William Henry Jackson Hand cart carry, Adirondacks, New York 1902

Moving fast. A lot of global debt gets much more expensive to pay off.

• Dollar at 14-Year Peak as Fed Rejuvenates Trump Rally (R.)

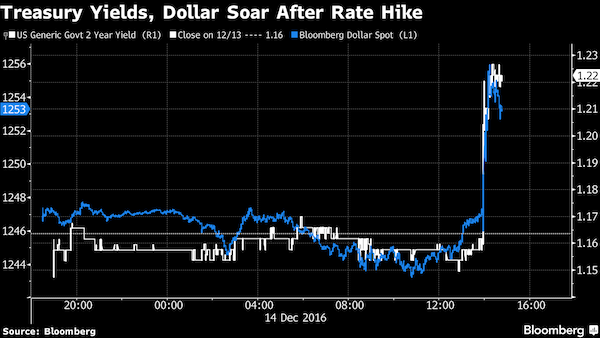

The dollar rose to a 14-year peak against a basket of major currencies on Thursday after the Federal Reserve boosted the number of projected interest rate hikes for 2017, rejuvenating the month-long Trump rally and knocking emerging market currencies. The Fed’s 25 basis-point interest rate increase on Wednesday was widely anticipated by financial markets though they appeared to have been caught out by the central bank signal of three hikes in 2017, up from around two flagged at its September policy meeting. The relatively hawkish Fed stance came as U.S. president-elect Donald Trump takes over with promises to boost growth through tax cuts, spending and deregulation. “The rate hike projections for 2017 being increased to three shows that Fed’s board is having to factor in the impact of Trump’s policies,” said Junichi Ishikawa at IG Securities in Tokyo.

The dollar index extended its overnight rally and was up 0.5% at 102.270. It touched 102.620, its highest since January 2003. The euro was down 0.2% at $1.0512 after sliding to $1.0468, a trough not seen in 21 months. The greenback set a 10-month high of 117.860 yen early on Thursday and was last up 0.3% at 117.390. The allure of higher U.S. yields took a predictable toll on emerging Asian currencies. The Chinese yuan fell to its lowest levels in more than eight years, after the central bank set the daily mid-point at the lowest since mid 2008. Low-yielding currencies such as the Singapore dollar and Korean won came under pressure, as investors grew anxious over the risk of capital being sucked out of regional economies toward dollar-based assets.

Yellen hiked rates and dotplot.

• Dollar Jumps as Fed Pulls the Trigger While Stocks, Debt Decline (BBG)

The dollar rallied, while Treasury yields spiked as the Federal Reserve signaled a steeper path for in interest rates going forward after their first hike to borrowing costs in 2016. U.S. equities slumped the most since October. The greenback climbed to its strongest level in 10 months versus the yen, advancing against most of its major peers as as traders speculated that U.S. rates may be elevated faster than previously thought. Utilities and energy shares drove the S&P 500 Index down 0.8% as two-year Treasury yields soared to their highest level in seven years. The dollar’s gains sent oil tumbling as gold also retreated. Emerging-market currencies were among the biggest decliners, while Asian index futures diverged amid the yen’s drop.

“The bottom line is that this is more hawkish than the markets expected,” said Dennis Debusschere at Evercore ISI in New York. “I don’t think the shift higher in the dots was priced in. The consensus going in was that they’d wait until they had details of the fiscal program before they actually raised the rate forecast, and they did that before they saw the details.” What was only the second U.S. rate increase in a decade tied off a volatile year for markets, with investors whipsawed by ructions in Chinese trading, then the shock wins for Brexit and Donald Trump. The Fed moving further into tightening territory puts it at the vanguard of a shift globally from easing monetary policy toward an increased focus on fiscal stimulus.

After hiking by 25 basis points, the central bank said it expects three rate increases in 2017, up from two in its September forecasts. Speaking to reporters after the decision, Fed Chair Janet Yellen sought to downplay the significance of that change in the projections. “This is a very modest adjustment in the path of the federal funds rate,” Yellen said during the press conference. The decision to raise rates is “a vote of confidence in the economy,” she said, noting that some fed officials, but not all, incorporated the assumption of a change in fiscal policies when making their forecasts.

“.. it appears the final bastion of safety has cracked”.

