Pablo Picasso Man with arms crossed 1909

https://twitter.com/BarryESharp/status/1450924047034826756

Sign at Chick-Fil-A

Just

Show someone who is still asleep this 2 min video. Even if it doesn’t resonate with them at this moment, they just might recall his words of things that are yet to come. #WakeUpAmerica pic.twitter.com/HpiUchudh2

— the girl who questions everything (@freethinkerbabe) October 12, 2021

The Exposé feels a little chaotic at times, but they do the work.

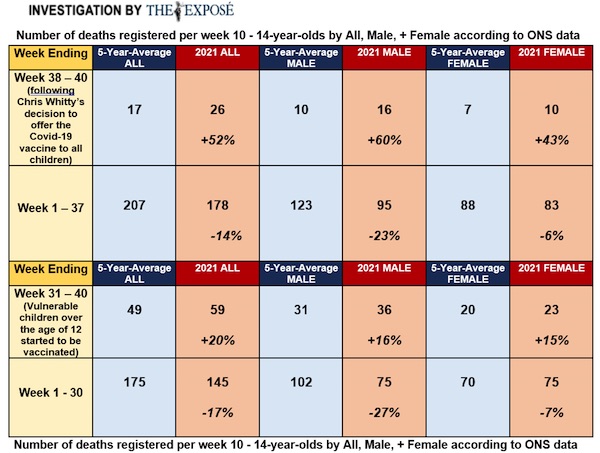

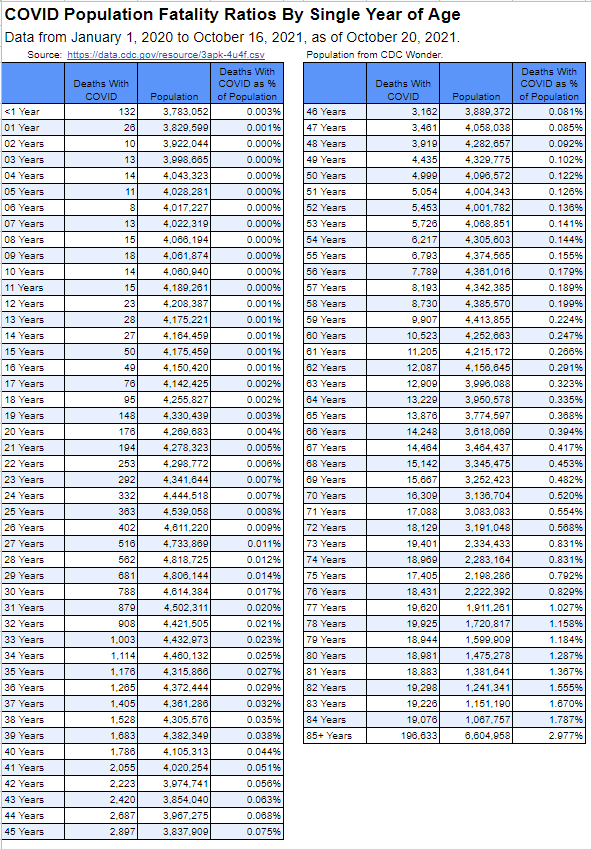

• Child Deaths Are 52% Higher Since They Were Offered The Covid-19 Vaccine (TE)

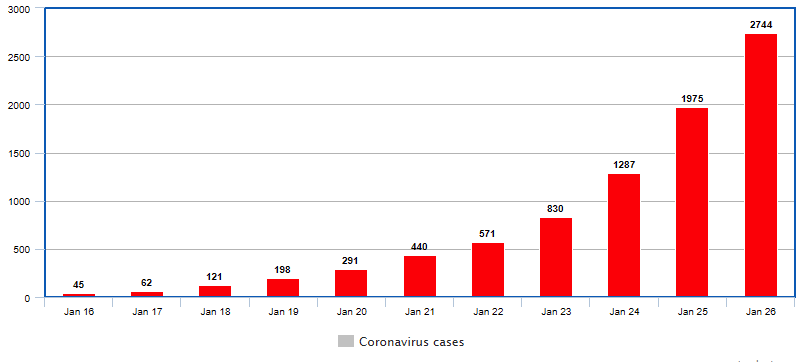

Chris Whitty advised the UK Government to roll-out the Pfizer Covid-19 vaccine to all children over the age of 12 in week 37 of 2021. Thanks to preparations already being made by the NHS to intrude on education in schools and administer the jab to children the programme got underway the following week (week 38). Official Office for National Statistics (ONS) data shows that between week 38 and week 40, the five-year-average number of deaths occurring among children aged between 10 and 14 was 17. However, the latest data available from the ONS shows that between week 38 and week 40, the number of deaths occurring among children aged between 10 and 14 was 26. This represents a 52% increase on the five-year average.

