Caravaggio St. John the Baptist in the wilderness 1604

Can’t wait for Christmas amd some days off. Close it down and it can’t fall further. Either that or give Jay Powell a call.

• S&P 500 Drops More Than 2% To New Low For 2018, Dow Dives 500 Points (CNBC)

Stocks tanked on Monday, pushing the S&P 500 to a new low for the year amid growing concerns that the Federal Reserve’s plan to raise interest rates could be too much for the economy and stock market to handle. The S&P 500 fell as much as 2.5% to 2,530.54, surpassing its February intraday low of 2,532.69. The broad market index finished the session down 2% at 2,545.94, its lowest close for the year. The Dow Jones Industrial Average lost 507.53 points to close at 23,592.98, bringing its two-day losses to more than 1,000 points. Shares of Amazon and Goldman Sachs led the declines.

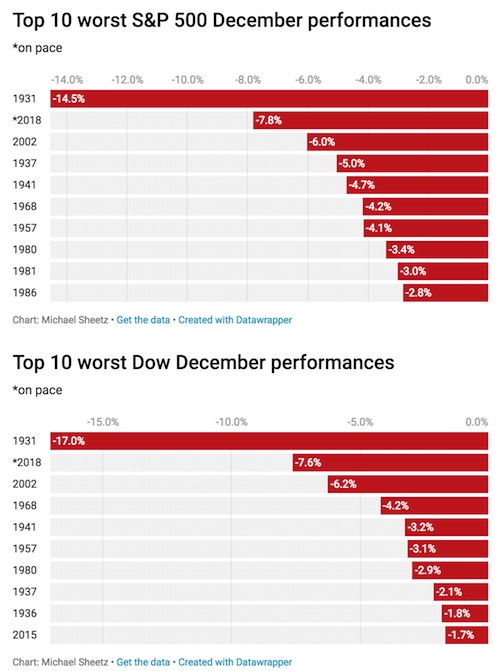

The Dow and S&P 500, which are both in corrections, are on track for their worst December performance since the Great Depression in 1931, down more than 7% so far for the month. The S&P 500 is now in the red for 2018 by 4%. The tech-heavy Nasdaq Composite dropped 2.2% to finish the day at 6,753.73 as Microsoft dropped 2.9%. The Russell 2000 — which tracks the performance of smaller companies — entered a bear market, down 20% from its 52-week high. DoubleLine Capital CEO Jeffrey Gundlach said Monday that he “absolutely” believes the S&P 500 will go below the lows that the index hit early in 2018. “I’m pretty sure this is a bear market,” Gundlach told Scott Wapner on CNBC’s “Halftime Report. The major averages fell to session lows following his comments.

There are so many death croses lately, the term loses meaning.

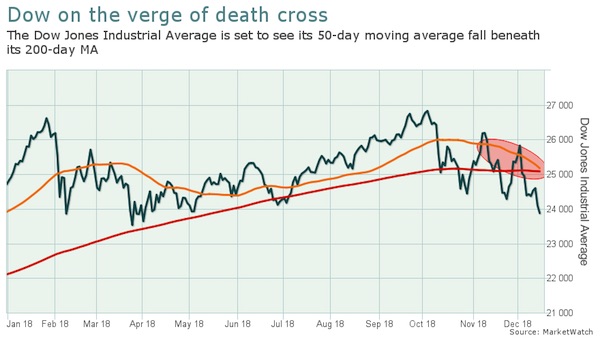

• The Latest Key Death Cross Is Poised To Engulf The Stock Market (MW)

Ominous-sounding death crosses have been emerging in the stock market like weeds, with the latest — and arguably, the last important such cross — about to take hold in the Dow. The Dow Jones Industrial Average is on the verge of joining other major equity benchmarks in a so-called death cross, where the 50-day — a short-term trend tracker — crosses below the 200-day, used to determine a long-term trend in an asset. Chart watchers believe that such a cross marks the point where a shorter-term decline graduates to a longer-term downtrend.

