Edvard Munch Christmas in the brothel 1904-05

It’s Christmas Eve and all we can talk about is war. The next step once the last Ukrainian dies, as Gonzalo also says, may well be to push Poland forward as the -willing- next proxy. Because the Poles do have the equipment, and the personnel to operate it.

Merry Christmas.

Rob Reiner

Listening to President Biden deliver his Christmas speech, you can’t help but be struck by his kindness, his compassion, his decency, his humanity. At times like this, I’m so grateful we have him.

— Rob Reiner (@robreiner) December 23, 2022

Gonzalo Will Poland Be The Next Proxy

Pelosi

https://twitter.com/i/status/1606110816540819457

Slowak flag

When they tried the Ukraine flag nonsense in the Slovakian parliament, based Slovaks weren't having it. Good for them. pic.twitter.com/XaNkllp2Rh

— Rosie's Fear & Loathing in Lugansk (@DarnelSugarfoo) December 22, 2022

stationary slit vision

Krampus.

The Santa we know came from a mashup of ancient pre-Christian Teutonic and Norse folk figures (Wotan, Odin) with the 4th century Greek bishop, St. Nicholas, a humble giver of gifts to children. That evolved in 19th century Anglo-America, with help from Washington Irving, Charles Dickens, and Clement Moore, into the jolly fat man in a fur-lined cloak, chortling merrily amid the platters of roast goose and baskets of sugarplums. And then, of course, the Santa character was retooled and stylized by the big advertising mills of mid-20th century Madison Avenue into the red-suited icon who functioned as a cosmic delivery-man to suburban houses where the little ones dwell, efficiently distributing Red Ryder BB guns and Barbie Dolls from sea to shining sea out of his reindeer-powered express vehicle, circling the entire globe in a single breathless night of glittering snow and shining stars, plangent with countless wishes from little hearts.

Strange to relate, in some corners of Europe, St. Nick acquired a traveling companion named Krampus. The two went from house-to-house in the dark hours of St. Nick’s name-day (Dec. 6) interrogating children as to their conduct. Dark and hirsute with horns, cloven hooves, and a darting red tongue, this monster acted the “bad cop” of the roving pair, badgering the little ones about their naughty or nice doings, and whacking them with a birch rod if he didn’t like their answers. If especially displeased, he stuffed kids into a basket for transport to Hell. A Krampus-like character reemerged in America this pre-Christmas week in the figure of Volodymyr Zelenskyy, president of Ukraine, who flew halfway around the world in a US government-issue magic sled to meet up with his chum, the new Santa Claus, “Joe Biden,” alleged current president of our land.

Mr. Z, still tricked-out in his wartime olive-green togs and scrufty beard, was here to lecture the boys and girls of Congress about being naughty or nice vis-à-vis “democracy” in his distant land, lately under a siege of angry bears. Ukraine did nothing to make the bears angry, you understand. They just lumbered in from the forest one day and started busting stuff up, as bears will. Ukraine has already received many gifts from Santa’s workshop, formerly known as the USA, toys much more impressive than any Red Ryder BB gun, for sure: howitzers, Javelin missiles, Stinger missiles, High Mobility Artillery Rocket Systems (HIMARS), Phoenix Ghost tactical drones, Switchblade tactical drones, Puma surveillance drones, Vampire anti-drone systems, Mi-17 helicopters, Harpoon coastal defense systems, and much more. (How did Santa fit it all in his sack?)

“Joe Biden” promised another fifty-billions of dollars to Mr. Z’s bear-extermination project, with the further objective of dethroning the king of all bears, the wicked Putin, who glowers at the world from the mouth of his faraway Kremlin Cave. Then, in Congress Wednesday night, before a coast-to-coast TV audience, Mr. Z tuned-up our elected boys and girls in the great House chamber, forked tongue darting, to tell heart-wrenching tales of bear-provoked terror. He played them like the very keys of a harpsichord — a trick he has performed before with an interesting twist on Ukrainian television. The elect of our land stood and cheered, ready to proclaim Ukraine the fifty-first state. Mr. Z stole a smooch from the ruler of Congress, the winsome Ms. Pelosi, and then disappeared in a puff of smoke that left a tang of sulfur wafting on the stale air.

