Vincent van Gogh Bridge in the rain (after Hiroshige) 1887

Oh man, I wrote one little article and mere hours later they’re all running for cover…

• David Davis Resigns As Brexit Secretary (Ind.)

David Davis has quit his cabinet job following a major row with Theresa May over her plans for post-Brexit relations with the EU. His resignation as Brexit secretary deals a heavy blow to the stability of the prime minister’s administration, with two other ministers almost immediately following suit. The departure of Mr Davis, Steve Baker and Suella Braverman, who had also served in the Department for Exiting the EU, could now embolden other senior figures to quit.

Ms May had been hoping to win over Brexiteers to her proposals agreed by the cabinet, including Mr Davis, on Friday – but since then Leave-backing Tory MPs have called for a change in leadership.The move comes on the eve of a major test for the prime minister as she faces the house of commons on Monday, to explain her proposals, and then a stormy meeting of Conservative MPs. In his resignation letter, Mr Davis wrote: “As you know there have been a significant number of occasions in the last year or so on which I have disagreed with the Number 10 policy line, ranging from accepting the [European] Commission’s sequencing of negotiations, through to the language on Northern Ireland in the December Joint Report. “At each stage I have accepted collective responsibility because it is part of my task to find workable compromises, and because I considered it was still possible to deliver on the mandate of the referendum, and on our manifesto commitment to leave the Customs Union and the Single Market.

China slowing down.

• World Trade Has Decelerated Sharply (Ashoka Mody)

World trade has decelerated sharply. This ill omen portends severe risks in the months to come. The greatest risks are in the eurozone – where Italy is the fault line along which the most acute vulnerabilities lie. In the three months ending in April, the annual pace of world trade growth dipped slightly below 4 percent, a sharp decline from 5.5 percent rate in the second half of 2017. Trade growth in 2017 was both a barometer and cause of rare “synchronized” GDP growth with nearly every country experiencing buoyant conditions. That sweet spot is fading because the Chinese economy is slowing down. With its huge size and extensive global trade relationships, changes in Chinese domestic economic priorities have a huge impact on trade and the world economic outlook.

A blistering pace of Chinese imports propped world trade growth until January this year, and a slowdown since then in Chinese imports has dampened world trade. The shift is a consequence of the attempt by Chinese leadership to diffuse a grossly oversized credit bubble. But reduced credit has squeezed investment in infrastructure projects and, hence, in the imports of goods and materials to support those projects. Recently, retail sales have also slowed. China’s credit bubble may yet burst, causing global economic and financial mayhem. Even if the Chinese economy merely slows down, which it seems almost certain to, global trade deceleration will continue. If, in addition, the global trade war escalates, global economic conditions could deteriorate rapidly.

Growth deceleration is already evident in the eurozone. German growth relies to an extraordinary degree on exports to China and, not surprisingly, German industrial production has been in the doldrums in the past few months. Moreover, when German exporters face weaker growth prospects, they buy less from their largely European suppliers, which significantly dampens economic growth in Europe. Italy will face the ill-effects of a global slowdown most acutely. After abysmal performance through much of the last decade, Italian GDP growth had picked up to annual rate of 1.8 percent in the second half of 2017. But that did not last. Already, Italian GDP growth is slowing and forecasts for the 2018 have are down to just above a 1 percent annual growth rate.

“.. fewer than 10 of the 800-plus Chinese equity mutual funds have made a positive return this year..”

• Market Turmoil Pushes Some China Funds To The Brink (R.)

It’s already been a harsh year for Chinese funds, hit by new rules aimed at reining in debt in the country’s financial system. Now, the sell-off in China stocks induced by trade war anxiety further threatens their health and for some, their survival. Case in point: private fund house Nanjing Hu Yang Investment Co has seen its assets under management halve to 50 million yuan ($7.5 million) over the past year on redemptions and investment losses. Its chairman, Zhang Kaihua, said he is putting his funds, which bet on consumer stocks, into “a state of dormancy”. He’s also stopped publishing fund performances and shelved capital raising plans. “Our only hope is that our existing clients can stick with us so that we can survive,” he said, adding that he has seen many of his peers drop out of the market.

