Jules Adolphe Breton The Song of the Lark 1884

Comey

Comey: ‘If Trump is elected he might weaponize the justice system against us just as we weaponized it against him.’ pic.twitter.com/VH7FyXAfHu

— @amuse (@amuse) June 5, 2023

McCain

https://twitter.com/i/status/1665614106634645504

Comer

https://twitter.com/i/status/1665769178442383360

Musk RFK

https://twitter.com/i/status/1665891058218049539

JUST IN – Robert F. Kennedy Jr Announces He Is Going to Mexico Tonight to Create a Plan to End the Border Crisis

"I'm actually going to the border tonight. I'm crossing the border around 3am into Mexico. And I'll be talking with people on both sides of the border and talking to… pic.twitter.com/kRUGTThy39

— Chief Nerd (@TheChiefNerd) June 5, 2023

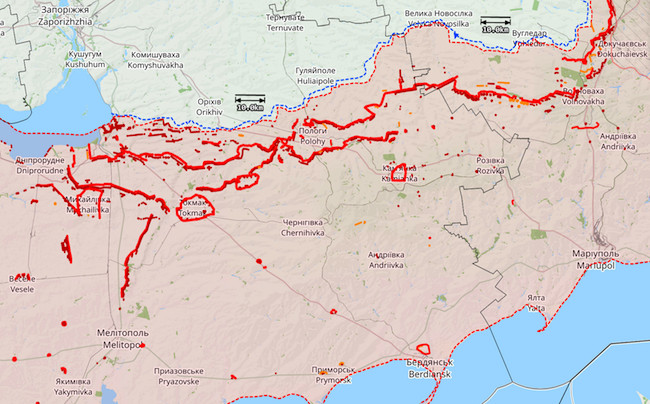

Zlatti71: Overnight (Sun-Mon), losses of the enemy in the Zaporozhye Direction and Southern Donetsk Region amounted to nearly 17APCS, 11IFVS, 9 Tanks, and beyond 900+ personnel. The advance of the enemy was only 700 metres near Velkya Novoselika; the enemy attempted to go on the offensive in Avdeevka however suffered significant losses and retreated.

In the Ugledarisky and Pobjeda (Marinskoye Tactical Region); the AFU attempted to probe the villages around Pobjeda; suffered losses amounting to nearly 250 personnel and 8 vehicles and retreated. On the Ugledarisky Tactical Region, the AFU attempted to probe the villages of Myliske and Pavlovka, however, suffered losses amounting to 13 vehicles (5 SMVs and 8 IFVs and APCs) and around 5 tanks.

In total, losses are nearing 2,000 personnel and almost 45 destroyed vehicles from one night of attack. Battles continue today, as the AFU is attempting another large-scale probing attack. Western vehicles are involved.

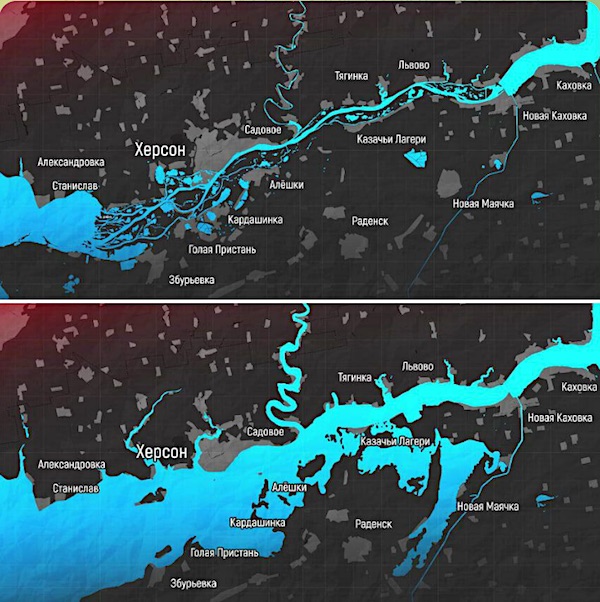

Michael Tracey: “Another round of “Russia keeps blowing up its own critical infrastructure for reasons no one can explain.” According to the allegations, Russia’s novel strategy for prosecuting the war is to bomb itself constantly..”

• Hydroelectric Dam In Kherson Partially Destroyed – Mayor (RT)

The Kakhovskaya hydroelectric dam in Russia’s Kherson Region, located on the Dnepr River upstream from the city of Kherson, suffered significant damage on Tuesday morning, according to a local official and several videos shared on social media. The upper part of the key infrastructure was “destroyed as a result of a strike,” the mayor of Novaya Kakhovka, Vladimir Leontyev, confirmed to RIA Novosti. While several of the dam’s floodgates were damaged and unleashed an uncontrolled stream of water, the underwater structure itself withstood the attack, the official claimed. Leontyev described the incident as a major “terrorist act” and said the water level downstream had risen by up to 2.5 meters, but added there was no need for evacuations thus far.

He noted that the area has seen higher water levels during previous floods caused by heavy rainfall, but emphasized that local officials were focused on helping citizens as they prepare for a worst-case scenario. “All services work in the city, all administration employees are in place. Electricity, gas, internet, communications are available,” the mayor continued. The dam was reportedly struck around 2am local time. A video captured from a drone has circulated on Telegram, purporting to show the aftermath of the attack, with streams of water seen flowing through the breach. Moscow has repeatedly blamed Kiev for numerous attacks on the Kakhovskaya dam, warning that a breach could result in the deaths of thousands of civilians. In turn, Ukraine has claimed that Russia was planning to blow up the dam in a false-flag operation aimed at framing Kiev for the flooding.

