Vincent van Gogh Sprig of Flowering Almond in a Glass 1888

Hope is the thing with feathers that perches in the soul

—and sings the tunes without the words

—and never stops at all.

– Emily Dickinson

Voting machines

Three new blockbuster pieces of evidence supporting new SCOTUS filing to eliminate the use of electronic voting machines. pic.twitter.com/z0IKggTk6X

— Jennifer Asper (@j3669) March 15, 2024

Ware County

https://twitter.com/i/status/1768795715034329444

Tucker Pence

Tucker: "Every city in America has become worse over the past few years… Your concern is that Ukraine don't have enough tanks… Where's the concern for America in that?"

Judas Pence: "That's not my concern." pic.twitter.com/rIrJNZ0Tl8— I'LL BE BACK!!! (@DavidYeshua4) March 15, 2024

Putin ID

Even Putin has to show his ID before voting… pic.twitter.com/Y7DSYUCnZ4

— Anna (@provemewrong411) March 16, 2024

Sciutto

CNN’s Jim Sciutto: “When General John Kelly told me the story of Trump’s praise for Hitler…he told me, he would sit across from the president at the time, praising Hitler, praising Hitler’s generals for being loyal to him, and he would be flabbergasted that he had to remind… pic.twitter.com/LonqNxKRO0

— Republicans against Trump (@RpsAgainstTrump) March 16, 2024

“Paris has had to recall unwanted ambassadors, shut down military bases, and withdraw thousands of troops. Where to put these French troops? In Ukraine, pitted against Russia?”

“..He has an inordinate ego that has been bruised, his delusions have been shattered, he is an impotent vassal of American imperialism, and he is desperate for his sordid political survival.”

“Kicked out of Africa… and now trying to start World War Three in Europe. How pathetic and criminal.”

• Out of Africa… Macron’s Belligerence Towards Russia (SCF)

Russian President Vladimir Putin was spot-on this week in his observation about why France’s Emmanuel Macron is strutting around and mouthing off about war in Ukraine. Putin remarked in an interview that Macron’s wanton warmongering over Ukraine was borne out of resentment due to the spectacular loss of France’s standing in Africa. One after another, France’s former colonial countries have told Paris in no uncertain terms to get out of their internal affairs. Since 2020 and the coup in Mali, there has been immense political upheaval on the continent, particularly in West and Central Africa, stretching from the vast Sahel region down to the equator. At least seven nations have undergone coups or government changes against Francophone rulers. They include Mali, Burkina Faso, Chad, Niger, Central African Republic, Gabon, and Guinea. The continent-wide changes have come as a political earthquake to France. The new African governments have adamantly rejected old-style French patronage and have asserted a newfound national independence.

Paris has had to recall unwanted ambassadors, shut down military bases, and withdraw thousands of troops. Where to put these French troops? In Ukraine, pitted against Russia? Popular sentiment across Africa is exasperated with and repudiating “Francafrique” corruption. Meanwhile, with an unmistakable end-of-era sense, French media have lamented “France’s shrinking footprint in Africa.” A former diplomat summed up the momentous geopolitical shift thus: “The deep trend confirms itself. Our military presence is no longer accepted. We need to totally rethink our relationship with Africa. We have been kicked out of Africa. We need to depart from other countries before we are told to.” Africa analysts are now watching two key countries closely. They are Senegal and Ivory Coast. Both are currently governed by pro-France presidents but the rising anti-French political tide is putting those incumbents at risk of either a coup or electoral ouster.

The blow to the French political elite cannot be overstated. The loss of status in its former colonies is conflating multiple crises tantamount to the traumatic loss of Algeria back in the early 1960s. Financially, for decades after handing over nominal independence to African nations, Paris continued to exploit these countries through control of currencies and their prodigious natural resources. Most of France’s electricity, for example, is generated from uranium ore mined in Africa – and obtained like most other African resources for a pittance. The system of neocolonial suzerainty was typically sustained by France bribing local corrupt regimes to do its bidding and offering security guarantees from the continuance of French military bases. Not for nothing did Paris think of itself as the African Gendarme.

One of the extraordinary curiosities of this neocolonial arrangement was that African nations were compelled to deposit their gold treasuries in France’s central bank. Any African nation trying to resist the neocolonial vassalage was liable to be attacked militarily through counter-coups, or its nationalist leaders were assassinated like Thomas Sankara in 1987, who was known as “Africa’s Che Guevara”. Nevertheless, the halcyon days of France’s dominance over its former colonies are over. African nations are discovering a new sense of independence and purpose, as well as solidarity to help each other fend off pressure from France to reinstate the status quo ante. The collapse of France’s status in Africa is perceived by the French establishment as a grievous loss in presumed global power.

No French politician can feel more aggrieved than President Emmanuel Macron. Macron imagines himself to be on a mission to restore “France’s greatness”. He seems to harbor fantasies of also leading the rest of Europe under the tutelage of Paris. It was Macron who proclaimed one of his grand objectives as achieving a reset in Franco-African relations, one which would renew continental respect for Paris and promote French strategic interests. How embarrassing for Macron that a whole spate of African nations are asserting that they no longer want to have anything to do with the old colonial power. Chagrin indeed.

[..] The French president declared with hysteria that: “If Russia wins this war [in Ukraine], Europe’s credibility will be reduced to zero.” Macron’s recklessness is criminal. He is talking up war with Russia based on sheer lies and vanity. When he says Europe’s credibility will be reduced to zero what he really means is that his credibility and that of NATO will be reduced to zero when Russia defeats the NATO-backed NeoNazi regime in Kiev. Macron is a most dangerous kind of politician. He has an inordinate ego that has been bruised, his delusions have been shattered, he is an impotent vassal of American imperialism, and he is desperate for his sordid political survival. The French people are all too well aware of the charlatan that poses like a Louis XIV Sun King in Elysée Palace basking in his presumed vainglory. How ironic. Kicked out of Africa… and now trying to start World War Three in Europe. How pathetic and criminal.

Brigitte

https://twitter.com/i/status/1768916052061405573

“..the way for Russia to beat the west in Ukraine was to continue letting them think they had a chance to win..”