In the past when market turmoil has hit China’s fund industry, such as in 2015, it has managed to bounce back on loose monetary policies and relaxations in rules for the sector. But this time, asset managers face a double whammy of fleeing investors and a central bank keen to see a mopping up of excessive liquidity in the financial system – pointing to prolonged pain for the industry. And as the U.S.-China trade war heats up – the two slapped tariffs on $34 billion worth of each other’s goods on Friday – the worry is that further declines in Chinese shares, which have fallen 10 percent since late June to two year-lows, could be the last straw for some funds.

According to Morningstar, fewer than 10 of the 800-plus Chinese equity mutual funds it tracks have made a positive return this year. Even before trade war fears ramped up last month, changes to asset management rules first outlined in 2017 and aimed at encouraging banks to reel in their investments in stocks and bonds had taken their toll. Equity fundraising dwindled to minimal levels, while redemptions and liquidations spiked.

Global trade decelerates, but US trade defecit soars.

• US Faces Soaring Trade Deficits, But Rising Energy Prices Bigger Danger (CNBC)

America’s foreign trade deficits on goods transactions are getting worse. After an increase of 7.7 percent in 2017, those deficits were growing in the first five months of this year at an almost identical annual rate. Particularly disappointing is the fact that there is no progress at all in bringing trade deficits down with the European Union and China. The deficit with those two large economic systems came in at $218 billion during the January-May period, accounting for nearly two-thirds (64 percent) of America’s total trade gap. That deficit was 11.3 percent more than recorded over the same interval of last year, and, at an annual rate, it comes close to half-a-trillion dollars.

Looking at the detail of these numbers, one can clearly see that trade deficits with the EU and China, growing at respective annual rates of 15 percent and 10 percent, are driven by a strong and unrelenting import penetration of American markets by European and Chinese companies. On current evidence, the short-term outlook for American foreign trade is not good for reasons of (a) different growth dynamics, (b) confrontational trade policies and (c) the political and security fallout exacerbated by intensifying trade disputes. Barring an inflation-induced recession, of which more later, the U.S. aggregate demand components — household consumption, residential investments and business capital outlays — are underpinned by high employment, increasing inflation-adjusted after tax incomes, low credit costs and targeted fiscal incentives.

An anticipated economic growth in the area of 2.5 to 3.0 percent for the rest of this year would still be more than an entire percentage point above the estimated non-inflationary potential of the U.S. economy. That strong demand pressure will continue to spill over into the rest of the world, and will support America’s vigorous imports of foreign goods and services. That’s music to European and Chinese ears.

And then what is Mueller going to do?

• White House Close To Refusing Interview With Russia Investigation (G.)

Donald Trump’s lawyer Rudy Giuliani has warned Robert Mueller, the special counsel investigating possible collusion between Russia and the Trump campaign during the 2016 presidential election, that the White House is close to refusing to grant an interview with the president. Giuliani took the increasingly belligerent tone of the White House up a notch on Sunday when he called the Russian investigation the “most corrupt I’ve ever seen”. Speaking on This Week on ABC News, he accused the special counsel of assembling a team of investigators around him that included “very, very severe partisans working on an investigation that should have been done by people who are politically neutral”.

Asked whether they had made a decision on whether or not Trump should participate in an interview with the inquiry, he replied: “We have not determined he will not sit down with Mueller, but we are close to that.” Giuliani’s round of the Sunday TV political talkshows is the latest sign that the core Trump team has decided to abandon its earlier approach of being seen to cooperate with the Russia investigation, and move towards an antagonistic position. On Friday, Giuliani told the New York Times that Mueller would get his interview with the president only if he could satisfy the White House that he had evidence that Trump had committed a crime.

The attorney and former mayor of New York, who is a long-standing friend of Trump’s, walked back that suggestion a little on Sunday. He said the White House did not require evidence of a criminal deed but at least some factual basis supporting suspicion of a crime. Giuliani revealed to CNN’s State of the Union that the White House legal team had debriefed all the witnesses to the Mueller investigation, and reviewed 1.4m pages of documents handed over to the special counsel. As a result, he claimed, he could confidently say that Trump had nothing to answer. “I have a pretty good idea because I’ve seen all the documents they have, we’ve debriefed all their witnesses. They have nothing. They would not be pressing for this interview if they had anything.”

John Ralston Saul is an interesting voice.