To underscore his seriousness, and using his secret powers, Mr. Z arranged for a bomb-cyclone storm to roar out of the North Pole a few days after his departure to give Americans a little taste of what it’s like to sit in the cold and dark at Christmas time — because the USA is such a blessed land as to have no problems of its own, and needs to be reminded about the sufferings of the less fortunate. And so it goes this Yuletide of 2022 in our charmed and exceptional country. The elves at Clusterfuck Nation wish you all a merry little Christmas!

“..Russia has been preparing non-stop for a full-scale continental war since at least 2014..”

• What Should We Make Of The Latest Muppet Show In DC? (Saker)

Since Dubya and Obama the White House has been occupied by weak and frankly clueless leaders, hence the various interests groups which control DC run “their own foreign policy”. So, like vectors, the various goals and means of the key actors add up to create a “sum vector” which can *look* like “a policy” or “a plan”, but it is no such thing. What is true of the US is even MORE true for NATO. Hence the Poles pulling at their chain like rabid dogs to the horror of the comparatively sane(er) Europeans. I fully agree with Andrei Martyanov – the folks in charge in the West are totally clueless and they have absolutely no idea how to walk away from the mess they created.

The Neocons probably would prefer a worldwide nuclear war to a Russian victory, but non-Neocon actors might not want to die for a sick, narcissistic, gang of ignorant yet self-worshiping thugs. Who will prevail? I have absolutely no idea. I am not sure anybody else knows either. What I do know is that Russia has been preparing non-stop for a full-scale continental war since at least 2014. Defense Minister Shoigu has declared that next year Russia will add five new artillery divisions, eight bomber aviation regiments, one fighter regiment, three motor-rifle divisions, two air-assault divisions, and six army aviation brigades to the Russian armed forces!

And, by the way, these “artillery divisions” will be what is called “high power” brigade/division in Russia, that is to say that they get the very heavy weapons, like 203mm and 240mm self-propelled mortars. Something which the newly recreated First Guards Tank Army (a “Shock Army” in Russian military terminology) would need to further increase its huge firepower power. And did I mention that Russia has fully modernized her nuclear triad and that key weapons factories in Russia are now working for 6 days weeks with 3 shifts working non-stop?

Zel DC

Apparently this is what modern war looks like. pic.twitter.com/XF9cN7DJ2I

— Maze (@mazemoore) December 23, 2022

Kiev and NATO can make any ‘peace plan’ that they know Russia won’t accept.

• Kiev Is Mulling Peace Plan, WSJ Reports (RT)

Ukraine may present its vision of peace around the last week in February, near the first anniversary of Russia’s offensive against the country, the Wall Street Journal has reported. The US newspaper, citing European and Ukrainian diplomats, claimed President Vladimir Zelensky and his team are currently working on such a formula. In its article on Thursday, the media outlet alleged that the Ukrainian leadership wants to strengthen its position at the negotiating table by making gains on the battlefield against Russia before unveiling any peace proposals. The topic of peace and how Ukraine sees it was high on the agenda of US President Joe Biden and his Ukrainian counterpart Zelensky during the latter’s visit to Washington on Wednesday.

However, according to the Washington Post, citing an anonymous senior US official, the discussion was largely “academic,” as the US and Ukraine believe Russia is not interested in any such negotiations at this point. Addressing G20 leaders in Indonesia last month, President Zelensky laid out a ten-point peace plan, which called for, among other things, the withdrawal of Russian troops from Ukraine and an “all for all” prisoner swap. The Kremlin, in turn, insisted that Kiev must recognize the “reality on the ground” as a prerequisite for any peace negotiations. In Moscow’s eyes, this reality includes the new status of Donetsk, Lugansk, Kherson and Zaporozhye regions as parts of Russia.

Unnamed Western officials cited by the Wall Street Journal had suggested that Russian President Vladimir Putin is preparing to launch a renewed offensive in the coming months and is not interested in any peace talks before he sees how those efforts pan out. Meanwhile, speaking to journalists on Thursday, the Russian head of state said that Moscow’s “goal is not to ramp up this military conflict, but, on the contrary, to end this war, that is what we are striving for and will strive for.” Putin noted that the sooner hostilities in Ukraine come to an end, the better, as the “intensification of fighting leads to unnecessary losses.”