• Europe Panics as Trump Rises from the Political Grave (Luongo)

Remember, that in 2022-23 when it looked like the US was hellbent on going forward in Ukraine, European leaders like Macron and others were more circumspect. They wanted to virtue signal about the dangers of Ukraine escalating. They got to look like the moderates in the war room, while still sending billions in aid and weapons, arm-twisting everyone into compliance. The real mask-off event for Europe’s real position on this war was their threatening Hungary’s Viktor Orban with complete economic devastation if he didn’t allow their $50 billion aid package to go through the European Council. Now that all of Nuland’s military plans have failed, Ukraine’s army has been destroyed for the third time, and all of their attempts to undermine the US legally and economically (Powell must Pivot!) have fizzled, Europe finds itself in the blind panic.

Because as poll after poll suggests, Trump will return to the White House in January and has plans to end the killing and the other shenanigans in Ukraine quickly. Orban is acting as Trump’s voice of reason to both Eastern Europe as well as Russia itself.: Orban, who spoke with Trump at the Mar-a-Lago estate in Florida on Friday, did not explain how exactly the American would do that, but said that cutting the flow of US aid was a crucial part of the plan. ”If the US will not provide the money, Europeans on their own will not be able to finance this war, and then the war will end,” Orban said in an interview with M1 broadcaster on Sunday. During his presidency, Trump had shown himself to be “a man of peace,” the Hungarian leader claimed.

That stance puts him in alignment with Hungary, unlike the administration of US President Joe Biden and many members of the EU, he added. ”The American Democratic government and the leadership of the EU, as well as the leadership of the largest EU member states are pro-war governments. Donald Trump is pro-peace, Hungary is pro-peace. At the bottom of everything lies this difference,” Orban declared. Trump’s many things, but he is no dummy when it comes to money. Cut the flow of funds and you end the war. The wildcard is the seizure of Russia’s foreign exchange assets which would be the dumbest thing all these people could do. This is why they won’t shut up about it.

For his part, Putin is as done with the current regime in the EU as he is with the Biden junta in the US. He’s tried to reason with them, and all we hear is the most over-the-top vitriol from the usual suspects, like Macron. Putin understands now that the only diplomacy will occur is at the point of his gun or not at all. And if Ukraine is going to escalate on behalf of Europe to attack critical infrastructure inside Russia he will take the gloves completely off, rather than just carpet bomb the line of contact. I told you last year that no matter what the West thinks there will be “No Truce With the Heartland.” And the way for Russia to beat the west in Ukraine was to continue letting them think they had a chance to win by leaving just enough hope to have the West keep funneling billions into a slaughterhouse.

“In any case, in the next year I will have to send some of my people to Odessa..”

• The Ever Widening War (Paul Craig Roberts)

I have no idea why French President Macron is talking so aggressively about war with Russia, saying he will send French soldiers to Odessa and telling Russia’s President Putin “We are a nuclear power and We are ready,” or who might have put him up to taking such an aggressive position. I have been writing for two years that Putin needs to end the conflict as the war continues to widen and will spin out of control. The way Putin has fought this conflict is a strategic blunder of the worst kind. Russia should have seized, Kharkiv, Odessa, and Kiev immediately and left the Ukrainian army trapped in the east cut off from supplies. If President Macron does put French soldiers in Odessa, Putin cannot complete the obvious military task in Ukraine without going to war with NATO. Russia has gained absolutely nothing by the pointless, endless prolongation of the conflict.

The war has widened, and now European leaders are talking about preparing for war with Russia. Two more countries, Sweden and Finland, have joined NATO, so Ukraine was kept out at the cost of two other additions. “The French authorities are considering sending their troops to Ukraine from 2023, Le Monde newspaper reported, citing sources. “According to them, the issue of sending the French military to Ukraine was discussed in “the strictest secrecy” at the Security Council at the Elysee Palace on June 12, 2023. Shortly before that, the French president spoke in favor of Ukraine’s early entry into NATO.

“Le Monde writes that on the eve of the second anniversary of the full-scale invasion, on February 21, 2024, Macron, after the ceremony of transferring the ashes of the French Resistance movement member Misak Manushyan to the Pantheon, raised the topic of Ukraine in a conversation with those who congratulated him on his “beautiful speech”. “In any case, in the next year I will have to send some of my people to Odessa,” Macron said, according to the publication. “French Army Chief of Staff General Pierre Schill told the publication that Macron’s words are “primarily a political and strategic message” to Russia about its readiness for such steps. The task of the military in this situation is “to prepare as many options as possible to help the president make political and military decisions.”

“Emmanuel Macron said on February 26, speaking after a conference of leaders of 20 European countries, that he does not rule out sending NATO troops to Ukraine. Many Western countries, including Germany and the United States, opposed it. The Kremlin responded that the appearance of NATO troops in Ukraine would lead to a direct conflict with Russia. “The French president clarified on March 4 that the authorities are not considering sending French troops to Ukraine, but are “starting discussions and thinking about everything that can be done to support Ukraine” on its territory. Macron later added that ” not ruling something out does not mean doing it.” “At a meeting with leaders of French political parties on March 7, Macron said that there should be no restrictions on supporting Ukraine. Deputy Head of the Russian Security Council Dmitry Medvedev said in response that ” then Russia no longer has any red lines in relation to France.”

“..creating a consensus-based list out of the dozens of nations that are literally itching to join the club..”

• Will BRICS Launch A New World In 2024? (Pepe Escobar)

Across the Global South, countries are lining up to join the multipolar BRICS and the Hegemon-free future it promises. The onslaught of interest has become an unavoidable theme of discussion during this crucial year of the Russian presidency of what, for the moment, is BRICS-10. Indonesia and Nigeria are among the top tiers of candidates likely to join. The same applies to Pakistan and Vietnam. Mexico is in a very complex bind: how to join without summoning the ire of the Hegemon. And then there’s the new candidacy on a roll: Yemen, which enjoys plenty of support from Russia, China, and Iran. It’s been up to Russia’s top BRICS sherpa, the immensely capable Deputy Foreign Minister Sergey Ryabkov, to clarify what’s ahead. He tells TASS: “We must provide a platform for the countries interested in rapprochement with the BRICS, where they will be able to work practically without feeling left behind and joining this cooperation rhythm. And as to how the further expansion will be decided upon – this should be postponed at least until the leaders convene in Kazan to decide.”

