Arkady Shaikhet Express 1939

How do we do it? What an achievement!

• Richest 1% Own 50% Of Global Wealth, Poorest 50% Own 1% (BI)

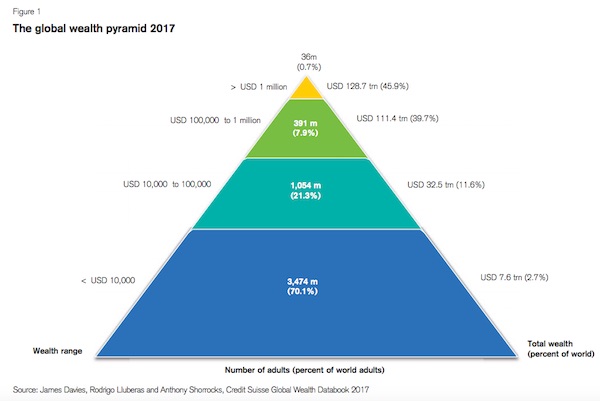

The world’s richest 1% of families and individuals hold over half of global wealth, according to a new report from Credit Suisse. The report suggests inequality is still worsening some eight years after the worst global recession in decades. The release of the Paradise Papers, a trove of leaked documents uncovered by investigative journalists detailing the offshore tax holdings of the world’s super wealthy, has reinforced just how rampant the problem of wealth inequality has become. “The bottom half of adults collectively own less than 1% of total wealth, the richest decile (top 10% of adults) owns 88% of global assets, and the top percentile alone accounts for half of total household wealth,” the Credit Suisse report said.

Put another way: “The top 1% own 50.1% of all household wealth in the world.” This handy pyramid chart, which shows the relative number of people at different wealth levels and how much of the world’s assets each bracket controls, speaks volumes about the level of income concentration, which by some measures has not been seen since the early 20th century:

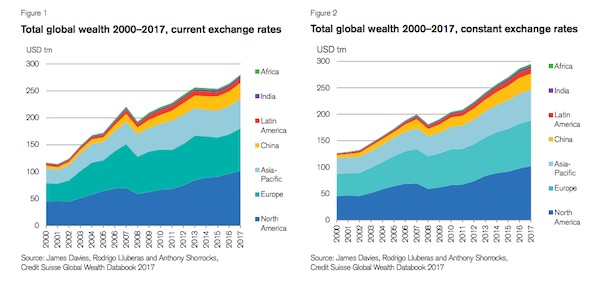

In most countries, including the United States, a large wealth gap translates into those at the top accruing political power, which in turn can lead to policies that reinforce benefits for the wealthy. President Donald Trump’s tax cut plan, for instance, has been widely criticized for favoring corporations and the wealthy over working families. Measured overall, Credit Suisse found total global wealth rose 6.4% in the year between mid-2016 and mid-2017 to $280.3 trillion. Stock market gains helped add $8.5 trillion to US household wealth during that period, a 10.1% rise. US inequality is considerably worse than in its more developed-country peers.

You really have to check the dates, to make sure this is not 10 year old news. The key word here is ‘surge’.

• US Auto-Loan Subprime Blows Up Lehman-Moment-Like (WS)

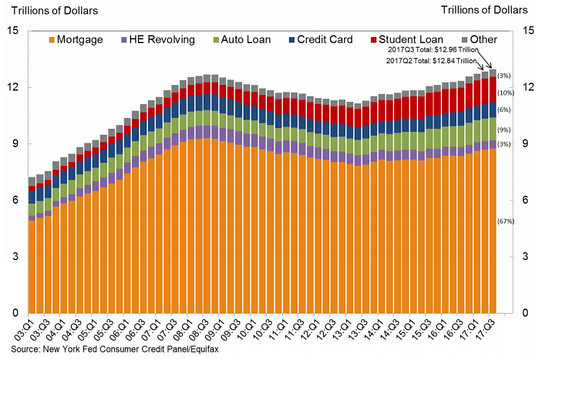

Given Americans’ ceaseless urge to borrow and spend, household debt in the third quarter surged by $610 billion, or 5%, from the third quarter last year, to a new record of $13 trillion, according to the New York Fed. If the word “surged” appears a lot, it’s because that’s the kind of debt environment we now have: Mortgage debt surged 4.2% year-over-year, to $9.19 trillion, still shy of the all-time record of $10 trillion in 2008 before it all collapsed. Student loans surged by 6.25% year-over-year to a record of $1.36 trillion. Credit card debt surged 8% to $810 billion. “Other” surged 5.4% to $390 billion. And auto loans surged 6.1% to a record $1.21 trillion. And given how the US economy depends on consumer borrowing for life support, that’s all good.