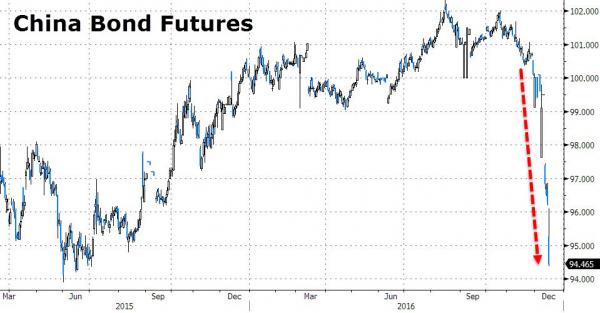

• Fed Fallout Escalates: China Bond Market Crashes Most On Record (ZH)

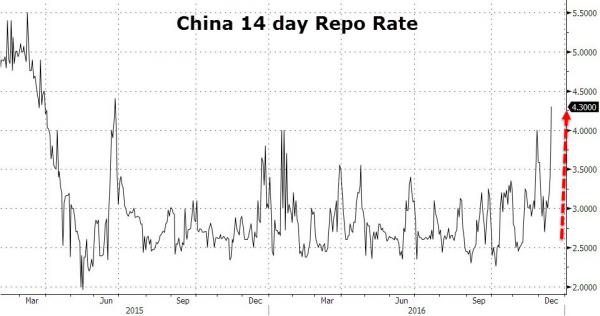

After a bubblicious surge higher over the last few months (as China’s hot money swishes from one trending-higher market to another), China’s bond market is collapsing. As Chinese money-markets tighten into new year, yuan weakens, and capital outflows accelerate, so it appears the final bastion of safety has cracked. Chinese bond futures crashed overnight by the most on record, erasing in a week the gains of the last 18 months. The rally began in 2014, buoyed by slowing economic growth and a monetary-easing cycle that kicked off in November that year. Now that is over…

As Chinese liquidity pressures ripple up from the short-term repo markets…

Offshore Yuan has tumbled 5 handles since The Fed raised rates…

And Japanese stocks cannot hold a bid despite the weaker yen. It appears Janet’s message about Trump’s fiscal plan is starting to sink in.

“They’re playing whack-a-mole constantly. They try to bring down one bubble, and something pops up somewhere else. They do that, and something comes up somewhere else..”

• Higher US Interest Rates Next Year Could Make Big Problems For China (CNBC)

Rising interest rates in the United States have an obvious effect on the world’s biggest economy — but less obvious is the impact those rates could have on the second biggest. Higher interest rates in the United States could make it harder for China to manage its exploding debt, as the Asian giant increasingly depends on borrowing in order to keep growing — while simultaneously trying to block capital from fleeing for more fruitful shores in America. “If the Federal Reserve [keeps increasing] interest rates in the United States, the single biggest casualty of that this time is going to be China, because there’s so much money just waiting to leave” the country, said Ruchir Sharma at Morgan Stanley. Sharma spoke Tuesday evening as part of a panel at the Asia Society in New York.

Sharma pointed out that over the last year, China has moved from one bubble to another: commodities, stocks and, currently, real estate. That is not a sustainable way for China to grow, he said, especially considering that China’s “debt increase over the last five years has been 60 percentage points as a share of its economy.” “They’re playing whack-a-mole constantly. They try to bring down one bubble, and something pops up somewhere else. They do that, and something comes up somewhere else,” said Sharma, who noted that housing prices in China’s largest cities have increased between 30 and 50% over the last 18 months alone. Fed officials on Wednesday approved the first U.S. interest rate increase in a year. The 0.25 percentage point hike was widely expected, but the more aggressive pace for future increases outlined by the Fed — three next year instead of the two that were previously expected — was not.

Rising U.S. rates typically mean better yields for U.S. Treasurys and a stronger U.S. dollar. And indeed, both bond yields and the greenback immediately moved higher after Wednesday’s announcement. “I certainly think we could hit a 3 (percent on the 10-year Treasury yield) by the first quarter” of next year, Rick Rieder, CIO, global fixed income at BlackRock, told CNBC on Wednesday. The 10-year was last at 3% in January 2014. [..] the ability to keep financing its “massive debt binge” is impaired, Sharma said, if too much money bleeds out of the system. And China needs a lot of money — and more and more of it — to keep hitting the largely arbitrary 6% GDP growth rate that Beijing has mandated for the country. “Today in China, it’s taking $4 in debt to create a dollar of GDP growth,” said Sharma

Oh no, it was never gone. It’s only been growing the whole time.

