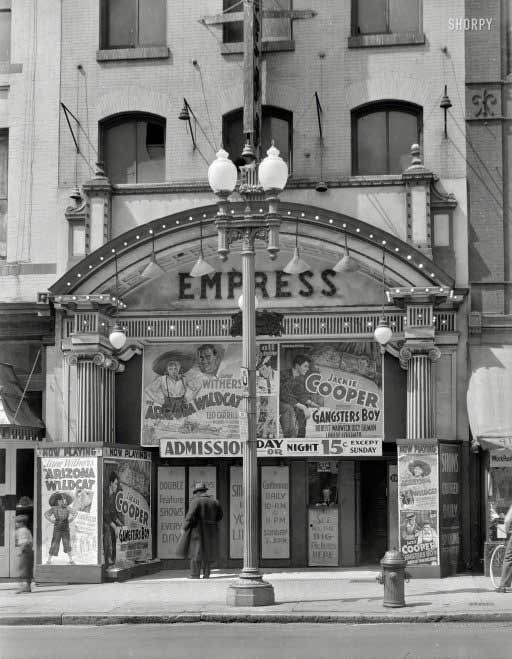

Walker Evans Air 1930s

“..many consumers in the survey also said they’re spending up to 40% of their income on discretionary purchases such as entertainment, leisure, hobbies and travel. And a quarter said they are prone to “excessive” and “frivolous” spending.”

• 40% of Americans Spend Up To Half Of Their Income Servicing Debt (MW)

Americans are struggling to get out of the red. Some 40% of Americans with debt are spending up to half of their monthly income paying it back. And that may not even be enough to cover how much they owe. That’s according to a study on debt Thursday released by Northwestern Mutual, a life insurance and financial services company. The polling company Harris Poll surveyed more than 2,000 U.S. adults in February 2017 on behalf of Northwestern Mutual. The survey found that nearly half of Americans are carrying at least $25,000 in debt, with an average debt of $37,000, excluding mortgage payments. About one in 10 surveyed said their debt was more than $100,000. “It becomes an ongoing cycle and really hard to get out of, given that people are not prioritizing debt and saving for their future as the first part of their budget,” Rebekah Barsch at Northwestern Mutual said.

Debts that are investments in the future, including mortgages and student loans, can be beneficial in consumers’ long-term financial plans, Barsch added. But many consumers in the survey also said they’re spending up to 40% of their income on discretionary purchases such as entertainment, leisure, hobbies and travel. And a quarter said they are prone to “excessive” and “frivolous” spending. Previous studies have shown similar results. The Federal Reserve announced in early April that collective American credit-card debt had hit $1 trillion. And total household debt, including mortgages, auto loans, credit card debt and student loans, had hit nearly $12.6 trillion. Housing-related debt is down nearly $1 trillion since its 2008 peak, but auto loan balances are $367 billion higher since then and student loans are $671 billion higher, the Fed found.

Mortgages made up 67% of the debt total in 2016. As a result, about 21% of Americans aren’t saving any of their income, according to an April survey from personal finance site Bankrate.com. When asked why they aren’t saving more, 38% of people said they had too many expenses, about 16% said they simply “hadn’t gotten around to” saving, 16% said they didn’t have a good enough job and 13% said they were struggling with debt. The amount each individual or family should put toward their debt is different, Barsch said. She recommended automatically allocating the largest percentage of one’s paycheck possible to high-interest debt and putting discretionary spending at the bottom of the priority list.

Same study, slightly different angle.

• Are American Debt Slaves Getting in Trouble Again? (WS)

American consumers are holding $1 trillion in revolving credit, mostly in credit card debt. So how well is this segment of consumer debt holding up? Synchrony Financial – GE’s spin-off that issues credit cards for Walmart and Amazon – disclosed on Friday that, despite assurances to the contrary just three months ago, net charge-off would rise to at least 5% this year. Its shares plunged 16% and are down 27% year-to-date. Credit-card specialist Capital One disclosed in its Q1 earnings report last week that provisions for credit losses rose to $2 billion, with net charge-offs jumping 28% year-over-year to $1.5 billion.

Synchrony, Capital One, and Discover – a gauge of how well over-indebted consumers are managing to hang on – have together increased their Q1 provisions for bad loans by 36% year-over-year. So this is happening. Other worries about consumer debt in the US are piling up. The $1.4 trillion in student loans are already in crisis, though the government backs them, and they cannot be charged off in bankruptcy. Mortgage debt is still hanging in there, given the surge in home prices that make defaults unlikely. But of the $1.1 trillion in auto loans, subprime loans packaged into asset backed securities are getting crushed by net charge-off rates that are worse than during the Financial Crisis.