The persistent threat was cited as one of the main reasons for evacuating civilians from certain communities in the area, and an eventual pullout of Russian forces from the city of Kherson to the left bank of the Dnepr River. Russian military and civilian officials, including acting Kherson Governor Vladimir Saldo, warned at the time that many areas in the region, including the city of Kherson, could be flooded if the Kakhovskaya dam were destroyed. Kherson Region was officially declared part of Russia in early October, together with Zaporozhye Region and the People’s Republics of Donetsk and Lugansk, after people in those territories overwhelmingly supported the move in referendums. Kiev and its Western backers have labeled the votes a “sham” and vowed to recapture the territories using any means necessary.

Ukraine considered blowing up the dam to paralyze Russian forces who were defending the city of Kherson – and even “conducted a test strike with a HIMARS launcher on one of the floodgates” – a former head of Ukraine’s Operational Command South, Major General Andrey Kovalchuk, admitted in an interview with the Washington Post in December.

Dam

The Novaya Khakovka dam has been massively breached. There is no clear attribution on who is responsible. The dam facilitates, among other things, the supply of the North Crimean Canal, and the flooding would have greater impacts on the Russian-controlled left bank. Seems Ukraine… pic.twitter.com/vO45z7DKtG

— Chebureki Man (@CheburekiMan) June 6, 2023

“..three lines of well prepared positions ten kilometer apart from each other. Each line consists of tank obstacles, mine belts, prepared anti-tank positions to monitor and counter potential breach attempts..”

“..Two days fighting with such losses would destroy a brigade’s battle capability. 24 days with such losses would in effect destroy the entire fist of 12 brigades UkrAF has gathered for the counteroffensive..”

• Ukraine Launches Its Counterattack (MoA)

The long announced Ukrainian counter offensive has started. New Ukrainian units, never seen before, have come to the front. The attack was launched by Ukraine for political reasons under pressure from its ‘western’ sponsors. Militarily it is unlikely to become successful but it will eat away at whatever is left of Ukraine’s military capabilities. Attacks happened all around the front. In the north towards Belgograd, to the east and, with the most forces, towards the south. There was so far little to no success in any of the attacks. The daily report by the Russian Ministry of Defense list as Ukrainian losses over the last 24 hours 910 soldiers, 16 tanks, 33 armored combat vehicles/infantry fighting vehicle and some 30 trucks. So far only the most forward positions of Russian troops have been attacked. There are two to three well organized defense lines behind those. The Russians can fall back whenever needed and let the artillery and air force destroy their oncoming enemies.

As I wrote previously about any attacks in the direction of Tokmak and Melitopol: “From the point of strategic value the chosen target is the right one. However, it is also the one where the Russian military has prepared its strongest defense lines. In military books this is known as ‘echeloned defense’ with three lines of well prepared positions ten kilometer apart from each other. Each line consists of tank obstacles, mine belts, prepared anti-tank positions to monitor and counter potential breach attempts and well prepared artillery support from behind the next defense line. To crack such a nut without air support and without significant artillery advantage is nearly impossible.

Source: @Inkvisiit, Scribblemaps

There may still come larger attacks in other directions. But how many could there be? As a former Swedish officer notes:

“June 4th UkrAF scaled up offensive operations on the Southern Front, but the losses are too high for long time success. Earlier operations were mainly reconnaissance in force with platoon and company sized combat groups. Yesterday the Ukrainian forces seemed to be battalion sized combat groups. According to Russian MoD 8 UkrAF battalions was involved in offensive operations SE of Mala Tokmachka (1), at the Vremivka salient (2) and East of Vuhledar towards Velikonovoselovka (3). The fighting was intense, but on most places Ukrainian forces was turned back, mainly by intense Russian artillery and air attacks. On some places UkrAF succeeded in capturing a couple of hundred meters. [If the Russian numbers are true], the prospects for a Ukrainian counteroffensive looks very dim.

This is even if we don’t take into account the ongoing intense Russian air and artillery offensive against UkrAF troop concentrations, ammunition and fuel depots. With losses of over 1000 KIA and WIA that means that a Ukrainian brigade of 4000 man loose at least 25 percent of its manpower. That’s on the brink of making a brigade unusable. Two days fighting with such losses would destroy a brigade’s battle capability. 24 days with such losses would in effect destroy the entire fist of 12 brigades UkrAF has gathered for the counteroffensive. With losses of around 12 brigades, 25 000 KIA/WIA, 250 tanks and 1000 IFVs/APCs all the strategic reserves UkrAF has built during the last 6 months would be gone. In exchange the Ukrainian side could have advanced maybe 10 km on some places or more generally 2-3 km along maybe half the southern front. Once again, IF the Russian claims are true, RuAF must feel relieved and UkrAF very worried by the results of the fighting on the Southern front June 4th.”

I strongly suspect that the Russian military will let the Ukrainian attacks run their course to then launch its own larger scale attacks against weakened Ukrainian defenses.

