Marcel Duchamp Sad young man on a train – Nude study 1911-12

Gonzalo

Tucker Macgregor

https://twitter.com/i/status/1504720080675954690

The New York Post deserves a Pulitzer. And Joe Biden needs to step down. Or Washington’s credibility is shot.

• Hunter Biden’s Infamous Laptop Confirmed In New York Times Report (NYPost)

A comprehensive report about the ongoing federal probe into Hunter Biden’s tax filings published by the New York Times on Wednesday night confirmed the existence of the first son’s infamous laptop. In October 2020, The Post exclusively reported on the contents of Hunter Biden’s laptop that he ditched at a Delaware repair shop in April 2019. The laptop’s hard drive contained a trove of emails, text messages, photos and financial documents between Hunter Biden, his family and business associates — detailing how the president’s son used his political leverage in his overseas business dealings. The repair shop owner reported the laptop to the FBI, which seized the device and its hard drive.

As part of their investigation into Hunter Biden, the Times reports, federal prosecutors have looked into emails between the first son and his former business associates that were recovered from the laptop. Some of the scrutinized correspondence was between Hunter Biden and Devon Archer, who had served with the first son on the board of Ukraine energy company Burisma, the report said. Archer, who was sentenced last month in an unrelated fraud case, has “cooperated completely” with the feds in their probe into Hunter Biden, The Post has reported. According to the Times, the emails between Hunter Biden, Archer and others regarding their international business activity came from files the publication obtained that “appears to have come from a laptop abandoned by Mr. Biden in a Delaware repair shop.”

People familiar with the emails and investigation confirmed their authenticity to the Times. The laptop confirmation was included in the Times report that also revealed how Hunter Biden paid off a tax liability of over $1 million — a year after he announced he was under investigation for defrauding the IRS. Hunter Biden has been under investigation for failing to pay taxes since his father was vice president, but the inquiry broadened in 2018 to look into how his international business dealings intersected with President Biden’s political career.

“He must have known full well that the story wasn’t “a bunch of garbage.” He must have known full well that it wasn’t “a Russian plant.”

• Sure Seems Joe Biden Knowingly Lied about the Hunter Biden Laptop Story (NR)

Next time President Biden speaks about . . . well, about anything really, remember that he knowingly lied to your face about the Hunter Biden laptop story — which the New York Times confirmed today, and which Joe Biden must have known was entirely true when it was first published in 2020 by the New York Post. In 2020, Joe Biden responded to Donald Trump bringing up the Post‘s story by saying on live television: There are 50 former national intelligence folks who said that what he’s accusing me of is a Russian plant. Five former heads of the CIA, both parties, say what he’s saying is a bunch of garbage. Nobody believes it except his good friend Rudy Giuliani.

This was a lie. Joe Biden is Hunter Biden’s father. He must have known full well that the story wasn’t “a bunch of garbage.” He must have known full well that it wasn’t “a Russian plant.” He must have known full well that Rudy Giuliani wasn’t the only one who believed it. Hell, he knew full well that Hunter Biden himself hadn’t denied the account, and instead had said that the laptop “absolutely” may have been his. And yet, when pressed, Biden said otherwise, because he assumed that the press and Silicon Valley would back him up in the lie. Which, of course, they did.

“..pending a “fact check[] by Facebook’s third-party fact checking partners” which, needless to say, never came — precisely because the archive was indisputably authentic.”

• The NYT Now Admits The Biden Laptop Is Authentic (ZH)

