Paris 1878

Until they get punched in the face.

• Everyone’s Got A Plan (Roberts)

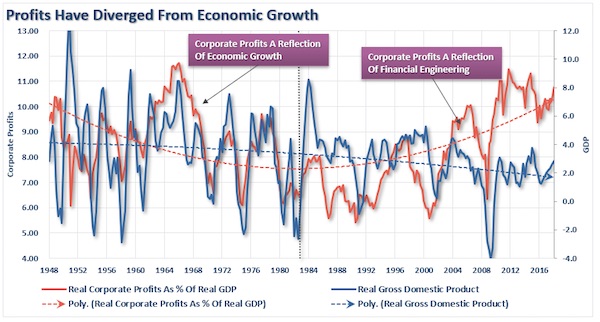

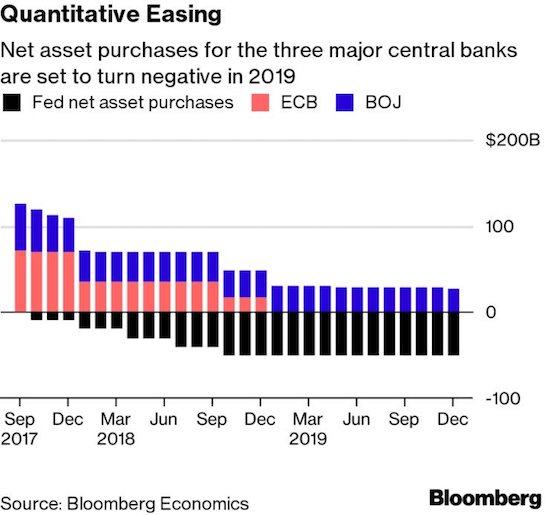

[..] much of the rally since the 2009 recessionary lows has been an influence of outside factors. Interest rates are low because of the Federal Reserve’s actions, corporate profitability is high due to share repurchases, accounting rule changes following the financial crisis, and ongoing wage suppression. But now, all of that is beginning to change. Interest rates are rising, the yield spread is flattening, and Central Banks globally are “beginning the end” of the “Quantitative Easing” experiment.

This is no small matter, although it is being dismissed as such. There has been a direct correlation between the “equity bull market” and the expansion of the Fed’s balance sheet. Yet, much to the Fed’s dismay, little of the asset surge translated into actual economic growth. But now, that support is being withdrawn and as such the market, unsurprisingly, has run into trouble. However, such shouldn’t matter if the economy, which ultimately drives earnings, is indeed firing on all cylinders as is commonly stated.

While corporate profitability has surged since the financial crisis, those profits have come at the expense of employees. Since 2009, wages for “non-supervisory employees,” which is roughly 83% of the current workforce, is lower today than at the turn of the century. The decline in economic growth epitomizes the problem that corporations face today in trying to maintain profitability. The chart below shows corporate profits as a percentage of GDP relative to the annual change in GDP. As you will see the last time that corporate profits diverged from GDP it was unable to sustain that divergence for long and economic growth subsequently declined with profits.

That was fast.

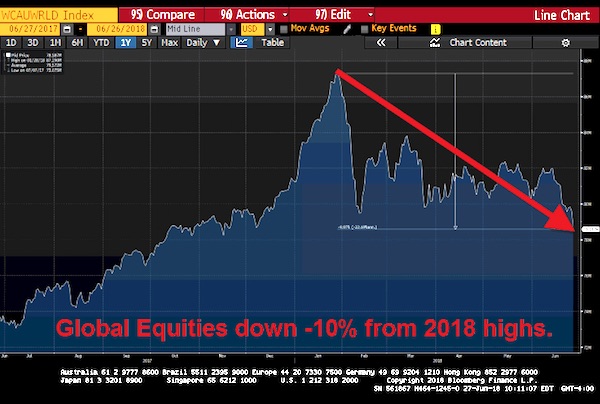

• How Much Have Global Equities Tumbled Since 2018 Peak? (HE)

-$8,700,000,000,00. That’s $8.7 trillion… From the 2018 peak, world equity indices are down -10% from $87 trillion in market capitalization to $78.6 trillion. Below are the top-10 largest drawdowns in country-specific equity markets from the 1/29 peak in global equities:

Venezuelan: -77%

Luxemborg: -54%

Argentina: -44%

Turkey: -32%

Brazil: -28%

Kazakhstan: -25%

Poland: -25%

Hungary: -24%

South Africa: -23%

China: -21%

“..cash-to-debt ratios more similar to those of speculative issuers..”