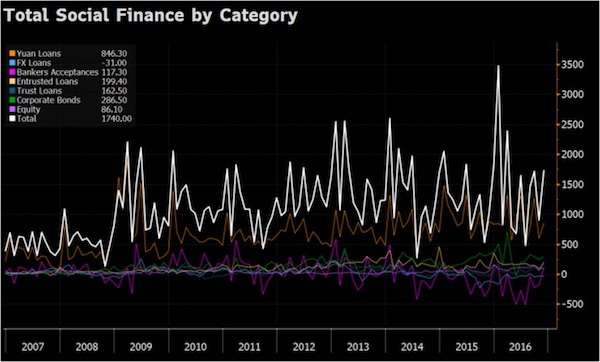

• Shadow Banking in China Appears to Have Made a Roaring Comeback (BBG)

Time to don the tin hats? Chinese shadow-banking activity registered a surprise jump in November, throwing into sharp relief how policy makers are struggling to make good on their vow to rein in the runaway loan growth that threatens the stability of the financial sector. Often cast as one of the weakest links in the global financial system given the potential threat it poses to Asia’s largest economy, shadow credit – which consists of trust loans, entrusted loans and bank-acceptance bills –rose sharply to 479 billion yuan ($69 billion), after having dropped to 55 billion yuan in October. The surprise rebound may be a reaction to expectations for continuing yuan weakness as companies look to increase their local-currency liabilities at the expense of dollar-denominated obligations.

“Today’s surprising data will likely trigger some regulatory concerns,” David Qu, China economist at Australia & New Zealand Banking, wrote in a note to clients on Wednesday, citing the size and opacity of off-balance sheet lending from trust companies, brokerages, micro-lenders, pawn-shops and even real-estate companies. The rise could reflect “short-term speculation due to expectations of renminbi depreciation and producer-price inflation,” analysts at Nomura Holdings Inc, led by Zhao Yang, wrote in a report on Wednesday. Efforts to curtail shadow lending may exacerbate this month’s liquidity squeeze, as the yield on 10-year government bonds shoots up to 3.24% from 2.74% at the end of October – their highest level in more than a year.

“If Chinese regulators start to restrict shadow banking activities, there may be spillover effects to the bond market due to liquidity tightening,” Qu adds, referring to the prospect that redemptions from wealth-management funds would force asset managers to trim their bond positions. Last month’s credit binge wasn’t confined to the shadow financial system. Total social finance, the broadest measure of new lending, expanded the most since March at 1.74 trillion yuan, up from 896.3 billion yuan in October. [..] The 11.8% increase on a year-on-year basis was driven by household lending growth, reflecting how property curbs have yet to kick in, as well as expansion in the shadow-banking sector.

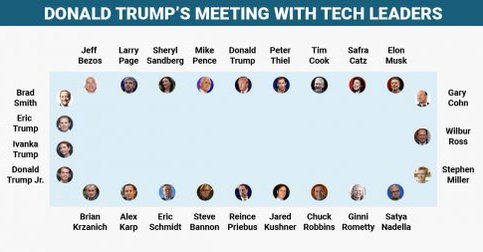

Tens of billions eating crow at that table. Trump knows exactly what Bezos, Cook etc. said about him not long ago. Eric Schmidt just about ran Hillary’s campaign.

• Trump Meets With Tech Titans: “No Formal Chain Of Command Around Here” (CNBC)

A confab of tech titans had a “productive” meeting with President-elect Donald Trump at Trump Tower on Wednesday, Amazon CEO Jeff Bezos told CNBC, as Trump moved to mend fences with Silicon Valley before taking office in January. Apple, Alphabet, Microsoft, Amazon, Facebook, Intel, Oracle, IBM, Cisco and Tesla were among the C-suite executives in attendance, with Apple CEO Tim Cook and Tesla CEO Elon Musk expected to get private briefings, according to transition staff. During the campaign, Trump issued a number of barbs directed at Bezos and his businesses, but at the meeting both men appeared nothing but complimentary. “I found today’s meeting with the president-elect, his transition team, and tech leaders to be very productive,” Bezos said.