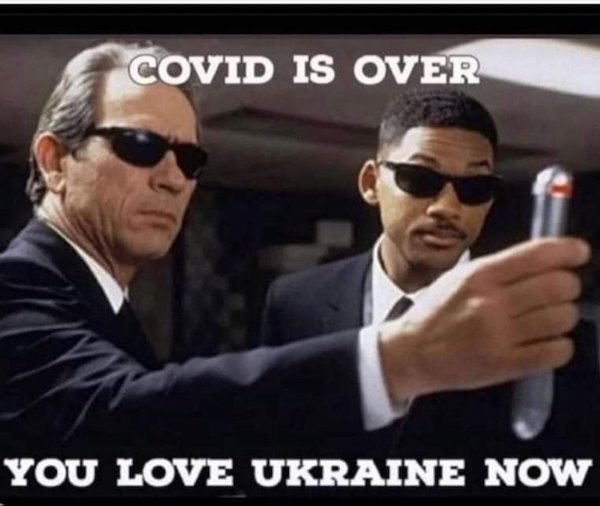

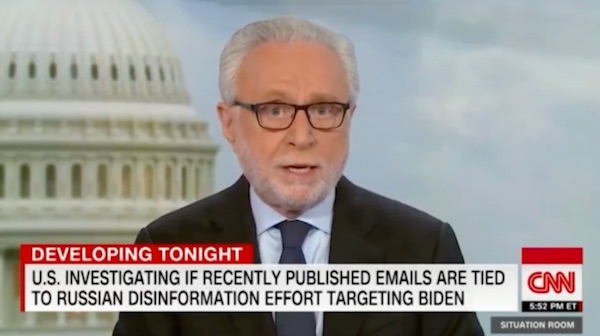

One of the most successful disinformation campaigns in modern American electoral history occurred in the weeks prior to the 2020 presidential election. On October 14, 2020 — less than three weeks before Americans were set to vote — the nation’s oldest newspaper, The New York Post, began publishing a series of reports about the business dealings of the Democratic frontrunner Joe Biden and his son, Hunter, in countries in which Biden, as Vice President, wielded considerable influence (including Ukraine and China) and would again if elected president. The backlash against this reporting was immediate and intense, leading to suppression of the story by U.S. corporate media outlets and censorship of the story by leading Silicon Valley monopolies. The disinformation campaign against this reporting was led by the CIA’s all-but-official spokesperson Natasha Bertrand (then of Politico, now with CNN), whose article on October 19 appeared under this headline: “Hunter Biden story is Russian disinfo, dozens of former intel officials say.”

These “former intel officials” did not actually say that the “Hunter Biden story is Russian disinfo.” Indeed, they stressed in their letter the opposite: namely, that they had no evidence to suggest the emails were falsified or that Russia had anything to do them, but, instead, they had merely intuited this “suspicion” based on their experience: We want to emphasize that we do not know if the emails, provided to the New York Post by President Trump’s personal attorney Rudy Giuliani, are genuine or not and that we do not have evidence of Russian involvement — just that our experience makes us deeply suspicious that the Russian government played a significant role in this case.

But a media that was overwhelmingly desperate to ensure Trump’s defeat had no time for facts or annoying details such as what these former officials actually said or whether it was in fact true. They had an election to manipulate. As a result, that these emails were “Russian disinformation” — meaning that they were fake and that Russia manufactured them — became an article of faith among the U.S.’s validly despised class of media employees. Very few even included the crucial caveat that the intelligence officials themselves stressed: namely, that they had no evidence at all to corroborate this claim. Instead, as I noted last September, “virtually every media outlet — CNN, NBC News, PBS, Huffington Post, The Intercept, and too many others to count — began completely ignoring the substance of the reporting and instead spread the lie over and over that these documents were the by-product of Russian disinformation.” The Huffington Post even published a must-be-seen-to-be-believed campaign ad for Joe Biden, masquerading as “reporting,” that spread this lie that the emails were “Russian disinformation.”

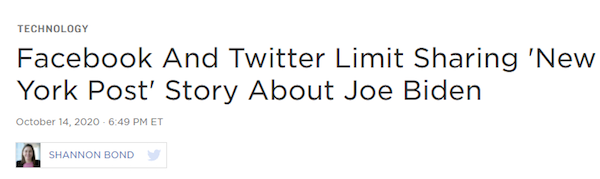

This disinformation campaign about the Biden emails was then used by Big Tech to justify brute censorship of any reporting on or discussion of this story: easily the most severe case of pre-election censorship in modern American political history. Twitter locked The New York Post’s Twitter account for close to two weeks due to its refusal to obey Twitter’s orders to delete any reference to its reporting. The social media site also blocked any and all references to the reporting by all users; Twitter users were barred even from linking to the story in private chats with one another. Facebook, through its spokesman, the life-long DNC operative Andy Stone, announced that they would algorithmically suppress discussion of the reporting to ensure it did not spread, pending a “fact check[] by Facebook’s third-party fact checking partners” which, needless to say, never came — precisely because the archive was indisputably authentic.