• Debt For US Corporations Tops $6.3 Trillion (CNBC)

The debt load for U.S. corporations has reached a record $6.3 trillion, according to S&P Global. The good news is U.S. companies also have a record $2.1 trillion in cash to service that debt. The bad news is most of that cash is in the hands of a few giant companies. And the riskiest borrowers are more leveraged than they were even during the financial crisis, according to S&P’s analysis, which looked at 2017 year-end balance sheets for non-financial corporations. On first glance, total debt has risen roughly $2.7 trillion over the past five years, with cash as a percentage of debt hovering around 33% for U.S. companies, flat compared to 2016. But removing the top 25 cash holders from the equation paints a grimmer picture.

Speculative-grade borrowers, for example, reached a new record-low cash-to-debt ratio of just 12% in 2017, below the 14% reported in 2008 during the crisis. “These borrowers have $8 of debt for every $1 of cash,” wrote Andrew Chang, primary credit analyst at S&P Global. “We note these borrowers, many sponsor-owned, borrowed significant amounts under extremely favourable terms in a benign credit market to finance their buyouts at an ever-increasing purchase multiple without effectively improving their liquidity profiles.” The trend persists even among highly rated borrowers: More than 450 investment-grade companies not among the top 1% of cash-rich issuers have cash-to-debt ratios more similar to those of speculative issuers, hovering around 21%.

Add the derivatives the BOE warned about to this mess.

• Deutsche Bank Fails Fed Stress Test, Three US Lenders Stumble (R.)

Deutsche Bank’s U.S. subsidiary failed on Thursday the second part of the U.S. Federal Reserve’s annual stress tests due to “widespread and critical deficiencies” in the bank’s capital planning controls. The Fed board’s unanimous objection to Deutsche Bank’s U.S. capital plan marks another blow for the German lender, sending its shares down 1% after hours. Its financial health globally has been under intense scrutiny after S&P cut its rating and questioned its plan to return to profitability. The Fed also placed conditions on three banks that passed the test. Goldman Sachs and Morgan Stanley cannot increase their capital distributions and State Street Corp must improve its counterparty risk management and analysis, the Fed said.

Deutsche Bank last week easily cleared the Fed’s easier first hurdle that measures its capital levels against a severe recession, the strictest ever run by the Fed. Thursday’s second test focuses on how the bank’s plan for that capital, such as dividend payouts and investments, stands up against the harsh scenarios. “Concerns include material weaknesses in the firm’s data capabilities and controls supporting its capital planning process, as well as weaknesses in its approaches and assumptions used to forecast revenues and losses under stress,” the Fed said in a statement. While failing the U.S. stress test would not likely affect the bank’s ability to pay dividends to shareholders, it will require Deutsche Bank to make substantial investment in technology, operations, risk management and personnel, as well as changes to its governance.

Businesses can no longer wait. It’s not Brexit itself, it’s the inability to make decisions.

• Corporate Brexodus Begins as “No-Deal” Brexit Looms (DQ)

“Exit” day is scheduled to begin on March 29, 2019, at 11 p.m. GMT. That’s 274 days away, and there’s scant sign of any progress on key sticking points such as the Northern Ireland border, the so-called “passporting” of UK financial services, and a future aviation agreement between the UK and the EU. Whatever the reasons for the potential departures from the UK, one of the things the recent constitutional crisis in Catalonia threw into stark relief is just how fickle and fearful money is, and just how quickly companies — even local ones — will up sticks if political developments in a particular region jeopardize their operations.

