Harris&Ewing Less taxes, more jobs, US Chamber of Commerce campaign 1939

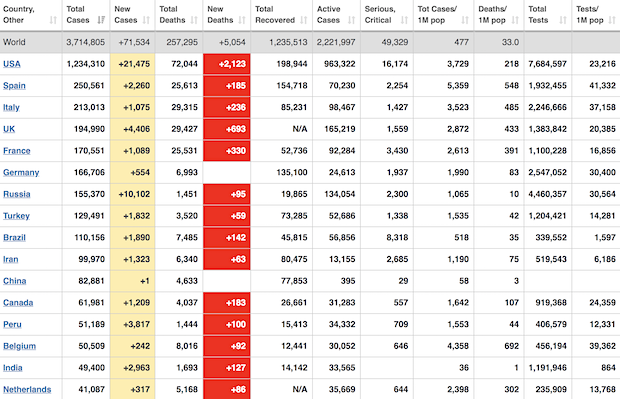

• US #coronavirus deaths rise by 2,333 in 24 hours: Johns Hopkins

• Cases 3,744,765 (+ 82,494 from yesterday’s 3,662,271)

• Deaths 258,884 (+ 6,137 from yesterday’s 252,747)

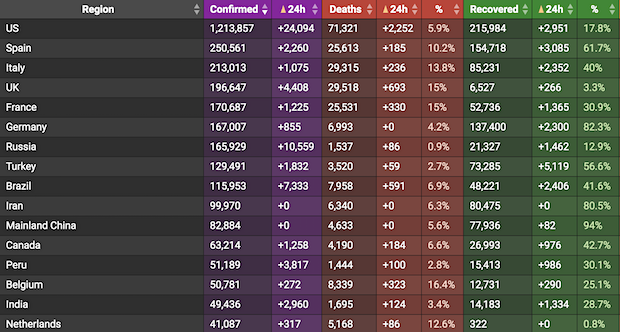

From Worldometer yesterday evening -before their day’s close-

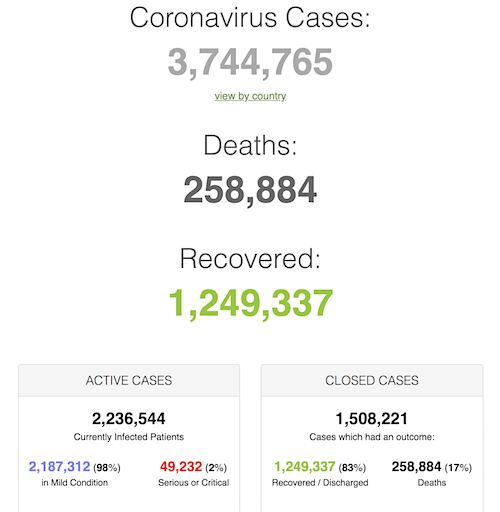

From Worldometer

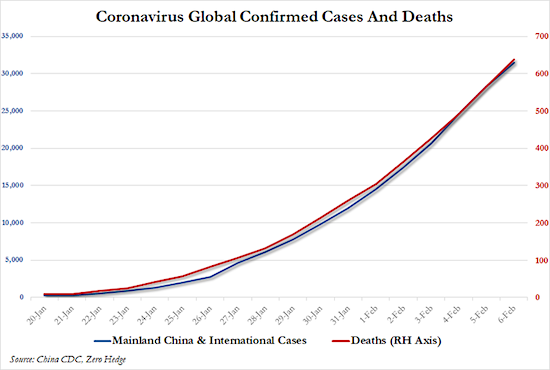

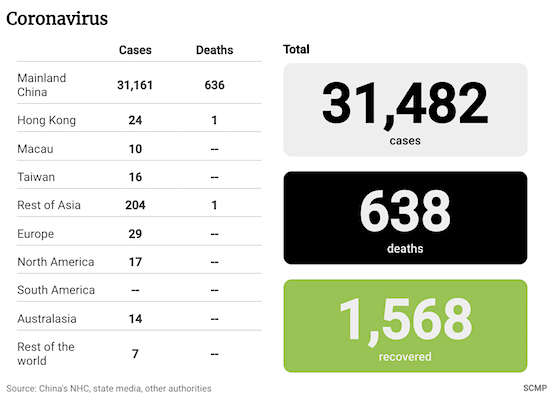

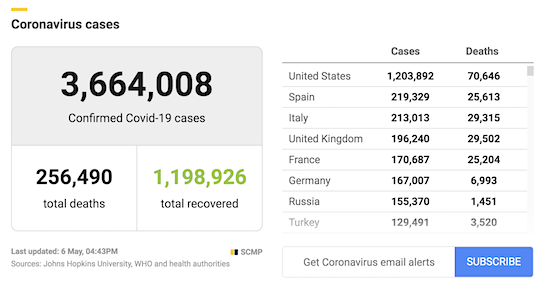

From SCMP:

From COVID19Info.live:

I was reading two things (first two articles in this overview): 1) that a new dominant corona strain appears more contagious, and 2) that it is a weakening strain. Now, that makes perfect sense, it’s a trade-off that’s ubiquitous in nature: when a virus becomes more contagious, it kills fewer of its new hosts. That way the death number remains the same, and enough potential hosts remain.