Sixteen of those deaths were among boys, representing a 60% increase on the five-year-average in which there had been 10 deaths among boys between week 38 and week 40. Whilst 10 of those deaths were among girls, representing a 43% increase on the five-year-average in which there had been 7 deaths among girls between week 38 and week 40. What’s even more concerning about the above numbers though is that deaths among children aged between 10 and 14 were significantly lower than the five-year-average up to the point Chris Whitty advised the Government to offer all children over the age of 12 a Covid-19 vaccine.

Official Office for National Statistics (ONS) data shows that between week 1 and week 37, the five-year-average number of deaths occurring among children aged between 10 and 14 was 207. However, the 2021 dataset from the ONS shows that between week 1 and week 37 of 2021 there were just 178 deaths among children aged between 10 and 14. This means deaths among children aged week 10 and 14 were 14% down on the five-year-average prior to being offered the Covid-19 injection.

However, it is known that children deemed to be vulnerable to Covid-19 due to certain underlying conditions were already being offered a Covid-19 injection prior to Chris Whitty’s decision to overrule the JCVI and offer the jab to all healthy children. [..] we assessed the numbers from the ONS five-year-average dataset on deaths (found here) and the ONS 2021 dataset on deaths and discovered that there had also been a notable increase in deaths among children since vulnerable kids had first been given the Covid-19 vaccine. We’ve compiled the following table on the ONS data:

Child Deaths Are 52% Higher?! Let’s jab all the kids.

• White House Details Plan To “Quickly” Vaccinate 28M Children Age 5-11 (ZH)

The Biden administration on Wednesday unveiled its plan to ‘quickly’ vaccinate roughly 28 million children age 5-11, pending authorization from the Food and Drug Administration (FDA). The jab – which doesn’t prevent transmission of Covid-19 will be available at pediatricians, local pharmacies, and possibly even at schools, according to the White House, which expects FDA authorization of the Pfizer shot for children – the least likely to fall seriously ill or die from the virus, in a matter of weeks, according to the Associated Press. “Federal regulators will meet over the next two weeks to weigh the benefits of giving shots to kids, after lengthy studies meant to ensure the safety of the vaccines. Within hours of formal approval, expected after the Centers for Disease Control and Prevention advisory meeting scheduled for Nov. 2-3, doses will begin shipping to providers across the country, along with smaller needles necessary for injecting young kids, and within days will be ready to go into the arms of kids on a wide scale”. -AP

According to the announcement, the White House has secured enough to supply more than 25,000 doses for pediatricians and primary care physicians who have already signed up to deliver the vaccine, while the country now has enough Pfizer vaccine to jab roughly 28 million kids who will soon be eligible, meaning this won’t be a slow roll-out like we saw 10 months ago when doses and capacity issues meant adults had to wait. Meanwhile, the White House is rolling out an ‘advertising’ campaign to convince parents and kids that the vaccine is safe and effective. According to the report, “the administration believes trusted messengers — educators, doctors, and community leaders — will be vital to encouraging vaccinations.” “COVID has also disrupted our kids lives. It’s made school harder, it’s disrupted their ability to see friends and family, it’s made youth sports more challenging,” said surgeon general Dr. Vivek Murthy in a Wednesday statement to NBC. “Getting our kids vaccinated, we have the prospect of protecting them, but also getting all of those activities back that are so important to our children.”

Why jab the kids? Well…

• Pfizer, Moderna to Rake in $93 Billion in 2022 COVID Vaccine Sales (CHD)

Vaccine makers Pfizer and Moderna are projected to generate combined sales of $93.2 billion in 2022 nearly twice the amount they’re expected to rake in this year, said Airfinity, a health data analytics group. Airfinity put total market sales for COVID vaccines in 2022 at $124 billion, according to the Financial Times. Pfizer vaccine sales are predicted to reach $54.5 billion in 2022, and Moderna’s will hit $38.7 billion. The estimates blow the earlier figures — $23.6 billion for Pfizer and $20 billion for Moderna — out of the water. “The numbers are unprecedented,” Rasmus Beck Hansen, CEO of Airfinity, told the Financial Times. Sales of the mRNA shots will continue to rise in 2022 due to boosters and countries stockpiling to ward off variants, Airfinity said.