International banks and asset managers with large London-based operations are now scrambling to augment their EU outposts to mitigate the loss of passporting rights which enable them to offer financial, advisory and trading services to corporate clients across all EU states with just one local licence. JPMorgan is reportedly looking to expand its office space in Milan, where it already has around 250 staff, while Goldman Sachs is planning to double the number of staff in Frankfurt, which currently stands at 400.

Bank of America is merging its London-based subsidiary with its Dublin-based Irish entity, which will become its main EU base. It has also said it will expand its investment banking activities in Paris and shift some of its London-based back-office operations to Dublin. It is also transferring three of its most senior UK-based bankers to Paris in one of the most senior Brexit staff redeployments to date by a major bank, according to Reuters. But moving key operations and staff across the channel is a costly, complex undertaking. Many companies would still prefer to play a waiting game, and most of the moves that have taken place so far have involved small parts of firms’ operations.

But according to the European Banking Authority (EBA), which itself is relocating from London to Paris, time is running out. In an opinion paper released on Monday, it warned that City of London authorities and many UK-based banks were far from ready for a no-deal scenario. “Financial stability should not be put at risk because financial institutions are trying to avoid costs,” the paper says. In a remarkable coincidence Monday also saw a separate warning from the ECB that any banks that haven’t submitted their licence applications for operating in the Eurozone by the end of the month could find themselves without a permit by the time of Brexit.

It’ll be her legacy.

• How Merkel Broke The EU (Pol.eu)

Angela Merkel’s response to Europe’s refugee crisis has earned the German leader a reputation the world over as a modern-day Jeanne d’Arc, a bold defender of Western ideals against a populist onslaught. “I have immeasurable respect for Angela Merkel,” former U.S. Vice President Al Gore said during a visit to Berlin this week. “I think she’s an outstanding leader faced with a very difficult set of challenges.” While that view persists across much of the West, at home, questions about her leadership are growing louder by the day. Beyond the domestic concerns, more and more of Merkel’s erstwhile allies are asking a question still considered sacrilegious among much of Germany’s establishment: Is she tearing Europe apart?

“Dear Angela Merkel, after nearly 13 years as chancellor, the only thing Europe has left for you is animosity,” Malte Pieper, a correspondent of the normally staid German public broadcaster ARD said in a commentary this week that created waves in Berlin. “All the meetings in recent months have illustrated this. Help to finally stop Europe from veering toward division instead of unity! Make room in the chancellery for a successor.” The German leader has what could well be her last chance to prove her critics wrong at this week’s European Council summit in Brussels. She is under intense pressure to return home with a deal on refugees — one that would allow her Bavarian partners, CSU, who face a tough election campaign, to claim victory in a protracted standoff over the potent question of asylum policy.

The trick will be to win such a deal without further alienating the rest of Europe. Trouble is, Merkel is relying on an argument that is losing its resonance. What’s really at stake, Merkel has suggested time and again, isn’t Germany’s refugee policy, but the very survival of the EU. “Europe has to stay together,” she said this month in an attempt to deflect the attacks against her. “Especially in this situation, in which Europe is in a very fragile position, it’s very, very important to me that Germany doesn’t act unilaterally.”

This is so absurd it’s hard to believe. They haven’t decided on anything but have their PR people take over. Think they can buy themselves camps in Egypt or Morocco. That money can solve the issue.

• EU Leaders Hail Summit Victory On Migration But Details Scant (G.)

European leaders papered over the divisions on migration with a promise that some EU countries would take in migrants rescued from the Mediterranean sea, after marathon talks at an EU summit lasting nearly 10 hours. Announcing the end of tense summit talks shortly before dawn, the head of the European Council, Donald Tusk, tweeted that EU leaders had reached an agreement, including on migration. Hours earlier that outcome had been in doubt, when Italy threatened to veto the entire text, unless other EU states did more to help with people arriving on Italian shores. Opposition from Poland, Hungary and other central European states to any hint of mandatory action meant talks dragged through the night.

