Vincent van Gogh Beach at Scheveningen in Stormy Weather 1882

Greenwald

Glenn Greenwald: "No matter how you slice it… the polls show that there's only one person who's likely to challenge Joe Biden and defeat him for reelection, and that's the person whom Biden's DOJ happens to be prosecuting in multiple cases…

Not just cases that have been… pic.twitter.com/lK24fLLWVM

— KanekoaTheGreat (@KanekoaTheGreat) August 11, 2023

Devine

.@mirandadevine: "David Weiss is the attorney that approved that sweetheart deal for Hunter Biden and who oversaw an investigation that, as the IRS whistleblowers showed us was a travesty of slow walking, obstruction, and basically protecting Joe Biden…

This is like putting… pic.twitter.com/DFCaVc4RDj

— KanekoaTheGreat (@KanekoaTheGreat) August 12, 2023

Schweizer

.@peterschweizer: "From the beginning, Joe Biden is at the center of all of this… The entire business enterprise was centered around his father's elevation to the Vice Presidency.

The deals in China get securred days after he shows up in China on Air Force Two with his father.… pic.twitter.com/5eTEyAWwKj

— KanekoaTheGreat (@KanekoaTheGreat) August 12, 2023

How much longer can the wagons protect them?

Event 201

⚠️Holy shit⚠️

US Congressman @RonJohnsonWI alleges that covid was “pre-planned by an elite group of people. Event 201”.

In reference to the John’s Hopkins Center tabletop exercise with the WEF and the Gates Foundation.

Pretty substantial allegations!pic.twitter.com/IfziWIE3SB

— Clandestine (@WarClandestine) August 11, 2023

“We’re getting closer every day to showing that Joe Biden was the ringleader in this, not Hunter Biden..”

• Comer Ready To Subpoena Bidens’ Phone, Bank Records, Grant Immunity (JTN)

House Oversight Committee Chairman James Comer on Friday night pointedly dismissed the appointment of a special counsel in the Hunter Biden criminal probe as “another maneuver… to obstruct” Congress and vowed to escalate his investigation by subpoenaing Hunter and Joe Biden’s phone and bank records and offering witnesses immunity. “We’re getting closer every day to showing that Joe Biden was the ringleader in this, not Hunter Biden,” Comer said in an exclusive interview with the “Just the News, No Noise” television show just hours after Attorney General Merrick Garland shocked Washington by announcing that he was upgrading Delaware U.S. Attorney David Weiss to a special counsel after four years of investigating the Biden family finances.

Comer dismissed Garland’s decision as ineffective, noting Weiss had years to bring serious charges and instead managed to construct a plea deal that spared Hunter Biden prison for tax evasion and gun charges that even the trial judge could not accept. “It’s another maneuver by the Justice Department to obstruct our investigation. I find it odd that, the day after I announced that we had put together a case that would win in court to subpoena Joe Biden’s personal bank records, then lo and behold, Merrick Garland strikes again,” Comer said.

“I assumed he would try to indict Trump or something. But no, he appoints a special counsel and he appoint the same person who had supposedly been investigating Hunter Biden for years, who let the statute of limitations expire on all of his obvious tax crimes, who tried to negotiate a sweetheart plea deal that led him off scot free. And less than two weeks later, after a judge rejects that sweetheart plea deal, Merrick Garland appointed special counsel for the sole purpose to obstruct our credible, effective oversight House investigation of Biden corruption.” Comer said he is now prepared to subpoena the credit card and bank records of the president and his son as well as their phone records to check witness allegations that Joe Biden got financial benefit from Hunter Biden’s clients and talked and met with them at various times.

“We’re at the point to where we put together a case where we have emails, we have text messages, we have pictures, we have bank records. Now we have sworn testimony from associates like Devon Archer. We are ready now to be able to subpoena the personal bank records of the Bidens,” he said. “What we’ve got now are their shady shell company. Now, we need the personal records,” he said. “Because when we show… that chart that shows China and Romania and Russia and the arrows go into shell companies and into the Biden’s family, we think there may be another arrow beyond the Biden family. And that would go to Joe Biden himself. And that’s what people have told us. That’s what the emails suggest. And that’s what we’re trying to determine now. And that’s where our investigation is headed.”