The Russian president went on to insist that the Kremlin has never refused to engage in peace talks with Ukraine. He claimed that it is the leadership in Kiev that “has forbidden itself from” going down this road. This is an apparent reference to a decree signed by Zelensky in early October, according to which Ukraine will not negotiate with Moscow as long as Putin remains in power there. The decision came in response to Moscow officially signing agreements with the Donetsk and Lugansk Peoples’ Republics as well as Kherson and Zaporozhye Regions, which joined Russia after holding referendums. “One way or another, all armed conflicts end with some negotiations on the diplomatic track,” Putin argued on Thursday. He also expressed hope that those “who are opposing us” realize this as soon as possible.

“..all that he has said until now did not take into account the reality on the ground..”

• Kremlin Comments On Kiev’s Purported Peace Plan (RT)

Kremlin spokesman Dmitry Peskov has said that Russia considers previous comments made by Ukraine’s President Vladimir Zelensky about the possibility of peace talks as detached from reality. He’d been asked on Friday to comment on media reports about a new peace plan being formulated by the leader’s office. “We are not aware of it,” the official told journalists during a briefing. “We have heard Zelensky’s statements about various steps, a peace plan. But all that he has said until now did not take into account the reality on the ground, which one simply cannot ignore.” The Wall Street Journal reported on Thursday that the Ukrainian government could reveal a new peace proposal sometime in February.

The Ukrainian leadership wants to achieve some battlefield victories first, to strengthen its position, the newspaper’s sources in the governments of the US and Ukraine claimed. Zelensky last month made public what he termed a peace plan for his nation during a speech to the G20 leaders, who were meeting in Indonesia. It involved full withdrawal of Russian troops from all territories that Kiev considers under its sovereignty. Russian Foreign Minister Sergey Lavrov said at the time that the terms were “unrealistic and inadequate” and that Zelensky’s speech was full of “militant, Russophobic and aggressive rhetoric.”

Zelensky was asked about a “just peace” ending the conflict, during a press-conference in Washington that he held this week alongside US President Joe Biden. He replied that he didn’t know what that term meant, before declaring that no amount of reparations would compensate for the losses of some Ukrainians, who want revenge on “inhumans.” Biden intervened to declare that both he and Zelensky ultimately wanted peace. US policy states a strategic defeat of Russia as a primary goal in the crisis. Russia and Ukraine were on the brink of reaching a ceasefire agreement in early April. But Kiev’s Western backers reportedly declined to support the deal that Kiev brought to the negotiation table. Moscow said the US and its allies derailed the talks so that they could inflict more damage on Russia, disregarding Ukraine’s interests.

The last Ukrainian.

• US Has Nothing To Lose, Everything To Gain, From Longer Ukraine Conflict (Luk.)

Putting aside the pomp, the theatricals designed tug at the heart strings and the rhetorical chatter, Ukrainian President Vladimir Zelensky’s visit to Washington could indeed be a milestone for the “European security” framework. A recent article by veteran German-American diplomat Henry Kissinger offered a new perspective in that he claimed a neutral status for Ukraine can no longer serve as a subject for negotiation, as the subject is no longer relevant. Ukraine is forming a powerful and capable armed force, actively assisted by the West, primarily the US, so its formal status – whether it’s a member of NATO or not – no longer matters. It is America’s de facto, if not de jure, military ally, in addition to having unique practical experience in a direct large-scale confrontation with Russia. One might add: it is motivated to pursue it.

Elaborating on this thought, it is reasonable to assume that, for the US, it’s even more comfortable for Ukraine to remain outside the formal alliance, as it expands the space for political-military action. There are no legal commitments, the level and scale of support can vary according to the situation at any moment, and the degree of Kiev’s loyalty to Washington as the main guarantor of resources is likely to exceed even that shown by Warsaw or the Baltic states. As will the degree of dependence on external aid. Ukraine, like Poland and the Baltics, is likely to become increasingly distrustful of continental Western Europe, as Kiev will interpret its inevitable internal contradictions as an implicit desire to make peace with Russia.