Russia Russia

During the second presidential debate, Joe Biden claimed that the election was about character and telling the truth. He then went on to blame Hunter's laptop on a Russian plot. pic.twitter.com/h7j7l1xnn4

— Hans Mahncke (@HansMahncke) March 17, 2022

Turn it into a movie.

• While You Weren’t Paying Attention (QTR)

It turns out that the party who spent four years accusing President Trump of Russian collusion performed a massive cover-up for Joe and Hunter Biden heading into the 2020 election that they have yet to be held accountable for. Go figure. I remember speaking to my father around the time of the election about the Hunter Biden laptop story, where presidential candidate Joe Biden’s son’s laptop was found to contain proof that the former Biden sold his influence to China while his father, the latter Biden, was Vice President of the United States. And in the midst of an ongoing media cover up of that story, I also remember talking to my father about former Hunter Biden business partner Tony Bobulinski coming forward and blowing the whistle on the Bidens in an effort to get the public to take notice.

Instead, Bobulinski was only given airtime by Fox News’ Tucker Carlson and was otherwise shunned and ignored by the rest of the left-leaning media. We both had watched Bobulinski’s interview and found him to be extremely credible. I remember my father saying that the censorship of the story and the story itself could, combined, be the biggest political scandal of all time. This caught me by surprise because my father, who has voted both Democrat and Republican over the last handful of elections, has lived through quite a few scandals. But now I understand what he was getting at. Selling your influence to China while running for President is a big deal. The media covering up that story completely in the United States in the midst of the election? An even bigger deal.

Because when you step back and objectively examine the issue of Joe Biden’s business dealings in China, it appeared that he was actually engaged in the types of conflict of interest that his party spent four years accusing President Trump of. Again, go figure. And then there was the laptop. After the New York Post broke what should have been a Pulitzer worthy story that Biden’s son had a laptop filled with incriminating evidence (in addition to dick pics taken while smoking crack with hookers), the story was promptly blackballed in the mainstream media and was talked about nowhere other than conservative news outlets. In fact, the mainstream media didn’t even give the story one shred of an objective chance. Half of the liberal media organizations covered the story as Russian disinformation, while the others didn’t carry it at all. The story was literally laughed off of TV and television as some kind of conspiracy theory.

And then a funny thing happened when the nation didn’t have access to what would turn out to be highly credible information: Joe Biden got elected president and, several months later, Politico reported that some parts of the laptop, including emails at the “center” of the controversy, were credible – a far cry from writing off the laptop as Russian disinformation.

Let’s see those charges.

• NY Times Admits Hunter Laptop Authentic, Possible Basis for Charges (Turley)

Last year, National Public Radio admitted that the Hunter Biden laptop was authentic and not Russian disinformation. It appears to have taken the New York Times even longer to move along that journalistic path of the Kübler-Ross process of grieving. The Times has now expressly and unambiguously stated that the laptop was abandoned by Hunter Biden, contains authentic emails, and is part of the basis for the ongoing investigation of Biden by federal authorities. Even with this admission against interests, the Times is downplaying the possible criminal charges in coverage strikingly different from its coverage of Trump officials charged on the same grounds. For those of us who have written about the laptop for two years, it has been a constantly barrage of criticism of spreading “Russian disinformation” or discussing manufactured emails.