[..] “We’re going to continue to exercise our subpoena power. Hopefully, when we move to impeachment inquiry, that’ll be able to give us tools like granting immunity,” he explained. “If we could grant immunity. I think people like Devon Archer would have would have said a whole lot more. I think people like Eric Sherwood would tell a lot of things that that the Bidens have done that we know they’ve done, that everyone in America knows they’ve done.”

Robert Hur? Almost forgot about him.

• Prosecutors Want To Interview Joe Biden In Classified Memos Case (JTN)

Special Counsel Robert Hur wants to interview Joe Biden in his classified memos investigation, and the president’s attorneys have been in negotiations for about a month. Hur was appointed last January, two months after special counsel Jack Smith was appointed to investigate former President Donald Trump’s handling of classified documents, according to NBC News. The issues being negotiated include the time and place of the interview, as well as the scope of the questions. The reporting on this suggests that the investigation has a way to go before wrapping up, but “an interview with the person at the center of an investigation typically takes place near the end of the process,” according to NBC.

While most of the classified documents found starting in November of last year were related to Biden’s time as vice president, some went as far back as when he was a U.S. senator from Delaware. They were found in his office in Washington at the Penn Biden Center, at a second office of the Penn Biden Center in the Chinatown area of Washington, D.C. and at his home in Wilmington, Del. Trump was indicted on 37 counts based on seven charges in June in his classified documents investigation. One such charge was for a violation of the Espionage Act. Based on current polling, both Trump and Biden are well ahead in their races to be the nominees of their respective parties, setting up a 2024 rematch of the 2020 election for president.

When the Weiss-negotiated Hunter plea deal was thrown out, Garland made Weiss a special counsel. What links the two moves is that both are designed to keep all information under wraps.

Garland and Weiss must know this will not be accepted -it’s against the law-, but they entered it on Friday, so they have a whole weekend in which Weiss is able to manipulate even more files than in his previous position.

Paul SPERRY: “By suddenly acquiring special counsel status, Hill investigators say embattled prosecutor David Weiss can now avoid testifying next month before the House Judiciary Committee and face grilling over reports he helped obstruct a broader investigation into Hunter Biden..”

Jack Posobiec: “The appointment of Weiss as a ‘Special Counsel’ allows the Biden DOJ to keep the investigation open indefinitely and stall all House requests for information to coverup the Biden family corruption ring..”

• Comer, Jordan Slam Hunter Biden Special Counsel ‘Coverup’ (ZH)

The Chairman of the House Committee on Oversight and Accountability, James Comer (R-KY) said in a Friday statement that the announcement of a special counsel in the Hunter Biden investigation is a DOJ “coverup.” “This move by Attorney General Garland is part of the Justice Department’s efforts to attempt a Biden family coverup in light of the House Oversight Committee’s mounting evidence of President Joe Biden’s role in his family’s schemes selling ‘the brand’ for millions of dollars to foreign nationals,” Comer said in a lengthy statement shortly after Attorney General Merrick Garland announced the appointment of US Attorney David Weiss as special counsel, the Daily Caller reports.

“The Justice Department’s misconduct and politicization in the Biden criminal investigation already allowed the statute of limitations to run with respect to egregious felonies committed by Hunter Biden. Justice Department officials refused to follow evidence that could have led to Joe Biden, tipped off the Biden transition team and Hunter Biden’s lawyers about planned interviews and searches, and attempted to sneakily place Hunter Biden on the path to a sweetheart plea deal,” the statement continues.

“Let’s be clear what today’s move is really about. The Biden Justice Department is trying to stonewall congressional oversight as we have presented evidence to the American people about the Biden family’s corruption. The House Oversight Committee will continue to follow the Biden family’s money trail and interview witnesses to determine whether foreign actors targeted the Bidens, President Biden is compromised and corrupt, and our national security is threatened. We will also continue to work with the House Committees on Judiciary and Ways and Means to root out misconduct at the Justice Department and hold bad actors accountable for weaponizing law enforcement powers,” Comer continued.