Pfizer will generate 64% of its sales, and Moderna 75% of its sales, from high-income countries in 2022, the analysts predicted. In April, Pfizer predicted 2021 COVID vaccine sales of $26 billion. After second-quarter results were reported, Pfizer upped the figure to $33.5 billion. Bernstein analyst Ronny Gal said the company could ring up an additional $10 billion in vaccine sales in 2021. Gal wrote: “The numbers are going to be much higher. The guidance of $33.5B reflects contracts signed to today which reflect total commitment to sell 2.1 million doses (at average price of $15.95). Pfizer notes they expect to manufacture 3 million doses. Presumably much of those will be sold as well, albeit at lower average price as consumption shifts to emerging markets. This is probably another $10 billion.”

“The second quarter was remarkable in a number of ways,” Pfizer CEO Albert Bourla said. “Most visibly, the speed and efficiency of our efforts with BioNTech to help vaccinate the world against COVID-19 have been unprecedented, with now more than a billion doses of BNT162b2 having been delivered globally.” On a conference call, Bourla said that while “it’s very early to speak” about the company’s sales expectations for next year, he put Pfizer’s 2022 production capacity at 4 billion doses.

“..mRNA jabs’ initially higher number of antibodies “declines sharply” over the same period..”

• Adenovirus Covid-19 Vaccine Shows Lower But ‘Stable’ Immunity (RT)

Different effects of the world’s Covid injection types are revealed in new study that shines light on ‘Adenovirus v mRNA’ debate The one-shot adenovirus J&J Covid-19 vaccine provides stable but low-level immunity that stays for months, a new study has found, while mRNA jabs’ initially higher number of antibodies “declines sharply” over the same period. An immune response induced by Johnson & Johnson’s Janssen adenovirus vaccine appears to show “minimal-to-no evidence of decline” over eight months, the fresh study in the US reports, detailing the dynamics of the antibody response in the “follow-up period” after immunizations with each of the three American vaccines.

Apparently, Pfizer and Moderna cannot boast a similar durability in their mRNA vaccines’ efficacy, the study shows. Antibody titer levels (a term of measurement) elicited by both of them tend to decline “sharply by six months after vaccination” and fall even further by eight months, according to the data collected by the specialists from the Beth Israel Deaconess Medical Center in Boston, Massachusetts, and the University of North Carolina at Chapel Hill. The two mRNA vaccines apparently still greatly outperform the one-shot Johnson & Johnson jab during the “peak immunity” period, between two and four weeks after full immunization, the study admits. In the long run, however, they quickly lose their sizeable lead in efficacy and eventually land at the same antibody response level as that of the Johnson & Johnson jab based on the adenovirus vector principle – the same as the ones used by the UK’s AstraZeneca and by Russia’s Sputnik V.

The study also demonstrated that the Johnson & Johnson jab supposedly even somewhat outperforms both mRNA vaccines when it comes to antibody responses eight months after full immunization. Its live-virus neutralizing antibody response and a certain type of T-cell response appeared to be higher than those of Pfizer and Moderna jabs at that time. Whether it is indeed better in the long run is difficult to ascertain, though, since the data obtained from just over 60 participants, including only eight immunized with a Johnson & Johnson jab, appear to be somewhat “lacking,” Maxim Skulachev, a leading research associate at the Belozersky Institute at Moscow State University (MSU), believes.

“..a marked reduction of 93% of released virion and 99.98% unreleased virion levels upon administration of IVM..”

• Repositioning Ivermectin For Covid-19 Treatment (SD)

Drug repositioning is a useful and effective idea for Covid-19 antiviral discovery. • Ivermectin has proven effective for HIV-1, Adenovirus, Influenza virus, SARS-CoV, and many more, in the past.• Due to genomic similarity between SARS-CoV-2 and the SARS-CoV, the role of the IMPα/β1 complex for viral protein (NSP12-RdRp) shuttling between the nucleus and cytoplasm holds great potential. • Ivermectin also exhibits great potential in reducing SARS-CoV-2 viral replication via numerous modes of action, such as the disruption of the Importin heterodimer complex (IMPα/β1)

Ivermectin (IVM) is an FDA approved macrocyclic lactone compound traditionally used to treat parasitic infestations and has shown to have antiviral potential from previous in-vitro studies. Currently, IVM is commercially available as a veterinary drug but have also been applied in humans to treat onchocerciasis (river blindness – a parasitic worm infection) and strongyloidiasis (a roundworm/nematode infection). In light of the recent pandemic, the repurposing of IVM to combat SARS-CoV-2 has acquired significant attention. Recently, IVM has been proven effective in numerous in-silico and molecular biology experiments against the infection in mammalian cells and human cohort studies. One promising study had reported a marked reduction of 93% of released virion and 99.98% unreleased virion levels upon administration of IVM to Vero-hSLAM cells.