The US economy is fueled by credit. Americans turning themselves into debt slaves makes it tick. Take it away, and what little growth there is – nearly zero in the first quarter – will dissipate into ambient air altogether. So it’s time to take the pulse of our American debt slaves In a new study, life insurer and financial services provider Northwestern Mutual found that 45% of Americans that have debt spend “up to half of their monthly income on debt repayment.” Those are the true debt slaves. Excluding mortgage debt, American carry an average debt of $37,000. Of them, 47% carry $25,000 or more, and more than 10% carry $100,000 or more in debt, excluding mortgage debt. Most of them expect to get out of debt before they die, but 14% expect to be in debt “for the rest of their lives.”

This debt adds stress. About 40% said that debt has a “substantial” or “moderate” impact on their financial security; and about as many consider debt a “high” or “moderate” source of anxiety. Given the rising defaults, this is likely to get worse. And what changes would most positively affect their financial situations? The top two: earning more money (29%) and getting rid of debt (26%). Alas, those two, for many people, are precisely the most elusive factors in the current economy. But there is a lot of irony in how Americans look at debt. The study asked them what they would do with a $2,000 windfall: 40% said they’d pay down debt. And this is the irony: they’d pay down their maxed out credit cards, but a few months later, their credit cards would be maxed out again, and thus that $2,000 would be consumed. Because the money always has to get spent.

Just in time for recess?!

• Congress Agrees $1 Trillion Budget Deal – But No Money For Border Wall (G.)

Negotiators have reached a bipartisan agreement on a spending package to keep the US federal government funded until the end of September, according to congressional aides. The House of Representatives and Senate must approve the deal before the end of Friday and send it to the president, Donald Trump, for his signature to avoid the first government shutdown since 2013. Congress is expected to vote early this week on the agreement that is likely to include increases for defense spending and border security. No money will be allocated for Trump’s pet project of a border wall with Mexico after he bowed to Democratic resistance to the plan. However, the deal will allocate an additional $1.5bn for border security, which one congressional aide described as “the most robust border security increase in roughly a decade”, and there was no language in the bill preventing Mexico from paying for the wall if it so desired.

A senior congressional aide told the Guardian that the deal increased defense spending by $12.5bn, with the possibility of $2.5bn more contingent on the White House presenting an anti-Isis plan to Congress. Trump had requested $30bn in increased defense spending. Democrats were pushing to protect funding for women’s healthcare provider Planned Parenthood and sought additional Medicaid money to help the poor in Puerto Rico get healthcare. Both of those goals were achieved. According to a senior congressional aide, the deal also protects other important Democratic priorities. The EPA’s budget is at 99% of current levels and includes increased infrastructure spending as well.

Stockman won’t let go.

• Trump Tax Plan ‘Dead On Arrival’, Wall Street ‘Delusional’ – Stockman (CNBC)

David Stockman has a stern message for investors: They’re living in a fantasy land about Trump. In a recent interview on CNBC’s “Futures Now,” the former director of the Office of Management and Budget under President Reagan said that “Wall Street is totally misreading Washington,” and President Trump’s promises of tax reform will be “dead before arrival.” The president is “essentially a 70-year old kid in a candy store who wants one of everything: More for defense, veterans, border walls, law enforcement, infrastructure and ‘phenomenal’ tax cuts, too—without the inconvenience of paying for any of it,” said Stockman. Of the proposed tax bill announced this week, he said, “It’s a wonderful fantasy…but there’s no way to pay for the $7.5 trillion cost of the main features.”

The White House announced a one-page tax reform plan on Wednesday, and some of the points Stockman highlighted include: Three tax brackets, double standard deduction and the reduction of corporate and non-corporate business taxes down to 15%. In a research note this week, Goldman Sachs pegged the cost of the tax plan to just under $5 trillion, when factoring in key changes such as repealing of the state and local tax, and a 35% top marginal rate instead of 33%. Goldman analysts expect the tax bill is “fairly likely” to become law, but warned progress could be slow. “I like [the tax plan] but you have to pay for it either with a new tax like the border adjustment tax, which is dead, or spending cuts which Trump has ruled off the table,” Stockman explained.

