NPC District National Bank, Dupont branch, Washington, DC 1924

This spells deflation.

• The Low Velocity Economy – US Money Velocity At All-Time Low (CI)

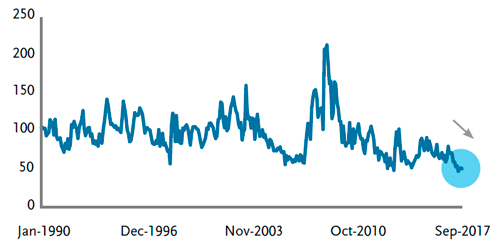

The velocity of money is a measure of the economic activity. It looks at how many times a unit of currency ($1 in the case of the United States) flows through the economy and is used by the various members of the economy. In the case of M2 velocity (includes cash and checking deposits (M1) as well as savings deposits, money market mutual funds and other time deposits), it is at an all-time low after peaking in 1998.

An alternative measure of velocity is MZM. MZM represents all money in M2 less the time deposits, plus all money market funds. Like M2 velocity, MZM velocity is at an all-time low.

Here is a chart of MZM velocity against the 10 year constant maturity Treasury rate.

What this chart says is that the economy is not catching fire despite the massive amount of money in circulation. And wage growth is terrible as well, despite Fed intervention.

Here’s to our policy makers in Washington DC!

Read more …

Back on the road to parity and beyond.

• Euro Plunges As ECB Official Pledges To Speed Up Bond Purchases (Bloomberg)

The euro tumbled the most in two months against the dollar after a European Central Bank official said the bank will speed up its bond-buying program before an anticipated mid-year lull. The single currency extended Monday’s decline after Executive Board member Benoit Coeure said the ECB will increase purchases under its quantitative-easing program from €60 billion in May and June, ahead of an anticipated drop-off in market liquidity. The euro was already weighed down by speculation Greece’s banking system is weeks away from insolvency, and fell versus all 16 of its major peers. Coeure’s remarks “provided an acute reminder of how fragile and volatile the markets have been in 2015,” said Lee McDarby at Nomura Holdings Inc. in London. “The euro weakened by over 1% almost instantly in response.”

The euro dropped as much as 1.4% to $1.1160, the lowest level in a week. A decline through $1.10 would reignite calls for a drop to parity with the dollar, McDarby said. Coeure’s comments about injecting money more quickly into the euro-zone economy emerged Tuesday morning as the text of a speech delivered in London the day before. ECB Governing Council member Christian Noyer said separately in Paris on Tuesday that the central bank is ready to extend QE if needed. The euro stayed lower after reports Tuesday showed regional consumer-price growth flatlined in April and German investor confidence declined this month by more than forecast in a Bloomberg economist survey.

Greece’s travails were already hurting Europe’s single currency, undoing a 4.6% rally in April that snapped nine months of losses. That rebound came amid signs of improvement in the 19-nation economy. Greek Prime Minister Alexis Tsipras and Finance Minister Yanis Varoufakis said Monday they were optimistic a deal to unlock bailout funds was within reach, even as creditors warned the country has yet to comply with the terms of its emergency loans. “We’re coming closer to the endgame for Greece,” said Lee Hardman at Bank of Tokyo-Mitsubishi. “The expectation is still an agreement will be reached between Greece and its creditors, but there’s a risk that they fail to reach one,” which may send the euro lower, he said.

Read more …

Just a start.

• 5 Bubbles Draghi’s QE Is Already Blowing (MarketWatch)

Sixty billion euros here. A hundred billion there. To paraphrase Everett Dirksen’s apocryphal quote about the U.S. budget, pretty soon you are talking about real money. Earlier this year, the European Central Bank launched its quantitative easing program with €60 billion a month of asset purchases by the central bank. Now, in response to some mild turbulence in the bond market, it is talking about front-loading QE, taking the total of fresh cash minted in Frankfurt every month up to 100 billion or even more. In short, real money. Academics will no doubt be discussing the effectiveness of QE in lifting the real economy for a couple of generations at least, and probably not reaching any definitive conclusions.

Perhaps it pulls countries out of a recession, or perhaps they would have eventually started to grow again anyway? One thing we can say for sure, however, is that it boosts asset prices. In fact, it is already happening. A series of Mario Draghi bubbles are already inflating across the eurozone. Where exactly? Well, Spanish construction is booming, Dublin house prices are soaring, German wages are accelerating, Malta is riding a wave of hot money, and Portuguese equities are among the best performers in the world. For a lucky few investors, QE is already working its magic.

The ECB president probably had no choice but to finally bite the bullet and launch the ECB’s own version of QE earlier this year. The continent was sliding rapidly into deflation, with prices dropping in countries such as Spain. The economy was slipping into a depression, and unemployment was rising relentlessly even as the rest of the global economy was recovering. The only real surprise was that it took so long. That doesn’t mean, however, that the money created won’t blow up asset prices. Indeed, it is already happening.

Read more …

“Deflation is where prices fall across the board for a sustained period.” No, it is not. And how can you solve a problem you don’t understand?

• Is The UK In The Early Stages Of Deflation? (Guardian)

Blink and you ll miss it. That sums up what the experts think about inflation turning negative in the UK for the first time since 1960, a time when Dwight Eisenhower was the US president and before the pre-fame Beatles had played a single note in Hamburg. That year, the period when the annual cost of living was falling proved to be brief, and the expectation is that it will be this time too. Why? Because the reason inflation has dipped below zero is largely due to the halving of oil prices in the second half of last year. Unless those falls in the cost of crude are repeated this year and it s almost certain they won t inflation will start to pick up again. The timing of Easter, which has an impact on the cost of air and sea travel, was also a factor. So, for now, it is a mistake to say the UK is in the early stages of Japanese-style deflation.

