not only sound, but working. “The European institutions consider that the policies of the ESM program are sound and if fully implemented can return Greece to sustainable growth and can allow Greece to regain market access,” said commission spokeswoman Annika Breidthardt. The plan, she added, had undergone “several parts of scrutiny”, and even the European court of auditors had provided feedback, which had been taken into account. [..] Hopes of a political breakthrough are now resting on meetings Tsipras will have later this week with German and French leaders. But on past form, lenders are unlikely to yield, and Greek officials are now worrying that the row could be the precursor of the IMF pulling out of the programme altogether.

“s it likely when around 45% of pensioners receive monthly payments below the poverty line of €665, and almost 4 million people, that is more than a third of the population, have been classed as being at risk of poverty or social exclusion, that Greece’s main problem is that pensions and tax credit allowances are too generous?”

• Tsipras To Propose To EU Leaders That IMF Be Excluded (Kath.)

Prime Minister Alexis Tsipras is to suggest to European counterparts this week that the IMF should be left out of the Greek program, sources have told Kathimerini. Tsipras is expected to sound out Francois Hollande, who he is due to hold talks with Wednesday, and Angela Merkel, with whom he will have a working lunch on Friday, about the idea of the Fund no longer having a role in Greece’s bailout. If an agreement cannot be reached on this proposal, Tsipras will put forward the possibility of the IMF retaining just a technical role in the program. Athens believes that the political cost of the Fund remaining on board has become too high after the latest spat between the government and the organization, which flared up as the institutions returned to the Greek capital for further talks aimed at completing the bailout review.

The talks resumed under a cloud after the IMF’s European director Poul Thomsen and head of research Maurice Obstfeld published a blog post on Monday night in which they denied that the Fund was responsible for asking Greece to adopt more austerity measures and claimed that the country’s pensions and tax benefits are still too generous. Finance Minister Euclid Tsakalotos confronted the IMF mission chief Delia Velculescu over the blog post when talks between the Greek government and the institutions resumed in Athens Tuesday. Velculescu is said to have assured the Greek minister that the IMF did not want to make negotiations harder but simply to express its view.

A little earlier, Tsakalotos had publicly countered the claims made by the IMF officials in their article. “In effect [the Fund] is arguing for Greek pensioners and poorer wage earners to make further economies, while it economizes on the truth,” he told The Guardian. “Greek expenditure on both pensions and other subsidies is about 70% of the EU average and 52% of that of Germany. Is it likely when around 45% of pensioners receive monthly payments below the poverty line of €665, and almost 4 million people, that is more than a third of the population, have been classed as being at risk of poverty or social exclusion, that Greece’s main problem is that pensions and tax credit allowances are too generous?” he added.

But of course they are short on anti-depressants too.

• Crisis Leaves Greeks Gloomiest In Europe And Beyond (R.)

Greece’s debt crisis has made its population the unhappiest not only in western Europe but also in comparison with people in some former Communist countries, a study showed on Tuesday. The “Life in Transition” survey conducted by the European Bank for Reconstruction and Development (EBRD) and the World Bank has questioned households across a broad region since 1991 as the Cold War came to an end, but Greece was included for the first time this year. Over 92% of Greeks said the debt crisis had affected them, with 76% of households suffering reduced income due to wage or pension cuts, job losses, delayed or suspended pay or fewer working hours.

Only one in 10 Greeks were satisfied with their financial situation and only 24% with life overall, compared with 72% in Germany and 42% in Italy, the two western European countries used as comparisons. The figure was 48% in post-communist countries. Austerity measures demanded by international creditors have been tough on Greeks. Pensions, for example, have been reduced by about a third since the crisis began in 2009. Only 16% of the respondents in Greece saw their situation improving over the next four years, compared with 48% in post-communist countries and 35 and 23% in Germany and Italy, respectively. “This signals that, despite the recent political changes and attempts at economic reforms that have taken place in the country, Greeks do not see their situation improving for the foreseeable future”, the report said.

So that stops all fracking, right?!