The euro jumped 0.6% on news of the deal, while French president Emmanuel Macron declared that European cooperation “has won the day”. Italy’s new prime minister, Giuseppe Conte, said: “We are satisfied. It was a long negotiation but from today Italy is no longer alone.” But the bloc dodged an agreement on controversial refugee quotas, as a quartet of central European countries resisted language on EU-wide responsibility. The outcome is already being seen as a thin deal. It also looked doubtful whether Angela Merkel has a deal that will secure the future of her coalition government, which has been rocked by disputes over handling refugees. On leaving the summit, the German chancellor conceded that “we still have a lot of work to do to bridge the different views”, but said it was “a good signal” that the EU had agreed a common text.

Merkel had warned on Thursday that the future of the European Union hinged on whether it could find answers to the “vital questions” posed by migration. [..] Finding a more consensual note, EU leaders called for migrant processing centres in north African countries. They agreed to “swiftly explore the concept of regional platforms in close cooperation” with non-EU countries and the UN refugee agency and the International Organisation for Migration, also a UN-backed agency. In essence, this means migrant processing centres in countries, such as Algeria, Egypt, Libya, Morocco, Niger and Tunisia. EU funds would be available to persuade countries to sign on, but so far no countries have agreed, while a couple have ruled themselves out.

Varoufakis and his wife on walls, symbolic and real.

• The Globalising Wall (Danae Stratou, Yanis Varoufakis)

We were hit by a great paradox: the more globalisation was meant to give reasons for dismantling the dividing lines, the less powerful the forces working to dismantle them were proving. Deepening divisions, patrolled by increasingly merciless guards, and convoluted architectural techniques, roads, tunnels and fortifications, appeared to us the homage that globalisation was paying to organised misanthropy. In this era of globalised financialisation, divisions were not what they used to be. In times past they simply fended off the enemy, and lightly imprinted the empires’ footprint on the land.

Before the ‘discovery’ of the autonomous individual, the ancient polis dreamt of demolishing its walls or, at least, of never having to keep its gates closed. When a son of an ancient Greek city won an Olympics event, the elders ordered the demolition of part of the city walls. Only at times of crisis or degeneracy were the gates ordered shut. Unlike today in North Korea or the southern states of the US, open gates were, then, a symbol of power. Hadrian and the Chinese emperors built great walls, but never with the intention of freezing human movement. They were porous walls, mere symbols of their empires’ self-imposed limits, and a form of early warning system.

[..] American deficits, even after they returned to their pre-2007 levels, could no longer stabilise globalisation. The reason? Socialist largesse for the few, and ruthless market forces for the many, damaged aggregate demand, repressed the entrepreneurs’ sales expectations, restricted investment in good jobs, diminished earnings for the many and, surprise surprise, confirmed the entrepreneurs’ pessimism that underpinned low investment and low demand. Adding more liquidity to that mix made not a scintilla of a difference as the problem was not a dearth of liquidity but the dearth of demand. Abysmal inequality was merely the symptom.

Wall Street, Walmart and walled citizens – those had been globalisation’s symbolic foundations before 2008. Today, all three have become a drag on globalisation. Banks are failing to maintain the capital movements that globalisation used to rely on, as total financial movements are less than a quarter of what they were in early 2007. Walmart, whose ideology of cheapness symbolised the devaluation of global labour and the gutting of traditional local businesses, is itself squeezed by the Amazon model, whose ultimate effect is a further shrinking of overall spending. Meanwhile, the 3D printer, CAD and AI robots promise to de-globalise – and re-localise – production, denying, in the process, countries like the Philippines and Nigeria the advantage that young populations used to bestow on them during the years of globalisation’s rude health.

Waste.

• The Living World Is Dying Of Consumption (Monbiot)

It felt as disorienting as forgetting my pin number. I stared at the caterpillar, unable to attach a name to it. I don’t think my mental powers are fading: I still possess an eerie capacity to recall facts and figures and memorise long screeds of text. This is a specific loss. As a child and young adult, I delighted in being able to identify almost any wild plant or animal. And now it has gone. This ability has shrivelled from disuse: I can no longer identify them because I can no longer find them. Perhaps this forgetfulness is protective. I have been averting my eyes. Because I cannot bear to see what we have done to nature, I no longer see nature itself; otherwise, the speed of loss would be unendurable.