“What you have down there is a total fiscal calamity that is going to basically dominate Washington.” Stockman expects a “constant fiscal crisis and stalemate” in D.C., which will ultimately delay the “good stuff,” like a tax cut, from ever happening. Of Trump’s first 100 days in office, Stockman again referred to the White House as a “pop up store giving out candy before the 100th day to say they’ve accomplished something.” Adding, “this isn’t a serious plan, it can’t be done. And I think it’s only indicative of the huge trouble that’s brewing down there in the beltway.” [..] “I don’t know what the stock market is thinking but if they have faith in a giant fiscal stimulus and tax cut then it’s a delusional faith that’s going to be badly disappointed and I think fairly soon,” he added.”

Suzuki -he’s 80 already?!- always got this.

• Economics Is A Form Of Brain Damage (RWE)

Environmentalist David Suzuki hits the nail on the head. The number of ways that economic theory systematically blinds you to the realities of the world we live in is almost uncountable. When Henry George’s land tax became widely popular, economists “disappeared” land as a factor of production from economic theories, merging it illegitimately with capital. Money is made to “disappear” by using the quantity theory of money to claim that money is veil. This makes it impossible to understand how the mechanisms of creation of money ensure that the wealthy can get rich at the expense of the rest of us.

The parasitical nature of the finance industry has been covered up by the idea of “wealth creation” — when wild speculation doubles the price of stocks, financiers have created wealth, which is a socially valuable activity, instead of a fraud and deception. The ideas of cut-throat competition, survival of fittest, and social darwinism have been used to justify a large number of free market activities which harm the masses to make profits for the wealthy. There is no doubt that believing all of the textbook economic theories leads to serious brain damage, as I myself have experienced — the process of unlearning has been slow and painful. Here is the 2 minute video by David Suzuki:

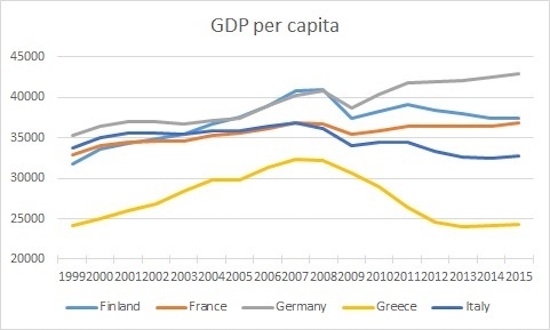

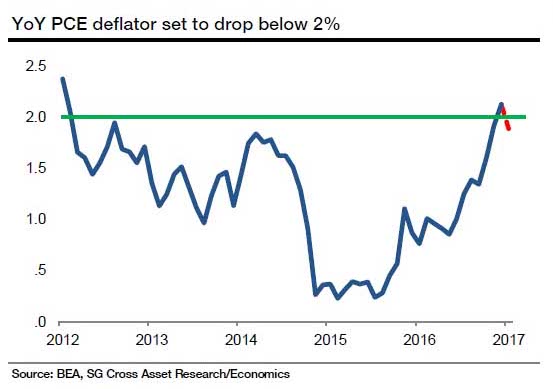

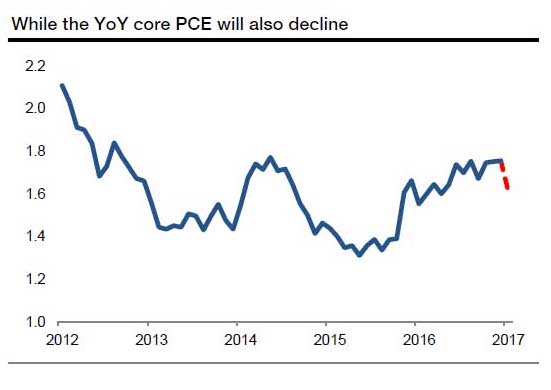

If you can’t properly define inflation, how could you possibly get this right? Inflation is a meaningless concept if you don’t take into account money velocity. And with falling money velocity because of maxed-out consumers, you will never get reflation.

• Why The Reflation Trade Is About To Fizzle (ZH)

As SocGen writes in previewing tomorrow’s Headline and Core PCE deflators numbers, after spending nearly five years missing to the downside on the inflation target, the Fed finally achieved its goal as the yoy headline PCE deflator hit 2.1% in February. Unfortunately, Fed officials cannot take a victory lap, because they will be right back to missing the target again when the March figures are released. The data in hand from the PPI and CPI suggest that the headline PCE deflator likely fell by 0.164% in March, which would result in the yoy rate falling from 2.1% to 1.9% (1.885% un-rounded).