IVM’s mode of action centres around the inhibition of the cytoplasmic-nuclear shuttling of viral proteins by disrupting the Importin heterodimer complex (IMPα/β1) and downregulating STAT3, thereby effectively reducing the cytokine storm. Furthermore, the ability of IVM to block the active sites of viral 3CLpro and S protein, disrupts important machinery such as viral replication and attachment. This review compiles all the molecular evidence to date, in review of the antiviral characteristics exhibited by IVM. Thereafter, we discuss IVM’s mechanism and highlight the clinical advantages that could potentially contribute towards disabling the viral replication of SARS-CoV-2. In summary, the collective review of recent efforts suggests that IVM has a prophylactic effect and would be a strong candidate for clinical trials to treat SARS-CoV-2.

“The FDA waits for a deep-pocketed sponsor to present a comprehensive package that justifies the approval of a new drug or a new use of an existing drug.”

• The FDA’s War Against The Truth On Ivermectin (AIER)

The FDA judges all drugs as guilty until proven, to the FDA’s satisfaction, both safe and efficacious. By what process does this happen? The FDA waits for a deep-pocketed sponsor to present a comprehensive package that justifies the approval of a new drug or a new use of an existing drug. For a drug like ivermectin, long since generic, a sponsor may never show up. The reason is not that the drug is ineffective; rather, the reason is that any expenditures used to secure approval for that new use will help other generic manufacturers that haven’t invested a dime. Due to generic drug substitution rules at pharmacies, Merck could spend millions of dollars to get a Covid-19 indication for ivermectin and then effectively get zero return. What company would ever make that investment?

With no sponsor, there is no new FDA-approved indication and, therefore, no official recognition of ivermectin’s value. Was the FDA’s warning against ivermectin based on science? No. It was based on process. Like a typical bureaucrat, the FDA won’t recommend the use of ivermectin because, while it might help patients, such a recommendation would violate its processes. The FDA needs boxes checked off in the right order. If a sponsor never shows up and the boxes aren’t checked off, the FDA’s standard approach is to tell Americans to stay away from the drug because it might be dangerous or ineffective. Sometimes the FDA is too enthusiastic and these warnings are, frankly, alarming. Guilty until proven innocent.

There are two reasons that Merck would warn against ivermectin usage, essentially throwing its own drug under the bus. Once they are marketed, doctors can prescribe drugs for uses not specifically approved by the FDA. Such usage is called off-label. Using ivermectin for Covid-19 is considered off-label because that use is not specifically listed on ivermectin’s FDA-approved label. While off-label prescribing is widespread and completely legal, it is illegal for a pharmaceutical company to promote that use. Doctors can use drugs for off-label uses and drug companies can supply them with product. But heaven forbid that companies encourage, support, or promote off-label prescribing. The fines for doing so are outrageous.

During a particularly vigorous two-year period, the Justice Department collected over $6 billion from drug companies for off-label promotion cases. Merck’s lawyers haven’t forgotten that lesson. Another reason for Merck to discount ivermectin’s efficacy is a result of marketing strategy. Ivermectin is an old, cheap, off-patent drug. Merck will never make much money from ivermectin sales. Drug companies aren’t looking to spruce up last year’s winners; they want new winners with long patent lives. Not coincidentally, Merck recently released the clinical results for its new Covid-19 fighter, molnupiravir, which has shown a 50% reduction in the risk of hospitalization and death among high-risk, unvaccinated adults. Analysts are predicting multi-billion-dollar sales for molnupiravir.

While we can all be happy that Merck has developed a new therapeutic that can keep us safe from the ravages of Covid-19, we should realize that the FDA’s rules give companies an incentive to focus on newer drugs while ignoring older ones. Ivermectin may or may not be a miracle drug for Covid-19. The FDA doesn’t want us to learn the truth. The FDA spreads lies and alarms Americans while preventing drug companies from providing us with scientific explorations of existing, promising, generic drugs.

