National Photo Co. “Two B&O freights wrecked in head-on crash at Laurel, MD switch” July 31, 1922

The scope of fraud, corruption and manipulation, as carried out throughout the financial industry in the past decade (and beyond), is not only deepening and widening as details become available. A third dimension is also coming to the forefront: the active contribution of regulators like the Bank of England (and undoubtedly other central banks, since, as Tyler Durden says: “there is never just one cockroach”) in enabling fraud in currency markets.

That the latest and strongest suspicion of involvement of the BOE in fraudulent behavior dates back to one particular meeting that took place less than two years ago(!), as the crisis was in its fifth year, and scores of banks had already been bought out and bailed out at the cost of a hefty cluster of trillions of dollars in taxpayer funds, including those banks the BOE aided and abetted in committing their fraud, should serve as a red hot warning sign.

It’s one thing to use the fact that the issues at hand are complicated and time-consuming, as an excuse for lengthy investigations. It’s quite another to be an active and integral part of corruption when such investigations into past crimes are ongoing.

That the process of truth finding is left in the hands of – to quite en extent – Bloomberg is yet another severe indictment against all regulators in and around the world’s financial centers, as well as the governments that nominate and appoint them. The picture that emerges is of a financial world in which people, both bankers and regulators, find it obvious that they are above the law. And why shouldn’t the former think so, when the latter tell them it’s fine to manipulate benchmark rates by conferring with “competitors”? Regulators are supposed to represent the law, and why would a banker attempt to be holier than the Pope?

Durden paints the underlying reasoning at Threadneedle Street for its behavior this way: “Here it comes: “If the BOE did not encourage currency manipulation by bankers, then the world would have crashed”. He’s probably not far off in that characterization. The idea that the whole world will end if your little part of it goes down must be contagious when you think in trillions of dollars on a daily basis. That such an impression justifies breaking the law, and encouraging other to do the same, however, is the proverbial one toke over the line.

And of course it sounds encouraging that NY regulator Benjamin Lawsky and others are diving into the manipulation of foreign currencies and the options and derivatives they come with. But we simply haven’t seen anything so far that has instilled any confidence in either the actions or the integrity of financial regulators anywhere in the world. And certainly in light of the latest revelations, you can be excused for not throwing a party just yet.

Whether it’s Libor, or some other manipulated rate, once there’s reason to believe that central banks and other state-appointed and endorsed regulators have condoned or encouraged criminal behavior on the part of traders, how are you going to prosecute them? Or to put it differently, how are you you going to do that without also prosecuting those you yourself appointed?

The financial world has acquired a whole new odor the past few days. I guess the question is who has the guts to get close enough without being overwhelmed by the foul aroma. The fact that the stench is spread at least in part by those who were put in place to fight it doesn’t make me very hopeful. The financial-political system stinks from all sides.

• BOE Staff Said to Have Condoned Currency Traders’ Conduct (Bloomberg)

Bank of England officials told currency traders it wasn’t improper to share impending customer orders with counterparts at other firms, a practice at the heart of a widening probe into alleged market manipulation, according to a person who has seen notes turned over to regulators. A senior trader gave his notes from a private April 2012 meeting of currency dealers and two central bank staff members to the Financial Conduct Authority about six weeks ago because of mounting media coverage of the investigation.

Traders representing some of the world’s biggest banks told officials at the meeting that they shared information about aggregate orders before currency benchmarks were set, three people with knowledge of the discussion said. The officials said there wasn’t a policy on such communications and that banks should make their own rules, according to the people. The notes could drag the U.K. central bank into another market-rigging scandal two years after it was criticized by lawmakers for failing to act on warnings that Libor was vulnerable to abuse.

If traders can show “they made Bank of England officials aware of practices in the FX market some time ago, then the bank will be at risk of being characterized as having endorsed, by its silence and inaction, the very practices which are now under investigation,” said Simon Hart, a lawyer at RPC LLP in London. [..]