Deflation is where prices fall across the board for a sustained period. It is an environment in which consumers put off making major purchases because they assume that the TV, car or freezer they want will be cheaper in the future than it is today. With consumer confidence high and unemployment falling, there seems no immediate prospect of this happening. Indeed, the opposite may well happen, with consumers tempted to increase their spending because their monthly pay cheques stretch further. Earnings growing at around 2% a year in conjunction with inflation 0.1% lower than a year ago equals a modest increase in real incomes that are likely to keep shop tills jangling in the months ahead.

A cut in average earnings growth from 2% to 1% would suggest the economy was in a downward wage-price spiral All that said, a wary eye needs to be kept on the inflation numbers. Core inflation the cost of living excluding volatile items such as energy and food fell to 0.8% in April, the lowest since 2001. If it fell further, the risk of deflation proper would increase. he unknown factor that could push core inflation lower is wages. Despite two and a half years of steady growth and shortening dole queues, earnings are still only growing at around their pre-crisis levels of 4%. The Bank of England believes they will start to pick up because firms will struggle to find workers from a shrinking pool of labour. But if the supply of labour continues to increase, employers could respond to falling inflation by making their pay offers less generous.

Read more …

Good plan. No chance.

• Bernie Sanders Wants Wall Street To Pay For Your College Tuition (Vox)

The big banks got bailed out, and presidential contender Bernie Sanders says they should pay it forward. The independent senator from Vermont introduced his plan on Tuesday, which would use a tax on stock trades to help pay students’ tuition. The price of attending a public college has been climbing since the 1980s. Sanders’s plan would shift the burden to pay for college away from students and families and back onto the government. Sanders’s bill, which he says would cost $47 billion in the first year, doesn’t stand a chance in the Senate. But it highlights an important question for higher education policy: can the federal government force states to make college more affordable?

Public college tuition has risen 30% in the past decade. Since 2004, published tuition rates have jumped from $6,448 in 2004 to $9,139 in 2014. Net tuition at public colleges — the amount students actually pay after financial aid is taken into account — has, meanwhile, nearly doubled since 2000. Part of this is a story about rising tuition costs, as the price to attend both public and private colleges has grown rapidly in recent years. But there is a second story here, one about states’ funding for higher education not keeping pace with all the students who want to attend — and leaving students to pay a bigger chunk of their bill.

In the late 1980s, only about a quarter of public college revenue came from tuition. The rest came from the state or other sources. Now students cover about half the cost of their education — and may soon provide the majority of public college revenues. In general, public colleges spend about the same amount per student that they did in 1987. States are spending more on higher education than they did in the past. But more people go to college than used to, and state budgets haven’t been able to keep up with enrollment increases and inflation. Students at public universities are now increasingly likely to borrow, and more likely to graduate with debt: 59% of students at public colleges took out loans in 2012, and students who borrowed graduated with an average of $25,600 in debt.

Sanders’s plan would set up a grant program to cover the share of tuition that students currently pay. The federal government would pay for two-thirds of the grant program’s budget, using a new tax on stock trades to raise an estimated $47 billion in revenue. States would be required to chip in the additional one-third of funding, as well as keep up their current spending levels on higher education. While Sanders’s proposal is far to the left of many Democrats, the type of grant program he proposed isn’t totally different from other proposals floated on Capitol Hill. Requiring states to fund higher education has been tried before, and it worked.

Read more …

Screwed by boomers.

• The Economy for Young Americans Is Still Terrible (Atlantic)

I’ve been doing a lot of thinking recently about the labor market for a longer forthcoming piece, and one of the mysteries I’ve been grappling with is: How do you describe how this economy is treating young people? Let’s start by singing the necessary praises. Last year was was the best for job-creation this century. We’re in the middle of the longest uninterrupted stretch of private-sector job creation on record. After creating mostly low-paying service jobs for the first few years of the recovery, the labor market is finally churning out more high-skill jobs. All of these things should be great news for young people. Should. But a deeper look at the Young-American Economy today suggests that, in contrast to the overall labor market, it is still sort of terrible.

To start with the camera lens zoomed all the way out: The majority of young people aren’t graduating from a four-year university. Rather they are dropping out of high school, graduating from high school and not going to college, or dropping out of college. Millennial is often used, in the media, as a synonym for “bachelor-degree-holding young person,” but about 60% of this generation doesn’t have a bachelor’s degree. And how are they doing, as a group? Young people don’t seem to have a jobs problem—their jobless rate is a bit elevated, but not alarmingly so. Rather they have a money problem. The jobs they’re getting don’t pay much and their wages aren’t growing. A recent analysis of the Current Population Survey last year found that the median income for people between 25 and 34 has fallen in every major industry but healthcare since the Great Recession began.

Zoom in on recent college graduates, and the picture gets more complicated. In The Washington Post, Ylan Q. Mui says “the era of the overeducated barista is coming to a close.” That would be nice, indeed. But the data suggests that the era is hardly over: Overeducated baristas, once totally ubiquitous, are now merely super-abundant. Under-employment (the share of college grads in jobs that historically don’t require a college degree) is high. The quality of jobs that underemployed young people are getting is getting worse. And for these reasons, wages are growing incredibly slowly, if at all.