Energy prices – now virtually unchanged from a year ago – in the CPI fell by 3.2% last month, and these likely flowed through into the PCE as well. However, given the smaller weight of energy in the PCE gauge, the drop in energy prices will result in a smaller drag on the headline PCE index (almost a tenth less than in the CPI). Meanwhile, the CPI’s food index increased by 0.34% in March (that being said, the PCE food index is broader, and the food indexes in the PCE not present in the CPI have been a bit volatile of late). So aside from anniversarying the unchanged Y/Y base effect, here is what else SocGen expects from tomorrow’s anti-reflationary PCE prints: the core PCE deflator looks to have declined by 0.1% in March (-0.072% un-rounded). A reading in line with our forecast would lead the yoy core rate to fall from 1.8% in February to 1.6% in March, which would be the weakest print in nine months.

It’s not just energy however: recall that one of the biggest drivers behind the CPI miss earlier this month was the sharp drop in wireless telecom services in the CPI, which will now flow into the PCE and subtract around 0.075 percentage points (pp) from the monthly change in the core PCE (which is less than the 0.15 pp drag in the core CPI given the lower weight of this index in the core PCE). In other words, the core PCE would have been flat if not for the wireless telecom services index. Offsetting some of this drag will be a positive contribution from health care. Data from the PPI suggests that the health care index may have advanced by around 0.2% last month, marking its biggest rise in five months. Data within the Q1 GDP report suggests that the gain may be closer to 0.3% in March. In any case, core services prices in March look to have been essentially unchanged, while core goods prices may have fallen by 0.3%.

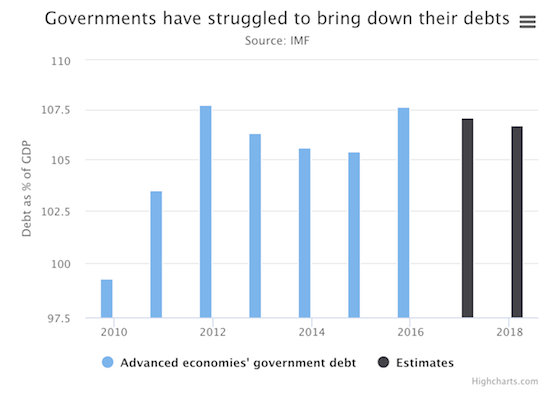

The central banks have trapped themselves and will seek to make you pay for it. Expect a lot of “economic growth will fix it all” comments. But it won’t, we spend $10 to get $1 of growth already.

• If Rates Ever Rise Above 3.5% “It Would Spark Massive Defaults” (ZH)

Earlier today in his weekly note, One River CIO Eric Peters explained that in their attempt to overturn the natural order of the global economic “ecosystem”, what central banks have done is “stunning, unprecedented… and arrogant”, and as a result it is only a matter of time before another “peak instability” moment emerges as “it stands to reason that our volatility-selling machine will break one day. We saw a glimpse of this in 2008-09. And yet, as Peters concedes in a follow up note, those same central bankers don’t have any other option but to kick the can because as the CIO notes, any attempt to break the current ultra-low rate regime would “spark massive defaults.”

Incidentally, those are the same defaults that should have happened during the “near systemic reset” of 2008/2009 but the Fed, in all its wisdom, decided to kick the can at the cost of trillions in global excess liquidity, and while it bought itself some time – in the process unleashing a global deflation wave thanks to zombie companies that should not exist yet do, and every day try to undercut each other on pricing – nearly ten years later it has discovered that it has no way out, for one simple reason: there is now too much accumulated debt. Here is Peters “modelling” out why the Fed is stuck with no way out:

“When debt expands constantly relative to GDP, there’s a limit to how high interest rates can rise without causing massive defaults,” said the Model. “There’s nothing inherently wrong with defaults, they can cleanse a system, but a rise in US defaults from today’s 2.5% to 6.0% would boost unemployment by 3%.” America’s economy is leveraged to the financial system, which includes non-capitalized liabilities; entitlements, pensions, healthcare. “US total debt/GDP is 300%, but if you include these non-capitalized liabilities, it’s more like 800%.” “These non-capitalized liabilities rise as both interest rates and economic growth decline,” continued the same Model. “Low growth produces less income, and low rates supply less investment returns on pensions. Which means companies need to set aside more money to pay the liabilities.” It’s a slow-moving economic death spiral.