For the US, this sort of “land-based unsinkable aircraft carrier” will come in handy. Such a trained and loyal satellite, on the one hand beside Russia and on the other pointing towards Western Europe – and Kiev’s narrative that thanks to its efforts, the rest of Europe can live in peace and not under Russian bombs – opens up many opportunities. The territorial configuration of Ukraine in this context is unimportant to Washington. Moreover, the preservation of part of the internationally recognised Ukrainian territory under Russian control cements the conflict, and leaves the rump with a reason to fight on.

For this it should be equipped and trained, but all its wishes don’t necessarily need to be fulfilled. As for preparing its forces, it is crucial, for Washington, to enhance Ukraine’s own capabilities so that any subsequent phases of the confrontation can continue without the direct involvement of US and NATO units. This is a very significant point. The scheme is, in principle, quite rational. There is no guarantee that it will work, because Russia has the power to prevent it (even if, so far, this hasn’t been very visible), but there are few risks for the US. And the notorious European security system – the reform of which was Russia’s key demand a year ago – if it ever comes back on the agenda, it will be under very different circumstances. The old approaches and demands will no longer apply.

“We are really low… and we’re not even fighting..”

• NATO Armies Drained By Ukraine Conflict – Media (RT)

The fighting in Ukraine has “exposed flaws in US strategic planning” and “revealed significant gaps” in the US and NATO military industrial base, the Washington Post reported on Friday. As Kiev’s forces consume more ammunition than the West can produce, the Pentagon seeks to cope by training them to fight more like Americans. “Stocks of many key weapons and munitions are near exhaustion, and wait times for new production of missiles stretches for months and, in some cases, years,” the Post noted, as part of a narrative about how the US has funneled some $20 billion in military aid to Kiev just this year. Only $6 billion of that has been in new weapons contracts, while the rest came from the Pentagon stockpiles.

The US military-industrial complex can make about 14,000 rounds of ammunition for the 155-mm howitzers, the Post quoted US Army Secretary Christine Wormuth, while Ukrainian forces go through about 6,000 a day during heavy fighting. The US military-industrial complex is “in pretty poor shape right now,” Seth Jones of the Washington-based think tank Center for Strategic and International Studies (CSIS) told the Post. “We are really low… and we’re not even fighting,” Jones said, adding that in scenarios where the US is facing China or Russia in a conventional conflict, “we don’t make it past four or five days in a war game before we run out of precision missiles.” Washington’s allies in Europe are in similar shape, the Wall Street Journal reported on Thursday.

Michal Strnad, owner of a Czech ammunition conglomerate, said Ukraine chews through 40,000 rounds a month, while all of the European NATO members put together can produce 300,000 a year. “European production capacity is grossly inadequate,” Strnad said, adding that it would take up to 15 years to restock at current production rates, if the conflict were to somehow end tomorrow. Moscow has repeatedly warned the US and its allies that shipments of increasingly modern and long-range weapons could lead to a direct confrontation between Russia and NATO, and accused the West of prolonging the conflict and causing civilian deaths in Ukraine. While Western officials have demanded a ramp-up of production for months, recent EU legislation blocked many investments into weapons manufacturing by designating it “not sustainable,” according to the Journal.

Germany is now in the process of funding a factory in Romania that could produce both NATO and Soviet-caliber ammunition for Ukraine. The Pentagon is trying to deal with the problem by training Ukrainian troops to “fight more like Americans” and use different tactics, according to the Post. “I think if we can train larger formations — companies, battalions — on how to employ fires, create conditions for maneuver, and then be able to maneuver like you’ve seen [the US military] maneuver on the battlefield, then I think we’re in a different place. Then you don’t need a million rounds” of artillery, a senior US official – who did not wish to be named – told the outlet.

“..Russia has unswervingly adhered to the three primary war objectives Putin articulated in his February 24th speech.”

In his February 21, 2022 speech, Putin meticulously recounted the relevant history of the region dating back multiple centuries, and focused specifically on the events that followed in the wake of the dissolution of the Soviet Union. In addition to Putin’s history lesson, he makes particular reference to a detailed proposal Russia delivered to the United States and its NATO allies in mid-December 2021 – a proposal that effectively amounted to a “final warning”; a last-ditch effort to avoid war in Ukraine. Consider his words carefully, and particularly in light of how Russia has unswervingly adhered to the three primary war objectives Putin articulated in his February 24th speech.

