Unknown Strictly no elephants 1939

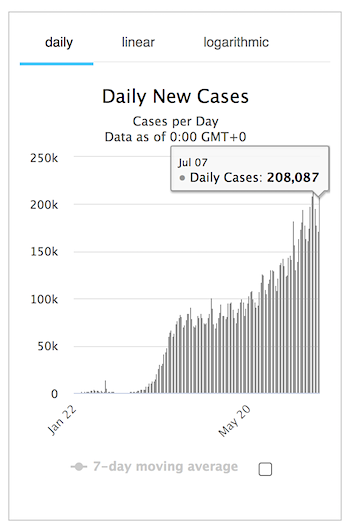

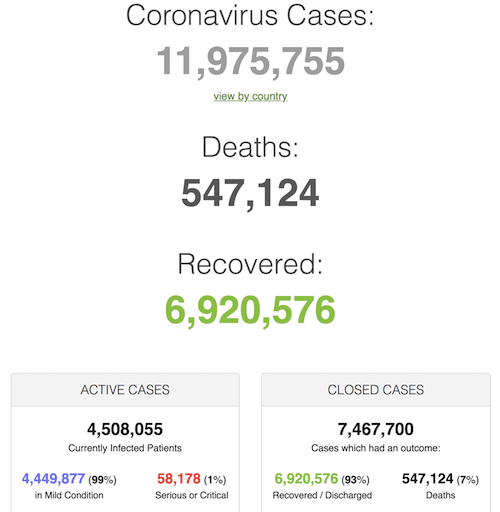

Not much good news on the COVID front. But the reported severe nerve- and brain damage is a new low. We still know very little about COVID19, though many people claim otherwise. Can’t be careful enough.

Yes we are testing more (bottom panel).

But of we were just stickling a swab in every nose that walked through the front door, the percent positive would fall. Instead it is rising (top panel).

This is bigger than more testing, the virus is also increasing/spreading. https://t.co/0aTFqshuM2 pic.twitter.com/ZVV6dX60CL

— Jim Bianco (@biancoresearch) July 8, 2020

Inflammation of nerves and brains. Psychosis, paralysis.

• Serious Brain Disorders In People With Mild Coronavirus Symptoms (G.)

Doctors may be missing signs of serious and potentially fatal brain disorders triggered by coronavirus, as they emerge in mildly affected or recovering patients, scientists have warned. Neurologists are on Wednesday publishing details of more than 40 UK Covid-19 patients whose complications ranged from brain inflammation and delirium to nerve damage and stroke. In some cases, the neurological problem was the patient’s first and main symptom. The cases, published in the journal Brain, revealed a rise in a life-threatening condition called acute disseminated encephalomyelitis (Adem), as the first wave of infections swept through Britain. At UCL’s Institute of Neurology, Adem cases rose from one a month before the pandemic to two or three per week in April and May. One woman, who was 59, died of the complication.

A dozen patients had inflammation of the central nervous system, 10 had brain disease with delirium or psychosis, eight had strokes and a further eight had peripheral nerve problems, mostly diagnosed as Guillain-Barré syndrome, an immune reaction that attacks the nerves and causes paralysis. It is fatal in 5% of cases. “We’re seeing things in the way Covid-19 affects the brain that we haven’t seen before with other viruses,” said Michael Zandi, a senior author on the study and a consultant at the institute and University College London Hospitals NHS foundation trust. “What we’ve seen with some of these Adem patients, and in other patients, is you can have severe neurology, you can be quite sick, but actually have trivial lung disease,” he added.

“Biologically, Adem has some similarities with multiple sclerosis, but it is more severe and usually happens as a one-off. Some patients are left with long-term disability, others can make a good recovery.” The cases add to concerns over the long-term health effects of Covid-19, which have left some patients breathless and fatigued long after they have cleared the virus, and others with numbness, weakness and memory problems. One coronavirus patient described in the paper, a 55-year-old woman with no history of psychiatric illness, began to behave oddly the day after she was discharged from hospital. She repeatedly put her coat on and took it off again and began to hallucinate, reporting that she saw monkeys and lions in her house. She was readmitted to hospital and gradually improved on antipsychotic medication.

Same topic, different take.

• Scientists Warn Of Potential Wave Of COVID-Linked Brain Damage (R.)

