Pablo Picasso� Carnival Bistro [Study] �1908

No, not what I would write. But might as well take an odd approach. One thing that hearing made clear: “..we as a nation are losing our way”.

• Well, I Think We Found Our Supreme Court Justice Today… (F.)

Well, I think we found our Supreme Court Justice today. This should be very good news for Republicans, who seem to be in an awful hurry to get this done quickly. It doesn’t look like we have to wait any longer. Let’s all take a deep breath and step back for a moment. All crazy partisan politics aside, let’s consider the qualities a good justice should have. A good justice should be objective and fair-minded, not guided by strong preconceived opinions. A good justice should be empathetic, not focused on oneself. A good justice should be calm, not angry. A good justice should show grace under pressure, not be easily rattled. A good justice should be even-tempered, not short-tempered. A good justice should be thoughtful, not strident. A good justice should in the face of adversity show courage, not petulance.

There are classic lines from Shakespeare’s The Merchant of Venice about mercy and justice: The quality of mercy is not strained. It droppeth as the gentle rain from heaven Upon the place beneath. At the end of the day good leadership is about temperament. Having the kind of calm demeanor and even temperament that enables one to make sound thoughtful decisions under pressure. Not decisions that are reflexive, impulsive, angry or politically driven. When one thinks of the sea of strident bitter recriminations that have engulfed this whole Supreme Court nomination process, and the partisan political football the Supreme Court has become, it feels like we’ve completely lost sight of what a Supreme Court ought to be. It feels, sadly, like we as a nation are losing our way.

Well, cheer up, the good news at least is I think we found someone today with the right temperament to make a fine Supreme Court Justice. Her name is Christine Blasey Ford.

And it’s the exact same disease.

• BIS’s Claudio Borio Says the World Economy Is About to Get Very Sick (Auerback)

When Claudio Borio speaks, the big bankers and investors, the economics profession, and senior policymakers listen quite carefully—even if his sentiments don’t reach the shores of the popular media. Borio, the chief economist for the Bank for International Settlements (BIS), the central bankers’ central bank, recently remarked on the fragility of the global economy, and suggested that we were on the verge of a significant relapsesimilar to the global crash experienced 10 years ago. Among the parallels he perceives: the proliferation of “collateralized loan obligations (CLOs), which are ‘close cousins’ of the infamous instruments known as collateralized debt obligations, or CDOs, and securities backed by residential mortgages,” the prevalence of which helped to crater the credit system in 2008.

Mindful as central bankers have been about the ready availability of liquidity, they have (as I have written before) omitted to “proactively… [charging] private market participants variable risk premiums commensurate with the risk of the underlying activity they are undertaking when providing credit.” Furthermore, Borio implies that the monetary and fiscal authorities expended excessive efforts toward restoring the status quo ante, instead of directing policy toward broader job creation and income generation, which would place the economy on sounder footing when the next downturn inevitably comes. Finally, the BIS’s chief economist also publicly mooted whether additional “medicine” of the kind that we used last time will be in sufficient supply to respond adequately when the next crisis emerges.

So is Dr. Borio correct in both his diagnosis and concomitant concern about the lack of readily available cures for the prevailing illness? And are there any key omissions in his analysis that could help to mitigate the inevitable relapse that he forecasts?

UBI vs austerity.

• Italy Agrees High Public Spending Reforms In Potential Clash With EU (G.)

The Italian government agreed to a 2019 budget deficit target at 2.4% of GDP on Thursday night in a move that was celebrated by leaders but could bring the heavily indebted country into conflict with the European Union. The economy minister Giovanni Tria succumbed to pressure from the government’s two deputy prime ministers – Luigi Di Maio, the leader of the anti-establishment Five Star Movement (M5S), and Matteo Salvini, who heads up the far-right League – to increase the target in order to pay for election campaign promises such as a universal basic income, flat tax and pension reforms. Tria, an academic who is not affiliated to either party, had been seeking a more conservative 1.9% in order to avoid adding to Italy’s debt pile, which currently stands at around 131% of GDP, the second highest in the eurozone after Greece.

Speculation that Tria would resign has been denied. “There is an accord within the whole government for 2.4%, we are satisfied, this is a budget for change,” Di Maio and Salvini said in a joint statement. Di Maio wrote on Facebook that the agreement marked a historic day and was a victory for Italian citizens, not the government. The means-tested basic income, which will cost €10bn, was a key feature of his party’s election campaign. “For the first time in the history of this country we will erase poverty thanks to the basic income,” he said. “We will finally give a future to the 6.5 million people, who until now have lived in poverty and been completely ignored.”

“..three-quarters of the size of the Irish economy in 2008.”