“Milley has repeatedly stated that Ukraine is unlikely to achieve its goals – which include seizing Crimea – by military force..”

• Ukraine ‘Well Prepared’ For Counteroffensive – Top US General Milley (RT)

Ukraine is “very well prepared” for its long-anticipated counteroffensive against Russian forces, Chairman of the Joint Chiefs of Staff Mark Milley told CNN on Monday. However, Ukrainian forces suffered heavy losses in a multi-pronged attack earlier in the day, and Milley cautioned that it’s “too early to tell”if the offensive will achieve its goals. Citing the “training, ammunition, advice, intelligence, etc” provided to Kiev by its Western backers, Milley claimed that Ukraine is “very well prepared” to retake territory from Russian forces. Ukrainian officials have promised for months to launch a counteroffensive, which was initially set to take place in spring. Ukrainian President Vladimir Zelensky claimed on multiple occasions that his military was “ready” for the anticipated push, but walked back these statements by saying that he needed more time, and Western weapons, to prepare for the operation.

Throughout this preparatory period, Ukraine reportedly lost around 50,000 servicemen in the battle for the Donbass city of Artyomovsk, also known as Bakhmut, as Russian missiles and drones continuously pounded ammunition dumps, fuel depots, and command centers, often deep into Western Ukraine. Amid mixed messages from Kiev and with its combat potential seemingly degraded by the fighting in Artyomovsk, the Ukrainian military launched what appeared to be the beginning of a counteroffensive on Sunday. Throughout Sunday and into Monday morning, the Russian Ministry of Defense said that Kiev’s forces attacked with six mechanized and two tank battalions along five sections of the frontline near Donetsk, and in other regions to the north and south.

The Russian military repelled the attacks with airstrikes and artillery fire, inflicting “significant losses”on the Ukrainians, the ministry said. According to Moscow, Ukraine has lost around 900 soldiers, 16 tanks, and 33 armored vehicles across the entire frontline since Sunday. Milley has repeatedly stated that Ukraine is unlikely to achieve its goals – which include seizing Crimea – by military force. Speaking to CNN on Monday, he continued to hedge his bets, saying that it is “too early to tell what outcomes are going to happen.”

Whatever:

“Morawiecki claimed earlier this year that Moscow would follow its campaign in Ukraine with “the next offensive, potentially on the Baltic states, or Finland, or Poland, or Romania or Moldova, any other country bordering.”

• NATO Unprepared To Fight Russia – Former US General (RT)

NATO would not be able to move troops and equipment eastwards fast enough to stop a hypothetical Russian invasion of Europe, a retired US general has warned. “Being faster than the Russians to get to a critical place is the only metric that matters for effective deterrence, and we still can’t do that,” Ben Hodges, a former commander of US Army Europe, told the Washington Post on Monday. “Military mobility is still a problem. It is better than it was five years ago, but that’s not the metric that matters.” Almost one year earlier, NATO Secretary General Jens Stoltenberg announced that the bloc would increase its number of high-readiness troops from 40,000 to 300,000, without explaining which countries would provide these soldiers or pay for their deployment.

All NATO has said is that 100,000 will be deployable within ten days and the rest within a month. Estonian officials are unhappy with the arrangement, the newspaper reported, and are seeking guarantees that reinforcements would arrive “not when Russian aggression starts, but from the moment we see the first indicators and warnings,” Estonian military chief Gen. Martin Herem told the Post. “If you look at a map, then how much of Estonia and for how long will we have to cede territory?” before NATO troops would arrive, Herem asked. No matter how prepared the troops are, Hodges noted that NATO would struggle to get heavy equipment to the battlefield to back them up, as there are not enough bridges and tunnels wide enough to transport armored vehicles throughout Europe, nor enough train cars to carry them.

Some countries also doubt the commitment of their allies. Until NATO leaders work out a plan to field Stoltenberg’s promised 300,000 troops, soldiers are stationed along Russia’s borders under bilateral agreements. Germany leads a NATO battle group in Lithuania, but has opposed the creation of a permanent brigade there. This has led the Lithuanians to worry that if war were to break out, political disagreement in Berlin could delay the arrival of reinforcements, former NATO assistant secretary general Camille Grand told the Post.

Ukrainian officials have repeatedly claimed that Russian forces will continue to press into Europe unless Kiev is given enough Western weapons to fend them off, while Polish Prime Minister Mateusz Morawiecki claimed earlier this year that Moscow would follow its campaign in Ukraine with “the next offensive, potentially on the Baltic states, or Finland, or Poland, or Romania or Moldova, any other country bordering.” The Kremlin has never expressed any intention of striking NATO territory, a move that would instantly bring Russia into war with the entire alliance. Moscow has repeatedly warned the West against deepening its involvement in the conflict by supplying arms to Kiev, arguing that doing so will prolong the fighting while making NATO members de-facto participants.

Ukr Bollywood

So far, Zelensky’s much anticipated ‘counter offensive’ has been a virtual propaganda event. Latest Ukrainian Bollywood piece recruits women to fly drones on frontline… pic.twitter.com/4zaRruwhMv

— Patrick Henningsen (@21WIRE) June 5, 2023

Sounds costly.