The key decision on BRICS+ expansion will only come out of the Kazan summit next October. Ryabkov stresses that the order of the day is first “to integrate those who have just joined.” This means that “as a ‘ten,’ we work at least as efficiently, or, rather, more efficiently than we did within the initial ‘five.'” Only then will the BRICS-10 “develop the category of partner states,” which, in fact, means creating a consensus-based list out of the dozens of nations that are literally itching to join the club. Ryabkov always makes a point to note, in public and in private, that the twofold increase of BRICS members starting on 1 January 2024 is “an unprecedented event for any international structure.” It isn’t an easy task, Ryabkov says: “Last year, it took an entire year to develop the admission, expansion criteria at the level of top officials. Many reasonable things were developed. And many of the things that were formulated back then got reflected in the list of countries that joined. But it would probably be improper to formalize the requirements. At the end of the day, an admission to the association is a subject of political decision.”

In a private meeting with a few select individuals on the sidelines of the recent multipolar conference in Moscow, Foreign Minister Sergei Lavrov spoke effusively of BRICS, with particular emphasis on his counterparts Wang Yi of China and S. Jaishankar of India. Lavrov holds great expectations for BRICS-10 this year – at the same time, reminding everyone that this is still a club; it must eventually go deeper in institutional terms, for instance, by appointing a secretariat-general, just like its cousin-style organization, the Shanghai Cooperation Organization (SCO). The Russian presidency will have its hands full for the next few months, not only navigating the geopolitical spectrum of current crises but, most of all, geoeconomics. A crucial ministerial meeting in June – only three months away – will have to define a detailed road map all the way to the Kazan summit four months later.

What happens after this week’s Russian presidential elections will also condition BRICS policy. A new Russian government will be sworn in only by early May. It is widely expected that there will be no substantial changes within the Russian Finance Ministry, Central Bank, Foreign Ministry, and among top Kremlin advisers. Continuity will be the norm. And that brings us to the key geoeconomics dossier: the BRICS at the forefront of bypassing the US dollar in international finance. Last week, top Kremlin adviser Yury Ushakov announced that BRICS will work towards setting up an independent payment system based on digital currencies and blockchain. Ushakov specifically emphasized “state-of-the-art tools such as digital technologies and blockchain. The main thing is to make sure it is convenient for governments, common people, and businesses, as well as cost-effective and free of politics.” Ushakov did not mention it explicitly, but a new alternative system already exists. For the moment, it is a closely, carefully guarded project in the form of a detailed white paper that has already been validated academically and also incorporates answers to possible frequently asked questions.

“..virtually every man of fighting age had been killed, wounded, or gone missing with the remaining few being hunted down by the draft officers..”

• Zelensky’s Draft Leaving Ukrainian Villages Without Men – WaPo (RT)

Some Ukrainian villages and small towns are left with hardly any adult men amid aggressive and indiscriminate mobilization tactics by the army recruiters, who are desperate to refill the ranks of the depleted forces, according to a report by the Washington Post. In an article published on Saturday, the outlet detailed the plight of the village of Makov, in the Khmelnitsky region in Western Ukraine, where virtually every man of fighting age had been killed, wounded, or gone missing with the remaining few being hunted down by the draft officers. “It’s just a fact, most of them are gone,” Larisa Bodna, deputy director of the local school, which keeps a database of students whose parents are deployed, told the outlet.

“People are being caught like dogs on the street,” noted another resident, whose husband was forcefully drafted last year, despite a medical condition that was meant to exempt him from the military service. “The whole village was taken this way,” her mother-in-law added. The newspaper noted that the sense of resentment is steadily growing among the civilian population, with the majority feeling that their men have been targeted disproportionately, compared to larger cities, where it is easier to go into hiding. The residents say that even those already serving in the army and youths below the draft age are being stopped and questioned on the streets. Multiple videos of troops forcing men into vehicles that have surfaced online in recent months, sparking rumors of kidnappings and contributing to panic among the locals.

Ukraine announced a general mobilization shortly after the start of the conflict with Russia in February 2022, but thousands managed to flee to the bordering Romania and Moldova. Following the failed counteroffensive in the summer of last year, Kiev was desperate to replenish the ranks, seeking to mobilize up to 500,000 new recruits. In late January, the Ukrainian lawmakers passed the first reading of a revised mobilization bill aimed at increasing the military ranks by lowering the conscription age from 27 to 25 and tightening draft conditions. The Russian military estimated Kiev’s casualties at over 444,000 killed or badly injured, as of the end of February. Ukrainian President Vladimir Zelensky claimed last month that only 31,000 Ukrainian soldiers had been killed in two years of hostilities with Russia, a figure that even journalists sympathetic to the Ukrainian cause have called implausibly low.

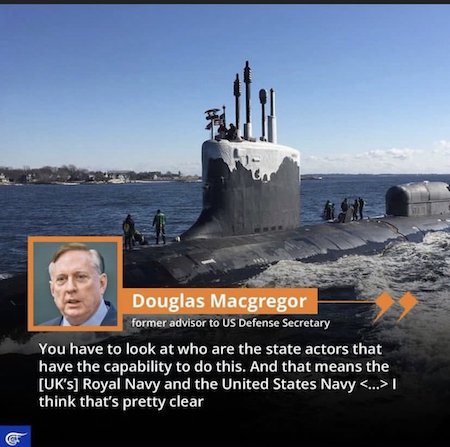

de Graaff

https://twitter.com/i/status/1769051139528364045

“..Washington is “destroying the vestiges of [its own] former prestige.” “The further we advance on the frontline, the more America will weaken and the rules-based world order will crumble..”

• Ukraine Outcome Will Weaken US – Envoy (RT)

Success for Russia in the Ukraine conflict would progressively weaken the US, Moscow’s ambassador in Washington DC has argued. Anatoly Antonov also accused the US and UK of preventing a peaceful resolution of the conflict during its early stages. In an interview with RIA Novosti news agency published on Saturday, Antonov accused the US of playing an “extremely negative” role in Ukraine, calling Washington a “sponsor of terrorism” and a “country that encourages murder and war.” According to the envoy, Washington is “destroying the vestiges of [its own] former prestige.” “The further we advance on the frontline, the more America will weaken and the rules-based world order will crumble,” the Russian diplomat added.