But that’s not necessarily what people see. The LA Times seems to expect the opposite: “The Los Alamos study does not indicate that the new version of the virus is more lethal than the original.”

It’s of course possible that a more contagious strain is also more lethal, but it wouldn’t seem to be the more logical chain of events.

• Now-Dominant Strain Of Coronavirus Could Be More Contagious Than Original (LAT)

Scientists have identified a new strain of the coronavirus that has become dominant worldwide and appears to be more contagious than the versions that spread in the early days of the COVID-19 pandemic, according to a new study led by scientists at Los Alamos National Laboratory. The new strain appeared in February in Europe, migrated quickly to the East Coast of the United States and has been the dominant strain across the world since mid-March, the scientists wrote. In addition to spreading faster, it may make people vulnerable to a second infection after a first bout with the disease, the report warned.

The 33-page report was posted Thursday on BioRxiv, a website that researchers use to share their work before it is peer-reviewed, an effort to speed up collaborations with scientists working on COVID-19 vaccines or treatments. That research has been largely based on the genetic sequence of earlier strains and might not be effective against the new one. Scientists with major organizations working on a vaccine or drugs to combat the coronavirus have told The Times that they are pinning their hopes on initial evidence that the virus is stable and not likely to mutate the way the influenza virus does, requiring a new vaccine every year. The Los Alamos report could upend that assumption.

The mutation identified in the new report affects the now-infamous spikes on the exterior of the coronavirus, which allow it to enter human respiratory cells. The report’s authors said they felt an “urgent need for an early warning” so that vaccines and drugs under development around the world will be effective against the mutated strain. In many places where the new strain appeared, it quickly infected far more people than the earlier strains that came out of Wuhan, China, and within weeks it was the only strain that was prevalent in some nations, according to the report. The new strain’s dominance over its predecessors suggests that it is more infectious, according to the report, though exactly why is not yet known.

The coronavirus, known to scientists as SARS-CoV-2, has infected more than 3.5 million people around the world and caused more than 250,000 COVID-19 deaths since its discovery late last year. The report was based on a computational analysis of more than 6,000 coronavirus sequences from around the world collected by the Global Initiative for Sharing All Influenza Data, a public-private organization in Germany. Time and again, the analysis found the new version was transitioning to become dominant.

[..] The Los Alamos study does not indicate that the new version of the virus is more lethal than the original. People infected with the mutated strain appear to have higher viral loads. But the study’s authors from the University of Sheffield found that among a local sample of 447 patients, hospitalization rates were about the same for people infected with either virus version. Even if the new strain is no more dangerous than the others, it could still complicate efforts to bring the pandemic under control. That would be an issue if the mutation makes the virus so different from earlier strains that people who have immunity to them would not be immune to the new version.

If it would follow SARS, it would die out completely. But that’s a long way away, and wishful thinking.

• New Mutation Indicates That Coronavirus Might Be Weakening (NYP)

A new coronavirus mutation discovered by Arizona researchers mirrors a change that occurred as the 2003 SARS virus began to weaken, the researchers announced. Lead study author Dr. Efrem Lim, an assistant professor at Arizona State University’s Biodesign Institute, and his team use a new technology called next-generation sequencing to rapidly read through all 30,000 chemical letters of the SARS-CoV-2 genome, or genetic code. That technology helps researchers determine how the virus is spreading, mutating and adapting over time. Out of the 382 nasal swab samples the researchers examined from coronavirus patients in the state, a single sample was missing a significant chunk of its genome. 81 of the letters were permanently deleted, according to the new study published in the Journal of Virology.

“One of the reasons why this mutation is of interest is because it mirrors a large deletion that arose in the 2003 SARS outbreak,” Lim said in a statement. During the middle and late phases of the 2003 SARS epidemic, the virus accumulated mutations that lessened its strength, according to the researchers. “Where the deletion occurs in the genome is pretty meaningful because it’s a known immune protein which means it counteracts the host’s antiviral response,” Lim told the Daily Mail. A weakened virus that causes less severe symptoms may get a leg up if it is able to spread efficiently through populations by people who don’t know they are infected, the scientists say. However, it’s too soon to say whether the novel coronavirus is beginning to lose its potency, according to the researchers.