“I shared the view that the administration should make innovation one of its key pillars, which would create a huge number of jobs across the whole country, in all sectors, not just tech—agriculture, infrastructure, manufacturing—everywhere.” Though many tech leaders actively opposed his election, Trump said at the meeting he was interested in helping tech do well — and that the executives can call any time, since there’s no formal chain of command. “We want you to keep going with the incredible innovation,” Trump said. “There’s no one like you in the world….anything we can do to help this go along, we’re going to be there for you. You can call my people, call me — it makes no difference — we have no formal chain of command around here.”

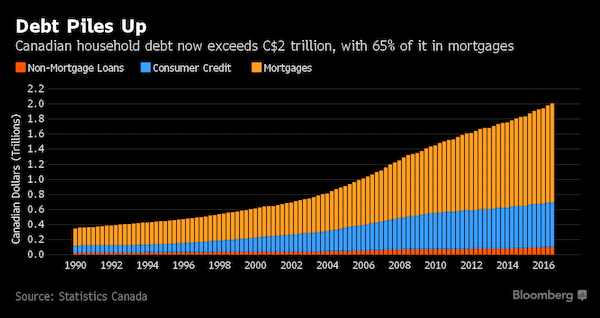

As someone commented on Twitter: “Carney’s baby is all grown up”.

• Canada’s Gravity-Defying Household Debt Swells to C$2 Trillion (BBG)

The appetite for bank borrowing remained unabated in the third quarter, setting fresh records for total credit and mortgage borrowing, Statistics Canada reported Wednesday. The widely-followed ratio of household debt to after-tax income rose to another record high of almost 167%. The numbers will intensify concern among policy makers the economy has become over-reliant on bank borrowing, and is vulnerable to a housing downturn and rising interest rates. The latest report covers the three months before Finance Minister Bill Morneau tightened mortgage lending rules again in October, a move designed to discourage Vancouver and Toronto home buyers from signing larger mortgages than they could handle.

“Household indebtedness continues to defy gravity and remains the Achilles heel of the Canadian economy,” said Charles St-Arnaud at Nomura Securities, who has worked in Canada’s finance department and central bank. “Continued increase in yields and job losses remain the biggest risks.” Credit-market debt climbed to C$2.005 trillion ($1.53 trillion) from C$1.980 trillion in the prior quarter. Those obligations jumped by 1.3% in the third quarter, faster than the 0.9% gain in household income. Total consumer debt exceeded the size of Canada’s economy for a second straight quarter, accounting for 101.2% of gross domestic product in the July-to-September period. Debts have climbed alongside the Vancouver and Toronto housing boom, fueled by job growth and rock-bottom borrowing costs.

Elections, anyone?

• EU Politicians Believe UK Post-Brexit Trade Deal Could Take Decade (G.)

Europe’s politicians believe a trade deal with the UK could take up to a decade or more and could still fail in the final stages, Downing Street has been warned by the UK’s ambassador to the EU. Sir Ivan Rogers, who conducted David Cameron’s renegotiation with the EU prior to the referendum, is reported to have told the prime minister that European politicians expected that a deal would not be finalised until the early to mid-2020s, according to the BBC. That deal could still be rejected by any of the 27 national parliaments during the ratification process. It is understood Rogers was reporting back conversations he had had with European politicians, rather than giving his own advice to the British government. “It is wrong to suggest this is advice from our ambassador to the EU,” a Number 10 spokesman said. “Like all ambassadors, part of his role is to report the views of others.”

Former Tory minister Dominic Raab, a leave campaigner, said it was “reasonable to set out a worst-case scenario of five to 10 years to iron out all the detail of a trade deal.” He told BBC Radio 4’s Today programme: “The crucial question is whether we maintain barrier-free trade in the meantime, in which case there’s no real problem. I have to say it’s very unlikely in the interim that the EU would want to erect trade barriers.” The reports come after Brexit secretary, David Davis, told a select committee hearing that “everything is negotiable” within a year and a half of the formal article 50 notification in March. The deal would then take about six months to be agreed by European leaders, the European parliament and the British parliament, he said.