“Last December, we handed over to our Western partners a draft treaty between the Russian Federation and the United States of America on security guarantees, as well as a draft agreement on measures to ensure the security of the Russian Federation and NATO member states. The United States and NATO responded with general statements. There were kernels of rationality in them as well, but they concerned matters of secondary importance and it all looked like an attempt to drag the issue out and to lead the discussion astray.

We responded to this accordingly and pointed out that we were ready to follow the path of negotiations, provided, however, that all issues are considered as a package that includes Russia’s core proposals which contain three key points. First, to prevent further NATO expansion. Second, to have the Alliance refrain from deploying assault weapon systems on Russian borders. And finally, rolling back the bloc’s military capability and infrastructure in Europe to where they were in 1997, when the NATO-Russia Founding Act was signed. – Vladimir Putin, Address by the President of the Russian Federation, February 21, 2022” I submit we can confidently assume Putin was as deadly serious on February 21, 2022 as he was on February 24, 2022; that he was not bluffing; that he was resolved to “raise the stakes” commensurate to whatever was required to achieve the objectives he had so carefully articulated.

I submit that his domestic popularity AND the support of his generals correlates closely to the perception that he will not waver from those objectives, and that it has only been the misplaced sense that he might be failing, or at least stumbling, or that he might even pull back from his stated objectives that has resulted in meaningful criticism arising from his domestic supporters, be it in government, the military, or the general public. I further submit that, in my estimation, it is precisely the burgeoning faith that Putin will resolutely pursue and achieve his stated objectives that has resulted in the unprecedented willingness of China, Iran, India, and other geostrategically important Eurasian and Global South nations to not only openly support Russia in this conflict, but to also, in many instances, openly defy imperial decrees forbidding military and commercial relations with Russia.

“..may keep them engaged for a prolonged time to make Russia suffer economically..”

• The US Love For Ukraine Or Hate Against Russia? (Awan)

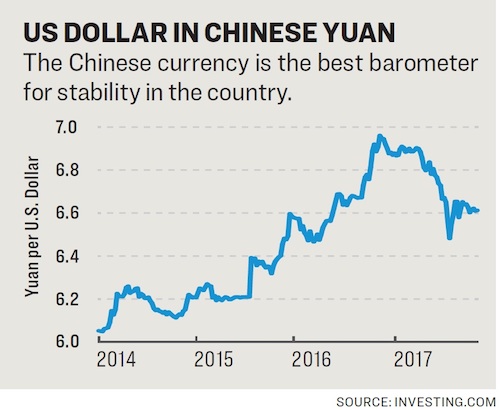

The US is not sincere with Ukraine nor in love. If the Americans love Ukraine, they might have provided unlimited weapons and advanced weapons to make Ukraine win. But, this is not their intention, not their goals. Actually, they are in hate with Russia and wanted to counter the revival of Russia through Ukraine and may keep them engaged for a prolonged time to make Russia suffer economically. The US put sanctions on Russia to harm it economically. Sanctions proved counterproductive and the Russian economy has not suffered at all. Its trade has remained the same, but, the trading partners have changed, China, India, Pakistan, and many other countries are becoming bigger trading Partners with Russia. Pushing out from the SWIFT banking system has no impact on its financial transactions as China has compensated and provided them with alternates.

It Oil and Gas export has not reduced, and India and China have been importing much more. Furthermore, the increase in Oil and Gas prices in the international market has become supported the Russian economy. On the other hand, Europe has been victimized by the Ukraine war. The Fuel and Food prices have jumped much high. Few European countries are providing subsidies to their citizens but not all of the European countries are rich enough to extend subsidies to their citizens. As a result, many Europeans are suffering. The public in Europe is turning against the Ukraine war and demanding the end of this war immediately. There are protests and agitations in some European capitals and slogans are heard against NATO and withdrawal from NATO.

The current leaders in Europe are bound under the agreement to support NATO and Ukraine’s war. But, it is predicted that in the upcoming some of the political parties may come up with the idea to promise the public to end the war, end NATO support or exiting from NATO, etc., may win the general elections. It is pretty sure that public sentiments will dominate in the next elections and visionary politicians will make bold decisions. There is an awareness in the public that blindly following the US is not the ultimate goal, but, must think about national interests. War in Europe is not desired, no one wants it and the public may reflect their anger at the time of voting. The next elections will be decisive and may change the fate of not only Europe but the whole world. Geopolitics might be changed completely. It is a matter of time only, public sentiments must be respected at all costs.