“The takeaway is that one virus had a large deletion which demonstrates that it is possible for the virus to transmit without having complete portions of its genetic material,” study co-author Matthew Scotch said in an email. “This was one virus and we do not suggest that this means a ‘weakening’ of any kind.” All of the patients whose samples the Arizona scientists analyzed had some clinical coronavirus symptoms — meaning that even the version with 81 deletions was still strong enough to make the patient at least somewhat sick, the Mail reported. This is the first time such a deletion has been seen in the 16,000 coronavirus genomes that have been sequenced to date, according to the researchers. That’s less than half a percent of the strains circulating, according to the scientists. There are about 3.6 million confirmed COVID-19 cases worldwide. “This is a drop in the bucket,” Lim told the Mail.

This would be a less contagious strain.

• Coronavirus Started Infecting People Globally Late Last Year (Hill)

The coronavirus has been circulating among people since late 2019 and appears to have experienced a highly rapid spread after the first infection, according to a new genetic analysis of 7,600 patients around the world. Researchers in Britain wrote in a report published Tuesday in the journal Infection, Genetics and Evolution that they examined samples taken at different times and from different places, concluding that the virus first began infecting people late last year. The researchers found evidence of quick spread but found no indication that it is becoming any easier to transmit the virus, which was first identified in Wuhan, the capital of China’s Hubei province, in December 2019.

“The virus is changing, but this in itself does not mean it’s getting worse,” genetics researcher Francois Balloux of the University College London Genetics Institute told CNN. The study indicated that infections in the U.S. and Europe specifically could have occurred weeks or months before the first official cases were reported in January and February, making it more difficult to find “Patient Zero” in any particular area. The findings shot down hopes from some doctors that the virus had in fact been circulating under the radar for months before it burst onto the scene, which would have indicated that there could be some immunity already built up. But Balloux told CNN at most only 10 percent of the population has been exposed to the coronavirus.

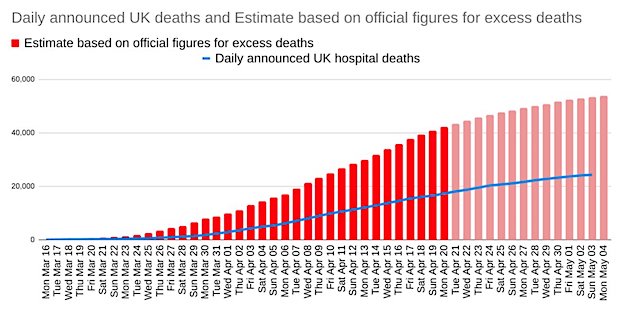

I was wondering why the numbers are so different, but one thing at least is that numbers for the UK, which includes Scotland and Northern Ireland, do not include Scotland and Northern Ireland. Curious.

And then there’s more: the UK appears to undercount deaths by some 20,000.

• UK COVID-19 Death Toll Rises Above 32,000, Highest In Europe (R.)

More than 32,000 people in the United Kingdom have died with suspected COVID-19, the highest official toll yet reported in Europe, according to data published on Tuesday. The Office for National Statistics said 29,648 deaths had taken place as of April 24 in England and Wales with COVID-19 mentioned in death certificates. Including deaths for Scotland and Northern Ireland, the official toll now stands at 32,313. That is more than Italy, previously Europe’s worst hit country, though its toll does not include suspected cases. Ministers dislike comparisons of the headline death toll, saying that excess mortality – the number of deaths from all causes that exceed the average for the time of year – is a more meaningful metric.

Chris Giles is economics editor at the FT.

Update: After today's official statistics on deaths linked to coronavirus, a cautious estimate of all UK deaths up to today 05 May stands at

53,800

A significant upward revision

1/

— Chris Giles (@ChrisGiles_) May 5, 2020

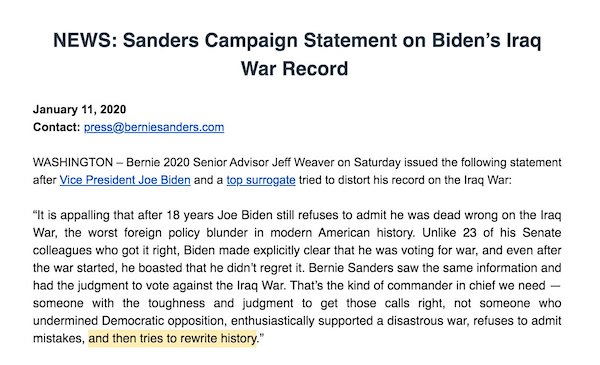

The case of the “whistleblower”, Rick Bright, is strongly linked to HCQ.