“..The former officers laid their boots and hats on the steps of the Capitol building in a stunt meant to represent “what the state’s lost..“

• Washington State Patrol Staff Shortage, Officers Quit Over Vaccine Mandate (RT)

Some 127 Washington State Patrol employees, more than half of them officers, were terminated after a vaccination deadline passed this week, with the force now bracing for staff shortage in critical areas and major costs. 74 commissioned officers – including 67 troopers, six sergeants and a captain – as well as 53 civil servants were “separated from employment” as they missed the October 18 deadline to provide proof of vaccination, the Washington State Patrol (WSP) reported earlier this week. The WSP stated that the employees quit the force “for varying reasons and in varying ways,” with chief John R. Batiste declaring that “we will miss every one of them.” “I extend a hardy thanks to those who are leaving the agency. I truly wish that you were staying with us,” he said.

The mass exodus from the 2,200-strong force is set to put a strain on the depleted ranks. Speaking to the Oregonian, WSP spokesman Chris Loftis said that in some cases, such as vehicle collisions that result in no casualties or obstruction to traffic, the affected drivers might be told to figure out the incident on their own and “clear the area rather than wait for a trooper to show up,” as would happen under normal circumstances Some employees fired over the vaccine requirement successfully received exemptions from the order, but that did not prevent them from being terminated. Loftis said that over 400 people were granted such exemptions, but not all of them were offered alternative employment due to the nature of the agency’s work. Still, he stressed that the 74 troopers that were effectively forced out “were people that we knew and cared about.”

This wasn’t a situation where 74 troopers left one day because they did something bad – they left in standing opposition to the vaccine mandate, based on their personal principles and convictions. Some of the terminated troopers turned out at the state Capitol on Tuesday in a symbolic protest against the mandate. The former officers laid their boots and hats on the steps of the Capitol building in a stunt meant to represent “what the state’s lost,” one of the participants, ex-trooper Bill Jordan, told local media. Jordan claimed that he received a religious exemption from the mandate, but WSP failed to accommodate him regardless. While Loftis said that the agency would step up its recruitment efforts by filling up new academy classes, the training of would-be troopers will come with a hefty price tag.

It is estimated that the mass exodus could cost taxpayers some $12.4 million, as about $168,000 per year is needed to train just a single cadet – the WSP has lost 67. The Washington State Patrol has not been the only agency to see resistance from state employees to compulsory vaccination orders. More than 1,800 workers in Washington state have been fired, resigned or retired due to the mandate, according to official data released on Tuesday. This amounts to about 3% of the state’s workforce that falls under the mandate, and those numbers could yet rise, as the cases of some 2,887 state employees are still pending.

“They don’t have to. They have friends in the White House.”

• Why Are Thousands Of Postal Workers Still Unvaxxed? (WND)

After spending several futile hours rummaging through media accounts and the United States Postal Service (USPS) website, I still had no answer to the question I set out to address: Are postal workers subject to a vaccine mandate? Wanting the straight skinny, I decided not to call USPS headquarters but to visit a facility and talk to the workers loading and unloading mail. To my good fortune I found a well-spoken, straightforward supervisor who told me, through his mask, what I wanted to know. “We are encouraged to get vaccinated, but we do not face a vaccine mandate like the military does,” he volunteered. “But,” he added helpfully, “we do have an indoor mask mandate.”

Two questions emerge from this encounter. The first is: Why are postal workers exempt from a mandate that is stripping other public service entities, including the military, of thousands of needed personnel? The second, why did I have to ask a postal worker to get the truth? The answer to the second question is the easier of the two – the media don’t want you to know. In mid-September there was a flurry of questions around the status of the USPS. On Sept. 16, the USA Today fact checker put those questions to rest. On that same day, the USPS put out an impressively ambiguous statement on COVID-19 vaccines. After much self-serving blather about the hard work of its 650,000 employees, management concluded:

“We are working closely with our union leadership so that once OSHA’s COVID-19 Vaccination Emergency Temporary Standard (ETS) is issued we can move quickly to determine its applicability to our employees and how best to implement.” Translation: “We are in no big hurry.” The ETS represents the fulfillment of President Joe Biden’s COVID-19 Action Plan announced on Sept. 9. The OSHA ETS runs a perversely long 44 pages and includes any number of useless admonitions, such as: “An employer with one or more employees working in a physical location controlled by another employer must notify the controlling employer when those employees are exposed to conditions at that location that do not meet the requirements of this section.”

On Oct. 12, OSHA submitted the ETS to the White House’s Office of Information and Regulatory Affairs for approval, which is where it stands as of this writing. USPS brass might argue that their hands are tied until the OSHA ETS is formalized, but unlike many private and public employers, they are making no obvious efforts to prepare their workers for this eventuality. They don’t have to. They have friends in the White House.