Dealers at the April 2012 meeting with Martin Mallett, the Bank of England’s chief currency dealer, and James O’Connor, who works in its foreign-exchange division, were told not to record the discussion or take notes, one of the people said. One trader wrote down what was said soon after leaving because of concerns spawned by investigations of attempted manipulation of the London interbank offered rate, or Libor, the person said.

Two traders at the meeting — Citigroup’s Rohan Ramchandani and UBSs Niall O’Riordan — are among at least 20 employees of global banks who have been fired, suspended or put on leave since Bloomberg News first reported in June that dealers said they shared information about client orders to manipulate benchmark rates used in the $5 trillion-a-day currency market, the world’s biggest.

Her’s Durden’s comment on the Bloomberg article above.

• Bank Of England Encouraged Currency Manipulation By Banks (Zero Hedge)

Raise your hand if you are surprised that, as has emerged, virtually every major bank was manipulating currencies (and everything else) whether as part of the “Bandits’ Club”, the “Cartel” or some other – until recently- secret message room.

That’s what we thought. Now raise your hand if you thought the manipulation could be so pervasive, so glaring and so in your face, that even the oldest central bank – the Bank of England – and who knows how many other monetary authorities, were openly encouraging traders from these private banks to do more of the illegal activity they had been engaging in – namely manipulating currencies – with their explicit blessing knowing very well such behavior is undisputedly illegal.

We hope at least one or two hands went up, because which it is one thing to be cynical about what is going on behind the scenes, it is something else to see the edifice of global corruption and criminality, whose only purpose was to preserve the status quo, unwinding before your very eyes substantiated by actual facts.

Such as this report by Bloomberg which confirms that yet another conspiracy theory is fact, as at least one central bank has been exposed to not only have known about a criminal activity that is now costing the jobs of hundreds of traders (and should lead to jail time), but to have urged it on.

Bank of England officials told currency traders it wasn’t improper to share impending customer orders with counterparts at other firms, a practice at the heart of a widening probe into alleged market manipulation, according to a person who has seen notes turned over to regulators.

A senior trader gave his notes from a private April 2012 meeting of currency dealers and two central bank staff members to the Financial Conduct Authority about six weeks ago because of mounting media coverage of the investigation, said the person, who asked not to be named while probes are under way.

Traders representing some of the world’s biggest banks told officials at the meeting that they shared information about aggregate orders before currency benchmarks were set, three people with knowledge of the discussion said. The officials said there wasn’t a policy on such communications and that banks should make their own rules, according to the people. The notes could drag the U.K. central bank into another market-rigging scandal two years after it was criticized by lawmakers for failing to act on warnings that Libor was vulnerable to abuse.

If traders can show “they made Bank of England officials aware of practices in the FX market some time ago, then the bank will be at risk of being characterized as having endorsed, by its silence and inaction, the very practices which are now under investigation,” said Simon Hart, a lawyer at RPC LLP in London.

Wait for it, wait for it… Here it comes: “If the BOE did not encourage currency manipulation by bankers, then the world would have crashed” – did we get the excuse that the Bank of England (and soon after, the Fed, the SNB, the BOJ and all other banks as there is never just one cockroach) will use to justify their criminal behavior? Why, of course. [..]

In other news, head FX traders for Goldman, JPMorgan, RBC and Deutsche have resigned in recent weeks, in what are clearly unrelated actions. Maybe they will want to also avoid flying in the coming weeks and months, as the last thing the market needs now are more revelations not only how manipulated everything is, but that the orders for such manipulation originate at the very top of the banker oligarchy.

Alternatively, maybe instead of perpetuating the “fair and efficient markets” lie, the world’s central banks will be kind enough to just let everyone in on where they determine to close what once were “markets” at any given day so that everyone can benefit from a broken and corrupt system, instead of just a few not so good bankers. After all, with everyone profiting from the no risk, guaranteed return market all the time, at least inflation will finally go off the charts.