• Kiev Renews Offensive In Donbass For 2nd Day – Russian Official (RT)

Ukrainian forces are attempting a major push against Russian troops for a second day, Vladimir Rogov, a Zaporozhye Region administration official, reported on Monday. The first effort on Sunday was repelled, with Kiev losing some 250 people and over a dozen tanks, according to the Russian Defense Ministry. The offensive began near the village of Vremevka in Donetsk Region early on Monday morning, Rogov said on social media. He assessed the maneuver as being better organized and involving more Ukrainian troops than the assault on Sunday. Kiev has long promised to launch a major counteroffensive against Russia. However, in recent weeks Ukrainian officials have explained delays by claiming that the country needs more Western weapons first. The operation on Sunday was described as “large-scale” yet “unsuccessful” by the Russian military.

The attack, which was carried out by Ukraine’s 23rd and 31st Mechanized Brigades, was repelled, the Defense Ministry reported, adding that Kiev lost more than 250 service members, 16 tanks, three infantry vehicles, and 21 armored vehicles in the clashes. Ukrainian President Vladimir Zelensky confirmed to the Wall Street Journal last week that his army was ready to commence the much-touted counteroffensive, claiming he expected it to be a success. His government considers the full takeover of all lands lost to Russia as the only acceptable result of the conflict. The US and its allies have pledged to support Ukraine “for as long as it takes” to inflict a strategic defeat on Russia. Moscow has described the hostilities as part of Washington’s proxy war against Russia. Russian officials have also said that by pumping weapons into Ukraine Western nations are simply prolonging the conflict but will not be able to change the outcome.

Somehow we seamlessly moved into Summer Counteroffensive.

• Ukraine To Forgo F-16s In Summer Counteroffensive: Defense Minister (Az.)

Ukraine’s defense minister says his country will forgo F-16 fighter jets but use all ground-based equipment in its widely anticipated counteroffensive against Russian forces this summer, Report informs. Oleksii Reznikov spoke in an exclusive interview with NHK on Sunday in Singapore, where he had joined senior defense officials from Asian and Western nations at a major security forum. When asked about the F-16 jets long coveted by Ukraine, Reznikov said they “will not be game changing this summer.” Some Western countries are training or have offered to train Ukrainian pilots to fly the aircraft.

Reznikov said it will take time to train Ukrainian pilots and that Ukraine will also have to arrange with its partners to secure engineers and technicians who can maintain and repair the sophisticated jets. He said Ukraine would be ready to deploy F-16s in the autumn or winter. Reznikov refused to answer a question about the view that Ukraine had launched “shaping operations,” which involve attacks on weapons storage facilities and other logistics bases to prepare for the counteroffensive.

It’s just one drunk commander. Nothing escalated. Or do you think the army likes drunk commanders?

• Wagner Captures Russian Commander As Prigozhin Feud With Army Escalates (G.)

Yevgeny Prigozhin’s Wagner group of mercenaries has captured a Russian commander, as the notorious leader further escalates his feud with the regular army. In a video posted on Prigozhin’s social media channels, Lt Col Roman Venevitin, the commander of Russia’s 72nd Brigade, tells an interrogator that, while drunk, he had ordered his troops to fire on a Wagner convoy. In the footage, which resembled clips of prisoner of war soldiers, Venevitin said he acted because of his “personal dislike” for Wagner and then apologised. Last week, Prigozhin accused the Russian army of trying to blow up his men as they were pulling back from the eastern Ukrainian town of Bakhmut.

The businessman, who is best known as “Putin’s chef” because of his catering contracts with the Kremlin, also claimed his men had discovered explosives, which he said were planted on purpose by defence ministry officials. The Russian ministry of defence has yet to comment on the footage. Two close family members of Venevitin confirmed to the Guardian that the man filmed in the video was their relative. Prigozhin, who has been arguing with top military officials for months, announced last week that his troops had largely pulled back from Bakhmut, most of which they captured last month after taking heavy casualties. The city is now believed to be controlled by the regular Russian forces.

The latest incident again exposes the rifts in Moscow’s war machine. It also comes amid an increase in fighting along the frontlines in the Donetsk and Zaporizhzhia regions, leading to speculation that Kyiv has launched its much-anticipated counteroffensive. Some nationalist pro-war commentators said Wagner’s arrest of a senior Russian soldier attested to Prigozhin’s growing influence within the Kremlin. “Yevgeny Prigozhin, whose subordinates posted a video in which they mock a senior officer and an entire brigade commander … is allowed to do whatever he wants. He is considered as the highest caste!” Igor Strelkov, a retired Russian special operations officer and popular military blogger, wrote on his Telegram channel.

Now both Zaluzhny and Budanov have disappeared from the radar. Why would they? And what’s the link to the new high precision satellite system Scott Ritter was talking about?

• Kiev Denies Death Of Intel Chief (RT)

Officials in Kiev have dismissed recent media reports about the alleged death of Kirill Budanov, the head of the Ukrainian military’s Main Intelligence Directorate (GUR), as a Russian “disinformation” attempt. The Ukrainian spymaster has not made any public appearances for around a week. The last time Budanov appeared in public was in video published by the GUR on May 29, a day before a Russian missile strike on Ukrainian “decision-making centers.” Since then, the GUR has only published a written statement by Budanov on June 4 but has not posted any official videos of him. Russian President Vladimir Putin confirmed in late May that the GUR headquarters was one of the targets of the Russian strike. The Russian Defense Ministry said that all of the “designated targets” had been successfully hit.