“People go too far these days in taking the liberty to ask questions and judge a person. “Whatever you say – ‘yes, no, maybe, I am thinking about it’ – they will take advantage.”

• Djokovic Claims It Would Be ‘Inappropriate’ To Say If He Is Vaccinated (RT)

Novak Djokovic says people are “taking the liberty” to ask questions about vaccine status and “judge a person”, speaking as an Australian head of government warned that unvaccinated players will face a struggle to receive visas. World number one Djokovic has repeatedly expressed his reservations about players being pressured to take a Covid jab, and the reigning Australian Open champion insists his decision is a “private matter” amid a string of controversies surrounding the likes of NBA star Kyrie Irving, who has been left out by the Brooklyn Nets because he is not vaccinated. Djokovic rival Stefanos Tsitsipas found himself at the center of a political row after he made a wide range of remarks about Covid and vaccines, and the Greek – whose own government seemed to distance themselves from views which appeared to include a suggestion that spreading the virus could have positive effects – now appears to be willing to be vaccinated.

Russian contender Andrey Rublev has become the latest player to drop their apparent reluctance because of the logistical issues not being vaccinated could cause, but Djokovic is yet to openly say he has had the treatment. “Things being as they are, I still don’t know if I will go to Melbourne,” Djokovic told Blic, speaking ahead of a first Grand Slam of the year in January which is likely to take place under tight restrictions. “I will not reveal my status, whether I have been vaccinated or not – it is a private matter and an inappropriate inquiry. “People go too far these days in taking the liberty to ask questions and judge a person. “Whatever you say – ‘yes, no, maybe, I am thinking about it’ – they will take advantage.”

“If you mandate, as a private employer, “vaccination” against Covid-19 any and all adverse events as a result of said jabs are now chargeable to you..”

• Dewey, Cheat’em And Howe (Denninger)

Oh, you’re a woke-poke employer eh? You think hiding behind OSHA — or the threat to issue a mandate by the government — in some way prevents you from being liable for injuries and/or deaths related to the vaccines? Uh, how would you like to defend that position in court given all of the following are true: The PREP act has no provision giving you legal immunity and cannot be amended by executive order as it is law, so you would need both houses of Congress to pass such a thing — and they have not. The producing firms and health care providers are immune from damages under that same PREP Act. Therefore under the general principle of joint and several liability guess who gets all of it: You do. You could have tried to claim that the Federal Government refused liability (and got away with it) for direct employees, and that would have been a pretty decent argument….. except, oops, that just went up in a puff of smoke.

“The Federal Employees’ Compensation Act (FECA) covers injuries that occur in the performance of duty. The FECA does not generally authorize provision of preventive measures such as vaccines and inoculations, and in general, preventive treatment is a responsibility of the employing agency under the provisions of 5 U.S.C. 7901. However, care can be authorized by OWCP for complications of preventive measures which are provided or sponsored by the agency, such as adverse reaction to prophylactic immunization. See PM 3-0400.7(a). Further, deleterious effects of medical services furnished by the employing establishment are generally considered to fall within the performance of duty. These services include preventive programs relating to health. See PM 2-0804.19. However, this executive order now makes COVID-19 vaccination a requirement of most Federal employment. As such, employees impacted by this mandate who receive required COVID-19 vaccinations on or after the date of the executive order may be afforded coverage under the FECA for any adverse reactions to the vaccine itself, and for any injuries sustained while obtaining the vaccination.”

Oops. If you mandate, as a private employer, “vaccination” against Covid-19 any and all adverse events as a result of said jabs are now chargeable to you, as the Federal Government itself has deemed that “mandated” vaccinations are indeed injuries that occurred while performing the job in question, irrespective of where the jab took place. Oh by the way your insurance firm has likely inserted a “pandemic exemption” into your liability coverage. That’s shown up in a whole lot of those policies over the last year or so, and it’s odds-on that’s the case for you as well. Incidentally there is plenty of evidence that these jabs will be eventually found to be responsible for a whole host of serious problems, and those do not end within a couple of weeks of the jab itself.