Read more …

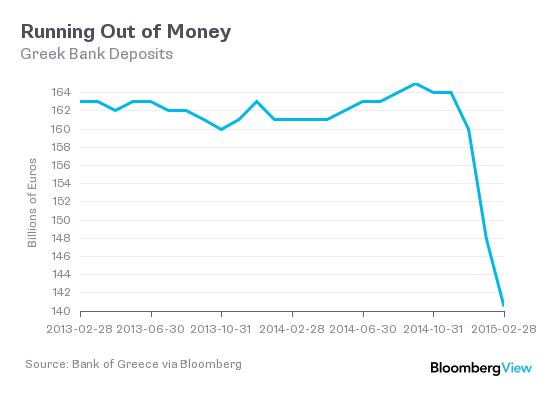

The EU, ECB and IMF have their eyes on Greek bank deposits.

• Theft Of Greek Bank Deposits To Send Shockwaves Around The World (KWN)

The troika of the EU, ECB and IMF have not yet pulled the plug on the Greek banks, but the following quote in the Financial Times from this weekend should be a warning to anyone who still has money on deposit in that country: “The idea of a ‘Cyprus-like’ presentation to Greek authorities has gained traction among some eurozone finance ministers, according to one official involved in the talks.” The ECB is up to its eyeballs swimming in unpayable Greek debt that it holds. The ECB is not going to take a loss on this Greek paper on its books. Because Greece does not have the financial capacity to repay what is now about €112 billion of credit exposure on the ECB’s books, the ECB has only two alternatives.

It can push the €112 billion of Greek debt it holds to the national central banks of the Eurozone and on to the backs of the taxpayers in those countries, which is politically untenable. Or it can confiscate depositor money in Greek banks, like it did in Cyprus and as the FT has now reported. The difference is that Greece presents a problem that is an order of magnitude bigger than Cyprus because of the huge debt it has outstanding. That means the shockwaves from a ‘Cyprus-like’ confiscation of bank deposits will reverberate throughout the Eurozone and far beyond because bank depositors in other countries will start asking, which country is next to confiscate bank deposits?”

Read more …

Steve’s excellent takedown of austerity.

• Greek Deception, Greek Tragedy, German Farce, German Myth (Steve Keen)

There is no prospect of Schäuble’s program working without a substantial write-down of Greek government debt—yet this is something the Troika refuses to countenance. In this sense the Troika’s program is the essence of farce, since it is persisting with a ludicrously improbable program. Schäuble’s assertion that the program imposed on Greece is “not blind “austerity”” also cannot be reconciled with the fact that the Troika’s program has had a far worse impact on Greece than the Troika expected. A European Parliament study pointed out that the Troika predicted that unemployment in Greece would peak at 15% in 2012, and fall thereafter. Instead, it rose to over 25%, and remains above this level today. Who else but the blind—or those acting in a farce—could ignore such a huge disparity between the ambitions of the Troika’s program and its actual results?

This failure is not because the Greeks haven’t tried hard enough—far from it. The cutbacks that were imposed at the direction of the Troika were extreme. They included, for example, a reduction in the minimum wage of more than 20%, and a 25% cut to hospital funding. How can this last measure be reconciled with Schäuble’s description of the Troika’s policies as “preparing aging societies for the future”? The Troika’s program has failed on its own terms because it had a far more drastic negative impact on the Greek economy than the Troika’s economic models predicted. The economy has contracted by 6% a year in nominal terms for several years—and by as much as 10% in inflation-adjusted terms. What was expected to be a “short, sharp shock” followed by a return to sustained growth has instead become a Greek Great Depression.

Read more …

Tell the creditors to go take a hike.

• Athens Proposes Bank Transaction Levy, Creditors Reject VAT Plan (Kathimerini)

Athens is promoting the idea of a special levy on banking transactions at a rate of 0.1-0.2%, while the government’s proposal for a two-tier value-added tax – depending on whether the payment is in cash or by card – has met with strong opposition from the country’s creditors. A senior government official told Kathimerini that among the proposals discussed with the eurozone and the International Monetary Fund is the imposition of a levy on bank transactions, whose exact rate will depend on the exemptions that would apply. The aim is to collect €300-600 million on a yearly basis.

Available data show that the annual level of bank transactions comes to over €660 billion but the government will likely exempt debit card transactions, such as cash machine withdrawals, given that the Finance Ministry is eager to promote the use of debit cards as part of its efforts to combat tax evasion. The precise terms of the levy have not yet been addressed but the idea is being discussed in principle, as it is seen to have considerable fiscal benefits and a low impact on ordinary household budgets. As for the proposal for shaving three percentage points from the VAT rate when a transaction is not made in cash, Greece’s creditors are opposed to the scheme, arguing that it would bring annual losses of 6.5 billion euros for state coffers.

Instead, they propose the main rate to be set at 18-20% and the low one (applying to food, drugs and books) to stand at 8%. At the same time, they want the discounted rate that applies on Aegean islands to be scrapped. Athens proposed a top VAT rate of 18%, dropping to 15% for cash-free transactions, and a 9.5% rate for food, drugs and books, falling to 6.5% for card transactions. Following the rejection of this idea from the country’s lenders, the Finance Ministry sent a new proposal that includes three VAT rates. According to sources, these are 7.5%, 15 and 21 or 22. It is estimated that this scheme would bring in an additional €800 million in revenues. However, €200 million of this would be returned to the Aegean islands to compensate for the increase in their VAT rates.