Currently, the Dow’s 50-day moving average stands at 25,173.14, compared against its 200-day average at 25,083.23, according to FactSet data, as of Friday’s close of trading. That puts the 50-day less than 90 points shy of breaching the long-term average, which could occur by the end of this week or next, based on the current pace of decline. The Dow has suffered a series of punishing drops on nagging fears of slowing global growth, unresolved trade worries and the pace of the Federal Reserve’s rate increases, with Monday’s action placing the Dow at its lowest close since March 23, 2018.

Thank the Fed.

• Stock Market On Pace For Worst December Since Great Depression (CNBC)

Two benchmark U.S. stock indexes are careening toward a historically bad December. Both the Dow Jones Industrial Average and the S&P 500 are on pace for their worst December performance since 1931, when stocks were battered during the Great Depression. The Dow and S&P 500 are down 7.8% and 7.6% this month, respectively. December is typically a very positive month for markets. The Dow has only fallen during 25 Decembers going back to 1931. The S&P 500 averages a 1.6% gain for December, making it typically the best month for the market, according to the Stock Trader’s Almanac. While the S&P 500 began dissemination in 1950, the performance data was backtested through 1928. It’s worth noting that historically, the second half of December tends to see gains.

The Fed has absolute control. I don’t see nearly enough people being afraid of that.

• How The Federal Reserve Could Spark A ‘Santa Claus’ Stock Rally (Yahoo!)

After a bruising few months for stocks, investors are banking on a ‘Santa Claus’ rally to close out 2018. Even with just a handful of trading sessions left in 2018, there is still one remaining catalyst that could spark a stock rally: the Federal Reserve. The market is pricing in a 78% chance the Fed announces a rate hike Wednesday, when it wraps up its two-day policy meeting, according to CME futures data. The rate hike itself wouldn’t spark the rally. In fact, rate hikes make stocks less attractive. But this rate hike is so priced in, that not going forward with it could signal that the Fed is worried about the economy. This would be the Fed’s fourth interest rate hike of 2018. It was in June that the Fed telegraphed this fourth rate hike.

Instead, the stock rally could be sparked by the Fed’s guidance about monetary policy in 2019. “For U.S. stocks to drift higher this week, the Fed will have to strike an easier tone about future rate hikes without signaling undue concerns about U.S. economic growth,” wrote Nick Colas, co-founder of DataTrek Research, in a note to clients Monday. But doing so may force them to downgrade U.S. economic growth forecasts for 2019, Colas said. “Changing course on rates without that air cover will make it look like the Fed is targeting asset price volatility (a.k.a. the “Fed Put”) or – worse – that the central bank is taking orders from the White House,” Colas noted, referring to President Trump’s months-long criticism — which occurred as recently as Monday — of the Fed’s monetary tightening.

[..] the Fed’s statement on Wednesday, roughly 200 words in length, will be scrutinized by investors. “The Fed could delete the words ‘gradual increases’ — meaning a hike every quarter is no longer a working assumption,” said Danielle DiMartino Booth, a former Fed advisor and CEO of Quill Intelligence. “That would take March off the table in theory and could spark a rally, even if based only on technicals, that could run into year-end.” The Fed has started to use the phrase “gradual increases” when referring to interest rate hikes in its statements starting in June. Prior to that, many of the statements included the phrase “gradual adjustments.” “Investors are hungry for even a morsel of dovishness, and what they do not say could be even more powerful than what they do say,” Booth noted.

I don’t think the problem is where Lance sees it.

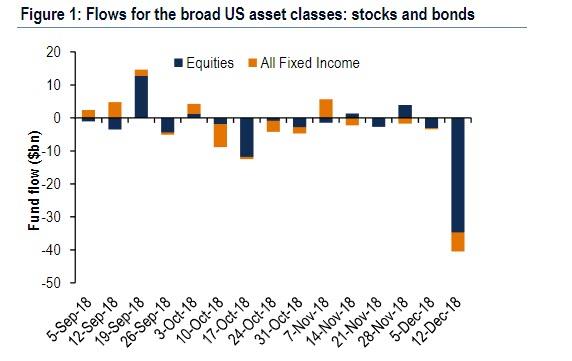

• You Have A “Trading” Problem (Roberts)