House Judiciary Committee Jim Jordan (R-OH) conveyed similar sentiments, telling the Caller: “David Weiss can’t be trusted and this is just a new way to whitewash the Biden family’s corruption. Weiss has already signed off on a sweetheart plea deal that was so awful and unfair that a federal judge rejected it. We will continue to pursue facts brought to light by brave whistleblowers as well as Weiss’s inconsistent statements to Congress.” According to Garland, “The appointment of Mr. Weiss reinforces for the American people the department’s commitment to both independence and accountability in particularly sensitive matters,” adding “I am confident that Mr. Weiss will carry out his responsibility in an even-handed and urgent manner, and in accordance with the highest traditions of this department.” We’re sure he’s quite confident.

Denninger’s not the only one who noticed this bit: “Durham’s appointment was invalid for the same reason — remember that? Where was the screaming then?”

NOTE: Durham’s probe also took 5 years or so. And what was the result?

• Now THAT Is Ridiculous (Denninger)

There is a point that the in-your-face fraud reaches where one must that there is no longer a functional law enforcement capacity within a part of the government. In this case that’s the entire Federal government, as this is the DOJ itself and the AG of the nation, Garland: “Attorney General Merrick Garland on Friday appointed U.S. Attorney David Weiss a special counsel in the Hunter Biden probe, as well as any other matters that arose or may arise from that investigation.” Weiss is the US Attorney who presented a negotiated plea agreement to the judge over Hunter’s conduct that the judge rejected as it appeared to have included terms intended to mislead both the court and the justice system generally. She sent that back, correctly flagging two provisions including an apparent undisclosed immunity deal that was out-of-scope of the charges that were negotiated.

This is flat-out improper and what’s worse is that it appeared both Weiss and Biden’s defense counsel colluded to place said terms in an addendum that was not disclosed in advance of the hearing to the judge which was clearly intended to keep her from knowing about it until, they hoped, she’s signed off on it. Further there are allegations that Biden’s counsel attempted to tamper with the evidentiary chain by trying to represent themselves as being related to counsel for parties that filed other briefs and have them either sealed or stricken from the record entirely. There was quite a tap-dance around that (as its a crazy-level breach of ethics, a violation of the duties of an officer of the court, as all counsel are, and also arguably criminal fraudulent misrepresentation) but as far as I know there hasn’t (yet anyway) been any serious consequences — although the judge was clearly inclined to hammer the responsible parties for very good cause.

That alone is enough to drag Garland out of office by his hair. But there’s more: The appointment appears to be facially-illegal and Garland knows damn well that it is. “(a) An individual named as Special Counsel shall be a lawyer with a reputation for integrity and impartial decision making, and with appropriate experience to ensure both that the investigation will be conducted ably, expeditiously and thoroughly, and that investigative and prosecutorial decisions will be supported by an informed understanding of the criminal law and Department of Justice policies. The Special Counsel shall be selected from outside the United States Government.”

Weiss cannot be appointed to this position as he is a sitting US Attorney! It is explicitly unlawful under the CFRs for Garland to appoint him — or any other sitting US Attorney. By definition a “Special Counsel” must not be a person inside the US Government; that’s the entire point of a Special Counsel! This act by Garland is not only impeachable it is void as Weiss is not qualified and thus the appointment is an open, public, in-your-face fraud. Where does this leave us as Americans? Nowhere good — and at some point we, as Americans, are going to have to deal with this problem whether we like it or not. PS: BTW Durham’s appointment was invalid for the same reason — remember that? Where was the screaming then?