The term ‘rules-based world order ‘ has been widely used by the administration of US President Joe Biden to describe the arrangement in which leading Western powers have for decades had significant leverage over the rest of the world. Critics, including Russia, say the system contravenes international law and is being abused by the West. Antonov also dismissed Western claims that Moscow is unwilling to engage in dialogue on Ukraine. He argued that “everything could have been settled peacefully. However, this did not sit well with the leadership of NATO countries, first of all the US and the UK.” Moscow and Kiev held talks in the Turkish city of Istanbul in late March 2022, with the negotiations eventually collapsing. Several media outlets claimed that then- British Prime Minister Boris Johnson persuaded the Ukrainian leadership to withdraw and keep fighting.

One of Ukraine’s negotiators, David Arakhamia, confirmed the reports last November, but Johnson himself has staunchly denied derailing the peace process. Earlier this week, Antonov warned that further Western participation in the Ukraine conflict could lead to the “most unpredictable consequences.” The official also claimed that CIA Director William Burns had de facto acknowledged the “direct involvement of the United States” in the hostilities. Addressing the Senate Select Committee on Intelligence on Monday, Burns argued that additional funding for Ukraine would enable the country to conduct “deep penetration strikes in Crimea,” further target the Russian Black Sea Fleet, and eventually “regain the offensive initiative.”

“The global politics of the new century can only be multipolar..”

• Russia Created ‘New Global Majority’ – Presidential Hopeful (RT)

Russia is playing a crucial role in the emergence of the new multipolar world and has already become one of its centers of power, presidential hopeful Leonid Slutsky believes. Slutsky spoke to RT on Saturday, with the country going through the second day of its three-day presidential polls. The politician, who leads Russia’s right-wing Liberal Democratic Party (LDPR), is seeking the top office alongside three other candidates – incumbent President Vladimir Putin, Nikolay Haritonov, and Vladislav Davankov. With an election reportage blackout period in place, the conversation revolved around more global issues the country is facing now and will face in the future than around the candidate himself.

Russia is playing a crucial role in making the world multiploar, having already become one of the important centers in it, Slutsky has said. “[Russia], today, has in fact already created a new global majority on the planet. This is not the Anglo-Saxon majority, the new global majority is the global South, Africa, Latin America. These are many, many nations of larger Eurasia that are against the unipolar world order, where all the decisions, on how life goes in one or another country are being made in Washington,” the candidate explained. The emerging multipolar world is bound to become a more fair and equal place, where any country regardless of its size, cultural background or anything else, will be able to decide its destiny, Slutsky believes. “The global politics of the new century can only be multipolar,” he stressed.

“The issue of the affiliation of Crimea and Sevastopol is closed. The peninsula is an integral part of Russia..”

• Issue of Crimea’s Affiliation Resolved Forever – Lavrov (TASS)

Crimea and Sevastopol are integral parts of Russia and the issue of their affiliation is closed forever, Russian Foreign Minister Sergey Lavrov said in a video address on the occasion of the 10th anniversary of the peninsula’s reunification with Russia on Saturday. “The issue of the affiliation of Crimea and Sevastopol is closed. The peninsula is an integral part of Russia,” the top diplomat stressed. Crimea has clear-cut prospects of its further development and Russia has resolved many problems inherited from Ukraine, Lavrov pointed out. “Over the past years, many problems inherited from Ukraine have been resolved. With clear-cut prospects of their further development, Crimean residents can look into the future with confidence and optimism,” he added. “Ten years ago, on March 16, 2014, Crimean residents determined their future independently and consciously, having reunited with Russia. I congratulate the peninsula’s residents on the decade of the historic reunification with Russia. I wish them health, well-being, prosperity and all the best,” Russia’s top diplomat said.

“..The UN has opened an investigation, while UNRWA defends itself against Israel’s accusations, and accuses Israel of torturing its employees to force false testimonies..”

• Israel Is Starving Gaza (Sahiounie)

On March 12, a Spanish ship, ‘Open Arms’, left Cyprus for Gaza. It is expected to arrive on Friday, March 15 carrying 200 tons of aid. This desperate attempt to stave off famine in Gaza is the brain-child of Spanish-American celebrity chef, José Andrés, founder of the non-profit World Central Kitchen (WCK). WCK has Palestinians building a jetty in Gaza, utilizing rubble and materials from bombed buildings, which will play a role in offloading the food and supplies. This jetty is a temporary structure and in not related to the pier the U.S. is planning. “I had no doubt that we could open the maritime route. The most difficult thing was the diplomatic side of it, and the easiest thing was getting to Gaza,” said Andrés. Andrés is an advisor to the White House, and held countless meetings in Israel, Egypt and Jordan to obtain the necessary permits, while also obtaining support from Cyprus, King Abdullah II of Jordan and the United Arab Emirates, which has co-financed the mission together with WCK.

After arrival, the 130 pallets of aid will go into trucks to be delivered to the 60 kitchens that the WCK has set up in the Gaza Strip, and to other aid distribution points. Israel controls all land crossings into Gaza, which has seven border crossings, six with Israel and one with Egypt. However, only the crossing at Rafah, with Egypt, is partially open. The quickest and most efficient way to delivery aid to Gaza is by land and the gates that exist. But, Israel restricts aid and supplies from entering in Gaza. All of the aid agencies report that their donations sit in parked trucks, filled to overflowing, but unable to enter Gaza because the IDF has locked the gates and refuses to open them. Israel maintains that they will not allow any aid into Gaza which could be used by Hamas. The aid agencies have repeatedly asked for a list of restricted items so that they can make sure their cargoes meet the criteria. However, Israel refuses to publish or distribute a list of restricted items.