As Sy Harding says in his excellent book “Riding The Bear:” “No such creature as a ‘buy and hold’ investor ever emerged from the other side of the subsequent bear market.” Statistics compiled by Ned Davis Research back up Harding’s assertion. Every time the market declines more than 10%, (and “real” bear markets don’t even officially begin until the decline is 20%), mutual funds experience net outflows of investor money. To wit: “Lipper also found the largest outflows on record from stocks ($46BN), the largest outflows since December 2015 from taxable bond ($13.4BN) and Investment Grade bond ($3.7BN) funds, and the 4th consecutive week of outflows from high yield bonds ($2.1BN), offset by a panic rush into cash as money market funds attracted over $81BN in inflows, the largest inflow on record.”

Most bear markets last for months (the norm), or even years (both the 1929 and 1966 bear markets), and one can see how the torture of losing money week after week, month after month, would wear down even the most determined “buy and hold” investor. But the average investor’s pain threshold is a lot lower than that. The research shows that it doesn’t matter if the bear market lasts less than 3 months (like the 1990 bear) or less than 3 days (like the 1987 bear). People will still sell out, usually at the very bottom, and almost always at a loss. So THAT is how it happens. And the only way to avoid it – is to avoid owning stocks during bear markets. If you try to ride them out, odds are you’ll fail. And if you believe that we are in a “New Era,” and that bear markets are a thing of the past, your next of kin will have our sympathies.

Xi is not reforming, he’s trying to keep China above water.

• China Politics Getting In The Way Of Reforms (G.)

Xi’s speech comes as the Chinese leadership is facing criticism over slowing growth and confrontation with the US. Observers hoped his speech would lay out new directions or reforms needed to help the Chinese economy, weighed down by debt and lagging consumption, and an overly dominant state sector. Instead, Xi stressed that the Party’s leadership and strategy up to now have been “absolutely correct.” He promised to support the state sector while continuing reforms in appropriate areas. His remarks lacked any detail about new policies and failed to inspire confidence in Asian markets. Hong Kong and Shanghai both dropped sharply during the speech. They are now off 1% for the day while losses have deepened to 1.8% in Tokyo and more than 1% in Sydney.

“President Xi was perhaps unsurprisingly long on rhetoric and short on details,” said Tom Rafferty, regional manager for China at the Economist Intelligence Unit. “There will be a sense of disappointment, among both local and international investors, that Xi did not give clearer signals about the direction of future economic reform at a time when the Chinese government’s commitment to market liberalisation is seen to have waned.” Critics say politics are getting in the way of needed reforms – a rare challenge to Xi, who has amassed power more quickly than any of his predecessors.

Central question is how much of it was borrowed. How much is based on unproductive investments and sheer waste?

• China To Mark Economic Miracle That Pulled 700 Million People Out Of Poverty (RT)

China has pledged more economic reforms to push growth higher and help offset any impact from the US trade conflict. It comes as the world’s second-largest economy marks the 40th anniversary of “reform and opening up” this week. Statistics show that more than 700 million Chinese people have shaken off poverty since Beijing started its program of economic reforms four decades ago. The figure accounts for over 70% of global poverty reduction during that period. The first wave of reform, which lasted from 1978 to 1989, was characterized by agricultural reform and revival of the private sector. The second wave of reform (from 1992 to 2012) resulted in the legalization of the market economy, China’s accession to the WTO, and a booming private sector.

China’s record in poverty reduction since reform and opening up is without parallel in human history, according to Wang Yiwei, professor of the School of International Studies at Renmin University. “Between 1978 and 2017, China’s economy expanded at an annual average 9.5% growth rate, increasing in size almost 35 times,” he told Xinhua News. The total expansion of China’s economy over a 39 year period was almost three times as much as Japan’s, Ross noted, adding that “No other economy commencing sustained rapid economic growth even remotely approaches the 22.3% of the world’s population as China had in 1978 at the beginning of reform and opening up.”

Australia hasn’t gone down in 2 decades. That takes a lot of debt.