Notably, the Biden family never outright denied that the laptop belonged to Hunter. They just kept repeating that it was Russian disinformation. It did not matter that recipients of the emails confirmed the authenticity of the messages detailing extensive influence peddling schemes by the Biden family. The Biden campaign assembled the usual list of experts to shut off debate by declaring that this was all false. It was a mantra from President Biden to a legion of reports. As Biden stated “There are 50 former national intelligence folks who said that what he’s accusing me of is a Russian plant. [F]ive former heads of the CIA, both parties, say what he’s saying is a bunch of garbage.” The press ran with that account despite the early determination of American intelligence that it was not Russian disinformation.

Washington Post columnist Thomas Rid wrote said the quiet part out loud by telling the media: “We must treat the Hunter Biden leaks as if they were a foreign intelligence operation — even if they probably aren’t.” Let that sink in for a second. It does not matter if these are real emails and not Russian disinformation. They probably are real but should be treated as disinformation even though American intelligence has repeatedly rebutted that claim. It does not even matter that the computer has seized the computer as evidence in a criminal fraud investigation or that a Biden confidant is now giving his allegations to the FBI under threat of criminal charges if he lies to investigators.

“NATO has a responsibility to prevent this conflict from escalating further,” Stoltenberg said..”

• German Chancellor Scholz: NATO Will Not “Intervene Militarily” In Ukraine (DW)

NATO Secretary-General Jens Stoltenberg met with German Chancellor Olaf Scholz and Foreign Minister Annalena Baerbock on Thursday, as the war in Ukraine entered its fourth week. The meeting came just after Ukrainian President Volodymyr Zelenskyy addressed the German Bundestag via video link. Scholz opened his remarks alongside Stoltenberg by praising Zelenskyy for his “impressive words.” But the German leader reiterated NATO’s refusal to intervene militarily in Ukraine. “One thing must also be made clear: NATO will not intervene militarily in this war,” Scholz said. Scholz’s view matched statements repeated by Stoltenberg on Thursday that the military alliance’s involvement in Ukraine would increase the likelihood of the war spreading.

In Berlin, the NATO chief said the alliance’s job is to de-escalate the conflict. “NATO has a responsibility to prevent this conflict from escalating further,” Stoltenberg said. “That would be even more dangerous and cause more suffering, deaths and destruction.” Stoltenberg also met with German Defense Minister Christine Lambrecht and German Foreign Minister Annalena Baerbock during his visit to Berlin. Beside Lambrecht, Stoltenberg called Germany’s new defense commitments of a special fund of €100 billion ($111 billion) and plans to commit 2% of GDP to its defense budget “impressive.” Baerbock said Germany is considering stationing more troops on NATO’s eastern flank.

Consistent.

• Putin Lays Out Demands For Cease-Fire In Call With Erdoga (ZH)

In a Thursday conversation with Turkish President Recep Tayyip Erdogan, Russian President Vladimir Putin reportedly outlined the conditions for ending his invasion of Ukraine. According to a BBC report, a Turkish official who listened to the call between the two leaders said that Putin would end his invasion if several conditions are met including a promise that Ukraine will remain neutral and not join NATO. Erdogan’s leading adviser and spokesman, Ibrahim Kalin, said Russia is also calling for Ukraine to undergo a disarmament process to mitigate threats to Russia in the future as well as legal protections for the Russian language in Ukraine. Additionally, Putin reportedly desires promises related to the “Denazification” of Ukraine.

Putin, according to the report, is also asking for face-to-face negotiations with Ukraine’s President Volodymyr Zelenskyy to hammer out his demands which Zelenskyy has previously stated he is not opposed to. According to Kalin, there were other conditions Putin listed that he did not go into much detail about but he believes they will involve territories that have broken away from Ukraine in the eastern Donbas region. The report states that it is “assumed” Putin will ask Ukraine to give up territory in the east and formally recognize that Crimea, which Russia illegally annexed in 2014, is a part of Russia. The demands are in line with previous reporting that stated Putin has told Ukrainian officials he will end his invasion if six major conditions are met. News of Putin’s willingness to negotiate an end to the war comes as his invasion enters its fourth week.

Macgregor to Celente: Ukraine War Will End Sooner Than You Think

And they are. Just not on someone else’s.