• America the Failed State (Chris Hedges)

Our “corporate coup d’état in slow motion,” as the writer John Ralston Saul calls it, has opened a Pandora’s box of evils that is transforming America into a failed state. The “unholy trinity of corruption, impunity and violence,” he said, can no longer be checked. The ruling elites abjectly serve corporate power to exploit and impoverish the citizenry. Democratic institutions, including the courts, are mechanisms of corporate repression. Financial fraud and corporate crime are carried out with impunity. The decay is exacerbated by the state’s indiscriminate use of violence abroad and at home, where rogue law enforcement agencies harass and arrest citizens and the undocumented and often kill the unarmed.

A depressed and enraged population, trapped by chronic unemployment and underemployment, is overdosing on opioids and beset by rising suicide rates. It engages in acts of nihilistic violence, including mass shootings. Hate groups proliferate. The savagery, mayhem and grotesque distortions familiar to those on the outer reaches of empire increasingly characterize American existence. And presiding over it all is the American version of Ubu Roi, playwright Alfred Jarry’s gluttonous, idiotic, vulgar, narcissistic and infantile king, who turned politics into burlesque.

“Congress works through corruption,” Saul [..] said when we spoke in Toronto. “I look at Congress and I see the British Parliament in the late 18th century, the rotten boroughs. Did they have elections? Yes. Were the elections exciting? Yes. They were extremely exciting.” Rotten boroughs were the 19th-century version of gerrymandering. The British oligarchs created electoral maps through which depopulated boroughs—50 of them had fewer than 50 voters—were easily dominated by the rich to maintain control of the House of Commons.

In the United States, our ruling class has done much the same, creating districts where incumbents, who often run unchallenged, return to Congress election after election. Only about 40 of the 435 seats in the House of Representatives are actually contested. And given the composition of the Supreme Court, especially with Donald Trump poised to install another justice, it will get worse. The corruption of the British system was amended in what Saul called “a wave upwards.” The 1832 Reform Act abolished a practice in which oligarchs, such as Charles Howard, the 11th Duke of Norfolk, controlled the election results in 11 boroughs. The opening up of the British parliamentary system took nearly a century. In the United States, Saul said, the destruction of democracy is part of “a wave downwards.”

No going back.

• BOJ’s Kuroda Expresses Resolve To Keep Ultra-Easy Monetary Policy (R.)

Bank of Japan Governor Haruhiko Kuroda on Monday stressed that the central bank would maintain its ultra-loose monetary policy until inflation hits its 2 percent target. He also reiterated that Japan’s economy would see inflation accelerate towards the BOJ’s target as the output gap improved and medium- to long-term inflation expectations heightened. “Japan’s economy is expected to continue expanding moderately,” Kuroda said in a speech at a quarterly meeting of the central bank’s regional branch managers. Under a yield curve control policy adopted in 2016, the BOJ pledges to guide short-term interest rates at minus 0.1 percent and the 10-year government bond yield around zero percent.

The EU can’t accept it.

• A Parallel Currency For Italy Is Possible (Pol.eu)

In Joseph Stiglitz’s recent article for the POLITICO Global Policy Lab (“How to Exit the Eurozone,” June 29, 2018), the Nobel-prize wining economist proposes that Italy issue a parallel currency as a way to retake control of its monetary policy. It’s an insightful idea, and one worth exploring. However, Stiglitz is wrong when he suggests that “introducing a parallel currency, even informally, would almost certainly violate the eurozone’s rules and certainly be against its spirit.” Our organization — the Group of Fiscal Money — has been very active in developing and promoting such a dual-currency scheme. We call it “Fiscal Money” and believe it could be used to avoid the uncertainties of exiting the euro while allowing Italy to recover economically without breaking any EU rule.

Our proposal is for government to issue transferable and negotiable bonds, which bearers can use for tax rebates two years after issuance. Such bonds would carry immediate value, since they would incorporate sure claims to future fiscal savings. They could be immediately exchanged against euros in the financial market or used (in parallel to the euro) to purchase goods and services. Fiscal Money would be allocated, free of charge, to supplement employees’ income, to fund public investments and social spending programs, and to reduce enterprises’ tax on labor. These allocations would increase domestic demand and (by mimicking an exchange-rate devaluation) improve enterprise competitiveness through a reduction in the cost of labor.