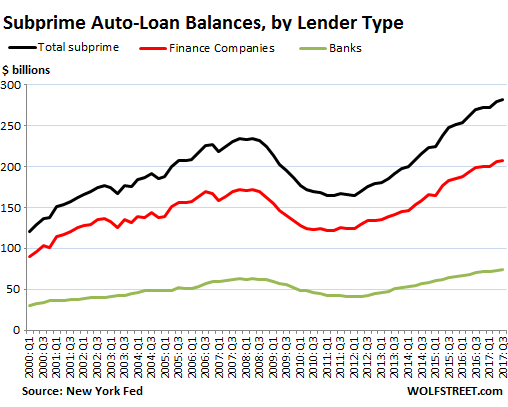

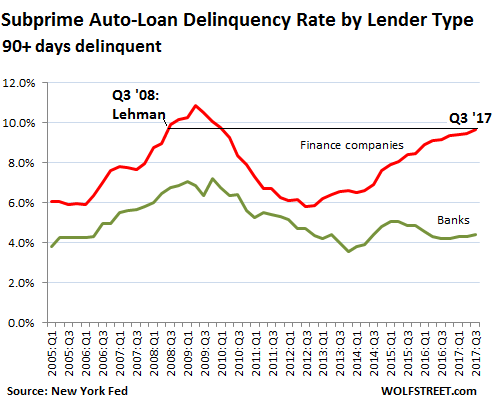

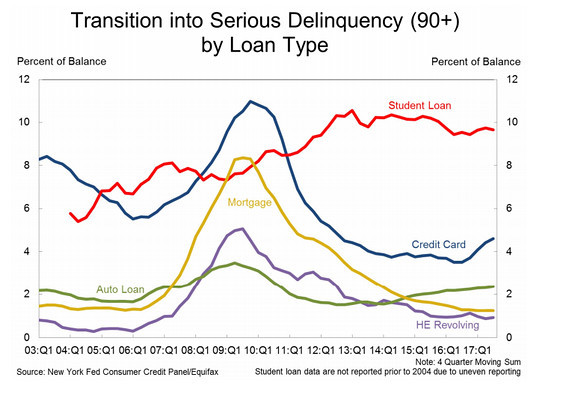

However, there are some big ugly flies in that ointment: Delinquencies – not everywhere, but in credit cards, and particularly in subprime auto loans, where serious delinquencies have reached Lehman Moment proportions. Of the $1.2 trillion in auto loans outstanding, $282 billion (24%) were granted to borrowers with a subprime credit score (below 620). Of all auto loans outstanding, 2.4% were 90+ days (“seriously”) delinquent, up from 2.3% in the prior quarter. But delinquencies are concentrated in the subprime segment – that $282 billion – and all hell is breaking lose there. Subprime auto lending has attracted specialty lenders, such as Santander Consumer USA. They feel they can handle the risks, and they off-loaded some of the risks to investors via subprime auto-loan-backed securities. They want to cash in on the fat profits often obtained in subprime lending via extraordinarily high interest rates.

Oh well.

• Household Debt Rises By $116 Billion As Credit-Card Delinquencies Pile Up (MW)

The numbers: Household debt rose by $116 billion, or 0.9%, to $12.96 trillion in the third quarter, the New York Fed said Tuesday. Credit-card debt rose by 3.1% while home equity lines of credit, or HELOC, balances fell by 0.9%. There were small gains in mortgage, student and auto debt. Flows into credit-card and auto loans delinquencies rose, with 4.6% of credit card debt 90 days or more delinquent, up from 4.4% in the second quarter, and 2.4% of auto loan debt seriously delinquent, up from 2.3%. That’s still nowhere near the 9.6% of student loan debt that is delinquent, which itself is understated because about half of those loans are currently in deferment, grace periods or in forbearance.