• Pseudo-Science Behind The Assault On Hydroxychloroquine (ZH)

Hydroxychloroquine (HCQ) was accepted as a COVID-19 treatment by the medical community in the US and worldwide by early April. 67% of the US physicians said they would prescribe HCQ or chloroquine CQ for COVID-19 to a family member (Town Hall, 2020-04-08). An international poll of doctors rated HCQ the most effective coronavirus treatment (NY Post, 2020-04-02). On April 6, Peter Navarro told CNN that “Virtually Every COVID-19 Patient In New York Is Given Hydroxychloroquine.” This might explain decrease in COVID-19 deaths in the New York state after April 15. The time lag is because COVID-19 deaths happen on average 14 days after showing symptoms. But on April 21, several perfectly coordinated events took place, attacking HCQ’s use for COVID-19 patients.

• The COVID-19 Treatment Guidelines Panel of the National Institute of Health issued recommendations with negative-ambivalent stance regarding the use of HCQ as a COVID-19 treatment. This surprising stance was taken contrary to the ample evidence of the efficacy and safety of HCQ and despite absence evidence of its harm. The panel also strongly recommended against the use of hydroxychloroquine with azithromycin (AZ), the combination of choice among practitioners.

• On the same day, a paper (Magagnoli, 2020) was posted on a pre-print server medRxiv, insinuating that HCQ is not only ineffective, but even harmful. This not-yet peer reviewed paper, by unqualified authors with conflicts of interest, received wall-to-wall media coverage, as it if were a cancer cure. It used data from Veterans Administration hospitals, spicing its effects. The paper has shown to be somewhere between junk science and fraud.

• Rick Bright, a government official who was probably more responsible for the low level of preparedness to the epidemic than most others, and had been re-assigned to a lower position earlier, emerged as a “whistleblower.” He claimed he had been demoted for opposing hydroxychloroquine, the claim to be soon debunked by documents bearing his signature. The media also gave him a wall-to-wall coverage.

On April 24, the FDA struck its own blow, issuing a stern warning against use of HCQ for COVID-19 treatment. While these warnings are not binding to doctors, they do produce a chilling effect. Consequently, either patients do not receive necessary treatment, or they receive it with a delay, sharper decreasing its effect. This allows detractors to question HCQ efficacy even more aggressively. Below, I review problems in the NIH COVID-19 Treatment Guidelines and other sources, used to wage anti-HCQ propaganda.

Not sure if laughing is the best reaction here.

• Goat and Pawpaw ‘Test Positive’ For COVID19 In Tanzania (AlJ)

Tanzania’s President John Magufuli has dismissed imported coronavirus testing kits as faulty, saying they returned positive results on samples taken from a goat and a pawpaw. Magufuli made the remarks during an event in Chato in northwestern Tanzania on Sunday. He said there were “technical errors” with the tests. The president, whose government has already drawn criticism for being secretive about the coronavirus outbreak and has previously asked Tanzanians to pray the coronavirus away, said he had instructed Tanzanian security forces to check the quality of the kits. They had randomly obtained several non-human samples, including from a pawpaw, a goat and a sheep, but had assigned them human names and ages.

These samples were then submitted to Tanzania’s laboratory to test for the coronavirus, with the lab technicians left deliberately unaware of their origins. Samples from the pawpaw and the goat tested positive for COVID-19, the president said, adding this meant it was likely that some people were being tested positive when, in fact, they were not infected by the coronavirus. “There is something happening. I said before we should not accept that every aid is meant to be good for this nation,” Magufuli said, adding the kits should be investigated.

On Saturday, Magufuli announced that he had placed an order for a herbal treatment for the coronavirus touted by the president of Madagascar. “I have already written to Madagascar’s president and we will soon dispatch a plane to fetch the medicine so that Tanzania can also benefit from it,” he said. The herbal remedy, called “Covid Organics” and prepared by the Malagasy Institute for Applied Research, is made out of Artemisia, a plant cultivated on the Indian Ocean island of Madagascar. Despite a lack of scientific evidence, President Andry Rajoelina of Madagascar claimed that the remedy has already cured some Madagascans of COVID-19. Children returning to school have been required to take it.

We can neatly divide the country, if not the world, according to people’s reaction to this.

Problem is even if she wasn’t tested at all, she could still be positive.

• Pennsylvania Woman Jailed For Refusing To Quarantine After Positive Test (Hill)

A Pennsylvania woman was jailed over the weekend for refusing to quarantine after testing positive for COVID-19, officials said Saturday. Erie County President Judge John Trucilla ordered that the woman be kept on electronic monitoring at home for at least a week after she spent a night in jail Friday for repeatedly violating her isolation order, the Erie Times-News reported. County Solicitor Richard Perhacs said the woman, who was unidentified at her Saturday court hearing, attended a party, did some banking and had her vehicle repaired after she tested positive. As a result, 27 people are now in quarantine after coming in contact with her or someone who was in contact with her.