Scientists warned on Wednesday of a potential wave of coronavirus-related brain damage as new evidence suggested COVID-19 can lead to severe neurological complications, including inflammation, psychosis and delirium. A study by researchers at University College London (UCL) described 43 cases of patients with COVID-19 who suffered either temporary brain dysfunction, strokes, nerve damage or other serious brain effects. The research adds to recent studies which also found the disease can damage the brain. “Whether we will see an epidemic on a large scale of brain damage linked to the pandemic – perhaps similar to the encephalitis lethargica outbreak in the 1920s and 1930s after the 1918 influenza pandemic – remains to be seen,” said Michael Zandi, from UCL’s Institute of Neurology, who co-led the study.

COVID-19, the disease caused by the new coronavirus, is largely a respiratory illness that affects the lungs, but neuroscientists and specialist brain doctors say emerging evidence of its impact on the brain is concerning. “My worry is that we have millions of people with COVID-19 now. And if in a year’s time we have 10 million recovered people, and those people have cognitive deficits … then that’s going to affect their ability to work and their ability to go about activities of daily living,” Adrian Owen, a neuroscientist at Western University in Canada, told Reuters in an interview.

In the UCL study, published in the journal Brain, nine patients who had brain inflammation were diagnosed with a rare condition called acute disseminated encephalomyelitis (ADEM) which is more usually seen in children and can be triggered by viral infections. The team said it would normally see about one adult patient with ADEM per month at their specialist London clinic, but this had risen to at least one a week during the study period, something they described as “a concerning increase”. “Given that the disease has only been around for a matter of months, we might not yet know what long-term damage COVID-19 can cause,” said Ross Paterson, who co-led the study. “Doctors need to be aware of possible neurological effects, as early diagnosis can improve patient outcomes.”

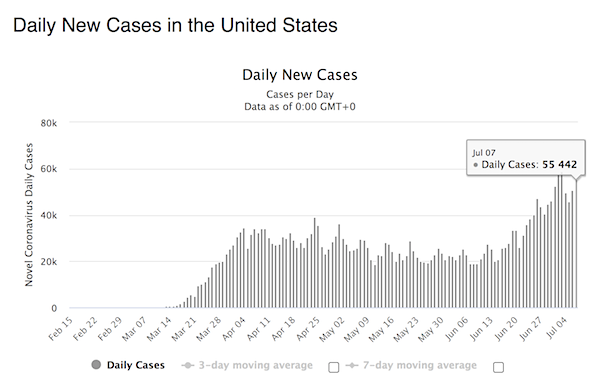

10,000 new cases per day is a lot for one state.

• Dozens Of Florida Hospitals Out Of Available ICU Beds (R.)

More than four dozen hospitals in Florida reported that their intensive care units (ICUs) have reached full capacity on Tuesday as COVID-19 cases surge in the state and throughout the country. Hospital ICUs were full at 54 hospitals across 25 of Florida’s 67 counties, according to data published on Tuesday morning by the state’s Agency for Health Care Administration. More than 300 hospitals were included in the report, but not all had adult ICUs. Thirty hospitals reported that their ICUs were more than 90% full. Statewide, only 17% of the total 6,010 adult ICU beds were available on Tuesday, down from 20% three days ago, according to the agency’s website.

Florida’s coronavirus cases have soared in the last month, with the state’s daily count topping 10,000 three times in the last week. The death rate from COVID-19 rose nearly 19% in the last week from the week prior, bringing the state’s death toll to more than 3,800. All ICU beds are filled at the three hospitals in Clay County, where the population is around 220,000. Florida Governor Ron Desantis on Monday encouraged state residents to seek care at hospitals if needed, citing concerns that people with life-threatening conditions other than COVID-19 had avoided hospitals earlier in the pandemic to the detriment of their health.

New highs in COVID-19 hopitalizations today in Texas (9,286), California (7,499), Arizona (3,356), & Georgia (2,096). Florida still not reporting this data but expected to be at new highs as well.

Texas hospitalizations are now about half of New York’s April 13 Peak (18,825). pic.twitter.com/saT4wBOUE2

— Charlie Bilello (@charliebilello) July 8, 2020

Different takes on asymptomatic cases emerging.

• Majority Testing Positive Have No Symptoms (BBC)

Only 22% of people testing positive for coronavirus reported having symptoms on the day of their test, according to the Office for National Statistics. This hammers home the role of people who aren’t aware they’re carrying the virus in spreading it onwards. Health and social care staff appeared to be more likely to test positive. This comes as deaths from all causes in the UK fell to below the average for the second week in a row. Between the end of March and June, there were 59,000 more deaths than the five-year average. Meanwhile, the UK government’s daily figures released on Tuesday showed another 155 people have died after testing positive for the virus. This takes the total number of deaths to 44,391.