“..partially relieves state energy major Gazprom from fulfilling its obligations to its foreign partners..”

• Russia Sets Its Own Gas Price Cap For EU (RT)

Russian President Vladimir Putin signed a decree on Thursday that partially relieves state energy major Gazprom from fulfilling its obligations to its foreign partners who hail from countries that have imposed sanctions on Moscow. According to the decree, published on the official government portal, Gazprom and its subsidiaries are prohibited from paying for gas, or for its production and transport, from joint projects with its EU partners in Russia if the amount of payment is higher than the cost established by the Russian government. The decree targets Gazprom’s joint ventures with Germany’s Wintershall and Austria’s OMV. In partnership with the two companies, Gazprom is developing two large natural gas deposits in Russia, the Yuzhno-Russkoye and the Urengoyskoye fields.

The regulation has been introduced retroactively, and so is enforeceable from March 1, 2022, and will be effective until October 1, 2023. The government has been charged with setting a price limit within ten days. Both Germany and Austria are members of the EU, which imposed multiple sanctions against Russia in connection with Ukraine. Head of Wintershall Mario Mehren said in April that Russia had crossed red lines in its partnership with European companies, which means the end of “an era of long and intensive economic cooperation” between Russia and Germany. However, over the summer he said that his company has no plans to quit its joint ventures in the country. OMV has refused to make new investments in Russian projects and has announced plans to review its participation in the Yuzhno-Russkoye field, where it owns a 25% stake. Both companies have yet to comment on Putin’s decree.

“..right now, we’d rather take a risk of a production cut than stick to the policy of selling in line with the threshold.”

• Russia Warns Of Oil Production Cut (RT)

Russia will not sell oil to countries that impose a price cap on its crude exports, Deputy Prime Minister Aleksandr Novak warned on Friday. According to Novak, Moscow may respond by reducing oil production by 500,000-700,000 barrels a day in early 2023. Russia is the world’s third biggest oil producer and the cuts would equate to roughly 5-6% of the country’s daily output. The G7 and EU’s $60-per-barrel ceiling on Russian seaborne crude came into force on December 5. The measure, along with a ban on EU imports of seaborne Russian flows, is aimed at curbing the Kremlin’s revenues. Russian oil cargoes that are traded above the threshold cannot access some key services from Western companies, including insurance.

“We are ready to partially cut our production early next year,” Novak warned in an interview with the Rossiya-24 TV channel. “We’ll try to find some common ground with our counterparts to prevent such risks. But right now, we’d rather take a risk of a production cut than stick to the policy of selling in line with the threshold.” The official described the potential production drop as “insignificant” [to Russia], reiterating that Moscow will not sell its crude to those who apply the Western price cap. Russian producers are able to reroute their exports to competing markets, including Asia, as the nation’s energy is still in high demand globally, Novak stressed.

On Thursday, President Vladimir Putin told reporters he will sign a decree on the nation’s response to the cap next week, which will feature “preventive measures.” Russia’s full-year oil production in 2022 will probably grow to 535 million tons, equivalent to around 10.74 million barrels per day (bpd), according to Novak. Data shows that in November, the country’s average daily output hit an eight-month high of 10.9 million bpd. Meanwhile, experts have warned that an output cut by Russia could tighten the global energy market as demand in China, the world’s largest oil importer, is forecast to rebound.

Ukrainian bots?

• Mass Twitter Suspension Of Accounts Criticizing Zelensky Visit To Congress (PM)

Zelensky brought his flag and his ask for cash and weapons to Congress during the prime time hours on Wednesday night, much to the fawning of American legislatures. In response, many who are critical of the massive expenditure to Ukraine, and of the US involvement in a war against Russia at all, took to Twitter to express their disdain. They were banned, and many speculated that it was bots who were to blame. Many accounts shared a photo of the two most powerful women in American politics, Vice President Kamala Harris and House Speaker Nancy Pelosi, who are second and third in line for the presidency respectively, hoisting high the flag of Ukraine in the US Congress while Zelensky spoke to that body. Dozens of accounts were summarily banned after criticizing the visit, Zelensky, the US’ involvement in Ukraine, and the horrifying vision of the Ukrainian flag being raised in Congress.