As a result, Italy’s output gap — that is, the difference between potential and actual GDP — would close without affecting the country’s external balance. Note that under Eurostat rules, Fiscal Money bonds would not constitute debt, since the issuer would be under no obligation to reimburse them in cash. Also, as non-payable tax assets (of which many examples already exist), they would not be recorded in the budget until used for tax rebates — that is, two years after issuance when output and fiscal revenue have recovered.

Blackmail.

• Berlin Eyes Deal For Migrant Returns With Greece By End July (K.)

Even as Germany’s interior minister Horst Seehofer threatens the launch of mass returns of migrants if bilateral agreements are not achieved, German defense minister Ursula von der Leyen has suggested that such an accord with Greece may be signed by the end of the month. In comments to Der Spiegel, Seehofer said the absence of bilateral deals was “not a good strategy” and that Germany will start returning migrants reaching its border if that situation is not rectified. For his part, Alexander Dobrindt of the Christian Social Union said he believed German plans to return asylum seekers to European Union countries of first entry would not necessarily be met by cooperation.

“Whoever is not in a position to honor fundamental European regulations cannot expect cooperation in other areas,” he said. Von der Leyen, for her part, expressed her conviction that a bilateral agreement with Greece was a matter of time. “We want an agreement with Greece by the end of the month,” she told the Funke publishing group, adding that such an accord could be an example for other countries. “The Italians want us to help them in exchange,” she said. “Solidarity is significant, for everyone, irrespective of who is in government in Rome,” she said.

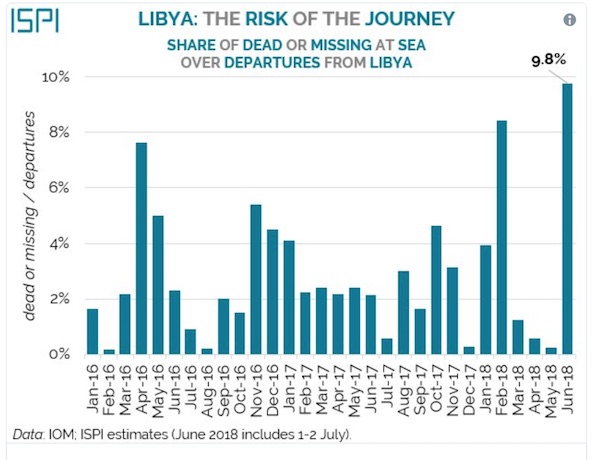

1 in 10 now drown.

• Italy Promises Billions To Libya If It Accepts The Return Of Migrants (EN)

Italy and Libya have agreed to reactivate a friendship treaty signed a decade ago that allowed migrants to be returned to Libyan territory. “We agreed to reactivate the 2008 Italian-Libyan friendship treaty,” said Libya’s foreign minister Mohamad Siala in a joint press conference in Tripoli with Italian counterpart Enzo Moavero Milanesi. He hailed the agreement reached during his first visit to Tripoli as “significant and promising”. The original treaty was signed by former Libyan dictator Moammar Gadhafi and Italy’s then prime minister Silvio Berlusconi, as they sought to turn a page on 40 years of stormy relations between the North African country and its former coloniser.

But the deal was suspended in February 2011, after the start of the uprising that saw Gadhafi forced from power and killed. The original treaty envisaged unlocking 4.2 billion euros of Italian investment in Libya as compensation for colonisation by Rome. In exchange, Libya would work to stop illegal migrants embarking from its shores — and receive those sent back to it. In Tripoli on Saturday the two ministers did not say if the text of the reactivated treaty had been amended. The agreement means “all the conditions are in place to work hand in hand to support stabilisation … (of) Libya’s security and unity”, Milanesi said. Libya “shares with the European Union the responsibility and the duty to deal with migrants”, he added.

The new anti-immigrant government in Rome has vowed to turn away all migrants who make it across the Mediterranean and into Italy. In recent days the UN has urged Rome to change its policy and re-allow charity rescue ships to operate in its waters and dock at its ports. It states that, whilst the amount of migrant attempting the crossing has gone down, the number of drownings has gone up.

Home › Forums › Debt Rattle June 9 2018