Read more …

The creditors want even higher rates.

• Varoufakis’ Overhaul Of VAT System May Skyrocket Food & Utility Prices (KTG)

Greek Finance Minister Yanis Varoufakis said it clearly Monday night on political program on private STAR TV. There will be a flat Value Added Tax of 18% for cash-transactions and a 3% discount – ie. 15% V.A.T. – for payments with credit or debit card. He assured that “the low V.A.T. of 6.5% will still be valid for food items, medicines, books, newspapers and other print material” provided the payments will be done via non-cash transactions. Otherwise,the VAT for these items will be 9.5%. With the current state of V.A.T. there is hardly any basic food item with 6.5% V.A.T. except bread and pasta. Varoufakis’ proposal for a rather complicated V.A.T. system will be submitted to the creditors with the aim to tackle Value Added Tax evasion, which is estimated to be €9.5 billion per year.

At the same time, the new system will allow tax authorities to follow step by step all purchases done by taxpayers due the online access of tax offices to bank accounts. It will not only give incentives of 3% V.A.T. discount to consumers for the purchase of products and services and force entrepreneurs to accept the “new deal and sell innovation”, it will also enable the tax authorities to check each newspaper, each shampoo and each carrot you buy, then sum the purchases up and check if taxpayers’ tax declaration and income matches to the expenses he/she has done. This however has not so much to do with people’s tax evasion or not.

It has to do with the unfair tax system of “deemed and fictitious income and taxation” imposed by the Troika in 2012 (or 2011) and according to which the tax office considers that each person needs €3,000 per year to cover his basic needs (food, cleaning material etc.). The person is then been taxed accordingly independently of whether it has an income or not. In fact, this measure is been implemented to people without income, that is Greece’s famous 25% jobless labor craft. If the person happens to live in own or rented apartment, another €2,000-3,000 are being added and the jobless has to be tax for the €5,000-6,000 income he does not have. Furthermore, with this measure it will be time for the Greeks to say Goodbye to privacy of their purchases and dirty little habits.

Read more …

From the Syriza desks.

• Europe’s Moment Of Truth (Tassos Koronakis, Central Committee of Syriza)

Dear friends, After almost four months of intensive negotiations, we have reached a moment of truth for our common European project. The Syriza-led government does its best to reach an honorable agreement with its European and international partners that respects both the obligations of Greece as a European member-state, but also the Greek peoples’ electoral mandate. The Syriza-led government has already started a series of reforms that tackle corruption and widespread tax-evasion. Spending is reined in and collected tax revenue exceeds expectations, reaching a primary budget surplus of 2.16 bn (January-April 2015), far above the initial estimation for a 287m deficit. Meanwhile, Greece has honored all debt obligations by its own resources, a unique case among European nations since any disbursement of funds has been cut off since August 2014.

Four months of exhausting negotiations have passed, where Greece’s creditors systematically insist on forcing on the SYRIZA-led government the exact austerity program that was rejected by the Greek people in the January 25 elections. Liquidity asphyxiation, orchestrated by the Institutions, has led to a critical situation for our country’s finances, making it unbearable to serve upcoming debt obligations. The Greek government has done its best to reach an agreement, but red lines -having to do with sustainable and not unrealistic primary surpluses, the restoration of collective contracts and the minimum wage, workers protection from massive lay-offs, the protection of wages, pensions and the social security system from further cuts, stopping fire-sale privatizations etc- are to be respected.

Popular sovereignty and democratic mandates are to be respected. Greek people’s patience and goodwill is not to be mistaken as willingness to succumb to unprecedented blackmail. European democracy is not to be asphyxiated. Times are crucial; political will from our European partners is needed to overcome the current stalemate. This call is not just a call for solidarity, it is a call for due respect of the foremost of European values. In this framework, SYRIZA appeals to all progressive and democratic social and political actors who acknowledge that Greece’s fight is not limited within its national borders, but constitutes a fight for democracy and social justice in Europe.

In these critical moments, we are calling for acts of social and political solidarity, ranging from the organization of rallies and awareness campaigns across Europe, to institutional initiatives in local, regional and national parliaments and personal or collective statements of support to the efforts of Greece to swift the European paradigm from disastrous austerity to a new model for sustainable growth. Your support is of utmost importance, not only for the people of Greece, but for the fate of the European idea.

Read more …

“Our economy here has relied almost entirely on building housing but everyone who can afford an apartment already has one..”

• China Slowdown Deepens Provincial Economic Divide (FT)

Last month more than 30 provincial taxi drivers drank poison and collapsed together on the busiest shopping street in Beijing in a dramatic protest against economic and working conditions in their home town. The drivers, who the police say all survived, were from Suifenhe, a city on the Russian border in the northeastern province of Heilongjiang. Such lurid acts of protest are an ancient tradition in China but the extremity of their action highlights one of the biggest problems facing Beijing as it tries to manage the worst economic slowdown in nearly three decades: a deepening provincial economic divide. An examination of regional growth rates across the country shows the slowdown has affected some areas far worse than others. Perhaps predictably, the worst-hit places are those that can least afford it.

Heilongjiang is among the poorest performers. While national nominal growth slipped to 5.8% in the first quarter compared with a year earlier — its lowest level since the global financial crisis — the province’s nominal GDP actually contracted, by 3.2%. In the provincial capital of Harbin, signs of economic malaise are everywhere. A large upscale mall in the centre of town with half a dozen boarded-up shopfronts is abandoned inside apart from a luxury home furnishing shop and a Bentley dealership with three salespeople asleep on couches in the corner. A short drive from the city centre and the primary reason for the region’s economic woes becomes clear. As far as the eye can see there are empty or half-built residential tower communities boasting names such as “Jade Lake World”, “River Chateau”, “Polyup Town” and Intime City”.