Here’s a case of betting against your own clients. Or not even betting really, but placing bets against those who pay you to act in their best interest, and then manipulating the wagers as you go along. And now the big bankers say: of course we’ll cooperate, look what terrible things our employees did, we had no idea, we’ll fire them. But what did they themselves know, and will we ever know?

• Foreign-Exchange Probe Widens (WSJ)

Foreign-Exchange Options the Latest Issue to Come Under Scrutiny

A regulatory probe that flamed up in one corner of the vast foreign-exchange market is now engulfing the entire industry. The latest conflagration: concerns about a type of foreign-exchange derivative that is widely used by financial institutions and companies world-wide, according to a person familiar with the matter. Regulators started asking banks last April to hunt for signs their employees were colluding with traders at other banks to manipulate an important exchange-rate benchmark. The investigation has since morphed into a much further-reaching international inquiry that is raising troubling questions for one of the world’s largest financial markets.

In the course of sifting through mountains of documentation, banks have found an array of apparent misconduct, according to people involved with the investigations. The banks’ findings, which they have reported to regulators, include instances of traders sharing sensitive information with clients, passing inappropriate information to rivals at other banks and trading in their personal accounts, these people say. “It’s the banks saying, ‘oh God, look what we’ve uncovered, there’s a whole lot of issues’,” a person familiar with the investigation said.

The result has been swift and widespread: a number of suspensions and firings that are hollowing out the senior ranks of foreign-exchange traders in London and other cities. Foreign-exchange options are the latest issue to come under scrutiny. These contracts, which banks often sell to clients, pay out in the event that exchange rates reach certain levels. They are heavily traded: A notional $337 billion changes hands in the overall FX options market each day, according to the Bank for International Settlements.

Behind the scenes, though, banks often buy or sell currencies aggressively to prevent those levels from being breached, according to traders and banking executives. That may be to the detriment of clients, who would otherwise potentially receive a payment, these industry officials say, although banks see it as a way to protect their cash. Such tactics are commonplace, traders say. One London banking executive described the issue as “huge” and “very complex” and said it recently has been a hot topic of industry discussion in the context of the manipulation investigations.

As part of banks’ internal reviews into their foreign-exchange businesses, some recently have found potential problems with trading involving the options, according to the person familiar with the matter. The banks have reported these issues to the U.K.’s Financial Conduct Authority, which is leading the investigation into possible foreign-exchange manipulation. The agency isn’t specifically investigating the options, but it is keeping its eye on the issue, this person said.

The wide range of apparent foreign-exchange misconduct has stunned industry insiders and prompted a parade of regulators to jump into the fray. The latest came Wednesday, when New York’s banking regulator requested information from more than a dozen global banks.

When its investigation began, the U.K.’s Financial Conduct Authority was largely centered on whether traders were seeking to manipulate the so-called 4 p.m. London fix, a popular benchmark used by money managers and others to value their assets, according to people familiar with that probe. The investigation particularly focused on electronic chat room messages that are a common tool used by traders and their clients.

In all, about 20 traders and bankers including some in New York, London and Tokyo have now been suspended or fired since authorities started to investigate the foreign-exchange markets. In addition, several senior currencies bankers have recently retired or resigned from their positions, including Citigroup’s top currencies banker, two partners at Goldman Sachs who worked in foreign-exchange, and Royal Bank of Canada’s co-head of foreign-exchange spot trading in London. All four employees decisions to leave weren’t linked to the currency-market investigations, according to people familiar with the matter.

In Germany, a subprime fraud case pops up that goes back 8-9 years. That’s how long these things can take, and why the BOE case mentioned above, which dates from April 2012, is so striking.