• Australia’s Central Bank Sees Risks From High Debt As House Prices Fall (R.)

A combination of falling home prices, stratospheric household debt and low wage growth posed downside risks to the Australian economy, the country’s central bank warned on Tuesday, even as it predicted the next move in interest rates would likely be up. Minutes of the Reserve Bank of Australia’s (RBA) December policy meeting showed members spent a considerable time discussing the recent slowdown in global growth momentum, partly caused by a bitter tariff dispute between the United States and China. Australia is heavily leveraged to global trade with China its No.1 trading partner so any deceleration in momentum overseas will likely be negative for the A$1.8 trillion economy.

Indeed, Australia’s gross domestic product expanded at a weaker-than-expected 2.8% pace last quarter, when policy makers were hoping for “above-trend” 3%-plus growth. Dismal private consumption was a major factor hurting economic activity, even though there were some early signs of a small uptick in wages growth. “The outlook for household consumption continued to be a source of uncertainty because growth in household income remained low, debt levels were high and housing prices had declined. Members noted that this combination of factors posed downside risks,” the RBA said.

The key to why Russia is seen as a problem. And that in turn leads to all the articles following this one.

• ‘No Existing Countermeasures’ To Russian Hypersonic Weapons – US Gov’t (RT)

The US is currently unable to repel an attack from the hypersonic weapons that are being developed by Russia and China, as they can pierce most missile defense systems, a recent US government report has revealed.

“China and Russia are pursuing hypersonic weapons because their speed, altitude, and maneuverability may defeat most missile defense systems, and they may be used to improve long-range conventional and nuclear strike capabilities,” the report by the Government Accountability Office (GAO) reads. The report also highlights the challenges to American security posed by Chinese and Russian anti-satellite weapons and stealth aircraft that “could fly faster, carry advanced weapons, and achieve further distances.”The rapid development of the cutting-edge technology “could force US aircraft to operate at father distances and put more US targets at risk,” the report notes. Speaking at a Valdai Club session in October, Russian President Vladimir Putin said that Russia surpassed its rivals in terms of hypersonic weapons, calling Russia’s prevalence in the field “an obvious fact.” “Nobody has precise hypersonic weapons. Some plan to test theirs in 18 to 24 months. We have them in service already,” Putin said. In March Putin unveiled several advanced weapons systems, including the Avangard hypersonic glider warheads and the Kinzhal –or Dagger– hypersonic cruise missile. The Kinzhal can fly at Mach-10 speed and has a reported range of 2,000 km (1243 miles).

It was reported that Russia’s advanced Sukhoi Su-57 jet might soon be armed with a missile similar to the Kinzhal. While the Avangard is about to enter military service, the Kinzhal has already been deployed with the force. Faced with the unmatched hypersonic capabilities, the Pentagon has launched about a dozen programs to protect the US from hypersonic weapons. A project named ‘Glide Breaker’ to develop an interceptor capable of neutralizing incoming hypersonic gliders has been in the works with The Defense Advanced Research Projects Agency (DARPA).

If you were African-American and you’re told all the time that you would have voted Hillary if not for the Russians co-opting you with $5,000 in ads, you would get mad too.

• The Bigotry Behind NY Times’ ‘Russians Targeted African-Americans’ (GJ)

This morning, the New York Times decided to stop insulting our intelligence and instead chose to insult decency. In an article written by Scott Shane and Sheera Frenkel, Russians allegedly unleashed an intricate plot to targeted African-Americans in order to foment discontent and dupe “black people” to vote against their self-interest. According to the corporate recorders at the NY Times, the reason that African-Americans did not uniformly vote for Hillary Clinton and the Democrats is because they were too dimwitted to think for themselves and were subsequently manipulated by foreign agents. [..] Let me dispel some myths here about people who refused to vote for Hillary since I happen to be one of them.

I chose to withhold my support not because Russians conditioned me to think that way but because I refused to support a warmongering sociopath otherwise known as John McCain in pantsuits. I’ve followed Hillary’s career long enough to know that she is a corporate courtesan who can’t get enough of destabilizing nations and enriching herself by trading access for cash. Eight years of Obama catering to Wall Street and furthering George Bush’s war first policies was enough for me to tap out. [..] In other words, just because my skin color is “black” does not mean I owe my vote and loyalty to Democrats. True enough, there was a time where I was an unflinching supporter of team blue, but after seeing how Democrats are no different than Republicans, I chose to wake up.