It comes after 16 new deaths were reported on Monday, but there are often reporting lags over the weekend. While the ONS survey includes relatively small numbers of positive swab tests (120 infections in all) making it hard to make any strong conclusions about who is most likely to be infected, there are some patterns coming through in the data: • Those in people-facing health or social care roles, and working outside their homes in general, were more likely to have a positive test. • People from ethnic minority backgrounds were more likely to have a positive antibody test, suggesting a past infection. • White people were the least likely proportionally to test positive for antibodies. • There was also some evidence that people living in larger households were more likely to test positive than those in smaller households.

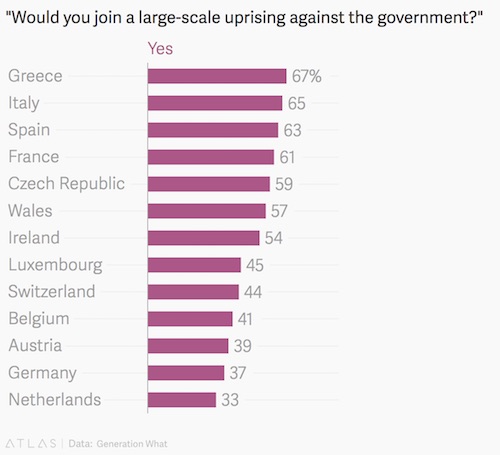

Looks like Greece may very soon have to choose between closing its borders or locking down its own people again.

• Stanford’ Ioannidis Says Greece Needs More Aggressive COVID Testing (GR)

After Greece’s opening up to travelers from much of the rest of the world on July 1, the nation has seen a troubling trend in the increasing numbers of coronavirus infections. Currently, as of today, 27 new COVID cases were diagnosed in Greece in the past 24 hours — and 14 of these are tourists. Speaking to Greek Reporter, the noted medical professor Dr. John Ioannidis of Stanford University, an expert in the field of epidemiology, questions the somewhat lax attitude Greece has taken, with its use of an algorithm arrived at by answers on a questionnaire and random testing of arrivals.

“I think it would be useful to require more aggressive (perhaps universal) testing for tourists coming from countries that have low testing rates. Most of these countries make small contributions to the Greek tourism budget anyhow, so one is risking the emergence of an epidemic wave without much tangible financial benefit.” The epidemiologist states “I understand that Greece desperately needs tourism funds, since tourism is responsible for about 20% of the GDP. The Greek and the European COVID task forces include capable scientists and I trust they have put a lot of thought on how to reopen the country to tourism. It is not an easy situation.

“Determining which country is eligible for allowing tourists from is difficult and our knowledge base is incomplete. I just want to caution that it is potentially misleading to base this decision on the number of cases that continue being detected in each country. Countries that deal seriously with coronavirus do more testing and come up with more detected cases. Conversely, countries that do little testing will find few cases, but this does not mean that coronavirus does not exist there.”

“Serbia is one example worth discussing, since 20 of the 36 tourist cases today were from there. In that country, the number of cases looked pretty low, but this was simply because relatively little testing was done. With only 11,000 cases detected in Serbia until the end of May, it is likely that the true number exceeded 200,000. Moreover, apparently there were substantial residual foci of epidemic activity. However, I think this is a problem that may be pertinent to Balkan countries in general. Testing in other Balkan countries is even less frequent than Serbia on a population basis.

Keep your focus on Sidney Powell and Obama.

• Is Strzok Memo the Rosetta Stone of Obamagate? (RCP)

It doesn’t seem to matter to the mainstream media that evidence has mounted into the stratosphere that Trump has been right all along about his campaign being illegally surveilled by the Obama administration. It doesn’t matter that Trump survived a two-plus year investigation by a special counsel and was cleared of any kind of collusion with the Russians. The Democrats and their agents in the Deep State know that whatever they do to harass Trump will be treated as noble and patriotic by the corrupt media, and that whenever evidence surfaces of their criminal behavior it will be promptly buried again.

Which brings us to the infamous handwritten notes by disgraced FBI agent Peter Strzok about a White House meeting that surfaced in a recent filing in the Flynn case. Strzok had already earned a prominent place in the “Wish I Hadn’t Done That” Hall of Fame for his serial confession via text message of not just marital infidelity but also constitutional perfidy. But the half-page of notes released by Flynn’s defense team rises to the level of a history-altering “Oops!” Indeed, it could well be the Rosetta stone that allows us to penetrate the secrets of the anti-Trump conspiracy that stretched from the FBI to the CIA, the Justice Department and the White House.