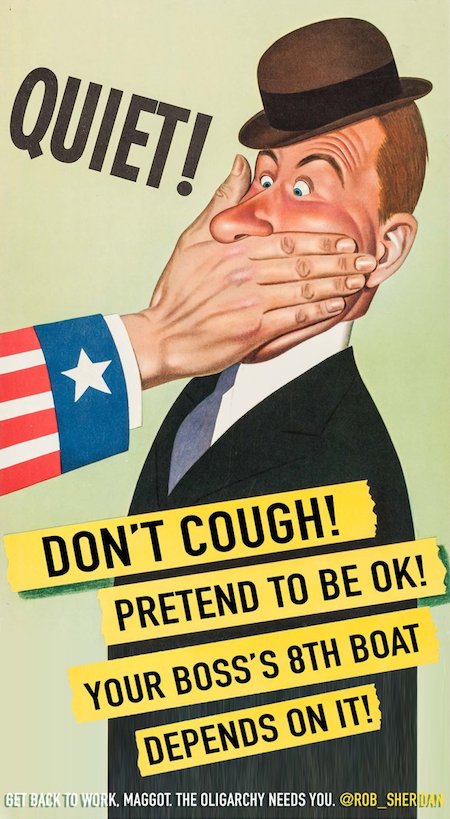

“..this is a really nice social media platform you’ve got there, would be a shame if something happened to it..”

• Appeals Court Judges Compare Biden Social Media Pressure To Mafia (JTN)

Fifth U.S. Circuit Court of Appeals Judge Jennifer Walker Elrod declared in court that the Biden administration’s efforts to persuade social media companies to remove, throttle and suppress purported misinformation on COVID-19, Hunter Biden’s laptop and elections reminded her of a mafia movie. That was just one of the most memorable examples of the frosty reception Justice Department Civil Division lawyer Daniel Tenny received Thursday from the three-judge panel considering whether to lift or modify last month’s ban on several forms of contact between the feds and companies — currently stayed by the 5th Circuit — as the First Amendment lawsuit led by Missouri and Louisiana proceeds. The back-and-forth at Thursday’s hearing resembled that between 6th Circuit judges and DOJ’s lawyer at a June hearing in a related social media censorship lawsuit against federal officials by users of X, formerly known as Twitter.

Both panels were appointed by Republican presidents. Echoing the injunction issued by U.S. District Judge Terry Doughty, the 5th Circuit judges repeatedly cited specific conversations from the factual record that suggest social media companies feared legal consequences for not complying with White House and agency requests to censor or diminish the reach of websites or social media postings of which the Biden administration disapproved. When Tenny claimed the injunction’s wording was so broad and vague it could ban the government from alerting the public about “untrue statements” about a natural disaster, Judge Don Willett countered that documented private conversations were the issue. Federal officials appeared to practice “fairly unsubtle strong-arming” and make “not-so-veiled threats” in the vein of “this is a really nice social media platform you’ve got there, would be a shame if something happened to it,” Willett said.

Tenny, upon hearing what the judges appeared to be interpreting as coercive pressure, tried to soft pedal the severity of that pressure. “The government is generically going to be angry” when companies resist taking action, but the communications show officials and companies alternating between “friendly” and “testy” conversations, not specific orders to comply “or else.” Judge Elrod didn’t seem particularly convinced, telling Tenny that “Or else” isn’t required when the government and companies have a “very close working relationship” that resembles a supervisor addressing a subordinate. The “irate messages” actually show high-ranking officials badgering counterparts about why they hadn’t taken action against specific accounts as requested, Judge Elrod said: “It’s like ‘jump and how high.'”

“..you can’t just have the government sweep up everything about you trying to find out if you did something wrong.”

• Congress Probing FBI Collection Of J6 Phone Location Data (JTN)

The House Judiciary Committee on Thursday launched a broad inquiry into the FBI’s use of “geofence warrants” to sweep up large buckets of Americans cell phone location data, a relatively new tool that is raising questions about search and seizure powers that date all the way back to the country’s founding, The tactic came to prominence during the Jan. 6 riot investigation when it was revealed more than 5,000 American phone devices had location data gathered by the FBI in a digital dragnet designed to identify anyone who was in or near the U.S. Capitol that fateful day. That geofence warrant plus revelations that the FBI accepted bank records volunteered by a major bank without seeking a warrant or subpoena have trigged concerns of both liberals and conservatives of a modern-day end run around the 4th Amendment.

“The use of geofence warrants raises serious Constitutional concerns,” House Judiciary Committee Chairman James Jordan wrote Attorney General Merrick Garland in a letter Thursday announcing the congressional inquiry. “First, location history data is not an exact science as the geo-location data represents only a probable estimation of a device’s location within a given radius and margin of error. Second, a geofence warrant is inherently tied to a specific location—not a known suspect, user, account, or crime. “For that reason, among others, courts have wavered on whether searches pursuant to geofence warrants comply with the Fourth Amendment’s requirements of probable cause and particularity,” Jordan added.