What happened: U.S. households aren’t aggressively leveraging up, and the ones that are did so had better credit. The higher level of auto loan originations was mainly to prime borrowers, and the median credit score to individuals originating new mortgages ticked up to 760 from 754. [..] Auto loans have grown for 26 straight quarters. But there are some worries as subprime auto loan performance continues to deteriorate — the delinquency rate for auto finance companies have grown by more than 2 percentage points since 2014, the New York Fed said.

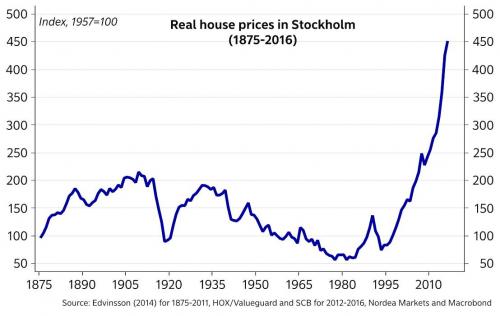

World’s biggest housing bubble?

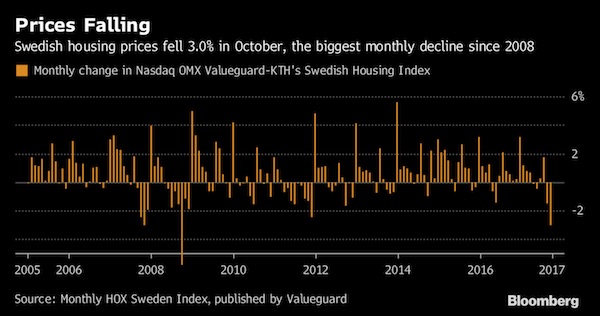

• Sweden’s Housing Market Shock is Hitting Its Currency (BBG)

Can a central bank steer the housing market? Not so long ago, Sweden’s Riksbank decided: no. Now, there’s a risk that decision may backfire as the biggest property market in Scandinavia risks sinking into a correction. The evidence of price declines was so worrying on Tuesday that it contributed to a 1.5 percent slump in the krona against the euro. A weak currency puts the Riksbank’s inflation target at risk. So should it be looking at the housing market more closely? Developments in Sweden’s housing market “could spark some doubts at the Riksbank as it may affect the overall economic outlook and inflation,” Nordea analyst Andreas Wallstrom said in a note. Sweden’s Riksbank has thrown all its energy into fighting deflation and, earlier this year, finally regained credibility on its inflation mandate.

Policy makers now say they may be ready to start raising rates in the middle of next year. At the same time, the Riksbank may extend a bond purchase program due to end this year. But in the minutes of the Riksbank’s latest rate meeting, Deputy Governor Cecilia Skingsley suggested that monetary policy, “under certain circumstances, can be used to combat the effects of major household debt.” She also said the housing market “must be carefully monitored,” given the latest developments. Nordea’s Wallstrom says the central bank will probably need to see a “sharp drop” in house prices with a direct impact on the real economy before it will look into adding significant stimulus. But the bank might decided to signal rates will stay where they are for even longer.

Which would cause panic and bank runs.

• ECB Seeks Power To Freeze Bank Deposits (BBG)

The European Central Bank intensified its push for a tool that would hand authorities the power to stop deposit withdrawals when a bank is on the verge of failing. ECB executive board member Sabine Lautenschlaeger said that bank resolution cases this year showed that a so-called moratorium tool, which would temporarily freeze a bank’s liabilities to buy time for crucial decisions, is needed. Her comment comes as policy makers in Brussels debate how such measures should be designed, and just days after the ECB officially called for the moratorium to extend to deposits as well. “If we have a long list of exemptions and we have a moratorium that doesn’t work, I do not want to have a moratorium tool,” Lautenschlaeger told a conference in Frankfurt on Tuesday. “Then you will never use it.”