• U.S. Dept. of State Thinks It’s an Authority on Fake News (RCP)

Some say America has a fake news problem. They might be on to something. Americans’ trust in our media is at one of its lowest points, and social media has made disinformation easy to spread. But as America is tackling its own fake news problem, our government is pretending to be experts on it in Zimbabwe. In fact, the U.S. is sending $100,000 to Zimbabwe to help that country tackle fake news, according to a grant notice from the U.S. Department of State. The grant description states that the goal of the grant is, “To improve and promote adherence to international best practice in implementing fundamental freedom of speech and the press freedom.”

It encourages a three-pronged approach: Strengthening public understanding of freedom of speech and press freedom, improving media literacy to combat disinformation and increasing media sustainability, innovation and professionalization. The idea that the U.S. is an expert on disinformation, free speech, and combating censorship, and that it should be teaching them to other countries, is absurd. Between domestic debates on big tech censorship, the increasing polarization of news outlets, and increasing disinformation on social media, the U.S. has no business telling other countries the right way to do such things, let alone spending tax dollars to do so.

@parsifaler thread: MOLECULAR MIMICRY.

• A Terrifying Monster To Blood Vessels – And Neurons (Chesnut)

OMNIPOTENT TROPISM; OMNIPOTENT MOLECULAR MIMICRY: A Terrifying Monster To Blood Vessels – AND NEURONS! Most Likely More. I don’t quite know how to say this. But I am shaking as I write this. I was smoking a cigar and contemplating a DM an amazing (and famous) doctor sent me. The DM was about Pericytes and the Spike Protein. And I just kept thinking about it. Slowly, it dawned on me. And now I am shaking as I write this. Spike in Endothelium. Spike in Pericytes. Spike in Basement Membrane. Spike in Myelin Sheath. Spike in Axon. Spike distributed through Blood Vessels. Spike distributed through Axons. Inducing Fibrosis. Inducing Autoimmunity. Don’t you see? It is an omnipotent burrower! And why? Because of its massive TROPISM!

And then I remembered a paper I had read from 2005. It talked about how Coronaviruses cause MS via molecular mimicry. Several mechanisms have been proposed to explain how a viral infection could lead to an autoimmune disease. Amongst these mechanisms is molecular mimicry. According to this model, a non-self agent first activates an immune cell. Then, the cell recognizes a self-element that shares antigenic conformation with the pathogen and directs a response towards it. Individuals who are genetically predisposed to respond to this antigenic determinant of a pathogen having a similar conformation to a determinant on a self-antigen could develop an autoimmune response following infection. Shared sequences or similar determinant conformations between coronavirus and myelin proteins such as myelin basic protein (MBP) and proteolipid protein (PLP) have been identified.

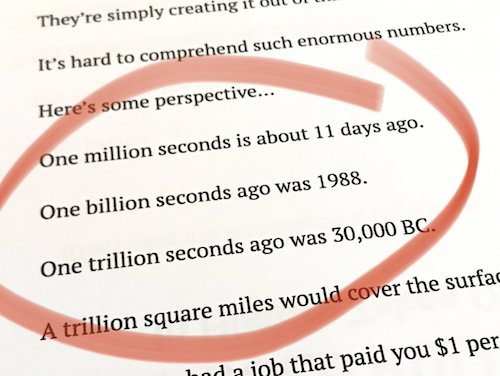

Molecular mimicry provides a unifying mechanism that could explain both the genetic and environmental aspects in the triggering of MS. So, if an ORDINARY Coronavirus can induce MS. What about one whose Spike Protein has a SIXTY-FOLD increase in peptide sharing? A massive heptapeptide sharing exists between SARS-CoV-2 spike glycoprotein and human proteins. Such a peptide commonality is unexpected and highly improbable from a mathematical point of view, given that, as detailed under the “Methods” section, the probability of the occurrence in two proteins of just one heptapeptide is equal to ~ 20-7 (or 1 out of 1,280,000,000). Likewise, the probability of the occurrence in two proteins of just one hexapeptide is close to zero by being equal to ~ 20-6 (or 1 out of 64,000,000). That’s right. The odds of TWO shared peptides occurring is 1 IN 1.28 BILLION. It may be that everything the Spike Protein touches is either attacked by the body, turns to scar tissue, or both. My God. Stop this MADNESS!