The woman reportedly cried throughout the emergency proceeding as she appeared via a video call from the Erie County Prison, according to the news outlet. She told Trucilla that she did not understand a letter she signed on April 29 saying the county could take legal action if she did not self-isolate. “I want to explain from the bottom of my heart that I apologize,” she told the judge, according to the Times-News. “It was a mistake. I’ve learned from my actions. I want to go home.” Trucilla ruled in a preliminary order that she had to remain at home until she was tested again on Friday but said she could be jailed for longer if she violated the order again. The judge will determine whether her self-isolation period needs to be extended based on that test.

County officials said they explained the letter to her multiple times. The woman first developed symptoms on April 12 and said Saturday that she was no longer experiencing them. Erie County Chief Public Defender Pat Kennedy, who represented the woman, requested she be electronically monitored at her home. “Based on my interaction with her, I don’t think that day in jail was lost upon her,” Kennedy said, according to the news outlet.

Shouldn’t Fauci and Birx simply resign? Or do they agree with the re-opening?

• White House To Wind Down Coronavirus Task Force, Focus Shifts To Aftermath (R.)

The White House coronavirus task force will wind down as the country moves into a second phase that focuses on the aftermath of the outbreak, President Donald Trump said on Tuesday. Trump confirmed the plans after Vice President Mike Pence, who leads the group, told reporters the White House may start moving coordination of the U.S. response on to federal agencies in late May. “Mike Pence and the task force have done a great job,” Trump said during a visit to a mask factory in Arizona. “But we’re now looking at a little bit of a different form and that form is safety and opening and we’ll have a different group probably set up for that.” Asked if he was proclaiming “mission accomplished” in the fight against the coronavirus, Trump said, “No, not at all. The mission accomplished is when it’s over.”

Trump said Anthony Fauci and Deborah Birx, doctors who assumed a high profile during weeks of nationally televised news briefings, would remain advisers after the group is dismantled. Fauci leads the National Institute of Allergy and Infectious Diseases and Birx was response coordinator for the force. “We can’t keep our country closed for the next five years,” Trump said, when asked why it was time to wind down the task force. More than 70,000 people in the United States have died from COVID-19, the respiratory illness caused by the virus. The U.S. death toll is the highest in the world. Trump acknowledged there might be a resurgence of the virus as states loosen the restrictions on businesses and social life aimed at curbing its spread. “It’ll be a flame and we’re going to put the flame out.”

Earlier, Pence said Trump was starting to look at Memorial Day on May 25 as the time to shift management of the response to the pandemic. [..] Health and Human Services Secretary Alex Azar and Food and Drug Administration chief Stephen Hahn said the Trump administration was committed to accelerating the search for a vaccine, with the goal of producing 100 million doses by the autumn and 300 million doses by the end of the year. “Whether that can be achieved or not, it is realistic,” said Azar. “We would not be doing this if we did not think it were realistic. Is it guaranteed? Of course it is not.” Most experts have suggested clinical trials to guarantee a vaccine is safe and effective could take a minimum of 12 to 18 months.

The government is intentionally doing such a shitty job, might as well let the for-profit boys do it.

• UK Government ‘Using Pandemic To Transfer NHS Duties To Private Sector’ (G.)

The government is using the coronavirus pandemic to transfer key public health duties from the NHS and other state bodies to the private sector without proper scrutiny, critics have warned. Doctors, campaign groups, academics and MPs raised the concerns about a “power grab” after it emerged on Monday that Serco was in pole position to win a deal to supply 15,000 call-handlers for the government’s tracking and tracing operation. They said the health secretary, Matt Hancock, had “accelerated” the dismantling of state healthcare and that the duty to keep the public safe was being “outsourced” to the private sector. In recent weeks, ministers have used special powers to bypass normal tendering and award a string of contracts to private companies and management consultants without open competition.

Deloitte, KPMG, Serco, Sodexo, Mitie, Boots and the US data mining group Palantir have secured taxpayer-funded commissions to manage Covid-19 drive-in testing centres, the purchasing of personal protective equipment (PPE) and the building of Nightingale hospitals. Now, the Guardian has seen a letter from the Department of Health to NHS trusts instructing them to stop buying any of their own PPE and ventilators. From Monday, procurement of a list of 16 items must be handled centrally. Many of the items on the list, such as PPE, are in high demand during the pandemic, while others including CT scanners, mobile X-ray machines and ultrasounds are high-value machines that are used more widely in hospitals.