Indeed, the evidence is mounting rapidly (see the all-cause “excess death” rates for various age groups, particularly cardiac and circulatory related, among young people now showing up in places like Scotland and England for examples) that there is a causal link between both strokes and heart attacks. I remind you that the FDA and pharmaceutical industry claimed, not all that long ago, that no such link existed for Vioxx. It was only after about 60,000 Americans had heart attacks and died, and several hundred thousand had non-fatal heart problems caused by it, that it was withdrawn from the market — five years later. Moderna and Pfizer may be immune from lawsuit but you are not, and further, the precedent by the Federal Government itself now exists based on their own public statement that if an employee gets screwed by the jab you demanded they take you’re on the hook whether that injury is evident five minutes afterward or five years later. Good luck *******s; you just got ****ed and it couldn’t happen to a nicer bunch.

“..one somehow feels bad for Hunter Biden. He’s not just a wreck, but a wreck with spectacularly bad luck.”

• “The Bidens”: Is the First Family Corrupt, or Merely Crazy? (Taibbi)

Schreckinger is young, and The Bidens was clearly written in a bit of a hurry, but he’s a skilled storyteller. The initial framing is clever, with a first first chapter titled, “Chekhov’s Laptop,” a reference to Russian playwright’s famous dictum that “if in the first act you have hung a pistol on the wall, then in the following one it should be fired.” Having primed the reader to look for that metaphorical gun on the wall, he opens with a scene that’s bananas even by the outré standards of first son Hunter Biden’s “tumultuous” life. Hunter in October of 2018 had gotten in an argument with his then-girlfriend, Hallie, who according to the funhouse physics of the first family was of course the widow of his late brother Beau.

In the course of that dispute, Hallie had taken his .38 revolver and thrown it out of Hunter’s pickup truck (a pickup truck?) into a trash can outside “Janssen’s, a high-end grocery store near Wilmington the family had long frequented.” When Hunter found out the gun was gone, he chivalrously sent Hallie back into the trash to get it. This turns out to be the first of many moments in The Bidens where despite a seemingly tireless instinct for indulgent selfishness, and a maximally unattractive profile as the coddled scion of political privilege, one somehow feels bad for Hunter Biden. He’s not just a wreck, but a wreck with spectacularly bad luck. In this case, not only has his dead brother’s widow taken advantage of his trusting nature and thrown away his pistol (the one a person with his recreational leanings probably shouldn’t have anyway, but does, and moreover has left unattended), she picked the one bin that’s both across the street from a high school and in a spot where an old man hunting for recyclables somehow finds it.

Now the thing is missing and poor Hunter, who if nothing else has a keen sense of his own potential for disaster, must be imagining the worst, which in his family is likely a headline: Boy, 13, Uses Gun Registered to Dickhead Senator’s Son to Kill Parents, Neighbor, Dog, Self. The Delaware State Police are called, the FBI for some instantly suspicious reason also shows up, the Secret Service also reportedly appears at the store where Hunter bought the gun (I say reportedly because the Secret Service denies this, the first of many details in The Bidens that ends up receding in a fog of conflicting accounts), and the ATF even makes an appearance. The gun was eventually found after a few days, when the old man turned it in. By that point Hunter had already skipped town and begun setting in motion a preposterous chain of events that have ramifications in national politics to the present day.

If a country is not capable of digging up the truth in matters like this (and the Bidens), it is a failed nation.

• Hillary’s Secretive, Russiagate-Flogging Pair of Super-Lawyers (Maté)

The indictment of Hillary Clinton lawyer Michael Sussmann for allegedly lying to the FBI sheds new light on the pivotal role of Democratic operatives in the Russiagate affair. The emerging picture shows Sussmann and his Perkins Coie colleague Marc Elias, the chief counsel for Clinton’s 2016 campaign, proceeding on parallel, coordinated tracks to solicit and spread disinformation tying Donald Trump to the Kremlin. In a detailed charging document last month, Special Counsel John Durham accused Sussmann of concealing his work for the Clinton campaign while trying to sell the FBI on the false claim of a secret Trump backchannel to Russia’s Alfa Bank. But Sussmann’s alleged false statement to the FBI in September 2016 wasn’t all. Just months before, he helped generate an even more consequential Russia allegation that he also brought to the FBI.

In April of that year, Sussmann hired CrowdStrike, the cybersecurity firm that publicly triggered the Russiagate saga by lodging the still unproven claim that Russia was behind the hack of Democratic National Committee emails released by WikiLeaks. At the time, CrowdStrike was not the only Clinton campaign contractor focusing on Russia. Just days before Sussmann hired CrowdStrike in April, his partner Elias retained the opposition research firm Fusion GPS to dig up dirt on Trump and the Kremlin. These two Clinton campaign contractors, working directly for two Clinton campaign attorneys, would go on to play highly consequential roles in the ensuing multi-year Russia investigation. Working secretly for the Clinton campaign, Fusion GPS planted Trump-Russia conspiracy theories in the FBI and US media via its subcontractor, former British spy Christopher Steele.