Each tower holds roughly 400 units and each community has between 20 and 50 towers. In the new Qunli district alone there are more than 30 completed or half-built communities. Without much industry, Harbin’s economy has traditionally relied on agriculture, tourism and trade with Russia but in the past five years it has been boosted by the enormous residential property construction binge seen all over China. “In the past few years a decent-sized cement company could sell 1m cubic metres of cement annually but now they are lucky to sell 100 cu m a day and they are all losing money,” says Chen Liyong, a 31-year-old taxi driver who lost his job at a cement company late last year. “Our economy here has relied almost entirely on building housing but everyone who can afford an apartment already has one and we don’t have anyone moving here from other places.”

Read more …

As I said: a kow-tow.

• John Kerry Admits Defeat Over Ukraine, And That’s A Good Thing (Salon)

It is just as well Secretary of State John Kerry’s momentous meetings with Russian leaders last week took place in Sochi, the Black Sea resort where President Putin keeps a holiday home. When you have to acknowledge that two years’ worth of pointless hostility in the bilateral relationship has proven none other than pointless, it is best to do so in a far-away place. Arriving in the morning and leaving in the afternoon, Kerry spent three hours with Sergei Lavrov, Russia’s very competent foreign minister, and then four with Putin. After struggling with the math, these look to me like the most significant seven hours the former senator will spend as this nation’s face abroad.

Who cannot be surprised that the Obama administration, having turned the Ukraine question into the most dangerous showdown since the Cold War’s worst, now declares cordiality, cooperation and common goals the heart of the matter? The question is not quite as simple as one may think. On the one hand, the policy cliques’ long swoon into demonization has been scandalously juvenile, and there has been no sign until now of sense to come. Grown men and women advancing the Putin-is-Hitler bit with straight faces. Getting the Poles, paranoids for understandable reasons on all questions to with Russia, to stage ostentatious displays of teenagers in after-school military exercises. American soldiers in those silly berets they affect drilling Ukrainian Beetle Baileys in “war-making functions,” as the officer in charge put it.

When the last of these theatrics got under way in mid-April, it was time for paying-attention people to sit up. As noted in this space, it seemed to indicate that we Americans were prepared to go to war with another nuclear power to rip Ukraine from its past and replant it in the neoliberals’ hothouse of client states—doomed to weakness precisely because corrupt leaders were enticed with baubles to sever their people from history. On the other hand, it took no genius to see what would eventually come. This column predicted long back—within weeks of the American-cultivated coup that deposed President Yanukovych in February of last year—that the Obama administration would one day be forced to retreat before it all came to resolution.

Read more …

Trying to stiff Russia. Not a good idea.

• It Begins: Ukraine Takes First Real Steps To Default (Mercouris)

The Ukrainian government is on the brink of declaring default. The Ukrainian government has proposed a bill allowing the government to impose a “moratorium” on payment of the country’s external debts. Such a moratorium is just another word for a default. It is the same device the Russian government used when it defaulted on its external debt in 1998. This is not quite the end of Ukraine’s debt saga. Ukraine will only be formally in default when it misses a payment. It is possible Ukraine has taken this step as a negotiating tactic to put more pressure on its Western creditors. It is also possible Ukraine is hoping to preserve some financial credibility by picking and choosing which creditors it will pay. As we have discussed previously, it might try to go on paying its Western creditors while defaulting on the debts it owes to Russia.

Frankly, this all looks unlikely and it seems that what we are looking at is an across-the-board default. In truth, as has been pointed out by several people — notably by Eric Kraus — the numbers of the various IMF plans have never added up, and a default looked increasingly inevitable from the moment the Maidan coup happened, when it became clear the Ukrainian government was heading into a confrontation with its economically critically important eastern regions and with its biggest trade partner Russia. The accelerating collapse of Ukraine’s economy (with GDP contracting by 17% in the first quarter by comparison with last year) and the deadlock in the negotiations with the Western creditors, appears to have made today’s default announcement unavoidable.

Read more …

“../the word Merkel said, “verbrecherische” has rarely been used by her before; it carries the connotation in colloquial German of gangsterism — and of Nazism.”

• Angela Merkel Has Been Abandoned By Kerry, Nuland And Putin (Helmer)

Angela Merkel, the German Chancellor, would do almost anything to get and keep power. That, in the opinion of powerful German bankers, includes making herself look ready for war with Russia in order to make her political rival, Frank-Walter Steinmeier, the coalition Foreign Minister and opposition leader in Berlin, look too weak to be electable when the German poll must be called by 2017. So, sources close to the Chancellery say, Merkel insulted President Vladimir Putin and all Russians to their faces last week. This week Victoria Nuland, the junior State Department official who told the chancellor to get fucked a year ago, was in Moscow, replacing Merkel with a settlement of the Ukraine conflict the Kremlin prefers.

“We are ready for this,” Foreign Minister Sergei Lavrov said last Thursday after meeting Secretary of State John Kerry. Referring to Nuland, Lavrov added: “we were not those who had suspended relations. Those, who had done it, should reconsider their stance….But, as usual, the devil is in the details.” Lavrov meant not one, but two devils, who have sabotaged every move towards a settlement of the Ukraine conflict since the start of 2014 – Nuland and Merkel. Merkel’s Kaput! moment came on May 10, when she went to Moscow to lay a wreath at the Tomb of the Unknown Soldier. Deutsche Welle, the state German press agency, called it Merkel’s “compromise after she stayed away from a Russian military parade the day before.”