Try these on for size: “Murray is a controversial figure who was removed from his post as a British ambassador amid allegations of misconduct.” Misconduct? Well: “Murray was a vocal critic of human rights abuses in Uzbekistan while serving as ambassador between 2002 and 2004, a stance that pitted him against the UK Foreign Office.”

• Ex-UK Ambassador: Clinton Emails Leaked By “Disgusted” Dem. Whistleblower (DM)

A Wikileaks envoy today claims he personally received Clinton campaign emails in Washington D.C. after they were leaked by ‘disgusted’ whisteblowers – and not hacked by Russia. Craig Murray, former British ambassador to Uzbekistan and a close associate of Wikileaks founder Julian Assange, told Dailymail.com that he flew to Washington, D.C. for a clandestine hand-off with one of the email sources in September. ‘Neither of [the leaks] came from the Russians,’ said Murray in an interview with Dailymail.com on Tuesday. ‘The source had legal access to the information. The documents came from inside leaks, not hacks.’ His account contradicts directly the version of how thousands of Democratic emails were published before the election being advanced by U.S. intelligence.

Murray is a controversial figure who was removed from his post as a British ambassador amid allegations of misconduct. He was cleared of those but left the diplomatic service in acrimony. His links to Wikileaks are well known and while his account is likely to be seen as both unprovable and possibly biased, it is also the first intervention by Wikileaks since reports surfaced last week that the CIA believed Russia hacked the Clinton emails to help hand the election to Donald Trump. Murray’s claims about the origins of the Clinton campaign emails comes as U.S. intelligence officials are increasingly confident that Russian hackers infiltrated both the Democratic National Committee and the email account of top Clinton aide John Podesta. In Podesta’s case, his account appeared to have been compromised through a basic ‘phishing’ scheme, the New York Times reported on Wednesday.

U.S. intelligence officials have reportedly told members of Congress during classified briefings that they believe Russians passed the documents on to Wikileaks as part of an influence operation to swing the election in favor of Donald Trump. But Murray insisted that the DNC and Podesta emails published by Wikileaks did not come from the Russians, and were given to the whistleblowing group by Americans who had authorized access to the information. ‘Neither of [the leaks] came from the Russians,’ Murray said. ‘The source had legal access to the information. The documents came from inside leaks, not hacks.’ He said the leakers were motivated by ‘disgust at the corruption of the Clinton Foundation and the tilting of the primary election playing field against Bernie Sanders.’

‘I don’t understand why the CIA would say the information came from Russian hackers when they must know that isn’t true,’ he said. ‘Regardless of whether the Russians hacked into the DNC, the documents Wikileaks published did not come from that.’ Murray was a vocal critic of human rights abuses in Uzbekistan while serving as ambassador between 2002 and 2004, a stance that pitted him against the UK Foreign Office.

“The former CIA official said the Obama administration may feel compelled to respond before it leaves office. “This whole thing has heated up so much,” he said. “I can very easily see them saying, `We can’t just say wow, this was terrible and there’s nothing we can do.'”

Well, if Obama is truly getting involved, he has 4 days in which to turn 37 Republican electors against Trump. As for the potential fallout, which may include various forms of social conflict should the Trump victory be overturned in the 11th hour at the Electoral College, then Putin will truly win as a result of what may then follow.

• US Accuses Vladimir Putin Of “Personal Involvement” In Election Hack (ZH)

And just like that the narrative of Russia hacking the presidential election has escalated to the highest possible level, and has officially jumped the shark. Moments ago, following a month-long barrage of unsubstantiated stories in the press accusing the Russian government of indirectly hacking the US presidential election, which culminated with last night’s 8,000 word NYT expose, and which followed a schism between the FBI and CIA, in which the former disputed the latter’s “fuzzy and ambiguous” claims that Russia sought to influence the presidential elections, moments ago the NBC News reported that U.S. intelligence officials believe with “a high level of confidence” that Russian President Vladimir Putin became personally involved in the covert Russian campaign to interfere in the U.S. presidential election.