Zelensky was treated to cheers, a standing ovation, and multiple rounds of applause. The flag being raised above Congress added insult to the injury of Zelensky asking for cash, in addition to his stating outright that no matter what the US was giving him it would not be enough. “I’m now getting reports of tons of accounts that were locked out our tweets that were taken down for posting images of Zelensky’s speech last night and being critical of him Seems to be a mass takedown campaign by Twitter,” Jack Posobiec reported. This after prominent account ALX was suspended pending deletion of his tweet criticizing Ukraine, Pelosi and Harris. Elon Musk replied to Posobiec’s post about ALX, saying that he was looking into it as the “tweet doesn’t violate ToS.”

Posobiec offered “Update, could be a mass-reporting situation by trolls or state actors.” The idea is that the tweets critical of Zelensky could have been the target of a mass-reporting campaign, with the intention of silencing anti-Zelensky sentiment on the platform. Former Trump administration official who served in the State Department and the Department of Defense William Wolfe said he was “back after an entirely arbitrary and unfounded suspension.” He had tweeted out the photo of Harris and Pelosi as well, saying “When we say ‘clown world’ this is what we mean.” For that tweet, he was slapped with a 12 hour ban. The Columbia Bugle simply tweeted the photo with “Bring a check next time,” and that caught a ban. The report from Twitter said the ban was for “Violating our rules against posting or sharing privately produced/distributed intimate media of someone without their express consent.” But of course, the image was a screen shot from the live broadcast of Zelensky speech, and Congress’ shilling for Zelensky, that was broadcast across many channels.

Tucker clapping

You should clap for Zelensky.

You'll get in trouble if you don't clap, that's why everyone clap all the time pic.twitter.com/WUhrJpwrTd

— Ignorance, the root and stem of all evil (@ivan_8848) December 23, 2022

“..an extraordinary story trespassed by Sisyphean tasks..”

• Can China Help Brazil Restart Its Global Soft Power? (Escobar)

The return of Luiz Inácio Lula da Silva for what will be his third presidential term, starting January 1, 2023, is an extraordinary story trespassed by Sisyphean tasks. All at the same time he will have to fight poverty; reconnect with economic development while redistributing wealth; re-industrialize the nation; and tame environmental pillage. That will force his new government to summon unforeseen creative powers of political and financial persuasion. Even a mediocre, conservative politician such as Geraldo Alckmin, former governor of the wealthiest state of the union, Sao Paulo, and coordinator of the presidential transition, was simply astonished at how four years of the Bolsonaro project let loose a cornucopia of vanished documents, a black hole concerning all sorts of data and inexplicable financial losses.

It’s impossible to ascertain the extent of corruption across the spectrum because simply nothing is in the books: Governmental systems have not been fed since 2020. Alckmin summed it all up: “The Bolsonaro government happened in the Stone Age, where there were no words and numbers.” Now every single public policy will have to be created, or re-created from scratch, and serious mistakes will be inevitable because of lack of data. And we’re not talking about a banana republic – even though the country concerned features plenty of (delicious) bananas. By purchasing power parity (PPP), according to the International Monetary Fund (IMF), Brazil remains the eighth-ranked economic power in the world even after the Bolsonaro devastation years – behind China, the US, India, Japan, Germany, Russia and Indonesia, and ahead of the UK and France.

A concerted imperial campaign since 2010, duly denounced by WikiLeaks, and implemented by local comprador elites, targeted the Dilma Rousseff presidency – the Brazilian national entrepreneurial champions – and led to Rousseff’s (illegal) impeachment and the jailing of Lula for 580 days on spurious charges (all subsequently dropped), paved the way for Bolsonaro to win the presidency in 2018. Were it not for this accumulation of disasters, Brazil – a natural leader of the Global South – by now might possibly be placed as the fifth-largest geo-economic power in the world.

No wonder they’re eager to sing.