Shoot him into space.

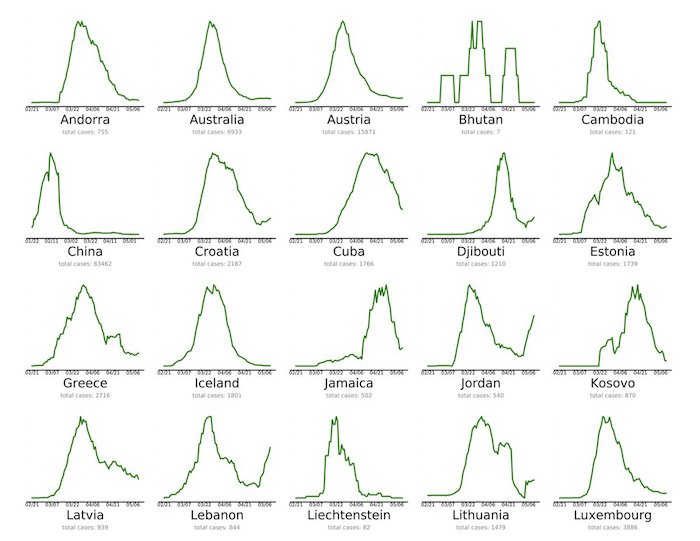

• Voice of Doom Dr Fauci Warns US Could Face More Covid Lockdowns (DM)

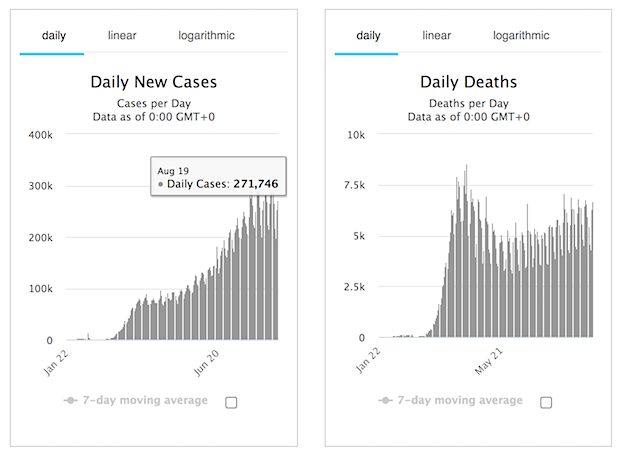

America’s top infectious-disease expert warned that the country could face more COVID-19 lockdowns if cases go up once again due to the latest variant, even as the most cautious begin to shrug off their virus fears once-and-for-all. Dr Anthony Fauci, head of the National Institute of Allergy and Infectious Disease and adviser to President Joe Biden, said easing restrictions, the waning protection from vaccines and the rise of the BA.2 subvariant around the world could bring on another wave of rising infections to the U.S. ‘If in fact we do see a turnaround and a resurgence, we have to be able to pivot and go back to any degree of mitigation that is commensurate with what the situation is,’ Fauci said in a CNN interview on Thursday. ‘We can’t just say, ‘We’re done. We’re going to move on.’ We’ve got to be able to be flexible because we’re dealing with a dynamic situation.’

Fauci added that the variant, which has seen a spike in the UK, could cause a surge in the U.S. as it appears to be as infectious as Omicron, but less fatal. ‘The overall mortality is actually down,’ Fauci said. ‘It’s a very interesting situation where the cases are going up, but it does not, at this point in time, appear to be any degree of severity.’ ‘We generally follow what goes on the UK by about two to three weeks,’ he added. ‘I would not be surprised in the next few weeks, given the fact that we’ve begun to open up, and we have an increase in the BA.2 variant, that we’ll be seeing an increase in cases.’ The warning came as COVID restrictions have been lifted all across the country amid a sharp drop in daily cases after the Omicron surge earlier this year.