What we know about the provenance of the notes comes from Flynn’s attorney Sidney Powell, who said they were written by Strzok about a meeting that took place on Jan. 4, 2017. The only problem is that the cast of characters in the memo duplicates those who were in attendance at the White House on Jan. 5, 2017, to discuss how the Obama administration should proceed in its dealings with Flynn, who was accused of playing footsie with Russian Ambassador Sergey Kislyak prior to assuming his official role as national security adviser. Attorney General William Barr has gone on the record (on the “Verdict With Ted Cruz” podcast) that the notes actually describe the Jan. 5 meeting.

If so, the notes strongly contradict Susan Rice’s CYA “memo to self” where the Obama national security adviser recounts the Jan. 5 meeting and stresses three times that President Obama and his team were handling the Flynn investigation “by the book.” Methinks the lady doth protest too much, especially now that we have Strzok’s contemporaneous notes to contradict her memo, which suspiciously was written in the final minutes of the Obama administration as Donald Trump was being sworn in at the Capitol.

From what we can tell, Strzok (unlike Rice) was not writing his memo to protect anyone. He seems to have merely jotted down some notes about what various participants in the meeting said, including President Obama, Vice President Joe Biden, Rice, Deputy Attorney General Sally Yates and Strzok’s boss — FBI Director James Comey. Chances are, at this point Strzok had no idea his dirty laundry was going to be aired or that his role as a master of the universe was going to be toppled.

That settlement makes me think of the one Epstein got, one of those “everything included” deals that make you wonder how legal they can be.

• US Judge Says “Tentatively Inclined” To Reject Bayer’s Monsanto Settlement (ZH)

As the EU’s antitrust regulator announces another round of sweeping antitrust investigations into the big US tech behemoths. an American judge is apparently making noises about throwing out a major settlement involving German multinational pharma conglomerate Bayer. According to the settlement, which we reported on a few weeks ago when it was first announced, Bayer had agreed to pay $10 billion to settle thousands of lawsuits brought against it over its purchase of Monsanto, the American agrichemical giant that’s best known for producing Roundup weed killer. The lawsuits stemmed from evidence that glyphosate, one of the primary ingredients of Monsanto’s Roundup, is actually carcinogenic.

Which means that by marketing Roundup into ubiquity, even pairing it with genetically modified crop seeds allowing farmers to spray the stuff then simply forget about it since it wouldn’t harm the crops. A landmark California Court ruling handed down in 2017 found Bayer liable for the plaintiffs’ cancers, since it now owned Monsanto. The mountain of litigation has weighed on Bayer’s share price ever since, making the Monsanto acquisition one of the biggest blunders in the history of the storied German firm. The two sides have been in negotiations virtually ever since, until two weeks ago, when a majority of the plaintiffs agreed to a $10 billion settlement.

BBG News: “U.S. District Judge Vince Chhabria wrote in a court filing Monday that a proposed system for dealing with future lawsuits over the herbicide is problematic. Shares of Bayer, which inherited the weedkiller through its purchase of Monsanto, fell as much as 6.9% in Frankfurt, the most intraday since March 23. The judge’s misgivings center on a plan to create a class of future claims as part of the nearly $11 billion settlement. Any change to that portion of the proposal wouldn’t necessarily affect the rest of the deal, in which the company agreed to resolve about 125,000 existing lawsuits. About 30,000 claims, contending that Roundup caused non-Hodgkin’s lymphoma, are not yet subject to deals between plaintiffs and Bayer. Some U.S. plaintiffs’ lawyers are vowing to file another wave of new suits that could add tens of thousands to that total.“

America at its ugliest.

• Purdue Pharma Made Political Contributions After Going Bankrupt (IC)

Last september, Purdue Pharma filed for bankruptcy after several cities sued the company for its role in creating the opioid crisis. By going bankrupt, it was able to get all litigation stayed; family members of the over 500,000 victims of the opioid crisis are now just creditors in the bankruptcy. The Sackler family — including Jonathan Sackler, a co-owner of Purdue who died Monday — made off with over $10 billion in company funds. Meanwhile, in December, the Democratic Attorneys General Association accepted $25,000 in donations from the company, according to data collected by Political MoneyLine. Several members of the Association are leading the litigation against Purdue.