Not sure I can fully incorporate the irony involved here.

• K Street Requests Taxpayer Bailout Of Corporate Lobbyists (IC)

K Street may soon have its own taxpayer-funded bailout. Industries as varied as oil refining, construction, fast food restaurants, and chemical manufacturing are seeking federal cash to support their lobbyists in Washington, D.C. Many of the largest lobbying forces are organized under the 501(c)(6) section of the tax code as trade groups. Corporations with similar concerns pool their money together to fund trade groups, which in turn employ thousands of lobbyists to shape elections and legislation on a daily basis. But the Paycheck Protection Program, the centerpiece of the small business rescue program, excluded such trade groups. That could change in the next round of stimulus legislation, which Congress is scheduled to debate later this month.

Lobbyists have stepped up a campaign to make sure professional influence peddlers are eligible for the PPP, or P3, funds. The push also includes a demand for an additional $25 billion for canceled events and other lost revenue from the coronavirus pandemic. The American Society of Association Executives, which represents trade group leadership, explained in a letter to lawmakers that trade group lobbyists need federal funding to better advocate for their clients. “These organizations are already relied upon to help coordinate federal resources to combat the coronavirus pandemic, and they require staff to fulfill this duty,” ASAE wrote. Trade groups, the ASAE letter notes, have faced declining revenue as corporations wind down dues payments and sponsorship fees in response to the economic downturn.

So many sectors of the economy are entire bubbles, and we’re going to bail them all out.

• US Airlines Burn Through $10 Billion A Month As Traffic Plummets (R.)

U.S. airlines are collectively burning more than $10 billion in cash a month and averaging fewer than two dozen passengers per domestic flight because of the coronavirus pandemic, industry trade group Airlines for America said in prepared testimony seen by Reuters ahead of a U.S. Senate hearing on Wednesday. Even after grounding more than 3,000 aircraft, or nearly 50% of the active U.S. fleet, the group said its member carriers, which include the four largest U.S. airlines, were averaging just 17 passengers per domestic flight and 29 passengers per international flight. “The U.S. airline industry will emerge from this crisis a mere shadow of what it was just three short months ago,” the group’s chief executive, Nicholas Calio, will say, according to his prepared testimony.

Net booked passengers have fallen by nearly 100% year-on-year, according to the testimony before the Senate Commerce Committee. The group warned that if air carriers were to refund all tickets, including those purchased as nonrefundable or those canceled by a passenger instead of the carrier, “this will result in negative cash balances that will lead to bankruptcy.” Separately, Eric Fanning, who heads the Aerospace Industries Association, will ask Congress to consider providing “temporary and targeted assistance for the ailing aviation manufacturing sector,” in testimony made public by the group. Boeing Co said last week it would cut 16,000 jobs by the end of the year, while GE Aviation plans to cut up to 13,000 jobs and airplane supplier Spirit AeroSystems Holdings Inc is cutting 1,450 jobs.

So much for competition as a model.

• After The Covid Rush: Brace For America’s Version Of Saudi Aramco (Cox)

Calamity creates opportunity. That has always been true when it comes to corporate consolidation. Recall how a series of mega-mergers and acquisitions transformed the banking industry after the 2008 financial panic. Wells Fargo snagged Wachovia. Bank of America scooped up Merrill Lynch. Lloyds TSB bought HBOS. BNP Paribas grabbed Fortis. JPMorgan got Washington Mutual and Bear Stearns. And so on. Before the coronavirus has taken its full physical and economic toll, expect more of the same. Strong banks ate the weak, and they were chivvied along by federal and state governments and regulators worried about the sustainability of their financial systems. Governments will play a central role now, too.

Even before the Great Lockdown, leaders were calling for relaxation of antitrust restrictions as a response to the emergence of stronger Chinese competitors. France and Germany railed against the European Commission blocking the merger between the rail businesses of Siemens and Alstom, complaining it would give Chinese giant CRRC free reign. President Donald Trump has tried to encourage telecom mergers to combat Huawei. These concerns have only become more pronounced as China appears to have rebounded from the virus more rapidly than the rest of the world. The political logic of protecting domestic companies through strategic alliances will apply after the pandemic and across a broad range of industries.