The FBI used the Fusion GPS’s now debunked “Steele dossier” for investigative leads and multiple surveillance applications putatively targeting Trump campaign volunteer Carter Page. CrowdStrike, reporting to Sussmann, also proved critical to the FBI’s work. Rather than examine the DNC servers for itself, the FBI relied on CrowdStrike’s forensics as mediated by Sussmann. The FBI’s odd relationship with the two Democratic Party contractors gave Sussmann and Elias unprecedented influence over a high-stakes national security scandal that upended U.S. politics and ensnared their political opponents. By hiring CrowdStrike and Fusion GPS, the Perkins Coie lawyers helped define the Trump-Russia narrative and impact the flow of information to the highest reaches of U.S. intelligence agencies.

“Libyans enjoyed free healthcare, free education, and a high standard of living.”

“We came, we saw, he died,” she said.

• The Killing Of Gaddafi 10 Years Ago Led To The Death Of The Nation Of Libya (RT)

During his 42 years in power, he increased the country’s literacy rate from 25% to 88%. Libyans enjoyed free healthcare, free education, and a high standard of living. Basic necessities such as electricity and gas were cheap, and the country was guaranteed a strong social safety net and welfare programs. Libya is 90% desert. Gaddafi sought to provide fresh water to all Libyans for consumption and agriculture – an endeavor in which he succeeded. He built the world’s largest irrigation project, the ‘Great Man-Made River’ in the 1980s. Boasting the world’s largest pipe network, it provides 70% of all the fresh water in Libya. Gaddafi called it the “Eighth Wonder of the World”. Costing over $25 billion, the project was entirely self-financed, without any loans or credits from foreign banks. Libya had grown to be a very wealthy country and had no external debt. NATO bombed the Great Man-Made River in July 2011, destroying key civilian infrastructure: a war crime.

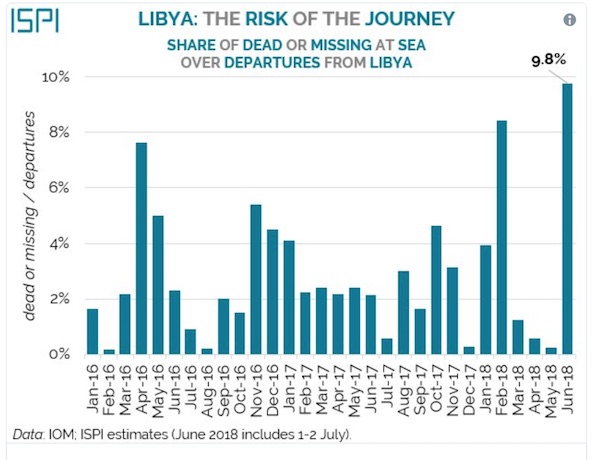

[..] Instead of an abundance of water, gold and oil in a thriving country with great infrastructure, Libya now has open slave-trade markets. Smugglers and human traffickers take advantage of migrants and refugees passing through to Europe, selling them off into bondage. Rival tribes and political factions fight over oil and other precious resources, determined to seize power for themselves. Meanwhile, pockets of Islamic State (IS, formerly ISIS), Al-Qaeda and other jihadist fighters lurk in the shadows, plaguing the war-torn country and its neighbors – groups who wouldn’t have dared establish a presence in Gaddafi’s Libya. Once a prosperous nation, since his fall, it has been taken over by terrorists, opportunists and thieves, and has plunged into chaos. This is what has become of Libya these last 10 years. This is what NATO created.

[..] In the 1970s, he tried to merge Libya with Egypt and Syria to form a unified Arab state. In 2009, he proposed that African nations adopt a single currency: the gold dinar. The Libyan Central Bank, which was 100% state-owned, had reserves of 144 tons of gold that he intended to use for this purpose. Gaddafi proposed that African countries buy and sell their resources exclusively in this new pan-African currency. This would enable them to transition away from the US dollar and the Central Africa (CFA) franc – a colonial currency used in 14 countries and controlled entirely by France. This was Gaddafi’s biggest sin. In wanting African nations to adopt a single currency, to control their own resources and have true independence, he posed a threat to Western monetary hegemony, so he had to go.

Support the Automatic Earth in virustime; donate with Paypal, Bitcoin and Patreon.