The strikes came in response to a Ukrainian drone attack targeting Moscow earlier the same day. Several residential buildings were damaged in the attack, with two people suffering minor injuries. The Defense Ministry described the drone raid as a terrorist attack staged by the “Kiev regime.” The ‘Center for Countering Disinformation’ run by the Ukrainian National Security and Defense Council said that all the reports about Budanov’s alleged death are “fakes” aimed at “sowing panic” among Ukrainians. It did not provide any evidence to disprove the reports or make any statements about Budanov’s whereabouts. In May, Budanov vowed to “keep killing Russians anywhere on the face of the earth until the complete victory of Ukraine.” He also claimed responsibility for supposedly assassinating “many” Russian public figures, without giving any names though.

The Kremlin subsequently said that Budanov’s words only prove that Russian President Vladimir Putin was right when he launched the Russian military operation in Ukraine. “We are essentially talking about a nation that is a de-facto sponsor of terrorism,” the presidential spokesman, Dmitry Peskov, told Russian media in mid-May in response to Budanov’s words. RIA Novosti reported earlier that Ukraine’s top general, Valery Zaluzhny, had sustained a severe injury to his head in another Russian strike. The general has not made any public appearances since mid-May. Kiev also branded those reports as fake. Zaluzhny’s Telegram channel has since said he held two phone conversations with top US officials but has posted no new videos of him.

“He branded the RDK and the ‘Freedom of Russia Legion’ militants as “scoundrels, bastards, murderers and fascists..”

• Russian Governor Reacts To Kiev-Backed Militants’ Demand For Meeting (RT)

Belgorod Region Governor Vyacheslav Gladkov said on Sunday that he was ready to meet the leader of the Russian Volunteer Corps (RDK), a neo-Nazi group of Russian nationals fighting for Kiev, if the militants return two of Moscow’s soldiers that were shown as captives in a recent video. “If [the Russian soldiers] are alive, [I’ll be at] the automobile border-crossing point Shebekino between 17:00 and 18:00,” Gladkov said in a video address published on his Telegram channel. He was referring to a border crossing separating Russia’s Belgorod Region from Ukraine’s territory. The governor was responding to a video published by the RDK and the ‘Freedom of Russia Legion’ – two neo-Nazi groups that previously claimed responsibility for several incursions into Russia this spring. Footage published by the militants shows them standing next to two Russian POWs, with one of them apparently injured.

Denis Nikitin, the RDK leader, claimed on the video that his fighters had entered the town of Novaya Tavolzhanka in Belgorod Region and offered to meet Gladkov in a local church “for a talk” in exchange for the POWs’ release. Gladkov said the fate of “our boys that are at the hands” of the militants was the only thing that prevented him from outright dismissing the militants’ offer. He branded the RDK and the ‘Freedom of Russia Legion’ militants as “scoundrels, bastards, murderers and fascists,” blaming them for civilian deaths. Later on Sunday, the defense ministry in Moscow said its troops and border guards had successfully repelled an attack by a sabotage group that had sought to enter Russian territory from Ukraine. The militants attempted to cross a river near Novaya Tavolzhanka but were struck with artillery and dispersed. The militants then had to fall back to Ukrainian territory, the ministry’s statement added.

A previous incursion by the RDK took place in late May. The attack left one civilian dead and 12 people injured, the Russian authorities said at that time. The Russian Defense Ministry announced in the wake of the raid that “over 70 Ukrainian terrorists, four armored combat vehicles, and five pickup trucks” had been destroyed in the militants’ clash with the Russian forces. Photos and videos released by the Russian ministry showed Western armored vehicles and equipment used by the Kiev-backed militants before being destroyed by the Russian troops. The Pentagon and the US State Department expressed doubts regarding the authenticity of the images. The Washington Post reported on Saturday that the sabotage group had used equipment and small arms provided by several NATO nations, including the US.

“..the group collaborated with the Russian Volunteer Corps, a neo-Nazi unit of Russian nationals fighting on behalf of Ukraine under the authority of the Ukrainian Defense Ministry..”

• Polish Militants Claim Involvement In Attack On Russia (RT)

Polish militants fighting for Ukraine released a statement on Sunday claiming their involvement in an attack on Russia’s Belgorod Region. The announcement, accompanied by alleged photo and video evidence, was shared on social media accounts of the so-called “Polish Volunteer Corps.” The statement appears to refer to an incursion by saboteurs into the Grayvoron District of Belgorod Region, which took place on May 22. The “Polish Volunteer Corps” said it unequivocally confirmed its role in the operation, stating that the group collaborated with the Russian Volunteer Corps, a neo-Nazi unit of Russian nationals fighting on behalf of Ukraine under the authority of the Ukrainian Defense Ministry. In a bid to prove its role in the May 22 raid, fighters from the Polish Volunteer Corps shared videos, in which they can be seen with Ukrainian T-72B tanks, American HMMWV armored vehicles, and Mi-8 helicopters of the Ukrainian Armed Forces.