• Irish Banks’ Loan Losses Hit €140 Billion In 10 Years After Crash (IT)

The State’s main 11 banks and building societies racked up a total of €140 billion in loan losses in the decade since western Europe’s worst property crash, according to data compiled by The Irish Times. That equates to about three-quarters of the size of the Irish economy in 2008. The figures include bad-loan charges that lenders took between 2008 and 2017, as well as losses on the sale of batches of loans to overseas investment firms and the National Asset Management Agency (Nama). As Saturday marks the 10th anniversary of the snap guarantee of the Republic’s banking system, property developer Sean Mulryan and former Central Bank governor Patrick Honohan have warned in interviews with The Irish Times of risks facing the recovering housing market and State finances.

The guarantee of six Dublin-based lenders would cost taxpayers €64 billion in bailouts and tip the State into an international bailout. Foreign-owned Bank of Scotland (Ireland), Ulster Bank and KBC Bank Ireland also required multibillion-euro capital injections from their parents during the financial crisis. The 11 banks’ net loan losses over the past decade amount to €134.2 billion – or 25 per cent of their total 2008 loans – according to the data, compiled from banks’ annual reports and regulatory filings. [..] Only five of the original lenders remain as standalone companies, as the State continues to grapple with the legacy of the crash. Housebuilding is running at half of estimated annual demand for 35,000 homes and banks are still dealing with high levels of distressed loans.

These people only warn when they’ve left the job. While in the job, they do exactly what they later warn against.

“Powell said that “overall vulnerabilities” were “moderate”. He also stated that banks today “take much less risk than they used to”.”

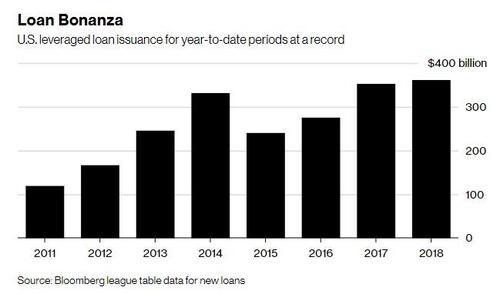

• Janet Yellen Says It’s Time For “Alarm” As Loan Bubble Runs Amok (ZH)

As rates move higher like they are now, the loans – whose interest rates reference such floating instruments as LIBOR or Prime – pay out more. As a result, as the Fed tightens the money supply, defaults tend to increase as the interest expenses rise and as the overall cost of capital increases. And because an increasing amount of the financing for these loans is done outside of the traditional banking sector, regulators and agencies like the Federal Reserve aren’t able to do much to rein it in. The market for leveraged loans and junk bonds is now over $2 trillion. Escalating the risk of the unbridled loan explosion, none other than Janet Yellen – who is directly responsible for the current loan bubble – recently told Bloomberg that “regulators should sound the alarm. They should make it clear to the public and the Congress there are things they are concerned about and they don’t have the tools to fix it.”

As we noted recently, the risks of such loans defaulting are obvious, including loss of jobs and risk to companies on both the borrowing and the lending side. Tobias Adrian, a former senior vice president at the New York Fed who’s now the IMF’s financial markets chief, told Bloomberg: “…supporting growth is important, but future downside risks also need to be considered.” He also stated that regulators had “limited tools to rein in nonbank credit”. But you’d never know this by listening to the Federal Reserve. According to Fed chairman Jerome Powell, during his press conference Wednesday, the Fed doesn’t see any risks right now. Powell said that “overall vulnerabilities” were “moderate”. He also stated that banks today “take much less risk than they used to”.

h/t Tyler. Monopoly on steroids.

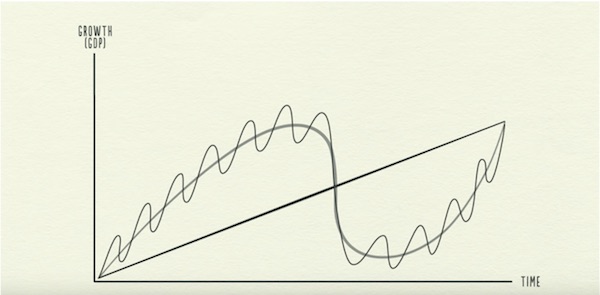

• Why Do Debt Crises Come in Cycles? (Dalio)

If you understand the game of Monopoly®, you can pretty well understand how credit cycles work on the level of a whole economy. Early in the game, people have a lot of cash and only a few properties, so it pays to convert your cash into property. As the game progresses and players acquire more and more houses and hotels, more and more cash is needed to pay the rents that are charged when you land on a property that has a lot of them. Some players are forced to sell their property at discounted prices to raise that cash. So early in the game, “property is king” and later in the game, “cash is king.” Those who play the game best understand how to hold the right mix of property and cash as the game progresses.