At the following press conference with Putin, Merkel said: “We have sought more and more cooperation in recent years. The criminal and illegal annexation of Crimea and the military hostilities in eastern Ukraine has led to a serious setback for this cooperation.” German sources say the word Merkel said, “verbrecherische” has rarely been used by her before; it carries the connotation in colloquial German of gangsterism — and of Nazism. “Merkel doesn’t seem to care what she says any longer,” a high-level German source says. “She exhibits more and more emotion these days, more irritation, and less care for what she says, and where. Putin understood exactly what she meant, and on the occasion she said it. He acted with unusual generosity not to react.”

The Kremlin transcript omitted Merkel’s remarks altogether. The Moscow newspapers ignored Merkel’s word and emphasized the positive Putin ones. “Our country fought not against Germany,” Putin replied to Merkel, “but against Nazi Germany. We never fought Germany, which itself became the Nazi regime’s first victim. We always had many friends and supporters there.

Read more …

“He who doesn’t regret the collapse of the USSR doesn’t have a heart; he who wants to see it reborn doesn’t have a brain.” (Putin)

• No, You Can’t Go Back To The USSR! (Dmitry Orlov)

One of the fake stories kept alive by certain American politicians, with the help of western media, is that Vladimir Putin (who, they vacuously claim, is a dictator and a tyrant) wants to reconstitute the USSR, with the annexation of Crimea as the first step. Instead of listening to their gossip, let’s lay out the facts. The USSR was officially dissolved on December 26, 1991 by declaration 142-H of the Supreme Soviet. It acknowledged the independence of the 15 Soviet republics, and in the place of the USSR created a Commonwealth of Independent States, which hasn’t amounted to much. In the west, there was much rejoicing, and everyone assumed that in the east everyone was rejoicing as well.

Well, that’s a funny thing, actually, because a union-wide referendum held on March 17, 1991, produced a stunning result: with over 80% turnout, of the 185,647,355 people who voted 113,512,812 voted to preserve the USSR. That’s 77.85% not exactly a slim majority. Their wishes were disregarded. Was this public sentiment temporary, borne of fear in the face of uncertainty? And if it were to persist, it would surely be a purely Russian thing, because the populations of all these other Independent States, having tasted freedom, would never consider rejoining Russia. Well, that’s another funny thing: in September of 2011, fully two decades after the referendum, Ukrainian sociologists found out that 30% of the people there wished for a return to a Soviet-style planned economy (stunningly, 17% of these were young people with no experience of life in the USSR) and only 22% wished for some sort of European-style democracy.

The wish for a return to Soviet-style central planning is telling: it shows just how miserable a failure the Ukraine’s experiment with instituting a western-style market economy had become. But, again, their wishes were disregarded. This would seem to indicate that Putin’s presumptuously postulated project of reconstituting the USSR would have plenty of popular support, would it not? What he said on the subject, when asked directly (in December of 2010) is this: He who doesn’t regret the collapse of the USSR doesn’t have a heart; he who wants to see it reborn doesn’t have a brain. Last I checked, Putin does have a brain; ergo, no USSR 2.0 is forthcoming.

Read more …

Third world.

• Dead Nation Walking (Jim Kunstler)

Many people seem to think that America has lost its sense of purpose. They overlook the obvious: that we are striving to become the Bulgaria of the western hemisphere. At least we already have enough vampires to qualify. You don’t have to seek further than the USA’s sub-soviet-quality passenger railroad system, which produced the spectacular Philadelphia derailment last week that killed eight people and injured dozens more. Six days later, we’re still waiting for some explanation as to why the train was going 100 miles-per-hour on a historically dangerous curve within the city limits.

The otherwise excellent David Stockman posted a misguided blog last week that contained all the boilerplate arguments denouncing passenger rail: that it’s addicted to government subsidies and that a “free market” would put it out of its misery because Americans prefer to drive and fly from one place to another. One reason Americans prefer to drive — say, from Albany, NY, to Boston — is that there is only one train a day, it never leaves on time or arrives on time, and it takes twice as long as a car trip for no reason that makes any sense. Of course, this is exactly the kind of journey (slightly less than 200 miles) that doesn’t make sense to fly, either, given all the dreary business of getting to-and-from the airports, not to mention the expense of a short-hop plane ticket.

I take the popular (and gorgeous!) Hudson River Amtrak train between Albany and New York several times a year because bringing a car into Manhattan is an enormous pain in the ass. This train may have the highest ridership in the country, but it’s still a Third World experience. The heat or the AC is often out of whack, you can’t buy so much as a bottle of water on the train, the windows are gunked-over, and the seats are often broken. They put wifi on trains a couple of years ago but it cuts out every ten minutes.

Anyway, even if Americans seem to prefer for the present moment to drive or fly, it may not always be the case that they will be able to. Several surprising forces are gathering to take down the Happy Motoring matrix. Peak oil is actually not playing out in the form of too-high gasoline prices, but rather a race between a bankrupt middle class unable to pay the total costs of motoring and an oil industry that can’t make a profit drilling for hard-to-get oil. That scenario is plain to see in the rapid rise and now fall of shale oil.