The governor of Belgorod Region, Vyacheslav Gladkov, also mentioned the presence of Polish citizens among the saboteurs. On his Telegram channel, he recounted the story of a woman, whose husband – a member of the local self-defense forces – was killed in front of her. According to Gladkov, the woman was held captive by two Ukrainians, and she stated that the other group members were Poles and Americans. Previously, the Main Directorate of Intelligence (GUR) of the Ukrainian Defense Ministry discussed the involvement of the “Russian Volunteer Corps” and members of the “Freedom of Russia” legion in the Belgorod Region operation.

However, the “Russian Volunteer Corps” issued a statement on Sunday denying that members of the “Polish Volunteer Corps” had crossed the Russian border. The group claimed on social media that their Polish fellow combatants were involved in tasks such as prisoner escort, along with military and medical logistics, but strictly within the borders of Ukraine. Warsaw has insisted it has nothing to do with the Polish militants fighting for Kiev. “The activities of Polish volunteers supporting Ukraine in the fight against Russia should not be identified with the authorities of the Republic of Poland”, said Stanislaw Zaryn, spokesman for the coordinating minister of the country’s special services.

That’s obvious.

• Ukraine Operates Network Of Saboteurs Inside Russia – CNN (RT)

Ukraine has cultivated a network of well-trained agents and Ukrainian sympathizers inside Russia to perform acts of sabotage across the country, CNN has reported, citing officials familiar with US intelligence. Kiev is believed to have provided those people with Ukrainian-made drones in order to stage attacks on Russian territory, the outlet claimed in an article published on Monday. The unnamed US officials also told CNN that those pro-Ukrainian agents were responsible for an attempted drone attack on the Kremlin in early May and that the UAVs used in it were launched from inside Russia.

At the time, two drones were disabled by air defenses while trying to strike the historic fortified complex in central Moscow. Ukrainian officials denied being involved, but Moscow labeled the incident “a pre-planned terrorist act” and an attempt on Russian President Vladimir Putin’s life by Kiev. CNN’s sources couldn’t say if those saboteur cells had anything to do with another drone attack on Moscow that took place last Tuesday. Several residential buildings in the capital were damaged in the raid, with two people suffering minor injuries. Three of the incoming drones were suppressed by electronic warfare measures, while five others were shot down by air defenses, according to the Russian military.

Two officials told CNN that Ukraine had been delivering whole UAVs and spare parts to build them to its agents via smuggling routes that had been allegedly established in Russia by Kiev. The issue of who is controlling those saboteurs is a “murky” one, according to CNN. However, it pointed out that US officials believed some agents within Ukraine’s intelligence community were involved in these attacks. Following the drone strike in Moscow a week ago, Putin accused Ukraine of “terrorist activity,” as well as trying to provoke Russia to come up with a tit-for-tat response.

Russia can ship it all to Africa by itself. But Ukraine cannot.

• Russia Sees No Prospects For Further Extension Of Grain Deal (TASS)

Russia sees no prospects for extending the grain deal again, but consultations with UN representatives on existing agreements continue, Deputy Foreign Minister Sergey Vershinin told reporters on Monday. When asked by TASS about the chances of extending the grain deal he replied: “We do not see them, but we continue, of course, consultations with UN representatives on both parts of those package agreements that, as you know, were signed in July last year.” The diplomat stressed that Ukraine has been putting forward various conditions for the implementation of the grain deal, which has already brought the situation to a standstill. “We have said several times that ammonia is included in the agreements that were signed in Istanbul. This implies that it should be exported and sold as a mutually beneficial commercial transaction.

Unfortunately, putting forward various kinds of requirements, as Kiev does, is very bad, and has already brought the situation to a standstill,” the deputy foreign minister said. Vershinin also recalled that the Russian side proceeds from the fact that “the concluded and existing agreements must be implemented in full.” “This means – without distortions in one direction or the other,” he stressed. The senior diplomat also announced that the Joint Coordination Center (JCC) in Istanbul has resumed ship inspections under the grain deal. “As far as we know, the Joint Coordination Center in Istanbul is working to overcome all the problems that arise, based on the procedural rules that were unanimously approved last year. It is assumed that there will be a consensus solution to emerging problems. Now these inspections are being resumed,” he said.

Note: I don’t subscribe to the NYT or any other outlet. That would go against the idea of being open to and for everyone: accept no paywalls anywhere. Through a mirror site, though, is OK. That’s also how I can do RT etc. Either post the entire article or make sure it’s available via a mirror site.

As for this NYT piece: Yeah, why not compare the Confederate flag with the swastika? No shame.

“Wearing Nazi symbols helps our enemies spread lies about our friends being Nazis — NY Times”

• Nazi Symbols on Ukraine’s Front Lines Highlight Thorny Issues of History (NYT)

Since Russia began its invasion of Ukraine in February 2022, the Ukrainian government and NATO allies have posted, then quietly deleted, three seemingly innocuous photographs from their social media feeds: a soldier standing in a group, another resting in a trench and an emergency worker posing in front of a truck. In each photograph, Ukrainians in uniform wore patches featuring symbols that were made notorious by Nazi Germany and have since become part of the iconography of far-right hate groups. The photographs, and their deletions, highlight the Ukrainian military’s complicated relationship with Nazi imagery, a relationship forged under both Soviet and German occupation during World War II. That relationship has become especially delicate because Russian President Vladimir Putin has falsely declared Ukraine to be a Nazi state, a claim he has used to justify his illegal invasion.