The collapse can be witnessed from one year to the next. The swift decline of the swift (down 25% in five years) is marked by the loss of the wild screams that, until very recently, filled the skies above my house. My ambition to see the seabird colonies of Shetland and St Kilda has been replaced by the intention never to visit those islands during the breeding season: I could not bear to see the empty cliffs, where populations have crashed by some 90% in the past two decades. I have lived long enough to witness the vanishing of wild mammals, butterflies, mayflies, songbirds and fish that I once feared my grandchildren would not experience: it has all happened faster than even the pessimists predicted.

Walking in the countryside or snorkelling in the sea is now as painful to me as an art lover would find visits to a gallery, if on every occasion another old master had been cut from its frame. The cause of this acceleration is no mystery. The United Nations reports that our use of natural resources has tripled in 40 years. The great expansion of mining, logging, meat production and industrial fishing is cleansing the planet of its wild places and natural wonders. What economists proclaim as progress, ecologists recognise as ruin. This is what has driven the quadrupling of oceanic dead zones since 1950; the “biological annihilation” represented by the astonishing collapse of vertebrate populations; the rush to carve up the last intact forests; the vanishing of coral reefs, glaciers and sea ice; the shrinkage of lakes, the drainage of wetlands. The living world is dying of consumption.

8 of which are in Asia.

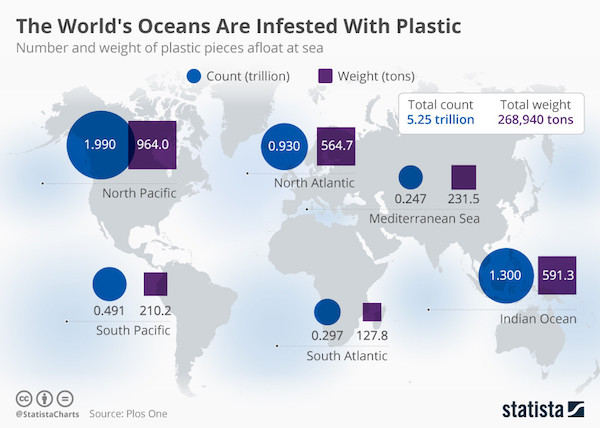

• 90% Of Plastic Polluting Our Oceans Comes From Just 10 Rivers (Wef)

Over the last decade we have become increasingly alarmed at the amount of plastic in our oceans. More than 8 million tons of it ends up in the ocean every year. If we continue to pollute at this rate, there will be more plastic than fish in the ocean by 2050. But where does all this plastic waste come from? Most of it is washed into the ocean by rivers. And 90% of it comes from just 10 of them, according to a study. By analyzing the waste found in the rivers and surrounding landscape, researchers were able to estimate that just 10 river systems carry 90% of the plastic that ends up in the ocean. Eight of them are in Asia: the Yangtze; Indus; Yellow; Hai He; Ganges; Pearl; Amur; Mekong; and two in Africa – the Nile and the Niger.

“We were able to demonstrate that there is a definite correlation in this respect,” said Dr. Christian Schmidt, one of the authors of the study from the Helmholtz Centre for Environmental Research. “The more waste there is in a catchment area that is not disposed of properly, the more plastic ultimately ends up in the river and takes this route to the sea.” Schmidt and his team found that the quantity of plastic per cubic metre of water was significantly higher in large rivers than in small ones. The rivers all had two things in common; a generally high population living in the surrounding region – sometimes into the hundreds of millions – and a less than ideal waste management process. The Yangtze is Asia’s longest river and also one of world’s most ecologically important rivers.

The river basin is home to almost 500 million people (more than one third of China’s population). It is also the biggest carrier of plastic pollution to the ocean. Recently, however, China has made efforts to curb waste. For years the country had imported millions of tons of recyclable waste from overseas, but a growing recycling burden at home prompted the government to shift its policy. Last year, it ended imports of “foreign garbage”. Recently it extended the ban to metals, saying stopping imports of foreign waste was “a symbolic measure for the creation of an ecological civilization in China”. And this year China has ordered 46 cities to begin sorting waste in order to reach a 35% recycling rate by 2020.

Home › Forums › Debt Rattle June 29 2018