In January, the Democratic Governors Association, headed by New Jersey Gov. Phil Murphy, accepted $50,000 from Purdue Pharma, as did the Republican Governors Association, headed by Texas Gov. Greg Abbott. Those donations come as states, including New Jersey, California, Delaware, Iowa, Kentucky, Maine, Massachusetts, Montana, Tennessee, and Vermont, are considering excise taxes on prescription opioids — which would be approved and implemented by governors. While Purdue is not publicly traded and as a result does not have to disclose risk factors to investors, close allies of Purdue, including the Healthcare Distribution Alliance and the lobbying group Pharmaceutical Research and Manufacturers of America, or PhRMA, have vocally opposed the taxes.

Fellow pharmaceutical companies Mallinckrodt and Endo International have raised concerns that the taxes could materially affect their bottom line in SEC disclosures. To date just five states — New York, Minnesota, Rhode Island, Maine, and Delaware — have implemented an opioid tax or fee. Adam Levitin, a bankruptcy law professor at Georgetown University, called the donations “astonishing.” “Given the politics of the case, there’s something incredibly brazen about this, such that I’m shocked that Purdue didn’t seek court approval,” Levitin said of the DAGA donation. “That they would give to the Dem AGs, but not the GOP AGs is really problematic given that the most aggressive AGs have been Dems.”

Simple solution: don’t use TikTok.

• Apple Suddenly Catches TikTok Secretly Spying On Millions Of iPhone Users (F.)

As I reported on June 23, Apple has fixed a serious problem in iOS 14, due in the fall, where apps can secretly access the clipboard on users’ devices. Once the new OS is released, users will be warned whenever an app reads the last thing copied to the clipboard. As I warned earlier this year, this is more than a theoretical risk for users, with countless apps already caught abusing their privacy in this way. Worryingly, one of the apps caught snooping by security researchers Talal Haj Bakry and Tommy Mysk was China’s TikTok. Given other security concerns raised about the app, as well as broader worries given its Chinese origins, this became a headline issue. At the time, TikTok owner Bytedance told me the problem related to the use of an outdated Google advertising SDK that was being replaced.

Well, maybe not. With the release of the new clipboard warning in the beta version of iOS 14, now with developers, TikTok seems to have been caught abusing the clipboard in a quite extraordinary way. So it seems that TikTok didn’t stop this invasive practice back in April as promised after all. According to TikTok, the issue is now “triggered by a feature designed to identify repetitive, spammy behavior,” and has told me that it has “already submitted an updated version of the app to the App Store removing the anti-spam feature to eliminate any potential confusion.” In other words: We’ve been caught doing something we shouldn’t, we’ve rushed out a fix. TikTok also told me that the platform “is committed to protecting users’ privacy and being transparent about how our app works.” No comment on that one. TikTok added that it “looks forward to welcoming outside experts to our Transparency Center later this year.”

All US sports teams need to be renamed.

• Madness of Political Correctness (Pelerin)

The madness of political correctness is mocked in this e-mail sent to Clarence Page of the Chicago Tribune after an article he published concerning a name change for the Washington Redskins. The author is unknown but perceptive, clever and sarcastic:. Dear Mr. Page: I agree with our Native American population. I am highly jilted by the racially charged name of the Washington Redskins. One might argue that to name a professional football team after Native Americans would exalt them as fine warriors, but nay, nay. We must be careful not to offend, and in the spirit of political correctness and courtesy, we must move forward. Let’s ditch the Kansas City Chiefs, the Atlanta Braves and the Cleveland Indians. If your shorts are in a wad because of the reference the name Redskins makes to skin color, then we need to get rid of the Cleveland Browns. The Carolina Panthers obviously were named to keep the memory of militant Blacks from the 60’s alive. Gone. It’s offensive to us white folk.

The New York Yankees offend the Southern population. Do you see a team named for the Confederacy? No! There is no room for any reference to that tragic war that cost this country so many young men’s lives. I am also offended by the blatant references to the Catholic religion among our sports team names. Totally inappropriate to have the New Orleans Saints, the Los Angeles Angels or the San Diego Padres. Then there are the team names that glorify criminals who raped and pillaged. We are talking about the horrible Oakland Raiders, the Minnesota Vikings, the Tampa Bay Buccaneers and the Pittsburgh Pirates! Now, let us address those teams that clearly send the wrong message to our children. The San Diego Chargers promote irresponsible fighting or even spending habits. Wrong message to our children.