Ukraine has worked for years through legislation and military restructuring to contain a fringe far-right movement whose members proudly wear symbols steeped in Nazi history and espouse views hostile to leftists, LGBTQ movements and ethnic minorities. But some members of these groups have been fighting Russia since the Kremlin illegally annexed part of the Crimea region of Ukraine in 2014 and are now part of the broader military structure. Some are regarded as national heroes, even as the far-right remains marginalized politically. The iconography of these groups, including a skull-and-crossbones patch worn by concentration camp guards and a symbol known as the Black Sun, now appears with some regularity on the uniforms of soldiers fighting on the front line, including soldiers who say the imagery symbolizes Ukrainian sovereignty and pride, not Nazism.

In the short term, that threatens to reinforce Putin’s propaganda and giving fuel to his false claims that Ukraine must be “de-Nazified” — a position that ignores the fact that Ukrainian President Volodymyr Zelenskyy is Jewish. More broadly, Ukraine’s ambivalence about these symbols, and sometimes even its acceptance of them, risks giving new, mainstream life to icons that the West has spent more than a half-century trying to eliminate. “What worries me, in the Ukrainian context, is that people in Ukraine who are in leadership positions, either they don’t or they’re not willing to acknowledge and understand how these symbols are viewed outside of Ukraine,” said Michael Colborne, a researcher at the investigative group Bellingcat who studies the international far right. “I think Ukrainians need to increasingly realize that these images undermine support for the country.” In a statement, the Ukrainian Defense Ministry said that, as a country that suffered greatly under German occupation, “We emphasize that Ukraine categorically condemns any manifestations of Nazism.”

So far, the imagery has not eroded international support for the war. It has, however, left diplomats, Western journalists and advocacy groups in a difficult position: Calling attention to the iconography risks playing into Russian propaganda. Saying nothing allows it to spread. Even Jewish groups and anti-hate organizations that have traditionally called out hateful symbols have stayed largely silent. Privately, some leaders have worried about being seen as embracing Russian propaganda talking points. Questions over how to interpret such symbols are as divisive as they are persistent, and not just in Ukraine. In the American South, some have insisted that today, the Confederate flag symbolizes pride, not its history of racism and secession. The swastika was an important Hindu symbol before it was co-opted by the Nazis.

Major “growth” engine. But always problematic.

• Should Beijing Shoulder Some Of The Local Governments’ Debts? (SCMP)

China’s local government debt crisis is approaching a tipping point as concerns over city and county government default risks mount and Beijing’s willingness to offer enough support to avert a meltdown is questioned. Late last month, Kunming, capital of the southwestern province of Yunnan, denied online reports that its local government financing vehicles (LGFVs) were having difficulty repaying debt after one of them was involved in a last-minute scramble to repay 2 billion yuan (US$282.3 million) on May 21. LGFVs were created to aid off-budget financing, especially for infrastructure spending, but weak disclosure requirements have led to concerns about hidden debt risks.

In April, a government think tank in Guizhou warned that the province, which neighbours Yunnan, could not manage its debt on its own and needed help from the central government. The report was subsequently removed by censors. Over the past few years, Beijing has stepped up its supervision of local government debt in a bid to curb risks and has said that local governments should not count on a state bailout. But Yu Yongding, a prominent economist and former central bank adviser, said the central government’s approach of relying on local governments to sort out their debt problems was wrong. “Local governments are the offspring of the central government, and the central government must also assume certain responsibilities,” Yu wrote in a blog post published on May 4 by the Economists 50 Forum, a Chinese think tank.

“Importantly, resolving local government debt should not lead to a further decline in economic growth. Of course, moral hazard cannot be encouraged. Those who are directly responsible for causing the deterioration of local debts should also bear corresponding responsibilities.” Yu estimated that the central government only contributed around 0.1 per cent of infrastructure spending, compared to nearly 60 per cent by LGFVs, which incurred higher borrowing costs. Hu Jie, a former senior economist at the US Federal Reserve Bank of Atlanta and now a professor at Shanghai Jiao Tong University, said the ratio of local debt to gross domestic product (GDP) in many provinces was already “too high”.

And deleveraging “too quickly” might trigger a series of defaults, Hu told the Shanghai-based news website guancha.cn in an interview published at the end of last month. “But when a local government has problems and cannot clean up the mess, the central government cannot stay out of it,” Hu said. There are no official figures for local governments’ off-balance sheet borrowing but most estimates indicate it has been growing.

After the Covid “The Science” debacle, we must be sceptical here too.