Instead, the IDF uses the aid as a weapon of war, intent on starving the civilians. The IDF claim that if they find one item in a cargo load which meets their undisclosed definition of prohibited items, they will not allow the entire cargo to enter. In one very famous case, the item was a single pair of small scissors to be used to cut the tape in conjunction with bandages. Doctors Without Borders, MSF, reported they have been repeatedly prohibited from importing electricity generators, water purifiers, solar panels and other medical equipment. On March 12, for the first time in three weeks, the UN’s World Food Program sent in six aid trucks to feed 25,000 people through a gate in the security fence. This is but a drop in an ocean of need, and is not sustainable. Some Arab nations, such as Morocco have sent supplies destined for Gaza to Israel’s Ben Gurion airport. All the experts agree, that land routes which already are established are the most efficient delivery method of aid to Gaza. But, it is Israel alone standing in the way, and this is their political objective.

Cargo trucks typically carry 20 tons, and the flow of trucks prior to the current conflict was about 500 a day. But, even that amount of daily arrivals would not meet the needs of the 2.3 million people in Gaza. Israel began a political campaign to discredit and destroy UNRWA, by accusing the agency of complicity with Hamas in the October 7 attack on Israel. With an accusation only, Israel was able to convince 16 donor countries to pull their funding, and have asked the UN General Assembly to disband the refugee agency, which would affect not only the people in Gaza, but also those in the Occupied West Bank. The agency is 75 years old, serves almost six million refugees, and now has had more than $437 million funds frozen. Spain announced a donation of $22 million on Thursday, and Canada and Sweden reported on Saturday that they would resume funding to the agency in light of unfounded claims, and the risk of famine.

The UN has opened an investigation, while UNRWA defends itself against Israel’s accusations, and accuses Israel of torturing its employees to force false testimonies that the IDF used as the basis of their accusations. Initially, the UN fired 12 UNRWA workers after the IDF claim. Philippe Lazzarini, the head of UNRWA, says that he has received no evidence of agency workers in conspiracy with Hamas. However, 150 UNRWA employees have died while working in Gaza, and 3,000 have been left homeless.

Finkelstein

"It's a satanic state, 60% say that Isrаеl is not using enough force."

– Norman Finkelstein pic.twitter.com/eqwep7DJqW

— DD Geopolitics (@DD_Geopolitics) March 16, 2024

Trojan horse.

• EU ‘Media Freedom’ Law Not What You Think It Is (Marsden)

The EU’s new Media Freedom Act has now been voted into law, with 464 votes for, 92 against, and 65 abstentions. There are some news outlets whose coverage of the vote I’d like to see. Like RT’s, where you’re reading this right now. But anyone who’s viewing this from inside the European Union’s bastion of democracy and freedom is likely doing so via a VPN connection routed through somewhere outside the bloc, to circumvent its press censorship.Nothing in this new law suggests that this will change, or that there will be increased access to information and analysis for the average person. Such improved freedoms might lead to people making up their own minds rather than having various flavors of a similar narrative served up for mass consumption. As has become par for the course in so-called Western democracies, inconvenient facts and analysis will still be dismissed as “disinformation” and criticism of the establishment still qualified as an effort to sow division – as though dissent itself wasn’t supposed to be proof of a healthy and vibrant democracy.

So, now that we’ve gotten out of the way any hope of lifting the EU’s top-down censorship in the absence of due process, exactly what kind of lip service does this new law pay to the lofty notion of media freedom?No spying on journalists or pressing them to disclose their sources. Well, unless you’re one of the countries that lobbied to be able to keep doing this – like France, Italy, Malta, Greece, Cyprus, Sweden, and Finland – so basically, a quarter of EU countries. Oh, but they have to invoke national-security concerns in order to do so. Which, as we know, they’re very discerning about. Like, they didn’t at all implement a virtual police state and extend its powers under the guise of fighting a virus with which French President Emmanuel Macron kept saying they were “at war.” Nor did Amnesty International point out the sweeping “Orwellian” trend across Europe, at least as far back as 2017, of exploiting domestic terrorist attacks to permanently embed what were supposed to be extraordinary powers into criminal law, via measures like “overly broad definitions of terrorism.”

So, no doubt they’ll be equally reasonable when slapping the “national security threat” label on a journalist whose work they want to peek at. At least now, under this new law, they do have to fully inform any targeted journalist of the steps being taken against them. Another thing that changes is that there’s to be a centralized database into which “all news and current affairs outlets regardless of their size will have to publish information about their owners,” according to an EU press release. May we propose a first candidate for that? The NGO Reporters Without Borders has praised this new law as a “major step forward for the right to information within the European Union.” The same NGO also just launched a “Svoboda” (Russian for “freedom”) satellite package eventually consisting “of up to 25 independent Russian language radio and television channels” aimed at Russia, Ukraine, and the Baltics.

The launch took place at the EU parliament, in the presence of EU “values and transparency” commissioner (yes, that’s a real title), Vera Jourova, who has said in support of the new media law that “it is a threat to those who want to use the power of the state, also the financial one, to make the media dependent on them.” But she has also said about this new Russia-targeting initiative that the EU state needs to “use all possible means to ensure that their work, that facts and information can reach Russian-speaking people.” This is the same person who advocated in favor of banning Russia-linked media outlets in the EU.

A new one every day.

”..a flight attendant accidentally hit a switch on the pilot’s seat, which pushed the pilot into the controls..”

• Boeing Tells Pilots To Check Seats After Latam Plane Incident (BBC)

Boeing has told airlines operating 787 Dreamliners that pilots need to check their seats as an investigation into an incident on a Latam flight continues. It comes after 50 people were hurt this week when a 787 dropped suddenly during a Latam Airlines flight. The Wall Street Journal reported that a flight attendant accidentally hit a switch on the pilot’s seat, which pushed the pilot into the controls, forcing down the plane’s nose. Latam is supporting investigations. During the incident people were thrown against the roof of the plane, which was travelling from Australia to New Zealand. Passenger Brian Jokat said at the time that a number of people suffered head injuries. Speaking to the BBC, Mr Jokat revealed that people had hit the ceiling with such force “some of the roof panels were broken”.