EU member states appear ready to heed the request, according to a Nov. 6 paper that develops their stance on a bank-failure bill proposed by the European Commission. They suggest giving authorities the power to cap deposit withdrawals as part of a stay on payments only after an institution has been declared “failing or likely to fail.” The power to install a moratorium “can in principle apply to eligible deposits,” the paper reads. “However, resolution authority should carefully assess the opportunity to extend the suspension also to covered deposits, especially covered deposits held by natural persons and micro, small and medium sized enterprises, in case application of suspension on such deposits would severely disrupt the functioning of financial markets.”

Low interst rates = low growth economies. The chicken and the egg.

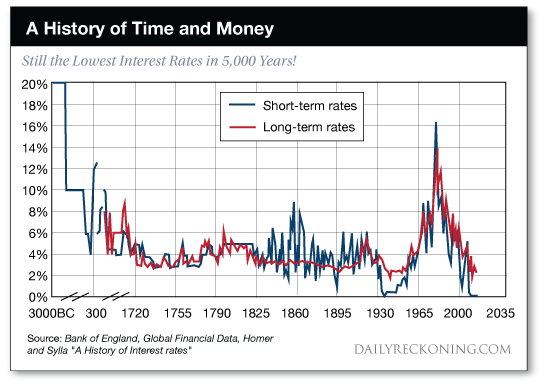

• What History Teaches About Interest Rates (DR)

“At no point in the history of the world has the interest on money been so low as it is now.” Who can dispute the good Sen. Henry M. Teller of Colorado? For lo eight years, the Federal Reserve has waged a ceaseless warfare upon interest rates. Economic law, history, logic itself, stagger under the onslaughts. We suspect that economic reality will one day prevail. This fear haunts our days… and poisons our nights. But let us check the date on the senator’s declaration… Kind heaven, can it be? We are reliably informed that Sen. Teller’s comment entered the congressional minutes on Jan. 12… 1895. 1895 — some 19 years before the Federal Reserve drew its first ghastly breath! Were interest rates 122 years ago the lowest in world history? And are low interest rates the historical norm… rather than the exception?

Today we rise above the daily churn… canvass the broad sweep of history… and pursue the grail of truth. The chart below — giving 5,000 years of interest rate history — shows the justice in Teller’s argument. Please direct your attention to anno Domini 1895: Rates had never been lower in all of history. They would only sink lower on two subsequent occasions — the dark, depressed days of the early 1930s — and the present day, dark and depressed in its own right. A closer inspection of the chart reveals another capital fact… Absent one instance at the beginning of the 20th century and a roaring exception during the mid-to-late 20th century, long-term interest rates have trended lower for the better part of 500 years.

Paul Schmelzing professes economics at Harvard. He’s also a visiting scholar at the Bank of England, for whom he conducted a study of interest rates throughout history. Could the sharply steepening interest rates that began in the late 1940s be a historical one-off… an Everest set among the plains? Analyst Lance Roberts argues that periods of sharply rising interest rates like this are history’s exceptions — lovely exceptions. Why lovely? Roberts: Interest rates are a function of strong, organic, economic growth that leads to a rising demand for capital over time. In this view, rates rose steeply at the dawn of the 20th century because rapid industrialization and dizzying technological advances had entered the scenery.

Likewise, Roberts argues the massive post-World War II economic expansion resulted in the second great spike in interest rates: There have been two previous periods in history that have had the necessary ingredients to support rising interest rates. The first was during the turn of the previous century as the country became more accessible via railroads and automobiles, production ramped up for World War I and America began the shift from an agricultural to industrial economy. The second period occurred post-World War II as America became the “last man standing”… It was here that America found its strongest run of economic growth in its history as the “boys of war” returned home to start rebuilding the countries that they had just destroyed.

“If you attribute all your problems to Trump, you’re guaranteeing more Trumps after him..”