“The Neo-Fisher Model posits that we can escape this trap by increasing interest rates. Which will raise investment returns, while simultaneously lifting growth. Fisher’s Model may be right, but it will never be tested in reality.” “In reality the world operates on monthly payments,” explained the same Model. “So if we tested the Fisher Model by raising interest rates meaningfully, we’d spark massive defaults.” Unemployment would jump dramatically. “Our central banking and political reaction function ensures that each rise in unemployment is followed by monetary stimulus.” In the 30yrs since Greenspan became Fed Chairman, borrowers have learned this lesson and responded by leveraging up. “And that’s why US interest rates will never rise sustainably above 3.5%.”

Think Justin still sleeps at night? If so, he needs some wake-up lessons.

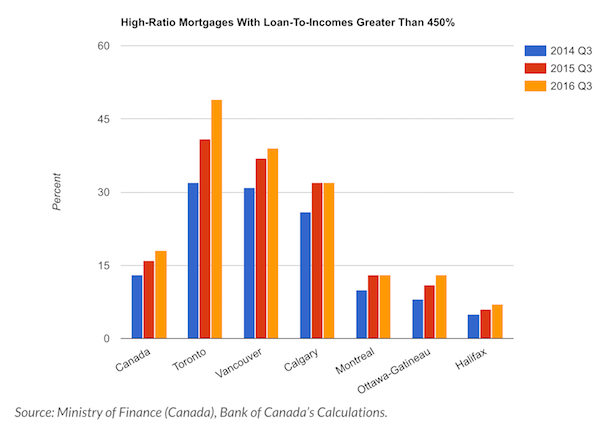

• Toronto Is The King Of Risky Mortgage Debt (BD)

Canadian real estate values continue to soar, and a record number of buyers are piling into risky loans. According to the Bank of Canada (BoC), and the Ministry of Finance (MoF), high ratio mortgage borrowers are extending themselves to the limit. While we covered how concerning this trend has become in Toronto, it’s not just isolated to that city. It’s a trend that’s growing across all Canadian urban centers. People taking out high-ratio mortgages combined with incomes too low for the property value, is spreading across Canada. A high-ratio mortgage is defined as a mortgage where the buyer leaves less than a 20% downpayment. The BoC and MoF have both expressed concern when high-ratio mortgages are paired with high income-to-loan ratios. The amount of high risk buyers is increasing as markets reach dizzying heights, especially in urban areas.

Vulnerability isn’t just the buyer’s ability to keep devoting a high percentage of their income to carrying payments. Since the number of these buyers are accelerating as prices get higher, they’re at a greater risk during a correction (not even a crash). Something as small as a 5% drop in value and many of these mortgages would be underwater. If this happens it would mean already broke homeowners would have to pay to get rid of their home. Combine that with a higher interest rate at renewal, and you can imagine the mayhem that can unfold. High-ratio mortgages with low income levels is a growing trend in Canada, but Toronto and Vancouver take it to the next level. Across Canada, 18% of high risk mortgages have extremely low incomes for the homes they’re in, an increase of 38% over two years.

Despite Vancouver’s insanely high prices, Toronto still tops the risky business of subprime borrowers. Toronto takes the top spot with a 53% increase during the same period, bringing their total to 49%. Coming in second is Vancouver which had a 25% increase over the past two years, bringing their total to 39%. These two cities are moving much faster than the average for the country, and they’re getting to dangerously high levels. Although Toronto and Vancouver take the cake, this trend is also growing across Canada, albeit with a lower impact. Over the past 2 years, Calgary saw a 23% increase of high ratio mortgages with at risk-income ratios, totalling 32%. Montreal saw a 30% increase over the past two years, bringing their total to 13%. Ottawa-Gatineau saw a massive 62.5% increase, bringing their total to 13%.

Complete delusion. Everywhere: “Canada’s financial system, deemed the world’s soundest by the World Economic Forum for eight straight years until 2016..” Over many of those years, this was already obviously happening.