Read more …

Are there any cars left that have not been recalled?

• Air Bag Defect Triggers Largest Auto Recall In US History (Guardian)

Japanese air bag manufacturer Takata is expected to declare about 33.8m vehicles defective on Tuesday, a move that is expected to lead to the largest auto recall in US history, the Detroit News reported, citing three officials briefed on the announcement. The company is expected to announce that it has filed a series of four defect information reports with the US National Highway Traffic Safety Administration (NHTSA), declaring both driver and passenger air bag inflators defective in the vehicles, the report said. The US Department of Transportation and the NHTSA said earlier that they would make a “major” announcement related to the air bag recall.

The number of vehicles with potentially defective Takata air bags recalled globally since 2008 has risen to about 36m following recalls over the past week by Japan’s Toyota, Nissan and Honda. The automakers have said that they decided to proceed with the recalls after finding some Takata air bag inflators were not sealed properly, allowing moisture to seep into the propellant casing. Moisture damages the propellant and can lead to an inflator exploding with too much force, shooting shrapnel inside the vehicle. Six deaths have been linked to the defective air bags, all in cars made by Honda, which has borne the brunt of the Takata recalls to date and which gave a disappointing profit forecast last month due to higher costs related to quality fixes.

Read more …

Great piece from a ‘cleared advisor’ to the government.

• I’ve Read Obama’s Secret Trade Deal. Warren’s Right to Be Concerned (Politico)

“You need to tell me what’s wrong with this trade agreement, not one that was passed 25 years ago,” a frustrated President Barack Obama recently complained about criticisms of the Trans Pacific Partnership (TPP). He’s right. The public criticisms of the TPP have been vague. That’s by design—anyone who has read the text of the agreement could be jailed for disclosing its contents. I’ve actually read the TPP text provided to the government’s own advisors, and I’ve given the president an earful about how this trade deal will damage this nation. But I can’t share my criticisms with you. I can tell you that Elizabeth Warren is right about her criticism of the trade deal.

We should be very concerned about what’s hidden in this trade deal—and particularly how the Obama administration is keeping information secret even from those of us who are supposed to provide advice. So-called “cleared advisors” like me are prohibited from sharing publicly the criticisms we’ve lodged about specific proposals and approaches. The government has created a perfect Catch 22: The law prohibits us from talking about the specifics of what we’ve seen, allowing the president to criticize us for not being specific. Instead of simply admitting that he disagrees with me—and with many other cleared advisors—about the merits of the TPP, the president instead pretends that our specific, pointed criticisms don’t exist.

What I can tell you is that the administration is being unfair to those who are raising proper questions about the harms the TPP would do. To the administration, everyone who questions their approach is branded as a protectionist—or worse—dishonest. They broadly criticize organized labor, despite the fact that unions have been the primary force in America pushing for strong rules to promote opportunity and jobs. And they dismiss individuals like me who believe that, first and foremost, a trade agreement should promote the interests of domestic producers and their employees.

Read more …

Of course it won’t. It will kill people.

• Italian Coastguards: Military Action Will Not Solve Migrant Crisis (Guardian)

The Italian coastguards leading migrant rescue missions in the southern Mediterranean have voiced concern about the EU’s migration strategy, arguing that military operations will not stop migration to Europe and calling instead for European navies to prioritise search-and-rescue missions. Speaking on Monday before EU defence and foreign ministers agreed to launch military operations against Libyan smugglers, coastguard captain Paolo Cafaro said a military campaign would not eradicate the root causes of the Mediterranean crisis. His colleagues Admiral Giovanni Pettorino and Capt Leopoldo Manna called for an increased focus on saving migrants’ lives, with Manna urging European navies, including that of Britain, to give him more control over their boats in order to streamline Mediterranean search-and-rescue activities.

All three are senior officers within Italy’s Guardia Costiera, a semi-autonomous wing of the Italian navy. Pettorino leads its search-and-rescue division; Cafaro is in charge of the division’s planned rescue missions; and Manna heads its emergency response control room, which has ultimate responsibility for managing how coastguard, navy, and merchant vessels of all nationalities respond to migrant SOS calls. Cafaro said: “The problem of migration, of desperate people, will not be solved with these [military] measures. It will assume other forms. They will try to find other ways.” Cafaro admitted it was desirable “to stop all the involvement of criminal organisations in this traffic, all the money that they earn from this traffic, this is [something that is] necessary to destroy. But the problem of migration cannot be solved with measures like these.”

Cafaro also questioned whether European navies would be able to target smugglers’ boats before they are used for migration missions, due to both the absence of a blessing from Libya’s official government and the UN, as well the complexities of the smuggling process. Smuggling boats are often simply fishing boats bought in the days prior to a trip, and kept in civilian harbours until the night of their departure. Cafaro said: “I think that different European navy ships at sea can intercept and destroy wooden boats – that I think is very possible and feasible. [But] they can’t do that in Libyan territorial waters. They must do that when they are in international waters, after the people on board have been rescued, and then they can do it.”

Read more …

Of course the Guardian can’t help itself: it must label Syriza ‘a populist party’.

• Far Right Set To Enter Government Coalition In Finland (Guardian)

Finland’s government is expected to include far right representation after the new prime minister, Centre party leader Juha Sipilä, confirmed that he was opening negotiations to bring the populist Finns party (PS) into coalition for the first time. The PS’s charismatic leader, Timo Soini, is poised to become a minister, probably with the finance or foreign affairs portfolio, after the party finished second in the general election on 19 April. Sipilä said it was the “best option” to meet the challenges facing the country, notably the economy. He said he wanted a strong coalition capable “of making reforms and implementing those decisions”.