• Deus ex Mueller isn’t Coming (CJ)

We know from the Snowden leaks on the NSA, the CIA files released by WikiLeaks, and the ongoing controversies regarding FBI surveillance that the US intelligence community has the most expansive, most sophisticated and most intrusive surveillance network in the history of human civilisation. Following the presidential election last year, anonymous sources from within the intelligence community were haemorrhaging leaks to the press on a regular basis that were damaging to the incoming administration. If there was any evidence to be found that Donald Trump colluded with the Russian government to steal the 2016 election using hackers and propaganda, the US intelligence community would have found it and leaked it to the New York Times or the Washington Post last year.

Mueller isn’t going to find anything in 2017 that these vast, sprawling networks wouldn’t have found in 2016. He’s not going to find anything by “following the money” that couldn’t be found infinitely more efficaciously via Orwellian espionage. The factions within the intelligence community that were working to sabotage the incoming administration last year would have leaked proof of collusion if they’d had it. They did not have it then, and they do not have it now. Mueller will continue finding evidence of corruption throughout his investigation, since corruption is to DC insiders as water is to fish, but he will not find evidence of collusion to win the 2016 election that will lead to Trump’s impeachment. It will not happen. This sits on top of all the many, many, many reasons to be extremely suspicious of the Russiagate narrative in the first place.

[..] If you attribute all your problems to Trump, you’re guaranteeing more Trumps after him, because you’re not addressing the disease which created him, you’re just addressing the symptom. The problem is not Trump. The problem is that America is ruled by an unelected power establishment which maintains its rule by sabotaging democracy, exacerbating economic injustice and expanding the US war machine. Stop listening to the lies that they pipe into your echo chambers and turn to face your real demons.

“IS may have been homicidal psychopaths, but they’re always correct with the money.” Says Abu Fawzi with a smile.

Lorry driver Abu Fawzi thought it was going to be just another job. He drives an 18-wheeler across some of the most dangerous territory in northern Syria. Bombed-out bridges, deep desert sand, even government forces and so-called Islamic State fighters don’t stand in the way of a delivery. But this time, his load was to be human cargo. The Syrian Democratic Forces (SDF), an alliance of Kurdish and Arab fighters opposed to IS, wanted him to lead a convoy that would take hundreds of families displaced by fighting from the town of Tabqa on the Euphrates river to a camp further north. The job would take six hours, maximum – or at least that’s what he was told. But when he and his fellow drivers assembled their convoy early on 12 October, they realised they had been lied to. Instead, it would take three days of hard driving, carrying a deadly cargo – hundreds of IS fighters, their families and tonnes of weapons and ammunition.

Abu Fawzi and dozens of other drivers were promised thousands of dollars for the task but it had to remain secret. The deal to let IS fighters escape from Raqqa – de facto capital of their self-declared caliphate – had been arranged by local officials. It came after four months of fighting that left the city obliterated and almost devoid of people. It would spare lives and bring fighting to an end. The lives of the Arab, Kurdish and other fighters opposing IS would be spared. But it also enabled many hundreds of IS fighters to escape from the city. At the time, neither the US and British-led coalition, nor the SDF, which it backs, wanted to admit their part. Has the pact, which stood as Raqqa’s dirty secret, unleashed a threat to the outside world – one that has enabled militants to spread far and wide across Syria and beyond?

Narratives are starting to move.

• How Western Imperial Power Set Out To Destroy Syria (Ren.)

Virtually unknown among large swaths the general public both in Britain and the U.S is the fact that Bashar-al Assad’s secular government won the first contested presidential election in Ba’athist Syria’s history on July 16, 2014, which was reported as having been open, fair and transparent. American Peace Council delegate, Joe Jamison, who was allowed unhindered travel throughout Syria, stated: “By contrast to the medieval Wahhabist ideology, Syria promotes a socially inclusive and pluralistic form of Islam. We [the USPC] met these people. They are humane and democratically minded…. The [Syrian] government is popular and recognised as being legitimate by the UN. It contests and wins elections which are monitored. There’s a parliament which contains opposition parties – we met them. There is a significant non-violent opposition which is trying to work constructively for its own social vision.”