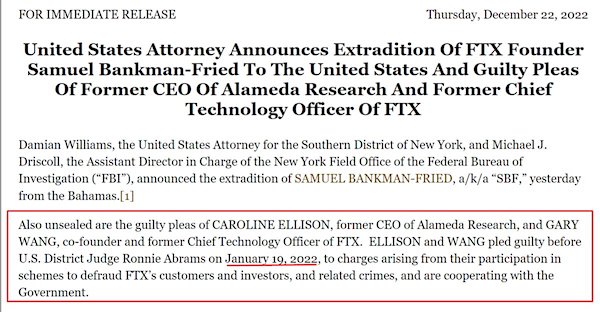

• United States Attorney Announces Extradition Of SBF To US (SDNY)

Damian Williams, the United States Attorney for the Southern District of New York, and Michael J. Driscoll, the Assistant Director in Charge of the New York Field Office of the Federal Bureau of Investigation (“FBI”), announced the extradition of SAMUEL BANKMAN-FRIED, a/k/a “SBF,” yesterday from the Bahamas.[1] Also unsealed are the guilty pleas of CAROLINE ELLISON, former CEO of Alameda Research, and GARY WANG, co-founder and former Chief Technology Officer of FTX. ELLISON and WANG pled guilty before U.S. District Judge Ronnie Abrams on December 19, 2022, to charges arising from their participation in schemes to defraud FTX’s customers and investors, and related crimes, and are cooperating with the Government.

U.S. Attorney Damian Williams said: “Last week, we announced charges against Samuel Bankman-Fried for a sweeping fraud scheme that contributed to FTX’s collapse and for a campaign finance scheme that sought to influence public policy in Washington. As I said last week, this investigation is very much ongoing, and it’s moving very quickly. I also said that last week’s announcement would not be our last, and let me be clear once again, neither is today’s.” FBI Assistant Director Michael J. Driscoll said: “With the pleas announced today, Ms. Ellison and Mr. Wang admitted they were willing participants in schemes to defraud FTX.com’s customers and backers out of their money. The FBI will continue to seek justice for the victims of this case. No matter how fraudsters dress it up or sell the scam, we will continue to make every effort to ensure those responsible for the scheme are held accountable in our criminal justice system.”

Check the date. They pled guilty 11 months ago

CAROLINE ELLISON, 28, is charged with and has pled guilty to two counts of conspiracy to commit wire fraud, each of which carry a maximum sentence of 20 years in prison; two counts of wire fraud, each of which carry a maximum sentence of 20 years in prison; one count of conspiracy to commit commodities fraud, which carries a maximum sentence of five years in prison; one count of conspiracy to commit securities fraud, which carries a maximum sentence of five years in prison; and one count of conspiracy to commit money laundering, which carries a maximum sentence of 20 years in prison. GARY WANG, 29, is charged with and has pled guilty to one count of conspiracy to commit wire fraud, which carries a maximum sentence of 20 years in prison; one count of wire fraud, which carries a maximum sentence of 20 years in prison; one count of conspiracy to commit commodities fraud, which carries a maximum sentence of five years in prison; and one count of conspiracy to commit securities fraud, which carries a maximum sentence of five years in prison.

Tucker SBF

Vivek Ramaswamy talks to @TuckerCarlson about SBF Being Released on Bail: "If he flees, it could have been $10 Trillion. Nobody's putting up that money. The whole thing is a story of smokescreens." pic.twitter.com/pxUthsIv52

— Daily Caller (@DailyCaller) December 23, 2022

RT

https://twitter.com/i/status/1606347049284165632

Paramount

When ROBERT EVANS learnt he was to be sacked as head of PARAMOUNT in the late 60s, he quickly put together this video to save his job.

In it he outlines some of the projects he has in development which will turn things around…

…including THE GODFATHER. pic.twitter.com/gZtaQE9NS6

— James Leighton (@JamesL1927) December 22, 2022

The rainbow starfrontlet (Coeligena iris) is a species of hummingbird in the “brilliants” tribe Heliantheini. Males have a glittering yellow-green forecrown that transitions through golden yellow to blue on the crown

All time favorite

My all time favorite.. ❤️ pic.twitter.com/cAZV7eRmWC

— Buitengebieden (@buitengebieden) December 23, 2022

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.