• LBBW Managers Tried on Subprime Securities Accounting Charges (Bloomberg)

Germany’s third criminal case over failed investments at bailed-out state lenders will start today in Stuttgart as current and former managers and employees of Landesbank Baden-Wuerttemberg go on trial. Seven serving or former management board members and two external auditors from PricewaterhouseCoopers face charges that subprime risks were hidden from the lender’s 2005 and 2006 accounts.

The Stuttgart-based bank invested in asset-backed securities through off-balance-sheet vehicles that should have been accounted for, prosecutors said. The board members “purposely veiled that LBBW in fact controlled the special-purpose vehicles, which had assets and liabilities of more than €6 billion,” prosecutors said in the indictment.

Government bailouts of banks that lost money on risky investments during the financial crisis have prompted criminal investigations across Germany. Former executives of HSH Nordbank, a Hamburg-based lender, are being tried over a collateralized-debt obligation transaction. Another trial started in Munich last week against seven former Bayerische Landesbank executives over a deal that led to €3.7 billion euros ($5 billion) of losses.

LBBW’s owners, which include the state of Baden-Wuerttemberg, the city of Stuttgart and regional savings banks, injected €5 billion of capital and provided a €12 billion lifeline after the lender reported a loss of €2.1 billion in 2008 due to writedowns on the value of securities and credit derivatives.

LBBW’s headquarters and 10 homes were raided in 2009 in the criminal probe. Prosecutors dropped part of the case, into allegations the managers violated their duties by approving some of the ABS transactions, in 2012 and indicted the men for accounting violations. The auditors were charged for signing off on the lender’s accounts. LBBW was audited by PwC in 2005 and 2006.

Ghana has its own versions of forex problems. Capital control will be an increasing phenomenon, as emerging currencies come under more pressure.

• Foreign currency holders threaten to sue banks & Bank of Ghana (CitiFM)

Many commercial banks as well as the Bank of Ghana (BoG) are likely to be hit with a tall list of legal suits following the introduction of new and revised forex rules by the BoG. This is because some holders of foreign currency and exchange accounts have threatened to hurl their banks and the Bank of Ghana to court over the new rules. The revised rules which took effect two days ago, among others, prohibit the issuing of cheques or cheque books in Foreign Currency Accounts (FCA). It also prohibits the withdrawal of not more that 10,000 dollars over the counter.

Holders of foreign accounts will also not be permitted to transfers from one foreign currency denominated account to another and contract loans in foreign currencies. The account holders are challenging the Bank of Ghana’s directive prohibiting the withdrawal of more than 10,000 dollars and the conversion to cedis when they make withdrawals on their dollar accounts. Citi Business News has also gathered individuals and businesses with foreign currency accounts have begun making massive withdrawals from their banks following the introduction of new and revised Forex rules.

A bank official who spoke to Citi Business News said efforts to convince customers to keep their accounts have yielded no positive results. “This will hurt the banking industry we will lose our customers nobody will open a dollar account and will be pleased if you covert it to cedis when they want to make a withdrawal and we are finding it very difficult to calm tempers.”

To the list of executive suicides in the past 2 weeks I would certainly add Tata Motors managing director Karl Slym, 51, who took over in 2012 “as the once red-hot Indian car market was going into a deep descent due to a sharply slowing economy, high fuel prices and surging borrowing costs”. India’s passenger car market, the sixth largest globally, fell 10% in 2013. [..] Tata Motors’ sales in FY13 declined 15.31%. The company’s market share fell to 11.71%, which has declined further to 8.5% at the end of the April-to-December period of FY14.

A 10% drop in India’s car market. Japanese carmakers expect a 10% fall in their domestic market for 2014. European car sales have plummeted the past few years. An industry in trouble.

• 4th Financial Services Executive (+1 COO) Found Dead (Zero Hedge)

The ugly rash of financial services executive suicides appears to have spread once again. Following the jumping deaths of 2 London bankers and a former-Fed economist in the US, The Denver Post reports Richard Talley, founder and CEO of American Title, was found dead in his home from self-inflicted wounds – from a nail-gun. Talley’s company was under investigation from insurance regulators.