Jamison added: “Our delegation came to Syria with political views and assumptions, but we were determined to be sceptics and to follow the facts wherever they led us”, he said. “I concluded that the motive of the US war is to destroy an independent, Arab, secular state. It’s the last of this kind of state standing.” The notion that the United States government and its allies and proxies, want to see the destruction of Syria’s pluralistic state under Assad destroyed, is hardly a secret. Indeed, one of Washington’s key allies in the region, Israel, has conceded as much. The claim by Israel’s defence minister, Avigdor Lieberman, that Assad’s removal is the empires “ultimate goal”, would appear to be consistent with the notion that the aim of the U.S government is to stymie the non-violent opposition inside Syria. Washington has been engaged in this strategy since early 2012 after having deliberately helped scupper Kofi Annan’s six point peace plan.

Members of the Syrian opposition within a newly reformed constitution who wanted to participate in democratic politics have instead been encouraged by the Western axis – as a result of bribing government forces to defect and through funding the Free Syrian Army – to overthrow the Assad government by violent means. As commentator Dan Glazebrook put it: “Within days of Annan’s peace plan gaining a positive response from both sides in late March, the imperial powers openly pledged, for the first time, millions of dollars for the Free Syrian Army; for military equipment, to provide salaries to its soldiers and to bribe government forces to defect. In other words, terrified that the civil war is starting to die down, they are setting about institutionalising it.”

Now proven by the BBC. What’s next?

• US Directly Supports ISIS Terrorists In Syria – Russia (Tass)

The Russian Defense Ministry has said it has obtained evidence the US-led coalition provides support for the terrorist group Islamic State (outlawed in Russia). “The Abu Kamal liberation operation conducted by the Syrian government army with air cover by the Russian Aerospace Force at the end of the last week revealed facts of direct cooperation and support for ISIS terrorists by the US-led ‘international coalition,’” the Russian Defense Ministry said. The ministry showed photo shoots made by Russian unmanned aircraft on November 9 which show kilometers-long convoys of IS armed groups leaving Abu Kamal towards the Wadi es-Sabha passage on the Syrian-Iraqi border to avoid strikes by the Russian aviation and the government army.

The US refused to conduct airstrikes over the leaving IS convoy. “Americans peremptorily rejected to conduct airstrikes over the ISIS terrorists on the pretext of the fact that, according to their information, militants are yielding themselves prisoners to them and now are subject to the provisions of the Convention relative to the Treatment of Prisoners of War,” the Russian Defense Ministry said. The Defense Ministry specified that “the Russian force grouping command twice addressed the command of the US-led ‘international coalition’ with a proposal to carry out joint actions to destroy the retreating ISIS convoys on the eastern bank of the Euphrates.” The Americans failed to answer the Russian side’s question on why IS militants leaving in combat vehicles heavily equipped are regrouping in the area controlled by the international coalition to conduct new strikes over the Syrian army near Abu Kamal, the Russian Defense Ministry stressed.

Mugabe under house arrest and according to South African media ‘planning to step down’. Rumors that Emmerson Mnangagwa, the vice-president Mugabe fired recently, will be interim president. Which in turn would confirm that the army acted because it doesn’t want Grace Mugabe in power.

• Zimbabwe’s Military Seizes Power (BBG)

The armed forces seized power in Zimbabwe after a week of confrontation with President Robert Mugabe’s government and said the action was needed to stave off violent conflict in the southern African nation that he’s ruled since 1980. The Zimbabwe Defense Forces will guarantee the safety of Mugabe, 93, and his family and is only “targeting criminals around him who are committing crimes that are causing social and economic suffering in the country in order to bring them to justice,” Major-General Sibusiso Moyo said in a televised address in Harare, the capital. All military leave has been canceled, he said. Denying that the action was a military coup, Moyo said “as soon as we have accomplished our mission we expect the situation to return to normalcy.” He urged the other security services to cooperate and warned that “any provocation will be met with an appropriate response.”