• Canada’s Home Capital Distress and the Contagion Odds (BBG)

The escalation of Home Capital’s distress last week has led one of its largest former investors to rethink – if only slightly – the prospects of troubles spreading through the rest of Canada. After the alternative-mortgage lender set up a C$2 billion ($1.5 billion) credit line to offset a run on deposits, Mawer Investment Management’s Jim Hall is recalculating the odds of a contagion widening across one of the world’s strongest financial systems. “The probability has gone from infinitesimal to possible — unlikely, but possible,” said Hall, CIOmoney manager, in an interview Saturday. “If depositors or bondholders start to lose faith in their banks, well then that becomes systemic.”

Mawer, which oversees more than C$40 billion in assets, sold about 2.8 million shares, or a 4.3% stake, in Home Capital in the past week, joining another money manager, QV Investors, in exiting its investment amid the imbroglio consuming the Toronto-based lender. Home Capital has been struggling since April 19, when Ontario’s securities regulator accused management of misleading investors over how the firm handled a review of mortgage brokers who falsified documents about borrowers’ income. Home Capital shares plunged 65% the following day, and the lender has since disclosed an accelerating pace of declines of its high-interest savings balances – deposits used to help fund its mortgage business.

For its part, Home Capital secured a loan to compensate for a drop in deposits and said it’s weighing a sale, hiring RBC Capital Markets and BMO Capital Markets to advise on financing and “strategic options.” Even if withdrawals continue, as expected, the new funding should mitigate it, the company said April 26. Canada’s banking regulator says it’s closely monitoring the situation and surveying other financial firms to assess their condition. “The assets look, at this point, still reasonably good,” Hall said, adding that Home Capital’s problem is a matter of confidence. “Confidence was lost in this company and the business model breaks apart. That’s the problem with banks.”

Canada’s financial system has lots of fire breaks, as Hall describes it, to prevent problems from spreading. “Even if a bank gets itself into a confidence issue, it can be effectively bailed out by another bank or by another financial institution or by ultimately the regulator,” Hall said. Bank failures in Canada’s financial system, deemed the world’s soundest by the World Economic Forum for eight straight years until 2016, are rare. Canadian banks sidestepped the worst of the 2008 financial crisis, having only a fraction of the $1.95 trillion of writedowns and losses suffered by financial firms worldwide.

Posted by Tyler. No time stamp that I could see, but this is an eternal truth anyway.

• A Perspective on Electric Vehicles (Science Errors)

An electric auto will convert 5-10% of the energy in natural gas into motion. A normal vehicle will convert 20-30% of the energy in gasoline into motion. That’s 3 or 4 times more energy recovered with an internal combustion vehicle than an electric vehicle. Electricity is a specialty product. It’s not appropriate for transportation. It looks cheap at this time, but that’s because it was designed for toasters, not transportation. Increase the amount of wiring and infrastructure by a factor of a thousand, and it’s not cheap. Electricity does not scale up properly to the transportation level due to its miniscule nature. Sure, a whole lot can be used for something, but at extraordinary expense and materials. Using electricity as an energy source requires two energy transformation steps, while using petroleum requires only one.

With electricity, the original energy, usually chemical energy, must be transformed into electrical energy; and then the electrical energy is transformed into the kinetic energy of motion. With an internal combustion engine, the only transformation step is the conversion of chemical energy to kinetic energy in the combustion chamber. The difference matters, because there is a lot of energy lost every time it is transformed or used. Electrical energy is harder to handle and loses more in handling. The use of electrical energy requires it to move into and out of the space medium (aether) through induction. Induction through the aether medium should be referred to as another form of energy, but physicists sandwich it into the category of electrical energy. Going into and out of the aether through induction loses a lot of energy.

Another problem with electricity is that it loses energy to heat production due to resistance in the wires. A short transmission line will have 20% loss built in, and a long line will have 50% loss built in. These losses are designed in, because reducing the loss by half would require twice as much metal in the wires. Wires have to be optimized for diameter and strength, which means doubling the metal would be doubling the number of transmission lines. High voltage transformers can get 90% efficiency with expensive designs, but household level voltages get 50% efficiency. Electric motors can get up to 60% efficiency, but only at optimum rpms and load. For autos, they average 25% efficiency. Gasoline engines get 25% efficiency with old-style carburetors and 30% with fuel injection, though additional loses can occur.

Applying this brilliant engineering to the problem yields this result: A natural gas electric generating turbine gets 40% efficiency. A high voltage transformer gets 90% efficiency. A household level transformer gets 50% efficiency. A short transmission line gets 20% loss, which is 80% efficiency. The total is 40% x 90% x 50% x 80% = 14.4% of the electrical energy recovered (85.6% lost) before getting to the vehicle and doing something similar to the gasoline engine in the vehicle.