Richard Talley, 57, and the company he founded in 2001 were under investigation by state insurance regulators at the time of his death late Tuesday, an agency spokesman confirmed Thursday.

It was unclear how long the investigation had been ongoing or its primary focus.

A coroner’s spokeswoman Thursday said Talley was found in his garage by a family member who called authorities. They said Talley died from seven or eight self-inflicted wounds from a nail gun fired into his torso and head.

Also unclear is whether Talley’s suicide was related to the investigation by the Colorado Division of Insurance, which regulates title companies.

A webchat with Ambrose Evans-Pritchard, never boring.

• Are we entering phase 3 of the Great Financial Crisis? – Webchat – (AEP)

Economic tremors are hitting emerging markets, the US recovery isn’t as strong as we have been led to think and the European Central Bank needs to start QE immediately. These are just a few of the thoughts of Ambrose Evans-Pritchard, the Telegraph’s international business editor, has covered world politics and economics for 30 years, based in Europe, the US, and Latin America.

In the webchat he discussed whether we are reaching another phase in the financial crisis of 2008, which brought the global markets close to collapse and triggered the Great Recession. “Phase 1 was US housing, Phase II EMU debt crisis, Phase III is Asian/China dealing with boom-bust,” he said in the webchat. “Some say US started this. In reality, EMU excesses even worse; China excess worse yet.” Central banks in the US and China are tightening emergency stimulus measures, seemingly without concern about the impact on emerging markets.

In the webchat Ambrose addresses the issue of the US Federal Reserve tapering and believes it should stop until “escape velocity” has been achieved. With the Fed tightening and China tightening it is possible that the world could see an 80pc crash in in flows to emerging markets, he says. “Tremors have already hit emerging markets.” In the eurozone the ECB has brushed aside calls for radical action to head off deflation and relieve pressure on emerging markets. As for the UK: ” The UK is a cork bobbing on a rough sea.”

So what would Ambrose do if he was head of the Bank of England, US Federal Reserve and the European Central Bank for a day? “Stay the course in the UK, freeze tapering in the US until “escape velocity” assured, launch Abenomics for Europe with €2 trillion QE immediately .. force German inflation to 4pc with relish.”

Ambrose has a really different take on yesterday’s German court decision on the Outright Monetary Transactions (OMT) issue. I think they essentially delayed any decision by referring it to the EU court, but Ambrose sees it as the Germans showing their dominance. What matters down the line is timing: how long will it take Europe to reach a verdict, and at what point will Mario Draghi need to use the OMT powers?

• German court parks tank on ECB lawn (AEP)

Germany’s top court has issued a blistering attack on the European Central Bank, arguing that its rescue plan for the euro violates EU treaty law and exceeds the bank’s policy mandate. The tough language leaves it doubtful whether the ECB’s back-stop scheme for Spanish and Italian bonds can be implemented if Europe’s debt crisis blows up again, and greatly complicates any future recourse to quantitative easing if needed to head off Japanese-style deflation.

The German constitutional court refrained from issuing a final ruling on the legality of the plan, known as Outright Monetary Transactions (OMT). It referred the case to the European Court instead, but only after having pre-judged the issue in lacerating terms that effectively bind German institutions. “The Court considers the OMT decision incompatible with primary law,” it said. “This is a massive attack on Europe’s rescue strategy. I do not know whether the markets have understood this yet,” said Clemens Fuest, head of Germany’s ZEW Institute.

Marcel Fratzscher, from Germany’s Institute for Economic Research (DIW), said the judgment kills the OMT for the time being. “I don’t think the ECB can activate the programme as long as the case remains open at the European Court,” he said. “The German Court has parked a tank on the lawn of the ECB,” said one expert closely involved with the case. “The bank’s nuclear weapon is no longer operational, but you could say they bought 18 months of eurozone calm, so the OMT served its purpose.”