The third partner in the coalition will be the conservative National Coalition party, led by outgoing premier Alexander Stubb. The coalition will have a comfortable majority, with 123 seats out of 200. Negotiations have begun on a detailed agenda for government. The Social Democrats, part of the previous government, will be in opposition after their crushing election defeat. Throughout the campaign, Soini, 52, assured voters he was ready to govern. He is a well-known Eurosceptic and a critic of the financial rescue package for Greece.

Soini avoided any reference to the euro on the campaign trail, though his party manifesto clearly states that Finland should renegotiate the terms of European Union membership and recover powers from Brussels. Soini also toned down his criticism of immigration, though he made no attempt to condemn the xenophobic comments of some other PS candidates. There is a consensus view, shared by the three main parties that have governed in the past, that it is preferable to have the populists on board, rather than allow them to gain ground in opposition. Along with Belgium and Greece, Finland is the third EU country with populist Eurosceptics in government.

Read more …

“WWIII: Capitalism vs Morality, the Final Battle to Save the World.”

• The Best Show This Summer: Pope’s ‘Morality Vs. Capitalism’ (Paul B. Farrell)

Yes it’s summertime, folks! Family vacations! Rock stars on concert tours across America: Garth Books. Katy Perry. U2. One Direction. Plus endless movie blockbusters opening in theaters near you: “Mad Max.” “Jurassic World.” “Age of Ultron.” “Terminator Genisys.” “Tomorrowland.” “Mission Impossible: Rogue Nation.” But one blockbuster tour is destined to beat all competition, break all records, hit the music charts at No.1 with a bullet, fill stadiums seating millions and rattling enemies with endless screenings condemning the dark side of capitalism, while raking in billions for humanity. Yes, when ticket sales ante up, Pope Francis will crush the competition with his summer-long blockbuster rollout: “WWIII: Capitalism vs Morality, the Final Battle to Save the World.”

On the surface it’s “WWIII: Capitalism vs Climate.” But in fact, capitalism’s at war with morality. Capitalism has lost its soul, has no moral code. Yes, capitalism does hate the very mention of global warming, bristles at any suggestion of protecting Planet Earth from climate change. But bottom line, this is a battle to the death with morality, capitalism’s at war with the gods. In their arrogance and narcissism, capitalists really do believe they are superior, the “Invisible Hand” of God. Unfortunately they don’t see what’s about to hit them, some even dismissing the pope as politically irrelevant. Big mistake. They’re also distracted by the traveling tent circus overcrowded with 20 GOP presidential candidates fighting for money from rich donors, headlines in local newspapers, broadcast sound bites, all to get a few voters out in Iowa cornfields.

But so far, this is little more than a noisy distraction, previews of coming attractions for a home movie. So what’s ahead for capitalists? Some talking points already emerged from the pope’s recent trial balloon. A “Declaration of Religious Leaders, Political Leaders, Business Leaders, Scientists and Development Practitioners” was released right after the Vatican’s “Climate Summit” at the Pontifical Academies of Sciences and Social Sciences in Rome. The summit opened with a clear declaration that everyone, rich and poor, has a “moral duty” to protect the environment. Listen:

“Human-induced climate change is a scientific reality, and its decisive mitigation is a moral and religious imperative for humanity … the poor and excluded face dire threats from climate disruptions, including the increased frequency of droughts, extreme storms, heat waves, and rising sea levels … The world has within its technological grasp, financial means and know-how to mitigate climate change while also ending extreme poverty … through the relentless pursuit of peace, which also will enable the shift of public financing from military spending to urgent investments for sustainable development.”

Read more …

Permaculture understands this: “.. attracting wild bees (in this case, by planting wildflowers at the edge of a crop) could aid in crop pollination – up to 50% of it, at least.”

• That’s Billion, With A Bee: The Massive Cost Of Hive Collapse (Reuters)

In farming, technology will only take you so far. GPS can help drive automated harvesters around the fields, satellites help to ensure the right crops get planted at the right time. But if you want your crops to grow, you’ll have to rely on something a little more old-fashioned: honey bees. And they’re dying in enormous numbers: The makers of insecticides containing neonics, Bayer and Syngenta chief among them, have a lot to lose if regulatory bodies end up siding with the environmentalists. More than 90% of the corn in the U.S. is treated with neonics, according to this release from Bayer. To put this in perspective, last year the USDA estimated that around 91.6 million acres of corn were planted in the United States. That’s a lot of neonic’d corn.

So what happens if — or when — we run out of honey bees? In addition to posing a huge risk to global food supply, there would be dire economic repercussions. Right now, the honey bee adds more than $15 billion to the U.S. economy alone, through its pollination of fruits, vegetables and other crops, according to a 2014 report from the White House. Worldwide, that number is around $365 billion per year. And it’s not just traditional farmers who would suffer. The honey bee industry in the U.S. pulls in more than $300 million in revenue a year, according to a December 2014 IbisWorld report.

But as the bees die, some fear the industry will go with them. The American Beekeeping Federation told the Wall Street Journal that its membership has been massively depleted over the past 20 years. The solution to a lack of honey bees might just be… different bees. At least that’s according to a University of Wisconsin-Madison study, which showed that attracting wild bees (in this case, by planting wildflowers at the edge of a crop) could aid in crop pollination – up to 50% of it, at least.

Read more …