In an interview with Just the News, Jordan said the geofence warrant inquiry was part of a larger effort to help Congress modernize civil liberty protections in an era of unprecedented digital surveillance and technological data gathering that also includes bank records and the Foreign Intelligence Surveillance Act that was abused during the Russia collusion scandal. “We know that regarding Jan. 6, a couple years ago that the FBI was looking to get your your phone data location, where you were in relation to the Capitol, were you around the Capitol,” Jordan told the John Solomon Reports podcast. “And it was just sort of this blanket approach No predicate to say you know Sally Smith, or John Jones was here. We have reasonable belief they did this. We’d like to know we want to double check that. Nothing like that. Just a blanket.

“And then you couple this with what we learned from a testimony from a whistleblower at the FBI, a few months back, where Bank of America just turned over their customers debit card and credit card purchases in the DC area around Jan. 6 2021. I mean, this is scary stuff,” he added. “It’s so contrary to the principles that our country was founded on. Like, you can’t just have the government sweep up everything about you trying to find out if you did something wrong. That’s not how our system works. “But it sure looks like that’s what’s happening in modern day America, particularly with this Biden administration.”

Jordan’s letter raised a second concern that geo-fence warrants may have been “weaponized for political ends” by the Justice Department, approved against conservatives and Trump protesters but not against liberal activists from the 2020 George Floyd riots. “Federal law enforcement’s interest in geofenced data appears selective,” he wrote. “For example, in 2020, Minnesota police sought a geofence warrant to investigate violent rioting in Minneapolis and the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF) used geofence warrants to investigate arson throughout Kenosha, Wisconsin. However, it seems that the FBI did not pursue geofenced data to investigate the violent crime occurring at federal facilities during a similar time frame. “In contrast, the FBI readily used geofencing at an unprecedented scope and scale as a part of its investigation and prosecution of the events of January 6, 2021,” he added.

They need to learn English first.

• F-16 Training For Ukrainian Pilots Barely Getting Off the Runway (Sp.)

Kiev might be clamoring for American-made F-16s amid its faltering counteroffensive, but the first Ukrainian pilots to undergo training on the fighter jets most likely will not be ready to fly them until next summer, according to a US report. A mere handful of six pilots will undergo the first round of instruction, with two other pilots picked as reserve candidates, according to cited senior Ukrainian government and military officials. However, this first group of pilots is not expected to wrap up training anytime soon, sources acknowledged to the outlet. The officials reportedly bemoaned delays by their Western patrons in implementing the instruction program. None of the previously touted “game-changing weapons” funneled from the West have made much impact on the catastrophically slow pace of Ukraine’s ground forces fighting in the ongoing NATO-Russia proxy war.

So begging for the multi-role US fighters to be added to the mix has become Ukrainian President Volodymyr Zelensky’s mantra of late. While Kiev may have banked on its pilots being ready to fly the single-engine craft, which debuted in the 1970s and has been updated repeatedly, by as early as September, that appears to have been wishful thinking. While sending Patriot missile system, NASAMS, HIMARS, Bradley fighting vehicles, Leopard II tanks, depleted uranium shells, and, more recently, cluster bombs, to Ukraine, President Joe Biden spent close to a year denying Ukrainian appeals for F-16s. He backtracked as the special military operation continued, saying in May that he would green light training Ukrainian pilots on US-made jets, and supported the transfer of the combat planes by other countries. Eleven NATO countries pledged to support the training, expected to primarily take place in Denmark, Romania, and the Netherlands.

After the start of training was pushed back several times, officials were now cited as saying the effort was only gradually getting off the ground. There had previously been reports that the training had hit a major snag due to the language barrier. Now, the outlet said that even though the selected Ukrainian pilots were already fluent in English, at least four months of special English lessons in Britain were required for them to grasp the terminology associated with the F-16s. To complicate matters further, the language instruction for pilots is to take place simultaneously with lessons for Ukraine’s ground staff – suggested as being less proficient in English. The reason for this was because Denmark had allegedly demanded that entire crews be sent together to train.