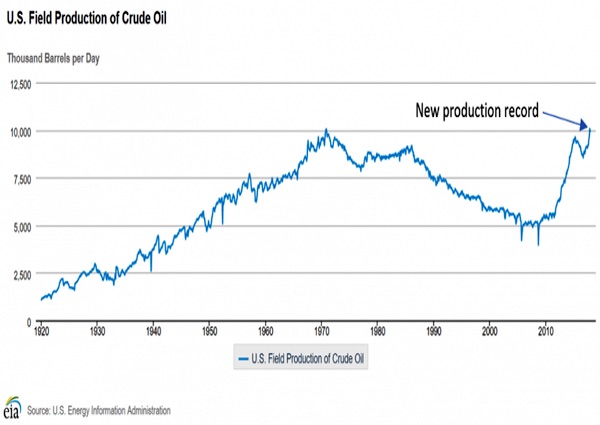

Governments will come away from Covid-19 with new priorities, ranging from safer, more domestic, manufacturing and supply chains to less risky balance sheets. If history rhymes, then pre-virus views about competition may take a back seat. As Edward Chancellor argued, this will lead to an unhealthy concentration of power. For the M&A business it opens all sorts of possibilities once considered taboo. Take the oil patch. Sliding demand has combined with efforts by the world’s largest producer, Saudi Arabia, to flood the market and nudge U.S. drillers toward bankruptcy. As the price of a barrel of West Texas Intermediate crude has fallen below $20 a barrel from $60 at the start of the year, producers have been lobbying Trump for a rescue.

It’s not inconceivable to imagine the largest American producers banding together to squeeze out costs and take a better grip of U.S. oil supply, maybe even aided by government loans and a streamlined regulatory process, effectively creating a potential rival to Saudi Aramco. Merging Exxon Mobil with Chevron would forge a company worth some $350 billion with 35 billion barrels of proved reserves. Heck, they might even fold in BP’s 20 billion of reserves and $75 billion market cap and “ExChevBrit”. It would be a shrimp compared to Aramco’s $1.6 trillion value and 270 billion barrels of proved barrels of oil – and that’s how they would justify a deal.

The sytem cannot tell if you’re 2 meters or 20 meters away. Next!

• Bluetooth Inventors See Problems For Coronavirus Contact Tracing (IC)

Named for the 10th century king Harald “Bluetooth” Gormsson, famous in Scandinavia for uniting (and Christianizing) the Danes, the humble, oft-derided wireless technology included in some form in nearly every portable device from the past decade and beyond is central to coronavirus contact tracing apps pushed by Apple, Google, and governments across the world. Banking on the standard’s ubiquity, and considerably improved reliability since the ’90s, these entities hope to turn billions of Bluetooth-enabled devices into an army of public health automatons that can map anyone who came into contact with someone who tests positive for Covid-19.

Although the exact plans for using Bluetooth vary between governments, the gist is simple: In order for your iPhone to connect to your friend’s Bluetooth speaker, it has to essentially shout its existence into the electromagnetic spectrum, sending repeated radio messages that announce that the device is turned on and willing to pair with another. It’s exactly these short, repeating radio wave bursts that tech companies and public health authorities hope can be used for contact tracing, by collecting an anonymized record of every Bluetooth announcement within a certain range. If one of these “HELLO, I AM BLUETOOTH!” messages ends up coming from an individual who later tests positive for Covid-19, the hope is that anyone else whose phone was able to detect that message could then be alerted and tested (or treated) accordingly.

No-one here links the good harvest to less pollution or glyphosate. Odd.

• French Beekeepers Look To Lockdown Exit To Sell Bumper Honey Harvest (R.)

Beekeepers in France are celebrating a bumper spring honey harvest after weeks of warm weather but will need a smooth unwinding of the coronavirus lockdown if they are to find a market for their produce. Down an overgrown track near the Chantilly Palace, where the James Bond film “A View to a Kill” was filmed in the 1980s, beekeeper Franck Portefaix says it could be the best season in four decades. “The blossom was almost three weeks early and the harvest is very, very good,” said Portefaix, who followed his parents into beekeeping 30 years ago. Nearby, colleagues in protective suits sprayed smoke over hives before opening them to extract the raw honey, most of which Portefaix’s business sells in markets. Temperatures in the l’Oise, north of Paris, in April hit as high as 30 degrees Celsius, more typical of early summer.

In a mediocre harvest, a beehive can produce 4-6 kg of honey, rising to 10 kg in a good harvest, but this spring Portefaix said the best performing among his 500 hives could produce up to 20 kg each. “1976 was really the year of reference, a very good year. And this year has begun much like that year. But not all beekeepers are cheering 2020. While northern and western regions of France basked in ideal April weather, prolonged dry spells hurt harvests in the south. Unfavourable weather also in the Landes region hurt acacia honey production. “With the upheaval to our climate, harvests are becoming increasingly unpredictable. It’s still early in the season, we need to temper our expectations,” said Henri Clement, a spokesman for the National Union of French Beekeeping.

French beekeepers' bumper spring honey harvest is a cause for celebration https://t.co/w6VRMncwD6 pic.twitter.com/wS50hg47O5

— Reuters (@Reuters) May 6, 2020

The FBI is above the law.