Now, let’s imagine how this Monopoly® game would work if we allowed the bank to make loans and take deposits. Players would be able to borrow money to buy property, and, rather than holding their cash idly, they would deposit it at the bank to earn interest, which in turn would provide the bank with more money to lend. Let’s also imagine that players in this game could buy and sell properties from each other on credit (i.e., by promising to pay back the money with interest at a later date). If Monopoly® were played this way, it would provide an almost perfect model for the way our economy operates. The amount of debt-financed spending on hotels would quickly grow to multiples of the amount of money in existence.

Down the road, the debtors who hold those hotels will become short on the cash they need to pay their rents and service their debt. The bank will also get into trouble as their depositors’ rising need for cash will cause them to withdraw it, even as more and more debtors are falling behind on their payments. If nothing is done to intervene, both banks and debtors will go broke and the economy will contract. Over time, as these cycles of expansion and contraction occur repeatedly, the conditions are created for a big, long-term debt crisis.

The board is behing Musk. But is that enough? It’s not just the SEC, the DOJ is on the case too.

• Elon Musk Tore Up Last Minute SEC Settlement, Decided To Fight Instead (ZH)

To many it was clear from the beginning: “It’s an easy case,” said Charles Elson, director of the John L. Weinberg Center for Corporate Governance at the University of Delaware. “He said in the tweet he had financing, and apparently he didn’t. … It’s about as straightforward as you can get.” And on Thursday afternoon, the SEC confirmed that indeed just those two words blasted to the entire world and contained in Elon Musk’s infamous “funding secured” tweet – it would emerge just days later that funding was not, in fact, secured- would serve as the basis for a securities fraud litigation against Elon Musk; and while Tesla wasn’t named in the suit as a defendant, the SEC is seeking to bar Musk, Tesla’s largest shareholder and its top executive, from serving as an officer or director of any U.S. public company.

It almost didn’t happen that way: according to the WSJ, the SEC complaint only came after a last-minute decision by Musk and his lawyers to fight the case rather than settle the charges. The SEC had crafted a settlement with Mr. Musk—approved by the agency’s commissioners—that it was preparing to file Thursday morning when Mr. Musk’s lawyers called to tell the SEC lawyers in San Francisco that they were no longer interested in proceeding with the agreement, according to people familiar with the matter. After the phone call, the SEC rushed to pull together the complaint that it subsequently filed, the people said. Considering that this is an open and shut case, one wonders if Musk was once again on drugs when he decided that instead of settling, he would fight the charges. Or he simply saw the “playbook” and decided to roll the dice…

In any case, a fighting Elon is just what the SEC – its reputation in tatters after years of not pursuing “big name” stock manipulators – needs to restore its image. The case ranks as one of the highest-profile civil securities-fraud cases in years. Its filing less than two months after the Aug. 7 tweets by Mr. Musk also marks an unusually rapid turnaround by an agency that has been under fire for its perceived failure to promptly bring significant cases in the financial crisis and other episodes. “It means there was not that much investigation they needed to do to get comfortable that it was a case they should bring, but also a case they can win,” said Michael Liftik, a former SEC enforcement lawyer now at Quinn, Emanuel, Urquhart & Sullivan LLP.

“.. he will vote down anything that fails to deliver the same benefits as membership of the single market and customs union.”

• Corbyn Talks With EU Officials Spark Fresh No-Deal Brexit Fears (G.)

Jeremy Corbyn has sparked fresh fears in Brussels of a no-deal Brexit after saying during talks with senior EU Brexit officials that he will vote down anything that fails to deliver the same benefits as membership of the single market and customs union. The Labour leader spent two hours with Michel Barnier, the EU’s chief negotiator, and Martin Selmayr, the most senior official in charge of planning for a cliff-edge Brexit. Emerging from the European commission headquarters, Corbyn said Barnier “was interested to know what our views are in the six tests”, referring to the criteria Labour has said must be met to ensure its MPs back a deal. The EU is increasingly concerned that the UK parliament will vote down any deal put forward by Theresa May.

One of Labour’s tests is that an agreement must offer the “exact same benefits” as membership of the single market and customs union. The Labour leader had initially planned a low-key visit to Brussels to attend the naming of a square in the Belgian capital in honour of the murdered Labour MP Jo Cox. It is understood, however, that the EU’s most senior officials were anxious to hear directly from Corbyn about his party’s plans, and invited him for a session of talks. After meeting Barnier and Selmayr, who is the secretary general of the European commission and in charge of no-deal planning, Corbyn insisted he was “not negotiating” but that there was an informal agreement that both sides would continue to talk.