The court judgment was shockingly harsh, though it left a possible way out if the OMT is redesigned and greatly limited in scope. “There are important reasons to assume it exceeds the ECB’s monetary policy mandate and thus infringes the powers of the Member States, and that it violates the prohibition of monetary financing of the budget,” said the court. The eight judges said they were “inclined to regard the OMT decision as an Ultra Vires act”, adding that this “creates an obligation of German authorities to refrain from implementing it”.

The verdict is a blow to the ECB’s president Mario Draghi, who unveiled the OMT in July 2012 with his pledge to do “whatever it takes” to save monetary union. The gambit restored faith in Spanish and Italian sovereign debt almost overnight and averted the imminent collapse of EMU, but Mr Draghi was always sailing close to the wind. The ECB insisted on Friday that “the OMT programme falls within its mandate”. One EU official said the Bundesbank is legally obliged to take part in OMT operations if called upon, but admitted that nobody can force it to obey. “If necessary we could still implement the OMT without Germany, but it would not send a good signal,” he said.

Hans Redeker, from Morgan Stanley, said the court – or Verfassungsgericht – had crippled the ECB. “They taken away the ECB’s weaponry, and greatly increased the hurdle for QE. The ECB won’t be able to respond as another wave of deflation hits from Asia, leaving the eurozone a step closer to a Japanese crisis,” he said. Ebrahim Rahbari, from Citigroup, said the surprise decision was a “clear negative” that binds the hands of the ECB. While the European Court may eventually validate the OMT, it cannot deviate far from the German verdict without provoking a political backlash. Udo di Fabio, a former judge at the Verfassungsgericht and author of earlier rulings on the euro, said the court is deliberately fencing in the ECJ, constraining its room for manoeuvre by issuing its own prior judgment.

This is the first time that the Verfassungsgericht has referred a case to the European Court. Contrary to general belief, however, the ECJ is not the higher judicial body. The referral is a courtesy, and in this case a clever political ploy. The Verfassungsgericht ruled in its famous judgment on the Maastricht Treaty in 1993 that it reserves the right to strike down any EU law that breaches the German Grundgesetz or Basic Law. It went even further in its ruling on the Lisbon Treaty in 2009, reminding the EU authorities in acid terms that the sovereign states are the “masters of the EU Treaties” and not the other way around.

It set out limits to EU integration and warned that whole areas of policy “must forever remain German”, adding that Germany must be prepared to “refuse further participation in the European Union” if EU aggrandizement threatens its democracy in any way. Today Europe’s most powerful court dropped another bombshell.

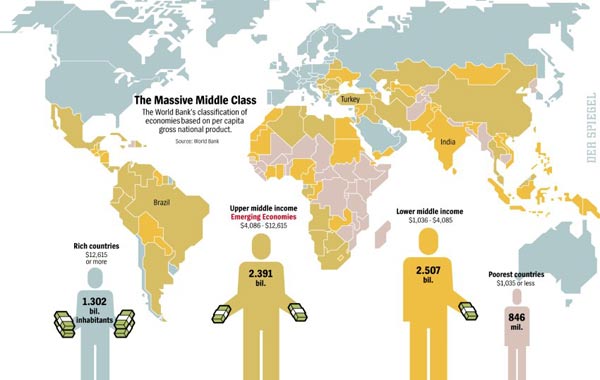

Der Spiegel does its overview of the recent BRICS and EM problems.

• Developing Economies Hit a BRICS Wall (Spiegel)

What has happened? Have the economic climbers reached the end of their tethers or is it merely a temporary slow-down? Some have warned of overreacting, but the development raises questions for the global economy and for the people in those countries where economic success went at least partially hand-in-hand with increased political freedoms and a new self-confidence.