By Stéphanie Hennette, Thomas Piketty, Guillaume Sacriste and Antoine Vauchez. As I’ve said, I don’t believe the EU can be reformed, because no-one has the power to do it.

• For A Treaty Democratizing Euro Area Governance (SE)

Over the last ten years of economic and financial crisis, a new centre of European power has taken shape: the ‘government’ of the Euro Area. The expression may seem badly chosen as it remains hard to identify the democratically accountable ‘institution’ which today implements European economic policies. We are indeed aiming at a moving and blurred target. Characterized by its informality and opacity, the central institution of that government, the Eurogroup of Finance Ministers of the Euro Area, operates outside the framework of the European treaties and is in no way accountable to the European Parliament, nor to national parliaments. Worse, the institutions that form the backbone of that government – from the ECB and the Commission to the Eurogroup and the European Council – operate following combinations that constantly vary from one policy to the other (Troika Memoranda, European Semester ‘budgetary recommendations’ and bank ‘evaluations’ under the Banking Union).

However scattered they may be, these different policies are truly ‘governed’, as a hard core emerged from the ever closer union of national and European economic and financial bureaucracies – French and German national treasuries, ECB executive board, senior economic officials from the European Commission. As matters stand, this is where the Euro Area is supposedly governed and where the proper political tasks of coordination, mediation and balancing among the current economic and social interests are carried out. In 2012, as he gave up reforming the Treaty on Stability, Coordination and Governance, a cornerstone of this Euro Area governance, François Hollande contributed to consolidating this new power structure. From then onwards, this European executive pole has only seen its competences expand.

Over a decade, its scope for intervention has become significant, ranging from ‘budgetary consolidation’ (austerity) policies to far-reaching coordination of national economic policies (Six Pack and Two Pack), the set-up of rescue plans for member states facing financial distress (Memorandum and Troika), the supervision of all private banks. Both mighty and elusive, the government of the Euro Area evolved in a blind spot of political controls, in some sort of democratic black hole. Who indeed controls the drafting process of Memoranda of Understanding, which impose significant structural reforms in return for the financial assistance of the European Stability Mechanism? Who scrutinizes the executive operations of the institutions making up the Troika?

Who monitors the decisions taken within the European Council of the Heads of State or Government of the Euro Area? Who knows exactly what is negotiated within the two core committees of the Eurogroup, i.e. the Economic Policy Committee and the Economic and Financial Committee? Neither national parliaments, which at best simply control their own executive, nor the European Parliament, which has carefully been sidelined from Euro Area governance. In view of its opacity and isolation, the many criticisms voiced against that Euro Area government seem well deserved, starting with Jürgen Habermas’ denunciation of a “post-democratic autocracy”.

Pre-empting Le Pen.

• Macron Says EU Must Reform Or Face ‘Frexit’ (BBC)

The front-runner in the French presidential election has told the BBC that the EU must reform or face the prospect of “Frexit”. Pro-EU centrist Emmanuel Macron made the comments as he and his far-right rival Marine Le Pen entered the last week of campaigning. French voters go to the polls on Sunday to decide between the pair. Ms Le Pen has capitalised on anti-EU feeling, and has promised a referendum on France’s membership. She won support in rural and former industrial areas by promising to retake control of France’s borders from the EU and slash immigration. “I’m a pro-European, I defended constantly during this election the European idea and European policies because I believe it’s extremely important for French people and for the place of our country in globalisation,” Mr Macron, leader of the recently created En Marche! movement, told the BBC.

“But at the same time we have to face the situation, to listen to our people, and to listen to the fact that they are extremely angry today, impatient and the dysfunction of the EU is no more sustainable. “So I do consider that my mandate, the day after, will be at the same time to reform in depth the European Union and our European project.” Mr Macron added that if he were to allow the EU to continue to function as it was would be a “betrayal”. “And I don’t want to do so,” he said. “Because the day after, we will have a Frexit or we will have [Ms Le Pen’s] National Front (FN) again.”