The person next to him, he added, appeared to be “glued to the ceiling”. “I did think for a split second: ‘This is it’,” he said. Emergency services later said one person was in a serious condition. Boeing said: “The investigation of Flight LA800 is ongoing and we defer to the investigation authorities on any potential findings.” “We have taken the precautionary measure of reminding 787 operators of a service bulletin issued in 2017 which included instructions for inspecting and maintaining switches on flight deck seats.” It recommended that operators perform an inspection of the switches “at the next maintenance opportunity”.

Chilean-Brazilian carrier Latam Airlines said it “continues to work in coordination with the authorities in order to support the ongoing investigation”. The aircraft was scheduled to fly on from Auckland to Santiago, the capital of Chile. The departure was cancelled and a new flight scheduled for Tuesday. The incident comes after a door panel came off a Boeing plane in January this year, with a report in February finding bolts meant to secure the panel were missing. And this week, a former Boeing employee known for raising concerns about the firm’s production standards was found dead in the US.

“That’s worth fighting for on behalf of all Americans.”

• Peter Navarro Asks Supreme Court to Avoid Reporting to Prison (ET)

Former Trump White House aide Peter Navarro on March 15 asked the Supreme Court to allow him to avoid reporting to prison for a contempt of Congress conviction as the matter is being appealed. His request came after the U.S. Court of Appeals for the DC Circuit denied his request for release from prison pending appeal. Mr. Navarro revealed on March 10 that he was ordered to report to a Miami prison on March 19 for a four-month sentence. Mr. Navarro filed an emergency petition to Chief Justice John Roberts on Friday afternoon, arguing that his appeal “will raise a number of issues on appeal that he contends are likely to result in the reversal of his conviction, or a new trial.” “For the first time in our nation’s history, a senior presidential advisor has been convicted of contempt of Congress after asserting executive privilege over a congressional subpoena,” Mr. Navarro’s lawyers wrote.

“Navarro is indisputably neither a flight risk nor a danger to public safety should he be released pending appeal,” they added. Mr. Navarro was convicted in 2023 of contempt of Congress for defying a subpoena from the House Jan. 6 select committee. His bid to stay out of prison while he appeals his conviction was turned down initially in February by U.S. District Judge Amit Mehta, who found that the trade adviser to former President Donald Trump failed to pose any substantial questions of law in his motion. Mr. Navarro then asked an appeals court to overturn Judge Mehta’s ruling. In the decision on March 14, the U.S. Court of Appeals for the D.C. Circuit rejected another bid.

“Appellant has not shown that his appeal presents substantial questions of law or fact likely to result in reversal, new trial, a sentence that does not include a term of imprisonment, or a reduced sentence of imprisonment that is less than the amount of time already served plus the expected duration of the appeal process,” the court said. The Justice Department’s appellate filing echoed Judge Mehta’s claim that Mr. Navarro hadn’t provided sufficient evidence to the court that President Trump invoked executive privilege. In denying Mr. Navarro’s request for release, Judge Mehta stated that Mr. Navarro failed at an evidentiary hearing to carry his burden of establishing a formal claim of privilege.

“United States v. Peter Navarro is a landmark constitutional case that will eventually determine whether the constitutional separation of powers is preserved, whether executive privilege will continue to exist as a bulwark against partisan attacks by the legislative branch, and whether executive privilege will remain, as President George Washington pioneered, a critical instrument of effective presidential decision-making,” Mr. Navarro said in a statement to The Epoch Times. “That’s worth fighting for on behalf of all Americans.”

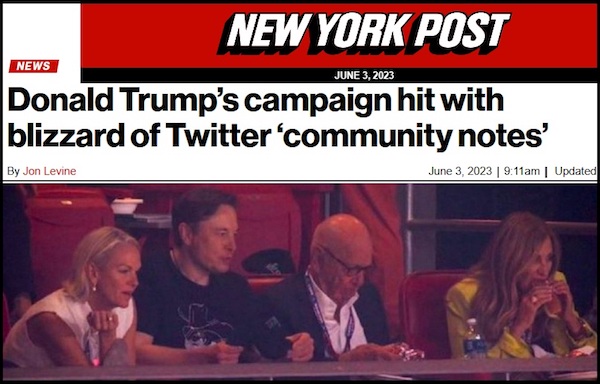

Lemon is not a very smart man.

• Don Lemon Made Crazy Demands Before Elon Musk Canned Him (NYP)

Don Lemon demanded the sun, the moon and the stars from the SpaceX boss – before being unceremoniously dumped this week, The Post has learned. The ex-CNN anchor sent over an astronomical wish list to Elon Musk during contract talks to host a show on the billionaire’s social media platform X – including a free Tesla Cybertruck, a $5 million upfront payment on top of an $8 million salary, an equity stake in the multibillion-dollar company, and the right to approve any changes in X policy as it relates to news content, according to a document reviewed by The Post. Lemon — who was expected to air an interview with Musk for next week’s debut episode on X — had also demanded a private jet flight to Las Vegas, a suite for him and his fiance, and that the company pay for their day drinking and massages, a source with knowledge of the situation said.

Musk agreed to do the interview with Lemon despite the fact that he was aware of some of Lemon’s outlandish demands, sources told The Post. The proposal reviewed by The Post was sent from Lemon’s agents at United Talent Agency to X’s leadership in December. The partnership was announced in January, but an X spokesperson told The Post that the company “did not have a final or signed agreement with Don Lemon or ‘The Don Lemon Show’” before Musk sat down for the explosive interview last week. Jay Sures, vice chairman at UTA, told The Post: “This is absolute, complete utter nonsense without an iota of truth to it.” Lemon was fired hours after the one-on-one sit-down, with Musk calling the anchor “dull” and “underwhelming.” The one-and-half hour grilling included testy exchanges about Musk’s political leanings, his past drug use and the site’s content moderation policy. It is scheduled to run on YouTube next week.

Lemon claimed on Wednesday that he was jettisoned by X because Musk reneged on his “free speech” pledge. Lemon’s discussions with the company began shortly after he was fired by CNN last April after a series of high-profile incidents, according to sources with knowledge of the situation. In an interview with veteran tech journalist Kara Swisher on Friday, Lemon claimed they held discussions over the summer in which the company threatened to fire him if he did not attend the Consumer Electronic Show in Las Vegas. CES, which was held earlier this year between Jan. 7 and 10, is one of the most highly anticipated events on the tech calendar as companies including X flock to the show in order to schmooze advertisers. A spokesperson for X called Lemon’s claim “a disingenuous lie.”