The bad news is quickly mounting. On Tuesday of last week, India’s central bank raised interest rates higher than expected in an effort to get massive inflation under control. That night, Turkey did the same thing, raising its prime lending rate to 10%. Soon thereafter, South Africa followed with an increase of its own. Developing countries have become uneasy and are doing all they can to slow investor flight and the collapse of their currencies.

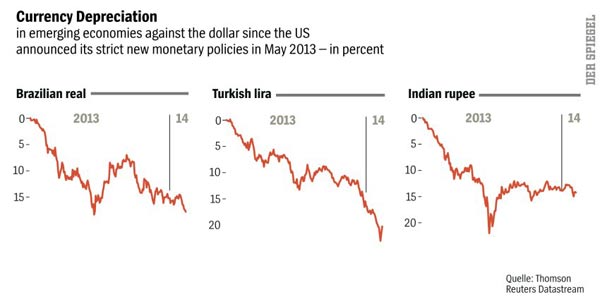

Indeed, it almost seems as though the supposed decline of the West was but an illusion. In recent years, hundreds of billions was invested in the sovereign bonds of developing nations because returns in the established Western markets were comparatively weak. But last May, it took just a few words from then-Federal Reserve head Ben Bernanke to reverse the flow. He hinted that the US central bank could begin pumping less money into the financial system if the American recovery continued. A first wave of investors fleeing the developing world was the result.

It took just half a year before Bernanke made good on his pledge. Now that the Fed has in fact begun to tighten monetary policy, a second wave has begun — and it is nothing short of a tsunami. Increasing numbers of investors have begun pulling out of uncertain markets in the belief that US growth and climbing interest rates are a sure thing. Since Bernanke’s announcement, Brazil’s real, the Turkish lira and the South African rand have lost up to a quarter of their value.

It is an extremely dangerous development for the countries affected, particularly for those that import more than they export like India and Brazil. The gap, after all, must be filled with money from abroad.

Two beautiful charts om environmental topics. Both more than worth a look.

• Data Made Beautiful: Climate and Fracking Water (Bloomberg)

A database of hydraulically fractured wells is overlaid on a map of baseline water stress in the United States. Colors represent water stress, black dots represent hydraulically-fractured wells. Source: WRI Aqueduct Water Risk Atlas

Texas has a lot of fracking resources. Water isn’t one of them. What does Texas’s fracking need most? That’s right: water, and lots of it.

Fracking, or hydraulic fracturing for the ill-humored, is the process of blasting chemical-rich water into the ground to cause tiny fractures from which natural gas can be collected. The technique is at the heart of the U.S. energy boom, which happens to coincide with some of the worst droughts in modern U.S. history.

This week Ceres, a group of data-loving visualizers, superimposed U.S. fracking wells over maps of water stress created by the World Resources Institute. Open the map, click the little circle in the bottom right to expand it to full screen and then zoom in.

Ceres’s analysis found that nearly half the fracked wells (black dots on the map) in the U.S. were in areas with high or extremely high water stress (areas in red). Scary stuff if you live in a water-stressed area. It’s interesting enough just to see those 40,000 wells spread across the country; keep in mind, this is just a sampling of frack wells built since 2011.

Example 3: NASA Does Climate Change

This visualization shows how global temperatures have risen from 1950 through the end of 2013. Source: NASA Goddard

NASA isn’t exactly known for its beautiful visualizations, but… er… Scratch that, NASA is totally known for its beautiful visualizations. You can explore a gallery of NASA projects by clicking here, or you can skip straight to today’s example, “Six Decades of a Warming Earth.”

The title is self-explanatory, as is the video. Simple, to-the-point and recently updated to include 2013 — NASA presents six decades of data in 14 seconds.

This article addresses just one of the many issues discussed in Nicole Foss’ new video presentation, Facing the Future, co-presented with Laurence Boomert and available from the Automatic Earth Store. Get your copy now, be much better prepared for 2014, and support The Automatic Earth in the process!

Home › Forums › Debt Rattle Feb 8 2014: A Third Dimension In Fraud