AP makes an ‘error’ and corrects: “The Associated Press reported erroneously that Assange over the past two years had continued to hack the accounts of politicians around the world. It should’ve said Assange had published material from hacked politicians’ accounts.”

• Britain, Ecuador Seeking An End To The Assange Standoff (AP)

Ecuador’s president said Wednesday that his country and Britain are working on a legal solution for Julian Assange to allow the Wikileaks founder to leave the Ecuadorian Embassy in London in “the medium term.” President Lenin Moreno told The Associated Press that Assange’s lawyers were aware of the negotiations. He declined to provide more details because of the sensitivity of the case. [..] Moreno said his country will work for Assange’s safety and the preservation of his human rights as it seeks a way for him to leave the embassy. “Being five or six years in an embassy already violates his human rights,” Moreno said on the sidelines of the UN General Assembly. “But his presence in the embassy is also a problem.”

Now the rest of the nation. How about New York State?

• Seattle Judges Throw Out 15 Years Of Marijuana Convictions (BBC)

Judges in Seattle have decided to quash convictions for marijuana possession for anyone prosecuted in the city between 1996 and 2010. City Attorney Pete Homes asked the court to take the step “to right the injustices of a drug war that has primarily targeted people of colour.” Possession of marijuana became legal in the state of Washington in 2012. Officials estimate that more than 542 people could have their convictions dismissed by mid-November. Mr Holmes said the city should “take a moment to recognise the significance” of the court’s ruling. “We’ve come a long way, and I hope this action inspires other jurisdictions to follow suit,” he said. Mayor Jenny Durkan also welcomed the ruling, which she said would offer residents a “clean slate.” “For too many who call Seattle home, a misdemeanour marijuana conviction or charge has created barriers to opportunity – good jobs, housing, loans and education,” she said.

Here’s what it will take.

• Austrian Fruit Grower Sentenced To Prison Over Bee Deaths (AFP)

An Austrian fruit grower was handed a rare prison sentence Wednesday for having illegally spread an insecticide which led to the deaths of dozens of neighbouring bee colonies. The 47-year-old man had spread a powerful insecticide called chlorpyrifos over his trees in the Lavanttal area of Carinthia province, at a time when their blossoms were still attracting bees. More than 50 colonies belonging to two neighbouring apiarists perished. The court in the city of Klagenfurt found the fruit grower guilty of “deliberately damaging the environment”, pointing to his experience and role in training others in his field as evidence that he knew the consequences of his actions.

He was sentenced to a year in prison, of which four months will be without probation. Ordered to pay more than 20,000 euros ($23,500) in compensation, he said he will appeal. The court said it hoped the sentence would serve as a deterrent and to remind others that the “use of pesticides needs to strike a balance between the environment and economics”. The widespread use of pesticides has been blamed for a steep rise in deaths among bees and other pollinating insects. In April the EU voted to outlaw the use of certain pesticides from the neonicotinoid family blamed for killing off bee populations.

And we’re still allowing glyphosate? We must insists on precautionary principle.

• Orca ‘Apocalypse’: Half Of Killer Whales Doomed To Die From Pollution (G.)

At least half of the world’s killer whale populations are doomed to extinction due to toxic and persistent pollution of the oceans, according to a major new study. Although the poisonous chemicals, PCBs, have been banned for decades, they are still leaking into the seas. They become concentrated up the food chain; as a result, killer whales, the top predators, are the most contaminated animals on the planet. Worse, their fat-rich milk passes on very high doses to their newborn calves. PCB concentrations found in killer whales can be 100 times safe levels and severely damage reproductive organs, cause cancer and damage the immune system. The new research analysed the prospects for killer whale populations over the next century and found those offshore from industrialised nations could vanish as soon as 30-50 years.

Among those most at risk are the UK’s last pod, where a recent death revealed one of the highest PCB levels ever recorded. Others off Gibraltar, Japan and Brazil and in the north-east Pacific are also in great danger. Killer whales are one of the most widespread mammals on earth but have already been lost in the North Sea, around Spain and many other places. “It is like a killer whale apocalypse,” said Paul Jepson at the Zoological Society of London, part of the international research team behind the new study. “Even in a pristine condition they are very slow to reproduce.” Healthy killer whales take 20 years to reach peak sexual maturity and 18 months to gestate a calf.

PCBs were used around the world since the 1930s in electrical components, plastics and paints but their toxicity has been known for 50 years. They were banned by nations in the 1970s and 1980s but 80% of the 1m tonnes produced have yet to be destroyed and are still leaking into the seas from landfills and other sources.

Photograph: Audun Rikardsen/Science

Home › Forums › Debt Rattle September 28 2018