Fauci returns

Fauci has re-emerged with a new dire warning pic.twitter.com/m5xSJImask

— Wittgenstein (@backtolife_2022) March 18, 2022

The vaccines still don’t work. What a surprise.

• Covid Immunity Declines Steeply In Care Home Residents In England (G.)

Immunity declines steeply among care home residents in the months after Covid vaccination, a study has found, leading to calls for regular boosters for the most vulnerable. The study of more than 15,000 care home residents found that protection against hospitalisation and death fell by one-third three to seven months after vaccination. The decline is far sharper than that seen in younger people, where immunity against infection wanes, but protection against severe illness appears to be robust. “What we’re seeing is that they are at increased risk of infection, hospitalisation and death as immunity wanes, and those increases look quite big,” said Prof Laura Shallcross, a public health expert at University College London and author of the paper. “That’s not good news at all.

“It suggests annual boosters in residents may not be enough,” she added. From April, a second booster (fourth dose), is being offered to adults aged 75 and over and residents in care homes. Further boosters could be rolled out in the autumn, depending on advice from the Joint Committee on Vaccination and Immunisation (JCVI), the health secretary, Sajid Javid said this week. The latest findings, which have been published as a preprint, could be influential in shaping this decision. They come from the Vivaldi study, funded by the UK Health Security Agency, which monitored Covid in staff and residents in 331 care homes across England from December 2020 to December 2021.

The researchers found that two vaccine doses were effective at preventing 85% of hospitalisations and 94% of deaths among care home residents between two and 12 weeks after the second dose. But this protection fell to 54% of hospitalisations and 63% of deaths at three to seven months after vaccination. The trajectory looked very different in the 19,000 staff who were also tracked in the study. In staff, with an average age of 45, protection against infection fell just slightly from a 50% to 42% reduced risk after three months. There appeared to be no substantial waning in immunity against severe disease for staff, with very few hospitalisations occurring after vaccination.

WEF.

• Stagflation Trap Will Lead To Universal Basic Income And Food Rationing (Smith)

This past week during a conference discussing Biden’s “Build Back Better” scheme House Speaker Nancy Pelosi was confronted with questions on skyrocketing inflation. After referring to higher gas prices as the “Putin Tax”, she went on to offer perhaps the dumbest (or most insidious) denial on the causes of inflation that I have ever heard. She stated: “When we’re having this discussion, it’s important to dispel some of those who say, well it’s the government spending. No, it isn’t. The government spending is doing the exact reverse, reducing the national debt. It is not inflationary.” Anyone with a basic understanding of economics and how central banks operate must have felt their brains explode when they heard this, I know I did.

But before I get into the numerous reasons why this claim is completely false in every way, I want to give a warning – It’s very easy in this situation to assume that Pelosi and even Biden are making these arguments because they are too stupid to grasp the fundamentals of debt creation, money velocity and fiat. That said, never mistake evil for mere ignorance. All higher level representatives of the White House are briefed by economic experts (spin doctors) well before they answer any questions on inflation, and the things they say have been carefully scripted. It’s possible Pelosi mixed her lies up a little bit, but the narrative the establishment is trying to promote is well planned. Asserting that money creation is a counterbalance to inflation instead of the cause is not brilliant, but it’s not designed to convince many people, only create confusion.

Let’s not forget that only last year these same people were telling the public that inflation was purely “transitory” and that there was nothing to worry about. Now they are trying to cover their tracks and the culpability of the Federal Reserve. I believe the goal here is to simply stall for time until the stagflationary collapse unfolds. They have the perfect scapegoat as they launch an economic war with Russia (and likely China in the near term), and the effects of this war will hurt the US and Europe far more than many realize.

Ukraine injured

https://twitter.com/i/status/1504656592830185474

John C. Reilly

https://twitter.com/i/status/1504579880851226634

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.