• Did The Mueller Team Violate Brady and Flynn Orders? (Turley)

With the release of the new material from the case of Michael Flynn, an array of experts came forward to assure the public that it was all standard procedure for investigators to conclude that there was no criminal conduct uncovered and then prosecutors creating a crime (including the use of a clearly unconstitutional law never used to convict anyone since the start of the Republic). Many of these same experts who have been espousing untethered (and ultimately rejected) theories for criminal and impeachment charges for years. Yet, what was most striking is how many also rejected any claim that the undisclosed evidence, at a minimum, violated Brady, the case requiring the government to turn over exculpatory information.

Indeed, Ben Wittes, a staunch defender of James Comey, assured readers “while you might not know much about federal law enforcement,” this is all “standard practices.” In fact, this is a clear and flagrant violation of the both Brady and the orders of Judge Emmet Sullivan. The fact that such violations are also dismissed by mainstream media and experts reflects how rage has distorted legal analysis in this Administration. Brady v. Maryland is a 1963 decision of the Supreme Court that prosecutors must under the Fifth and Fourteenth amendments disclose favorable evidence to defendants upon request, if the evidence is “material” to either guilt or punishment. There are also due process rights requiring the disclosure of any evidence that would allow the defense to attack the reliability, thoroughness, and good faith of the police investigation or to impeach the credibility of the state’s witnesses. Kyles v. Whitley, 514 U.S. 419 (1995).

Courts like Judge Sullivan in the Flynn case issue standard orders under this and other cases requiring disclosure of evidence that are exculpatory or material to issues like impeachment. Many of us who work on the criminal defense side have long frustrating histories with courts in dealing with violations of Brady and other cases. Often these violations are exposed after sentencing (unlike in Flynn). Courts often cite cases like Strickler v. Greene to decline to order a new trial unless “the nondisclosure was so serious that there is a reasonable probability that the suppressed evidence would have produced a different verdict.” That is a standard that is difficult to overcome. However, this case exposes a particularly obvious set of violations.

Babylon Bee

• China Fires Entire Propaganda Team: US Media Already Does Their Job (BB)

The Chinese government has laid off its entire propaganda arm, cutting thousands of jobs at China Central Television and other state-run media outlets as the American media is already doing their job for them. “It seemed kinda redundant for us to have a state-run media when we have the American press,” said President Xi at a press conference Monday. “The American media is carrying water for us. It’s pretty incredible. We unleashed a virus on the world and lied about it for months, and the American press can’t stop praising us. As long as they make their orange leader look bad, they’ll repeat any line we feed them.”

“Really, we Commies could learn a lot from the propaganda of the press over in America,” he added admiringly. The Communist dictator sat the nervous, state-owned journalists down and asked them, “What would you say you do there?” to which they responded, “We take the propaganda and tell it to the people.” But President Xi wasn’t fooled, saying that the American press already does that and the redundancy would be eliminated. Luckily for the state-owned journalists and broadcasters who lost their jobs in China today, CNN was hiring.

We try to run the Automatic Earth on people’s kind donations. Since their revenue has collapsed, ads no longer pay for all you read, and your support is now an integral part of the process.

Thank you.

A great thread, putting together lots of studies:

A lot of discussion recently about transmission dynamics, most of which are extrapolated from viral loads & estimates. What does contact tracing/community testing data tell us about actual probability of #COVID19 transmission(infection rate), high risk environments/age?

[thread]— Dr Muge Cevik (@mugecevik) May 4, 2020

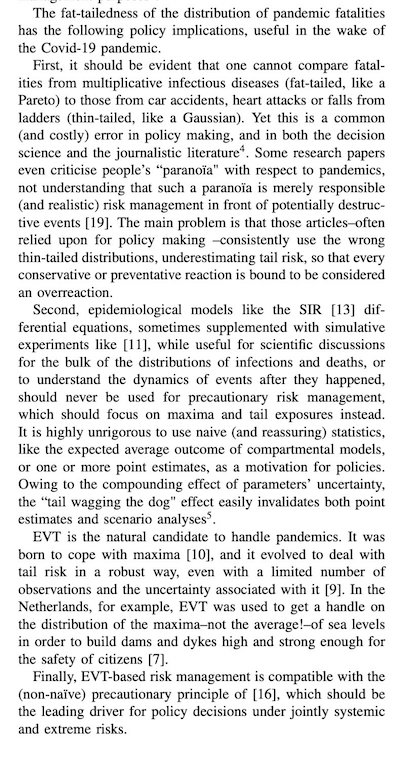

Taleb. People often don’t get why you need not median values but extremes, maxima, to build a good model, building, theory, policy.

EVT= Extreme value theory

Support the Automatic Earth for your own good.