• Final EPA Study Confirms Fracking Contaminates Drinking Water (EW)

The U.S. Environmental Protection Agency (EPA) has released its widely anticipated final report on hydraulic fracturing, or fracking, confirming that the controversial drilling process indeed impacts drinking water “under some circumstances.” Notably, the report also removes the EPA’s misleading line that fracking has not led to “widespread, systemic impacts on drinking water resources.”The report, done at the request of Congress, provides scientific evidence that hydraulic fracturing activities can impact drinking water resources in the United States under some circumstances,” the agency stated in a media advisory. This conclusion is a major reversal from the EPA’s June 2015 pro-fracking draft report. That specific “widespread, systemic” line baffled many experts, scientists and landowners who—despite the egregious headlines—saw clear evidence of fracking-related contamination in water samples.

Conversely, the EPA’s top line encouraged Big Oil and Gas to push for more drilling around the globe. But as it turns out, a damning exposé from Marketplace and APM Reports revealed last month that top EPA officials made critical, last-minute alterations to the agency’s draft report and corresponding press materials to soft-pedal clear evidence of fracking’s ill effects on the environment and public health. Thomas Burke, EPA deputy assistant administrator and science advisor, discussed the agency’s final report released Tuesday. “There are instances when hyrdofracking has impacted drinking water resources. That’s an important conclusion, an important consideration for moving forward,” Burke told reporters today, according to The Hill. Regarding the EPA’s contentious “national, systemic conclusion,” Burke said, “that’s a different question that this study does not have adequate evidence to really make a conclusive, quantified statement.”

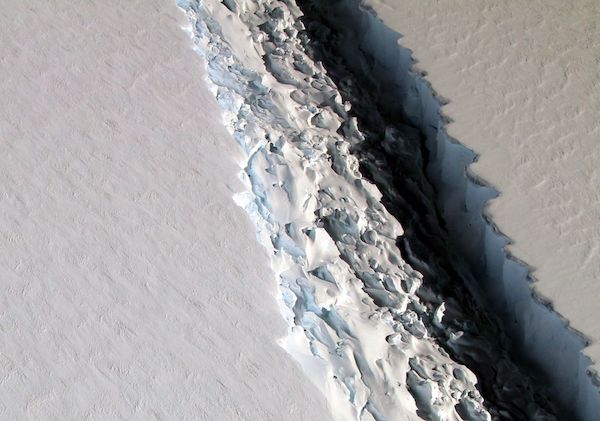

Small state, but big chunk of ice.

• A Crack In Antarctica Is Forming An Iceberg The Size Of Delaware (PopSci)

An iceberg the size of Delaware is starting to break away from Antarctica. It began with a small crack, but has now grown 70 miles long and more than 300 feet wide. When it reaches the edges of the ice sheet, the state-sized chunk will drift away into the sea. The crack is a third of a mile deep—reaching all the way to the sea below. It’s a relatively new rift in the ice sheet, called Larsen C, but is following in its icy brethren’s footsteps: Larsen A and B both broke away from the main Antarctic sheet in the last two decades in much the same way. All three began with clefts in the ice and eventually floated away to disintegrate. That dramatic a cleft is unusual—it’s more common for ice sheets to slowly break up along the edges and fall in smaller chunks. Only in the last half century has it become common for the Antarctic to form these dramatic fault lines, and scientists say global warming is likely to blame.

NASA has been monitoring the Larsen ice sheets since Larsen A broke off in 1995. Larsen B followed it in 2002, and Larsen C is expected to go the same way soon. Operation IceBridge has surveyed the polar ice caps annually for the past eight years as a way to track changes in the glaciers and ice sheets. The MIDAS Project, a U.K.-based research group, first reported the Larsen C rift in 2014 and has kept a watchful eye on it ever since. [..] The more than 2,400 square miles that is likely to break away from Larsen C will only be about 12% of the ice sheet’s total area. But once that part comes loose, the MIDAS Project predicts that the rest of the sheet could become unstable and completely disintegrate. The crack is growing steadily and shows no signs of stopping, though the break won’t happen immediately. It takes much longer for ice sheets to break up—unlike many human relationships, this one will last through the holiday season.

A rare ice crack not formed by that squirrel from the Ice Age movies – NASA/John Sonntag

Home › Forums › Debt Rattle December 14 2016