The language hurdle is believed to have pushed back the beginning of actual combat training, anticipated to take six months, as far as to January, sources said. As for the second batch of pilots, ostensibly of the same size, they might be nowhere near ready to fly F-16s until the end of next year. It was added that 20 more Ukrainian pilots were currently ready for English-language training. “This is called dragging it out,” a Ukrainian official was quoted as fuming. However, the sources revealed that they feared railing openly against their US and European “benefactors” lest they “appear ungrateful.”

“Our opponents know these provisions perfectly well..”

• Russia Committed To Principle Of Inadmissibility Of Nuclear War (TASS)

Russia is taking all necessary measures to guarantee national security but is firmly committed to the principle of the inadmissibility of a nuclear war, the Russian foreign ministry said on Friday, commenting on the decisions made by Russia, the United Kingdom and the United States to not target strategic nuclear missiles. “The leadership of our country is firmly committed to the principle of the inadmissibility of a nuclear war. We proceed from the fact that there can be no winner in such a war and that it must not be unleashed,” the ministry said. “Russia is taking all necessary measures to ensure its national security, territorial integrity and sovereignty. And it will continue to do so.” According to the ministry, preventing a potential act of aggression against Russia and its allies “is among its highest state priorities.”

The ministry noted that the situation in the sphere of international security and strategic stability is degrading and “discussions about the expediency of measures on not targeting strategic nuclear forces, which have been in place between Russia, the United Kingdom, and the United States since the early 1990s, have visibly invigorated.” “Calls are being heard to denounce the relevant agreements in which Russia takes part, “trigger a mechanism of nuclear deterrence,” and aim Russian missiles at the United States and the United Kingdom,” the ministry said. It recalled that on January 14, 1994, Russia and the United States signed the Moscow declaration, where the sides agreed not to aim strategic nuclear missiles at each other. A similar agreement with London was signed on February 15, 1994.

“These are political agreements and impose no legal obligations on the sides. Since they are not international treaties as defined in the Vienna Convention of the Law of Treaties of 1969, the procedure of their termination of denunciation is not regulated by international law,” the ministry said. “As for triggering the nuclear deterrence mechanism, in line with the provisions of the fundamentals of Russia’s state policy in the sphere of nuclear deterrence that were endorsed by the Russian presidential decree of June 2, 2020 No355, nuclear deterrence is carried out permanently with respect to certain states and military coalitions (blocs, unions) which view Russia as a potential enemy and possess nuclear weapons and/or other types of weapons of mass destruction or a considerable combat potential of conventional forces. One of the principles of nuclear deterrence is maintaining a certain part of forces and nuclear deterrence means on permanent combat alert. Our opponents know these provisions perfectly well,” the ministry stressed.

“Sullivan, Blinken, Nuland… They have the reins of power and they’re telling Biden what to do. They have a sense of unreality that they can prevail. ”

• Ray McGovern Has Never Been More Scared of Nuclear Catastrophe (SP)

A retired CIA expert on Russia and rare voice of reason coming from the bowels of the American deep state, Ray McGovern joins host Robert Scheer on another edition of the Scheer Intelligence podcast. With world peace, nuclear weapon prudence and film critique on the agenda, McGovern and Scheer delve into a host of relevant issues stemming from the war in Ukraine and the history behind it. From Christopher Nolan’s “Oppenheimer,” to CNN’s strange truthful broadcast on Ukraine’s counteroffensive, the old boys from the Bronx prod each other’s encyclopedic minds to try and make sense of the state of the world.