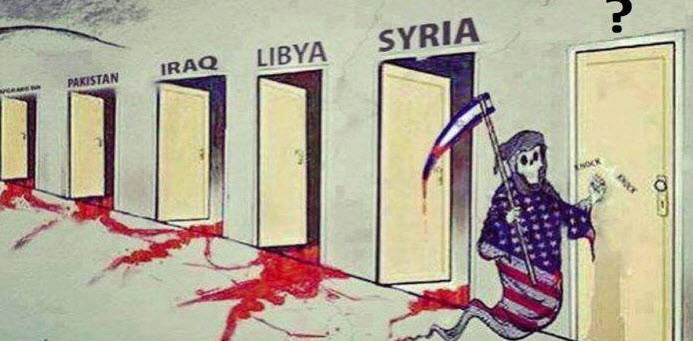

What I would expect.

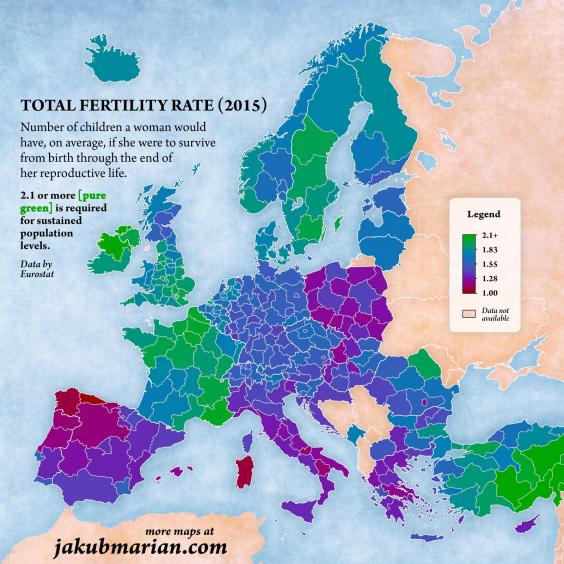

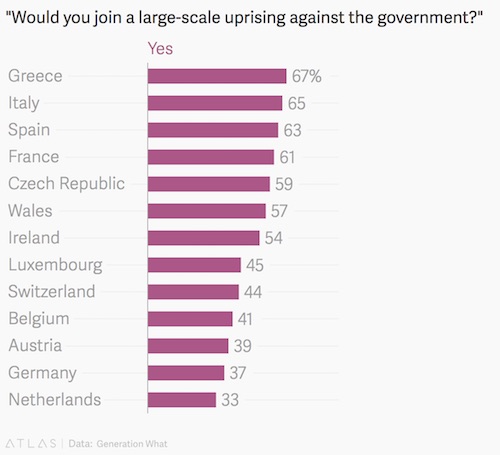

• Europe’s Youth Don’t Care To Vote—But They’re Ready To Join A Mass Revolt (Qz)

Young Europeans are sick of the status quo in Europe. And they’re ready to take to the streets to bring about change, according to a recent survey. Around 580,000 respondents in 35 countries were asked the question: Would you actively participate in large-scale uprising against the generation in power if it happened in the next days or months? More than half of 18- to 34-year-olds said yes. The question was part of a European Union-sponsored survey, titled “Generation What?” The report went on to focus on respondents from 13 countries to better understand what young people are optimistic and frustrated about in Europe. Among these spotlighted countries, young people in Greece were particularly interested in joining a large-scale uprising against their government, with 67% answering yes to the question. Respondents in Greece were also more likely to believe politicians were corrupt and to have negative perceptions of the country’s financial sector.

His ‘solution’ is self-defeating. More pension cuts and more taxes will cut more money velocity, hence more GDP. Which means Greece is less able to pay back anything at all.

• Schaeuble Says Greece Has Made Good Reform Progress (R.)

German Finance Minister Wolfgang Schaeuble was quoted in a newspaper interview on Sunday saying that Greece has made strong progress towards introducing reforms that could lead to the imminent release of further financial support. “If the Greek government upholds all the agreements, European finance ministers could complete the review on May 22 and then soon after that release the next tranche,” Schaeuble told the Funke media group newspapers. Greece and its international creditors reached a preliminary agreement at a meeting of eurozone finance ministers in April to set up the next transfer of some €7 billion in aid. But the finance ministers will not release the tranche until the audit is completed.

“The longer it takes, the more uncertainty will be in the financial markets and economy,” Schaeuble added. He said the Greek government had promised to make further adjustments in pensions as well as improve tax collection. Asked why he was optimistic the aid could soon be released, Schaeuble said, “Because we negotiated in a very determined fashion and the Greek government said it would adjust the pensions more strongly to the economic situation. “That’s not easy – I know that. And it wants to improve the tax collection system so that tax revenues will rise again from 2020.”