Lemon wanted to be flown to the convention with his longtime fiance on a private jet and be put up in a private suite, as well as for X to foot the bill for alcoholic beverages and massages that he and his fiance ordered during their stay at the Vdara, the MGM-run resort on the Las Vegas Strip, according to people familiar with the matter. The negotiations progressed after Musk brought former NBCUniversal advertising executive Linda Yaccarino on board as chief executive officer of X, sources said. But the talks stalled over Lemon’s extensive demands, which included executive assistants as well as a marketing budget that ranged from $10 million to $15 million, people with knowledge of the situation told The Post. A spokesperson for Lemon told The Post: “There is nothing in your list of demands that you claim Don made of X that is true. Literally nothing.”

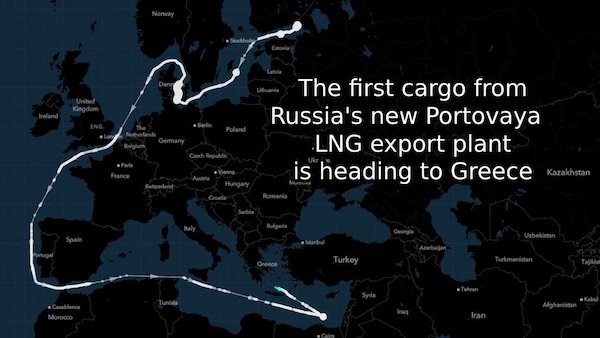

“The vast constellation of low-Earth orbit satellites will be able to track targets on the ground in real time nearly anywhere across the world..”

• Musk Building Huge Spy Satellite Network – Reuters (RT)

Elon Musk’s secretive Starshield project will allow the US military and spies to track their targets and support American and allied ground forces in real time almost anywhere across the globe, Reuters has reported, sharing new details about the billionaire’s dealings with the Pentagon. SpaceX has been launching prototype military satellites alongside “civilian” payloads on Falcon 9 rockets since at least 2020, before eventually securing a lucrative $1.8 billion contract with the National Reconnaissance Office (NRO) in 2021, Reuters wrote on Saturday, citing five unnamed sources familiar with the project. The vast constellation of low-Earth orbit satellites will be able to track targets on the ground in real time nearly anywhere across the world, the sources claimed. One of them boasted that Starshield would ensure “no one can hide” from the US government. Starshield also reportedly aims to be “more resilient to attacks” by rival space powers.

It remains unclear how many Starshield satellites are currently operational and when the sytem is expected to fully come online, with SpaceX and the Pentagon ignoring Reuters’ requests for comment. The NRO admitted that it is developing “the most capable, diverse, and resilient space-based intelligence, surveillance, and reconnaissance system the world has ever seen,” but refused to comment on SpaceX’s role in the project. The SpaceX CEO previously acknowledged the development of the military alternative to the “civilian” Starlink system, saying in September that it would be “owned by the US government” and controlled by the Department of Defense. “Starlink needs to be a civilian network, not a participant to combat,” Musk said, referring to the use of the satellites in Ukraine throughout the conflict with Russia. Musk donated around 20,000 Starlink terminals to Ukraine shortly after Russia launched its military operation in February 2022. Since then, Kiev’s troops heavily relied on the system to maintain communications and operate combat drones along the front line.

While pledging support for Ukraine, Musk has repeatedly said he favors a peaceful resolution of the conflict. The billionaire has come under fire from US officials after refusing Kiev’s demands to use the Starlink network to aid strikes on Russia’s Black Sea fleet. In turn, Musk argued that activating Starlink in Crimea would be in breach of US sanctions. In the absence of any direct orders from the US leadership, SpaceX opted not to contravene regulations despite Kiev’s request to do so, the entrepreneur explained. Earlier this month, US lawmakers reportedly launched another probe into SpaceX, after Ukrainian claims that Russian troops allegedly used Starlink satellite service on the conflict frontline. Musk has denied the allegations, insisting that “no Starlinks have been sold directly or indirectly to Russia.” The Kremlin has also insisted that the Russian military has never ordered Starlink terminals.

An overview can be handy, even if it’s BBC.

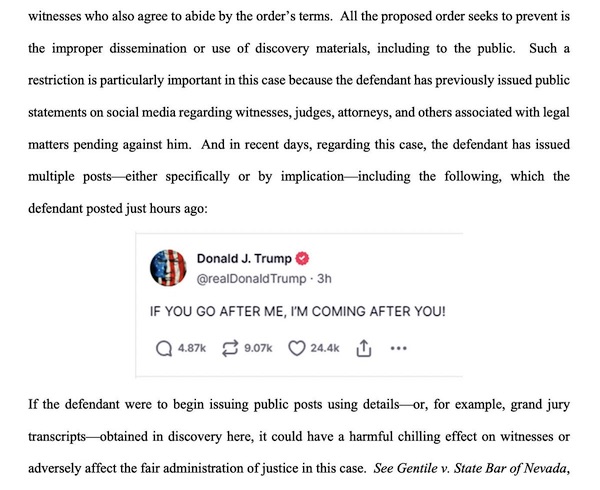

• Where Donald Trump’s Four Criminal Trials Stand After More Delays (BBC)

New York document dump Mr Trump’s New York City trial on charges that his hush-money payments to adult film star Stormy Daniels constituted business fraud and violated federal campaign finance laws was scheduled a week from Monday, on 25 March. That’s no longer the case. The US justice department just turned over more than 73,000 pages of documents related to its own hush-money investigations that the Trump legal team had subpoenaed back in January. Another 15,000 pages are still expected. “Prosecutors have been stumbling a bit,” says John Coffee, a professor at Columbia University. He adds that the confusion and delays in producing documents make it seem as though the justice department and the New York district attorney’s office are feuding.