While mixed opinions over the atomic bomb film fill the first segment of the episode, the conversation seems to always make its way back to the importance of potential nuclear war on the horizon. As McGovern said, “I spent six decades, count them, six decades following Soviet and now Russian policy. Most of that time professionally and now… really just as intently and I have never, never had so much fear that we are on the cusp of a nuclear catastrophe.” McGovern, an adviser to seven presidents, also dives into the motivations and ramifications of such reckless foreign policy decisions, made by people who supposedly check all the qualification boxes:

“Sullivan, Blinken, Nuland… They have the reins of power and they’re telling Biden what to do. They have a sense of unreality that they can prevail. That was very clear at their first major foreign policy adventure, where the Chinese were kind enough to come to Anchorage, Alaska and they were treated like the British imperialists treated the Chinese on the Yangtze River two centuries ago!” In the end, it is the citizens back home as well as the soldiers on the front lines who get dealt a bad hand from these decisions. McGovern points out the bleak realities of what these aid packages to countries like Ukraine really mean to all parties involved. The most sinister part being how it happens in front of people without them even knowing and that is by design, courtesy of McGovern’s famously coined military, industrial, congressional, intelligence, media, academia, think tank (MICIMATT) complex.

SCF op-ed last week.

• US-Led NATO Drowns Ukraine in a Bloodbath (SCF)

New figures indicate the Ukrainian military death toll is at least 400,000 after 500 days of conflict. The real figure may actually surpass 500,000. This is much greater than previously estimated, which was already dreadful. Yet, Washington incoherently keeps pushing the failed counteroffensive to the “last Ukrainian”. This bloodbath is an obscenity, a vast imperial crime, with no effort at all by the U.S. and European leaders to sue for peace. Crudely put, war is a racket and the warmongers make a packet. Not surprisingly, the actual casualty figures suffered by the Kiev regime’s military are a closely guarded secret. The NATO sponsors are also keeping a tight lip on the ghoulish losses because to do so would be an admission of the abysmal failure of their proxy war against Russia, and that would entail incurring an almighty political backlash from the Western public. Therein lies a diabolical Catch-22.

Nevertheless, despite the best efforts to conceal the carnage, up to recently several independent observers had estimated the death toll for the Ukrainian forces to be around 250,000 to 300,000 since the conflict erupted on February 24, 2022. Russian military casualties have been put at about 10 percent of those inflicted on the Ukrainian side. New data this week, however, indicate the scale of losses for the NATO-backed Kiev regime to be much higher. Satellite imagery cited by Intel Republic’s Telegram channel of newly dug cemeteries in Ukrainian territory suggests that at least 400,000 military personnel have died in battles with Russian forces. The graves presume individual bodies buried. In addition, not recorded are the countless dead who have been obliterated on battlefields or left to rot by Kiev regime commanders.

Another measure is gleaned from grim reports this week in the U.S. media that there have been 50,000 amputees among Ukrainian soldiers, according to the supply of prosthetic limbs from German manufacturers. Extrapolation from that figure of casualties corroborates the far higher estimate of war dead. Consequently, in light of the amputee numbers, comparisons have been made even by the U.S. media with the level of attrition seen during World War One. The latter is notorious for its horrendous and senseless slaughter of men. The comparisons are correct but strangely glided over by the U.S. media without dwelling on what should be compelling abhorrence towards the violence. If the battles in Ukraine have been previously called a “meat grinder”, then it would be accurate to refer to the country more as a bloodbath.

SCF op-ed this week.

• US and NATO Arms Industries Hit Record $400 Billion in Sales (SCF)

Western weapons manufacturers are popping champagne corks over record sales with total revenues hitting $400 billion for last year. According to media reports, this coming year-end will see that record figure exceeded by another salivating $50 billion. Ukraine may be resembling a bloodbath, as we noted in last week’s editorial. But apparently, Western military corporations are swimming in a bonanza of profits and stock market investments. Most of this lucrative new business stems from NATO’s proxy war with Russia in Ukraine, which is heading toward its second year. There is no sign of a diplomatic effort from the West or the Kiev regime it sponsors to end the bloodshed.

The main corporate beneficiaries making a financial killing from Ukraine are by far the American firms. They include such behemoths as Lockheed Martin, Boeing and RTX (formerly Raytheon). But also enjoying soaring profits are arms makers in other NATO countries: BAE in the United Kingdom, Airbus in France, Netherlands and Spain, Leonardo in Italy, and Germany’s Rheinmetall. This week the Joe Biden administration requested another $24 billion in U.S. taxpayer-funded aid to Ukraine. It’s hard to keep track of the money flowing from NATO countries to prop up the Nazi regime in Kiev. Even the NATO authorities don’t seem to know the precise figures, such is the rampant corruption that is inevitably associated with the vast doling of funds. But estimates of total U.S. and NATO aid to Ukraine range from $150 billion to $200 billion over the past year alone.