[..] The level of duplicity on display by establishment voices is truly astounding. If leading Democrats and media personalities want to know who is responsible for the rise of Trump, they should look in the mirror. After all, it was Hillary Clinton’s “pied piper” strategy—heeded by her sycophants in the press—that elevated a reality show clown into a serious contender. Hillary Clinton and her cronies rigged the primaries, spent more than $1.2 billion and Trump was given more than a billion dollars in free media by CNN, MSNBC and their ilk, yet we are supposed to believe that $5,000 in Google ads and $50,000 on Facebook was enough to tilt the outcome of the 2016 elections.

Who exactly here operates a troll factory?

• Racist ‘Russians’ Targeted African-Americans In 2016 Election – Reports (RT)

Low voter turnout among African-Americans is usually blamed on purged voter rolls or decades of socioeconomic stasis – but in 2016, ‘evil’ Russia was the main culprit, according to two controversial reports for the US Senate. Though described as “Senate reports” by mainstream US media outlets, the two documents were actually compiled by third parties. The first was produced by a consultancy called New Knowledge, with the help of two other researchers, while the second was done by a group at Oxford University and the UK research firm Graphika. By the social media giants’ own admission, the criteria for labeling posts as “Russian” is so broad as to be practically meaningless.

That hasn’t stopped the authors of the two reports, though, who saw President Vladimir Putin’s fingerprints on every keyboard and under every bed. In particular, they argued, the “Russians” sought to depress the 2016 turnout by targeting Black Americans. Both groups relied on posts provided to the US government by Twitter, Facebook and Google and identified as coming from the St. Petersburg-based Internet Research Agency (IRA), also known as the “troll factory.” “These campaigns pushed a message that the best way to advance the cause of the African-American community was to boycott the election and focus on other issues instead,” said the Oxford report.

“The most prolific IRA efforts on Facebook and Instagram specifically targeted black American communities and appear to have been focused on developing black audiences and recruiting black Americans as assets,” says the New Knowledge report. While some African-American activists saw the reports as recognition of their community’s influence in US politics, others pointed out that blaming the “Russians” downplayed very real and long-standing racism in American society.

African-Americans have no opinions of their own, and neither do Yellow Vests. They’re all like Putin’s zombie armies. Next up is Orban blaming Putin for Hungary’s protests.

• Russia! The Gift That Keeps Giving For The BBC, Even In France (Bridge)

Given the rash of conspiracy theories leveled against Russia of late, it is no surprise that the BBC is deep-sea fishing for a Kremlin angle to explain the protests against the government of French President Emmanuel Macron. This new and improved beast of burden to explain every uprising, lost election, accident and wart, popularly known as ‘Russia’ – a strategy rebuked by none other than President Putin as “the new anti-Semitism” – provides craven political leaders with a ready-made alibi when the proverbial poo hits the fan. Yes! It can even rescue Emmanuel Macron, who just experienced his fifth consecutive weekend of protests in the French capital and beyond.

Here is the real beauty of this new media product, which promises to outsell Chanel No.5 this holiday season. Reporting on ‘Russia’ does not require any modicum of journalistic ethics, standards or even proof to peddle it like snake oil to an unsuspecting public. Simply uttering the name ‘Russia’ is usually all it takes for the fairytale to grow wings, spreading its destructive lies around the world. ‘Russia’ is truly the gift that keeps on giving! Allow me to demonstrate how easy it is to apply. Just this weekend, BBC journalist Olga Ivshina was engaged in correspondence with a stringer in France. In an effort to explain what has sparked the French protests, Ivshina gratuitously tossed out some live ‘blame Russia’ bait.