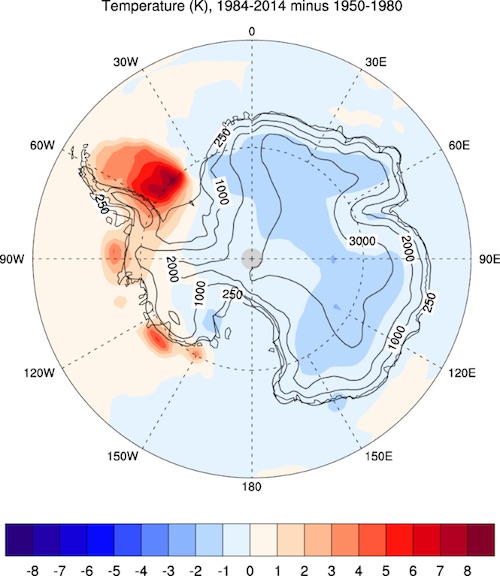

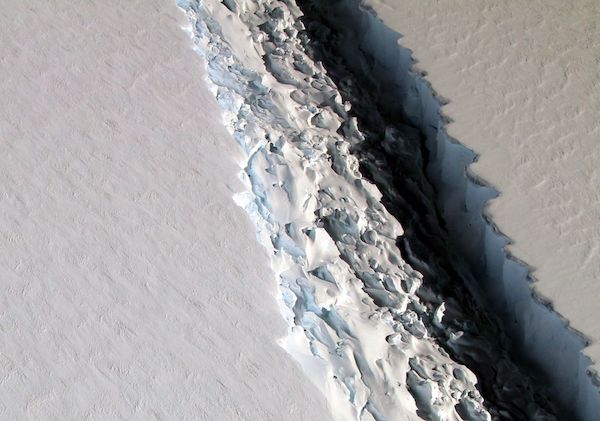

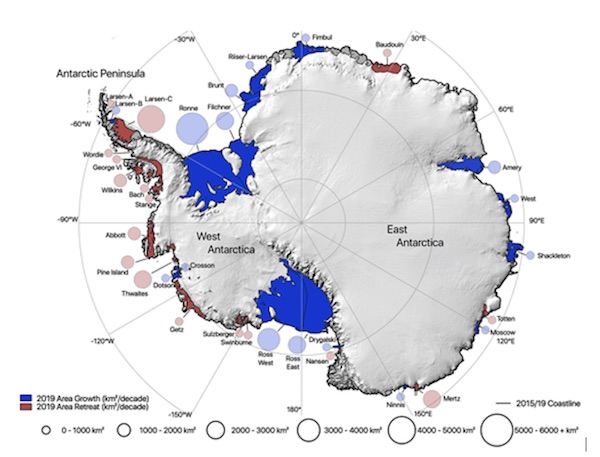

• Ice Shelves Surrounding Antarctica Grew In Overall Size From 2009-2019 (DS)

The ice shelves surrounding Antarctica grew in overall size during the 11 years to 2019, according to dramatic new evidence published by three climate scientists from the University of Leeds. The growth was significant with overall shelf area increasing by 5,305 km2, adding 0.4% to the total shelf area in the 11 years under review. The paper has just been published by the influential European Geosciences Union, but it raises questions within the ‘settled’ climate science narrative, so it is highly unlikely to be covered by mainstream media.

The Leeds researchers looked at satellite data to measure the annual calving position and area of 34 ice sheets accounting for 80% of the Antarctica coastline. They found reductions in the area on the Antarctica Peninsula and West Antarctica of 6,693 km2 and 5,563 km2 respectively were outweighed by growth in East Antarctica of 3,532 km2 and 14,028 km2 in the large Ross and Ronne-Filchner ice shelves. The largest retreat occurred on the Larsen C shelf when 5,917 km2 was lost in a single calving event that made alarmist headlines around the world. The largest increase, noted in slightly less media detail, was the 5,889 km2 advance on the Ronne platform.

Ice shelves around the coast of Antarctica play an important role in the cycle of ice production since they often buttress the glaciers behind them. Remove the plug and glaciers can move at a faster rate towards the coast. The shelves show considerable natural variation allowing alarmists to cherry-pick significant collapses into the sea to promote a hypothesis that the overall climate is breaking down. Typical of this coverage was an article by BBC science correspondent Jonathan Amos in 2021 under a ‘climate change’ heading, noting, “The Antarctic ice shelf in the line of fire.” In 2017, i News reported comments broadcast by Sir David Attenborough said to warn that “Antarctica’s melting ice sheets could flood London by end of century”.

The above map displays the ice shelf areas in blue that have increased in size and colours in red those that have decreased. The two large blue areas are the Ross and Ronne-Filchner areas. Little loss is shown over the east of the continent with deficits concentrated in the West. In total, 18 ice shelves are said to have retreated and 16 larger platforms have grown in area. Overall, the shelves gained 661 giga tonnes of mass over the decade. The scientists note that using a ‘steady’ state process, by which they mean no change in any variable, would produce an estimate of substantial loss over the period. They argue their work demonstrates the importance of using “time-variable calving flux observations to measure change”.

In short, and in less scientific terms, check actual observations, and ignore make-believe computer models, and the resulting stories published by climate alarmists promoting the collectivist Net Zero project. It is not a surprise that ice shelves are currently thinning in parts of West Antarctica. The area is riddled with buried volcanos, with the recent discovery of another 91 bringing the known total to 138. Across the West Antarctica Rift System, their heights range from 300-12,600 ft. In addition, areas around the Thwaites-Pine Island-Pope glacier have a thin Earth crust causing one group of scientists to note that the “elevated geothermal heat flow band” is exerting a “profound influence on the flow dynamics of the Western Antarctica Ice Sheet”.

Alex Jones

https://twitter.com/i/status/1665566489527693313

Argentina TV

https://twitter.com/i/status/1665377678197768193

“The magnificent facade of Strasbourg Cathedral – what did they know in 1439 that we have forgotten?”

Twigs

https://twitter.com/i/status/1665568374146084864

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.