What we are seeing is an audacious racket whereby the American and European public are subsidizing the funneling of their own taxpayers’ money into the coffers of weapons firms. And there is no democratic choice in the matter. It’s a fait accompli. Or, put another way, extortion. Of course, too, part of this huge scam is the hefty financial cuts for the inner circle of the Kiev regime, including its puppet president, Vladimir Zelensky, and the brazenly sleazy defense chief Aleksy Reznikov. It is reckoned that at least $400 million has been grafted by the top members of the regime from the arms bazaar flowing into Ukraine. Reznikov has even boasted that his country serves as a testing ground for NATO weaponry.

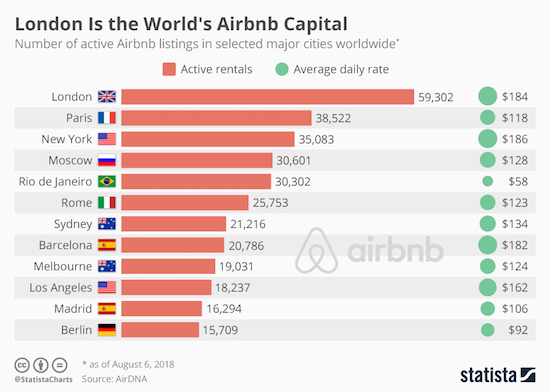

“.. the company will have the right to sue hosts who have not paid the tax, and thus raise the funds to pay the government bill..”

• Italy Launches $550 Million Airbnb Case (RT)

Italian authorities have accused US-based online accommodation booking firm Airbnb of not paying roughly €500 million ($547 million) in taxes, national news outlet Il Sole 24 Ore reported on Friday. A probe has been launched by Italy’s Revenue Agency (Agenzia delle Entrate), a government body that enforces financial laws and collects taxes, according to the outlet. Italian legislation governing short-term rental platforms states that professional landlords that lease accommodation must pay a 21% flat-rate tax on income they receive from rentals. In cases with non-professional hosts, or property owners for whom rentals are not the main source of income, platforms such as Airbnb have to act as agents and withhold the tax from transactions, before turning it over to the authorities.

Non-professional hosts make up the majority of Airbnb offers. The platform has repeatedly tried to contest the Italian legislation, but has so far failed. The EU Court of Justice ruled in December last year that the Italian law does not contradict broader EU legislation, effectively giving Italy the green light to demand the tax from the platform. According to the report, Airbnb has been negotiating with the Italian Revenue Agency for months to identify the exact group of hosts for whom the company should act as a tax agent. The final bill will depend on the number of non-professional hosts that Airbnb represents, the news outlet noted. Analysts have warned that after Airbnb and Italy’s tax authorities come to an understanding, the company will have the right to sue hosts who have not paid the tax, and thus raise the funds to pay the government bill.

If the estimations are correct, the €500 million settlement will be the second-highest figure ever requested by Italy from an internet company, following the €870 million it demanded from Meta platforms. The multinational owner of Facebook and Instagram was accused of failing to pay VAT in the country earlier this year. In the last ten years, Italy’s authorities have stepped up efforts to battle tax evasion and have collected nearly €3 billion from multinationals that initially failed to pay tax, according to Il Sole 24 Ore. Over €800 million was collectively paid by internet giants Apple, Google, Meta, PayPal, and Netflix.

3D

Awesome 3Dpic.twitter.com/me5vKzETK0

— Figen (@TheFigen_) August 12, 2023

Draco

The flying dragon

Draco is a genus of flying lizards, otherwise known as flying dragons or gliding lizards. These lizards are capable of gliding flight,not powered flight, using membranes extended to create wings, those structure are called patagia

pic.twitter.com/CYEXalEgaD— Science girl (@gunsnrosesgirl3) August 12, 2023

Mandarin duck

https://twitter.com/i/status/1690472670700175361

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.