Perhaps because the official narrative has so far been unable to gather traction with the previous “shotgun approach” in which just “Russia” was accused of handing the election to Trump, four short days before the Electoral College vote, the narrative has changed and it now involves the very pinnacle of Russia’s government: the president himself. Citing two senior officials with direct access to the information, NBC reports that “new intelligence shows that Putin personally directed how hacked material from Democrats was leaked and otherwise used. The intelligence came from diplomatic sources and spies working for U.S. allies, the officials said.” So why did Putin hack a few million rust belt Americans into believing that their lives under Obama, and by extension Hillary, were bad enough that they demanded a change? NBC provides the following spoonfed logic:

Putin’s objectives were multifaceted, a high-level intelligence source told NBC News. What began as a “vendetta” against Hillary Clinton morphed into an effort to show corruption in American politics and to “split off key American allies by creating the image that [other countries] couldn’t depend on the U.S. to be a credible global leader anymore,” the official said.

Ultimately, the CIA has assessed, “the Russian government wanted to elect Donald Trump.” And this is where the latest turn in the story falls apart, because even NBC – which will blast this report on prime time TV to all America – admits “the FBI and other agencies don’t fully endorse that view”, but it adds “few officials would dispute that the Russian operation was intended to harm Clinton’s candidacy by leaking embarrassing emails about Democrats.”

As I said, looks like Tsipras has had enough.

• Eurozone Suspends Short-Term Debt Relief for Greece (WSJ)

Greece’s European creditors suspended proposed debt-relief measures for the country after the Greek government surprised them by announcing it would boost welfare benefits for low-income pensioners, a sign of escalating tensions over the country’s bailout. The moves come as Athens and its international creditors—which include the eurozone and the IMF—are struggling to conclude their latest review of the country’s rescue plan of as much as €86 billion ($92 billion) in loans. “The institutions have concluded that the actions of the Greek government appear to not be in line with our agreements,” a spokesman for Jeroen Dijsselbloem, the Dutch finance minister who presides over the group of his eurozone counterparts, said in a statement on Twitter.

“No unanimity now for implementing short-term debt measures,” he added. The step puts further pressure on Greece’s government, which is considering calling snap elections in 2017 as it grapples with slumping popularity and is losing hope of winning concessions on deeper debt relief or austerity from the eurozone and the IMF. Greece’s embattled Prime Minister Alexis Tsipras surprised Greeks and the country’s creditors last week with handouts that his government hadn’t previously discussed with bailout supervisors, which represent eurozone governments and the IMF. Mr. Tsipras promised 1.6 million pensioners a Christmas bonus of between €300 and €800. He also suspended a planned increase in sales tax for Aegean islands that have received large numbers of refugees from the Middle East and elsewhere.

Eurozone officials expressed frustration that the country’s creditors were not told in advance by Greece of its plans—widely seen as a lure to voters ahead of elections—and said the new measures would have to be assessed to determine whether they were in line with the country’s bailout commitments. “We will adhere to the [bailout] program to the letter, but whatever outperformance in revenue arises by following to the program, we will not ask anyone in order to give this money to those most in need,” Mr. Tsipras said Tuesday from the small island of Nisyros.

Can you imagine the opposition in your country doing this? They would risk being persecuted for treason. In Europe, it’s the new normal. But he might as well ask Putin.

• Greek Opposition Leader To Seek Backing In Brussels For Snap Polls (Kath.)

In talks with officials on the sidelines of a summit of the European People’s Party in Brussels that started Wednesday, conservative New Democracy leader Kyriakos Mitsotakis is to press his argument that Greece needs snap elections to sweep away the current leftist-led government and bring in a more reform-friendly administration. Mitsotakis is to meet Thursday with European Commission President Jean-Claude Juncker and European Economic and Monetary Affairs Commissioner Pierre Moscovici, among others.

ND sources are hoping that EU officials will welcome Mitsotakis’s call for political change, coming as it does just a few days after Prime Minister Alexis Tsipras unsettled the country’s creditors by announcing Christmas bonuses for thousands of pensioners and vowing to keep in place a value-added tax discount for remote islands that the government had promised its lenders to revoke. The meetings come as ND leads leftist SYRIZA by a wide margin in opinion polls. Mitsotakis’s argument is that snap polls would not be destabilizing, as they had been in January 2015, as ND is a reformist power compared to the SYRIZA coalition with Independent Greeks which the conservative party describes as “unreliable and opportunistic” in its policy-making.

Home › Forums › Debt Rattle December 15 2016