The New York Giants and the San Francisco Giants promote obesity, a growing childhood epidemic. Wrong message to our children. The Cincinnati Reds promote downers/barbiturates. Wrong message to our children. The Milwaukee Brewers. Well that goes without saying. Wrong message to our children. So, there you go. We need to support any legislation that comes out to rectify this travesty, because the government will likely become involved with this issue, as they should. Just the kind of thing the do-nothing Congress loves. As a die-hard Oregon State fan, my wife and I, with all of this in mind, suggest it might also make some sense to change the name of the Oregon State women’s athletic teams to something other than “the Beavers” (especially when they play Southern California). Do we really want the Trojans sticking it to the Beavers? I always love your articles and I generally agree with them. As for the Redskins name, I would suggest they change the name to the “Foreskins” to better represent their community, paying tribute to the dick heads in Washington DC.

Apparently the prison in Brooklyn is a horror.

• Ghislaine Maxwell Arraignment Scheduled For July 14 (R.)

Ghislaine Maxwell, the former associate of Jeffrey Epstein, will be arraigned on July 14 on charges of luring underage girls so that the financier, now dead, could abuse them, according to a court order issued Tuesday evening. Judge Alison Nathan in Manhattan federal court said a bail hearing would be held at 1 pm EST that day via video conference. Maxwell, 58, arrived at the federal Metropolitan Detention Center (MDC) in Brooklyn on Monday. She was arrested on July 2 at a mansion in New Hampshire, where investigators said she had been lying low. Prosecutors said Maxwell groomed girls so Epstein abuse them at lavish homes in Palm Beach, Florida; New Mexico and Manhattan.

Epstein was awaiting trial on federal charges of trafficking minors between 2002 and 2005 when he was found hanged in a federal facility in Manhattan in August. Medical examiners concluded his death was a suicide. Nathan said on Tuesday that to optimize video quality, only the judge, Maxwell, her lawyer and a prosecutor would appear on video at the hearing. The judge said others could access audio of the hearing by telephone. Maxwell faces up to 35 years in prison.

It was always about blackmail. But how useful is that to her at this point?

• Ghislaine Maxwell ‘Has Secret Stash Of Epstein Sex Tapes’ (DM)

Ghislaine Maxwell has a secret stash of Jeffrey Epstein’s twisted sex tapes and will use the footage as an insurance policy to save herself, a former friend exclusively revealed to DailyMail.com. Maxwell, 58, was arrested at her hideout in Bradford, New Hampshire last Thursday. She was charged with six federal crimes, including enticement of minors, sex trafficking and perjury. The British socialite was arguably Epstein’s closest friend and she is alleged to have acted as his madam, accused of securing underage girls for the multi-millionaire, who reportedly kept evidence of his perverted sex acts against the minors. When officials raided Epstein’s Manhattan townhouse after his arrest last July, they found thousands of graphic photos that included images of underage girls and a safe filled with compact discs labeled ‘nude girls’, according to authorities.

Maxwell’s former friend explained: ‘Ghislaine has always been as cunning as they come. She wasn’t going to be with Epstein all those years and not have some insurance. ‘The secret stash of sex tapes I believe Ghislaine has squirreled away could end up being her get out of jail card if the authorities are willing to trade. She has copies of everything Epstein had. They could implicate some twisted movers and shakers.’ They added: ‘If Ghislaine goes down, she’s going to take the whole damn lot of them with her.’ The former friend continued: ‘Not only did Epstein like to capture himself with underage girls on camera – he wanted to make sure he had something to hold over the rich and powerful men who took advantage of his sick largesse.’

‘I’ll bet anything that once it comes out that Ghislaine has those tapes these men will be quaking in their Italian leather boots. ‘Ghislaine made sure that she socked away thumb drives of it all. She knows where all the bodies are buried and she’ll use whatever she had to save her own a**.’ The day after Epstein’s suicide last August, the New York Times published an account by journalist James B. Stewart who had interviewed Epstein in August 2018. In the course of their conversation, Epstein told Stewart he had filed away dirt on his famous house guests, ‘some of it potentially damaging or embarrassing, including details about their supposed sexual proclivities and recreational drug use’. Maxwell’s next court appearance is on Friday in New York. She is currently being held without bail.

We try to run the Automatic Earth on donations. Since their revenue has collapsed, ads no longer pay for all you read, and your support is now an integral part of the interaction.

Thank you.

Support the Automatic Earth in virustime.