The former president’s lawyers requested a 30-day trial delay, which the New York prosecutors agreed not to block. That’s just the start, though. Mr Trump’s lawyers want hearings into why the documents, which include witness interviews, took so long to produce. They also want an additional delay for time to review the new evidence and prevent the trial from starting on Passover and, for good measure, a dismissal of the case entirely. Trial date: Originally scheduled for 25 March, on Friday it was delayed until April, at the earliest.

Fani’s choice After days of tense legal hearings, the judge presiding over the sprawling 2020 election-interference case against Mr Trump and 18 of his co-defendants issued his decision on whether Fulton County District Attorney Fani Willis can remain in charge of the prosecution. The answer is yes – but with a catch. Either she or Nathan Wade, the special prosecutor she hired – and had a romantic relationship with – will have to step aside. Mr Wade resigned on Friday. Judge Scott McAfee said that there were “reasonable questions” about whether the two attorneys had testified untruthfully and an “appearance of impropriety” that had to be remedied.

While he ultimately concluded that evidence did not support removing the district attorney entirely, such language will provide plenty of ammunition for Mr Trump and his team to use in the court of public opinion, where they might be able to shape the views of prospective jurors. “Everybody here is likely to be influenced by the news coverage of the judge’s decision,” says Adrienne Jones, an assistant political science professor at Atlanta’s Morehouse College. “It’s not likely people are ignorant of what’s happening.” The judge’s announcement comes just a few days after he dismissed three of the 13 charges against the former president for being too vague. Prosecutors will have an opportunity to clarify and re-indict Mr Trump, however. Trial date: The prosecution has proposed an 5 August start.

Classified files slow-walk Down in Fort Pierce, Florida, Judge Aileen Cannon has been reviewing a series of attempts by Trump’s legal team to get the federal case against the president for obstruction of justice and mishandling classified documents dismissed. On Thursday, she rejected one of the motions – but she must decide on six others and seems in no big hurry to do so. She is also expected to issue a decision at some point on a schedule for when the trial will begin. At the moment, the start date is 20 May, but both the prosecution and Mr Trump’s teams have suggested pushing that back. Ms Cannon, who was appointed to the federal bench by the former president, is considering how to handle disclosure of the troves of classified documents that are part of the case, and any decision – or appeal of that decision – could lead to even more extensive delays. Trial date: Special Counsel Jack Smith has offered 8 July as a rescheduled start. Mr Trump’s lawyers have said that if the case isn’t pushed after the election entirely, the earliest they would be ready to begin is August.

Supreme Court limbo The biggest case against the former president, the federal prosecution for his role in the 6 January, 2021, attack on the US Capitol, is also the one that is in the most doubt. The US Supreme Court has agreed to review whether Mr Trump is immune from criminal prosecution for actions he took as president. The high court stepped in after two lower-level courts ruled that the trial could proceed. Last week, the court set oral arguments for the case on 25 April, and at this rate the justices may not issue a decision until the end of June, near the end of their formal session. Once the Supreme Court hands down its ruling, assuming it does not say that Mr Trump is immune, the judge presiding over the trial has estimated that it will take an additional 88 days to get ready for a trial. This all plays into Mr Trump’s primary legal strategy, which has been to push back all the legal cases against him for as long as possible and, if preferable, until after the November election. If he wins there, and returns to the presidency in January 2025, there are multiple ways he could make the federal cases against him disappear. “They are the masters of delay,” says Prof Jones. Trial date: Not scheduled and not expected anytime soon.

Jim Carrey meets Jerry Lewis

Jim Carrey meets Jerry Lewis pic.twitter.com/mDA6Q5Ir3H

— Fascinating (@fasc1nate) March 16, 2024

Ibogaine

https://twitter.com/i/status/1769021393209856148

Elephant

https://twitter.com/i/status/1768809775360577950

Dromedary

Unusual sleeping position for a dromedary camel.pic.twitter.com/nir46L0Lf5

— Massimo (@Rainmaker1973) March 16, 2024

Shave

Stop shaving, I'll show you the easiest way to remove hair from your face, armpit and the body…. pic.twitter.com/ylf69ZAQPh

— Cardio Arena (@CadioArena) March 16, 2024

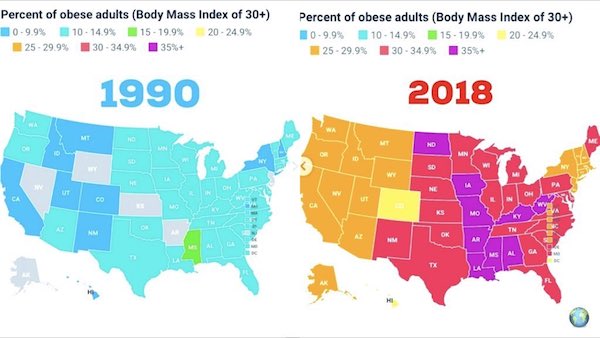

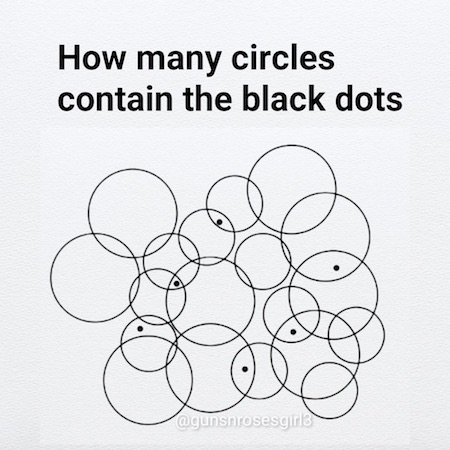

Percentages

https://twitter.com/i/status/1768867288512643563

Salt water

This lamp efficiently converts salt water into electricity, providing weeks of light on just half a litre

pic.twitter.com/nZVbH8Dxom— Science girl (@gunsnrosesgirl3) March 16, 2024

Sunset

Love pic.twitter.com/iEATlPoGfG

— Enez Özen (@Enezator) March 16, 2024

Innocents

https://twitter.com/i/status/1768728247796216212

Baduanjin

Do this CHINESE technique for 10 minutes daily for a flat tummy, thin waist and thinner legs…(proven by SCIENCE) pic.twitter.com/Qd4IXj71SF

— Brand Lab (@X_B_Lab) March 15, 2024

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.