“And maybe some Russian business is making big bucks on it,” the BBC journalist solicited in an effort to conjure up fake news out of thin air. “Maybe they are eating cutlets out there en masse, for example. Or maybe the far-right are the main troublemakers?” When the question only managed to elicit an uncomfortable laugh from the stringer, the nonplussed BBC journalist exposed more trade secrets than was probably advisable. In fact, what followed seems to have been the only nugget of truth to emerge from the discussion. Ivshina confided that she was “looking for various angles” since the broadcaster, like a modern day Dracula flick, was “out for blood.”

“The next scheduled chapter in the story is Gen. Flynn’s sentencing this Tuesday. It would be a surprise if the Judge does not observe that Mr. Mueller has acted in contempt of court. Ditto if the charge against Gen. Flynn is not thrown out. ”

Last Friday morning, we adjourned the blog in anticipation of Special Counsel Robert Mueller handing over certain FBI documents in the General Flynn matter demanded by DC District Federal Judge Emmett G. Sullivan no later than 3:00 p.m. that day. Guess what. Mr. Mueller’s errand boys did not hand over the required documents — original FBI 302 interrogation reports. Instead, they proffered a half-assed “interview” with one of the two agents who conducted the Flynn interrogation, Peter Strzok, attempting to recollect the 302 half a year after it was written. Of course, Mr. Strzok was notoriously fired from the Bureau in August for bouts of wild political fury on-the-job as FBI counter-intel chief during and after the 2016 election. (This was the second time he was fired; the first was when Robert Mueller discarded him from the SC team in 2017 as a legal liability.)

So, 3:00 p.m. Friday has come and gone. It appears that the FBI 302 docs have come and gone, too. Actually, we have reason to believe that nothing ever created on a computer connected to the internet can actually disappear entirely. Rather, the data gets sucked into the bottomless well of the NSA server-farm out in Utah. Most likely, the original 302s exist and Mr. Mueller is pretending he can’t find them. In effect, it appears that Mr. Mueller has responded by gently whispering “fuck you” to Judge Sullivan.

Interestingly, The New York Times didn’t even report the story (nor The WashPo, nor CNN, nor MSNBC). Since their “Russia Collusion” narrative is foundering, they can’t tolerate any suggestion that their Avenging Angel of Impeachment, Mr. Mueller, is less than the sanctified plain dealer he affects to be. Judge Sullivan kept his own counsel all weekend. The next scheduled chapter in the story is Gen. Flynn’s sentencing this Tuesday. It would be a surprise if the Judge does not observe that Mr. Mueller has acted in contempt of court. Ditto if the charge against Gen. Flynn is not thrown out. After all, the main articles of evidence against him apparently don’t exist.

And if it turns out that Mr. Mueller and his team are disgraced by their apparent bad faith behavior in the Flynn case, what then of all the other cases connected to Mueller one way or another: Manafort, Cohen, Papadopoulos? And the other matters still in question, such as the Trump Tower meeting with the Russian “Magnitsky” lawyer and Golden Golem Junior, the porn star payoffs… really everything he has touched. What if it all falls apart?

This is it. Given recent claims that emissions must be cut five times more than is now recognized, and there are just 2 years left to do anything meaningful concerning climate change, this is it.

• Coal Demand Will Remain Steady Through 2023 -IEA (CNBC)

Coal consumption is expanding after two years of decline, but miners should brace for another period of sluggish growth, according to the International Energy Agency. In its latest annual report, the IEA forecasts global coal demand will remain essentially stable over the next five years, inching up by just over 1% between 2017 and 2023. The reason for coal’s stagnation remains unchanged from recent years: Developed nations are ditching the fossil fuel, while India and other emerging economies are turning to coal to quickly scale up electric power generation.

“In a growing number of countries, the elimination of coal-fired generation is a key climate policy goal. In others, coal remains the preferred source of electricity and is seen as abundant and affordable,” said the IEA, a Paris-based agency that advises developed nations on energy policy. The IEA’s forecast comes on the heels of a series of reports that the world is falling short of commitments to prevent catastrophic impacts from climate change and running out of time to take action. Burning coal for electric power and industrial purposes such as steelmaking is a major contributor to global warming.

Home › Forums › Debt Rattle December 18 2018