The action came a day after armed forces commander Constantine Chiwenga announced that the military would stop “those bent on hijacking the revolution.” As several armored vehicles appeared in the capital on Tuesday, Mugabe’s Zimbabwe African National Union-Patriotic Front described Chiwenga’s statements as “treasonable” and intended to incite insurrection. Later in the day, several explosions were heard in the city. The military intervention followed a week-long political crisis sparked by Mugabe’s decision to fire his long-time ally Emmerson Mnangagwa as vice president in a move that paved the way for his wife Grace, 52, and her supporters to gain effective control over the ruling party. Nicknamed “Gucci Grace” in Zimbabwe for her extravagant lifestyle, she said on Nov. 5 that she would be prepared to succeed her husband.

65,000 homes in Paris alone.

• Airbnb Puts Automatic Rental Cap On Central Paris Offers (R.)

Short-term rental website Airbnb, which has been challenging traditional hotel operators such as Accor and Marriott, said it would automatically cap the number of days its hosts can rent their property each year in central Paris. The decision, which goes into effect in January and mirrors initiatives already in place in London and Amsterdam, will force hosts to effectively comply with France’s official limit on short-term rentals of 120 days a year for a main residence. It comes as Airbnb, similar to its taxi-hailing peer Uber, is facing a growing crackdown from legislators worldwide – triggered in part by lobbying from the hotel industry, which sees the rental service as providing unfair competition. Airbnb and other rental platforms have also been criticized for driving up property prices and contributing to a housing shortage in some cities such as Paris or Berlin.

Airbnb, which has denied having a significant impact on housing shortages, has been trying to placate local authorities. “Paris is Airbnb number one city worldwide and we want to insure our community of hosts expands in a responsible and sustainable manner,” said Emmanuel Marill, Airbnb general manager for France. In Paris, the automatic rental cap will apply only to the city’s first four districts (“arrondissements”) unless the property owner has proper authorization. These districts include tourist hotspots such as the Marais, and landmarks such as the Louvre and the place de la Concorde square. Airbnb is implementing the cap as the Paris city council has made it mandatory from December for people renting their apartments on short-term rental websites to register their property with the town hall.

Ian Brossat, the housing advisor to the Paris Mayor, told Reuters that the cap should extend to the whole of Paris. “Under the law, websites must withdraw listings that do not comply with the law throughout Paris. One cannot accept that a website complies with the law only in the first four arrondissements of Paris,” said Brossat. With over 400,000 listings, France is Airbnb’s second-largest market after the United States. Paris, which is the most visited city in the world, is Airbnb’s biggest single market, with 65,000 homes.

Fine them until they do?! Half the city of Athens will turn into Airbnb if they don’t.

• Airbnb Refuses To Disclose Financial Data To Greece’s Finance Ministry (KTG)

Airbnb refused to provide the Greek Finance Ministry with information on property rentals thus delaying the launch of an online platform where owners should register the rental transactions and pay the necessary taxes. According to information obtained by economic news website economy365.gr, the Finance Ministry has tried for five months to get in touch with executives of the company in California as well as of other companies (Novasol etc). However, the companies showed no intention to cooperate with Greek authorities who have requested that the tax number of property owner is being registered to every property at the Airbnb platform. Owner’s tax number would facilitate the imposition of taxes on rentals via Airbnb. The tax legislation on short-term leases through digital platform like Airbnb was voted last year. The law foresees taxes of 15%-45% and a limited number of rentals per year.

Registration is mandatory. Authorities will provide the property owner with a certification number that has to be declared on any website and social media advert, including, of course, the Airbnb platform. Fines can reach up to 5,000 euros, if a property owner does not register on the Greek authorities registration platform and tries to evade taxes from short-term rentals. The state has estimated that revenues from Airbnb rentals could reach 48 million euros per year. According to the Finance Ministry property owners try to bypass the 3% commission to Airbnb and upcoming taxes by direct contact to customers via messenger or telephone. The payments are done cash at the arrival and not through the platform. In this way, property owners can bypass not only the commission but also registration of the rentals and future taxes. Just in case and even if one day, the Airbnb decides to hand over its Greek data to the tax authorities. For the time being it looks as the Greek goal to tax Airbnb properties has to be postponed.

Home › Forums › Debt Rattle November 15 2017